iShares US Consumer Services

Latest iShares US Consumer Services News and Updates

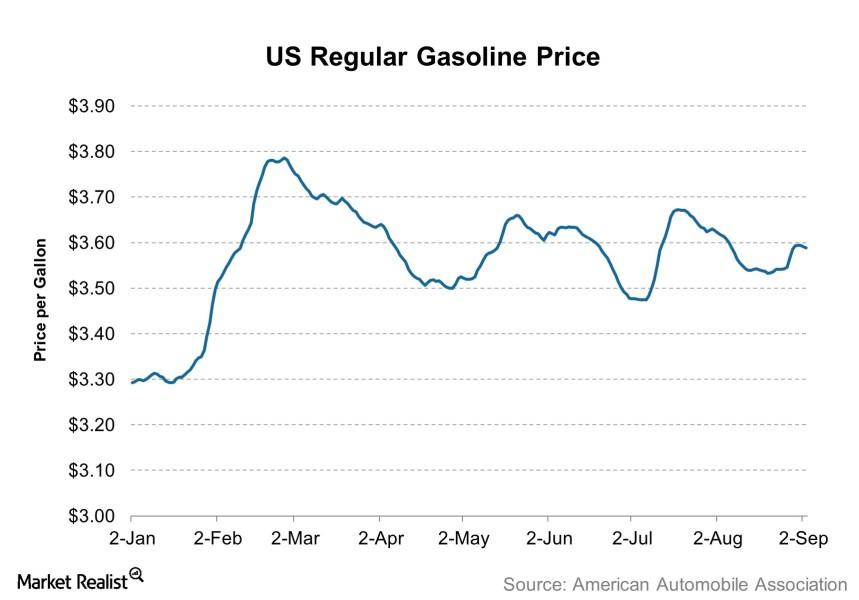

Syria strike would raise gas prices and reduce restaurants’ sales

Why higher gasoline prices can reduce people’s leftover spending at restaurants, which will negatively affect restaurant sales.

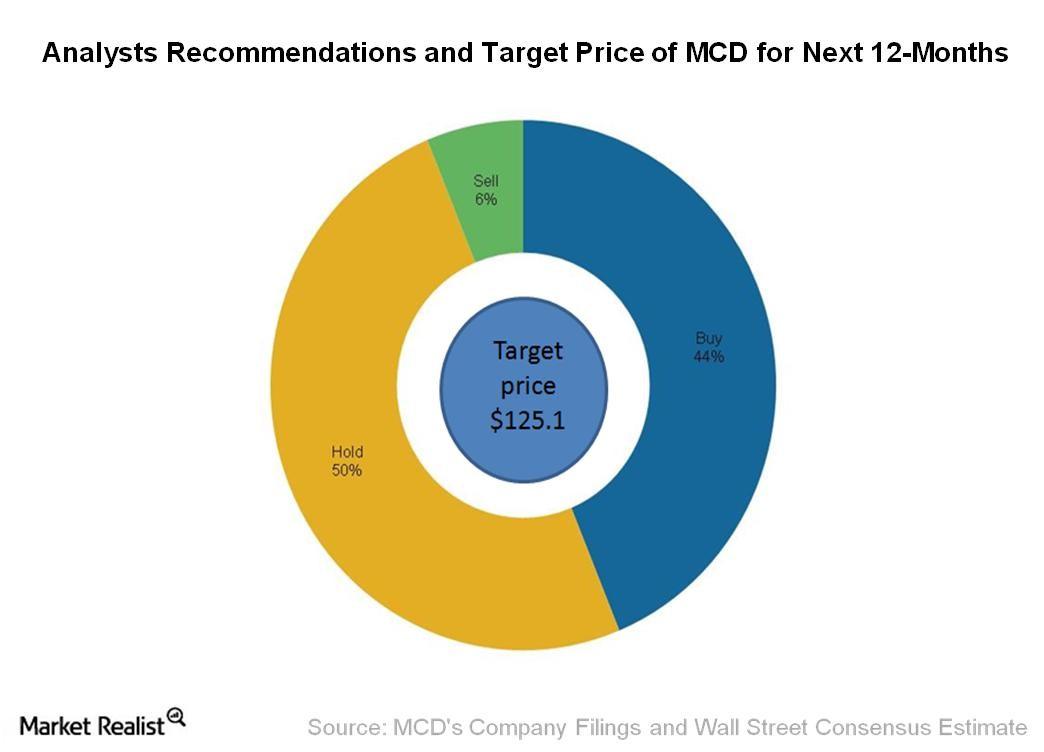

Analysts Revised the Price Target after McDonald’s Earnings

Wall Street analysts set a price target of $125.1 for the next 12 months with a return potential of 5% from the closing price of $119.2 on January 25.

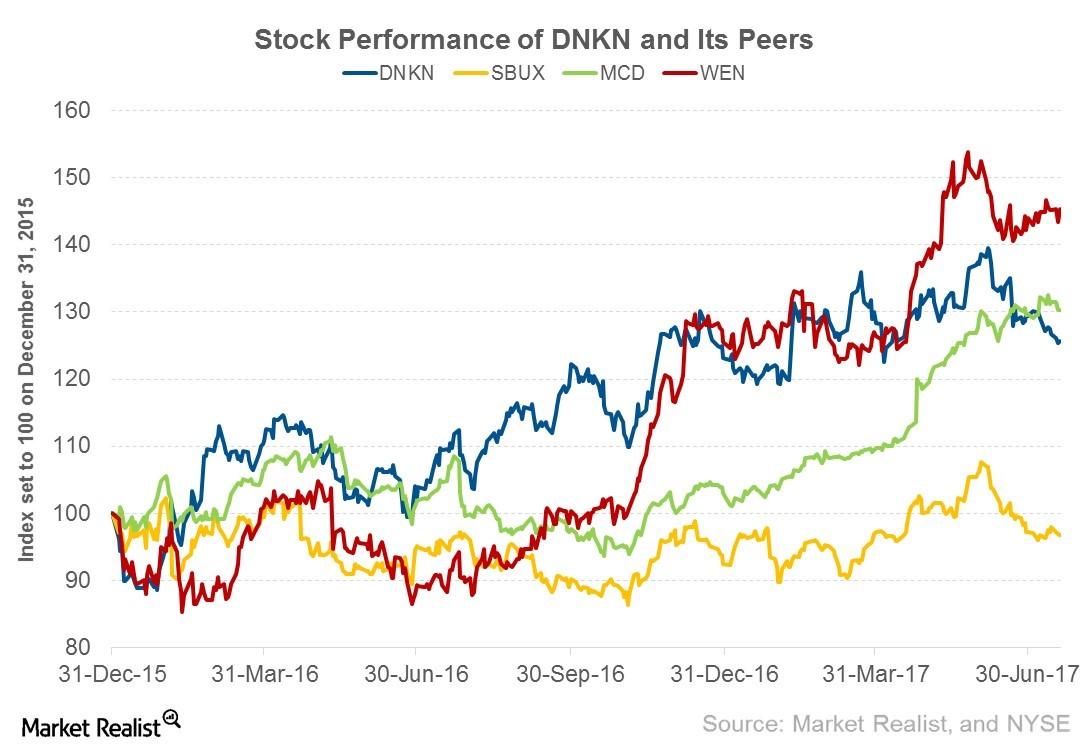

Will Dunkin’ Brands’ 2Q17 Earnings Boost Its Stock Price?

Dunkin’ Brands, the owner of the Dunkin’ Donuts and Baskin-Robbins brands, is scheduled to announce its 2Q17 earnings before the market opens on July 27, 2017.

