Melco Crown Entertainment Ltd

Latest Melco Crown Entertainment Ltd News and Updates

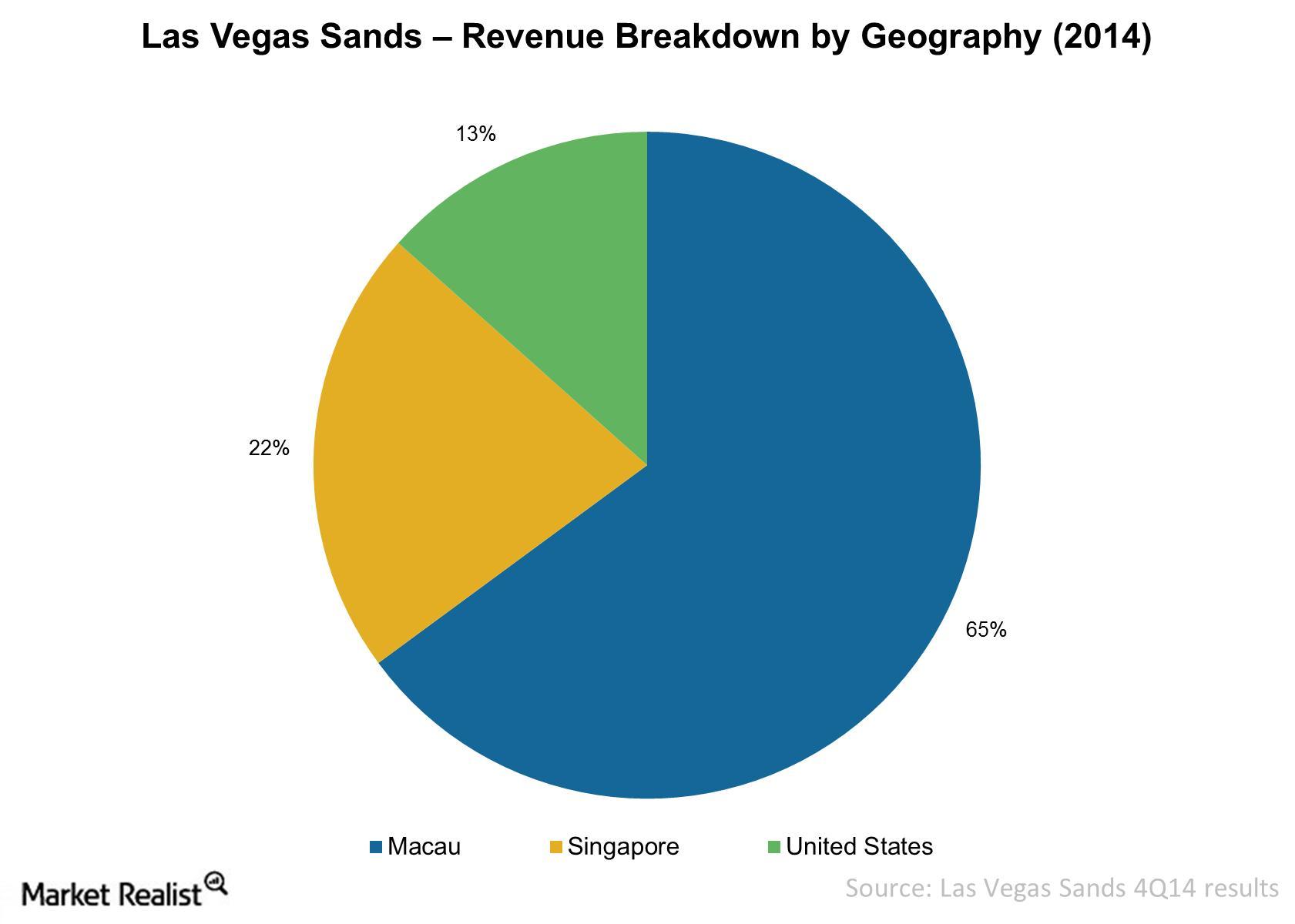

Must-know: A breakdown of Las Vegas Sands’ revenue

Las Vegas Sands (LVS) earns revenue through casinos, hotels, food and beverages, and convention or retail operations. The company’s main revenue driver is casino revenue. It’s generated from slot machines and table games. Casino revenue represents ~79% of the total revenues.

