How Much Upside Is Left in Starbucks’s Stock Price?

Starbucks’s (SBUX) share price has been soaring since it announced its fiscal 4Q16 results on November 3, 2016. Let’s explore why.

Nov. 20 2020, Updated 11:57 a.m. ET

Stock performance

Starbucks’s (SBUX) share price has been soaring since it announced its fiscal 4Q16 results on November 3, 2016. As of November 28, the company was trading at $57.4, a rise of 11.2% from its price on November 3.

Analysts expected the company to post EPS (earnings per share) of $0.55 on revenue of $5.68 billion in fiscal 4Q16. The company beat the consensus estimate with EPS of $0.56 on revenue of $5.71 billion. SBUX’s better-than-expected earnings and revenue increased investors’ confidence in the stock, leading to a rise in its price. For a detailed look at Starbucks’s fiscal 4Q16 performance, read Starbucks Posts Strong 4Q16 Earnings: What Does the Future Hold?

The victory of Donald Trump in the US presidential election also contributed to a rise in Starbucks’s share price. Investors expect Trump to loosen regulations, which could be beneficial for restaurant chains. If Trump repeals or changes the Affordable Care Act, restaurants will be relieved of employees’ health insurance expenses. Investors also don’t expect Trump to raise the federal minimum wage.

Year-to-date performance

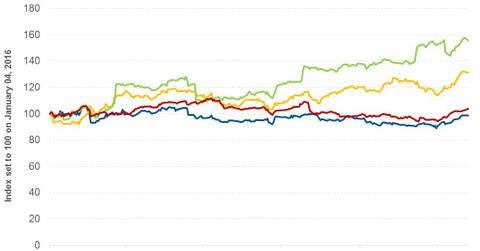

Despite the recent rise in Starbucks’s stock price, the company’s share price has returned -1.2% year-to-date (or YTD). Since the beginning of 2016, SBUX’s peers Dunkin’ Brands (DNKN), Domino’s Pizza (DPZ), and McDonald’s (MCD) have returned 31.3%, 55.7%, and 3.6%, respectively.

The comparative broader index, the iShares US Consumer Services ETF (IYC), has returned -6.9%. IWP has invested ~11.5% of its investments in restaurants and travel companies.

Series overview

In this series, we’ll look at Starbucks’s revenue and EPS estimates for the next four quarters. We’ll also look at Starbucks’s valuation multiple, recent recommendations, and target price for the next 12 months.

Let’s start by looking at analysts’ revenue estimates for Starbucks over the next four quarters.