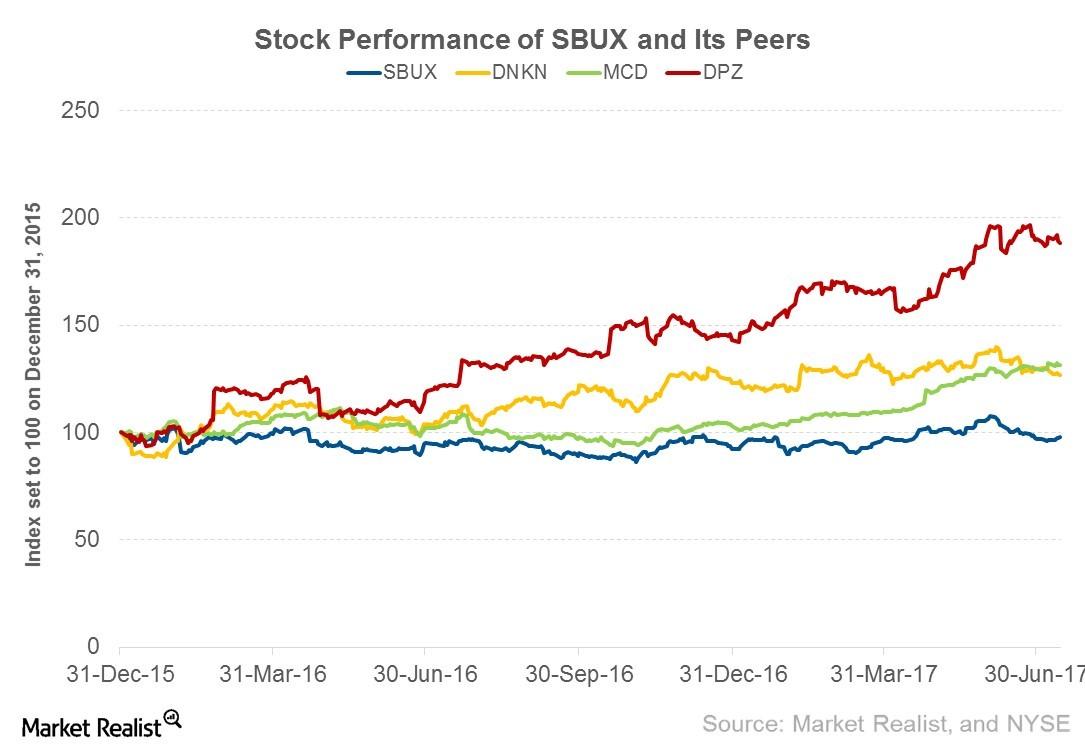

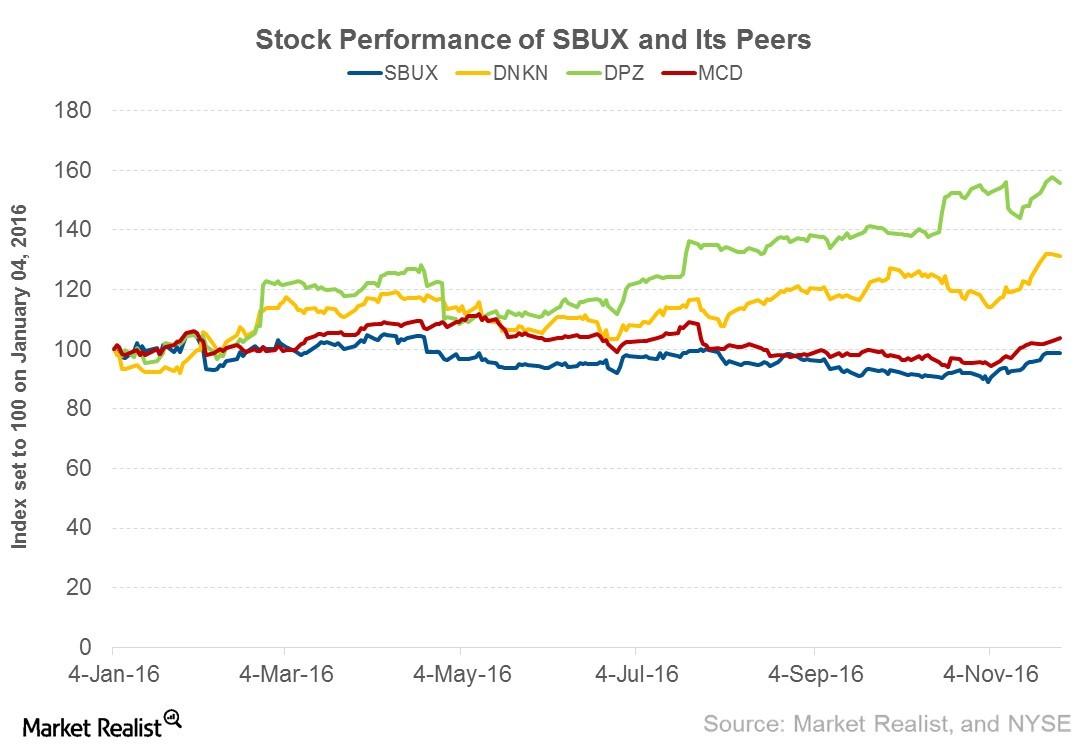

Will Starbucks’s Fiscal 3Q17 Earnings Boost Its Stock Price?

Starbucks (SBUX) is scheduled to announce its fiscal 3Q17 earnings after the market closes on July 27, 2017. Starbucks’ fiscal 3Q17 extends from April 3, 2017.

How Much Upside Is Left in Starbucks’s Stock Price?

Starbucks’s (SBUX) share price has been soaring since it announced its fiscal 4Q16 results on November 3, 2016. Let’s explore why.

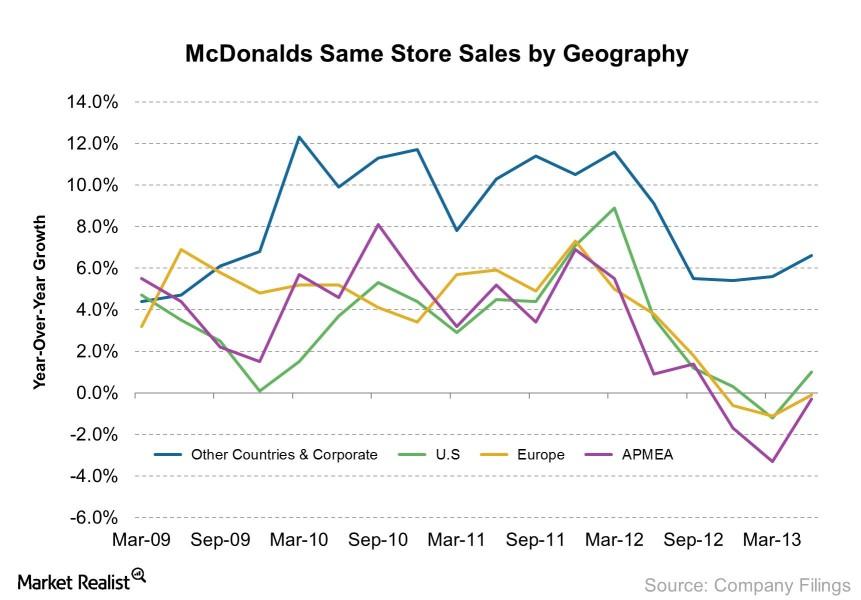

Are McDonald’s higher sales in Europe part of a larger trend?

In this series, we uncover the key indicators investors should know to help them stay calm and position themselves correctly in the restaurant market. Investing is an art and a science. There is no secret formula.

Six Flags Entertainment: An overview of the largest theme park

Six Flags Entertainment Corp. (SIX) is the world’s largest regional theme park company with $1.1 billion in revenue and 18 parks across North America.

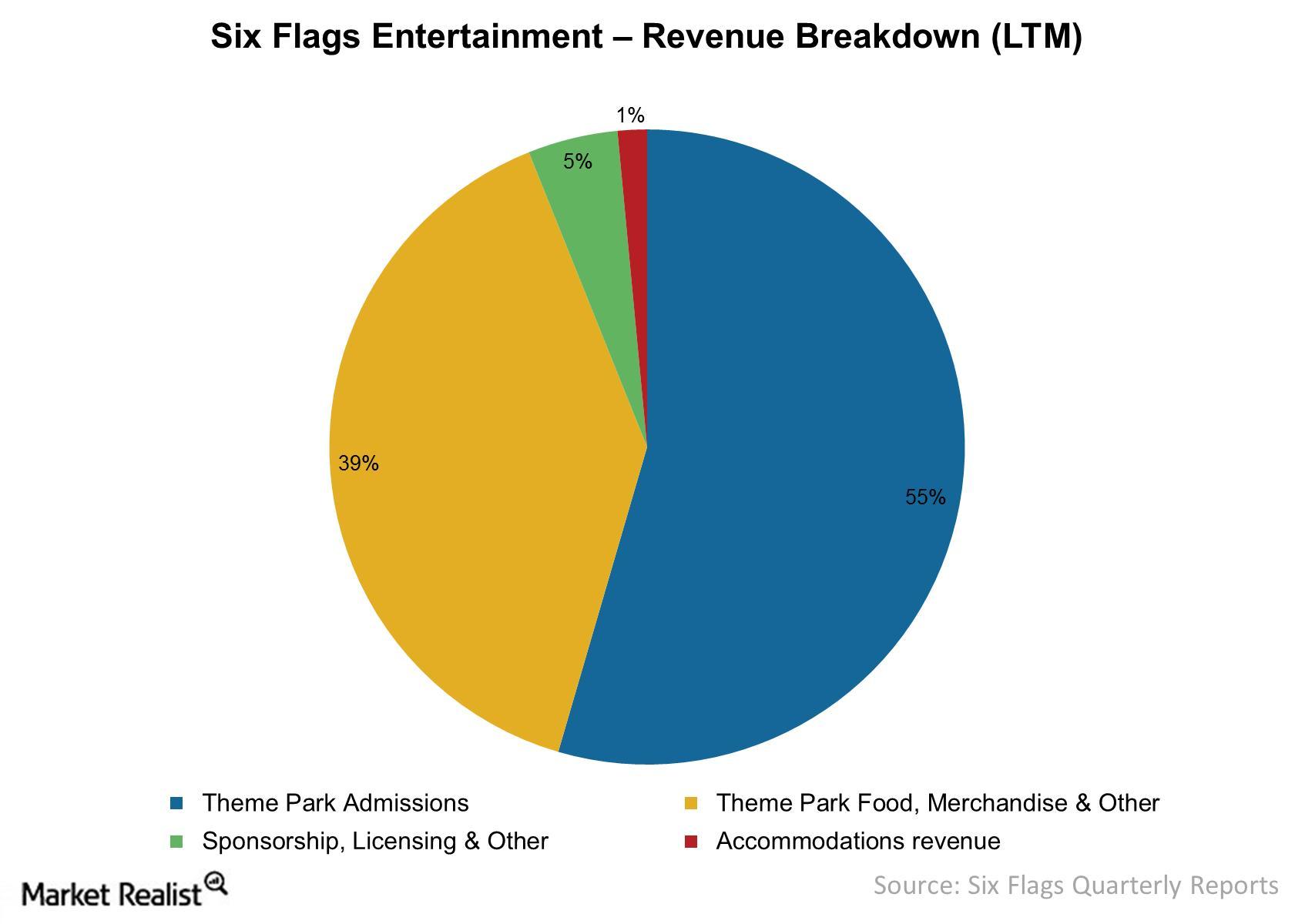

Must-know: How Six Flags generates its revenues

Six Flags derived 55% of its revenues from theme park admissions for the last 12 months ended September 30, 2014.

