First Trust Dow Jones Internet Index Fund

Latest First Trust Dow Jones Internet Index Fund News and Updates

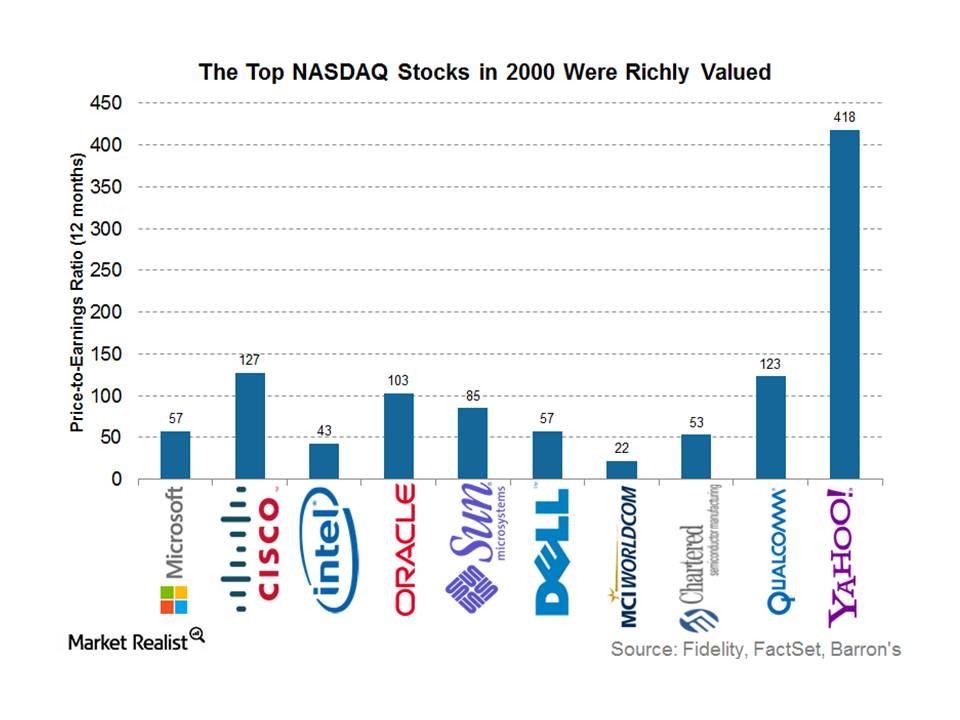

Dotcom Bubble 2.0? We Don’t Think So!

Although tech stocks have been buoyant in 2015, we don’t think that this means the advent of dotcom bubble 2.0. There are some key differences.Consumer Must-know: Why did Amazon launch a mobile credit card reader?

For example, Amazon (AMZN) recently launched a credit card reader. Merchants can use it to conduct payments through a smartphone or tablet.

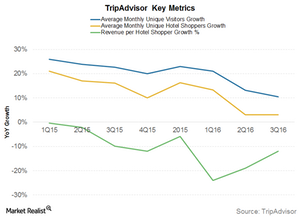

What Do the Key Metrics for TripAdvisor Suggest?

For 3Q16, TRIP’s revenue per shopper fell 12%. This is slightly better than the 24% decline seen in 1Q16 and the 19% decline seen in 2Q16.

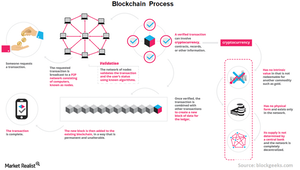

How Digital Assets Could Generate Income

Blockchain technology holds a lot of promise due to its many advantages such as transparency, faster transactions at lower costs, and a reliable system.

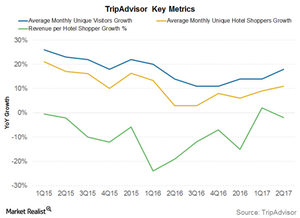

What Do TripAdvisor’s Key Metric Trends Suggest?

TripAdvisor’s (TRIP) average monthly unique visitors in 2Q17 rose 18.0% YoY (year-over-year) to 414.0 million users compared to 2Q16.

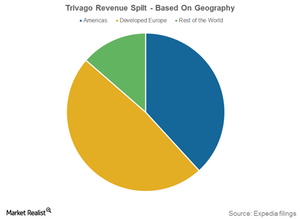

A Close Look at Trivago’s Business Model

Trivago combines hotel content from various sources on its platform. These hotels are then displayed to users based on their search criteria.

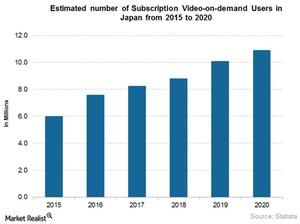

How Is Netflix Performing in Japan?

Netflix considers Japan to be a brand-sensitive market. Once it establishes its brand, it expects its connection with the Japanese audience to be long term.

