Asset Utilization by Hyatt Hotels

Hyatt had the lowest return on assets (or ROA) ratio among its peers at 4.6% for fiscal 2014 due to lower profits generated from its assets.

Jan. 7 2016, Updated 8:07 a.m. ET

High PPE to total assets ratio

Hyatt (H) has a high-quality asset base. The company owns hotels in gateway cities and leading tourist destinations. It believes that as demand increases, higher operating leverage from owning hotels should result in accelerated earnings growth.

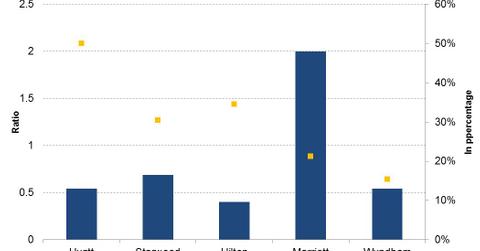

This is reflected in Hyatt’s high plant, property, and equipment (or PPE) ratio to its total assets. The PPE to total assets ratio of Hyatt for the year ended 2014 is the highest among its peers, at 50%. Hilton (HLT) recorded a PPE of 34.5%, followed by Starwood (HOT) at 30.4%, Marriott at 21.2%, and Wyndham at 15.4%.

Asset turnover ratio

Hyatt (H) recorded a lower-than-average asset turnover ratio among its peers at 0.54 for fiscal 2014. Among its peers, Marriott recorded the highest asset turnover ratio at 2, followed by Starwood (HOT) at 0.69, Wyndham (WYN) at 0.54, and Hilton at 0.4. Hyatt has the lowest asset turnover ratio due to higher number owned properties. The

Hyatt has the lowest asset turnover ratio due to a higher number of owned properties. The company’s asset-heavy model gives lower revenue per dollar worth of assets. From the chart, it is clear that the companies with lower PPE-to-net-asset ratio have a higher asset turnover ratio. The only exception is Wyndham, which has a low asset turnover

The only exception is Wyndham, which has a low asset turnover despite its low PPE-to-net-asset ratio. This is due to the high exposure of Wyndham to its timeshare business. Hyatt has seen marginal growth in its asset turnover ratio from 0.49 in 2010. The assets have seen flat growth since 2010. Rapid growth in revenue has resulted in a higher asset turnover ratio.

ROA and ROE

Hyatt had the lowest return on assets (or ROA) ratio among its peers at 4.6% for fiscal 2014 due to lower profits generated from its assets. Marriott had the highest ROA of 16%, followed by Starwood at 9.4%, Wyndham at 7.5%, and Hilton at 5.1%. Hyatt’s return on equity is also the lowest among its peers at 7.3%, compared to its peers Wyndham at 36%, Starwood at 25.9%, and Hilton at 14.8%.

Hyatt had one of the lowest leverage ratios among its peers for the year ended December 31, 2014. The capital structure, which relies heavily on equity, has resulted in a lower-than-average return on equity.

Investors can gain exposure to the hotel sector by investing in the First Trust US IPO Index ETF (FPX), which invests about 6% in the hotel sector.