Ally Schmidt

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Ally Schmidt

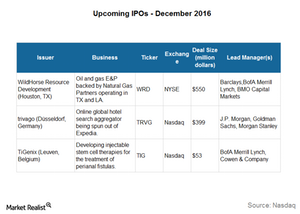

Trivago’s Expected IPO on December 16

Trivago, Expedia’s (EXPE) German hotel booking site, filed for an IPO in the US on November 14, 2016. The expected date for the Trivago IPO is Friday, December 16.

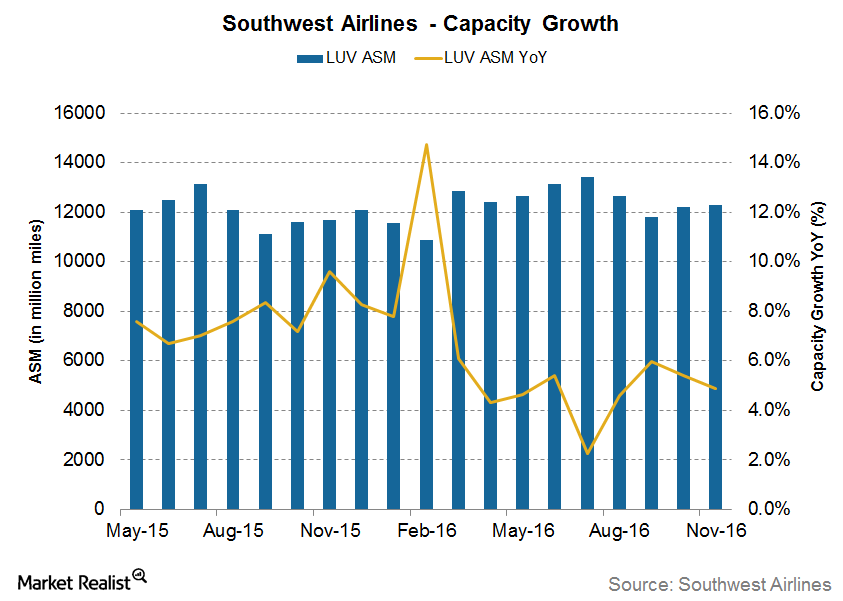

Southwest Airlines: Slowing Capacity Growth in November

For November 2016, Southwest Airlines’ (LUV) capacity grew 4.9% YoY (year-over-year). It’s slower than 5.4% YoY growth the previous month.

How Did Boeing Stock React?

Immediately after Donald Trump’s tweet, Boeing (BA) stock fell 1%. Other defense contractor stocks also had to bear the brunt.

Analyzing Trivago’s Financials: Revenue at the Cost of Ads

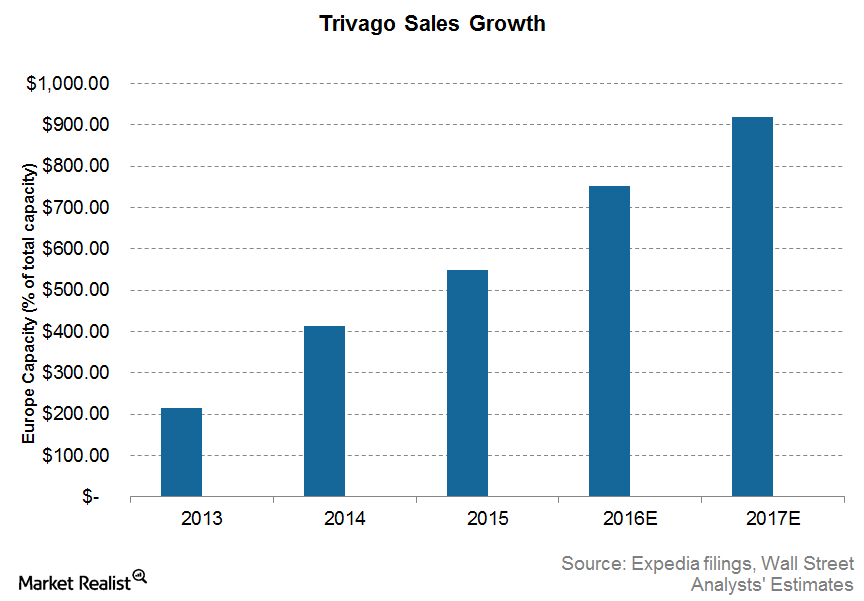

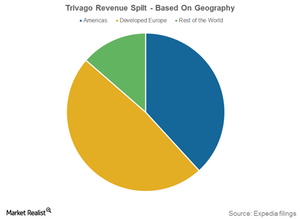

Trivago’s revenue has risen an impressive 90.0% CAGR from 2010 to 2013. As Trivago’s markets mature, the growth rate will decline, as is evident from recent trends.