Must-know: The most popular casino games

Casinos’ popularity is growing. This suggests that people like to gamble occasionally. Unfortunately, they don’t always win. For most of the people, the real fun is playing the game—not necessarily winning.Consumer Must-know: Key performance metric tracked by Las Vegas Sands

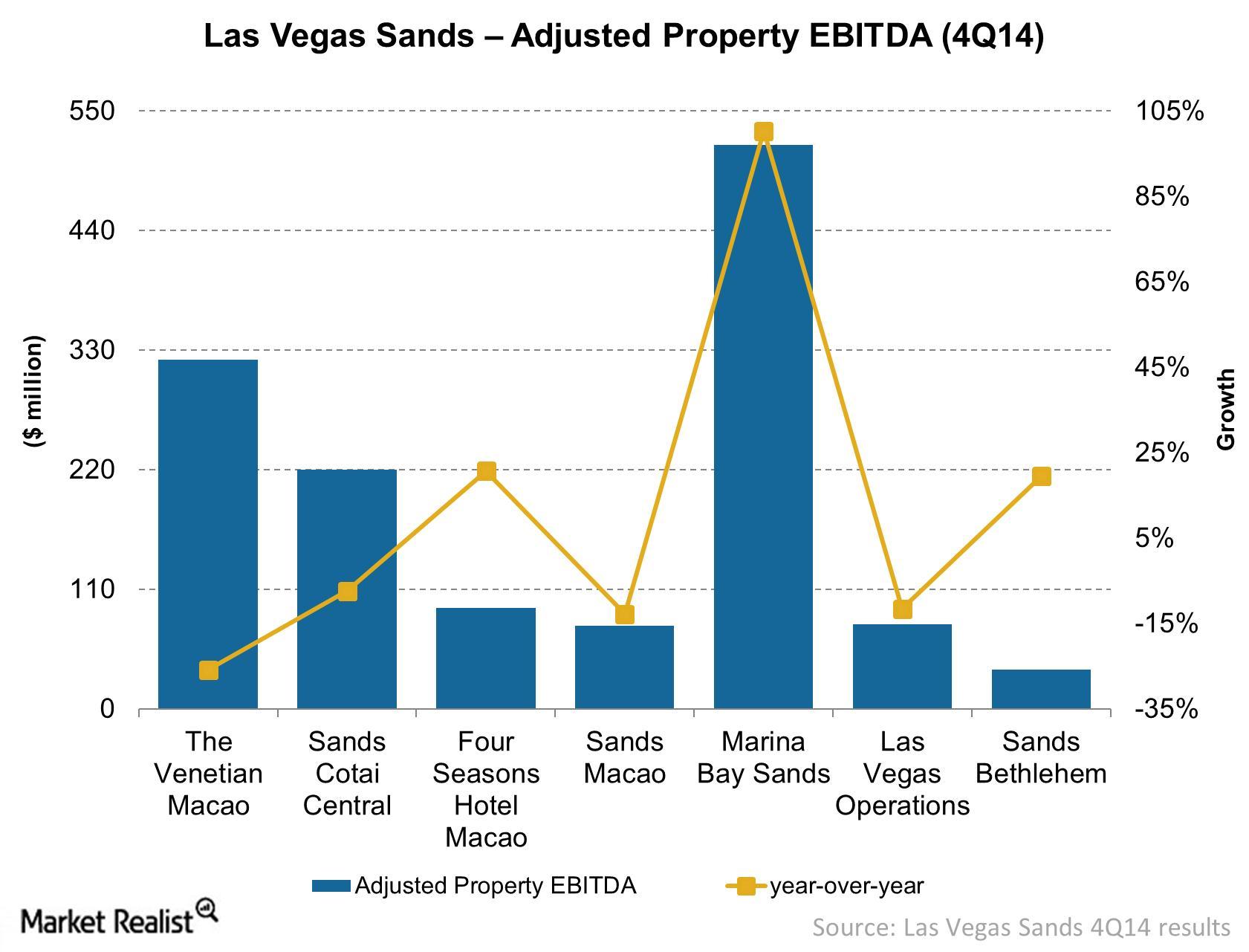

Adjusted property EBITDA shouldn’t be regarded as an alternative to looking at income from operations, which indicates operating performance. Nor is it an alternative to looking at cash flow from operations, which measures liquidity.