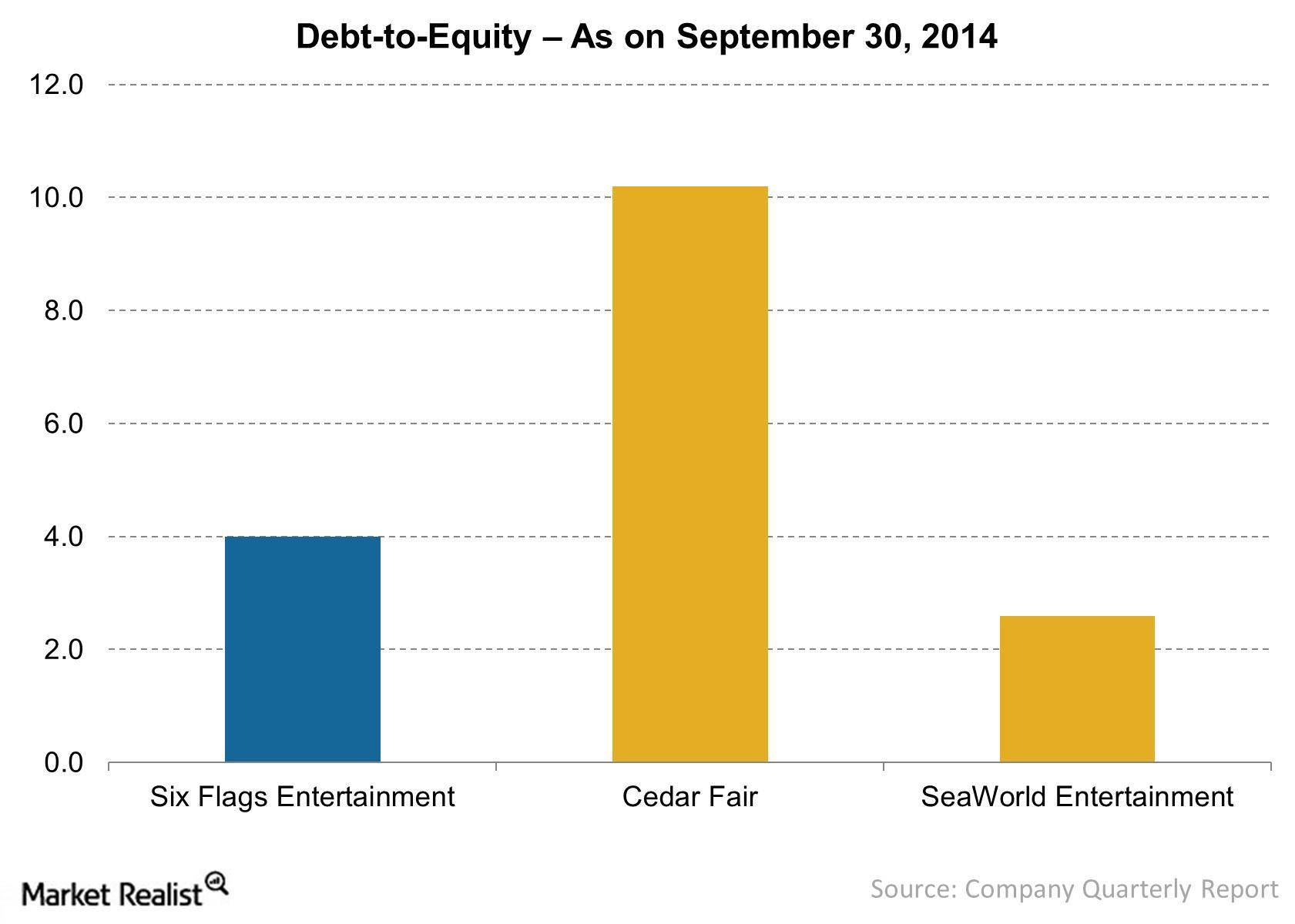

Must-know: A look into Six Flags’ debt-to-equity ratio

Industry debt-to-equity ratio is about 5.5. Six Flags’ debt-to-equity ratio of 4.0 shows the company aggressively finances operations with debt capital.

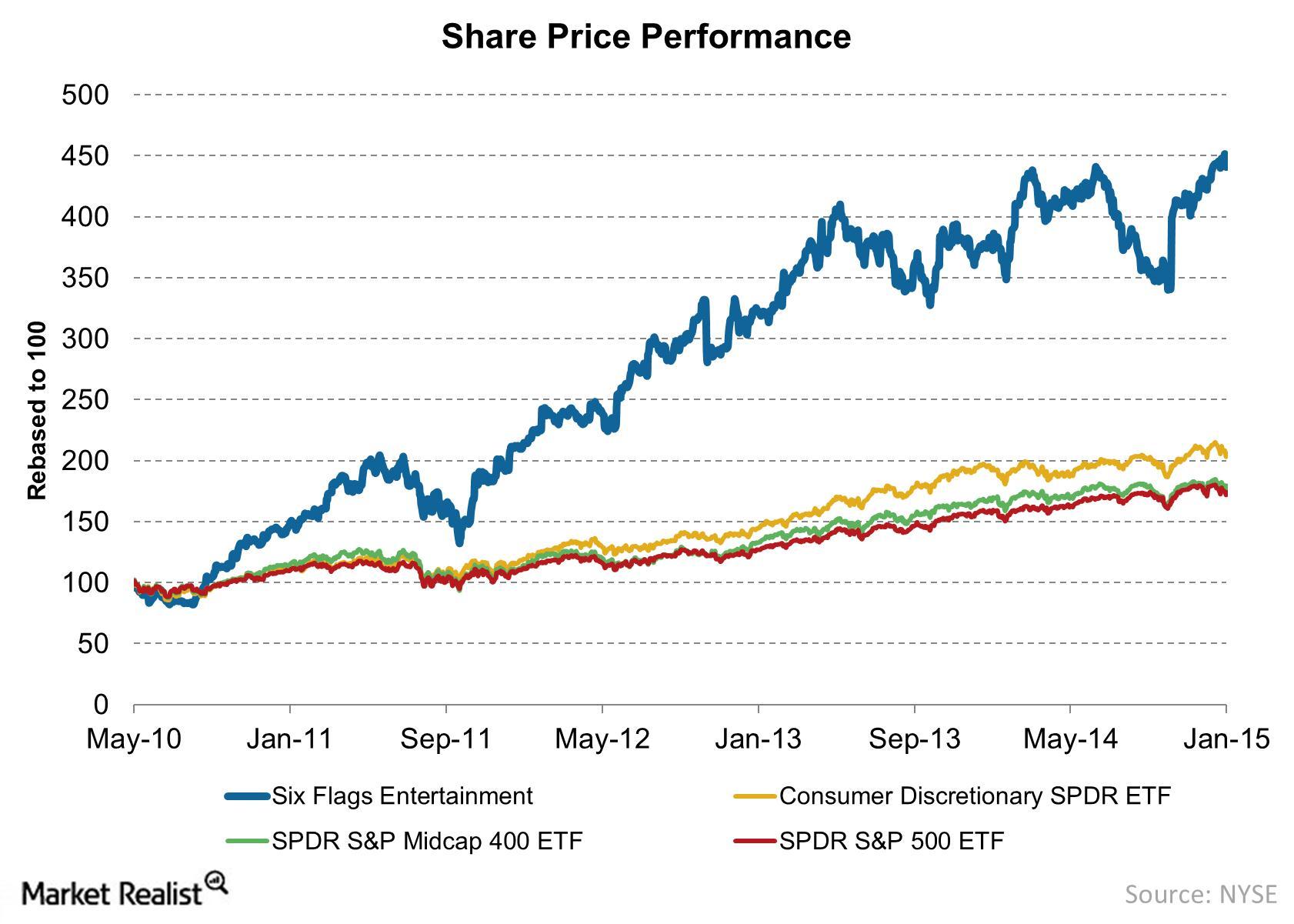

Share price performance for Six Flags since bankruptcy recovery

Six Flags’ share price on May 10, 2010, reflects $7.36 per share, the price of new common stock upon the company’s emergence from bankruptcy.

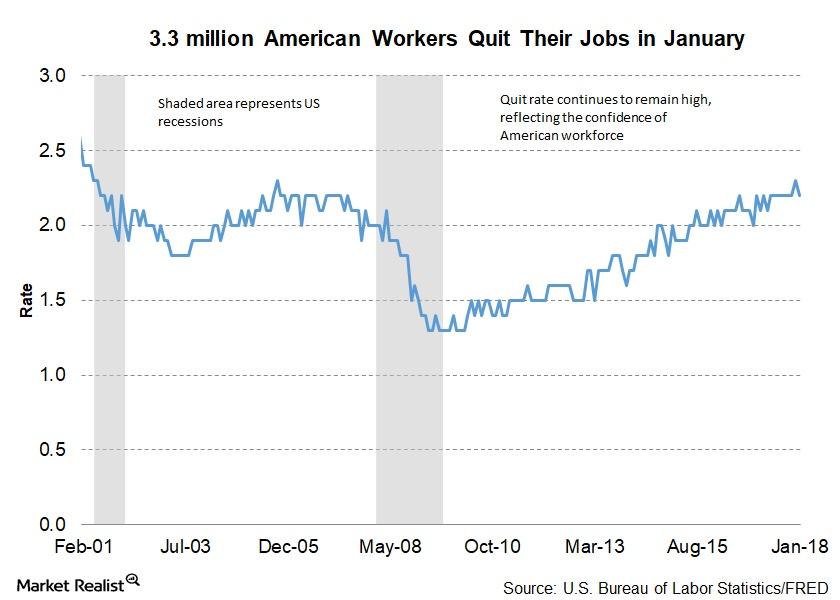

Why the US Workforce’s Quit Rate Has Remained High

January’s JOLTS (Job Openings and Labor Turnover Survey) data, which contains information about job openings and total separations, was reported on March 16.

