Wynn Resorts Ltd

Latest Wynn Resorts Ltd News and Updates

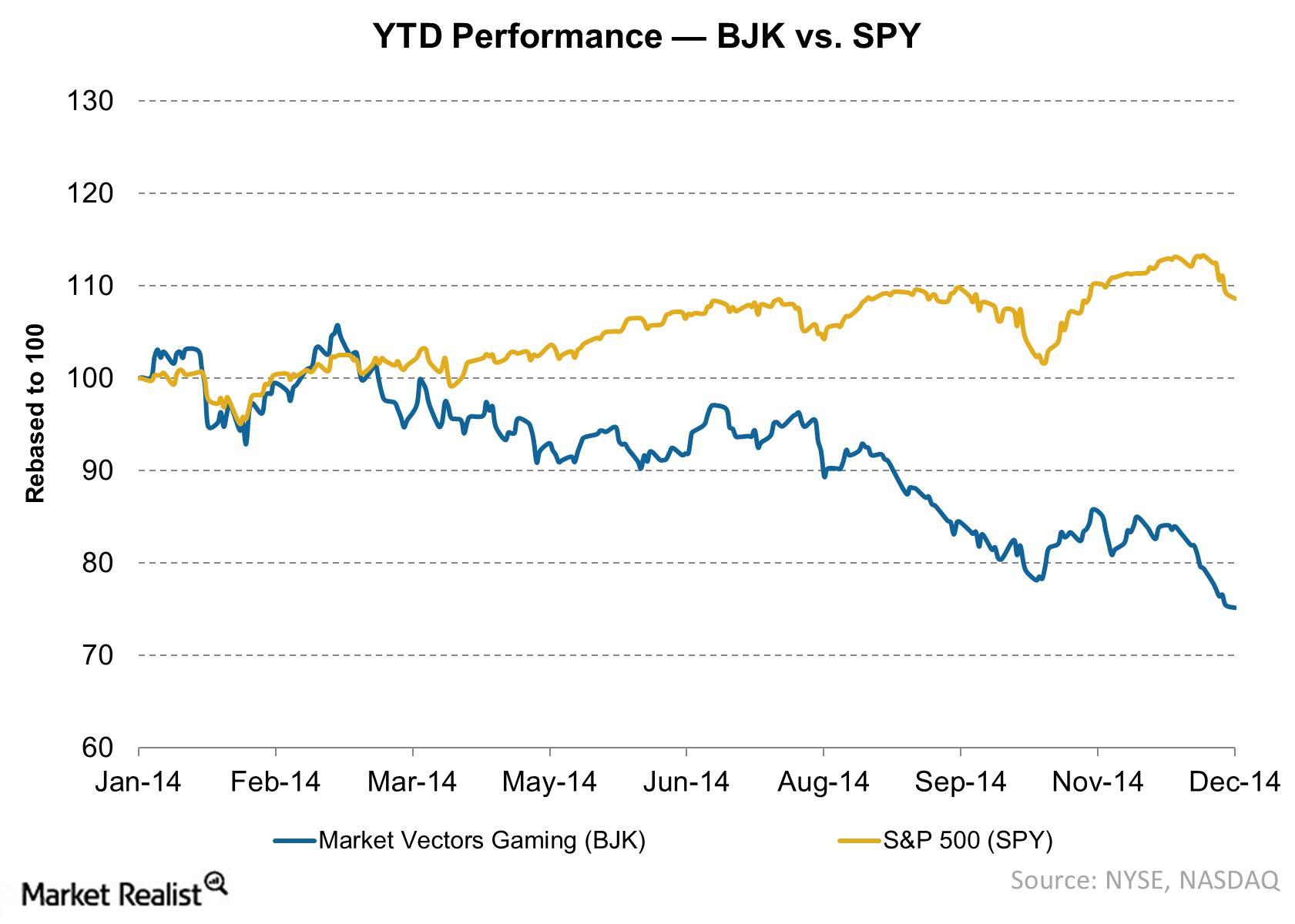

The Odds Look Stacked Against Macau Gaming Stocks

China is tightening rules for a new industry: gambling. As a result, Macau gaming stocks are losing value rapidly.

