Introducing Wyndham Worldwide, a Hotel Super Power

Wyndham Worldwide is considered the world’s largest hotel franchiser. It owns the world’s largest vacation ownership and exchange network.

Dec. 15 2015, Published 4:40 p.m. ET

Wyndham Worldwide

Wyndham Worldwide (WYN) is considered the world’s largest hotel franchiser. It also owns the world’s largest vacation ownership and exchange network. The company’s mission is “to send people on the vacation of their dreams” by offering a diverse range of brands and products in over 100 countries deemed worth visiting. Some of Wyndham’s well-known brands include Super 8, Days Inn, Ramada, Wyndham Hotels and Resorts, RCI, WorldMark, and Club Wyndham.

Wyndham Worldwide’s history

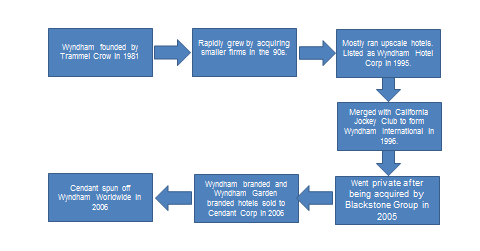

Founded by Trammell Crow, a real estate developer from Dallas, Texas, Wyndham Worldwide started out as a hotel management company in 1981. Throughout the 1990s, the company expanded rapidly by acquiring smaller firms through leverage. These included property management, vacation exchange, and vacation rental companies such as RCI and Fairfield Communities.

Unfortunately for Wyndham, the company struggled to stay afloat just a few years after September 11, 2001, given its high indebtedness and the suddenly weak US travel market. In 2005, the company went private after being acquired by Blackstone Group (BX), a private equity firm. Blackstone sold Wyndham-branded and Wyndham Garden-branded hotels to Cendant Corporation, a travel and real estate company, but Blackstone rebranded some of the remaining hotels as LXR Luxury Resorts. Finally, in 2006, Cendant merged its previously owned hospitality businesses with Wyndham businesses and spun off Wyndham Worldwide.

Related ETFs and what’s to come in this series

Investors can gain exposure to the hotel sector by investing in the Consumer Discretionary Select Sector SPDR Fund (XLY), which invests 14.3% of its total portfolio in the hotel sector. XLY invests approximately 0.6% of its portfolio in Marriott International (MAR), 0.5% in Starwood Hotels & Resorts Worldwide (HOT), approximately 0.4% in WYN, and about 0.2% in Wynn Resorts (WYNN).

In this nineteen-part series, we’ll take a comprehensive look at Wyndham Worldwide’s business, including regional distribution, occupancy rates, growth strategies, key revenue drivers, valuation multiples—and more.

But first, let’s look at Wyndham Worldwide’s segments and competitors.