A Close Look at Trivago’s Business Model

Trivago combines hotel content from various sources on its platform. These hotels are then displayed to users based on their search criteria.

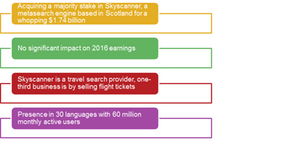

Why Did Ctrip Invest in Skyscanner?

In its earnings call on November 23, Ctrip.com (CTRP) announced that it acquired a majority stake in Skyscanner, a metasearch engine based in Scotland, for ~$1.7 billion.

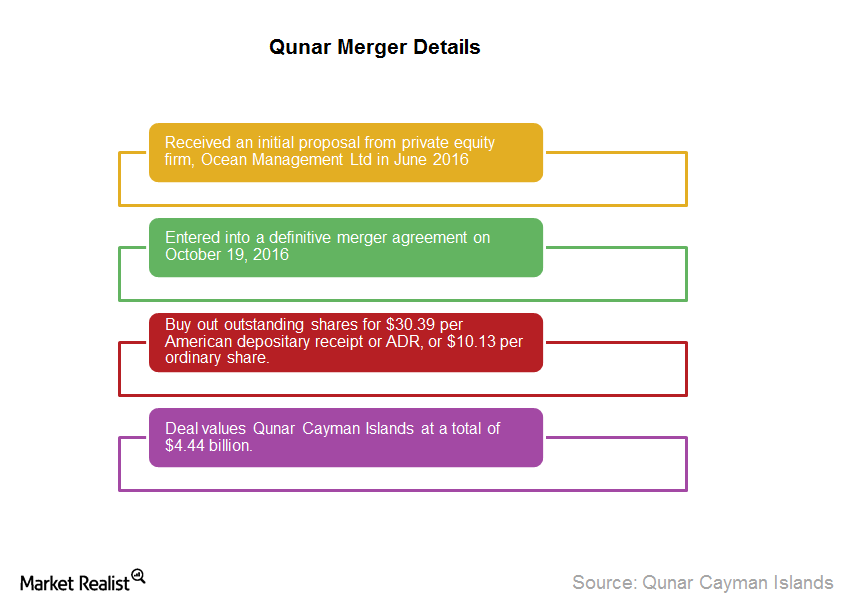

Qunar Is Going Private: How Does It Affect Investors?

In June 2016, Qunar (QUNR) received an initial proposal from private equity firm Ocean Management.

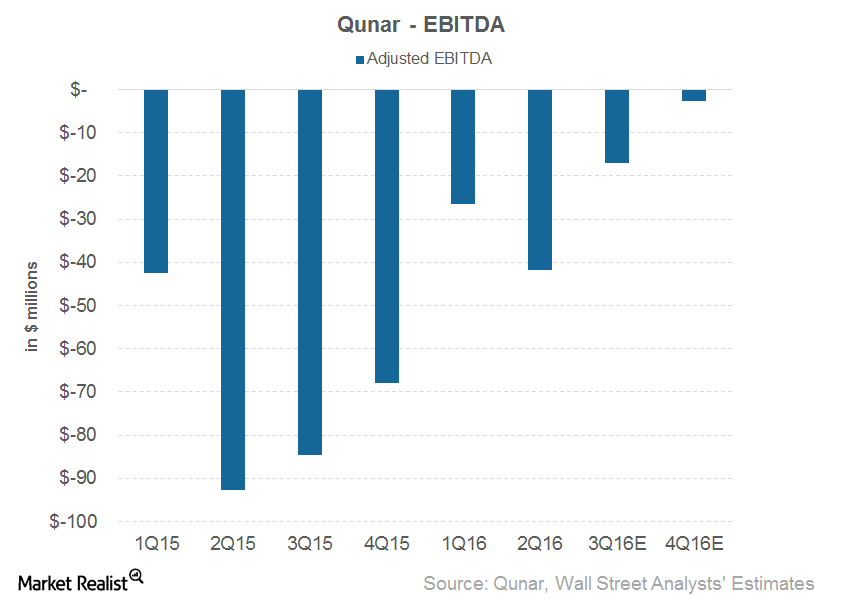

Why Isn’t Qunar Profitable Yet?

Analysts are estimating that Qunar Cayman Islands (QUNR) will incur an EBITDA loss of $17 million in 3Q16 and $3 million in 4Q16.