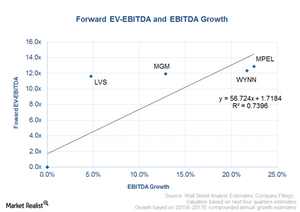

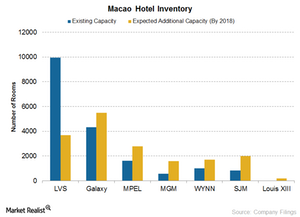

The Valuation of Macao Casino Stocks

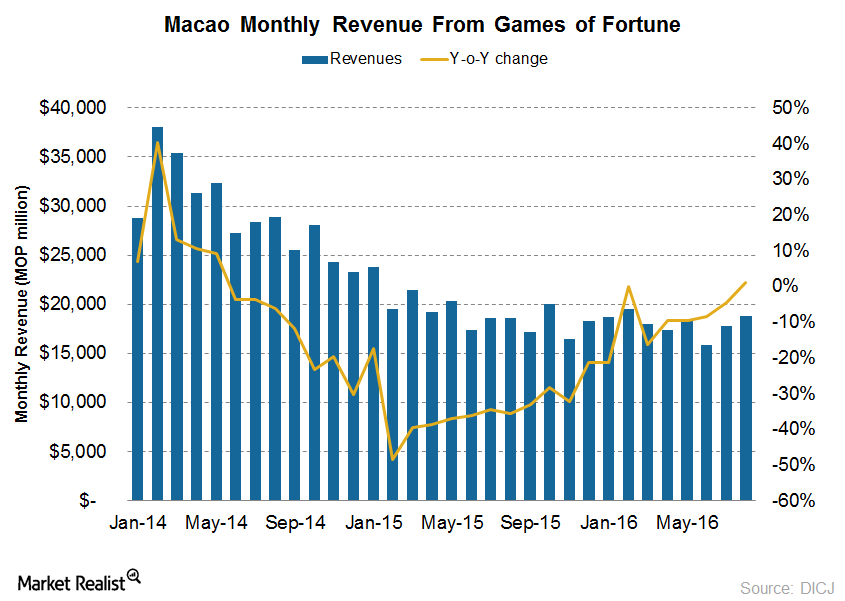

Macao’s shift from VIP gaming to the mass gaming market and non-gaming revenue is expected to benefit Macao in the long run.

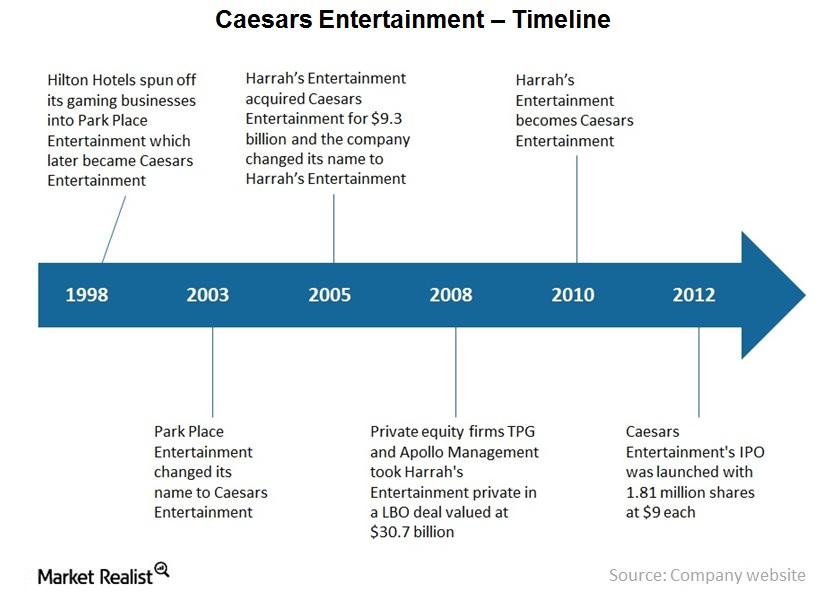

Overview of Caesars Entertainment and its complicated past

Caesars Entertainment has 51 casinos in 13 U.S. states and five countries. 38 are in the U.S. and primarily consist of land-based and riverboat casinos.

