Macao Casinos Hope Hotel Supply Will Drive Demand

Macao’s casinos are trying to change Macao from a gaming-only destination to more of a Las Vegas–like destination.

Sept. 4 2017, Updated 9:06 a.m. ET

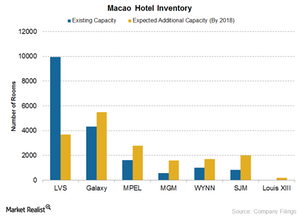

Huge room additions

Macao’s casinos, including Las Vegas Sands (LVS), MGM Resorts (MGM), Melco Crown Entertainment (MPEL), and Wynn Resorts (WYNN), are trying to change Macao from a gaming-only destination to more of a Las Vegas–like destination. Las Vegas, in addition to its casinos, is also known for hosting huge conventions and conferences. It has ~150,000 hotel rooms.

At the end of April, Macao had approximately 37,000 hotel rooms. That’s expected to increase by 14,150 rooms if all projects come on stream. That’s a 38.8% cumulative growth and a 17.8% two-year compound average growth, which is high by both standards.

Against the law of economics

Macao casinos are hoping that increased hotel supply will drive demand and stop the decline in revenues. However, could that be going against the law of economics? The casino industry has long believed that “if you build it, they will come.”

Las Vegas increased its room supply by 16,000 rooms, a 12.0% increase, during the recession of 2008. After that, hotel occupancy fell to 80.0% in 2009 from 90.0% earlier. RevPAR (revenue per available room) fell 30.0% to $93.

Hotel occupancy gives reason to cheer

For Macao, the good news is that hotel occupancy is on a rising trend. For July 2017, hotel occupancy reached a peak of 93.8%, a rise of 3.8% YoY (year-over-year). The rise in occupancy was driven by three-star to five-star hotels.

Five-star hotels saw a higher occupancy of 93.1%, a rise of 4.3% YoY. Four-star hotel occupancy rose to 94.1%, a growth of 3.0% YoY, and three-star hotel occupancy rose to 96.5%, a growth of 2.3% YoY.

RevPAR

For July 2017, RevPAR fell 0.20% YoY, which was better than the 3.7% YoY fall in June. However, most analysts are concerned that the huge supply to come will increase pressure on RevPAR.

Year-to-date performance

Year-to-date as of July 2017, hotel occupancy has risen 5.9 percentage points. However, RevPAR has fallen 3.1% YoY in the same period.

Investors can gain exposure to casino stocks by investing in the iShares US Consumer Services ETF (IYC), which invests 1.6% of its portfolio in casinos, including 0.71% in Las Vegas Sands (LVS), 0.50% in MGM Resorts (MGM), and 0.35% in Wynn Resorts (WYNN). It has no holdings in Melco Crown Entertainment (MPEL).