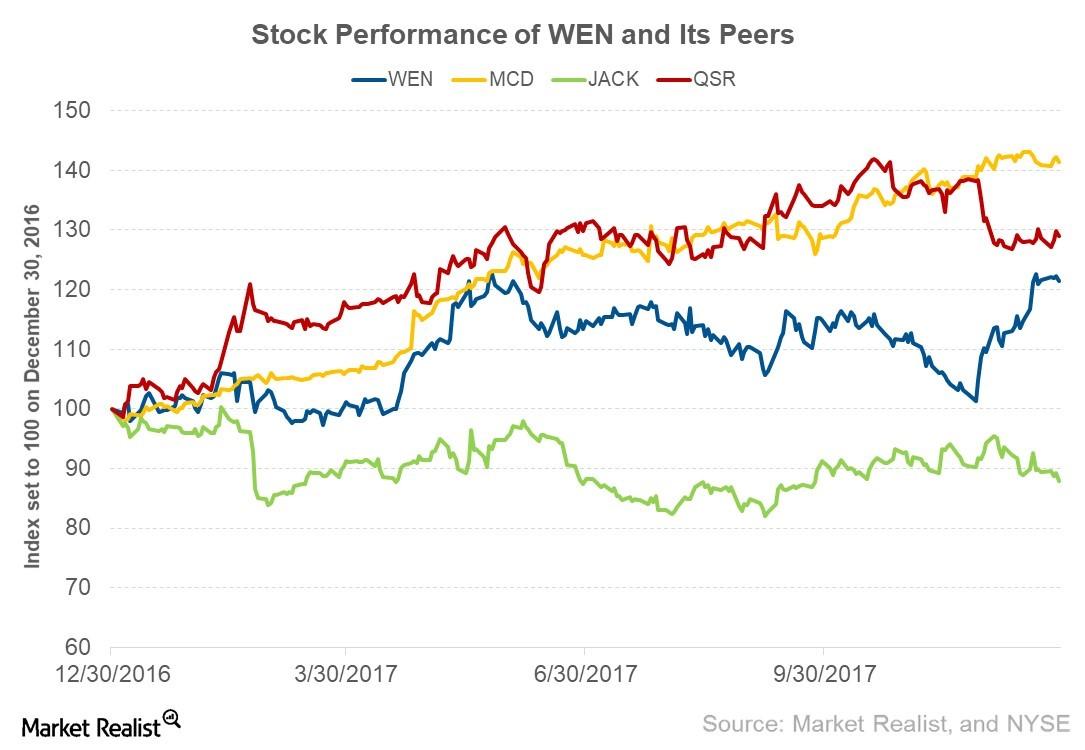

What’s Driving Wendy’s Stock Price

In this series, we’ll look at analysts’ earnings and revenue estimates for the next four quarters. We’ll also review Wendy’s valuation and analysts’ recommendations.

What Rising Services Activity Means for the US Economy

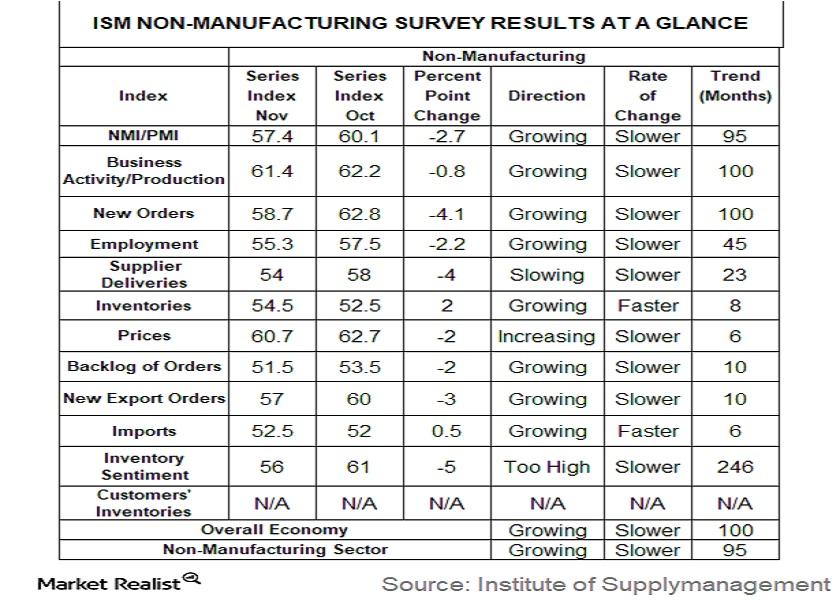

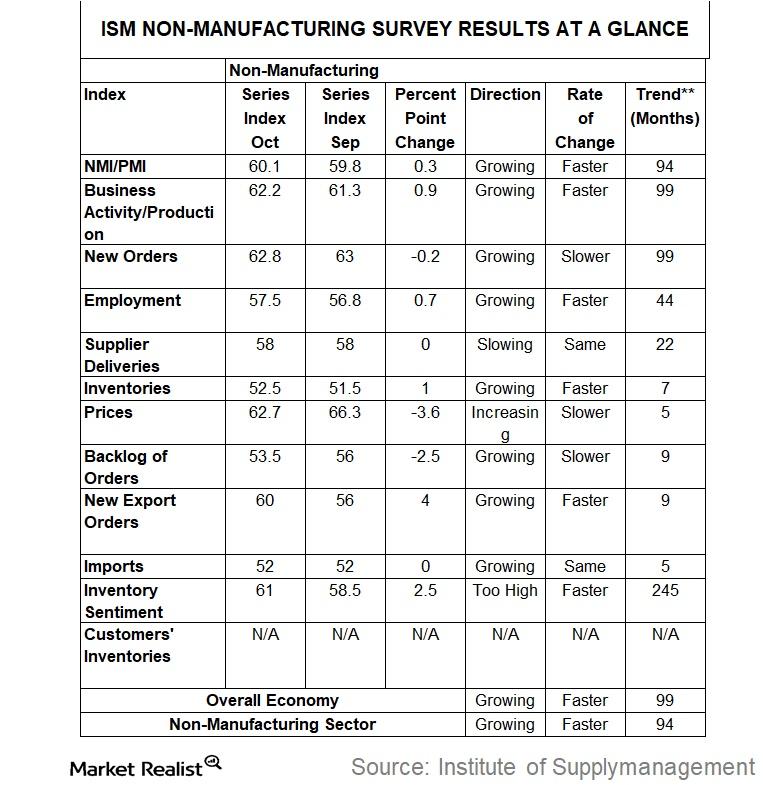

After reaching a lifetime high in October 2017, the ISM (Institute of Supply Management) non-manufacturing index fell 2.7 percentage points to 57.4%.

This ISM Index Hit a Lifetime High in October

For October, service sector activity rose at a pace not seen since the inception of the report. The non-manufacturing index reached a lifetime high of 60.1.

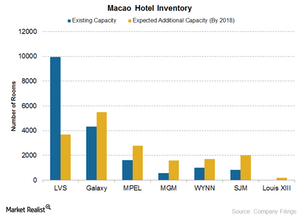

Macao Casinos Hope Hotel Supply Will Drive Demand

Macao’s casinos are trying to change Macao from a gaming-only destination to more of a Las Vegas–like destination.

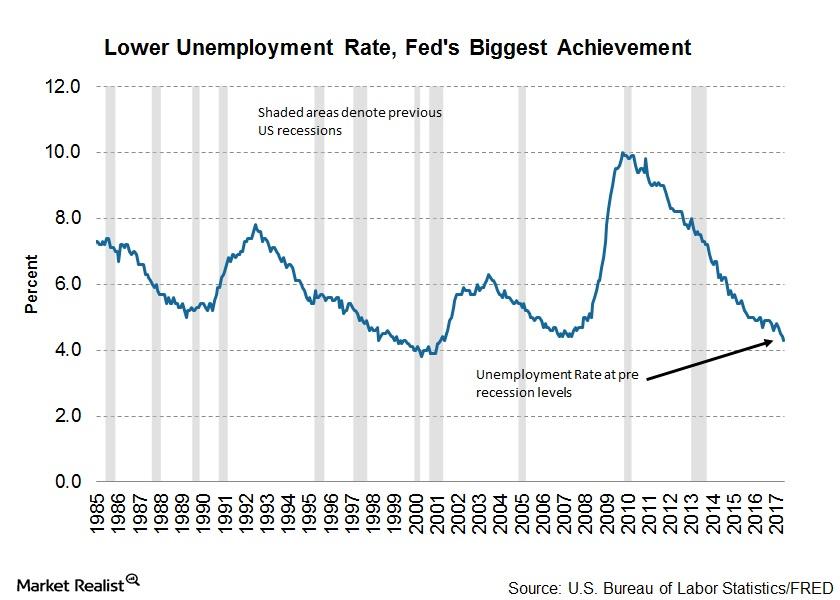

Why the Fed Isn’t Satisfied with Labor Market Conditions

Despite the strong growth in employment numbers, the Fed’s latest monetary policy report had some comments about slow wage growth.

