Morgan Stanley, Citibank Doubt Longevity of Iron Ore Price Rally

Morgan Stanley is bearish on the future prospects of iron ore prices. The broker estimates that the iron ore prices will fall to $40 per ton in 2H16 and $35 per ton in 4Q16.

Sept. 2 2016, Updated 10:04 a.m. ET

Long-term consensus is bearish

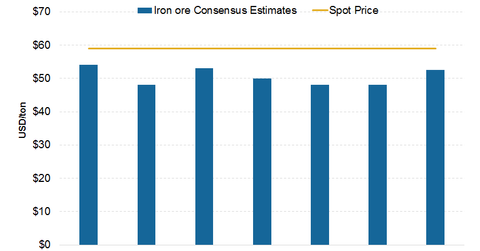

Analysts have increased their short-term iron ore price forecasts due to stronger-than-expected temporary factors. However, many on Wall Street are convinced of the rally’s longevity. The Bloomberg median iron ore price forecast is $48 per ton for both 2017 and 2018.

Westpac and Citibank

According to Westpac Banking Corp., the benchmark iron ore prices should fall below 2015’s record low of $38.30 per ton. The bank believes that over the next few months, weaker demand, strong supply, and increasing inventories should mean a struggle for iron ore prices.

Citi also believes that the iron ore prices should fall from here. It is estimating the price of $51 per ton for 4Q16 and $45 per ton for 2017. According to Citi analysts, “There are short- to medium-term risks in iron ore and coal as the impact of Chinese stimulus that has boosted the 2016 year to date abates.”

Morgan Stanley is bearish

Morgan Stanley is also bearish on the future prospects of iron ore prices. The broker estimates that the iron ore prices will fall to $40 per ton in 2H16 and $35 per ton in 4Q16.

Morgan Stanley added, “While the enforcement of steel production capacity cuts and higher credit liquidity for steel-intensive projects may mitigate seasonal flows, offering short-term support for trade flows and steel and ore prices, winter constraints on Asia’s trade and deployment of steel are profound, invariably retarding second-half relative price performances.”

The iron ore miners also shared this view. BHP Billiton (BHP) maintains that the iron ore prices will remain low for at least another ten years due to oversupply. Rio Tinto (RIO) also thinks that there could be a downside to iron ore prices due to the supply overhang from Vale SA (VALE) and the Roy Hill project. This in turn, would be negative for miners (GCC) such as Fortescue Metals Group (FSUGY) and Cliffs Natural Resources (CLF).