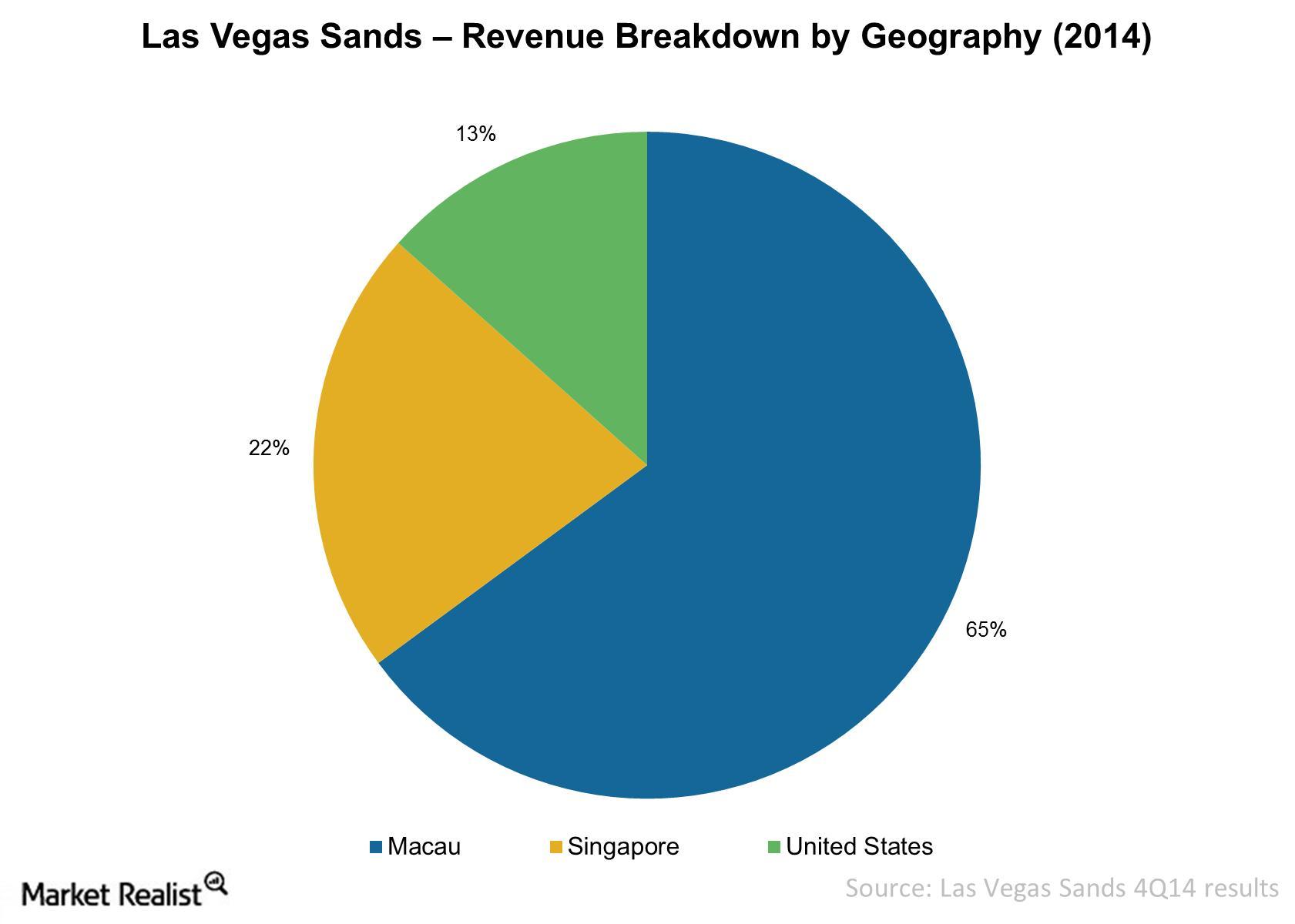

Must-know: A breakdown of Las Vegas Sands’ revenue

Las Vegas Sands (LVS) earns revenue through casinos, hotels, food and beverages, and convention or retail operations. The company’s main revenue driver is casino revenue. It’s generated from slot machines and table games. Casino revenue represents ~79% of the total revenues.

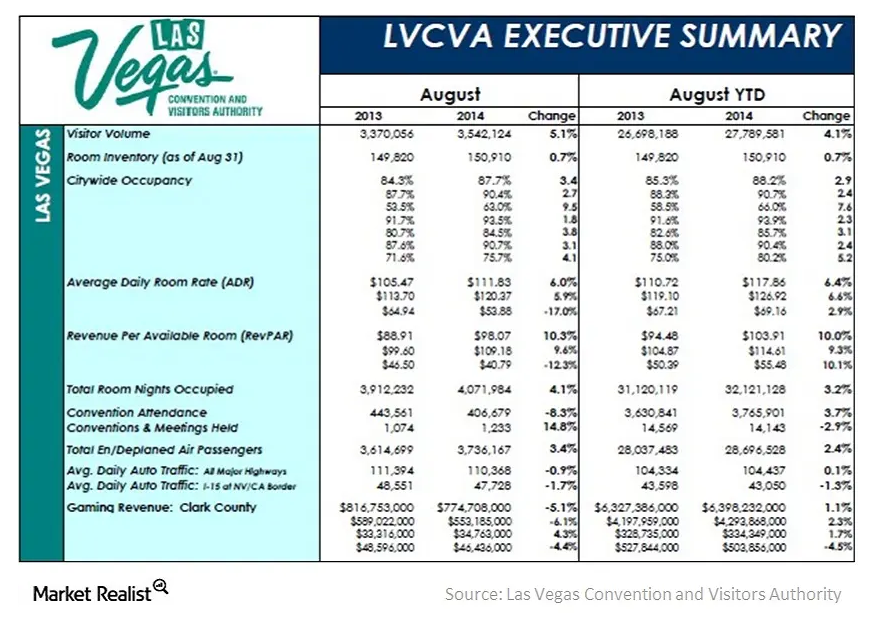

Must-know: Important performance metrics for casino resorts

The occupancy rate is very important for casino resorts. The occupancy rate shows the relationship between the number of occupied rooms and the total number of rooms.

Must-know: The most popular casino games

Casinos’ popularity is growing. This suggests that people like to gamble occasionally. Unfortunately, they don’t always win. For most of the people, the real fun is playing the game—not necessarily winning.

Key Indicators And Recent Trends In The Casino Industry

Casino gambling is spread across major destinations around the world. Casinos, at major destinations, are being influenced by certain factors. This is hampering industry growth.Consumer Must-know: Key performance metric tracked by Las Vegas Sands

