FORTESCUE METAL

Latest FORTESCUE METAL News and Updates

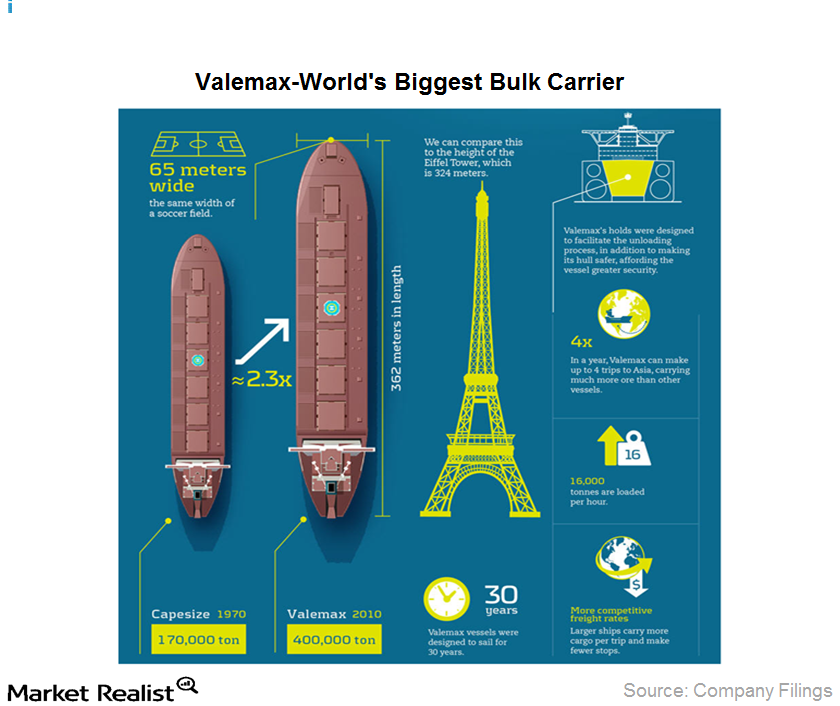

Valemax ships sail Vale SA to cost-effective distribution

Valemax ships are ultra-large vessels, capable of carrying 400,000 dwt (dead weight tons) each. That’s 2.3 times more than traditional Capesize ships. They also emit 35% less CO2 per ton of ore transported.

Vale SA: Overview of the world’s largest iron ore company

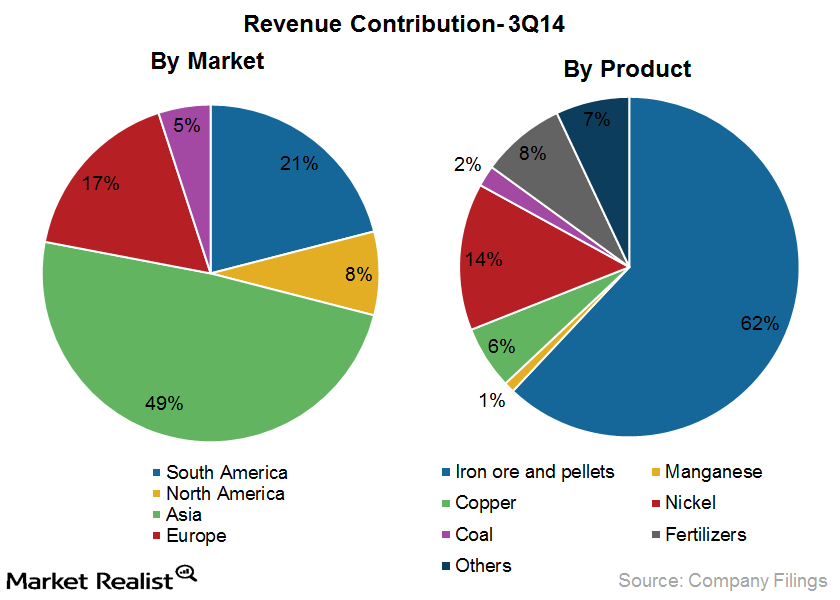

Vale SA (VALE) is a Brazilian multinational diversified metals and mining company. It is the world’s largest producer of iron ore and iron ore pellets and the world’s second-largest producer of nickel.

Vale SA: Top-quality iron ore and pellets

Vale SA (VALE) is the world’s largest producer of iron ore and pellets. Pellets are manufactured by gathering together the powder generated during the ore extraction process.

How Vale SA values its iron ore customers

Vale SA offers technical assistance to its customers and operates sales support offices in several cities. These offices monitor customer requirements and ensure timely deliveries.

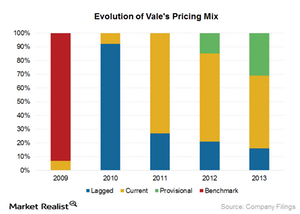

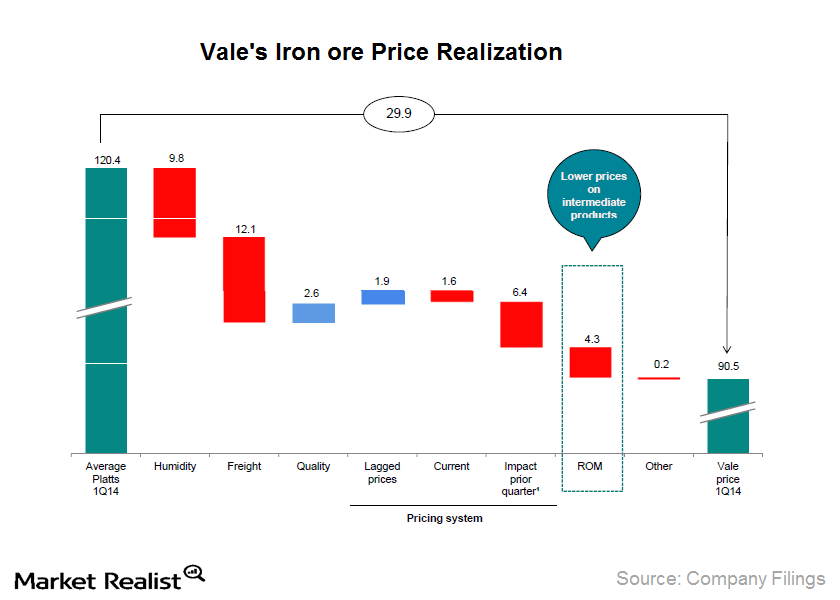

Realized price: The factors impacting Vale SA iron ore

Realized prices for iron ore vary depending on quality, moisture content, freight costs, and pricing mechanisms. ROM sales reduced Vale’s realized price by about $6 per ton in 2013.

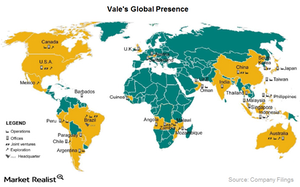

Where Vale SA operates and why

Currently, the the private sector is leading significant expansion and major rehabilitation of Mozambique’s infrastructure. Vale itself is investing in the development of the Nacala infrastructure project.