Las Vegas Sands’ adjusted property earnings double in Singapore

Las Vegas Sands’ adjusted property EBITDA at Marina Bay Sands in Singapore doubled, reaching a property record of $518.5 million, up ~100% year-over-year.

Recent developments for Wynn Resorts

Wynn Resorts (WYNN) is currently constructing Wynn Palace, a fully integrated resort in the Cotai area of Macau.

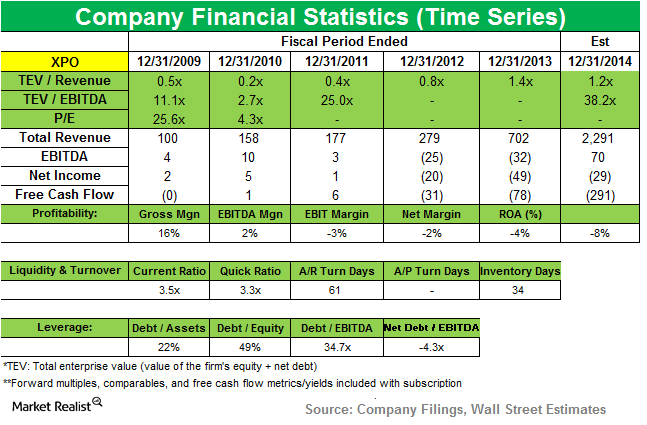

OTPP opens new position in XPO Logistics

OTPP added a new position in XPO Logistics Inc. (XPO) during the third quarter that ended in September. The position accounted for 0.46% of the fund’s total portfolio.

