Ally Schmidt

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Ally Schmidt

How Did US Airlines Fare in 4Q15?

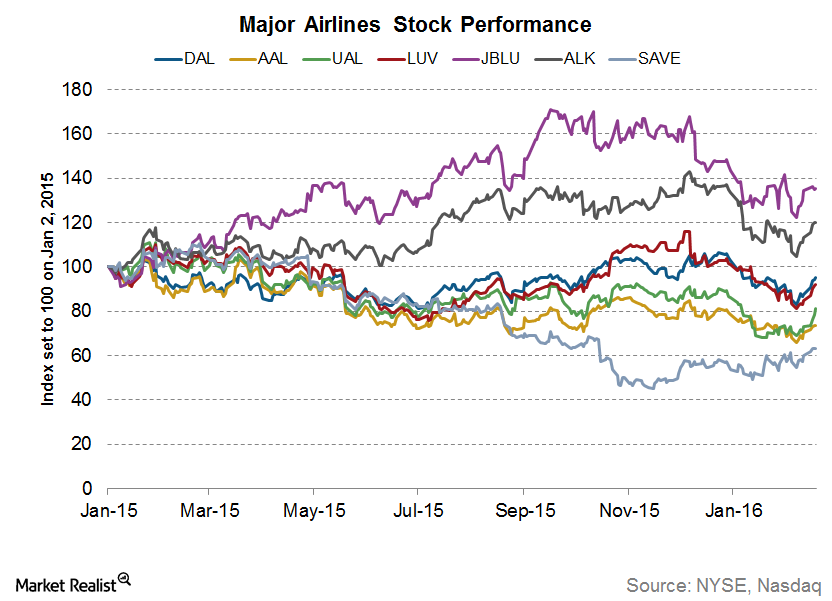

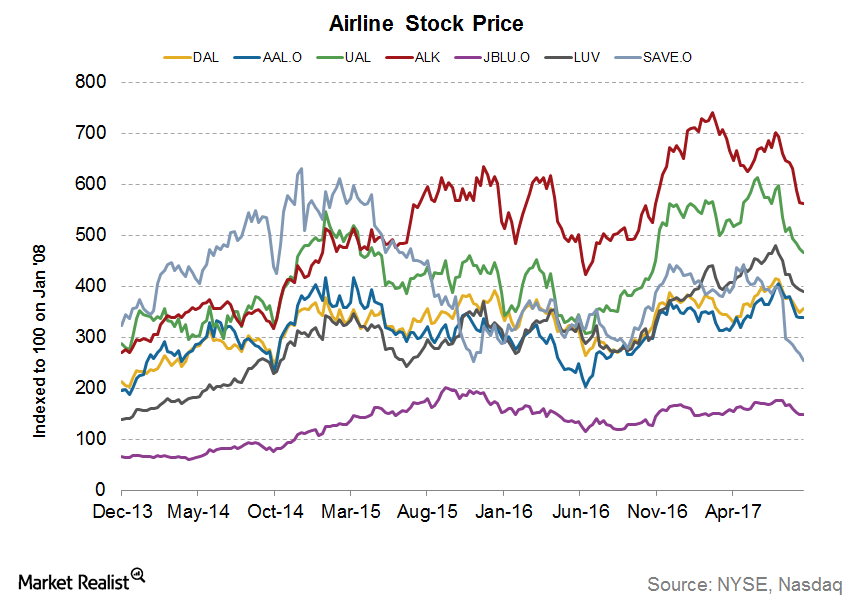

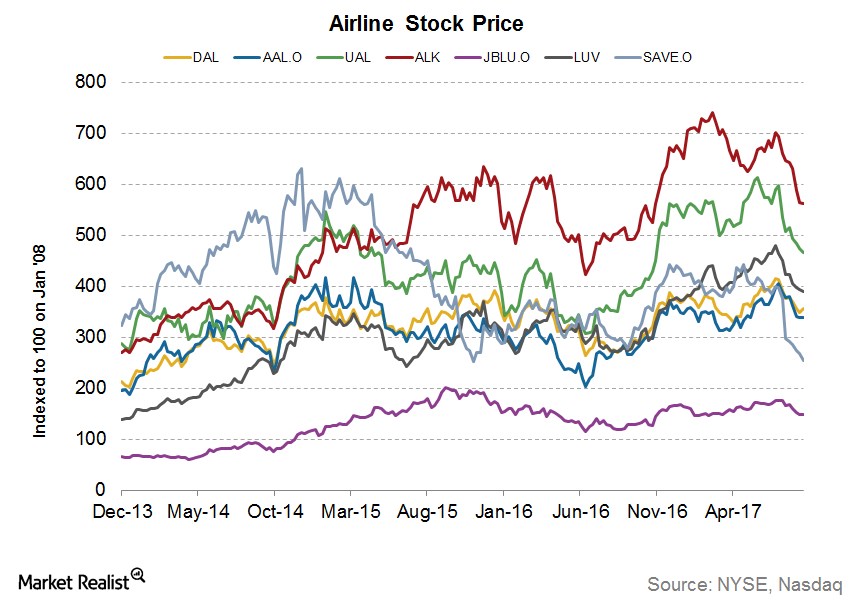

In this series, we’ll explore the key highlights of the major US airlines’ 4Q15 earnings. In 4Q15, the stocks of most legacy players outpaced those of regional carriers.

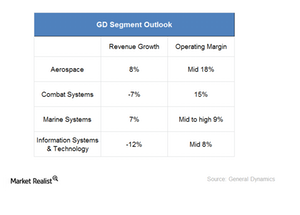

Outlook for General Dynamics’ individual business segments

In this part of the series, we’ll look at the outlook for General Dynamics’ individual business segments. General Dynamics has four major business segments.

What Should Airline Industry Investors Look Out for in 2016?

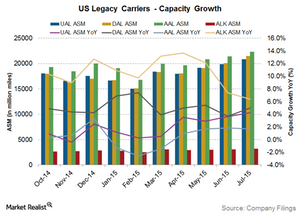

Growing capacity is necessary for revenue growth. However, capacity expansion that exceeds demand growth can lead to declining utilization.

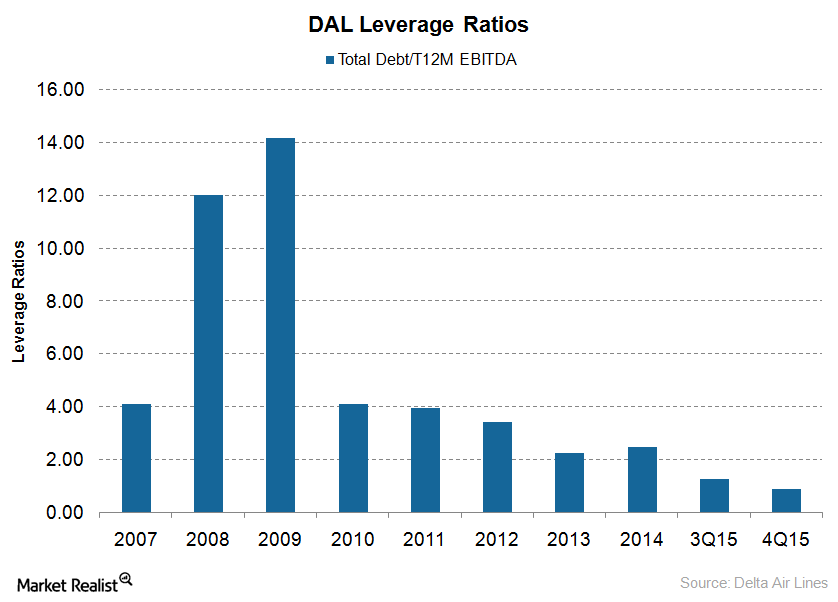

Can Delta Air Lines Continue to Reduce Its Debt in 2016?

