Hilton Worldwide Holdings Inc

Latest Hilton Worldwide Holdings Inc News and Updates

Overview: Hilton Worldwide Holdings Inc.

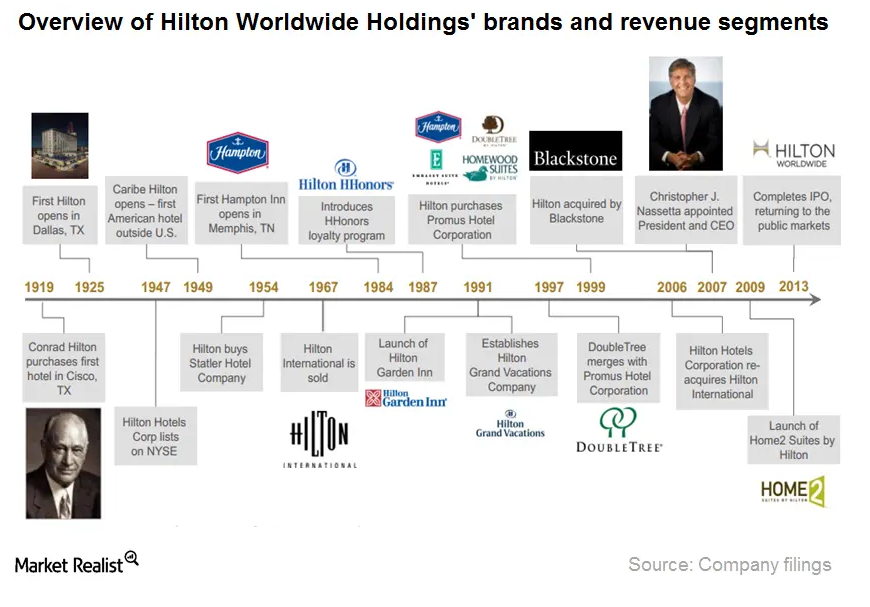

Hilton Worldwide Holdings is one of the largest hospitality companies in the world. It was founded in 1919 by Conrad Hilton. The company started when he bought his first hotel in Texas.Consumer Why trend in fee income is an important source of revenue

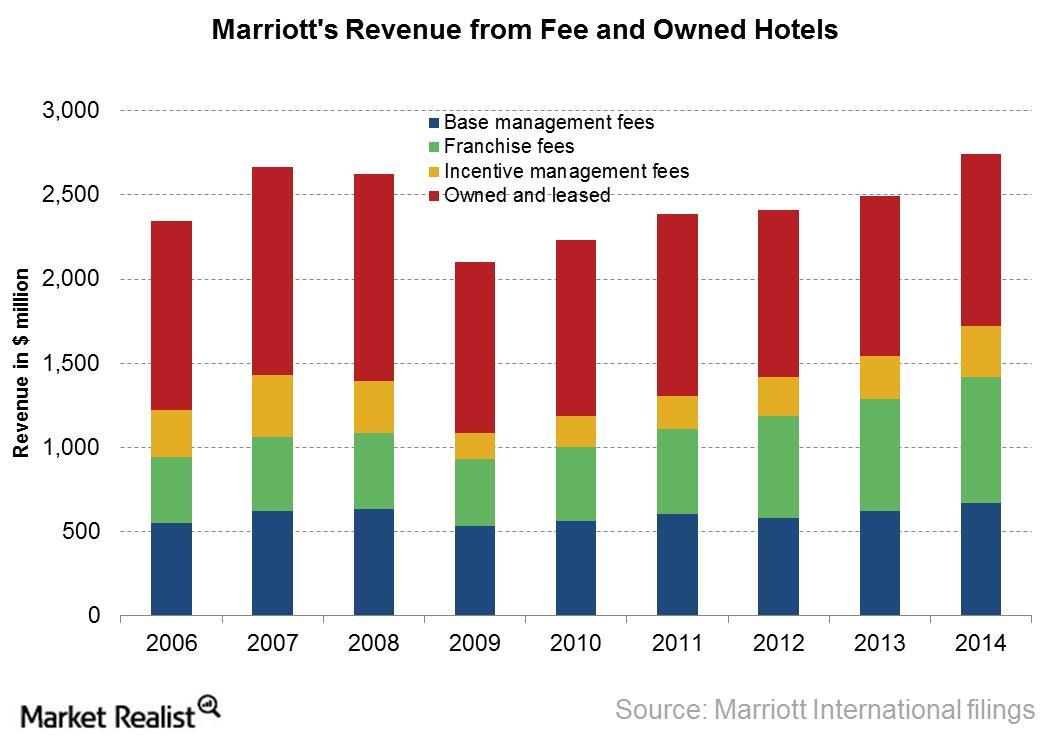

Marriott increased its fee income at a ten-year compound annual growth rate (or CAGR) of 7.6% to $1,543 million in 2013—from $742 million in 2003.

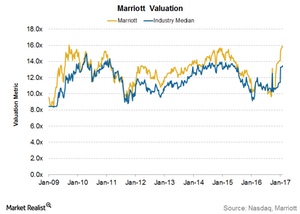

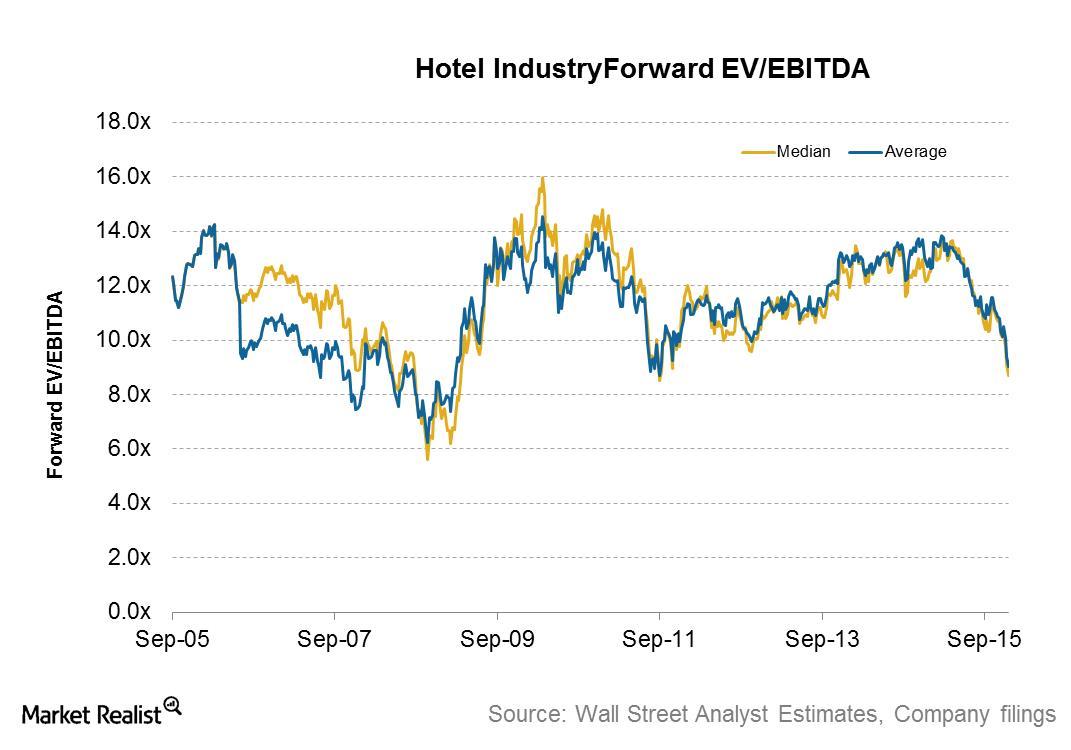

Understanding Marriott International’s Valuation Multiple

In fiscal 2014, Marriott had forward EV-to-EBITDA multiple of 15.3. It was trading at 11.2 as of January 1, 2016, which was the highest among peers.

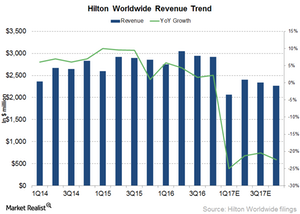

Will Hilton’s Top Line Grow in 2017?

For 1Q17, analysts are estimating Hilton’s (HLT) revenue to fall 25% to $2.1 billion.

Why Marriott is Buying Back Its Own Shares

Marriott repurchased 7.7 million shares of common stock valued at $544 million in 4Q14 and 24 million shares for $1.5 billion in 2014.Consumer Why Marriott is slowly expanding in international markets

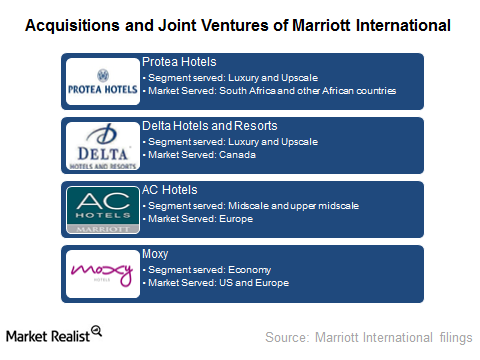

Marriott has been expanding its presence in the international market. It added new brands in Europe, Asia Pacific, and the Middle East and African regions.Must-know: Marriott International Inc.