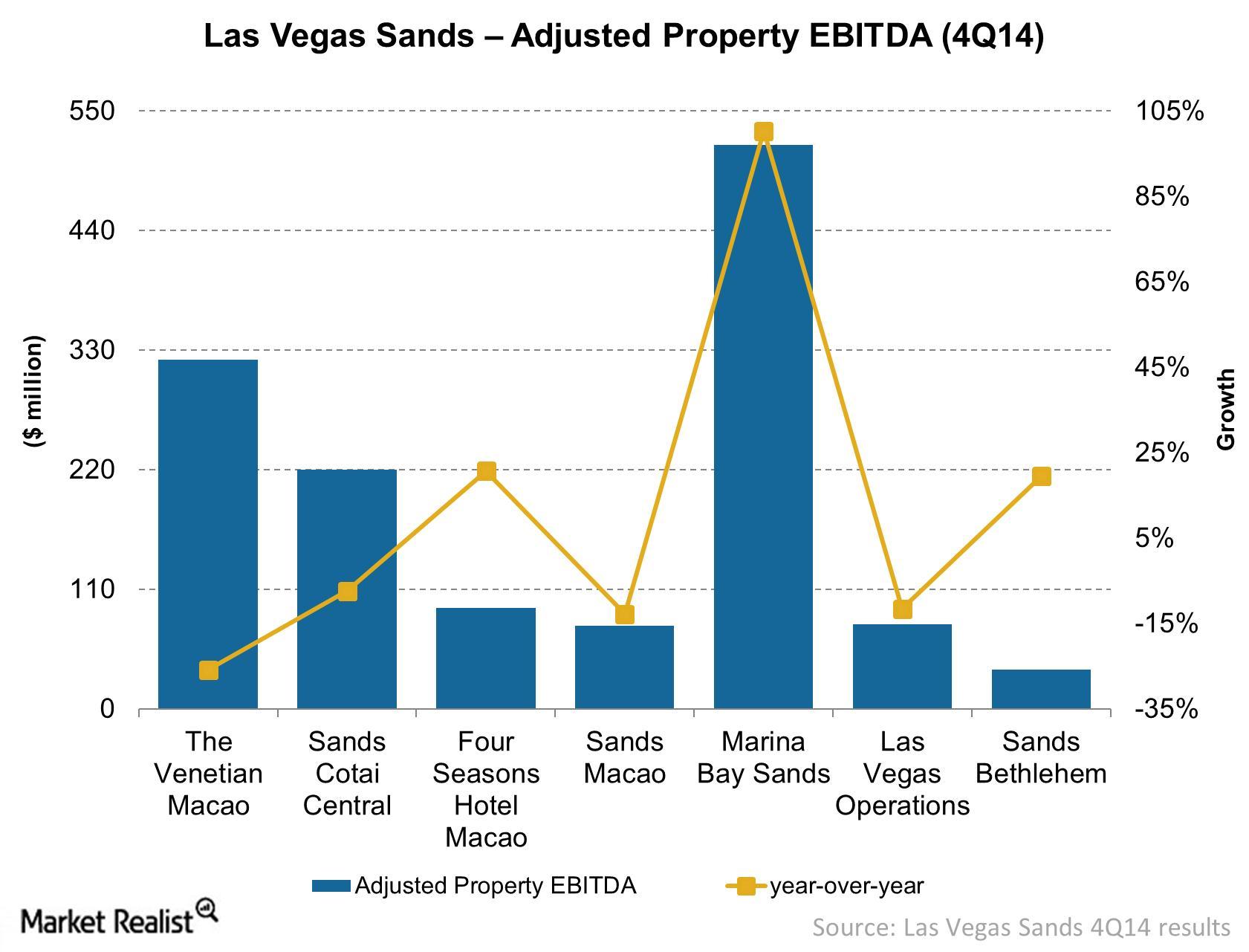

Adjusted property EBITDA shouldn’t be regarded as an alternative to looking at income from operations, which indicates operating performance. Nor is it an alternative to looking at cash flow from operations, which measures liquidity.

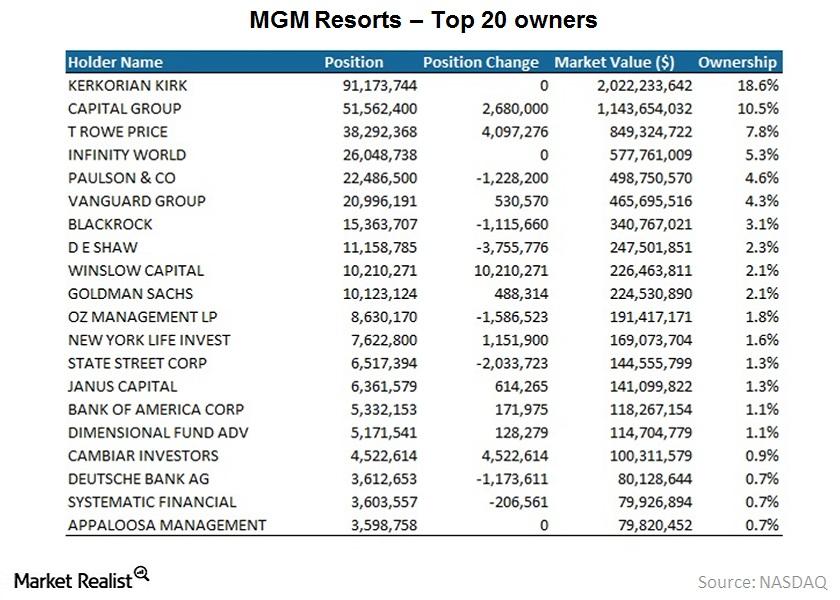

Why investors should learn about MGM’s top shareholders

As an investor, you should know whether or not MGM’s (MGM) management is committed to its future. Management shows its commitment by owning shares.

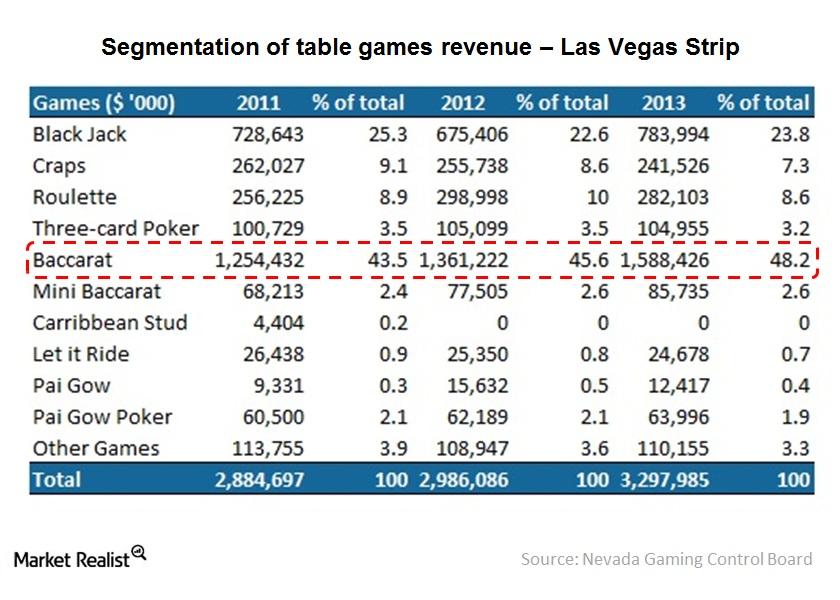

Why Baccarat gambling provides revenue for the Las Vegas Strip

The casinos in the Las Vegas Strip clearly benefit from high-end Baccarat play. Over the last four years, Baccarat revenue ranged from 43.5% of table games revenue in 2011 to 48.2% in 2013.

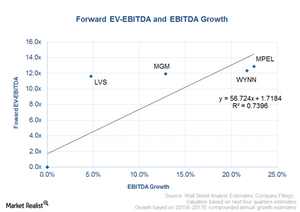

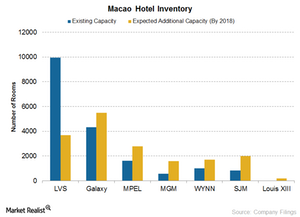

The Valuation of Macao Casino Stocks

Macao’s shift from VIP gaming to the mass gaming market and non-gaming revenue is expected to benefit Macao in the long run.