Delta Air Lines (DAL) expects to generate more than $7 billion–$8 billion of operating cash flow and ~$4 billion–$5 billion of free cash flow. It plans to reduce its adjusted net debt to $4 billion by 2020.

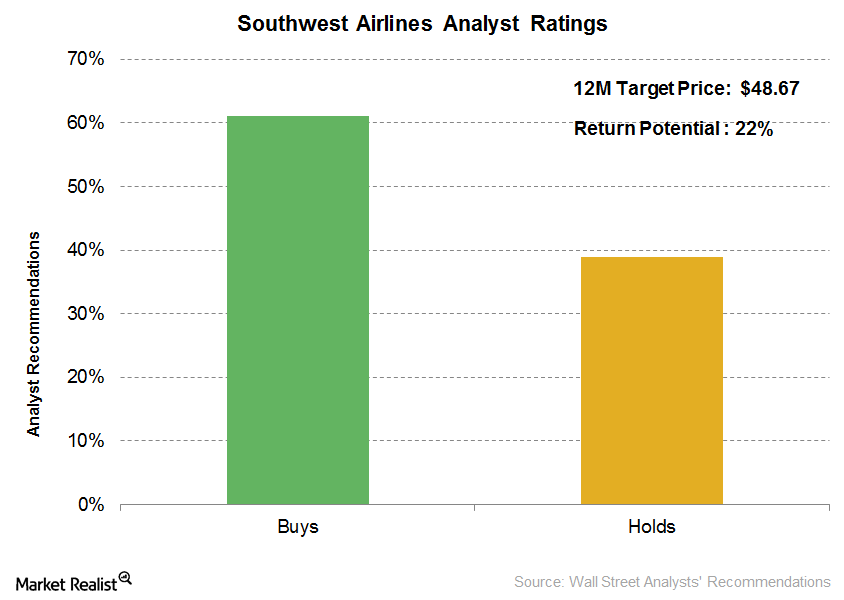

Why Did Analysts Fall Out of Love with Southwest Airlines?

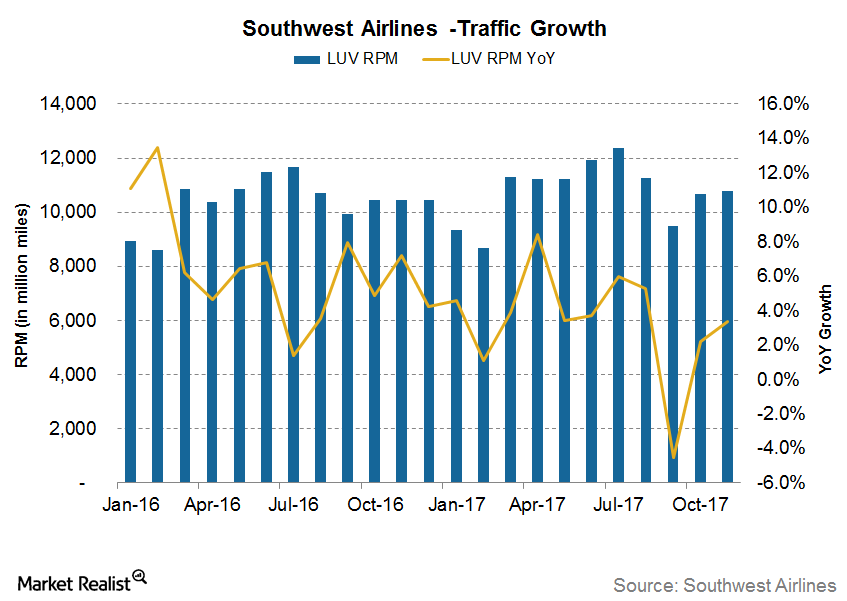

Out of the 18 analysts tracking Southwest Airlines (LUV), 11 analysts (61.1%) have a “buy” recommendation on the stock versus 71% analysts that had a “buy” recommendation on Southwest in 2Q16.

What Helped Alaska Air Group Drive its 2Q15 Earnings?

Adding newer destinations Alaska Air Group (ALK) added a number of new routes in the second quarter of 2015, such as: Boise to Reno Eugene to San Jose, California Los Angeles to Baltimore Los Angeles to Gunnison–Crested Butte Los Angeles to Monterey Los Angeles to San Jose, Costa Rica Portland to Austin Seattle to Charleston […]

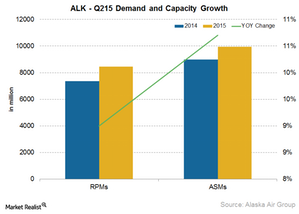

Alaska Airlines Capacity Growth Is Faster than That of Its Peers

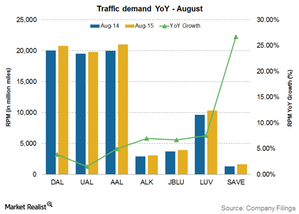

Alaska Air Group saw the highest surge in traffic demand and was the leader in capacity growth, with a 6.4% YoY increase in its capacity in July 2015.

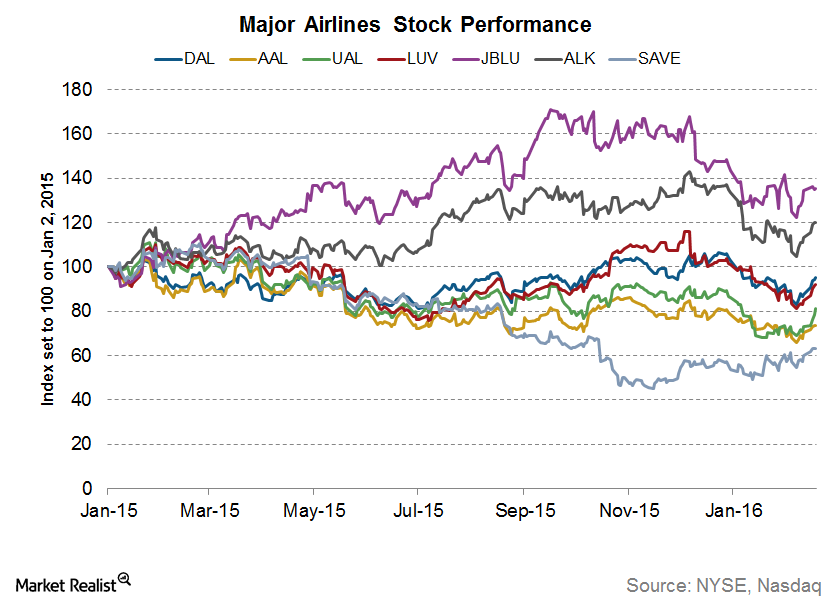

Why Airlines Got off to a Bad Start in 2016

2016 has been the worst start for the S&P 500 in the past eight years. US airlines also saw a bad start. The Dow Jones U.S. Airline Index has fallen 4% YTD.

