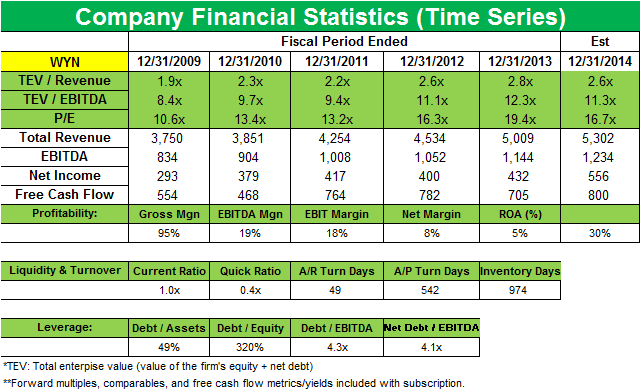

Wyndham Worldwide Corp

Latest Wyndham Worldwide Corp News and Updates

Overview: Hilton Worldwide Holdings Inc.

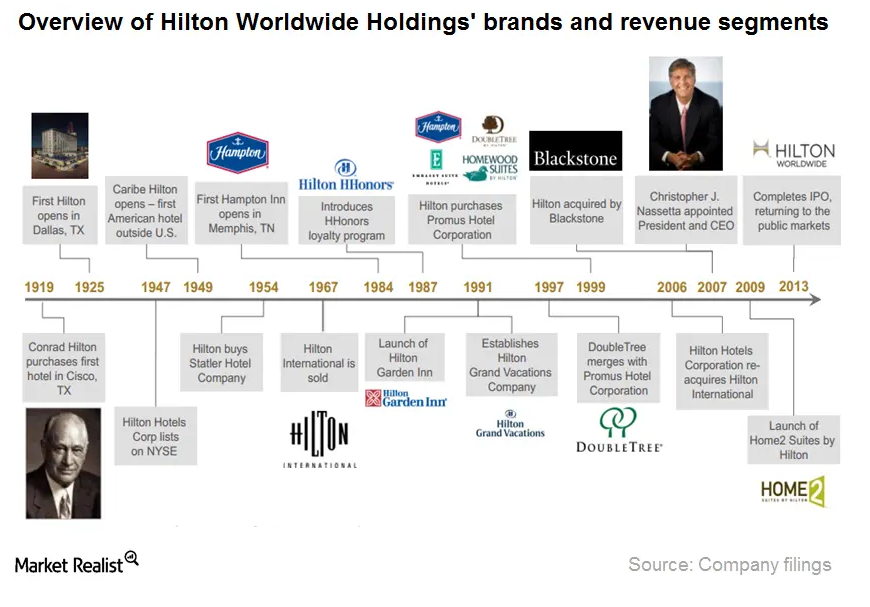

Hilton Worldwide Holdings is one of the largest hospitality companies in the world. It was founded in 1919 by Conrad Hilton. The company started when he bought his first hotel in Texas.

Why Chilton starts new position in Wyndham Worldwide

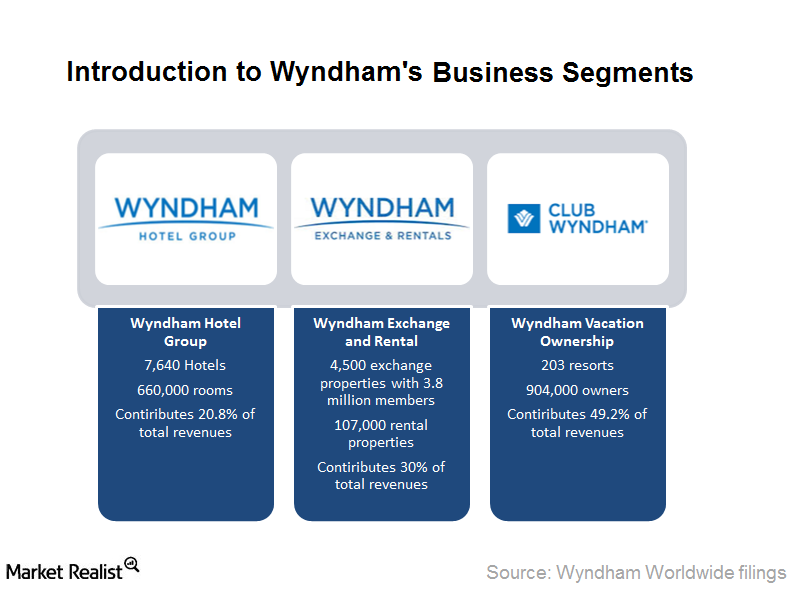

Approximately 63% of Wyndham’s revenues come from fees for providing services referred to as its “fee-for-service” businesses.Consumer Why trend in fee income is an important source of revenue

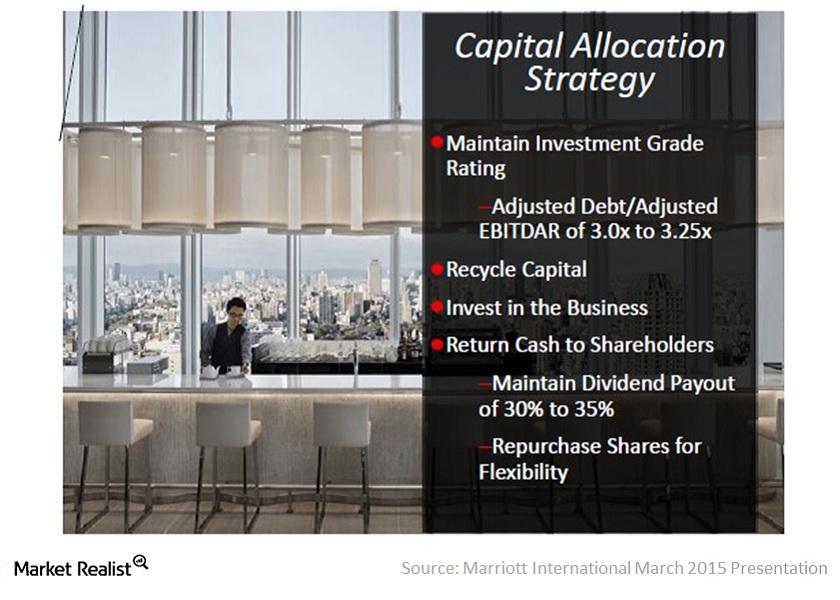

Marriott increased its fee income at a ten-year compound annual growth rate (or CAGR) of 7.6% to $1,543 million in 2013—from $742 million in 2003.

Big Hotels on the Block: Sizing up Wyndham Worldwide’s Competitors

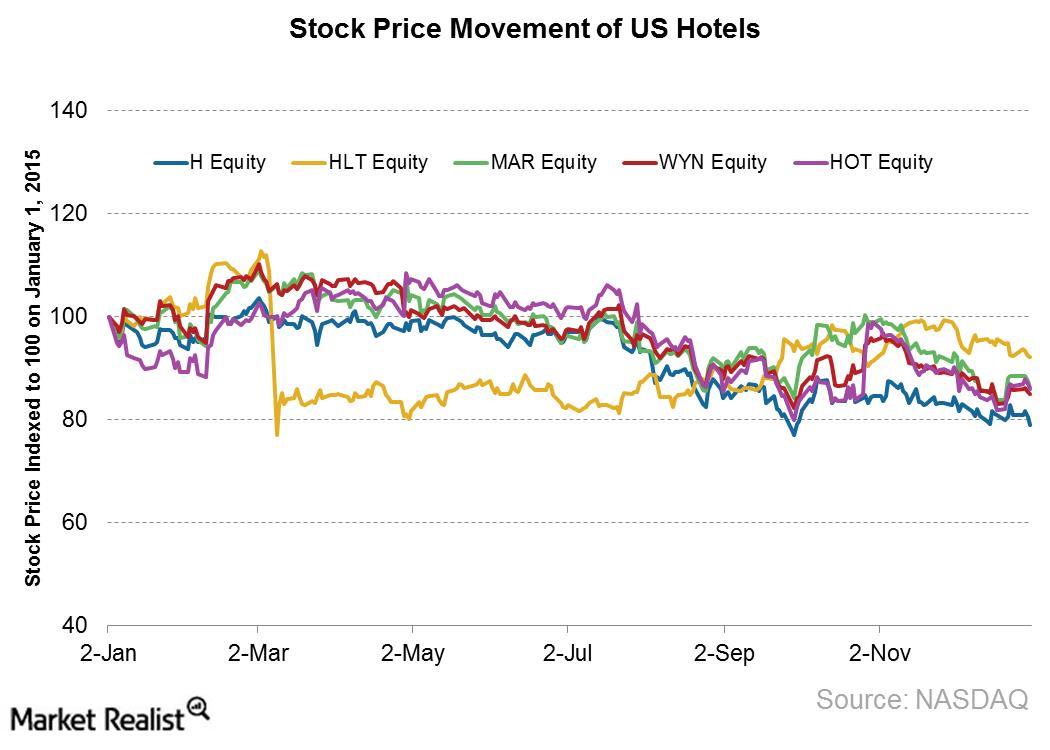

Since 2010, Wyndham’s stock has outperformed all its peers, growing by over 270%. In that time, Marriot grew by ~176%, Starwood by 102%, and Hyatt by 67%.