Can Ctrip Continue to Grow Its Revenues in 2016?

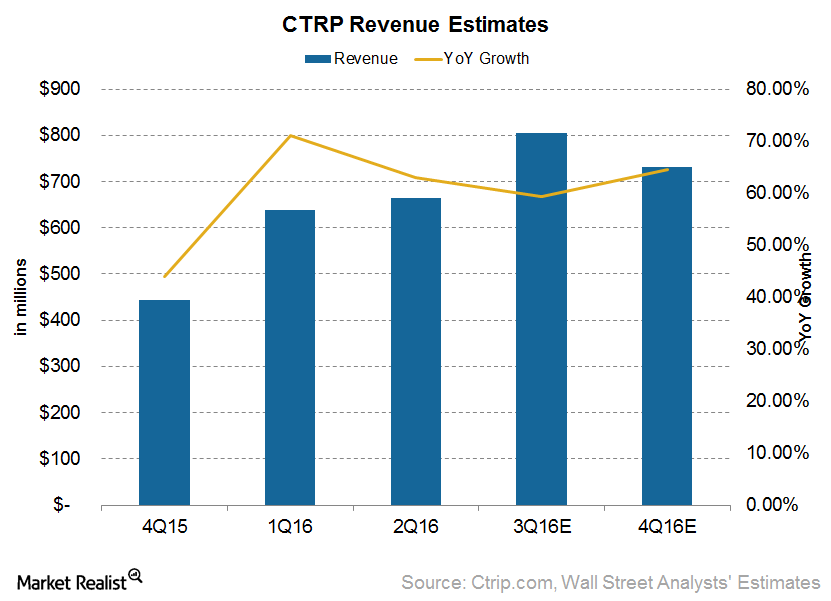

For 3Q16, analysts are estimating that CTRP’s (CTRP) revenue will grow by 63% to $811 million, including sales from Qunar (QUNR).

What Are Analysts Recommending for Ctrip?

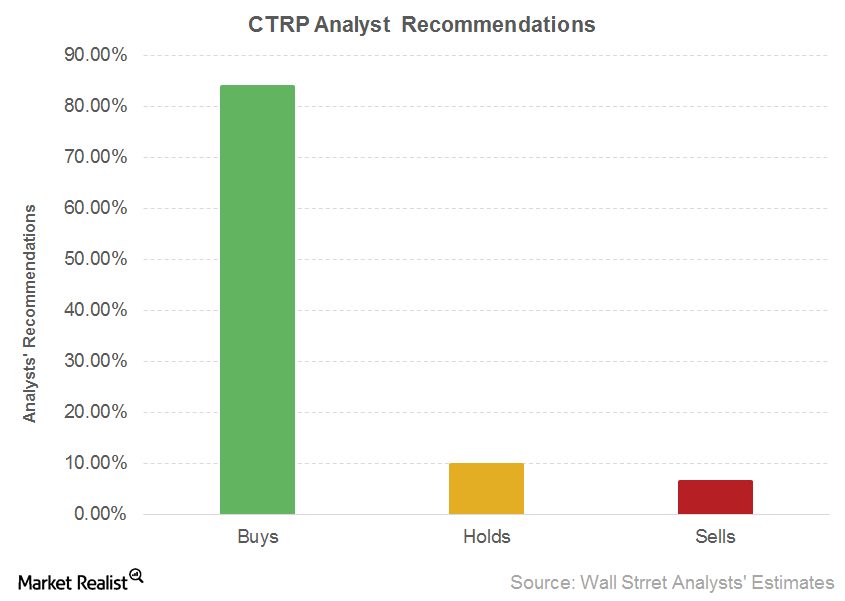

According to Reuter, of the 31 analysts tracking Ctrip, 26 analysts have issued a “buy,” while three have issued a “hold,” and two have issued a “sell.”

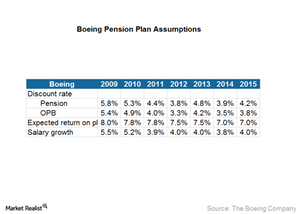

Why Boeing Pension Plan Assumptions May Be Too Optimistic?

If BA manages to achieve its estimated returns and asset allocation, the weighted-average expected rate of return on plan assets would be short of 7%.

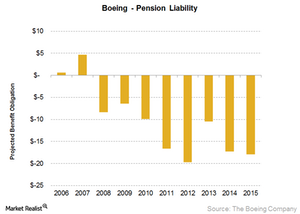

Inside Boeing’s Often Overlooked Risk: Pension Liabilities

For Boeing (BA) to fulfill this promise to its employees, it would require $17.9 billion—a huge sum by any standard.