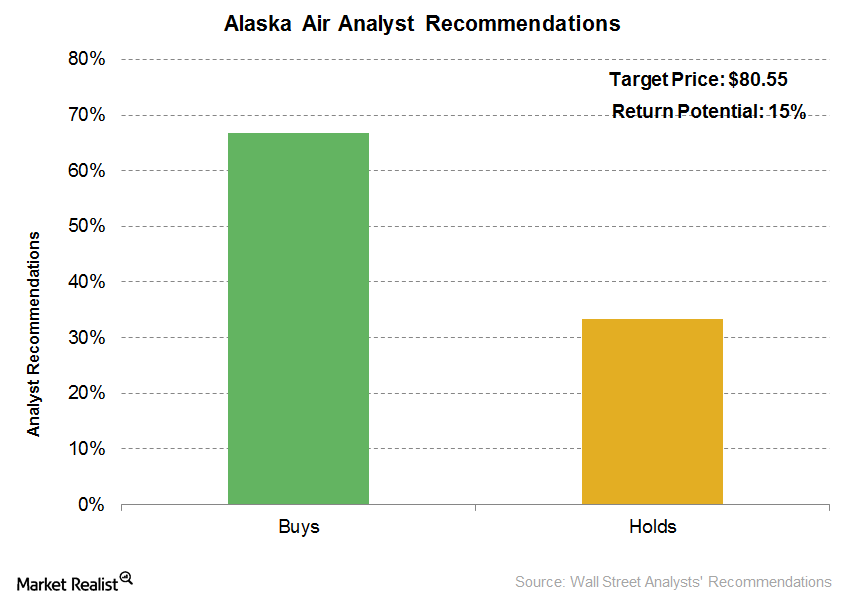

More Analysts Have Turned Positive on Alaska Air Group

Alaska Air Group’s (ALK) consensus 12-month target price is $80.55, which indicates a 15.2% return potential on October 10, 2016.

Can Airline Capacity Utilization Improve Going Forward?

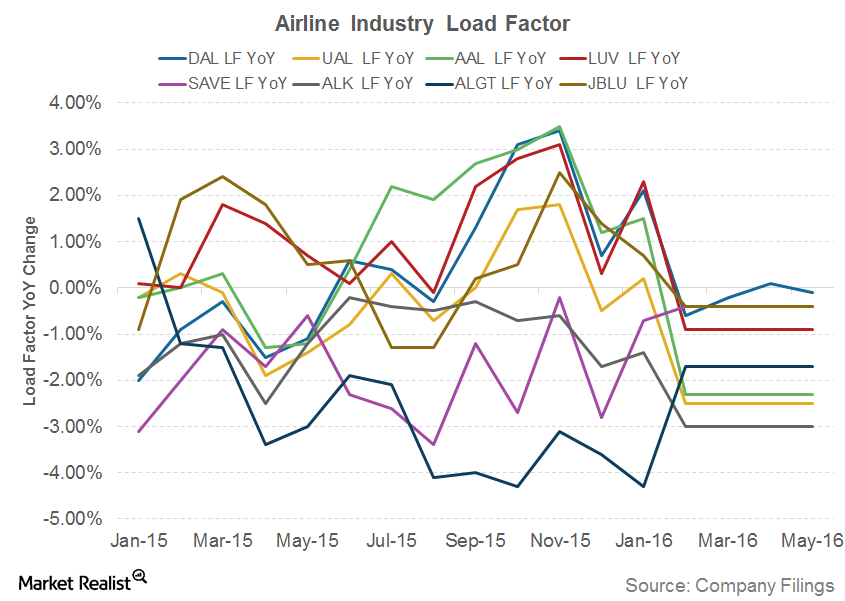

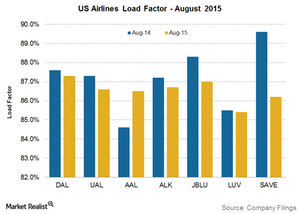

Airline capacity utilization is measured using the passenger load factor, which is calculated by dividing traffic numbers by capacity numbers.

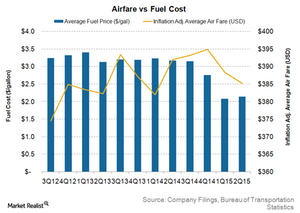

Will Airfares Continue to Decline in 2016?

According to a study by Expedia, airfares fell by about 5% in 2015. Despite this decline, passenger complaints are on the rise. Many consumer leaders also lobbied for airfare reductions.

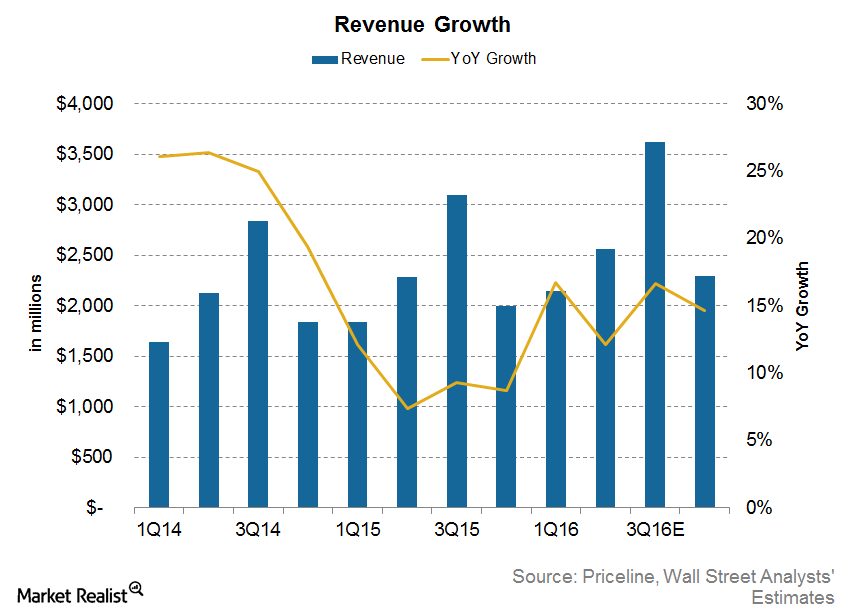

Will Market Share Gains Continue to Drive Priceline’s Revenue Growth in 2016?

For 3Q16, analysts are estimating Priceline’s revenues to grow by 16.6%, which would be higher than the 12% growth the company saw in the second quarter.