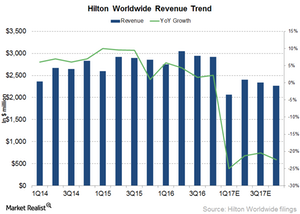

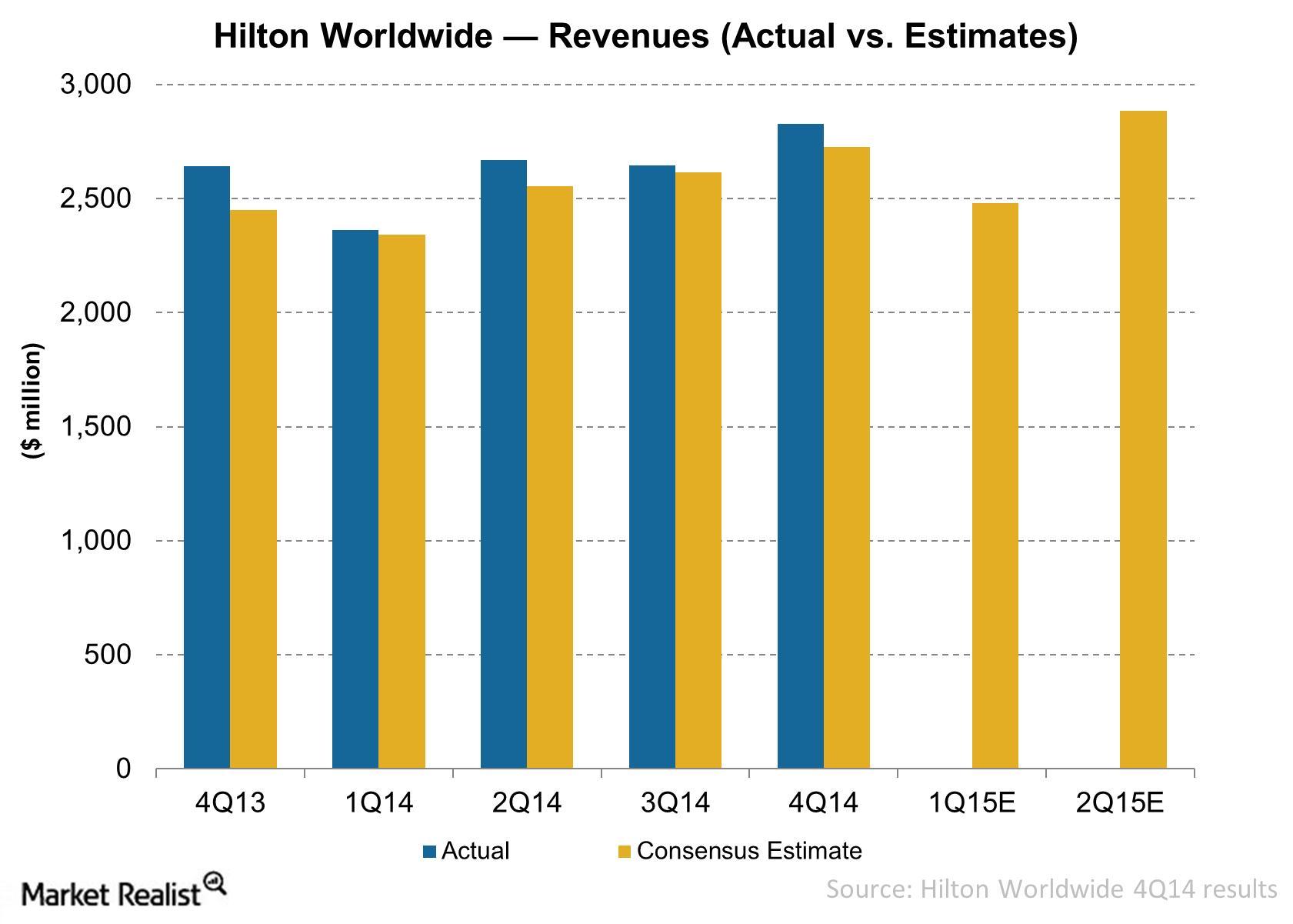

Will Hilton’s Top Line Grow in 2017?

For 1Q17, analysts are estimating Hilton’s (HLT) revenue to fall 25% to $2.1 billion.

Why Marriott is Buying Back Its Own Shares

Marriott repurchased 7.7 million shares of common stock valued at $544 million in 4Q14 and 24 million shares for $1.5 billion in 2014.

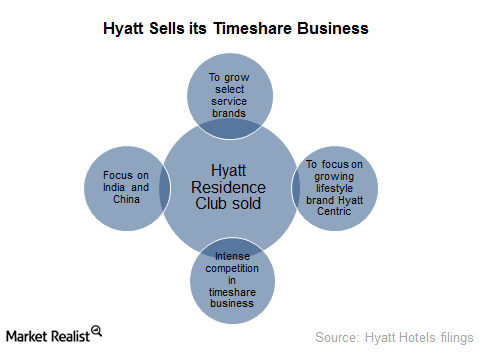

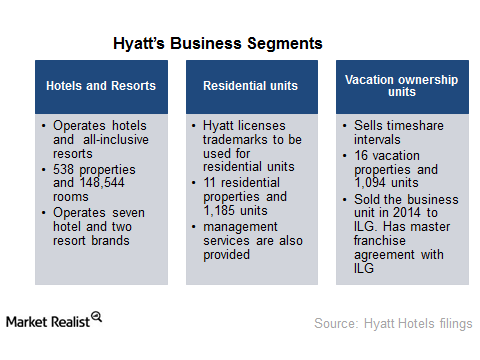

Why Did Hyatt Sell Its Vacation Ownership Segment?

Hyatt is focusing on increasing its presence to under-penetrated markets. The company believes that its presence in emerging markets such as India and China is essential for its growth.Consumer Why Marriott is slowly expanding in international markets

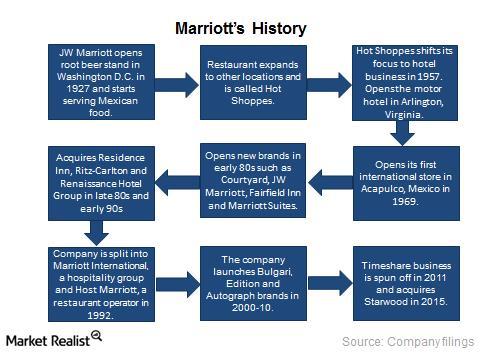

Marriott has been expanding its presence in the international market. It added new brands in Europe, Asia Pacific, and the Middle East and African regions.Must-know: Marriott International Inc.

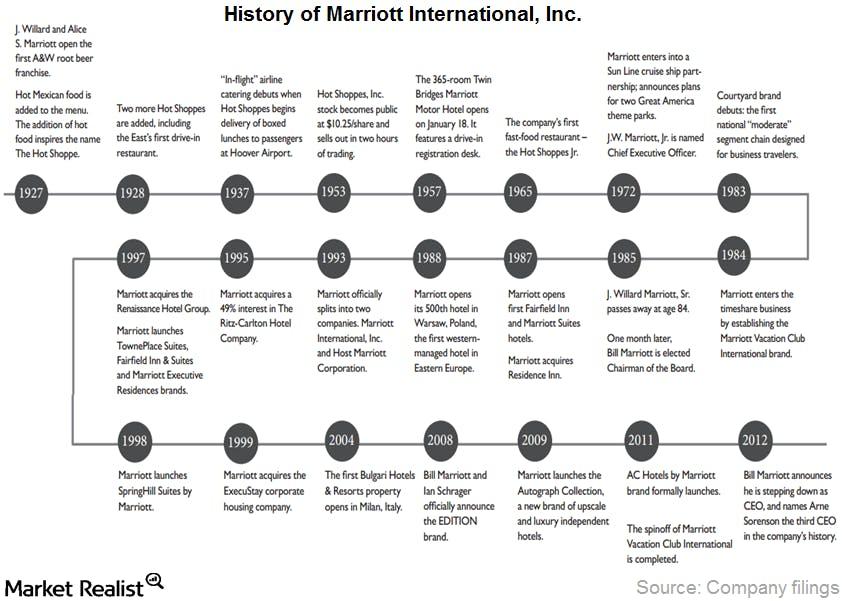

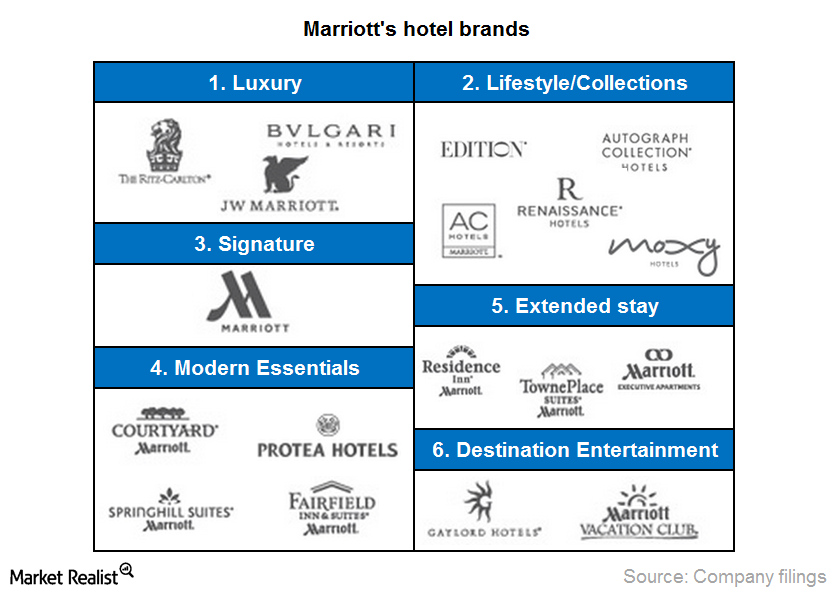

Marriott International’s headquarters are in Bethesda, Maryland. The company was founded in 1927 by J. Willard and Alice S. Marriott.Consumer Hilton’s diversified portfolio with 11 world-class brands

