WisdomTree Continuous Commodity Index Fund

Latest WisdomTree Continuous Commodity Index Fund News and Updates

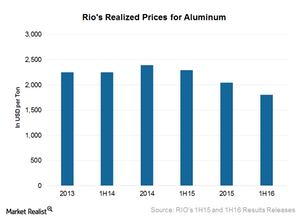

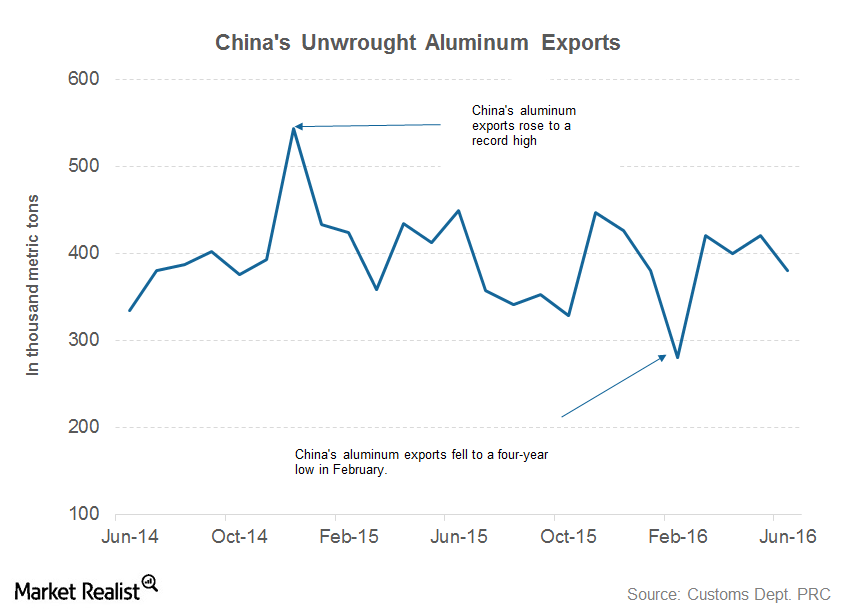

Rio’s Aluminum Division Didn’t Bow to Commodity Price Pressures

Rio Tinto’s (RIO) Aluminum division contributed 19% of its 1H16 underlying EBITDA (or earnings before interest, tax, depreciation, and amortization).

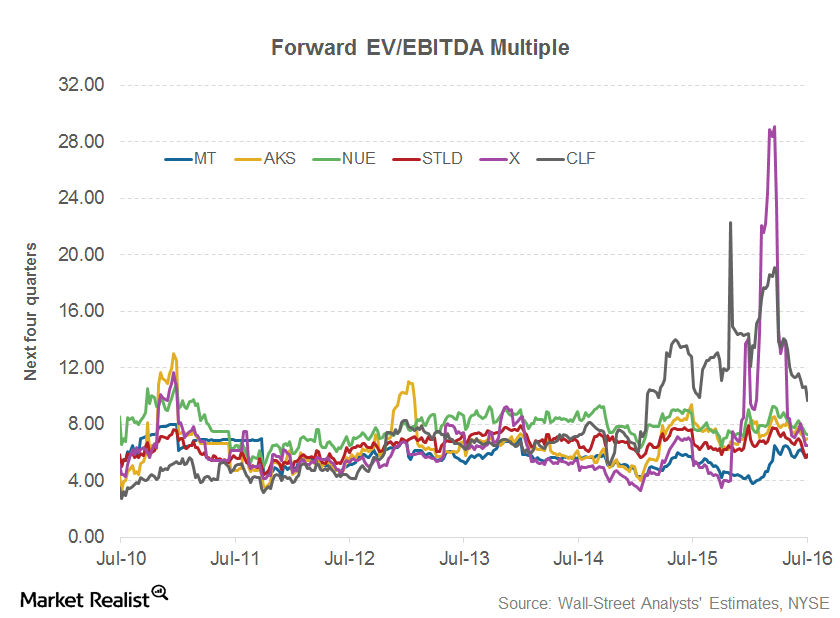

Could There Be More Upside to Cliffs Natural Resources’ Valuation?