What Is FedEx Management’s Outlook for the Future?

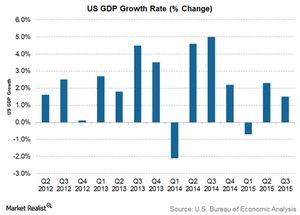

FedEx continues to see growth in the global economy. It expects the US GDP to grow by 2.4% in 2015 and by 2.6% in 2016, driven by increased consumer spending.

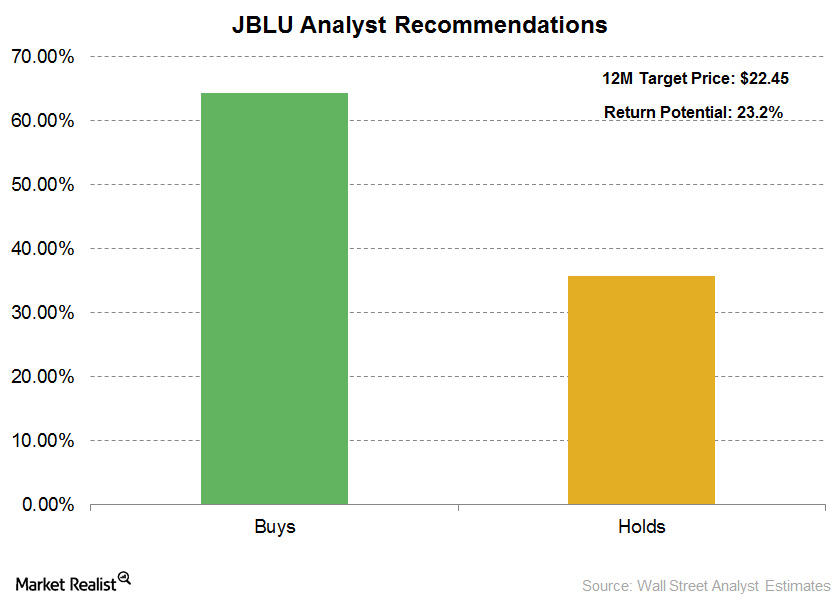

What Are Analysts’ Recommendations for JetBlue Airways?

According to a Bloomberg consensus, JetBlue Airways is expected to see earnings per share (or EPS) of $0.6 in the quarter, compared to EPS of $0.58 in 3Q15.

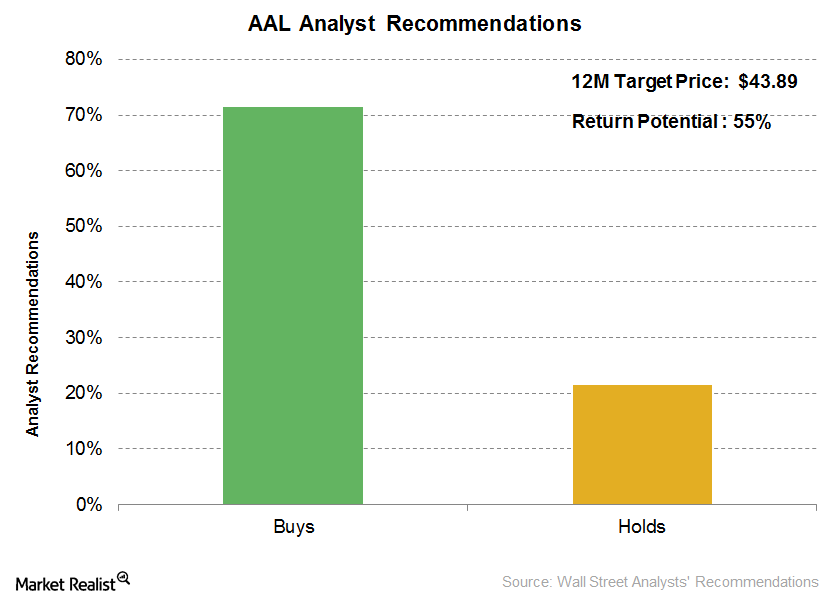

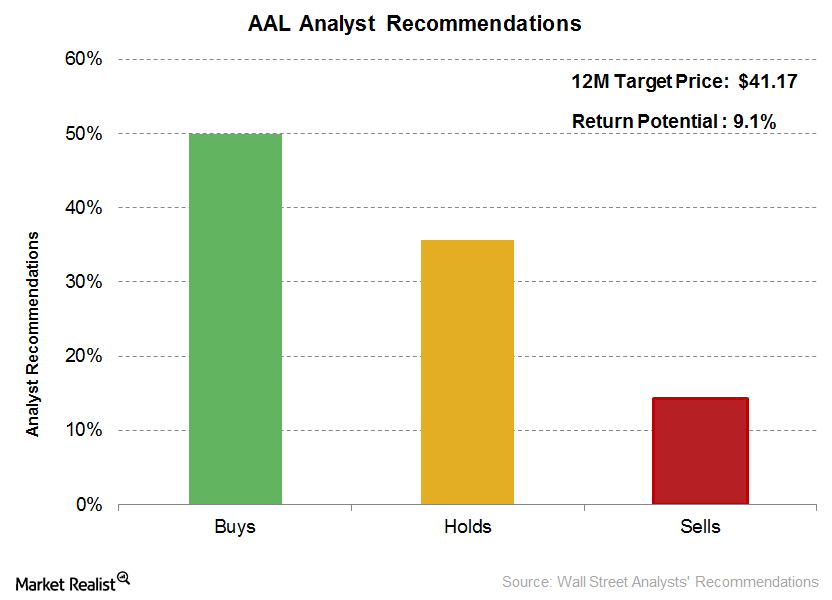

Why Most Analysts Still Recommend ‘Buys’ on American Airlines

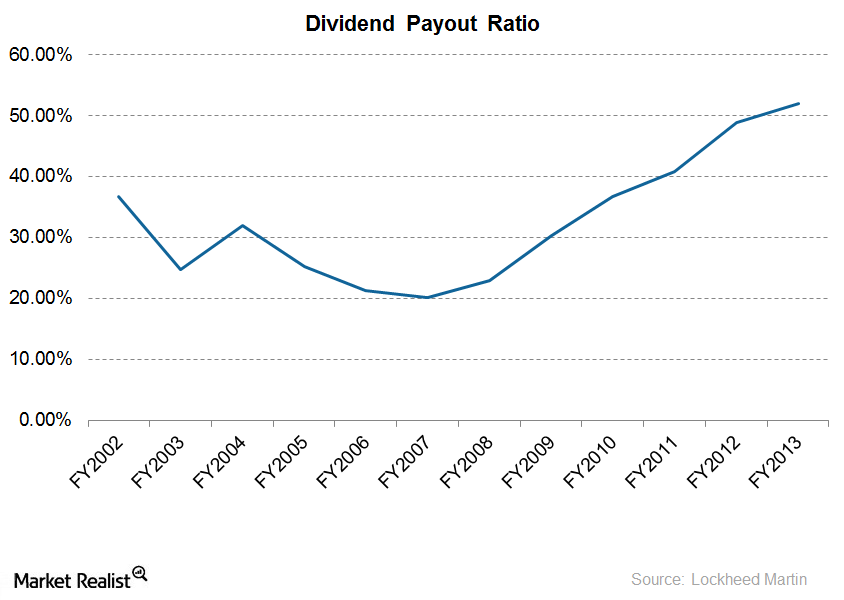

According to Bloomberg’s consensus, out of the 14 analysts tracking American Airlines (AAL), 71.4% have “buy” recommendations.Industrials Comparing Lockheed Martin with other major defense contractors

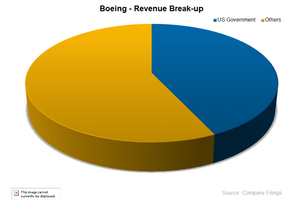

With total sales of $45,358 million in 2013, Lockheed Martin is the largest defense contractor in the world. The other major defense contractors in the world include The Boeing Company and Raytheon Company.