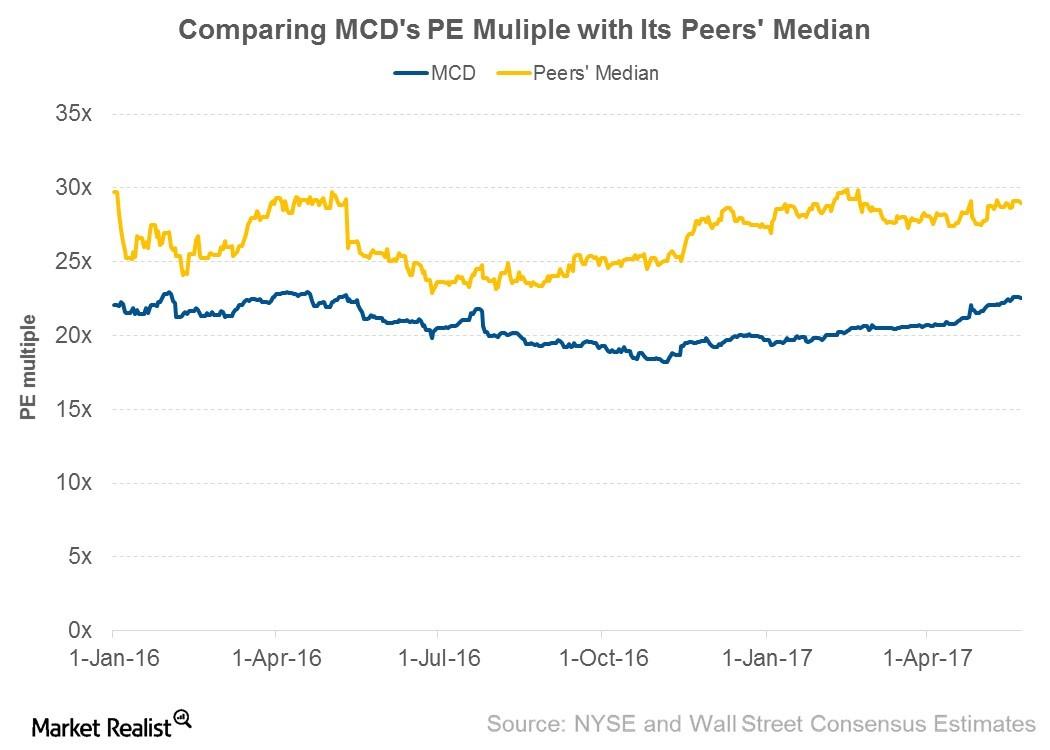

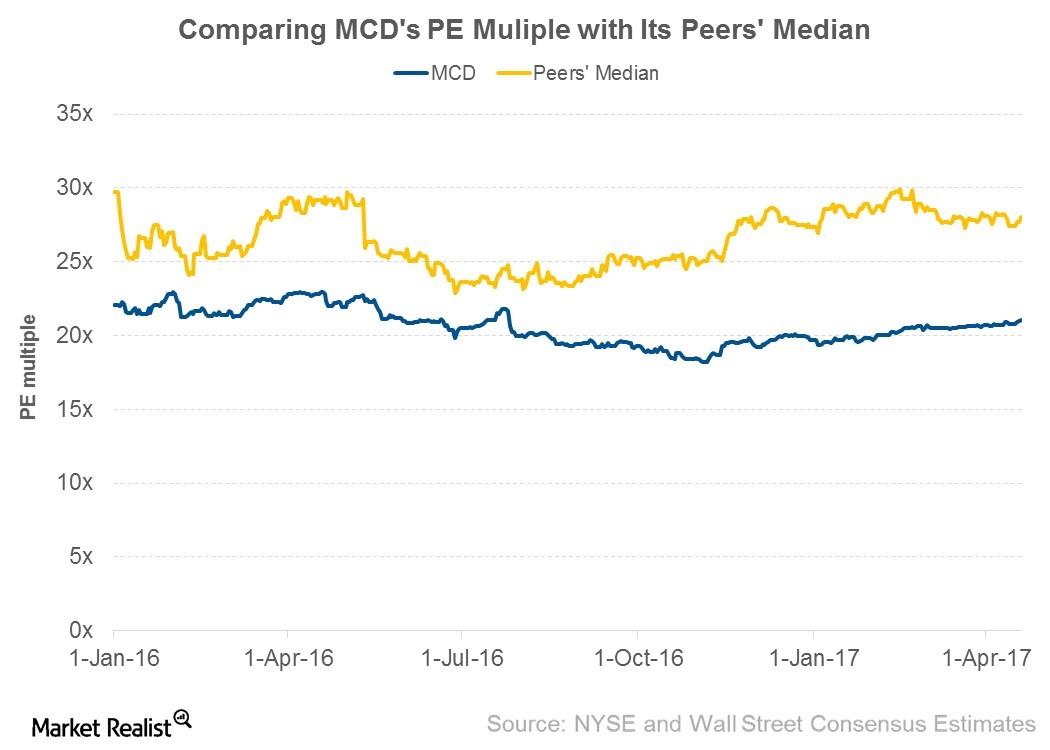

Analyzing McDonald’s Valuation Multiple

As of May 24, 2017, McDonald’s was trading at a PE multiple of 22.6x—compared to 21.3x before the announcement of its 1Q17 earnings.

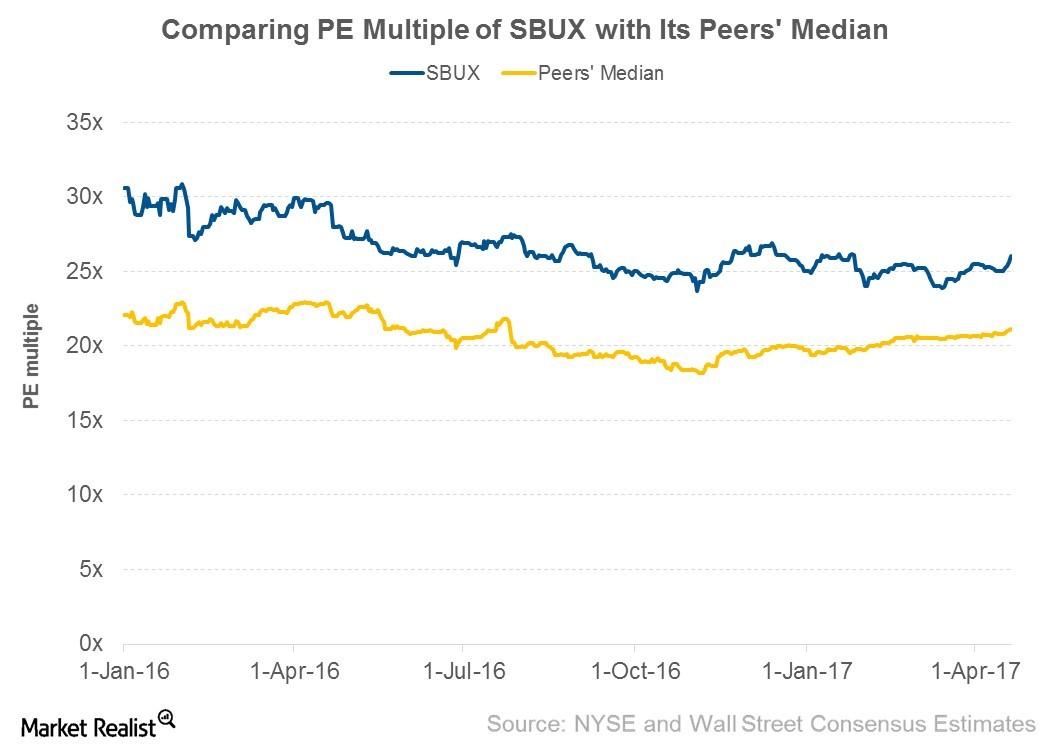

How Starbucks’s Valuation Compares to Peers

For the next four quarters, analysts are expecting Starbucks to post EPS growth of 12.8%.

Where McDonald’s Valuation Multiple Stands Next to Peers

As of April 19, 2017, McDonald’s was trading at a PE multiple of 21.1x, as compared to 19.9x before the announcement of its 4Q16 earnings.

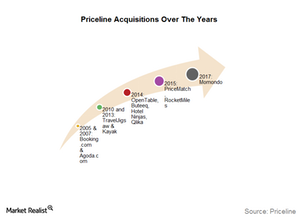

Priceline’s String of Acquisitions Continues with Momondo

Earlier this month, the Priceline Group (PCLN) signed a deal to acquire Momondo Group. Priceline will acquire all outstanding shares of Momondo for $550 million in an all-cash deal.