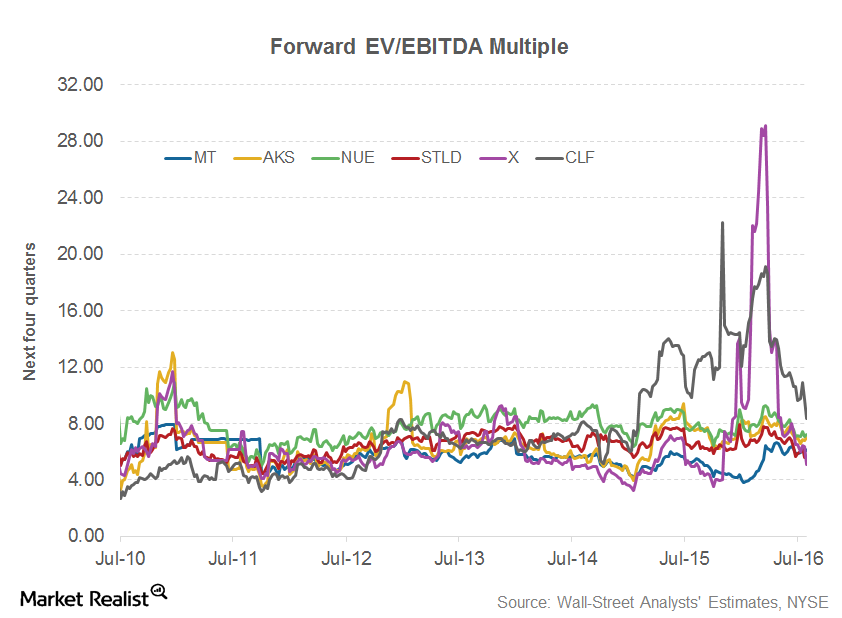

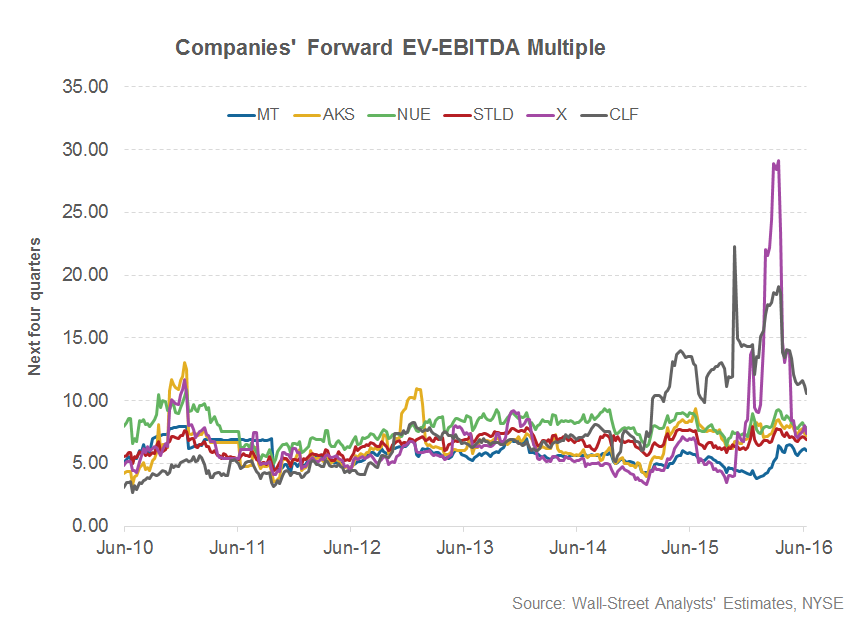

For companies in cyclical industries such as steel and mining, the EV-to-EBITDA multiple is the preferred valuation metric.