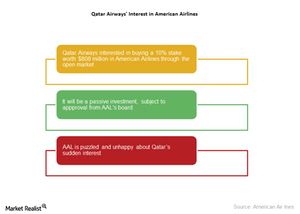

Why Is Qatar Airways Interested in American Airlines?

In the last week of June 2017, Qatar Airways’ CEO, Akbar Al Baker, disclosed the carrier’s interest in buying a 10% stake worth $808 million in American Airlines through the open market.

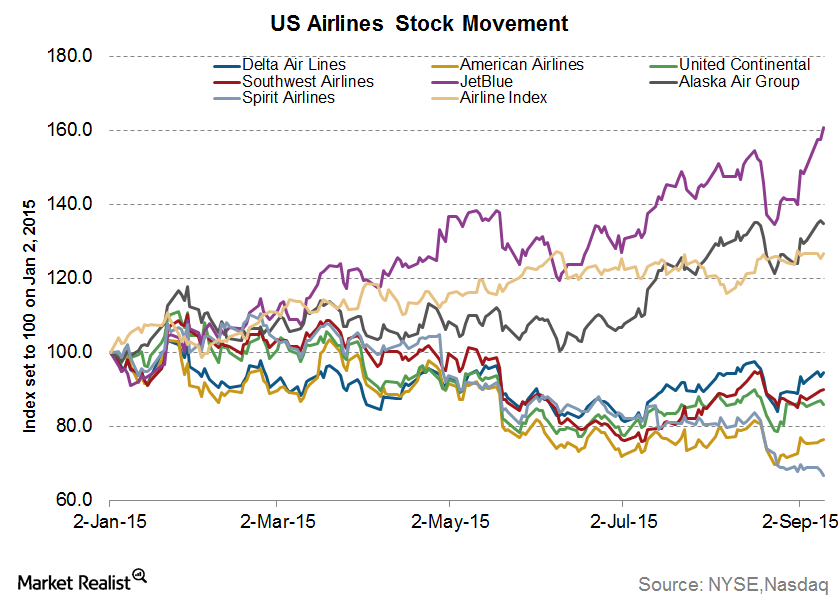

Most Airline Stocks Continue to Tumble in August

In 2015, most airline stocks have fallen, and the NYSE ARCA Airline Index (XAL), which is composed of the major US airline stocks, has also tumbled as much as 13.5% year-to-date.

An investor’s introduction to Lockheed Martin Corporation

In 2013, Lockheed Martin clocked revenues of $45.4 billion. Of its revenues, 82% come from the U.S. government, around 17% from international customers, and 1% from other U.S. commercial customers.

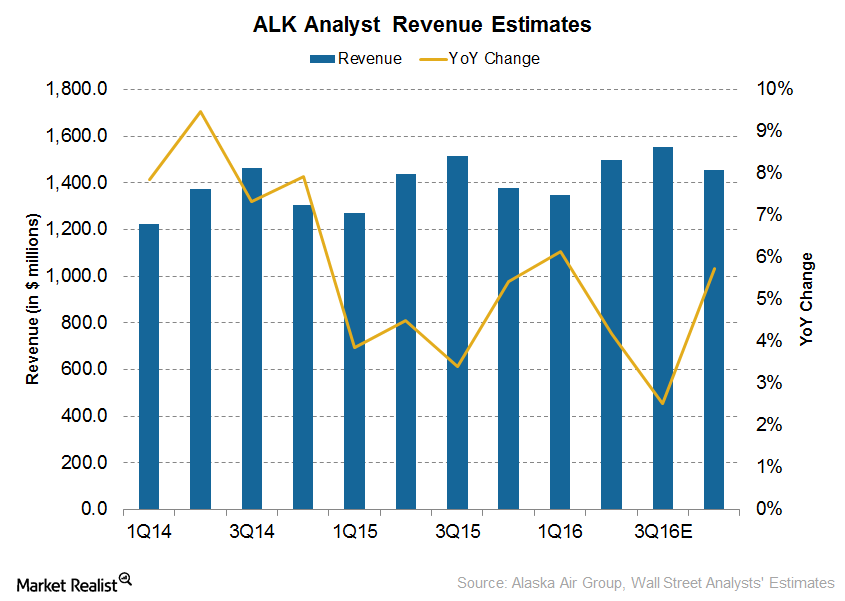

Alaska Air: Why Analysts Forecast Higher Revenue in Next 2 Years

For 2Q16, analysts are estimating 4.2% revenue growth for Alaska Air Group (ALK), which is slower than the 6.2% growth in 1Q16.

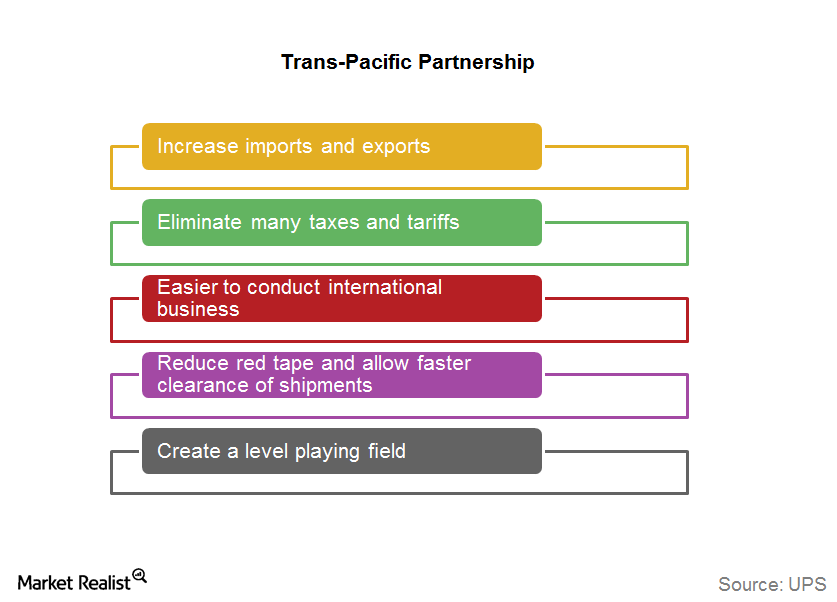

UPS and the Trans-Pacific Partnership: Simplicity in Trade?