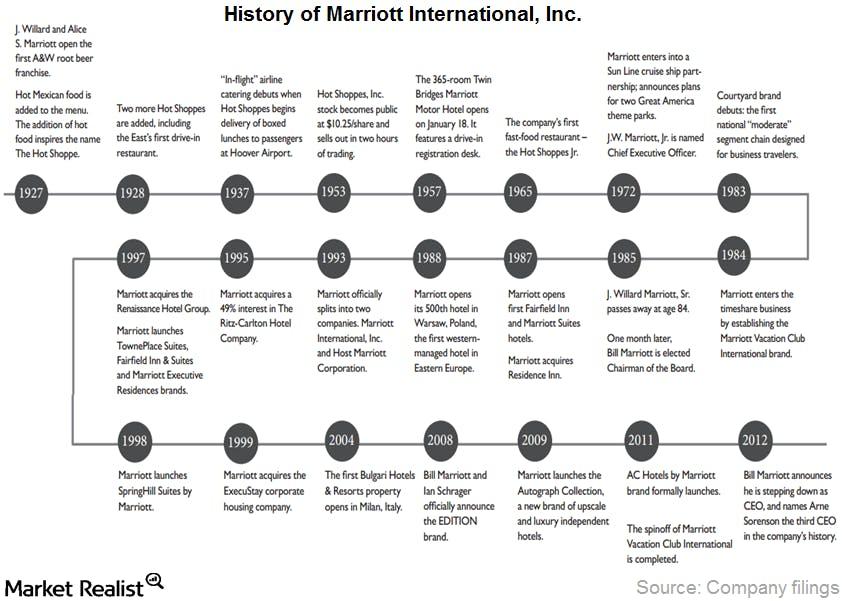

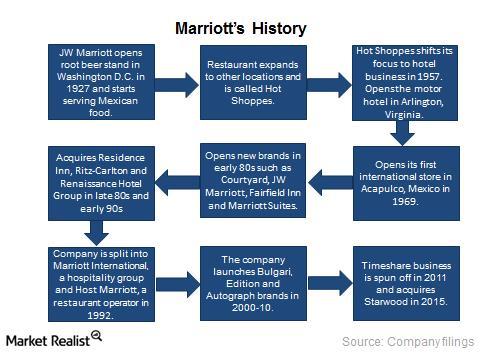

Marriott International’s headquarters are in Bethesda, Maryland. The company was founded in 1927 by J. Willard and Alice S. Marriott.Consumer Hilton’s diversified portfolio with 11 world-class brands

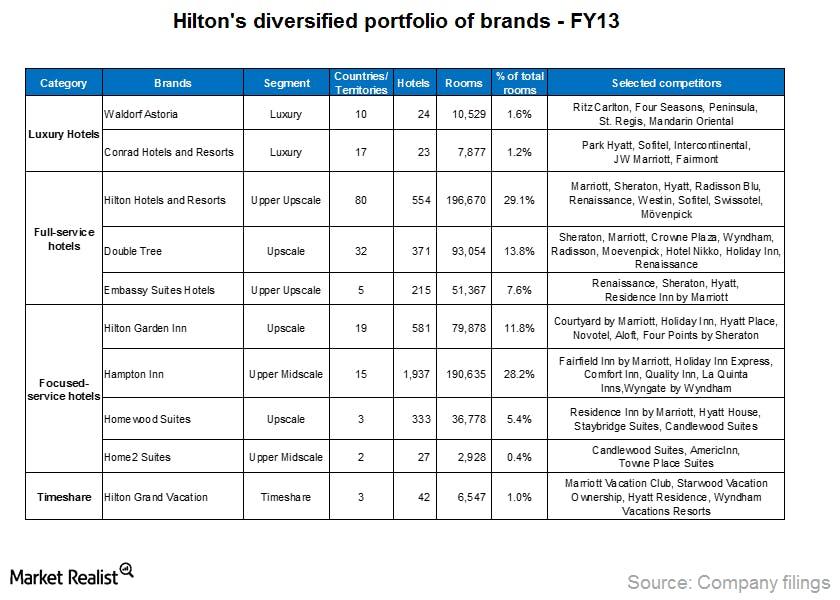

Hilton’s goal is to serve any customer, anywhere in the world, for any lodging need that they have. The company has a portfolio of 11 world-class brands. Hilton’s portfolio allows it to accomplish this goal.Hilton’s hotel room composition by brand and chain scale

Hotel companies, like Hilton, expand their operations based on the demand for accommodations by location. They also expand based on customer preference for the level of service offerings.

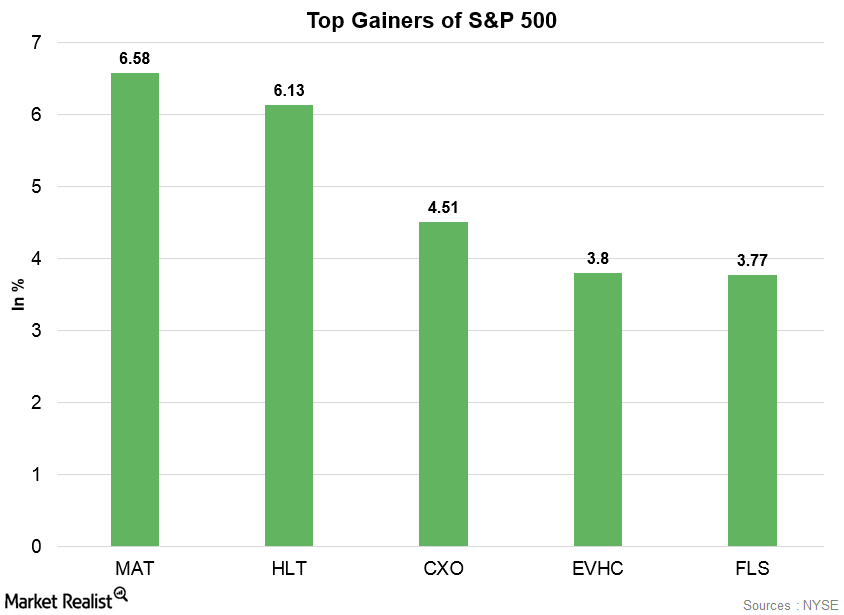

Mattel: S&P 500’s Top Gainer on April 11

Mattel, which is an American multinational toy manufacturing company, was the S&P 500’s top gainer on Wednesday.

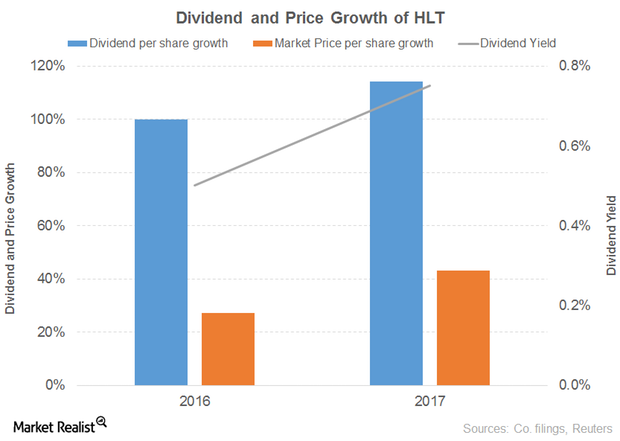

Hilton Worldwide Holdings Looks Promising despite a Tough 2017

Hilton Worldwide Holdings’ (HLT) revenue grew 3% in 2016. Management and franchise fees, timeshare, and other revenues from managed and franchised properties drove the growth in 2016, offset by owned and leased hotels.

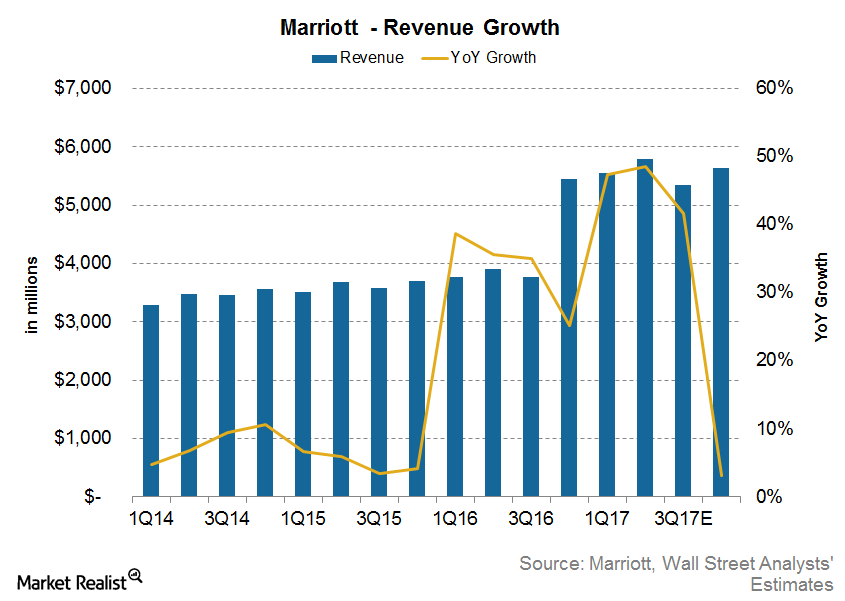

Marriott’s Revenue Is Now Expected to Go This Way in 2017

In 2Q17, Marriott’s revenues grew 49% YoY to $5.8 billion, compared with $3.9 billion in 2Q16, due to higher fee revenues and RevPAR and room growth.