Must-know: An overview of MGM Resorts

MGM Resorts (MGM) was founded in 1986. MGM is based in Nevada. It’s one of the leading global hospitality and entertainment companies.

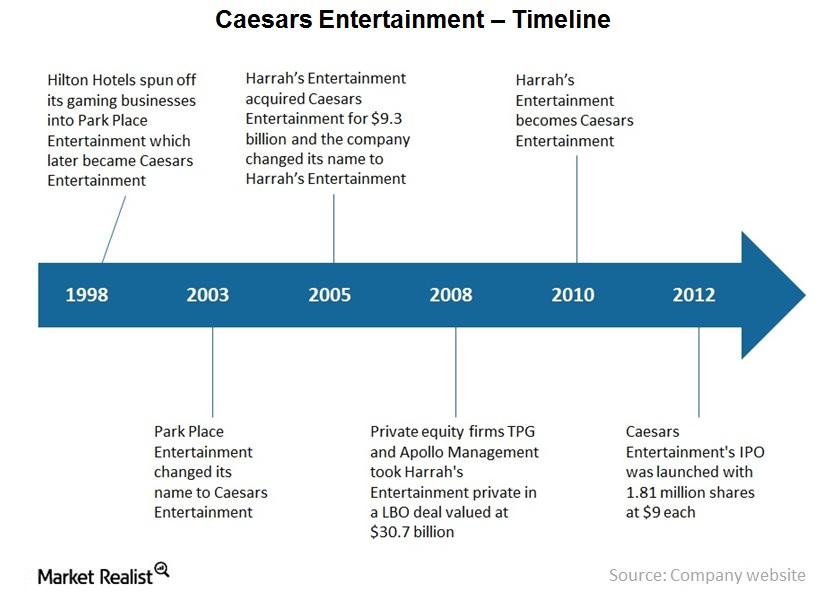

Overview of Caesars Entertainment and its complicated past

Caesars Entertainment has 51 casinos in 13 U.S. states and five countries. 38 are in the U.S. and primarily consist of land-based and riverboat casinos.

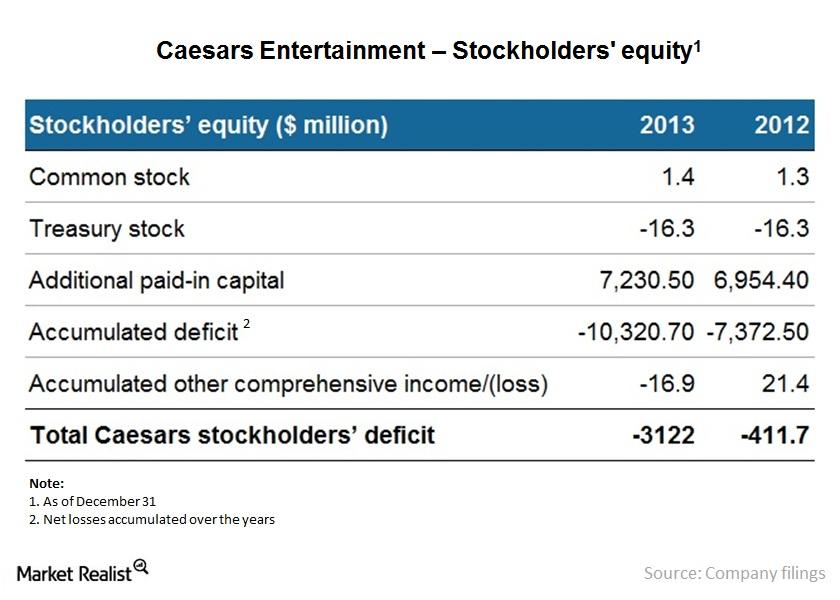

Why Caesars Entertainment’s stockholders’ equity is negative

Caesars Entertainment’s (CZR) stockholders equity is negative, according to its latest balance sheet. Stockholder equity consists of capital contributed and retained earnings.

GAN Inks iGaming Deal with Wynn, Stock Jumps 12 Percent

On Oct. 5, GAN stock surged more than 12 percent after the company announced a 10-year partnership with Wynn Resorts to offer iGaming and Internet sports betting in Michigan.

Las Vegas Sands’ adjusted property earnings double in Singapore

Las Vegas Sands’ adjusted property EBITDA at Marina Bay Sands in Singapore doubled, reaching a property record of $518.5 million, up ~100% year-over-year.

