BTC iShares Commodities Select Strategy ETF

Latest BTC iShares Commodities Select Strategy ETF News and Updates

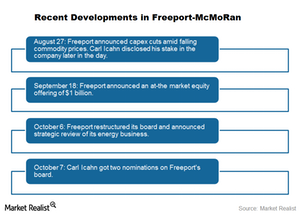

Icahn Lift or Commodity Drag: What Could Drive Freeport-McMoRan?

Freeport-McMoRan (FCX) jumped smartly in August after activist investor Carl Icahn disclosed his 8.5% stake in the company, known as the “Icahn lift.”

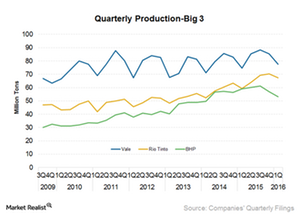

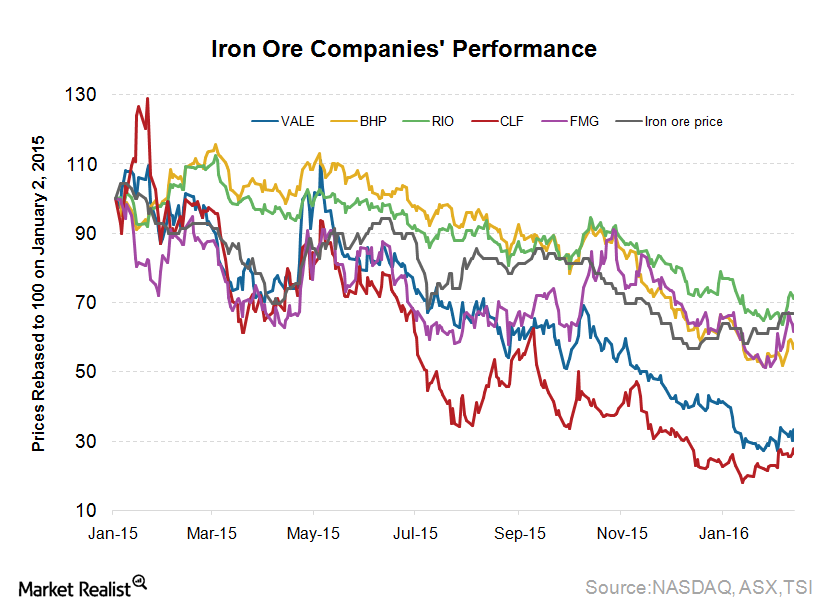

Why Rio Tinto Believes Iron Ore Prices Can Sustain

According to Bloomberg, Rio Tinto CFO Chris Lynch has suggested that iron ore prices will not collapse, as many expect.

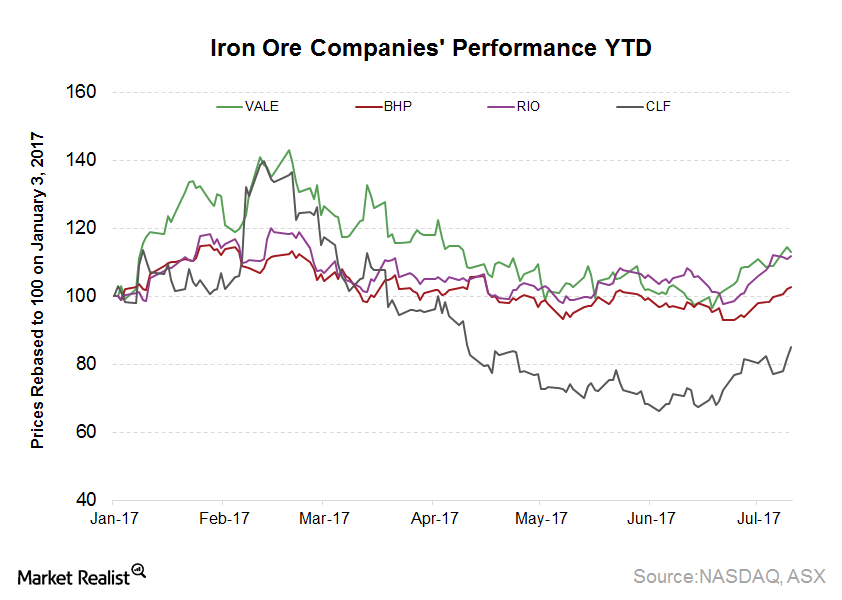

Understanding BHP Billiton’s Earnings Beat in Fiscal 2H17

BHP’s underlying net profit of $3.2 million was a solid improvement, as compared to the profit of $412 million in 4Q15.