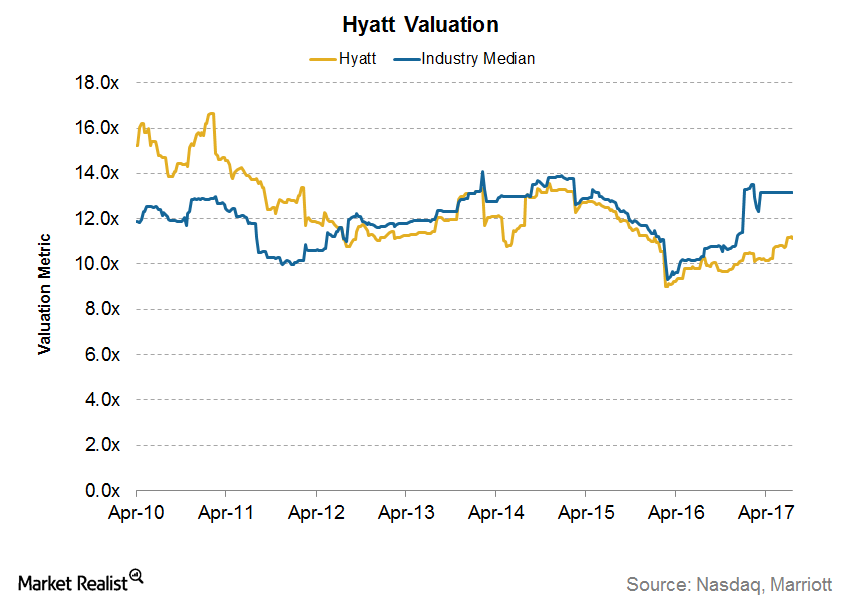

How Hyatt’s Valuation Compares

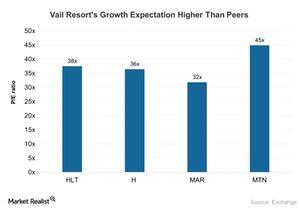

Current valuation Hyatt (H) currently trades at a forward EV-to-EBITDA multiple of 15.1x. Hyatt’s valuation is significantly higher than its average valuation since January 2010 of 13.0x. Peer comparison Hyatt’s valuation is among the highest in its peer group. Marriott International (MAR) has a multiple of 15.3x, Hilton Worldwide Holdings (HLT) is trading at a […]

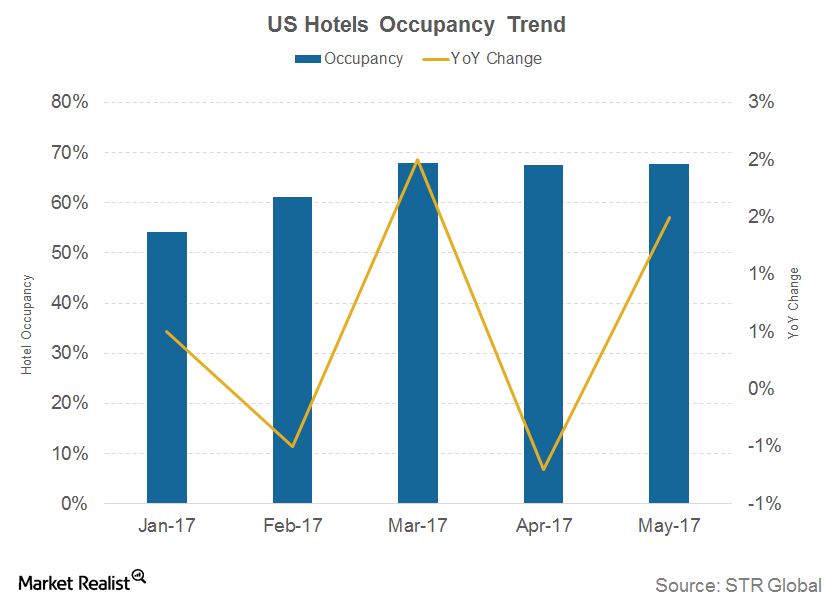

Average Daily Rate Will Drive US Hotel Industry Growth

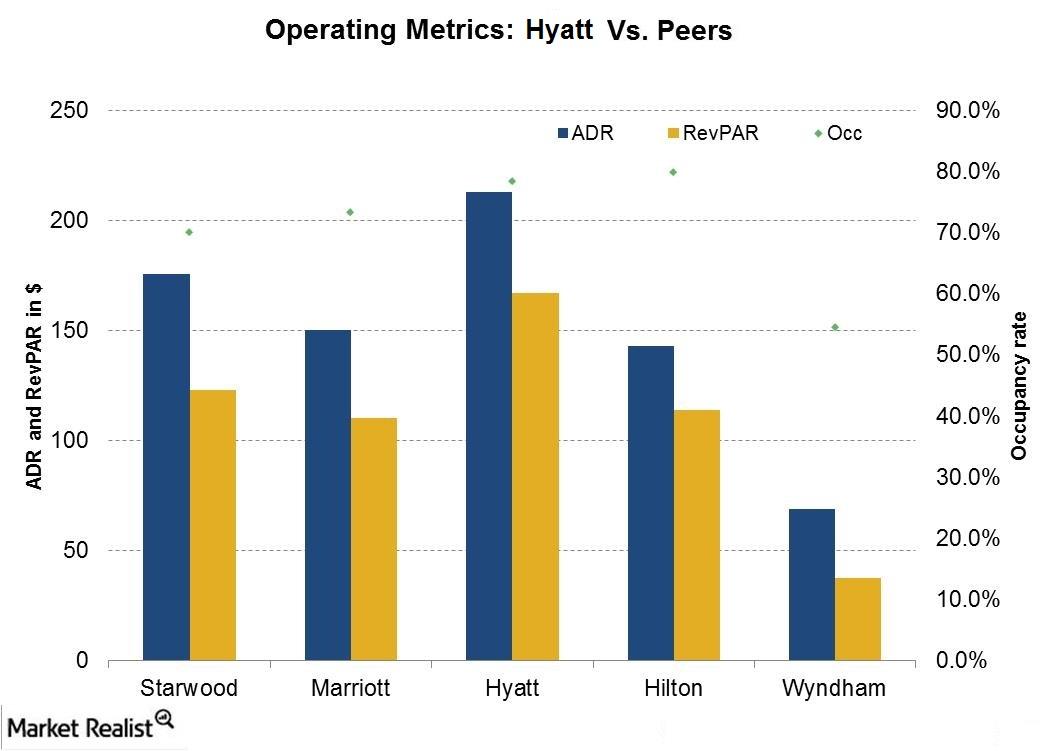

The average daily rate (or ADR) measures the average room price paid in the market. In 1Q17, the ADR rose 2.5% year-over-year (or YoY) to $124.27.

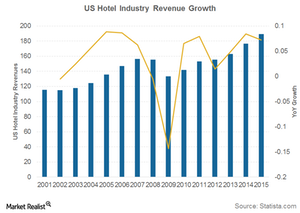

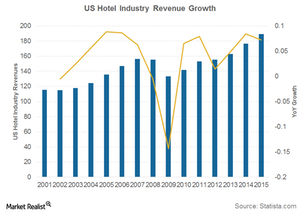

US Hotel Industry Supply to Outpace Demand in 2017

The US hotel industry saw its largest revenue fall of 14% year-over-year (or YoY) in 2009. Since then, recovery has been steep.

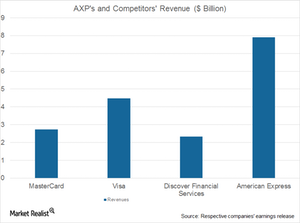

American Express to Ride on Partnerships, Digitization

American Express (or Amex) (AXP) has entered into digital partnerships with Airbnb, Facebook (FB), and Uber in order to offset the revenue loss from Costco (COST).

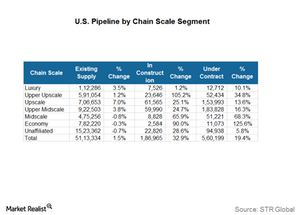

Why Hotel Investors Should Follow Construction Pipeline Data

According to STR Global’s US Construction Pipeline Report for January 2017, rooms under contract rose 16.1% to reach 576,000 rooms in 4,763 hotel properties.

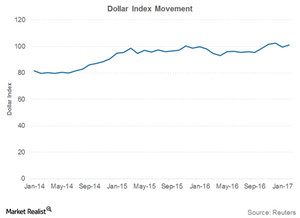

What a Strong US Dollar Means for the US Hotel Industry

The strength of the US dollar measured against currencies that are widely used in international trade is measured by the Trade Weighted Dollar Index.

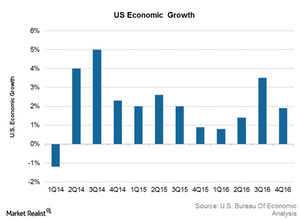

Why Economic Growth Is Important for the US Hotel Industry

A booming economy allows people to spend money on discretionary items such as air travel, so hotel revenues are higher during economic growth and lower during economic contraction.

What You Need to Know about the US Hotel Industry Performance

The hotel industry is largely driven by the growth of the general economy, which instills spending confidence in both businesses and households.

Vail Resorts: Exceptional Takes Time, According to Baron

Baron Capital began investing in Vail Resorts in 1997, and it owns a ~15%–20% stake in the company. According to Ron Baron, this investment has returned ~50%–75%.