The Trans-Pacific Partnership is expected open cross-border trade between member nations by increasing imports and exports and cutting taxes and tariffs.

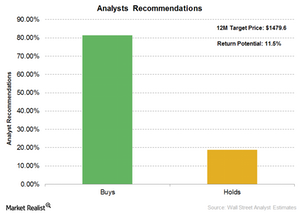

What Do Analysts Recommend for Priceline?

Priceline’s consensus 12-month target price is $1,479.55, which indicates an 11.5% return potential.

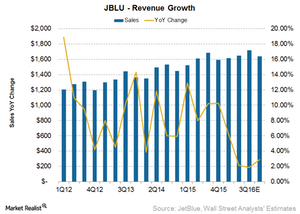

Are Analysts Expecting JetBlue Airways’s Revenue to Grow in 2Q16?

Analysts are estimating 2Q16 revenue of ~$1.7 billion for JetBlue Airways (JBLU), which is a year-over-year increase of 2.2%.

An investor’s introduction to Boeing

This introduction to Boeing (BA) provides basic information about the aerospace manufacturing leader’s products, services, and third-quarter performance.

How American Airlines Stock Reacted to Its Guidance Update

American Airlines (AAL) stock rose almost 0.94% on September 12, the day of its traffic release.

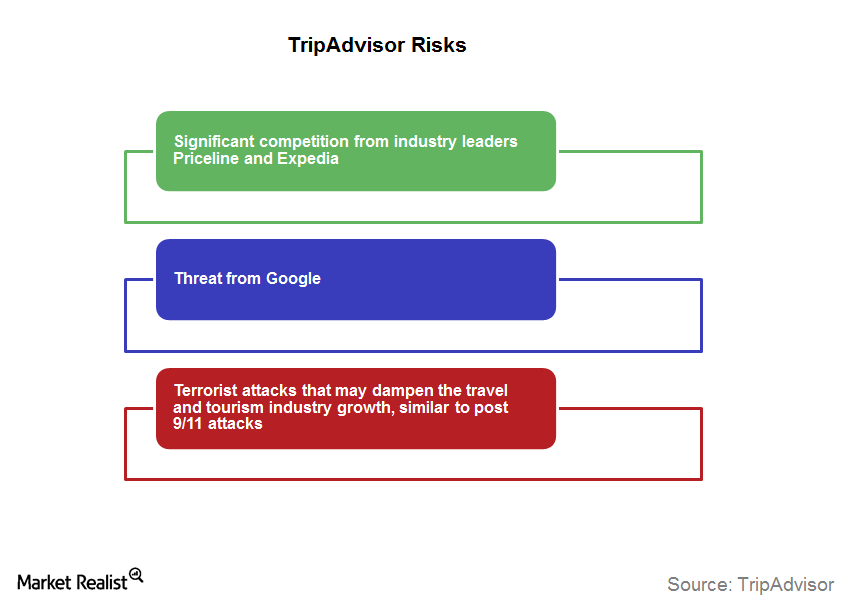

TripAdvisor’s Future: Key Risks that the Company Could Face

Online travel industry leaders like Priceline (PCLN) and Expedia (EXPE) have a mixed relationship. They’re partners as well as competitors.

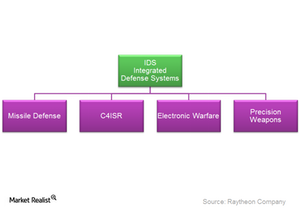

Raytheon Company’s Integrated Defense Systems

Raytheon’s Integrated Defense Systems segment saw marginally lower sales during the year due to lower sales across most of its major programs such as the Patriot program.

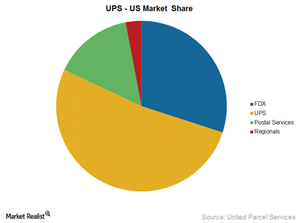

A Look into UPS’s Domestic Package Segment

UPS’s Domestic Package segment provides an array of guaranteed ground and air package transportation services, depending on the customer’s need.

Why Have Some Analysts Become Less Positive on American Airlines?

Out of the 14 analysts tracking American Airlines (AAL), 50% have a “buy” recommendation on the stock as compared to the 71.4% that had a “buy” rating in 2Q16.

Did Delta’s Guidance Cut Prompt a Losing Streak for Airlines?

Delta Air Lines (DAL) stock fell 3.5% after its traffic release on September 5, 2017. The negativity has spread to other players.

US Airlines Capacity Growth Outpaces Demand, Load Factor Drops

Decreasing load factors across the airline industry mean that airlines are not able to fill up their seats as fast as they are adding seats. This justifies investor fears of overcapacity.

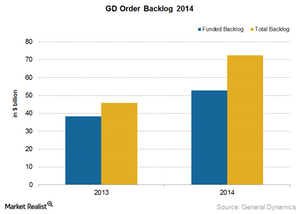

What does General Dynamics’ order backlog reflect?

General Dynamics’ total backlog grew from $45.9 billion at the end of 2013 and to $72.4 billion at the end of 2014. This was a whooping 58% increase.

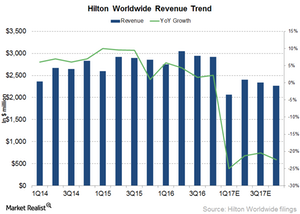

Will Hilton’s Top Line Grow in 2017?

For 1Q17, analysts are estimating Hilton’s (HLT) revenue to fall 25% to $2.1 billion.

Airline Industry Demand Continues to Grow in August

The demand for air travel experienced considerable growth in the month of August, driven by traditional vacation travel as well as lower fares of major air carriers.

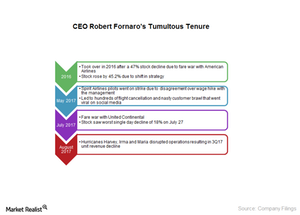

Fornaro’s Turbulent Ride and Achievements at Spirit Airlines

For October, SAVE was ranked third on the metric according to the Department of Transportation. That’s a huge improvement since Spirit has historically been last.