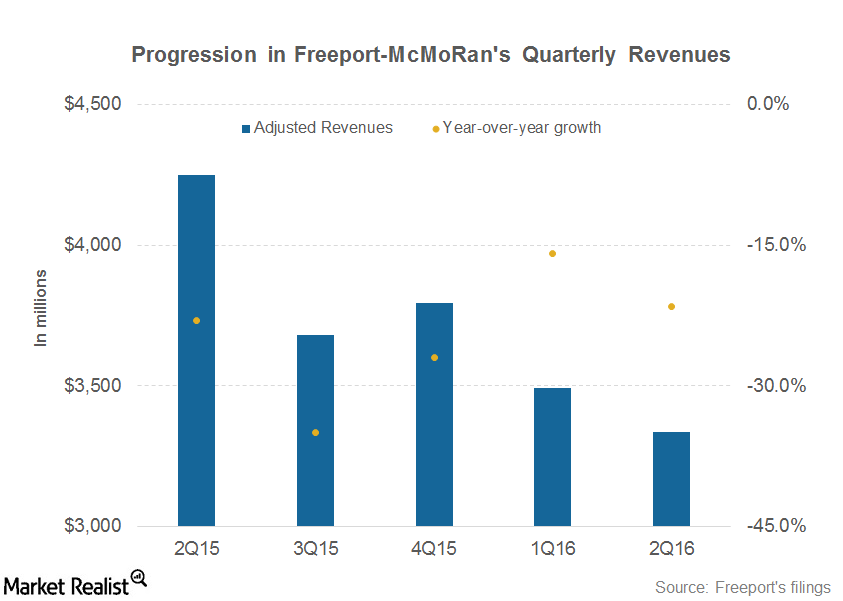

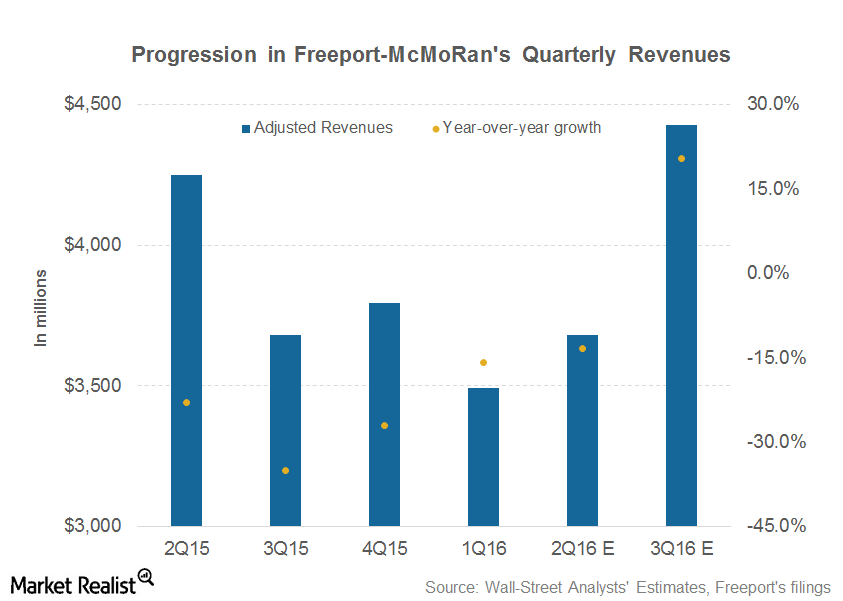

Why Freeport-McMoRan Missed Q2 Revenue Estimates

Freeport-McMoRan (FCX) posted revenues of $3.3 billion in 2Q16. In contrast, Freeport posted revenues of nearly ~$4.2 billion in 2Q15.