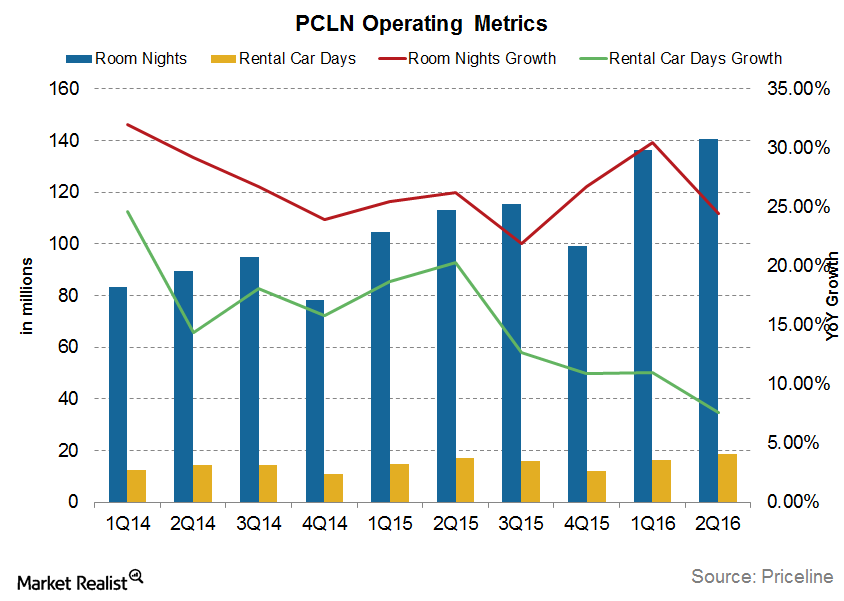

What Do Priceline’s Key Metrics Suggest?

From 2012 to 2014, Priceline Group’s (PCLN) gross bookings grew at an average of 30%. For 2015, accounting for the strong US dollar, growth was just 10%.

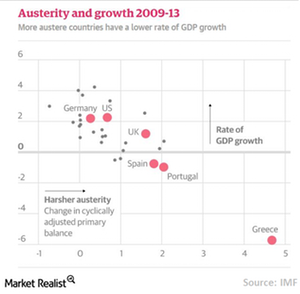

Assessing the Paradigm Shift in the Fiscal Policy

Fiscal policy has turned more expansionary, with stress on fiscal spending and monetary easing, thereby flooding the financial markets worldwide with huge liquidity.

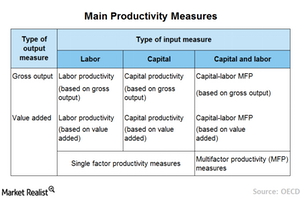

What Are the Traditional Measures of Labor Productivity?

Labor productivity is an important tool to measure the strength of a country’s economy. Policymakers often use this indicator to compare output efficiency during a particular period.

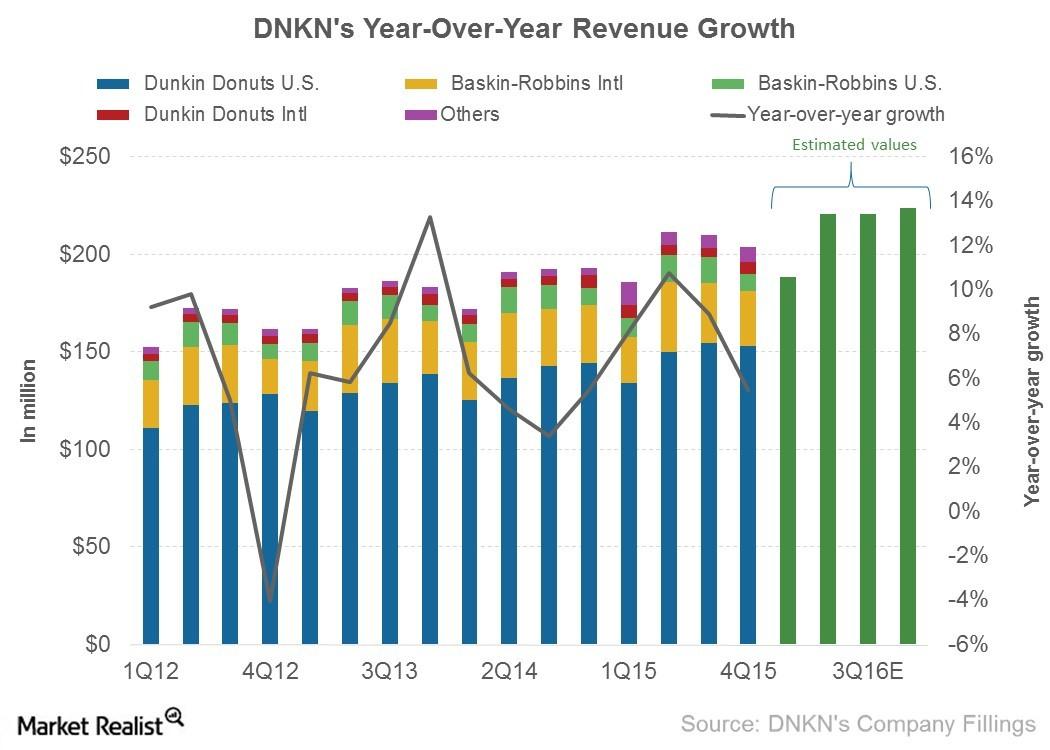

Unit Growth and Dunkin’ K-Cup Sales Drove 4Q15 Revenue Growth

Dunkin’ Brands (DNKN) earns its revenue from five different channels: Dunkin’ Donuts US, Dunkin’ Donuts International, Baskin-Robbins US, Baskin-Robbins International, and others.

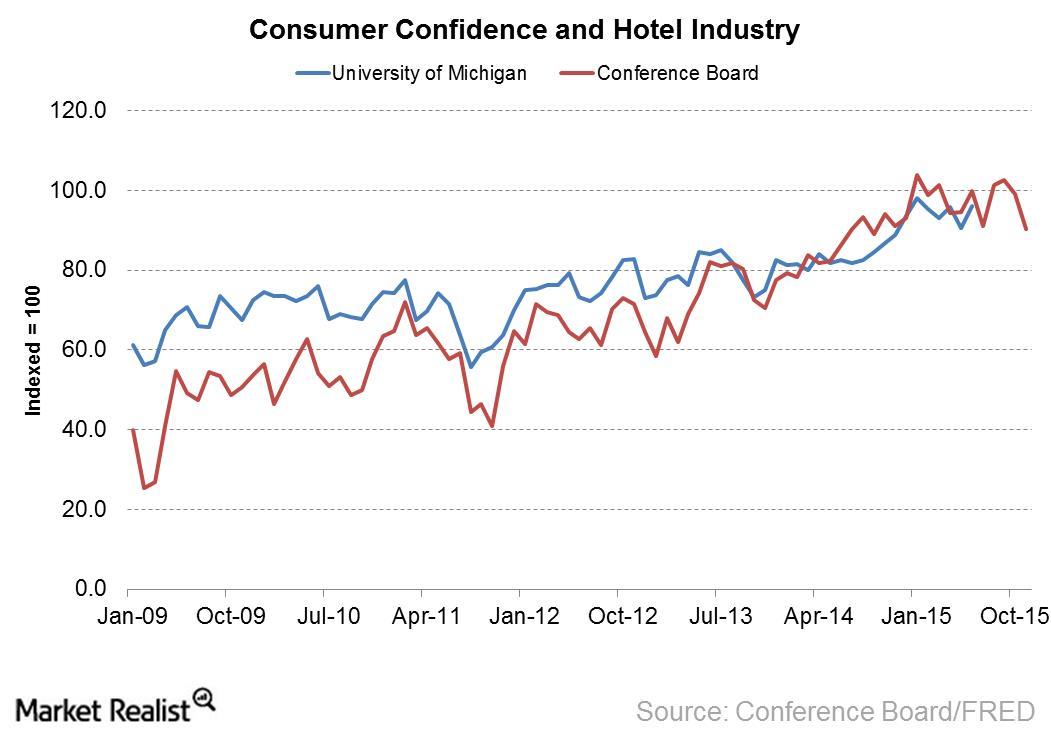

How Could Falling Consumer Confidence Affect the Hotel Industry?

The Conference Board Consumer Confidence Index as of November 2015 was 90.4 compared to 102.6 in September 2015.

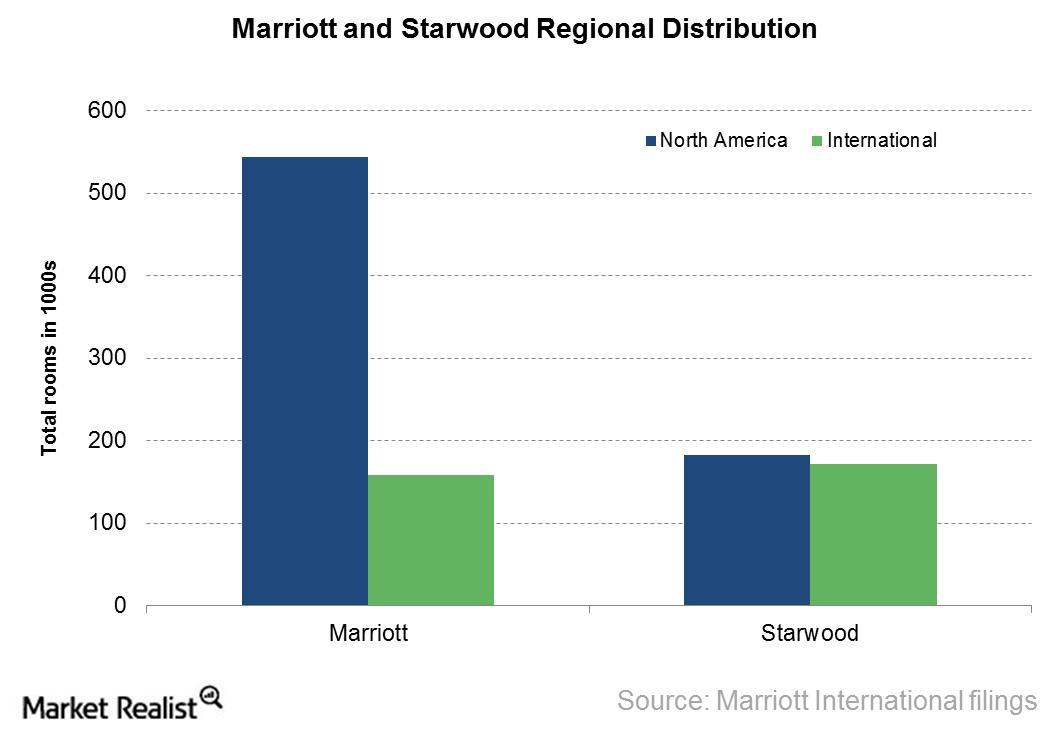

Just How Much Does Marriott International Stand to Benefit from the Starwood Acquisition?