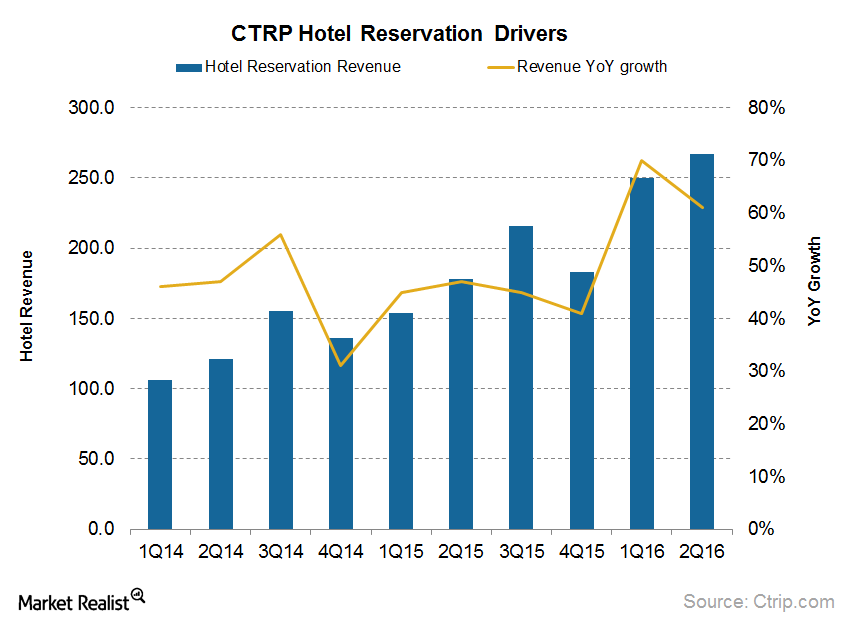

Which Segment Is Ctrip’s Biggest Contributor to Growth?

Hotels make up a significant part of Ctrip’s revenues—39% of total revenues in 2Q16—similar to OTA peers Priceline, Expedia, and TripAdvisor.

Is Southwest’s Demand Growth Enough to Fill Its Added Capacity?

In November 2017, Southwest Airlines’ (LUV) traffic grew 3.4% year-over-year (or YoY). This growth was higher than its capacity growth of 2.5% YoY in the same month.

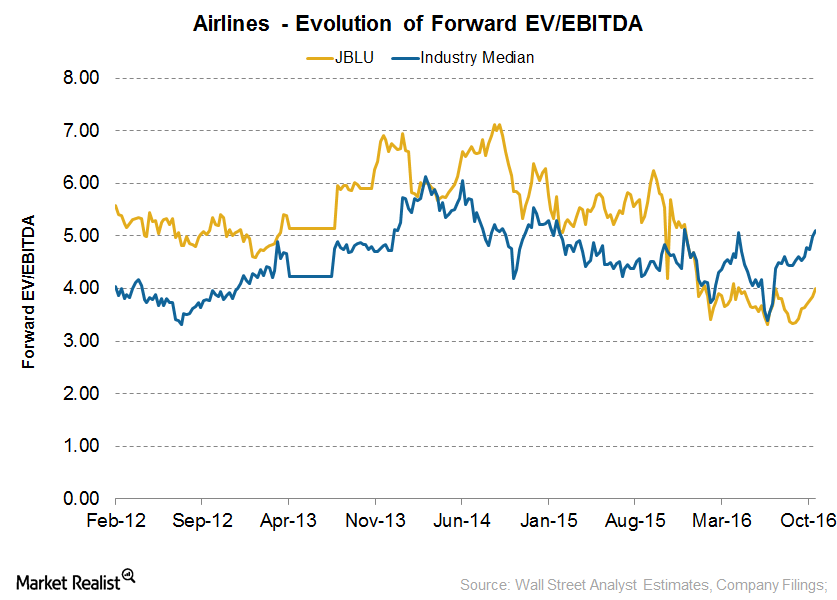

Airline Relative Valuations: What Is Priced In?

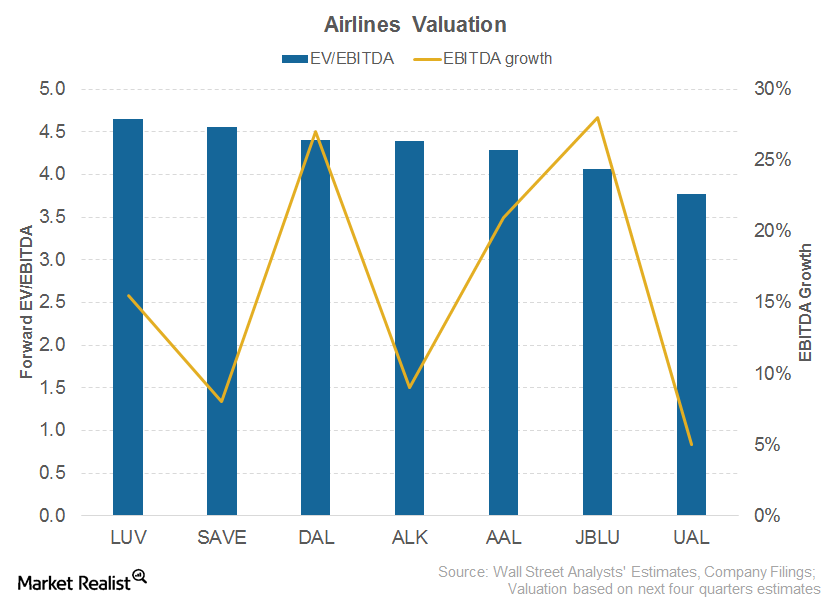

The airline industry is capital-intensive, with high levels of depreciation and amortization and varying degrees of debt and operating leases. To neutralize these factors, we use the EV-to-EBITDA ratio to value airline stocks.

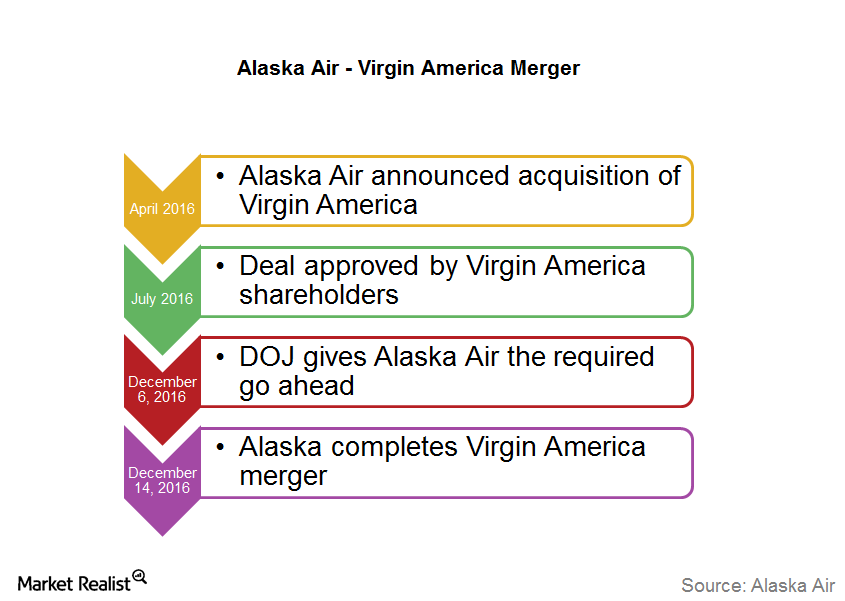

Alaska Air Group Completes Virgin America Merger

On April 4, 2016, Alaska Air Group (ALK) announced its acquisition of Virgin America for $57 per share in cash, which amounted to $2.6 billion.