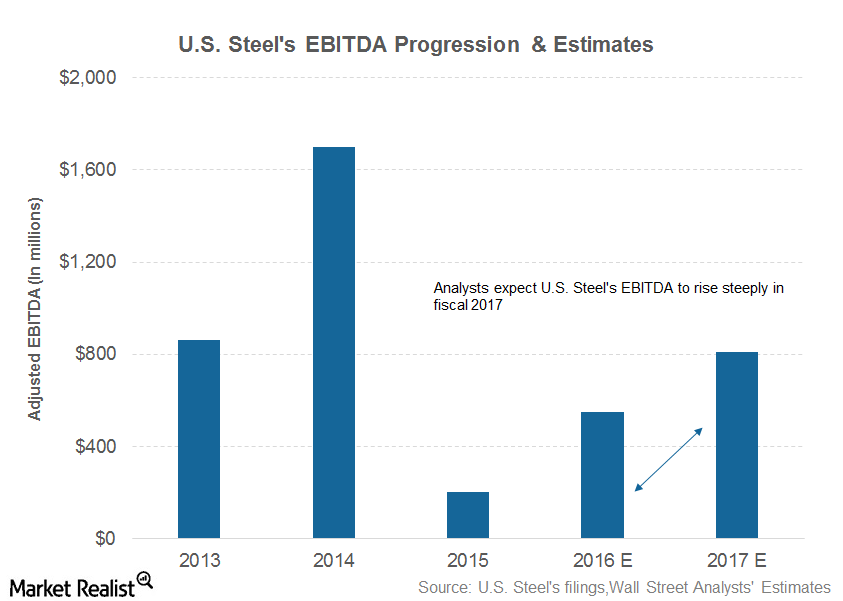

2Q16 Earnings Call: Will U.S. Steel Raise Its 2016 Guidance?

One would expect U.S. Steel to increase its 2016 guidance during its 2Q16 earnings call. However, U.S. Steel might be conservative.

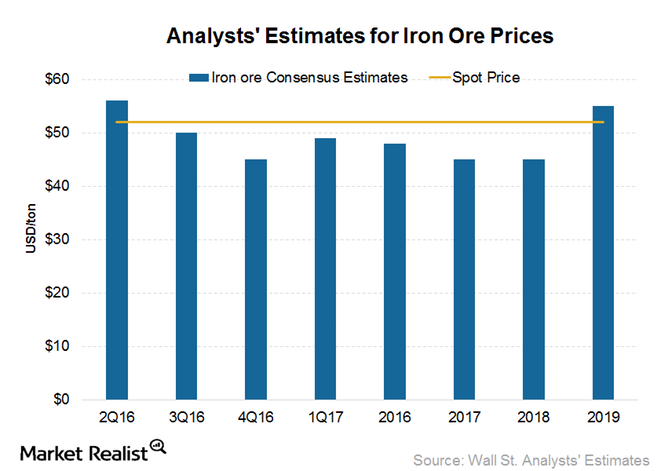

Morgan Stanley, Citibank Doubt Longevity of Iron Ore Price Rally

Morgan Stanley is bearish on the future prospects of iron ore prices. The broker estimates that the iron ore prices will fall to $40 per ton in 2H16 and $35 per ton in 4Q16.

What’s Been Driving Cliffs Natural Resources’ Valuation

Valuations Valuation multiples are key metrics that investors consider carefully. With the help of relative valuations, we can compare a company’s valuation with its closest peers’ valuations. There are several valuation metrics that we can use. For companies in cyclical industries such as steel and mining, the EV/EBITDA (enterprise value to earnings before interest, taxes, depreciation, and amortization) […]

