Rio Tinto Reported Overall Strong Production Results for 4Q15

Rio Tinto’s copper production was a slight miss, falling short ~1% of the fiscal 2015 guidance. This was mainly due to weaker throughput at Escondida.

Jan. 20 2016, Published 9:05 a.m. ET

Production results and highlights

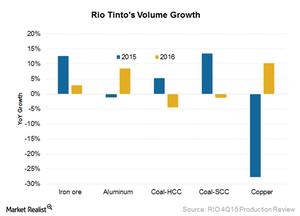

Rio Tinto (RIO) reported overall strong production results for 4Q15 and 2015. There were no major surprises on either side. Rio Tinto’s iron ore production and guidance were slightly below the market expectations. Volumes came in at 327.6 million tons. Destocking was higher, with shipments of 336.6 million tons. The guidance for Iron ore volumes was for shipments of 340 million tons. The guidance for 2016 is for shipments of 350 million tons.

Copper production was a slight miss, falling short ~1% of the fiscal 2015 guidance. This was mainly due to weaker throughput at Escondida.

Coal and aluminum were in line with guidance. The aluminum production of 3.3 million tons was flat year-over-year. Coal production was at or above guidance for the year. Rio guided for lower thermal coal production for 2016, mainly due to the fall from the sale of its Bengalla joint venture.

Mineral sands were weaker as Rio pulled back production to match demand. Diamonds also remained weak as issues at the Argyle diamond mine are worked through.

We’ll discuss key production highlights from these segments in detail later in this series.

Rio’s peers

BHP Billiton (BHP) will report its production results on January 20, 2016. Cliffs Natural Resources (CLF) will announce its results for the year ending December 2015 on January 27, 2016. Plus, Freeport-McMoRan (FCX) will report its results for the year ending December 2015 on January 26, 2016.

Investors can consider the Materials Select Sector SPDR ETF (XLB) to get a diversified exposure to the materials sector. Metal producers currently form ~9% of XLB’s portfolio