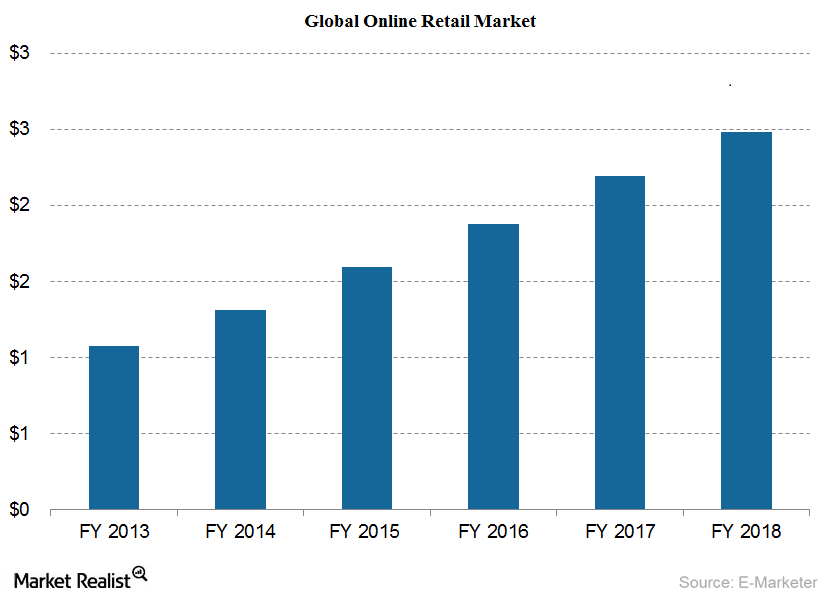

Huge Growth Potential in the Global e-Commerce Market

The global e-commerce market is expected to grow at a CAGR (compound annual growth rate) of 17 from $1.3 trillion in 2014 to $2.5 trillion by the end of 2018.

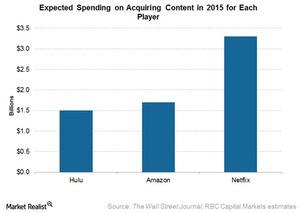

Netflix Prefers Original Content over Content Licensing

Netflix holds the content licensing rights to its original content, but this original content is currently produced by outside studios like Disney’s ABC Studios.

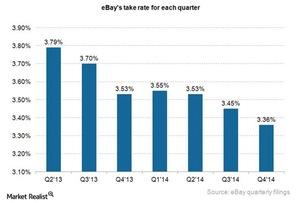

Why eBay isn’t worried about a falling take rate

eBay’s take rate fell from 3.79% in 2Q13 to 3.53% in 2Q14. However, the company isn’t worried about it since take rate is offset by healthy revenue growth.

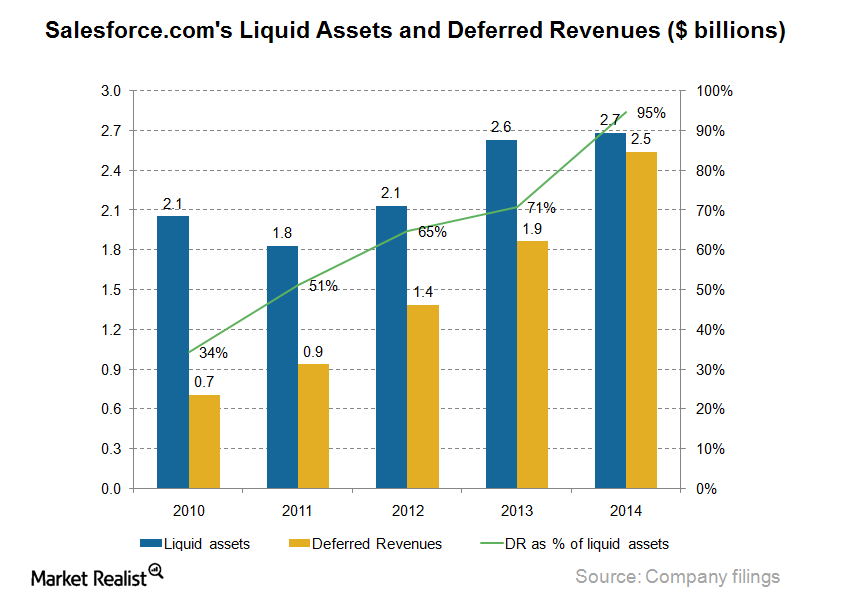

Must-know: Is an increase in deferred revenues cause for concern?

Salesforce.com (CRM) has a subscription business. It collects revenue for many of its offerings and applications before services. The company reports that the “deferred revenue” is rendered from its customers. In 2011, deferred revenue formed 65% of its liquid assets. It grew to 95% in 2014.