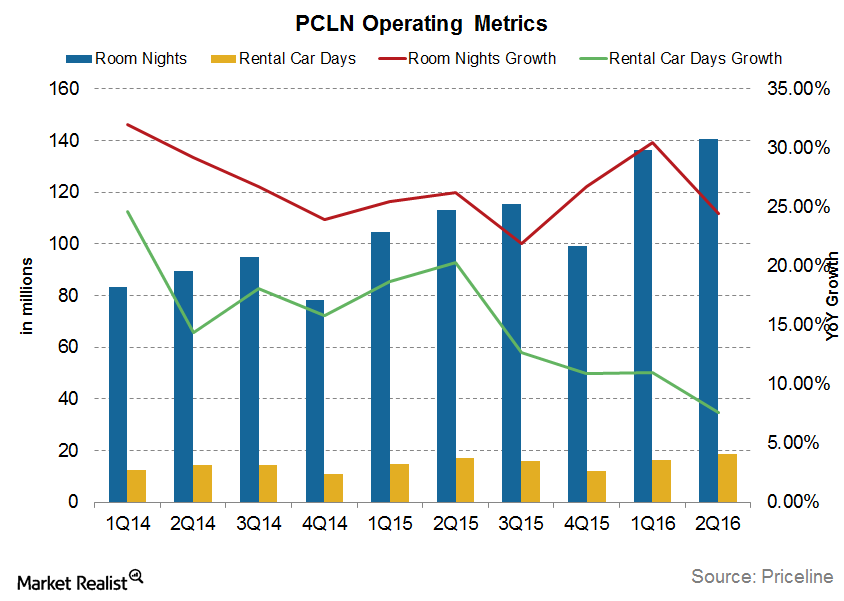

What Do Priceline’s Key Metrics Suggest?

From 2012 to 2014, Priceline Group’s (PCLN) gross bookings grew at an average of 30%. For 2015, accounting for the strong US dollar, growth was just 10%.

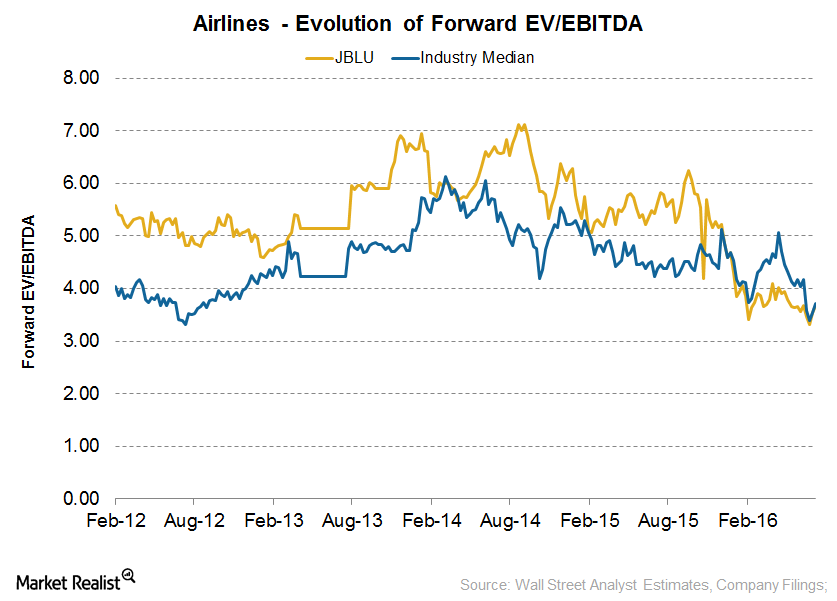

Could JetBlue’s Valuation Change after 3Q16?