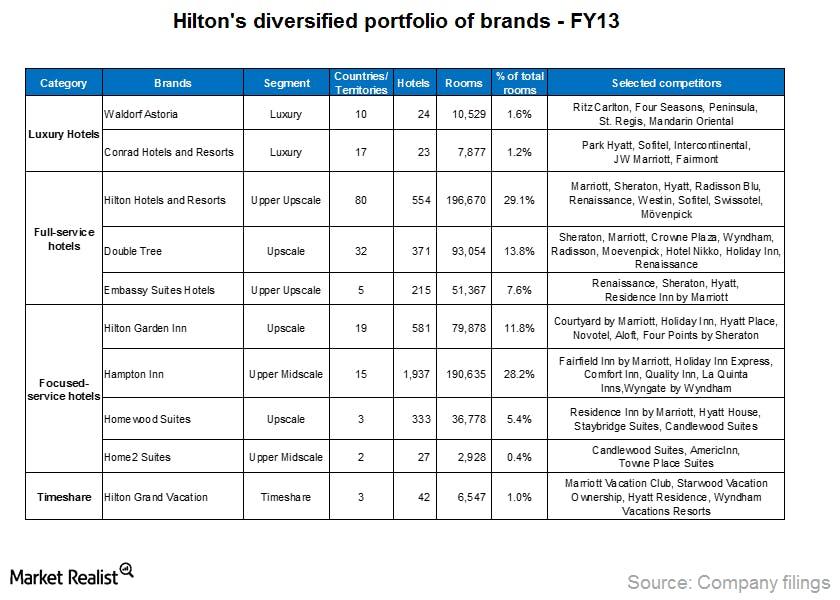

Hilton’s goal is to serve any customer, anywhere in the world, for any lodging need that they have. The company has a portfolio of 11 world-class brands. Hilton’s portfolio allows it to accomplish this goal.Hilton’s hotel room composition by brand and chain scale

Hotel companies, like Hilton, expand their operations based on the demand for accommodations by location. They also expand based on customer preference for the level of service offerings.

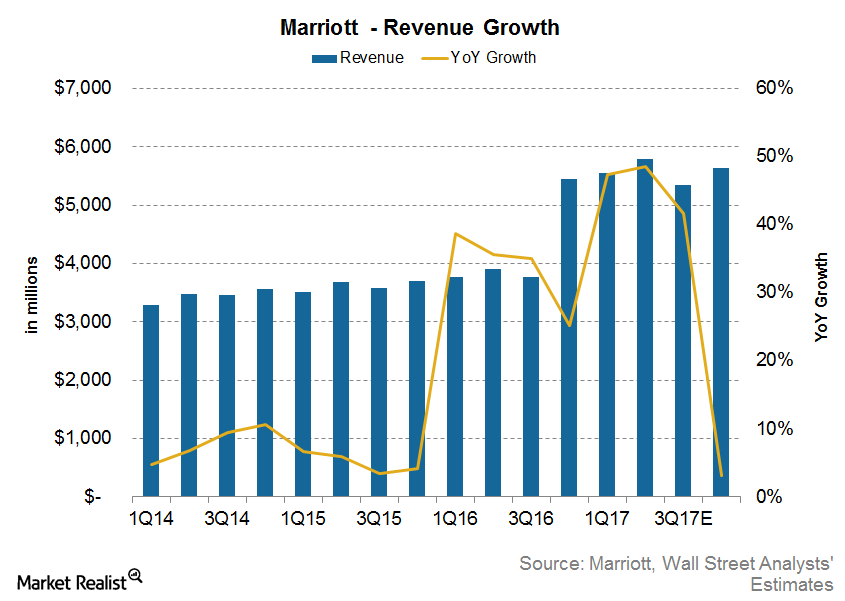

Marriott’s Revenue Is Now Expected to Go This Way in 2017

In 2Q17, Marriott’s revenues grew 49% YoY to $5.8 billion, compared with $3.9 billion in 2Q16, due to higher fee revenues and RevPAR and room growth.

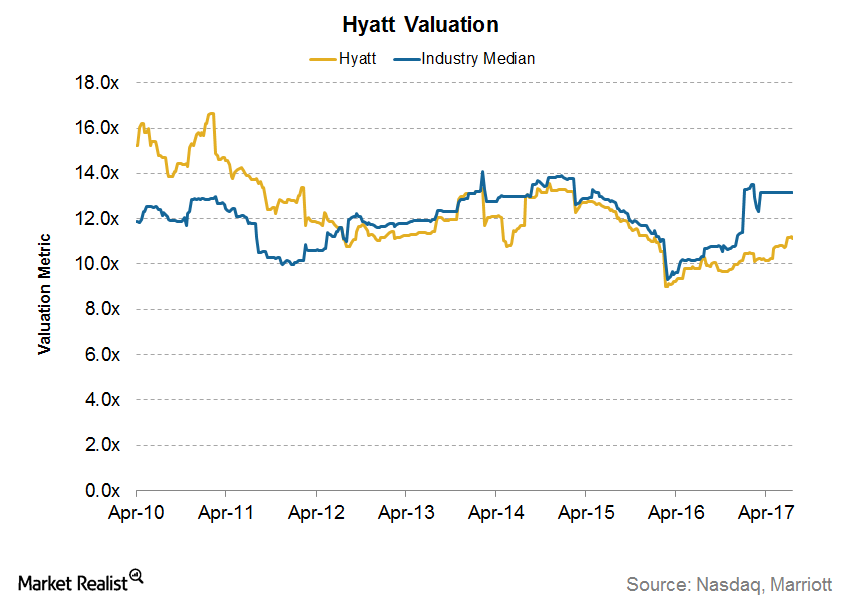

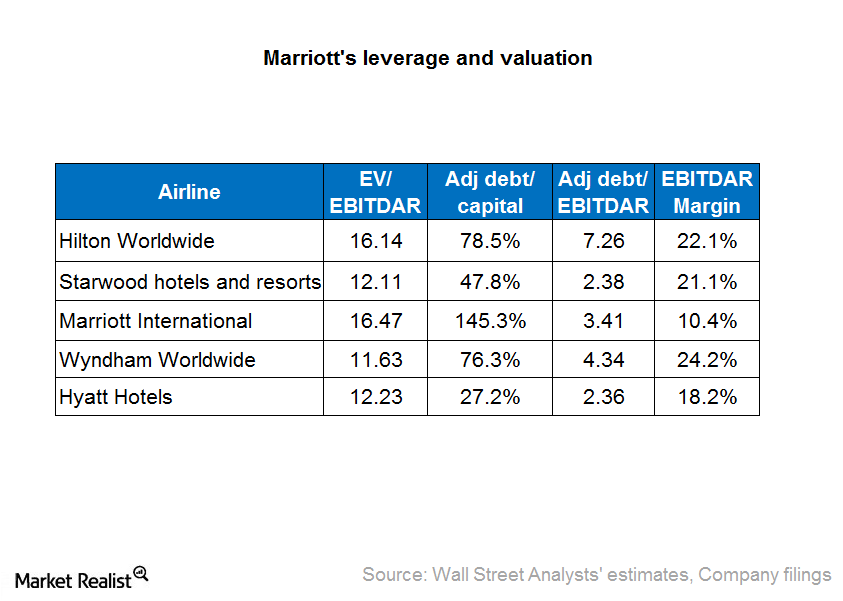

How Hyatt’s Valuation Compares

Current valuation Hyatt (H) currently trades at a forward EV-to-EBITDA multiple of 15.1x. Hyatt’s valuation is significantly higher than its average valuation since January 2010 of 13.0x. Peer comparison Hyatt’s valuation is among the highest in its peer group. Marriott International (MAR) has a multiple of 15.3x, Hilton Worldwide Holdings (HLT) is trading at a […]