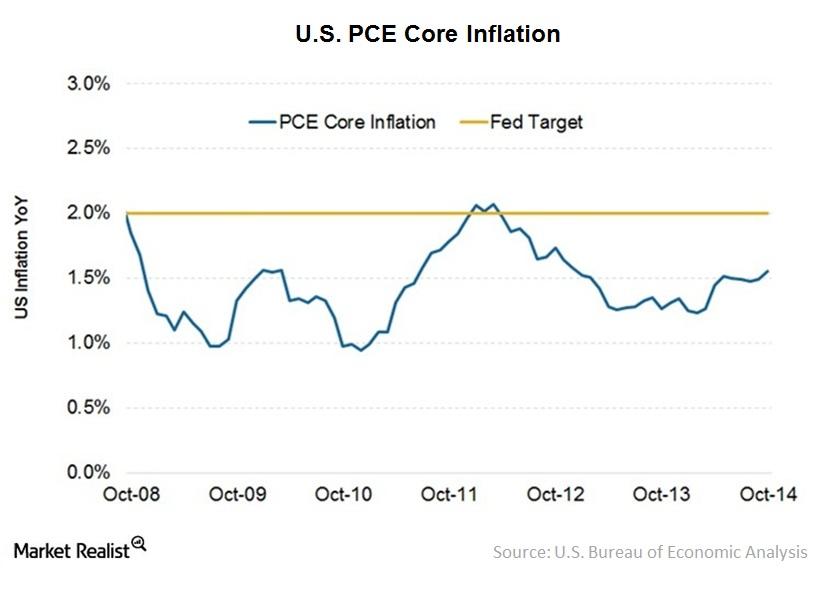

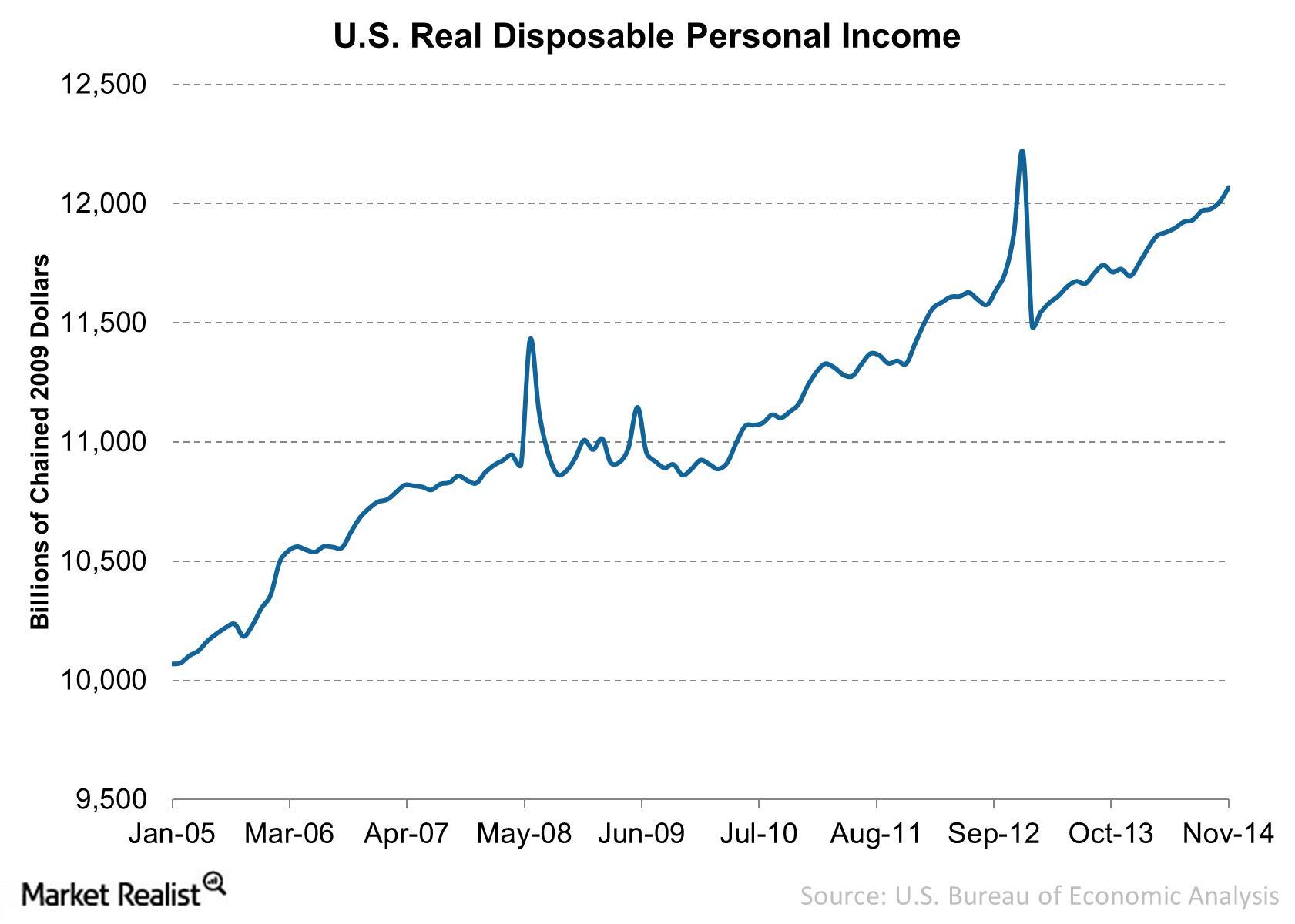

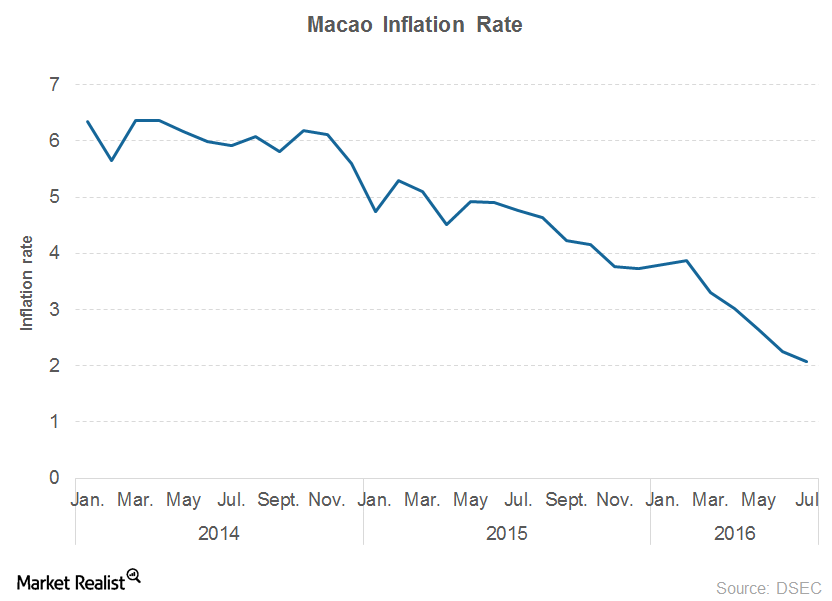

Why The Casino Business Is Affected By Inflation

When inflation is low, consumers have greater purchasing power. They have a higher spending capacity. Greater purchasing power is a positive sign for casino resort companies.