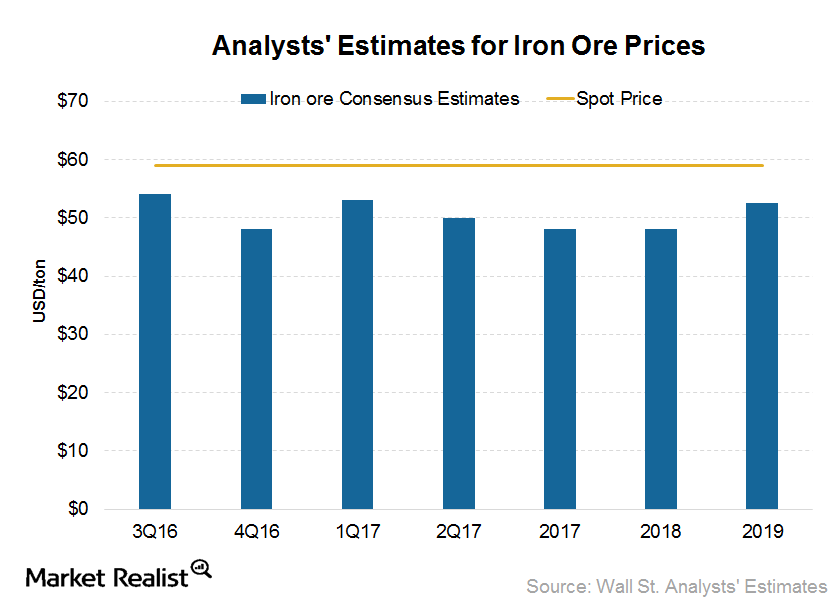

What Analysts Have to Say about Iron Ore Prices

Analysts have increased their short-term iron ore price forecasts due to stronger-than-expected temporary factors.

Can 2Q16 Mark a Turnaround for Freeport-McMoRan’s Revenues?

Analysts expect Freeport-McMoRan (FCX) to post revenues of ~$3.7 billion in 2Q16 and $4.4 billion in 3Q16.

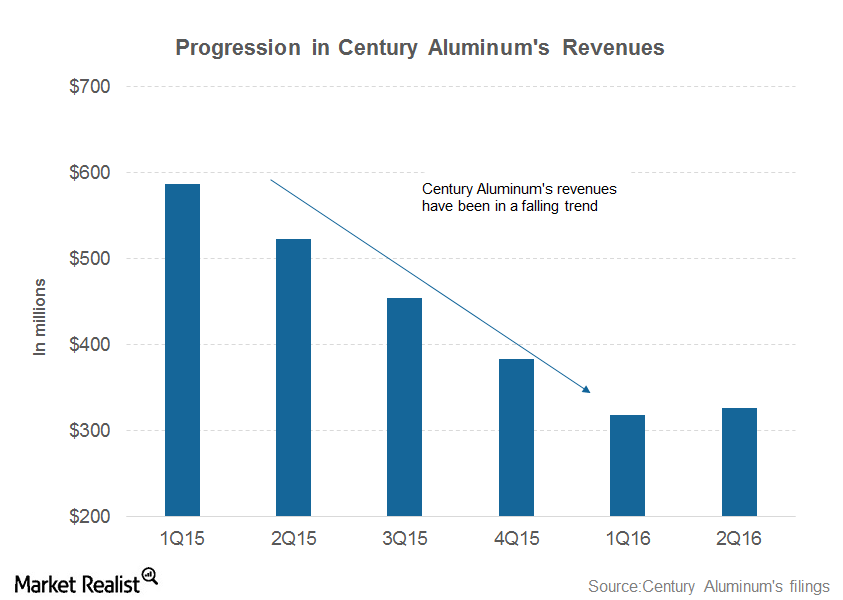

Century Aluminum Misses 2Q16 Revenues: Should You Be Concerned?

Century Aluminum reported revenues of $326 million in 2Q16. The revenue miss shouldn’t be a major concern given its performance on other metrics.