Marriott’s acquisition of Starwood will likely help Marriott double its international portfolio while diversifying its global presence.

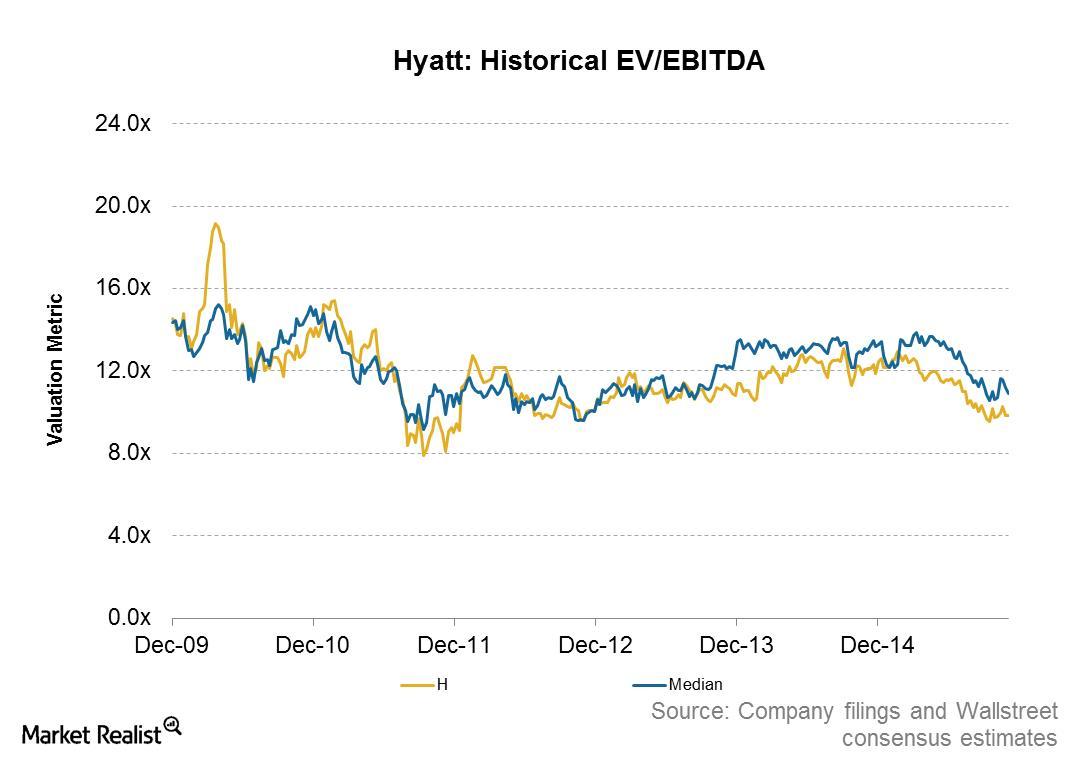

Investor Essentials: Understanding Hyatt’s Valuation Multiple

Hyatt’s EV/EBITDA has moved in line with the median valuation multiple of its peers. Hyatt, with rare exceptions, has always traded at a discount to the median valuation multiple of its peers.

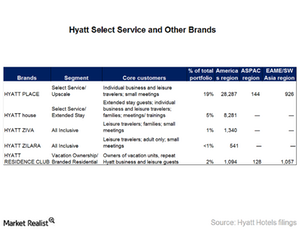

Introduction to Hyatt’s Select Service Brands and Other Brands

Hotels that offer accommodation with limited services and amenities are called select service hotels. Hyatt (H) operates about 37,500 rooms and two brands under this segment.

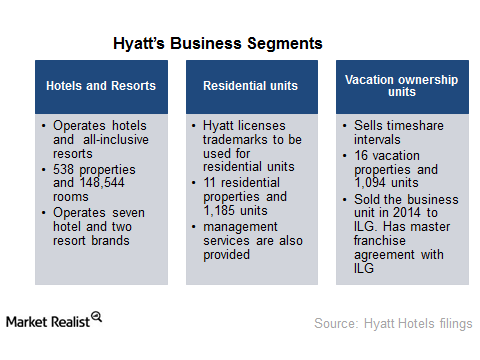

An Overview of Hyatt Hotels’ Competition

Some of Hyatt’s competitors—Hilton (HLT), Marriott (MAR), Wyndham (WYN), and Starwood (HOT)—compete in all the segments: Hotels and Resorts, Residential Units, and Vacation Ownership Units.

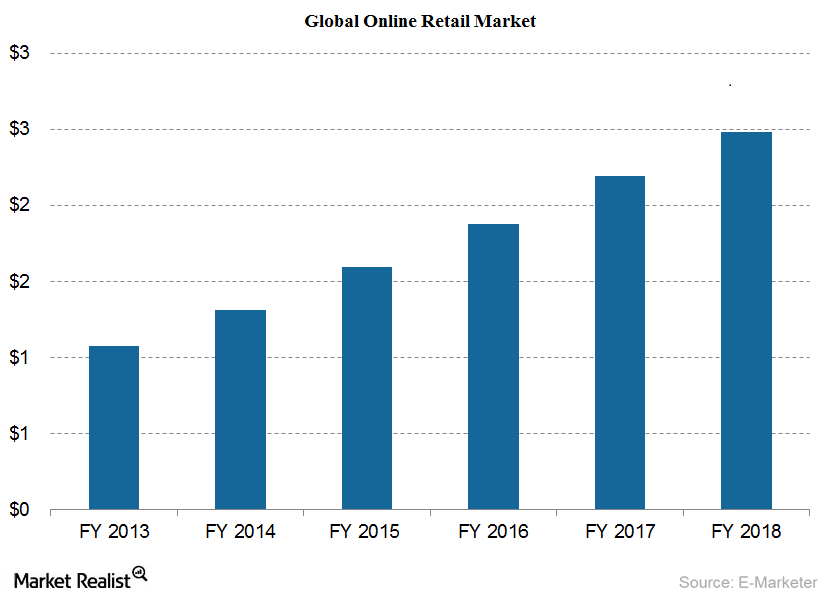

Huge Growth Potential in the Global e-Commerce Market

The global e-commerce market is expected to grow at a CAGR (compound annual growth rate) of 17 from $1.3 trillion in 2014 to $2.5 trillion by the end of 2018.

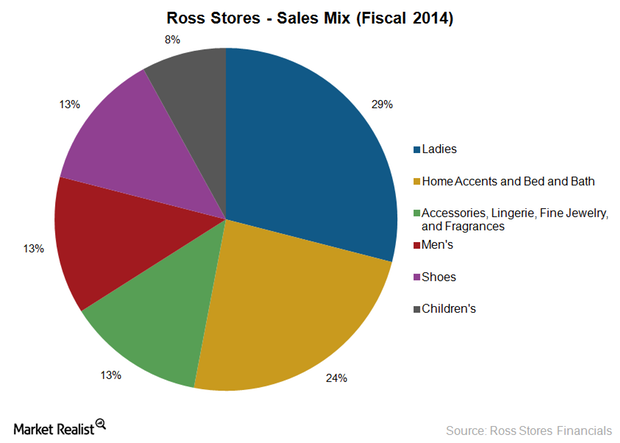

Key Components of Ross Stores’ Sales Mix

In fiscal 2014, women’s apparel accounted for 29% of Ross Stores’ sales of $11 billion. Home accents is also a key category at 24% of total sales.

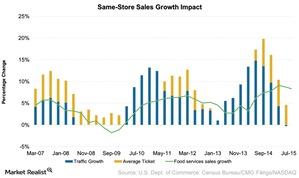

Will Chipotle Report Low Same-Store Sales Growth in 3Q15?

Chipotle (CMG) experienced tremendous same-store sales growth in 2014, with most of its quarters reporting a double-digit growth.

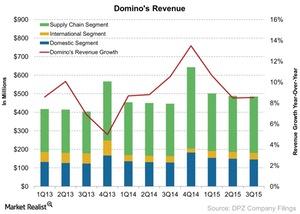

Why US Economic Activity Is Important to Domino’s Pizza

Although Domino’s is spread over 75 countries, most of the company’s revenue comes from domestic markets and is more sensitive to economic conditions in the US.