What Are Investors Willing to Pay for Marriott International?

Marriott (MAR) currently trades at a forward EV-to-EBITDA multiple of 15.8x. Its valuation has been significantly higher than its average valuation.

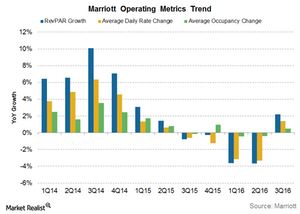

What Do Marriott’s Key Metrics Suggest ahead of 4Q16 Results?

For 3Q16, Marriott and Starwood Hotels & Resorts together added 17,600 rooms, taking the total to 4,554 properties and 777,000 timeshare resorts.

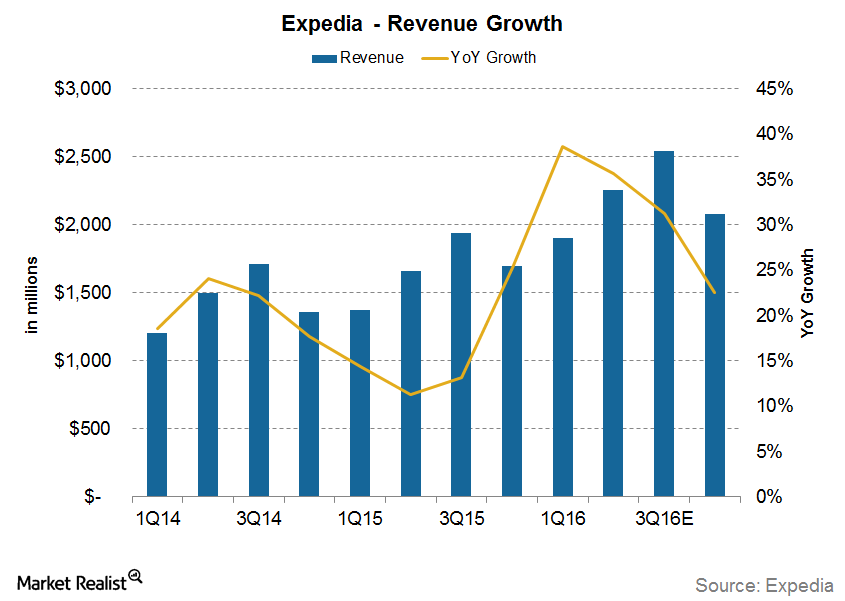

Can Expedia Continue Its Revenue Growth in 2016?

For 3Q16, analysts are estimating Expedia’s (EXPE) revenue to rise 31.3%. That’s slightly lower than the growth in the first and second quarters.

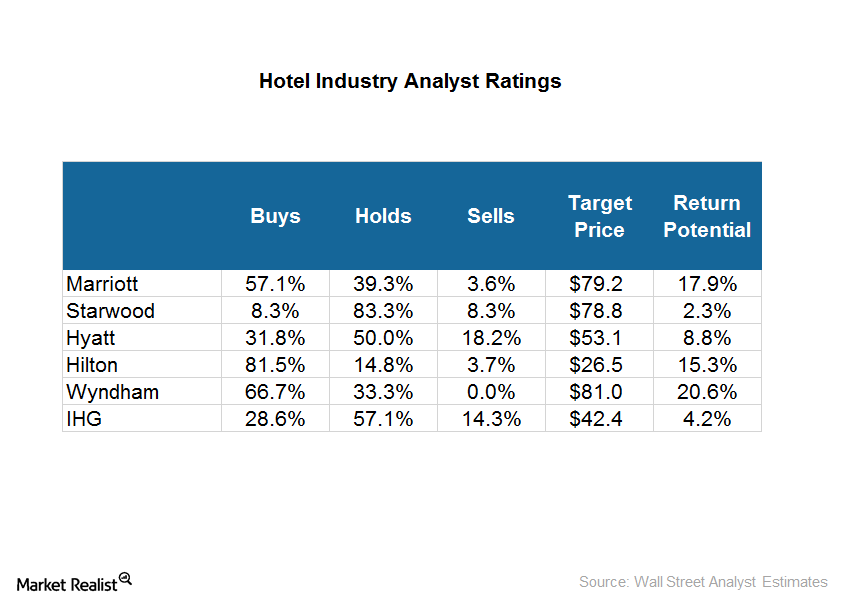

What Are Analysts’ Recommendations for Hotel Stocks?

Wyndham has the highest return potential of 21% with a target price of $81. Marriott is next with a return potential of 18% and a target price of $79.15.

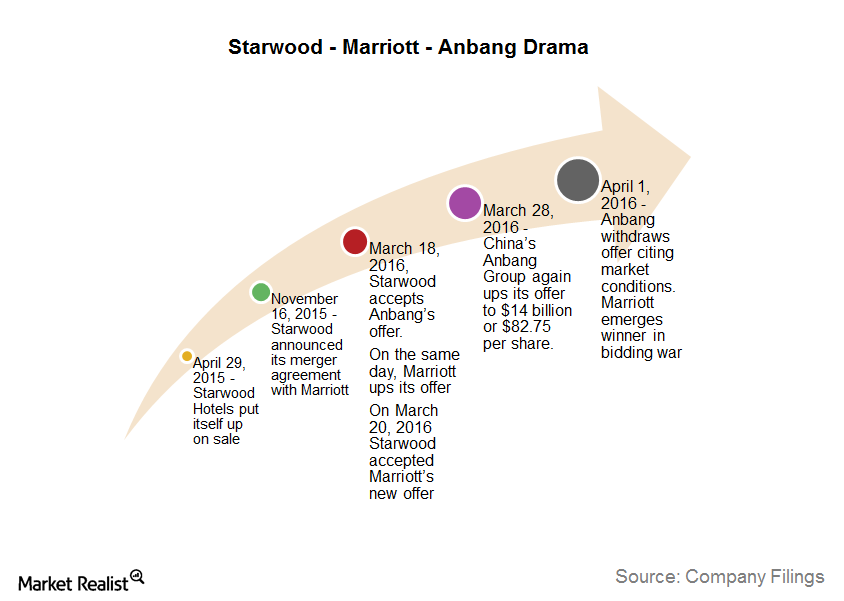

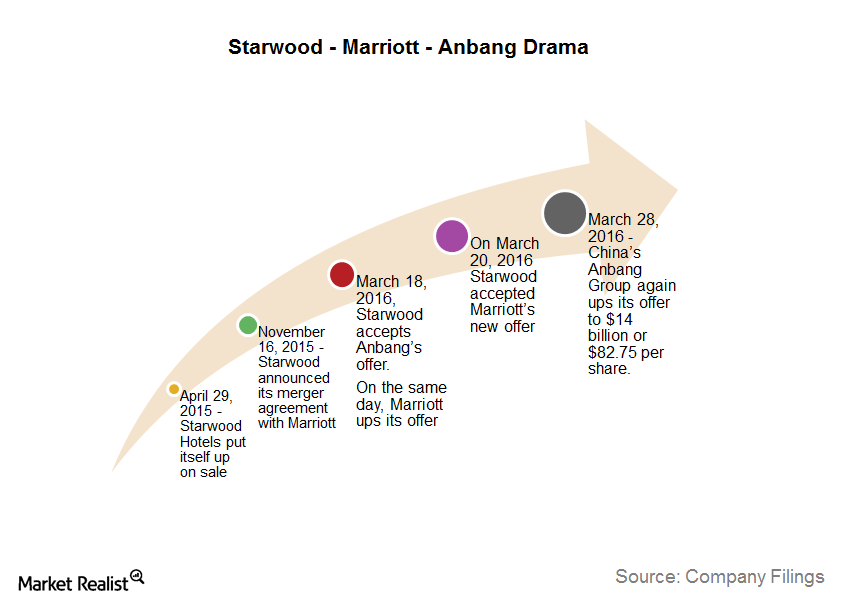

Analyzing the Key Events before the Marriott-Starwood Merger

On April 29, 2015, Starwood put itself up for sale. On August 29, 2015, Anbang offered to buy it at a 20% all-cash premium deal on its last closing price.

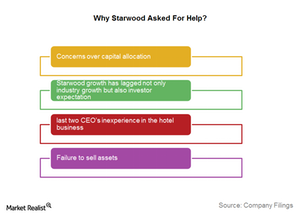

Why Did Starwood Sell Itself?

The last two years have been marked by turmoil for Starwood Hotels (HOT). Starwood’s properties include brands like the Sheraton, Westin, St. Regis, and W hotels.