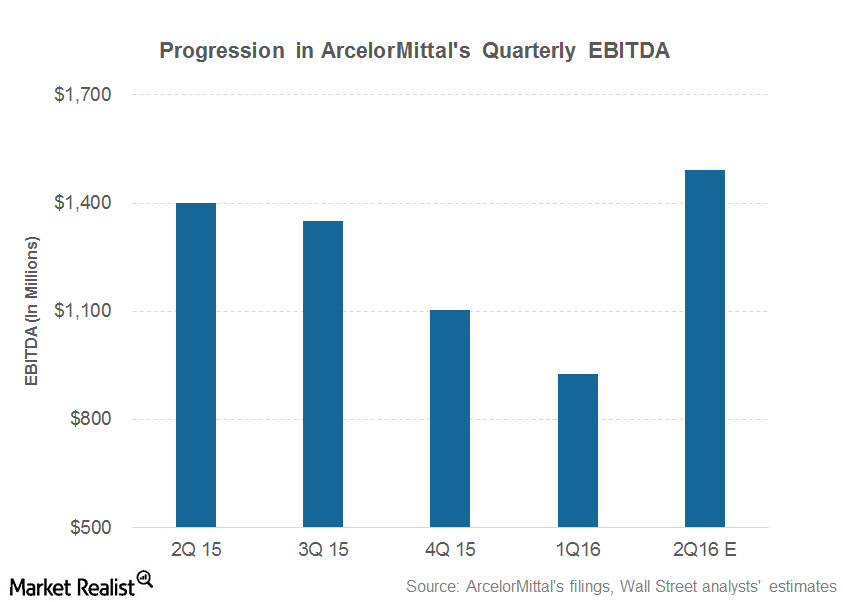

Are ArcelorMittal’s 2Q16 Earnings Estimates a Little Aggressive?

ArcelorMittal (MT) posted adjusted EBITDA of $927 million in 1Q16 and ~$1.4 million in 2Q15.

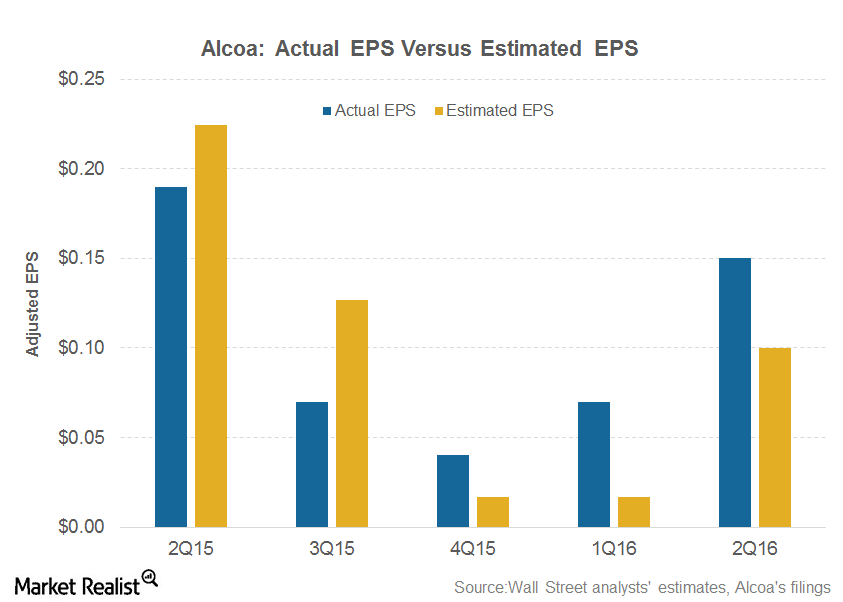

Can Higher Commodity Prices Boost Alcoa’s 3Q16 Earnings?

Alcoa expects its fiscal 2016 net income to rise by $160 million for every $100 per metric ton rise in aluminum prices.

Alcoa’s 2Q16 Earnings: Everything You Need to Know

Alcoa (AA) reported its 2Q16 earnings yesterday after the market closed. Here’s what you should know.

Is Cliffs’s Valuation Justified?

Cliffs Natural Resources (CLF) is trading at a forward EV/EBITDA multiple of 11.0x compared with its last five-year average of 8.0x.

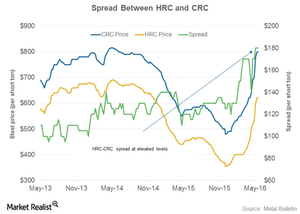

What Slowdown? US Steel Prices Rose 50% This Year

Steel companies’ earnings are sensitive to changes in steel prices. In recent quarters, their earnings have been negatively impacted by falling steel prices.