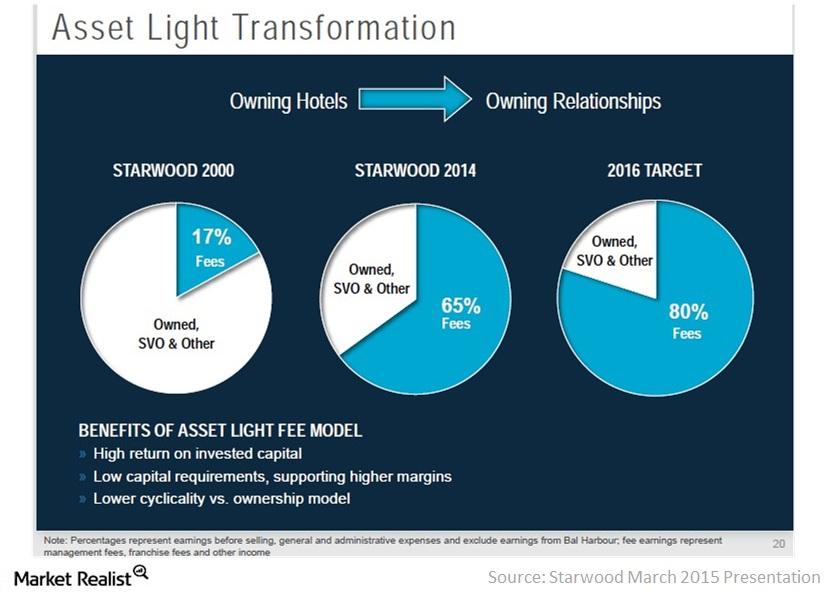

Analyzing Starwood’s Asset-Light Strategy

In 2006, Starwood’s management embarked on an asset-light strategy. It decided to sell a significant portion of Starwood’s owned hotel portfolio.

Starwood’s Vacation Ownership Business Spin-Off

On February 10, 2015, Starwood Hotels and Resorts announced plans to spin off its vacation ownership business into a separate publicly traded company.

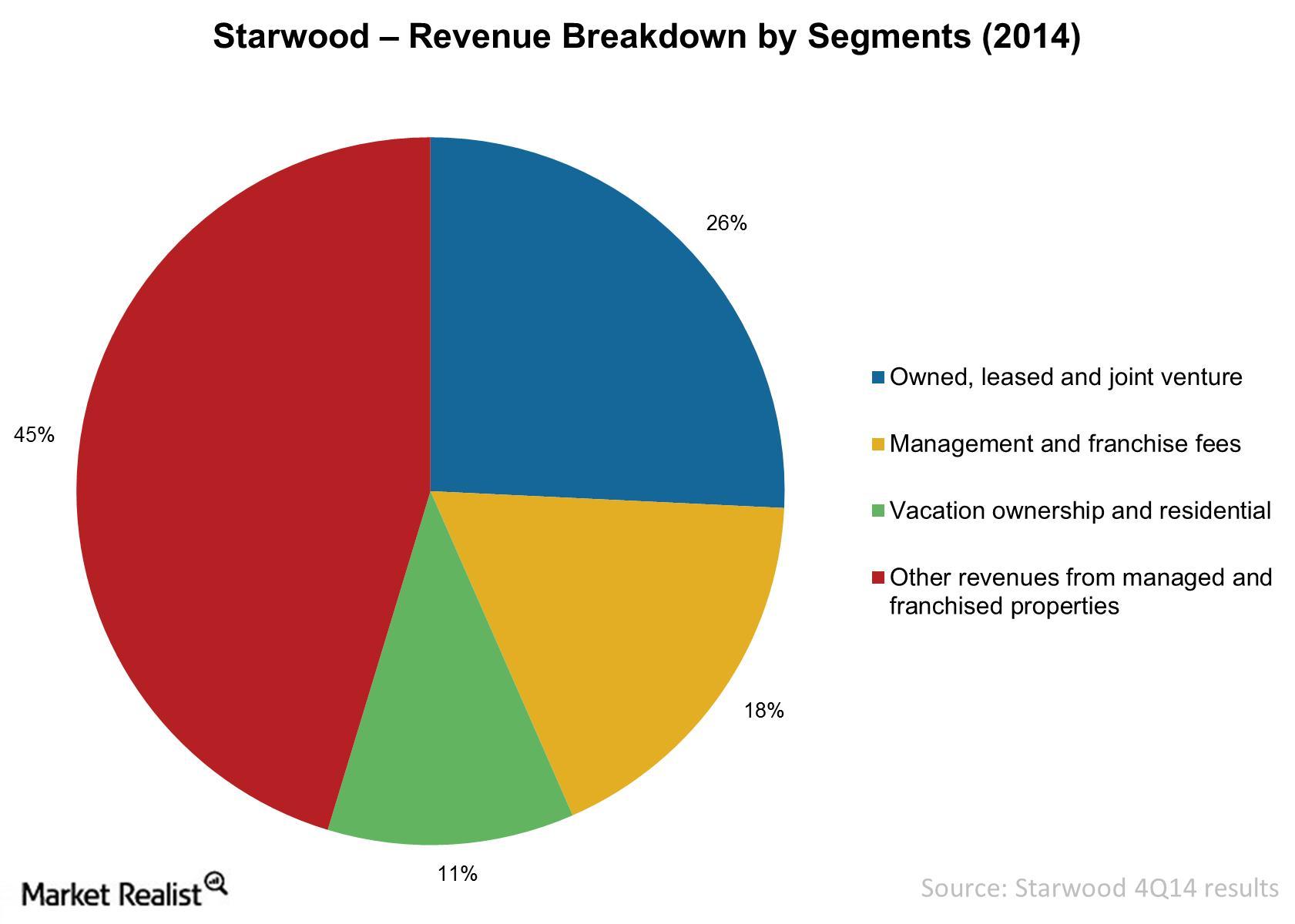

What Are Starwood’s Revenue Sources?

The revenue from owned, leased, and consolidated joint ventures is primarily derived from hotel operations. This includes room rentals and food and beverage sales.

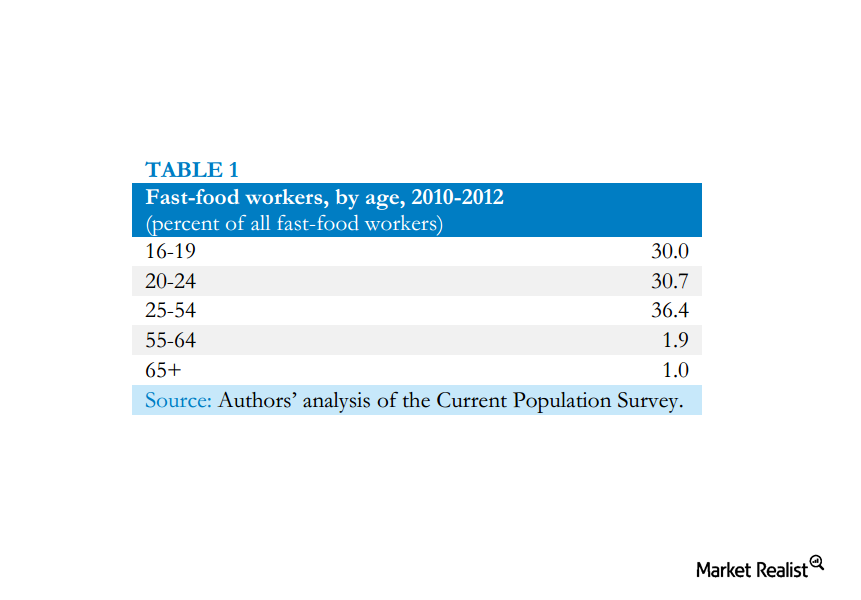

Must-know: Majority of fast food workers “not” above 25 years old

Why the unionization of all fast food workers, which would increase the bargaining power of employees and possibly lead to higher wages, in quite unlikely.

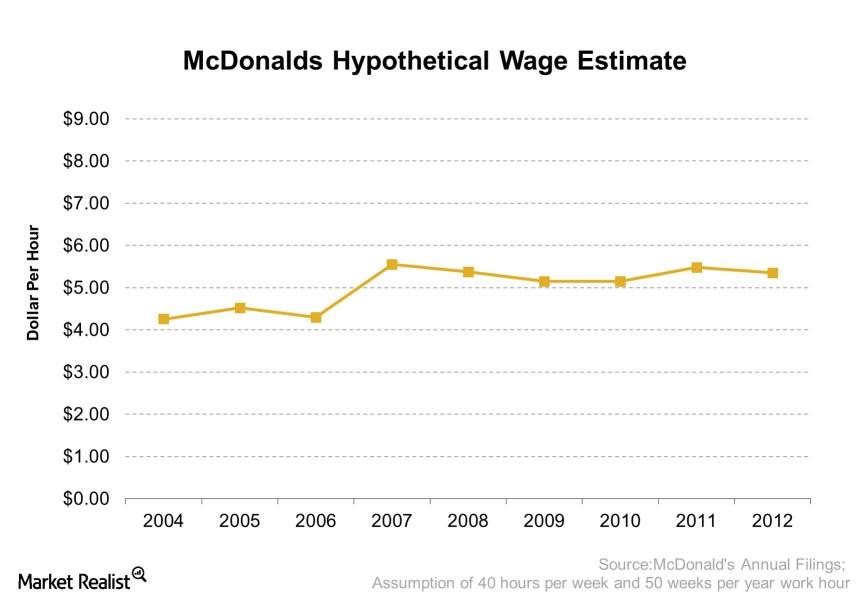

Why do most workers at McDonald’s work part-time?

Part-time work is most likely an industry-wide characteristic within the food retail business.