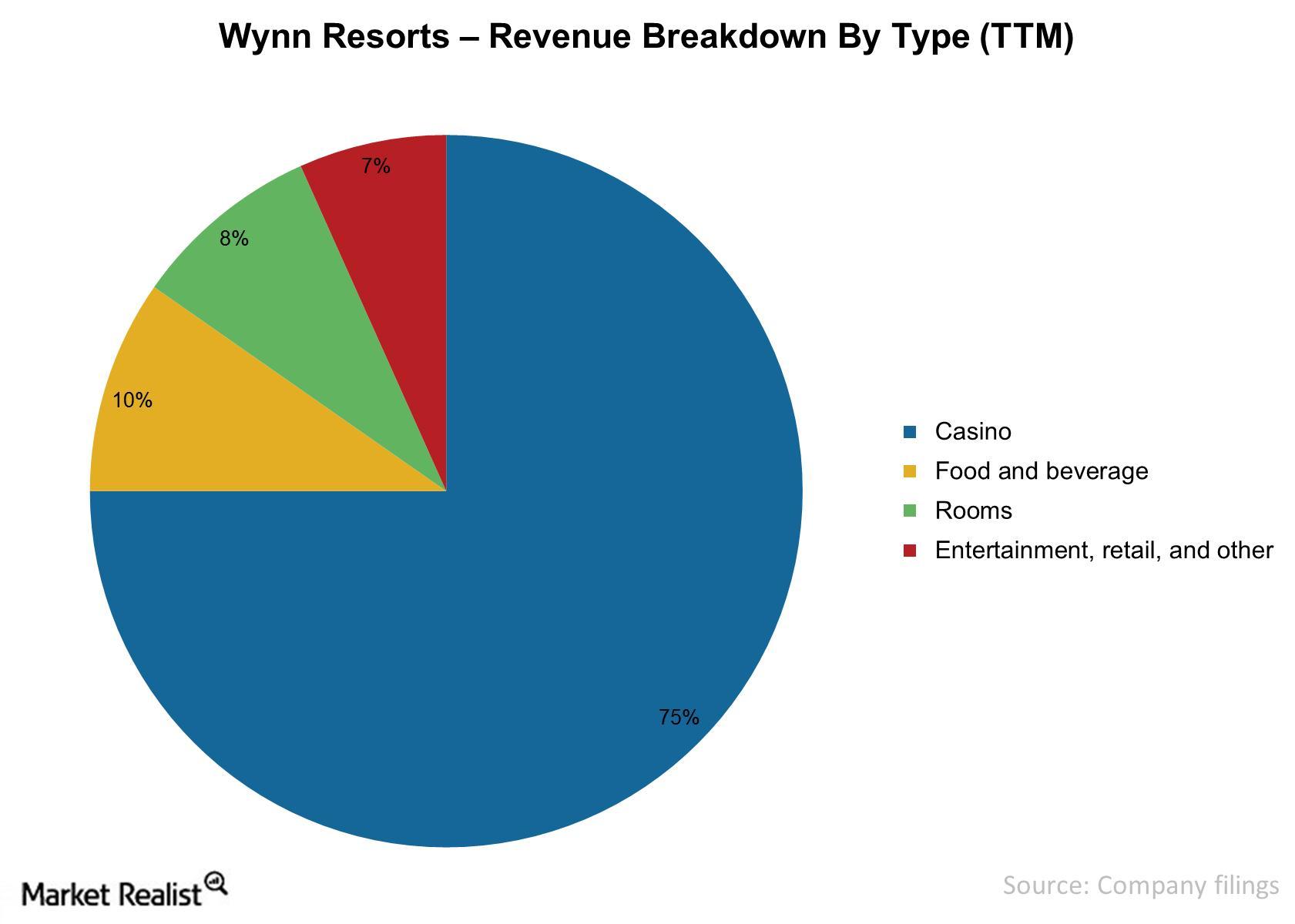

Wynn Resorts: A revenue breakdown

Wynn Resorts (WYNN) earns its revenues through casinos, hotels, food and beverages, and entertainment and retail operations.

Recent developments for Wynn Resorts

Wynn Resorts (WYNN) is currently constructing Wynn Palace, a fully integrated resort in the Cotai area of Macau.