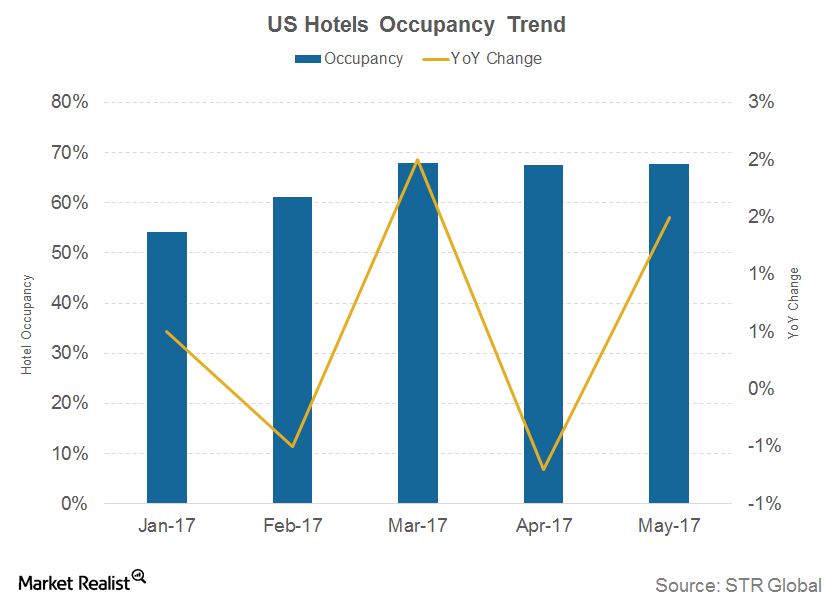

Average Daily Rate Will Drive US Hotel Industry Growth

The average daily rate (or ADR) measures the average room price paid in the market. In 1Q17, the ADR rose 2.5% year-over-year (or YoY) to $124.27.

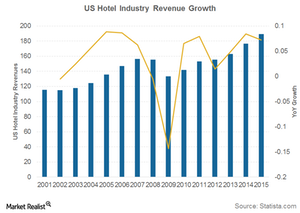

US Hotel Industry Supply to Outpace Demand in 2017

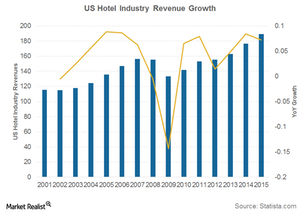

The US hotel industry saw its largest revenue fall of 14% year-over-year (or YoY) in 2009. Since then, recovery has been steep.

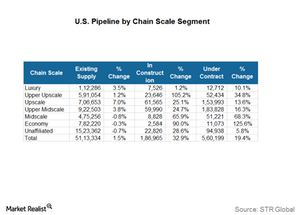

Why Hotel Investors Should Follow Construction Pipeline Data

According to STR Global’s US Construction Pipeline Report for January 2017, rooms under contract rose 16.1% to reach 576,000 rooms in 4,763 hotel properties.

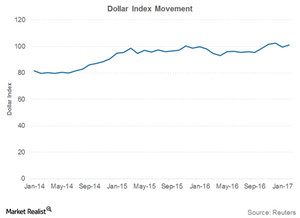

What a Strong US Dollar Means for the US Hotel Industry

The strength of the US dollar measured against currencies that are widely used in international trade is measured by the Trade Weighted Dollar Index.

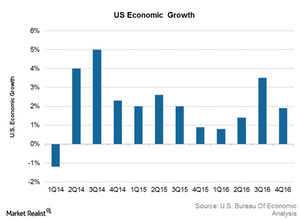

Why Economic Growth Is Important for the US Hotel Industry

A booming economy allows people to spend money on discretionary items such as air travel, so hotel revenues are higher during economic growth and lower during economic contraction.

What You Need to Know about the US Hotel Industry Performance

The hotel industry is largely driven by the growth of the general economy, which instills spending confidence in both businesses and households.

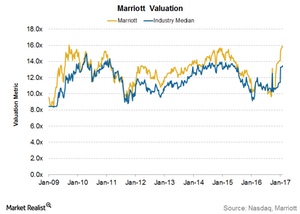

What Are Investors Willing to Pay for Marriott International?

Marriott (MAR) currently trades at a forward EV-to-EBITDA multiple of 15.8x. Its valuation has been significantly higher than its average valuation.

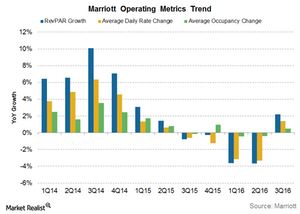

What Do Marriott’s Key Metrics Suggest ahead of 4Q16 Results?

For 3Q16, Marriott and Starwood Hotels & Resorts together added 17,600 rooms, taking the total to 4,554 properties and 777,000 timeshare resorts.

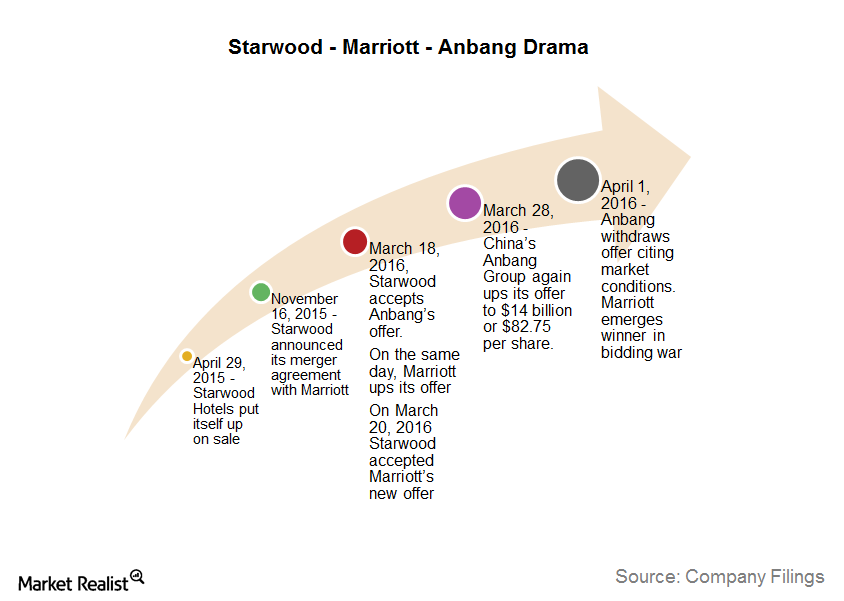

Analyzing the Key Events before the Marriott-Starwood Merger

On April 29, 2015, Starwood put itself up for sale. On August 29, 2015, Anbang offered to buy it at a 20% all-cash premium deal on its last closing price.

Marriott–Starwood Merger Synergies: The World’s Largest Hotel Chain

The Marriott–Starwood deal holds immense significance for Marriott International because the combined entity of Marriott International and Starwood Hotels and Resorts Worldwide would create the world’s largest lodging company.

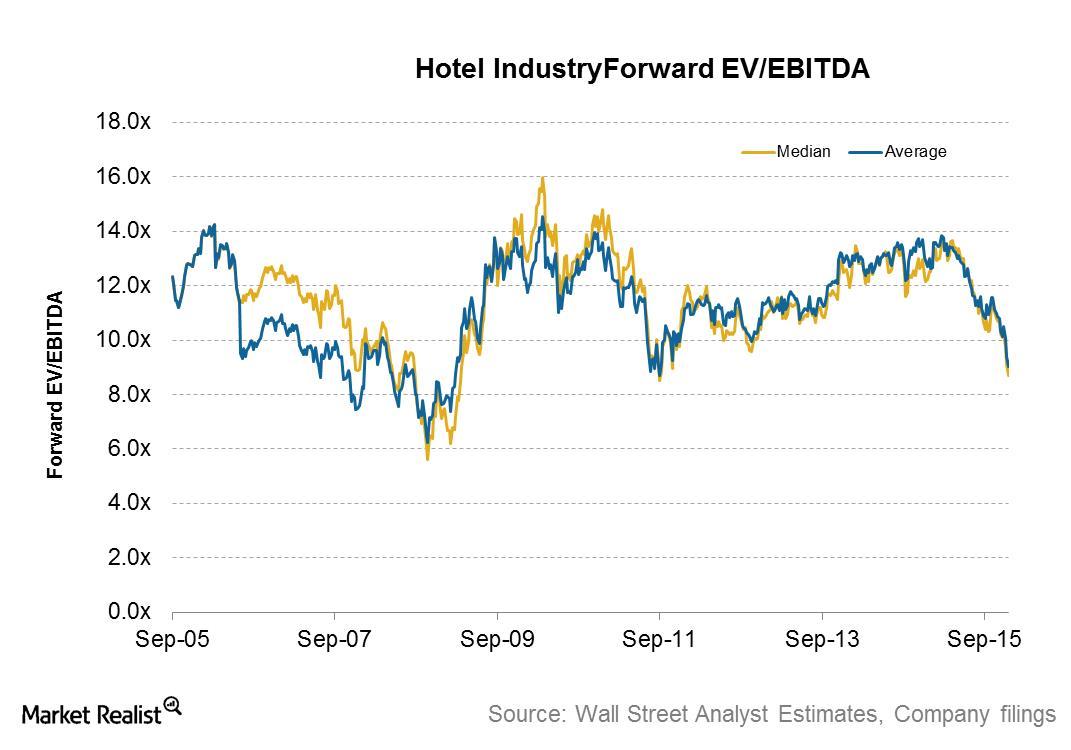

Understanding the Hotel Industry Valuation Multiple

The forward EV-to-EBITDA multiple for the hotel industry currently stands at 9. It has declined from 13.1, which was recorded at the beginning of 2015.

