Huge Growth Potential in the Global e-Commerce Market

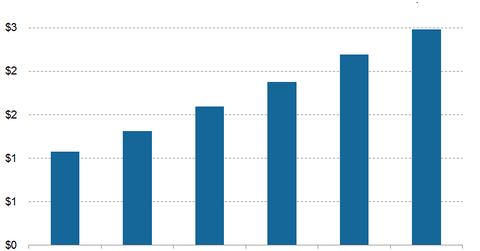

The global e-commerce market is expected to grow at a CAGR (compound annual growth rate) of 17 from $1.3 trillion in 2014 to $2.5 trillion by the end of 2018.

Nov. 17 2015, Published 9:48 a.m. ET

Global retail sales to reach $28.3 trillion by fiscal 2018

According to a report from eMarketer, global retail sales—including in-store and online purchases—are set to grow to $28.3 trillion by the end of fiscal 2018 from $22.5 trillion in 2014. The global e-commerce market is expected to grow at a CAGR (compound annual growth rate) of 17 from $1.3 trillion in 2014 to $2.5 trillion by the end of 2018. Online retailers like eBay (EBAY), Alibaba (BABA), and Amazon (AMZN) will be looking to increase their market share and revenue in the next few years.

China and the US lead in e-commerce

China and the US are the leading players in the global e-commerce market. They accounted for more than 55% of internet retail sales in 2014. In the next five years, eMarketer forecasted that China’s growth will “widen the gap” between the US and itself. It will likely report more than $1 trillion in retail e-commerce sales. It will account for ~40% of the worldwide sales. In comparison, the US will maintain its position as the second-largest online retail market in 2018. Its sales will likely reach $500 billion in 2018. It’s followed by United Kingdom with expected sales of $124 billion and Japan with expected sales of $106 billion.

Amazon is part of the iShares U.S. Consumer Services ETF (IYC) and the First Trust Dow Jones Internet IndexSM Fund (FDN). It accounts for 6.80% and 11% of the ETFs, respectively.