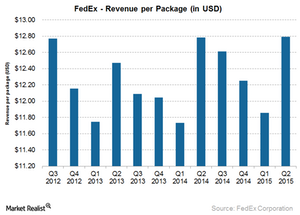

FedEx’s New Pricing Policy Improves Its Efficiency

Effective January 2015, FedEx changed its pricing policy for all of its FedEx Ground packages less than 3 cubic feet to a “dimensional weight pricing” mechanism.

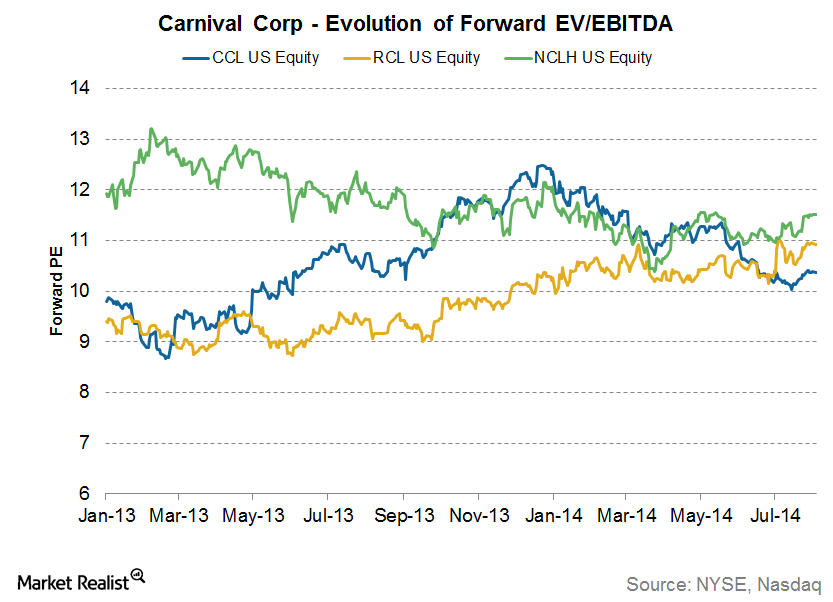

How Is Carnival Valued Compared to Its Peers?

Currently, CCL’s forward EV/EBITDA ratio stands at 10.4x. CCL enjoyed its highest valuation of 63x during September 2006. It reached its lows of ~5x in November 2008.

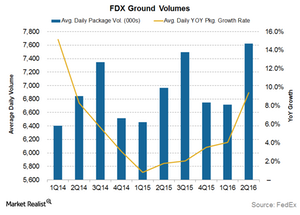

FedEx Ground: Delivering on E-Commerce Growth

FedEx Ground is being driven by the booming growth in e-commerce, and it contributed to 35% of the company’s revenues but 44% of its profits.

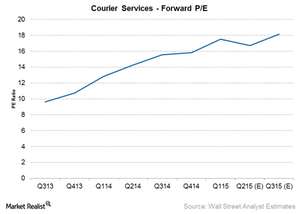

Analyzing the Valuation Trend of Courier Services

The economic upturn since 2009 has improved growth prospects for the courier companies. This coupled with improving industry margins has led to improving industry valuations.

Airlines Passenger Yield Continues to Decline in August 2015

Passenger yield declined by 8% year-over-year for August 2015 to 15.3 cents from 16.6 cents. This is the highest decline since the start of the year.

Is a Rerating of Airlines’ Valuation Multiple Possible?

Currently, American Airlines (AAL), Southwest Airlines (LUV), and Alaska Air Group (ALK) are all trading at ~5x their forward EV-to-EBITDA multiples.

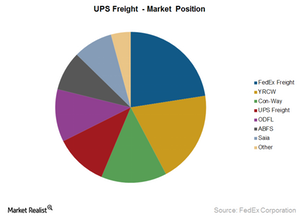

What Does UPS’s Supply Chain & Freight Segment Do?

UPS has addressed complex supply chain issues such as transportation, distribution, and international trade and brokerage services by offering a variety of services.

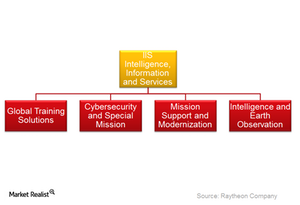

Raytheon’s Intelligence, Information and Services Segment

The Intelligence, Information and Services segment was almost in line with last year. So were the operating income and margins, all of which saw marginal declines.

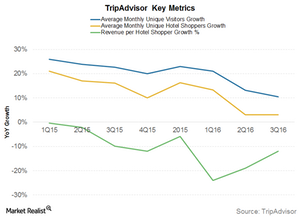

What Do the Key Metrics for TripAdvisor Suggest?

For 3Q16, TRIP’s revenue per shopper fell 12%. This is slightly better than the 24% decline seen in 1Q16 and the 19% decline seen in 2Q16.

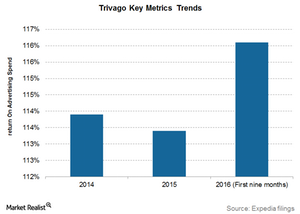

Analyzing Trivago’s Key Metrics

RQPR rose 2.1% in 2015 to 1.5 euros compared to 1.4 euros in 2014. For the nine months ended in September 2016, RQPR fell 6.0%.

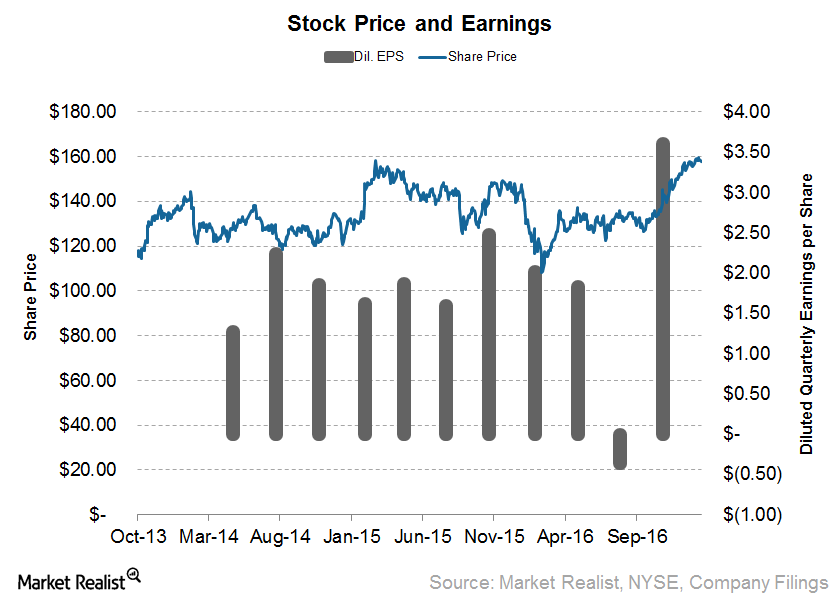

Analyzing the Performance of Boeing Stock in 2016

In this series, we’ll assess Boeing’s (BA) key indicators for 4Q16. We’ll look at analyst estimates for BA’s 4Q16 performance and assess whether the indicators justify the estimated earnings results.