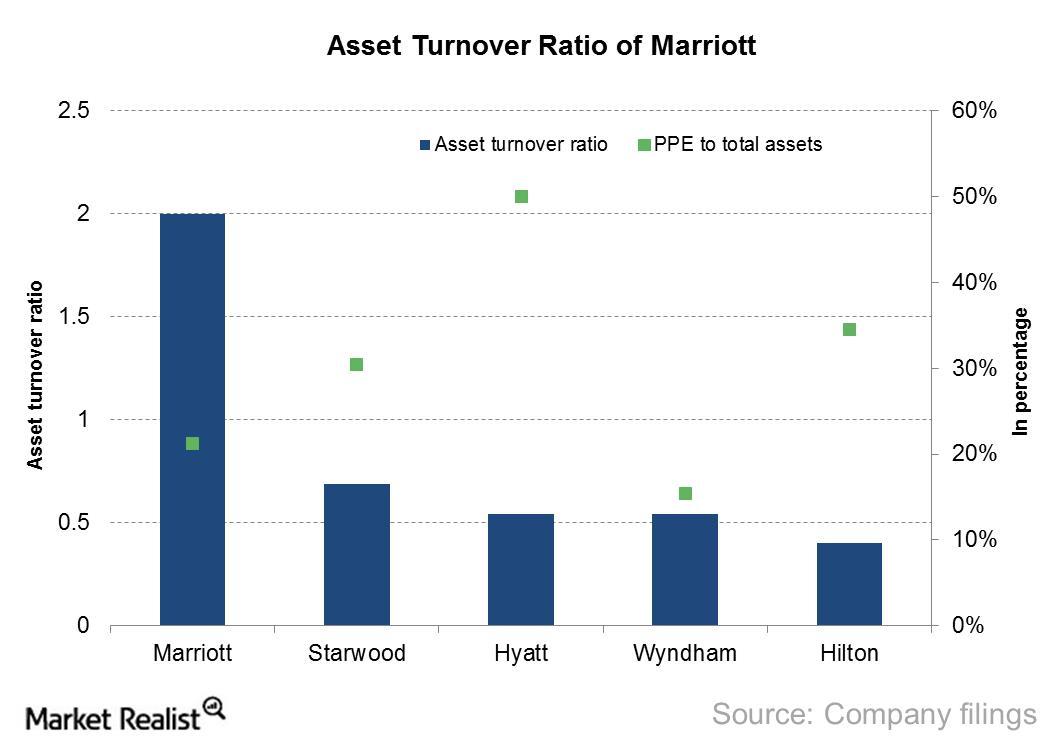

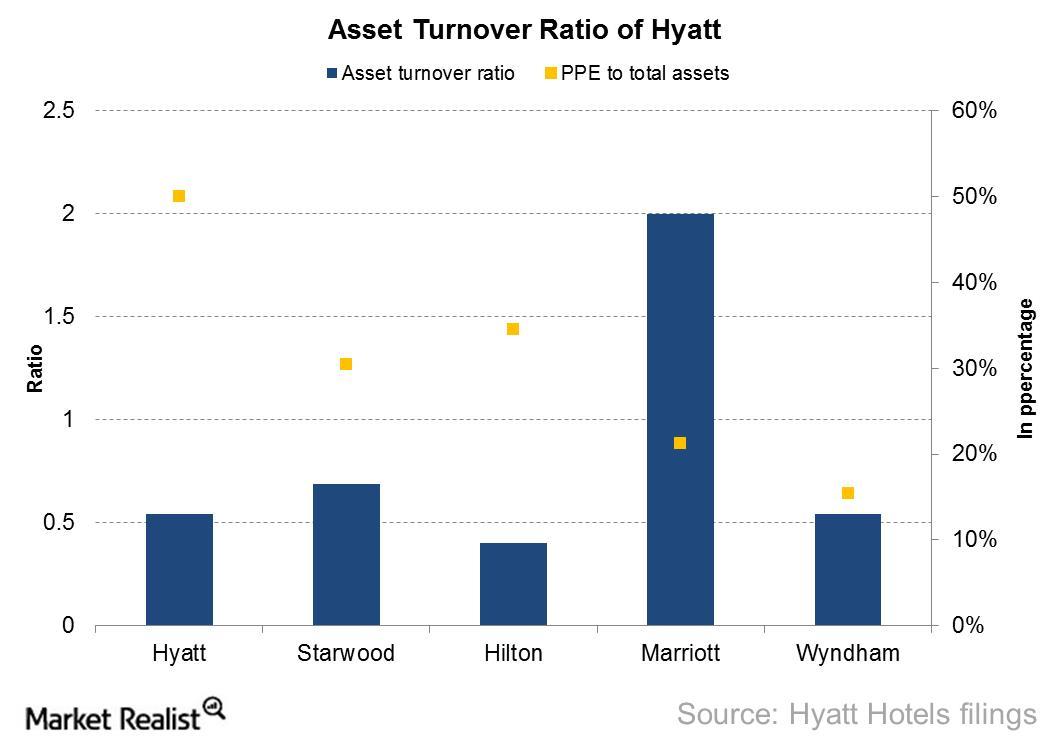

What You Ought to Know about Marriott International’s Asset Utilization

Marriott has one of the lowest asset bases among its industry peers, having reduced its PPE-to-total-assets ratio from 24% in 2012 to 21.2% in 2014.

Marriott International’s Expansion in the Franchise Model Is Bearing Fruit

Marriott’s operating margin increased from 5.9% in 2010 to 8.4% in 2014. Its operating income grew from $695 million in 2010 to $1,159 million in 2014.

An Investor’s Introduction to the US Hotel Industry

Hotel investors can use the indicators discussed in this series to gauge the industry’s general trends. Leisure travelers make up ~60% of the total hotel room sales, and business travelers account for 40% of total sales.

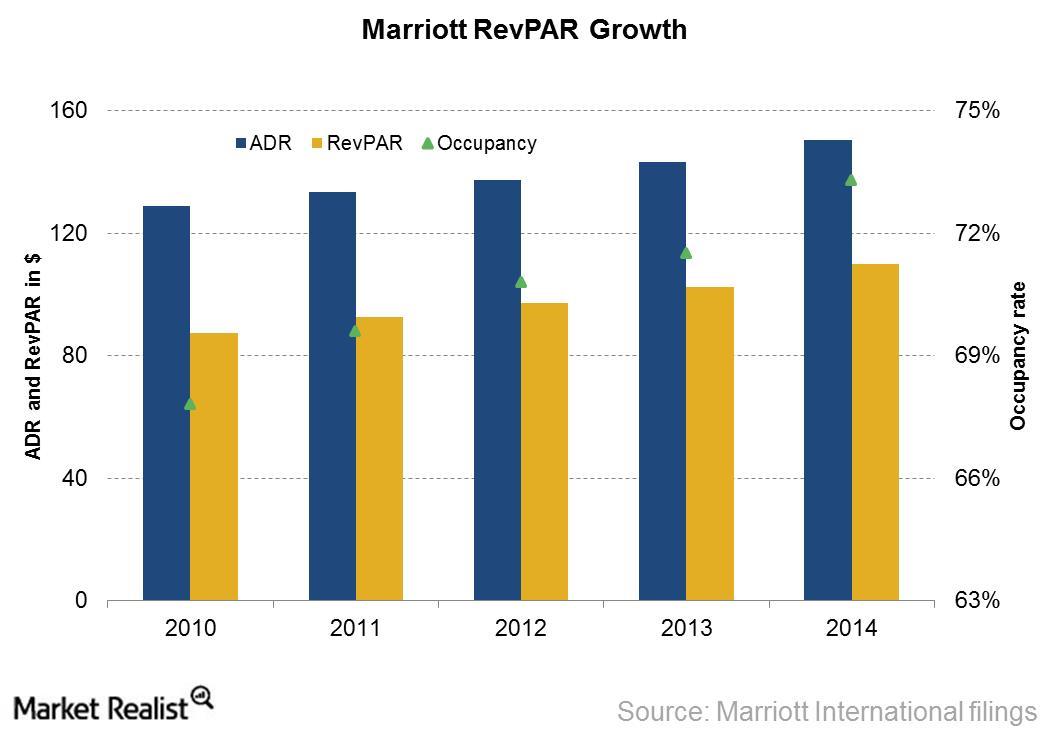

Industry-Wide Demand Growth Drives Marriott International’s RevPAR

Marriott International saw strong increases in RevPAR—from $87 to $110—between 2010 and 2014.