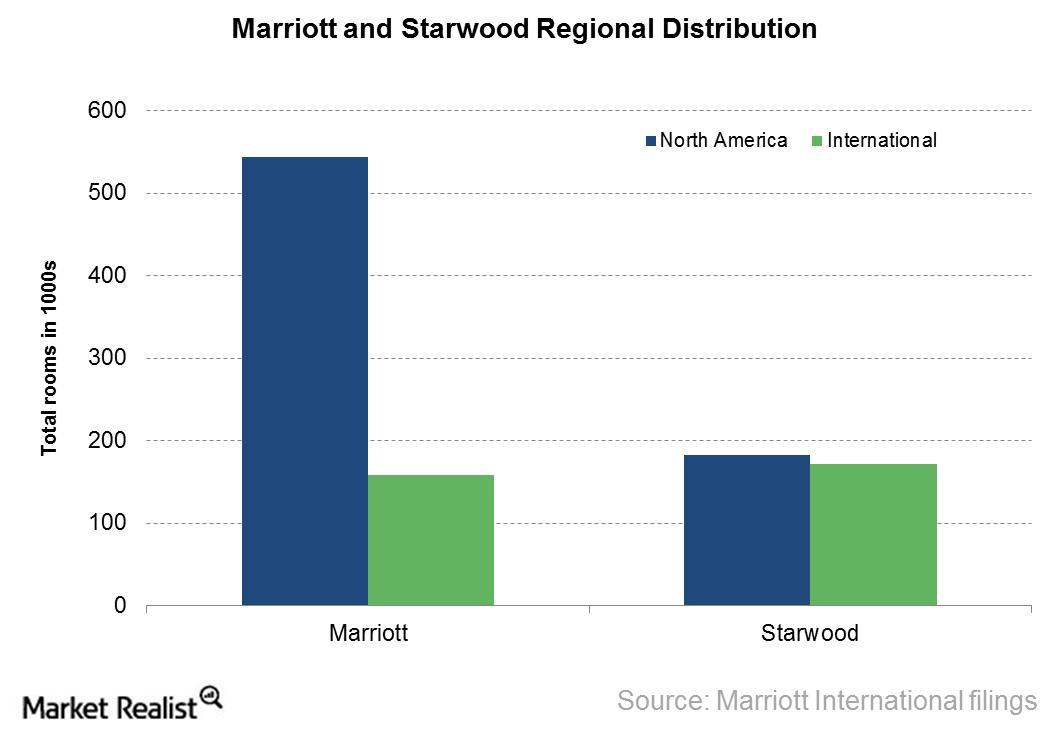

Marriott–Starwood Merger Synergies: The World’s Largest Hotel Chain

The Marriott–Starwood deal holds immense significance for Marriott International because the combined entity of Marriott International and Starwood Hotels and Resorts Worldwide would create the world’s largest lodging company.

The Starwood Sale: The Story to Date

In this series, we will discuss why Starwood (HOT) decided to put itself up for sale, how a merger with Starwood would benefit either Marriott or Anbang, and who could probably win this takeover tussle.

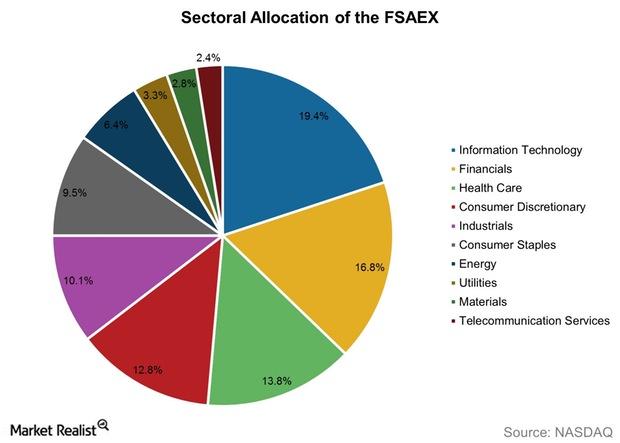

Fast Facts about the Fidelity Series All-Sector Equity Fund

The Fidelity Series All-Sector Equity Fund was founded in October 2008 and has an expense ratio of 0.67%. Shares of this fund are offered only to certain other Fidelity funds.

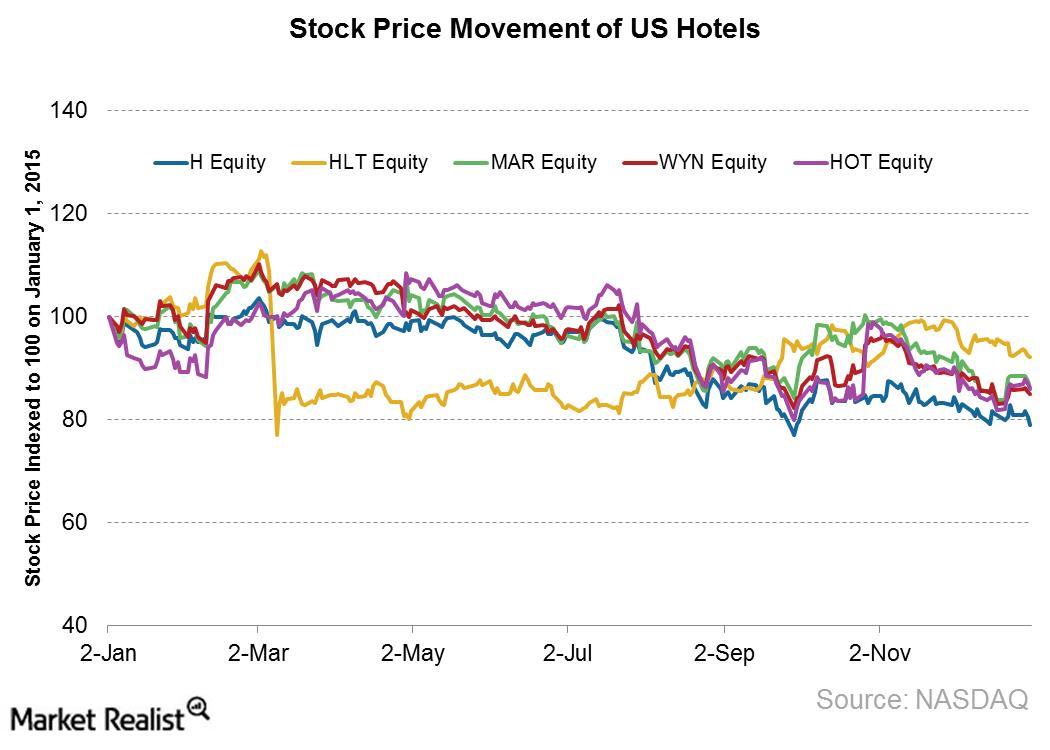

Understanding the Hotel Industry Valuation Multiple

The forward EV-to-EBITDA multiple for the hotel industry currently stands at 9. It has declined from 13.1, which was recorded at the beginning of 2015.