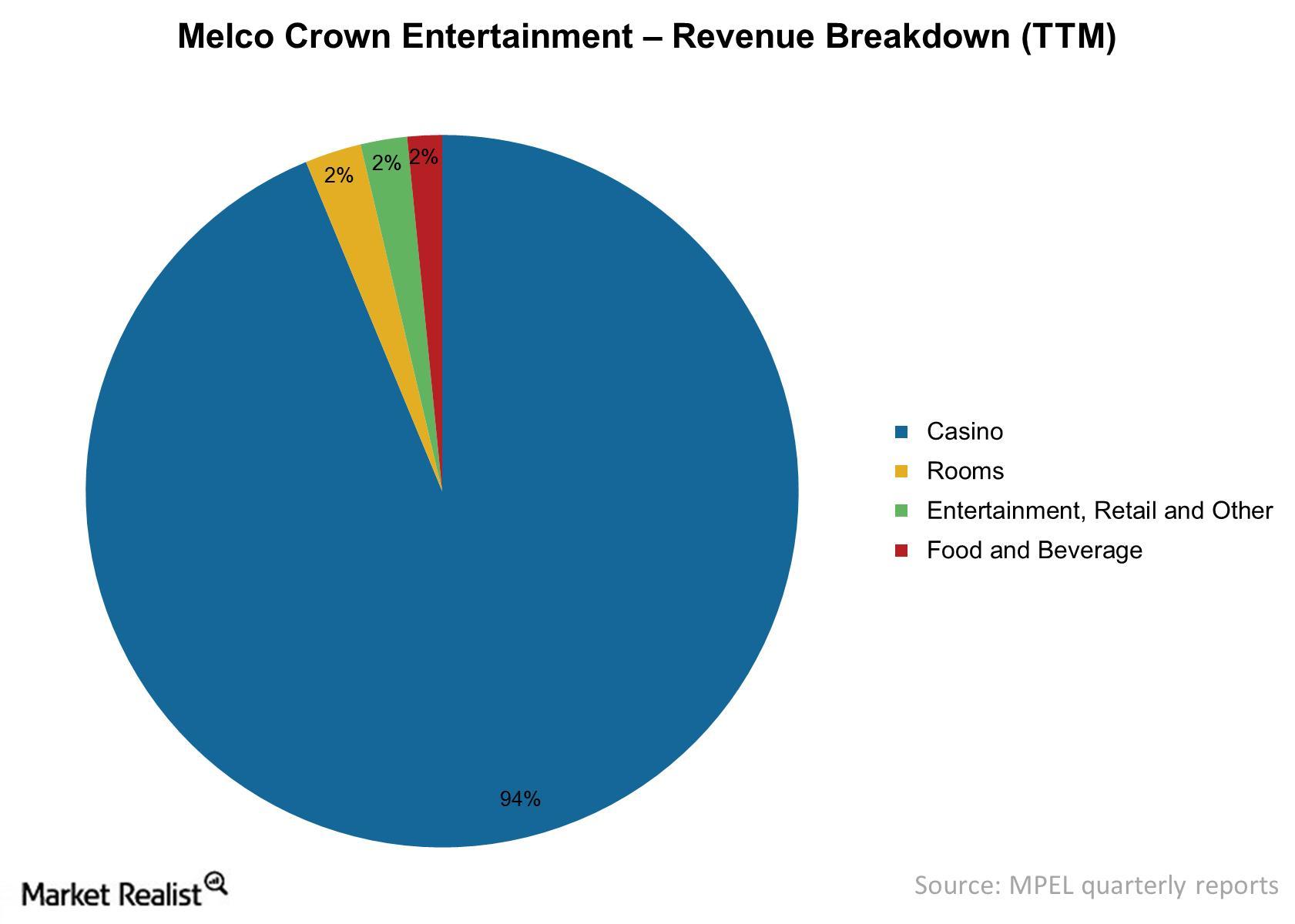

Why Melco Crown Is Profitable In The Casino Space

MPEL derives ~94% of revenues from casino operations. Its casino business gross margin is 50% for the trailing 12-month period ending September 30, 2014.

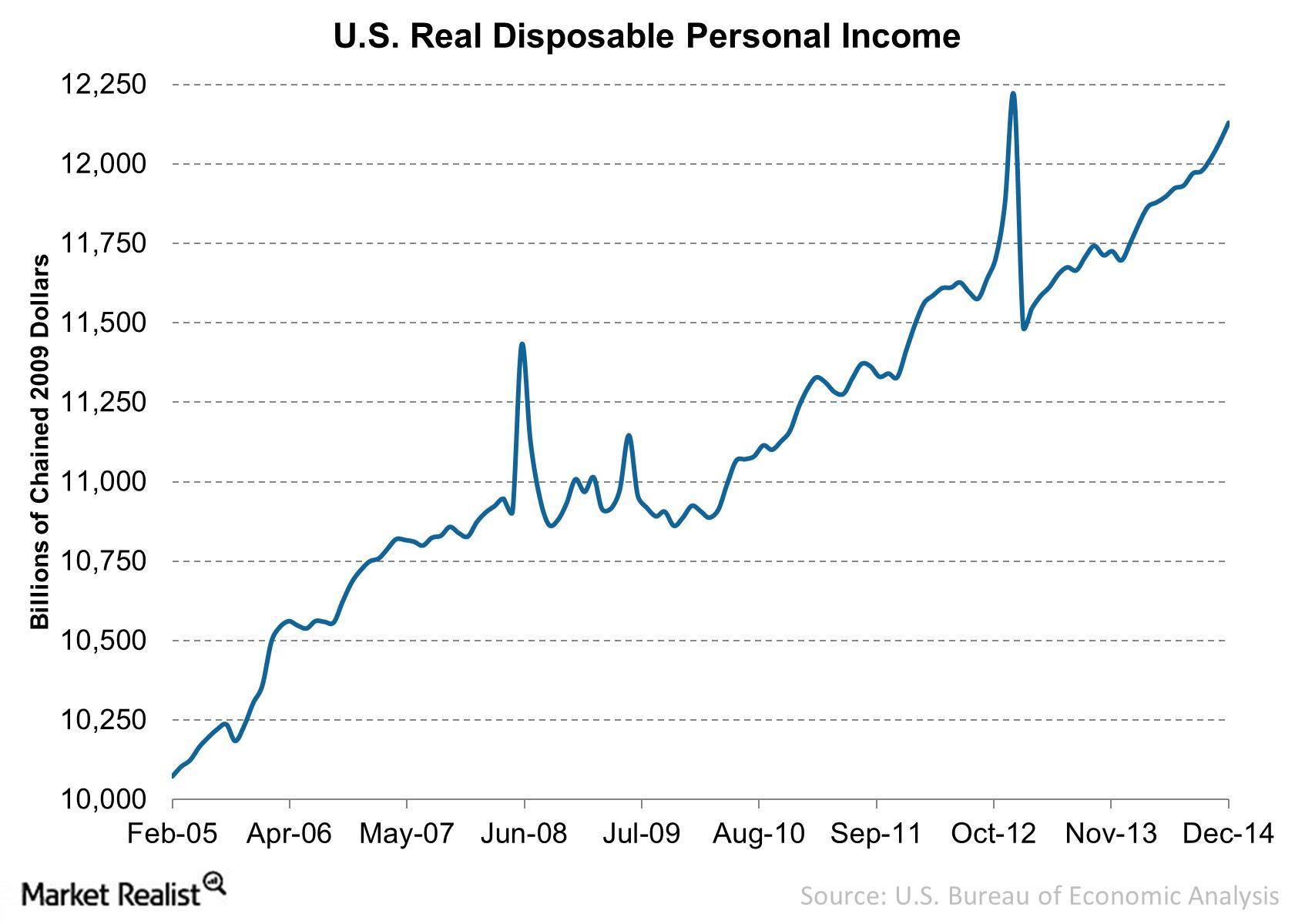

Why Casinos Rely On Disposable Income

On a year-over-year basis, real disposable income increased 2.9%. More disposable income boosts consumer buying power.

An important overview of Las Vegas Sands, a casino company giant

An overview of Las Vegas Sands (LVS) shows that the company currently owns 70.1% of Sands China Ltd., which operates LVS’s four Macao properties.