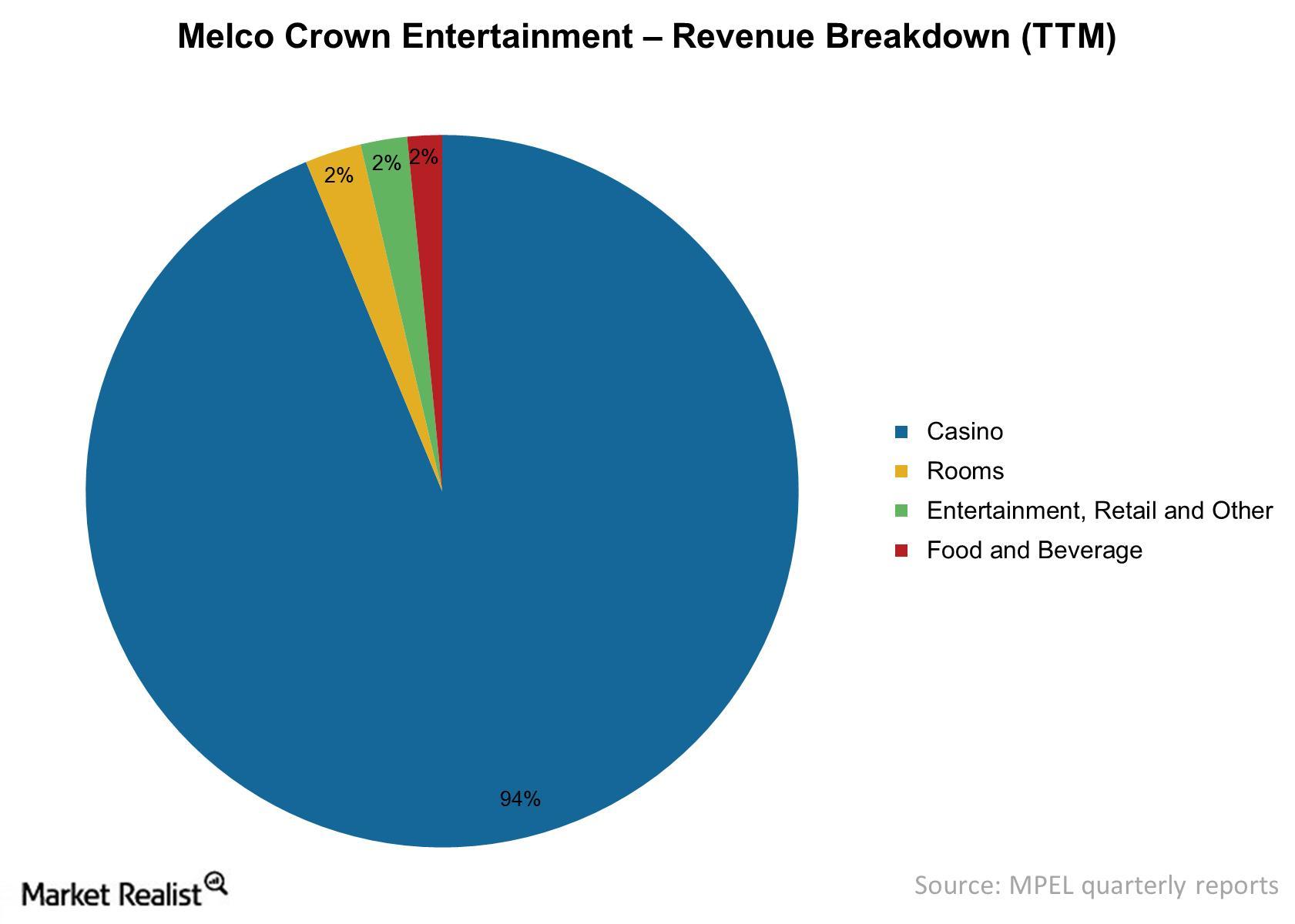

Why Melco Crown Is Profitable In The Casino Space

MPEL derives ~94% of revenues from casino operations. Its casino business gross margin is 50% for the trailing 12-month period ending September 30, 2014.

An important overview of Las Vegas Sands, a casino company giant

An overview of Las Vegas Sands (LVS) shows that the company currently owns 70.1% of Sands China Ltd., which operates LVS’s four Macao properties.

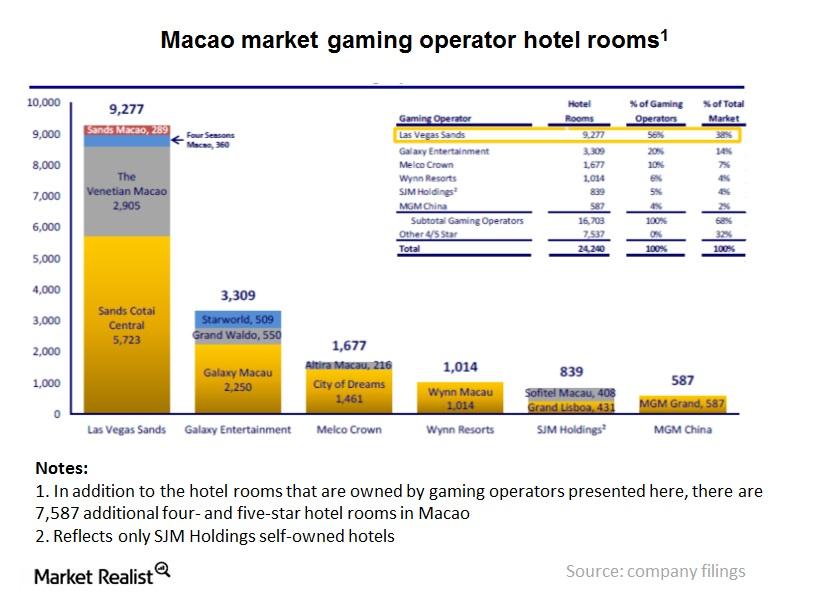

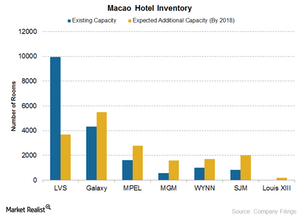

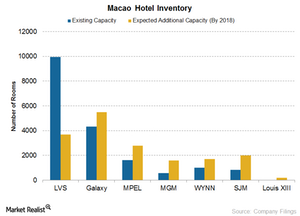

Macao Casinos Hope Hotel Supply Will Drive Demand

Macao’s casinos are trying to change Macao from a gaming-only destination to more of a Las Vegas–like destination.