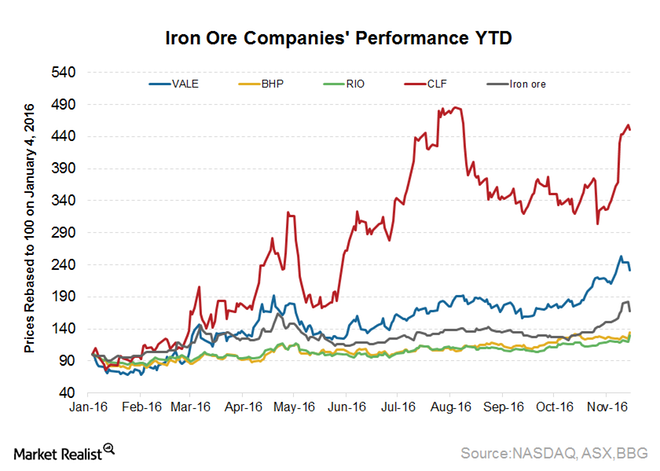

These Factors Could Affect Vale Stock in 2H17

After significantly outperforming its peers in 1Q17, Vale’s (VALE) performance deteriorated in 2Q17.

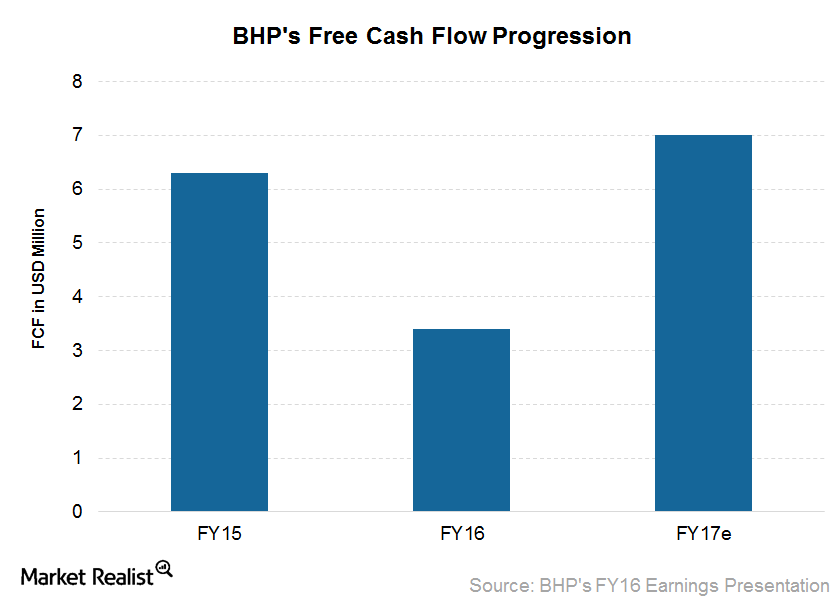

What Could Drive BHP Billiton’s Free Cash Flows for Fiscal 2017?

BHP Billiton’s (BHP) (BBL) unit costs declined by 16% in fiscal 2016, supported by increased capital efficiency. This helped BHP generate strong free cash flow.

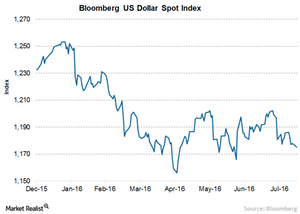

Fading Risks Are Working in Favor of Emerging Markets

Low commodity (GSG) prices in the first quarter of the year impacted commodity-driven emerging markets like Russia, Brazil (EWZ), Indonesia, and Venezuela.

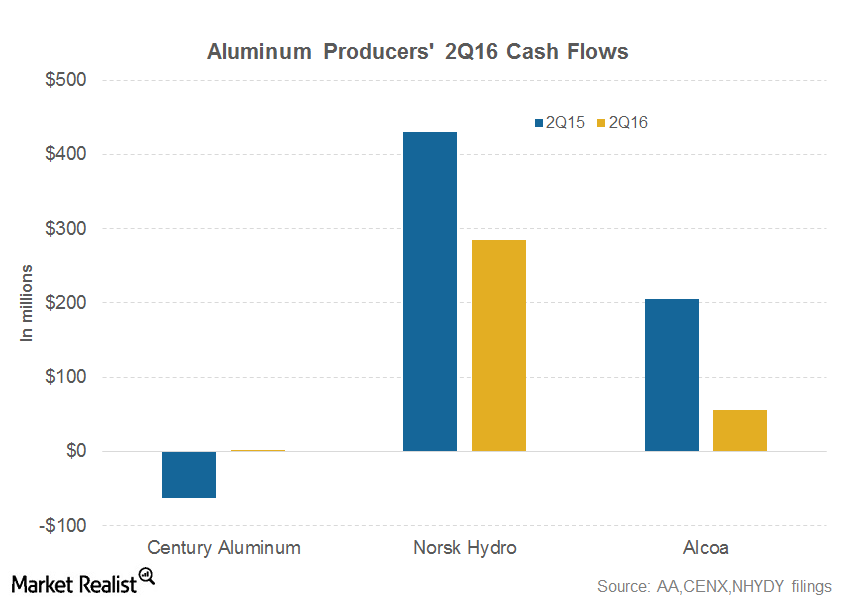

Can Alcoa Generate Positive Free Cash Flows in 2016?