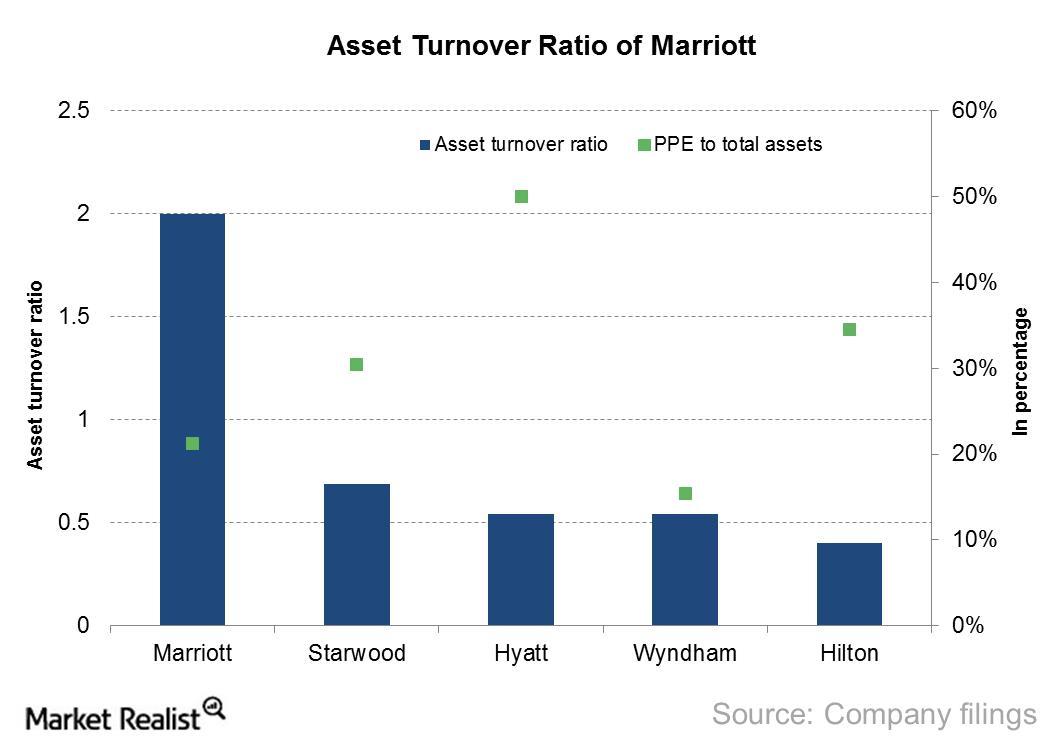

What You Ought to Know about Marriott International’s Asset Utilization

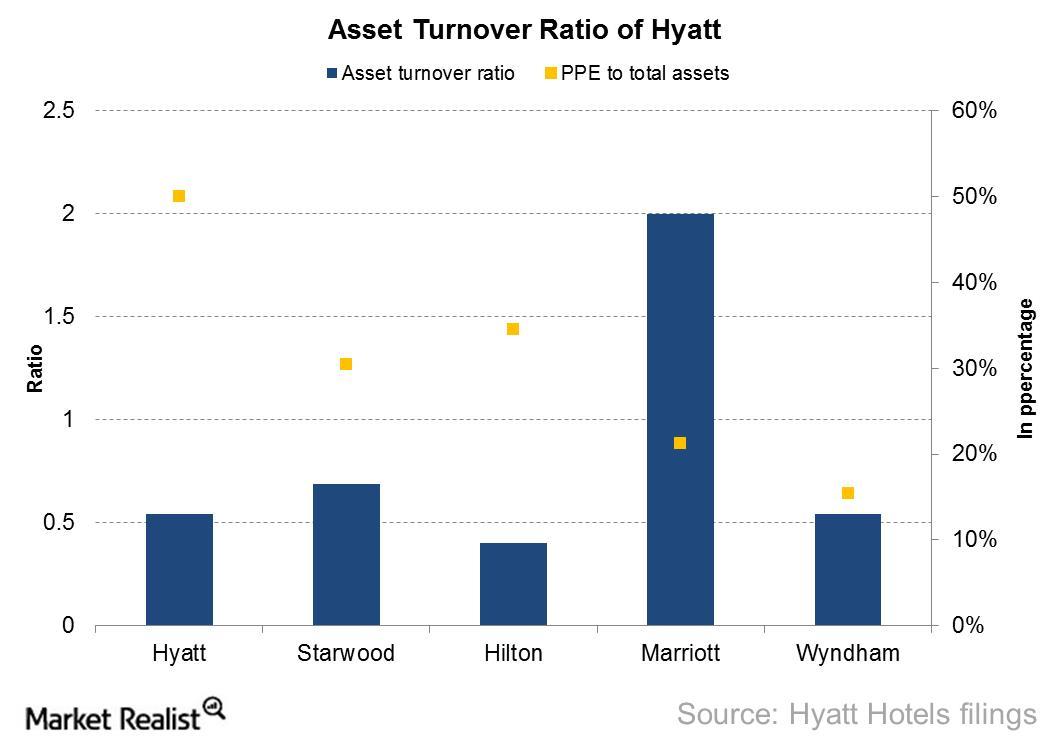

Marriott has one of the lowest asset bases among its industry peers, having reduced its PPE-to-total-assets ratio from 24% in 2012 to 21.2% in 2014.

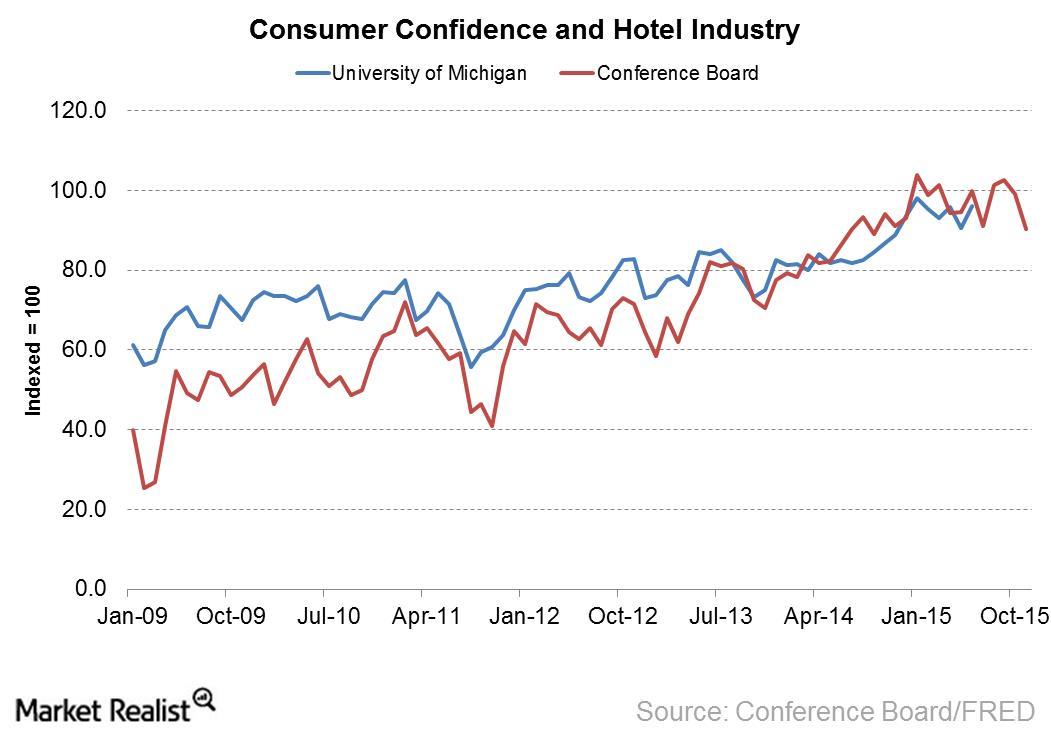

How Could Falling Consumer Confidence Affect the Hotel Industry?

The Conference Board Consumer Confidence Index as of November 2015 was 90.4 compared to 102.6 in September 2015.

An Investor’s Introduction to the US Hotel Industry

Hotel investors can use the indicators discussed in this series to gauge the industry’s general trends. Leisure travelers make up ~60% of the total hotel room sales, and business travelers account for 40% of total sales.

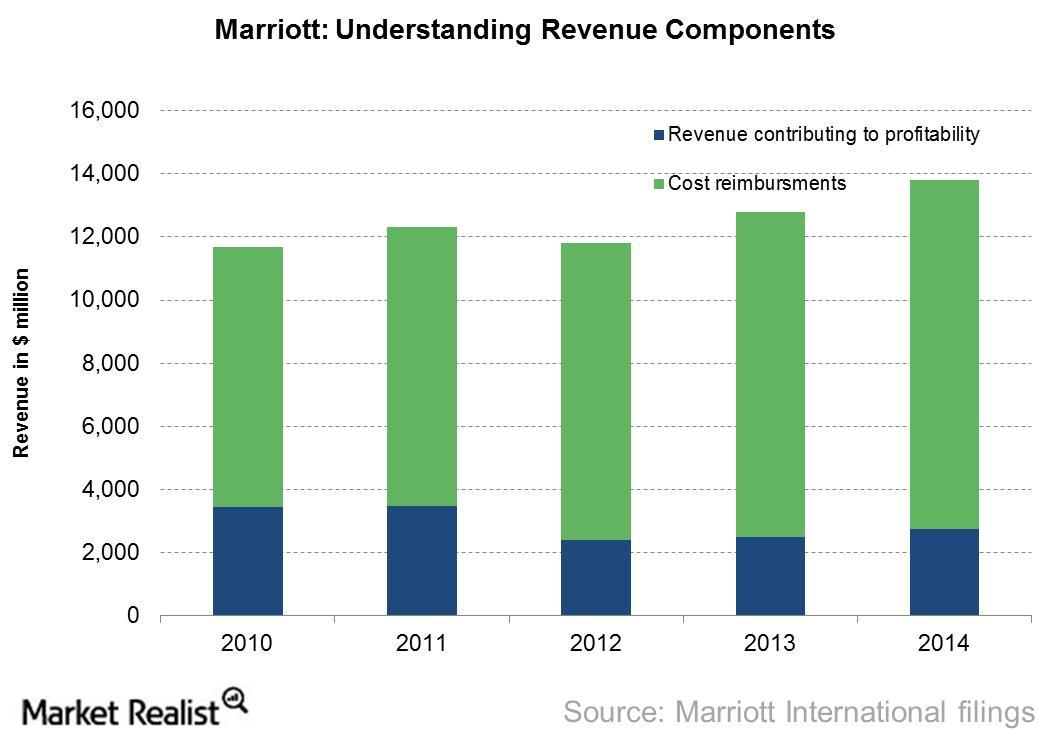

Understanding Cost Reimbursements as a Key Part of Marriott International’s Revenues

Cost reimbursements make up a major component of Marriott’s revenues and mostly consist of salaries paid to employees working in Marriott-managed hotels.

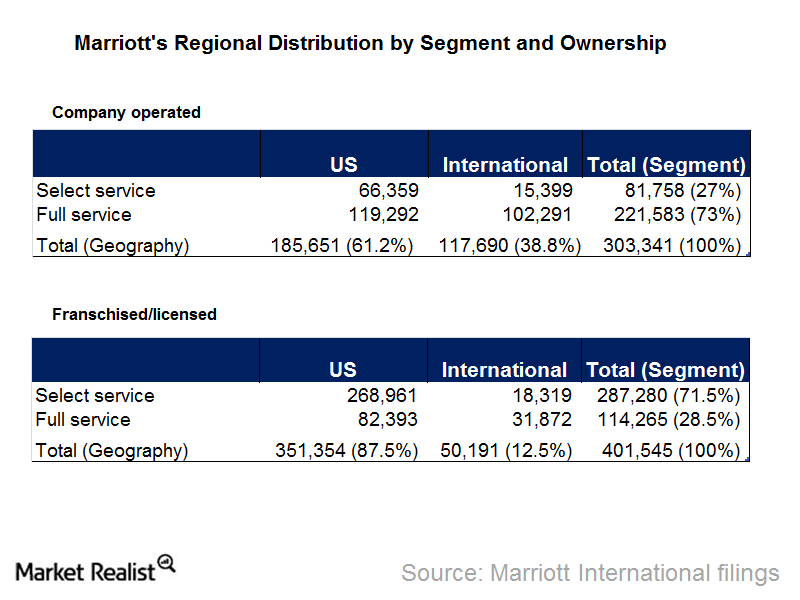

Why Marriott Relies Heavily on Its Franchise Model for Growth

Marriott now focuses on capital-light segments like franchised properties. Its fee incomes rose from $1.2 billion to $1.7 billion between 2006–2014.