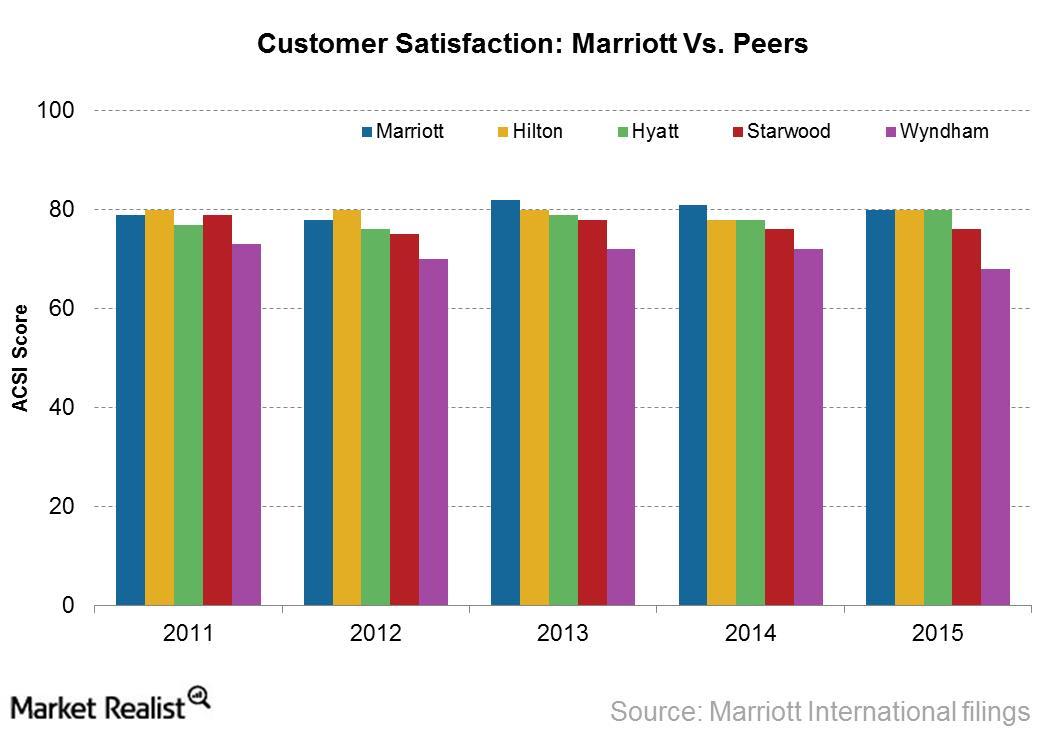

Marriott International in the Eyes of Customers: Outside Looking In

In 2015, Marriott topped the ACSI survey with a score of 80. It also topped the survey in 2014 and 2013, with scores of 83 and 81, respectively.

Introducing Marriott International: Your Key Company Overview

Marriott International is known for its wide range of budget and luxury hotels. Its acquisition of Starwood will make it the world’s largest hotel chain.

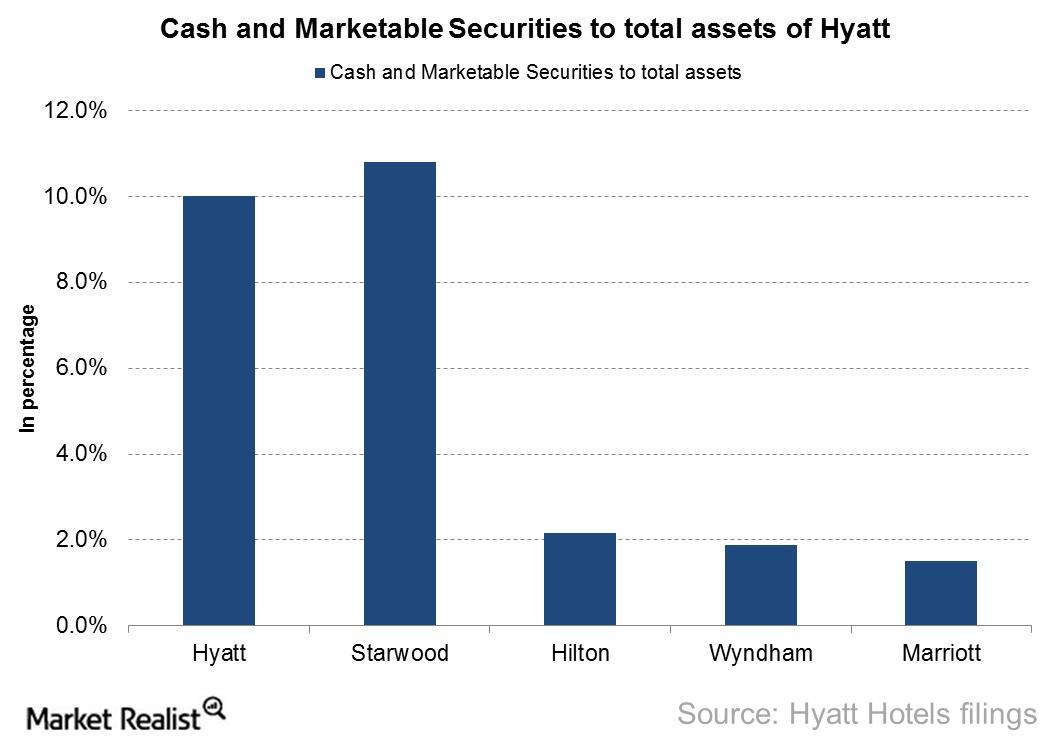

Why Hyatt Has High Liquid Assets Compared to Its Peers

As of December 31, 2014, Hyatt’s cash, cash equivalents, and marketable securities as a percentage of total assets is one of the highest among its peers, at 10%.

Asset Utilization by Hyatt Hotels

Hyatt had the lowest return on assets (or ROA) ratio among its peers at 4.6% for fiscal 2014 due to lower profits generated from its assets.

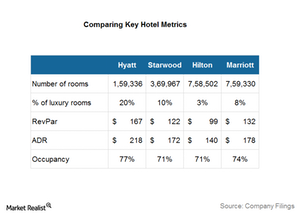

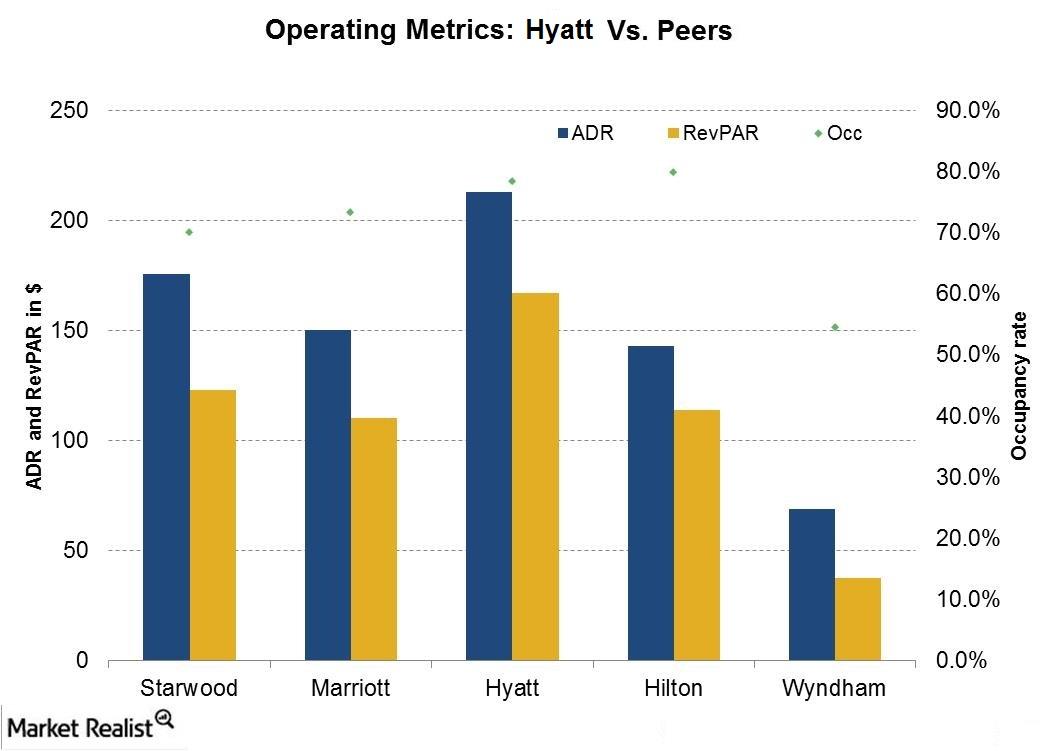

Why Hyatt Has the Highest ADR and Occupancy Rate Among Its Peers

At 76.2%, Hyatt Hotels (H) had one of the highest occupancy rates among its peers for its owned and leased hotels in 2014.

An Overview of Hyatt Hotels’ Competition

Some of Hyatt’s competitors—Hilton (HLT), Marriott (MAR), Wyndham (WYN), and Starwood (HOT)—compete in all the segments: Hotels and Resorts, Residential Units, and Vacation Ownership Units.