Alcoa (AA) generated free cash flows of $55 million in 2Q16—compared to $205 million in the same quarter last year.

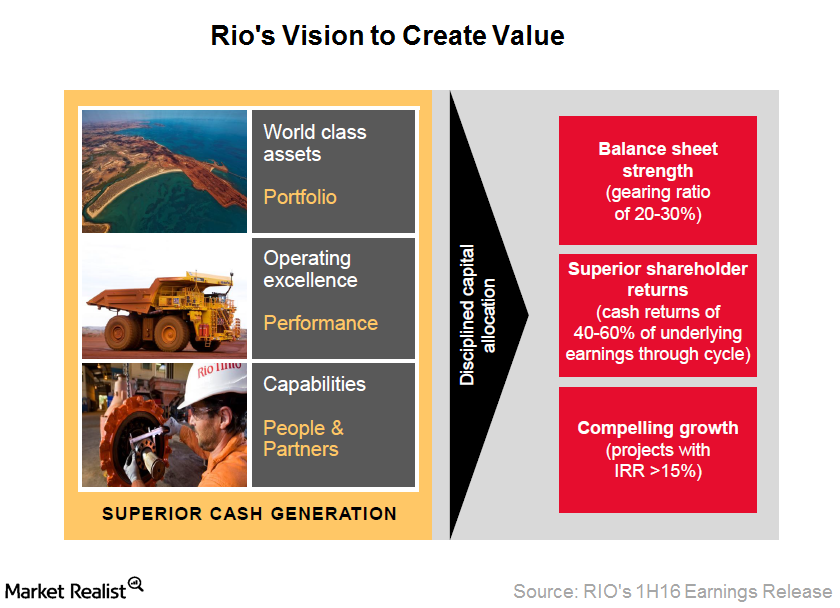

Rio Tinto’s Earnings during 1H16 Were Driven by This

Rio Tinto reported its 1H16 results on August 3, 2016. Its underlying earnings came in at $1.6 billion, 7% ahead of consensus expectations of $1.5 billion.

How Fallen Angels Could Reward Investors

Fallen angel bonds—high-yield bonds originally issued with investment grade credit ratings—are generally known for offering potential value. A big source of this value has been the tendency of fallen angels to be oversold below what may be considered fair value, leading to a downgrade to high yield. A less obvious source of value for fallen angels […]

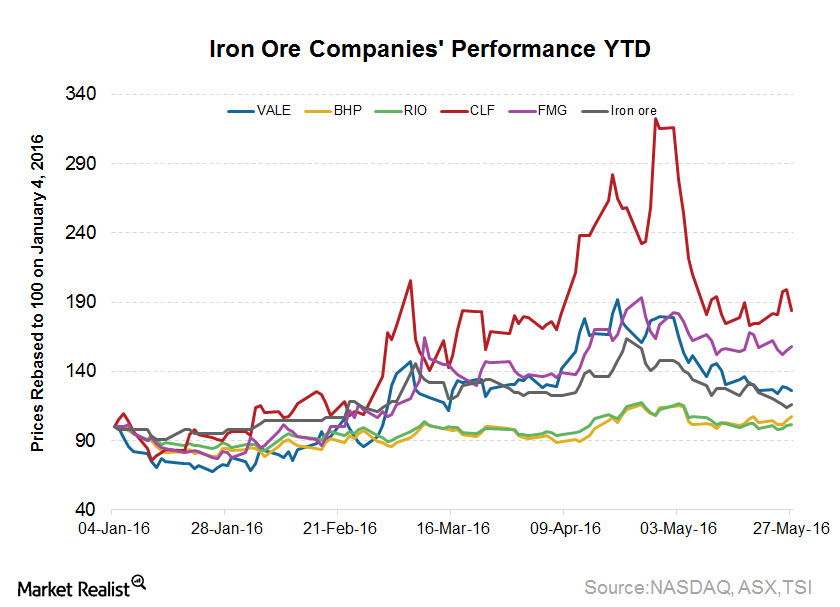

Why Is the Iron Ore Price Rally Losing Steam?

In this series, we’ll analyze the demand-supply fundamentals for iron ore and see whether the recent surge was a one-off phenomenon or the start of a more sustained uptick in prices.

Rio Tinto Surprised the Markets with Dividend Policy Change

Rio Tinto’s 2015 results were mostly in line with market expectations. Underlying EBITDA and underlying profits were $12.6 billion and $4.5 billion, respectively.

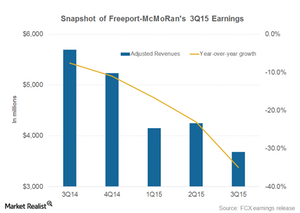

Why Freeport-McMoRan’s 3Q15 Revenues Fell Off a Cliff

In this part of the series, we’ll explore the trend in Freeport-McMoRan’s (FCX) revenues.