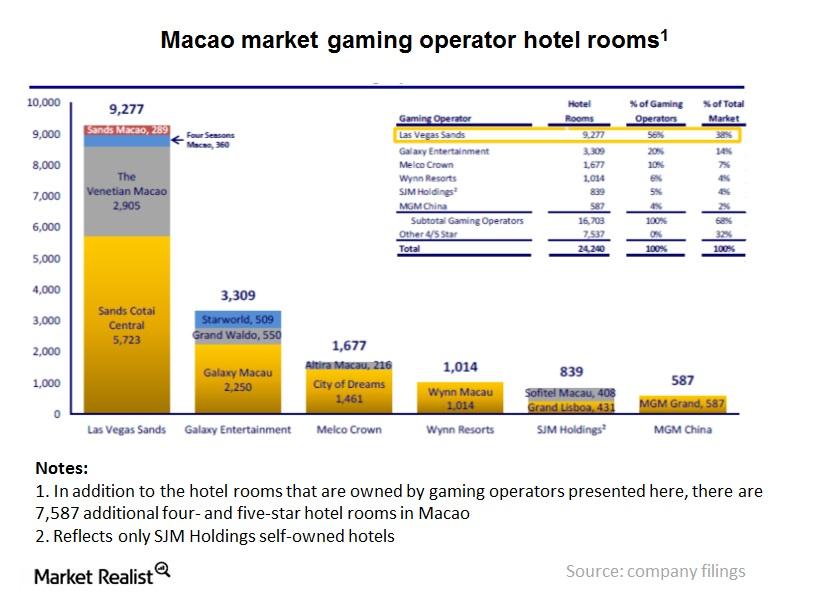

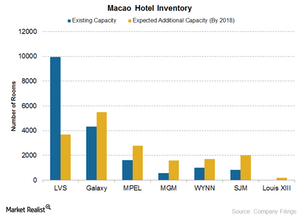

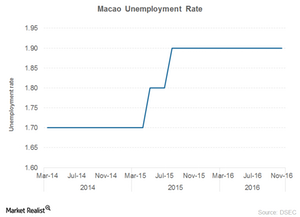

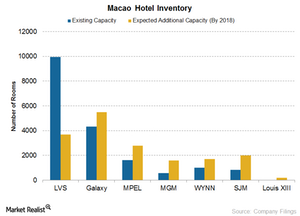

Macao Casinos Hope Hotel Supply Will Drive Demand

Macao’s casinos are trying to change Macao from a gaming-only destination to more of a Las Vegas–like destination.

Is Oversupply a Concern for Macao Casinos?

Macao casinos’ $28 billion investment in integrated resorts is set to change the city’s gaming business.

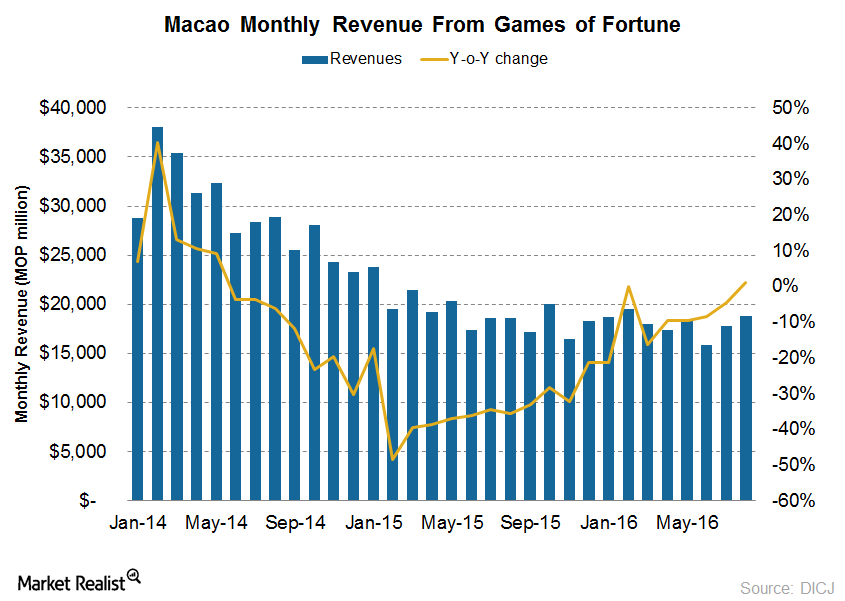

Is the Mass Market Shift Working for Macao Casinos?

As VIP business continues to remain sluggish, casinos are increasingly turning their attention towards the mass market.

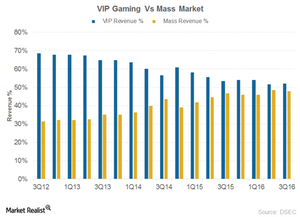

Why Should Investors Keep an Eye on Macao’s Unemployment Rate?

For September 2016 through November 2016, the unemployment rate stood at 1.9%.

Hotel Inventory Is Rising, but Is There Enough Demand?

Macao casinos’ $28-billion investment in integrated resorts will change the city’s gaming. Capacity additions should increase the number of slot tables too.

What Do Macao’s Inflation Numbers Indicate?

The annual inflation in Macao fell to ~2.1% in July 2016. Inflation has, in fact, been on a declining trend in the region since February 2016.

Revival or Luck: Analysts’ Takes on Macao’s Revenue Rise

After 26 consecutive months of declining revenues, Macao gaming revenues have finally shown a small spurt of growth.

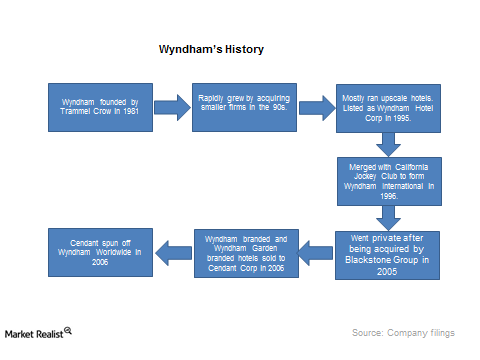

Introducing Wyndham Worldwide, a Hotel Super Power

Wyndham Worldwide is considered the world’s largest hotel franchiser. It owns the world’s largest vacation ownership and exchange network.

Disposable income increases, drives demand for leisure

Real disposable income increased 3.7% year-over-year. This boosts consumer buying power and means consumer spending in leisure activities may increase.Consumer Must-know: A SWOT analysis of Las Vegas Sands

The strengths, weaknesses, opportunities, and threats (or SWOT) analysis is a useful tool for decision-making in businesses and organizations. It helps companies identify the positive and negative factors inside and outside an organization.Consumer Why the casino industry is rapidly expanding into new markets

The international gaming industry is growing quickly. It’s expanding to new jurisdictions. Many U.S. commercial casino companies, including Las Vegas Sands (LVS) and Wynn Resorts (WYNN), have helped the industry become an important part of the global economy.