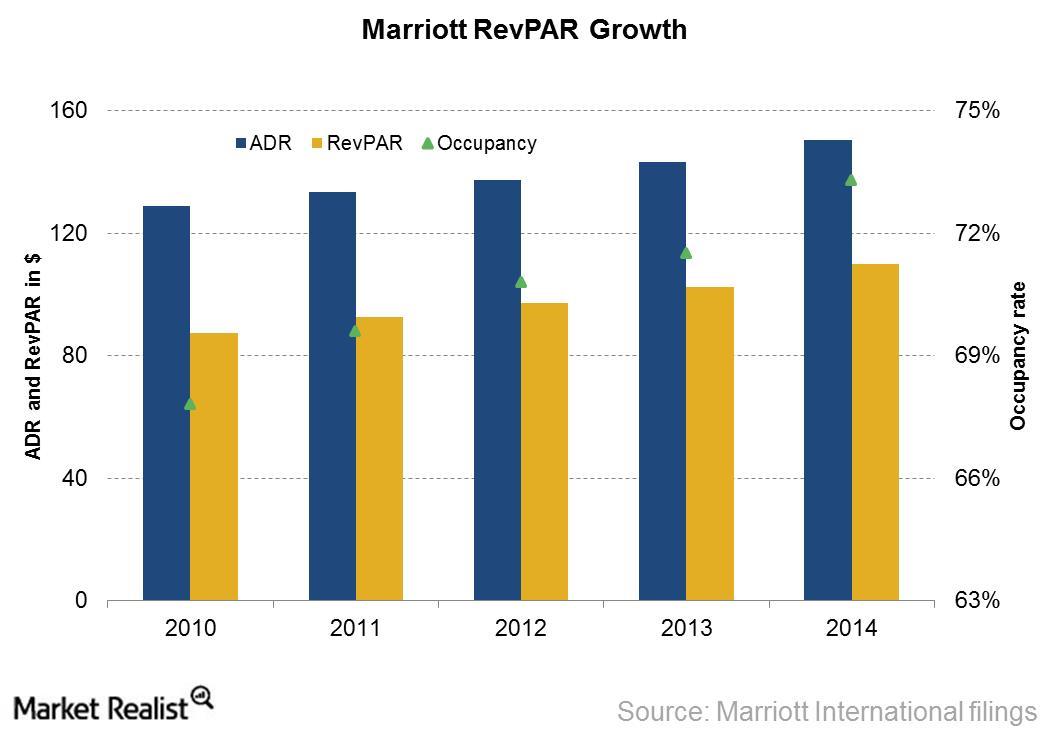

Industry-Wide Demand Growth Drives Marriott International’s RevPAR

Marriott International saw strong increases in RevPAR—from $87 to $110—between 2010 and 2014.

Just How Much Does Marriott International Stand to Benefit from the Starwood Acquisition?

Marriott’s acquisition of Starwood will likely help Marriott double its international portfolio while diversifying its global presence.

Acquisitions and Joint Ventures Drive Marriott’s International Expansions

Marriott has been able to expand its international business by both acquiring and creating brands that enable it to enter new markets and market segments.

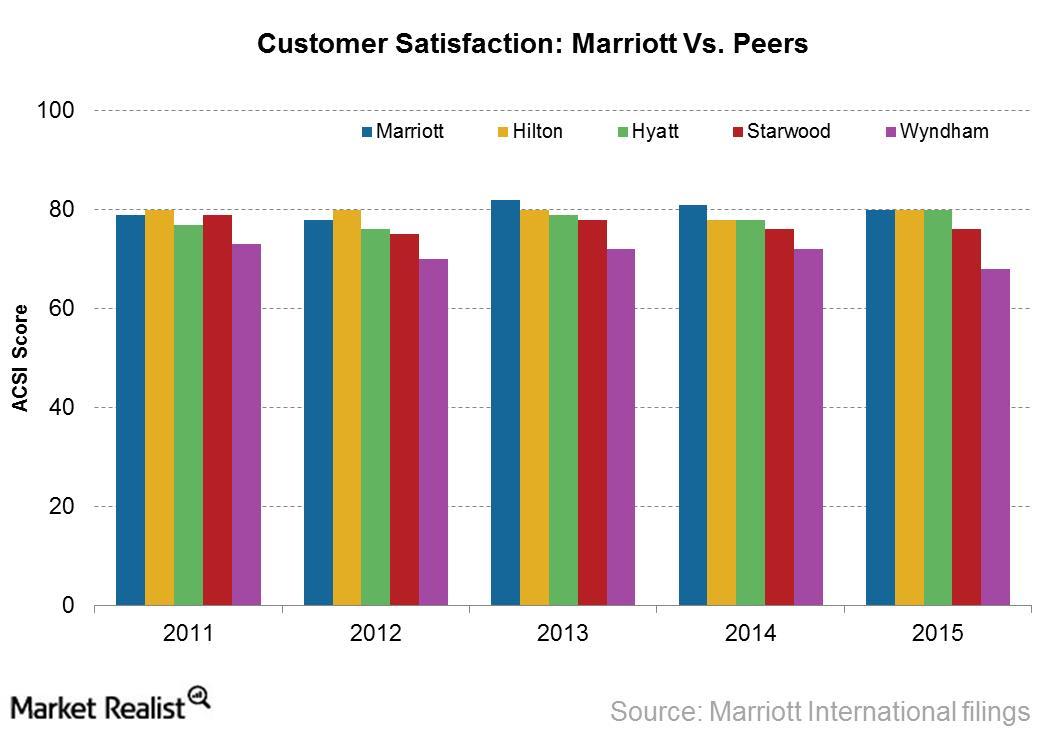

Marriott International in the Eyes of Customers: Outside Looking In

In 2015, Marriott topped the ACSI survey with a score of 80. It also topped the survey in 2014 and 2013, with scores of 83 and 81, respectively.

Marriott International’s Business Model by Service Category: Key Investor Takeaways

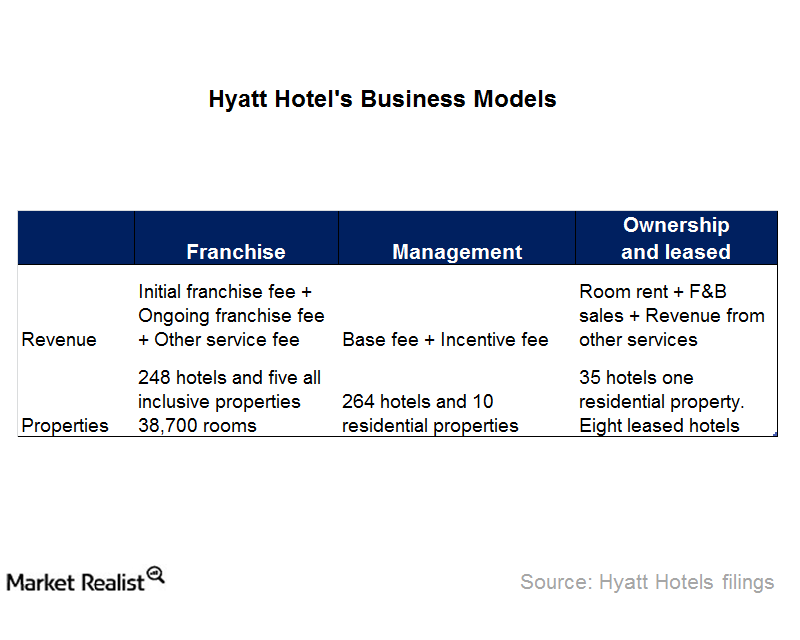

At the end of 2014, Marriott had around 2,882 franchised hotel properties, with 388,670 rooms under the franchise model.

Introducing Marriott International: Your Key Company Overview

Marriott International is known for its wide range of budget and luxury hotels. Its acquisition of Starwood will make it the world’s largest hotel chain.