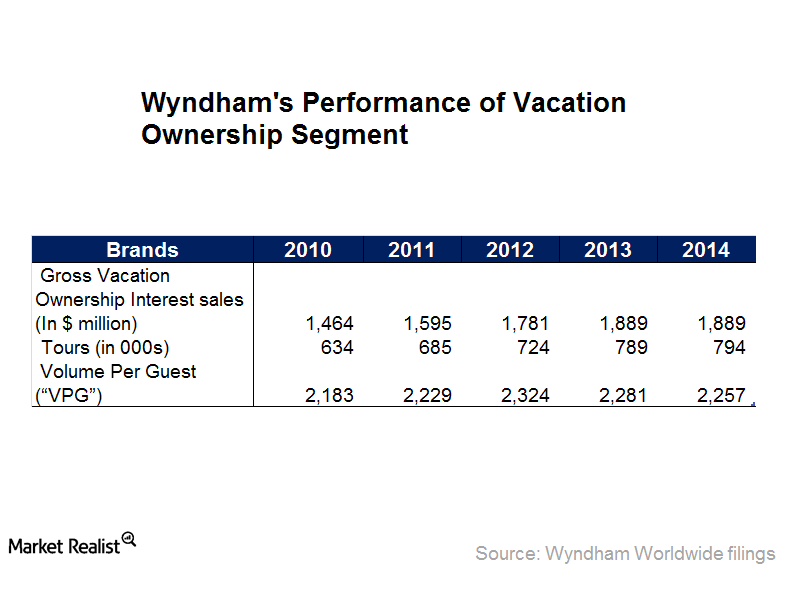

What’s Driving the Revenues of Wyndham Worldwide’s Vacation Ownership Segment?

Vacation unit sales rely on disposable income available to customers. The stable US economy and growing household incomes have positive impacts on Wyndham.

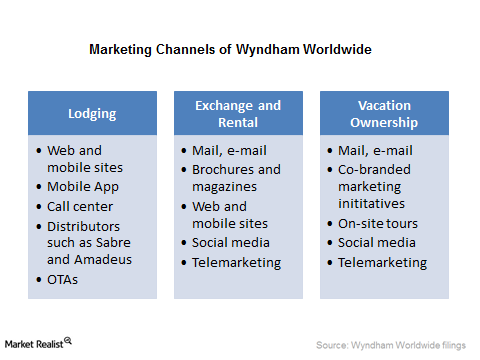

How Wyndham Uses Technology to Offer Greater Value to Its Clients

Wyndham invests in technology to improve its e-commerce capabilities and marketing abilities and to help it differentiate itself from competitors.

A Rundown of Wyndham Worldwide’s Wyndham Hotel Group Segment

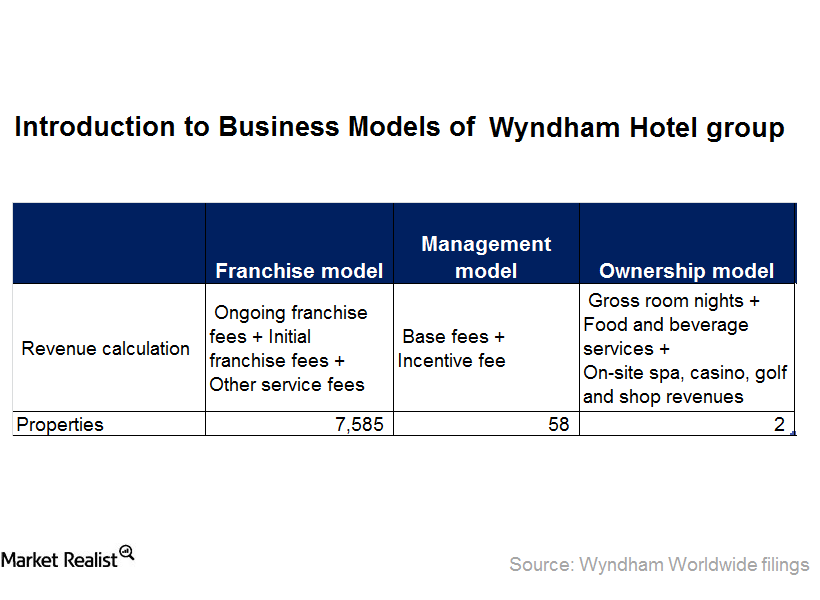

Wyndham Hotel Group provides services under a franchise model but also offers professional oversight and operations support under a management model.

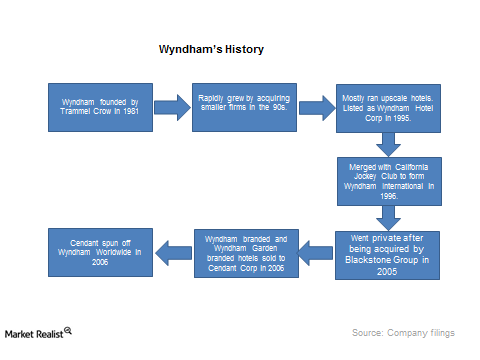

Introducing Wyndham Worldwide, a Hotel Super Power

Wyndham Worldwide is considered the world’s largest hotel franchiser. It owns the world’s largest vacation ownership and exchange network.

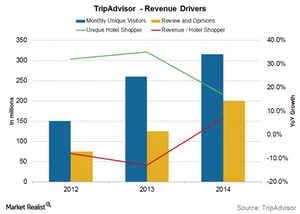

TripAdvisor’s Revenue Drivers for Its Largest Revenue Stream

What are the key revenue drivers of TripAdvisor’s (TRIP) click-based advertisement revenue? We can break them down into a few key metrics.

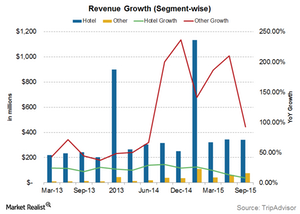

Which Segment Will Continue to Drive TripAdvisor’s Growth?

The hotels segment is TripAdvisor’s main segment, contributing about 82% of the company’s total revenues.

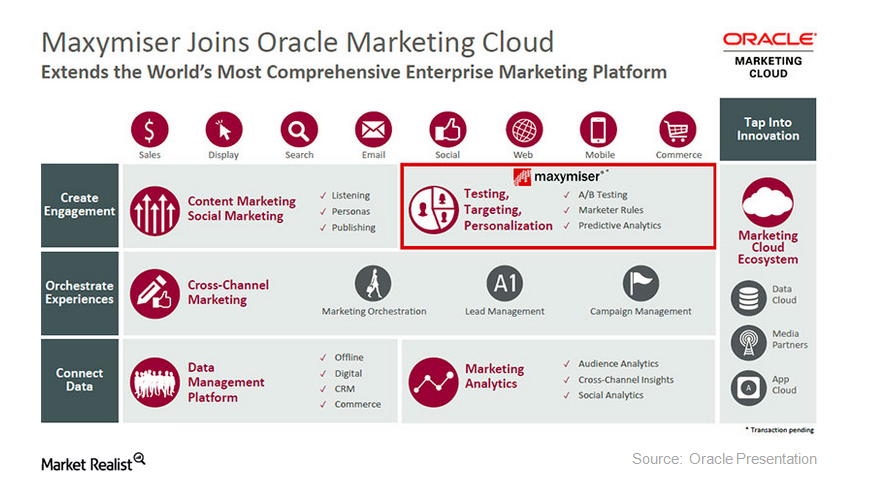

Oracle Made another Marketing Cloud Acquisition: Maxymiser

On August 20, 2015, Oracle (ORCL) announced the acquisition of Maxymiser. The financial details of the deal weren’t disclosed.