Is Oversupply a Concern for Macao Casinos?

Macao casinos’ $28 billion investment in integrated resorts is set to change the city’s gaming business.

Is the Mass Market Shift Working for Macao Casinos?

As VIP business continues to remain sluggish, casinos are increasingly turning their attention towards the mass market.

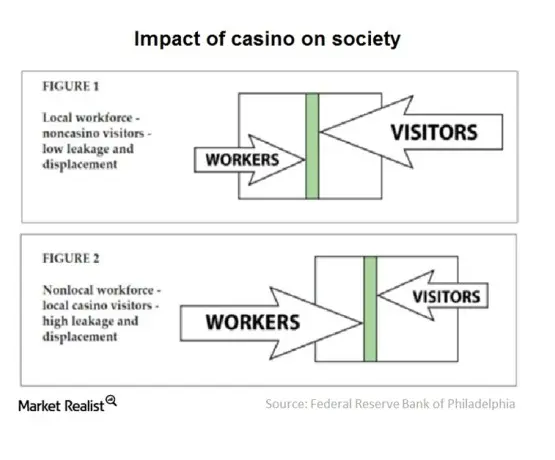

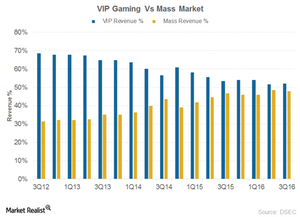

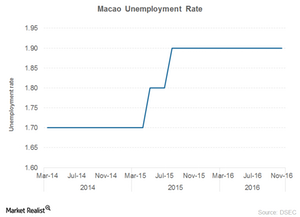

Why Should Investors Keep an Eye on Macao’s Unemployment Rate?

For September 2016 through November 2016, the unemployment rate stood at 1.9%.

Hotel Inventory Is Rising, but Is There Enough Demand?

Macao casinos’ $28-billion investment in integrated resorts will change the city’s gaming. Capacity additions should increase the number of slot tables too.

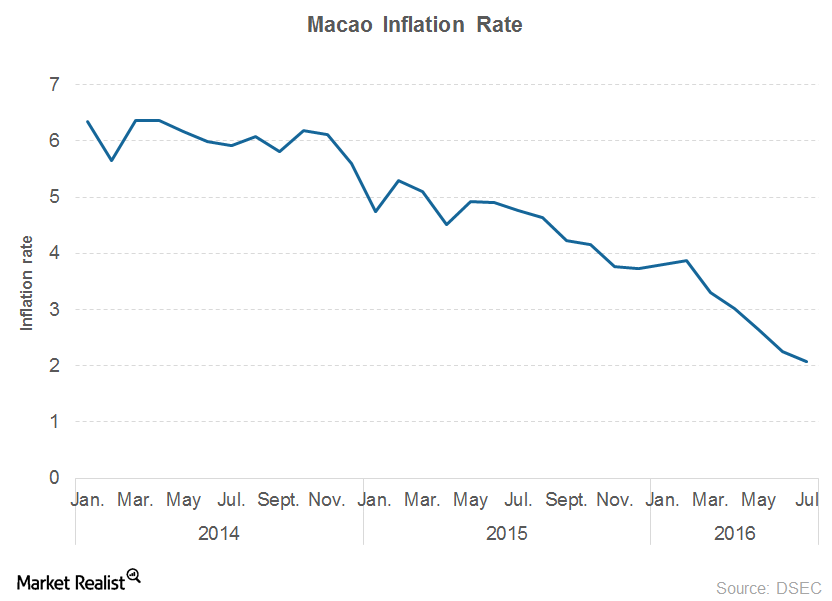

What Do Macao’s Inflation Numbers Indicate?

The annual inflation in Macao fell to ~2.1% in July 2016. Inflation has, in fact, been on a declining trend in the region since February 2016.

Revival or Luck: Analysts’ Takes on Macao’s Revenue Rise

After 26 consecutive months of declining revenues, Macao gaming revenues have finally shown a small spurt of growth.Consumer Why the commercial gaming market is increasing for casinos

Casino gaming is the largest part of the commercial gaming market. It continues to grow in popularity. There has been a surge in demand for casino games. As a result, new casino destinations have been created. Existing casinos have also been expanded.