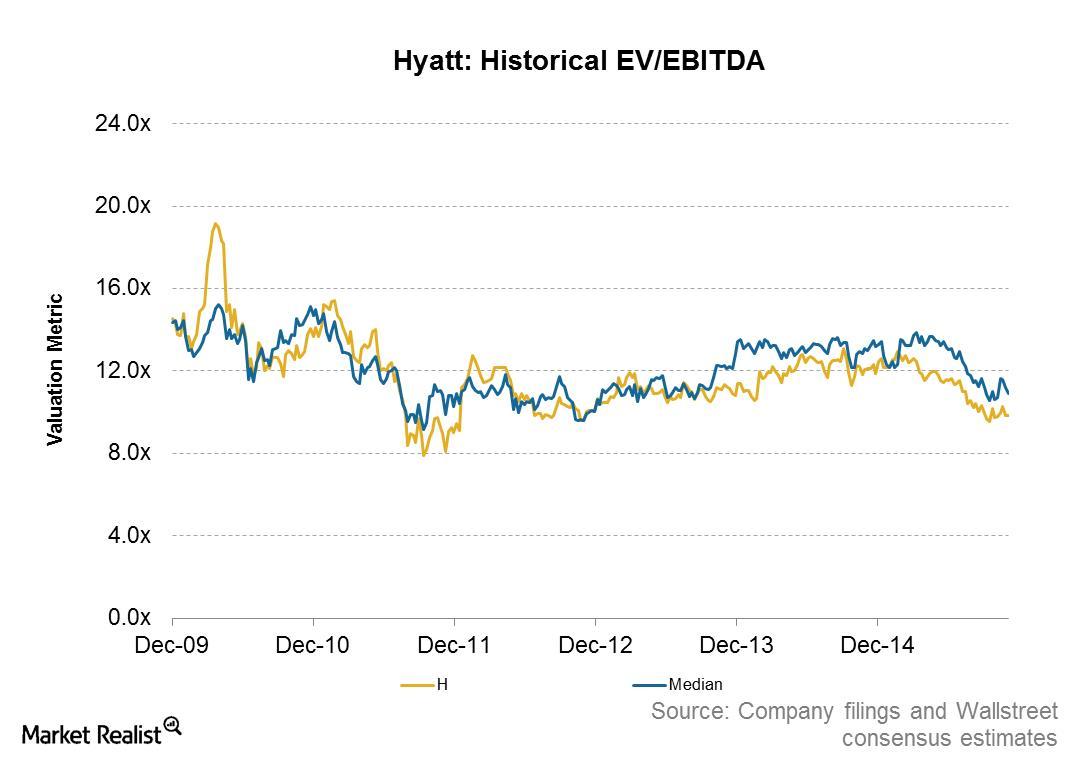

Investor Essentials: Understanding Hyatt’s Valuation Multiple

Hyatt’s EV/EBITDA has moved in line with the median valuation multiple of its peers. Hyatt, with rare exceptions, has always traded at a discount to the median valuation multiple of its peers.

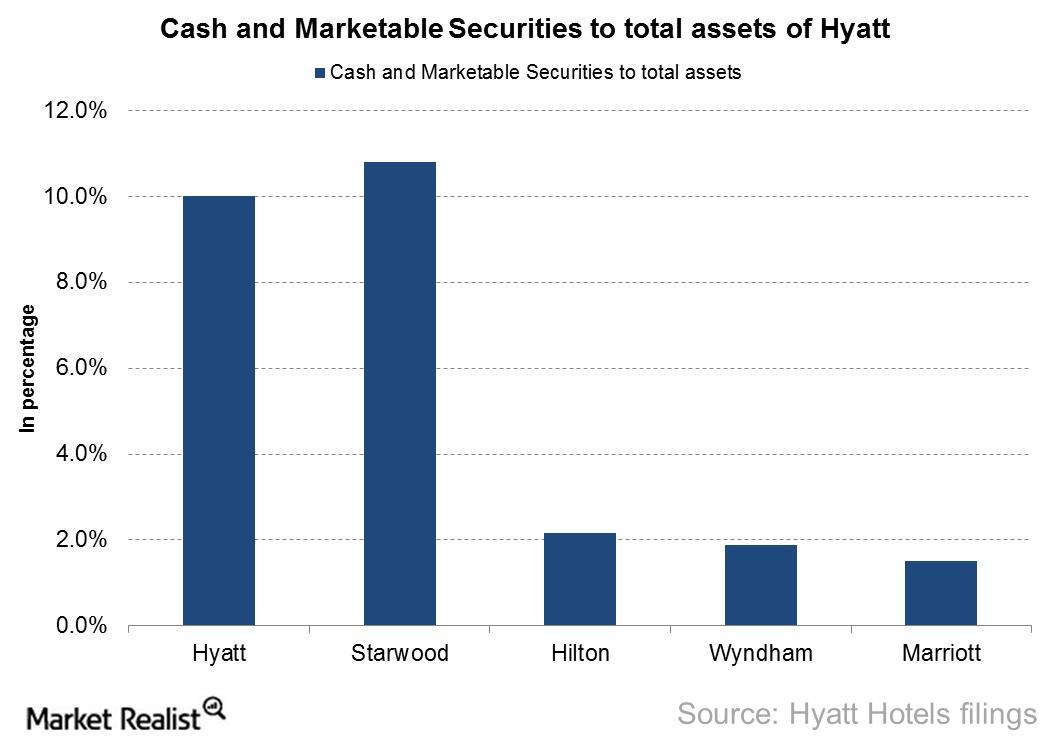

Why Hyatt Has High Liquid Assets Compared to Its Peers

As of December 31, 2014, Hyatt’s cash, cash equivalents, and marketable securities as a percentage of total assets is one of the highest among its peers, at 10%.

Asset Utilization by Hyatt Hotels

Hyatt had the lowest return on assets (or ROA) ratio among its peers at 4.6% for fiscal 2014 due to lower profits generated from its assets.

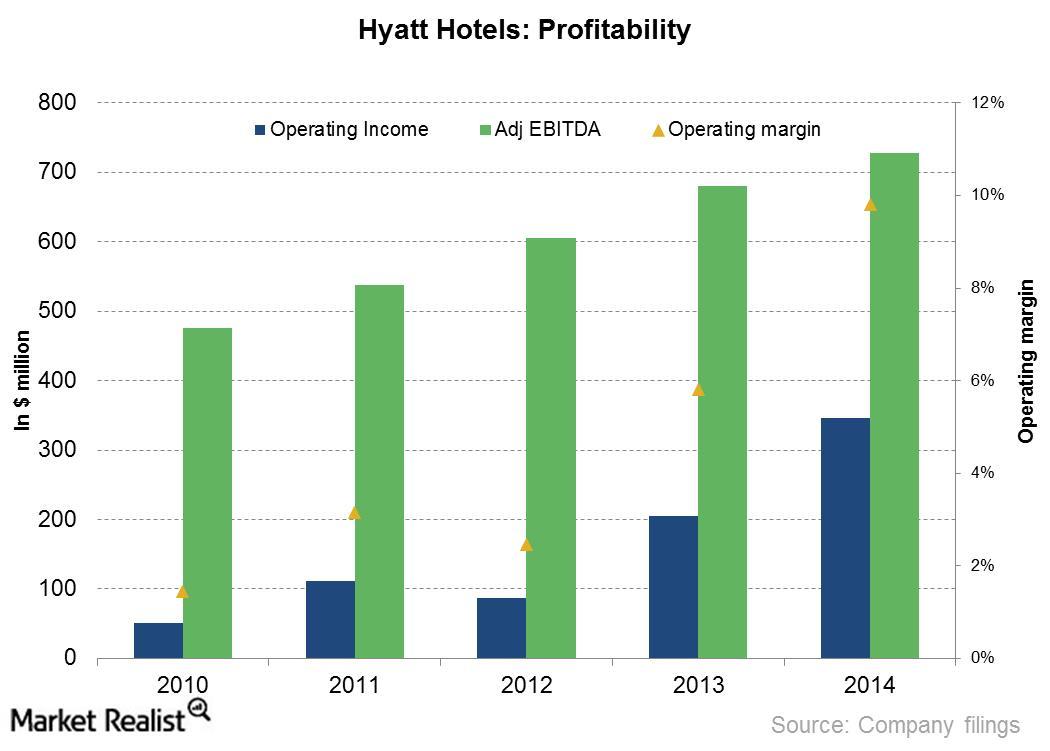

Profitability Margins Grew for Hyatt Hotels

Operating margins for Hyatt Hotel (H) increased from 1.4% in 2010 to 6.3% in 2014. The growth in margins was largely driven by steady growth in revenue and declining expenses from the owned and leased hotels segment.

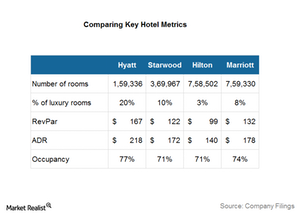

Why Hyatt Has the Highest ADR and Occupancy Rate Among Its Peers

At 76.2%, Hyatt Hotels (H) had one of the highest occupancy rates among its peers for its owned and leased hotels in 2014.

How Does Hyatt Make Money from Its Hotels?

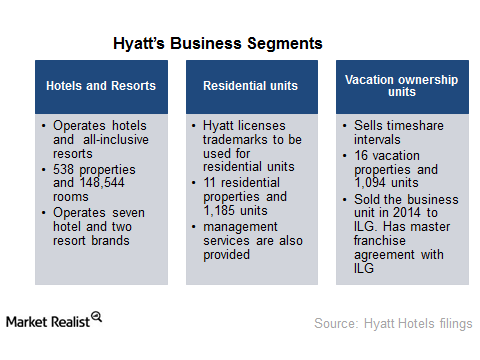

Hyatt (H) operates its hotels and other business segments under three models: franchise, management, and ownership models.

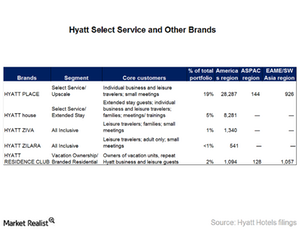

Introduction to Hyatt’s Select Service Brands and Other Brands

Hotels that offer accommodation with limited services and amenities are called select service hotels. Hyatt (H) operates about 37,500 rooms and two brands under this segment.

An Overview of Hyatt Hotels’ Competition

Some of Hyatt’s competitors—Hilton (HLT), Marriott (MAR), Wyndham (WYN), and Starwood (HOT)—compete in all the segments: Hotels and Resorts, Residential Units, and Vacation Ownership Units.