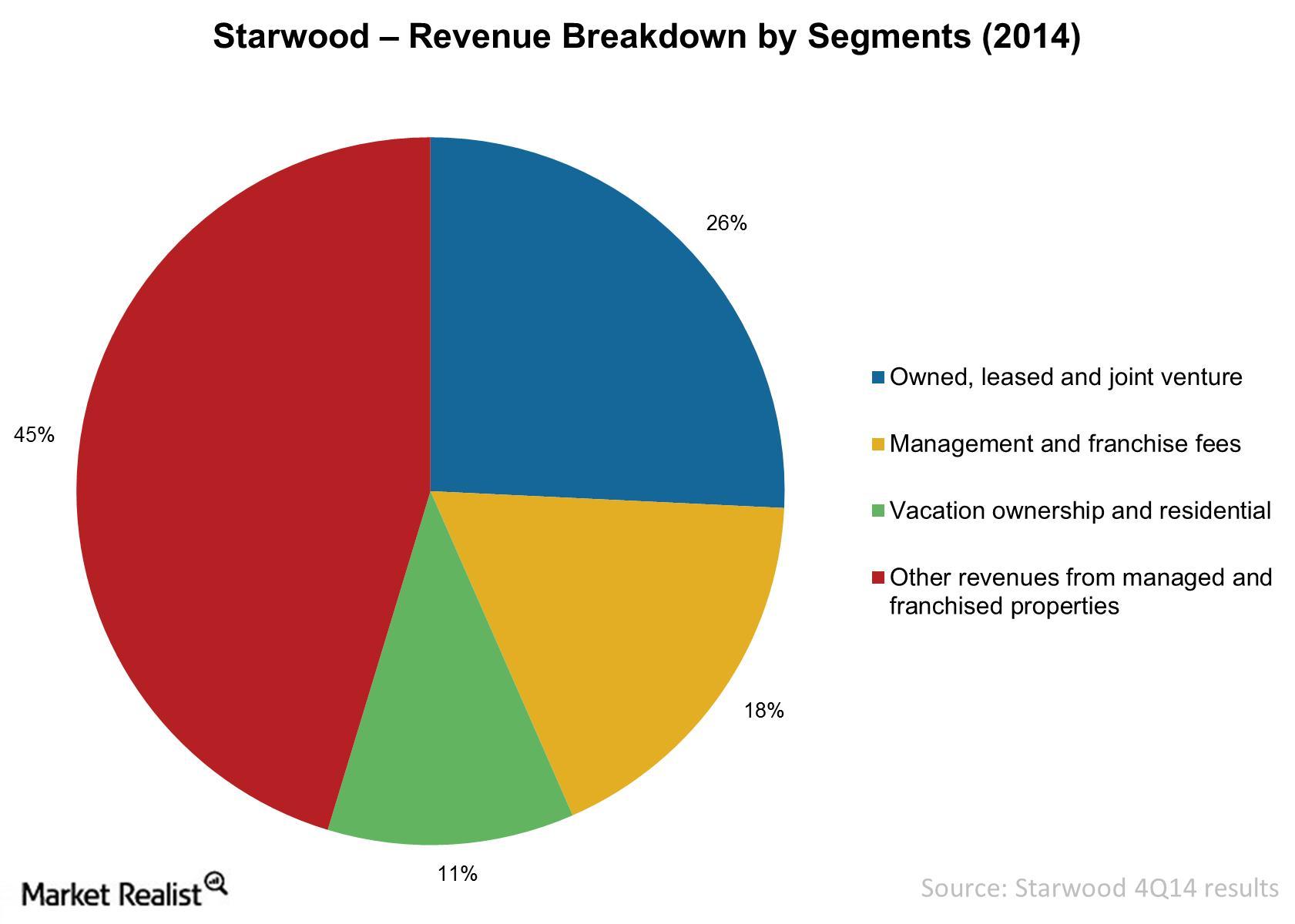

What Are Starwood’s Revenue Sources?

The revenue from owned, leased, and consolidated joint ventures is primarily derived from hotel operations. This includes room rentals and food and beverage sales.

Why Marriott’s Revenue Increased in 2014

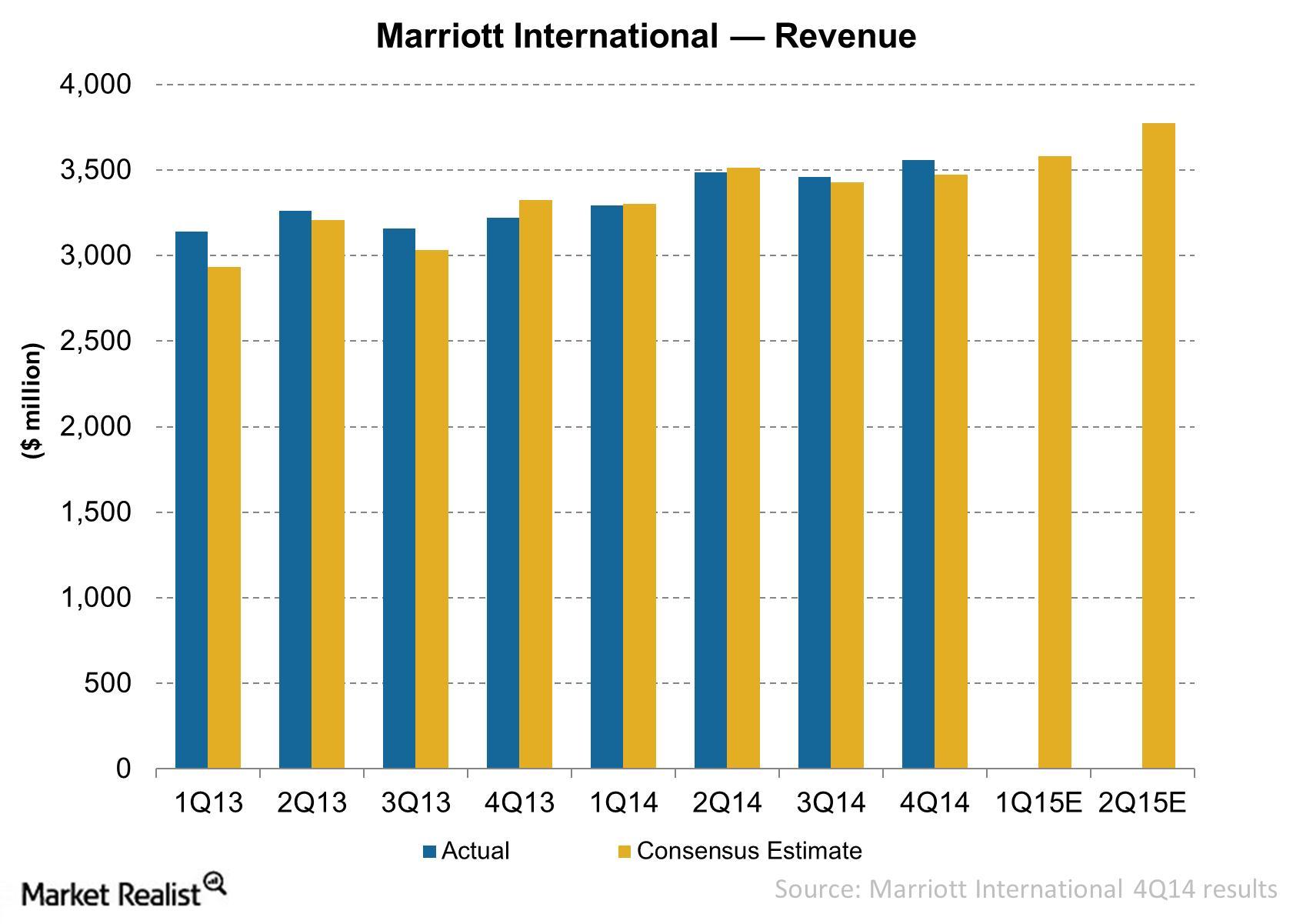

Marriott’s revenues totaled nearly $3.6 billion in the fourth quarter of 2014, compared to $3.2 billion in the fourth quarter of 2013.

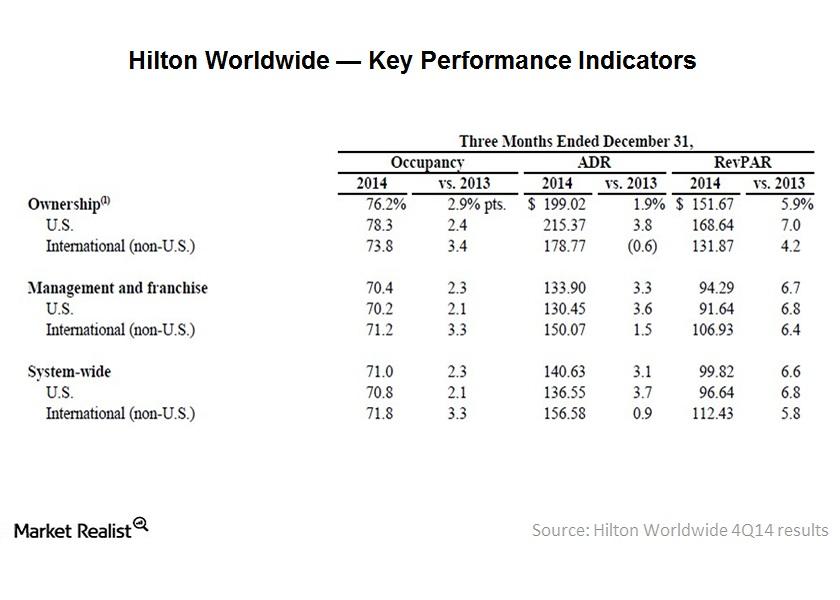

Hilton’s revenue was driven by occupancy and room pricing

Hilton Worldwide (HLT) generates revenue from its hotel operations. Hilton’s system-wide occupancy increased 2.3% YoY to 71% in 4Q14.

Why did Hilton’s revenue increase in 2014?

Hilton’s 4Q14 revenue increased 7% YoY to $2,828 million. For 2014, its revenue increased by 10.5 billion, or 7.9%—compared to 2013.Consumer Why Marriott’s hotels have a specific ownership structure

Marriott (MAR) operated a total of 3,916 hotel properties in fiscal year 2013. Most of these properties were either managed, franchised, or licensed.

Why it’s important to understand Marriott’s brands

Marriott has a diverse portfolio of 18 brands. It describes the brands as “individually distinct and collectively powerful.”

Why the EV/EBITDAR multiple is best for valuing hotel companies

The EV to EBITDAR multiple is used in businesses where there’s significant rental and lease expenses—hotels and airlines. We’ve used this to analyze Marriott’s valuation.Consumer Understanding Hilton’s operating cost

Hilton has operating expenses related to its owned and leased hotels and timeshare properties. This is separate from depreciation and amortization expenses.Consumer Key revenue drivers for the hotel industry

RevPAR is calculated by dividing hotel room revenue by the total available room nights. It’s used in the hotel industry to measure the company’s ability to generate greater revenue from each room.