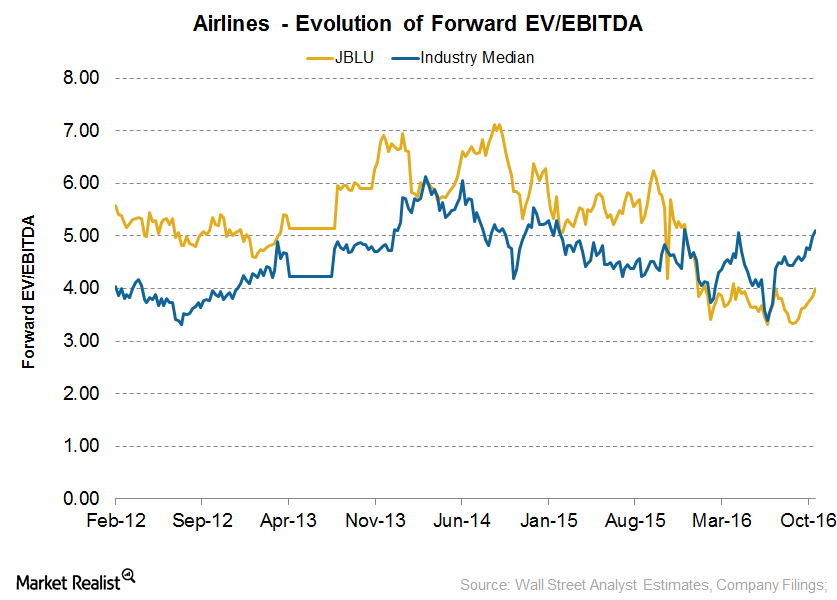

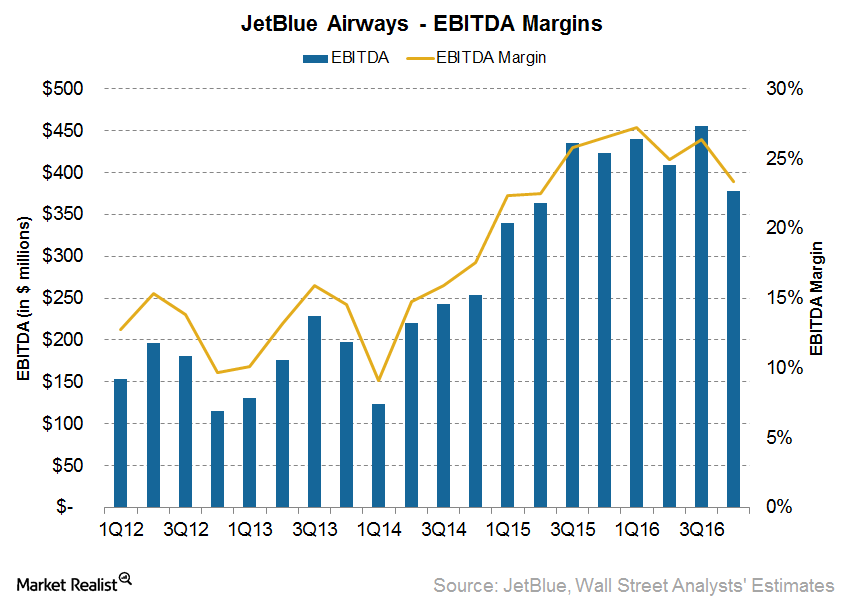

Currently, JetBlue Airways (JBLU) is valued at 4x its forward EV/EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiple.

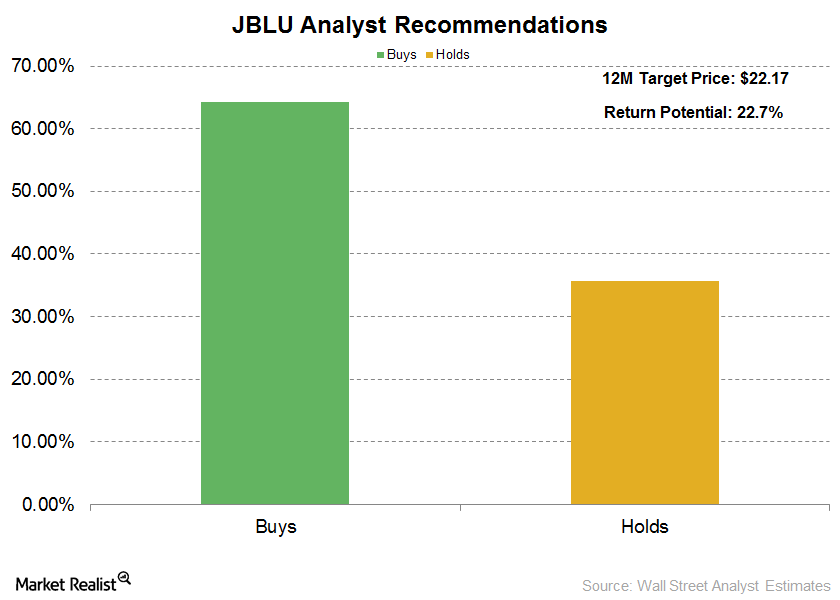

JetBlue: The Latest Analyst Estimates and Recommendations

Following JetBlue’s 2Q16 earnings release, analysts’ consensus estimate for revenues remains unchanged.

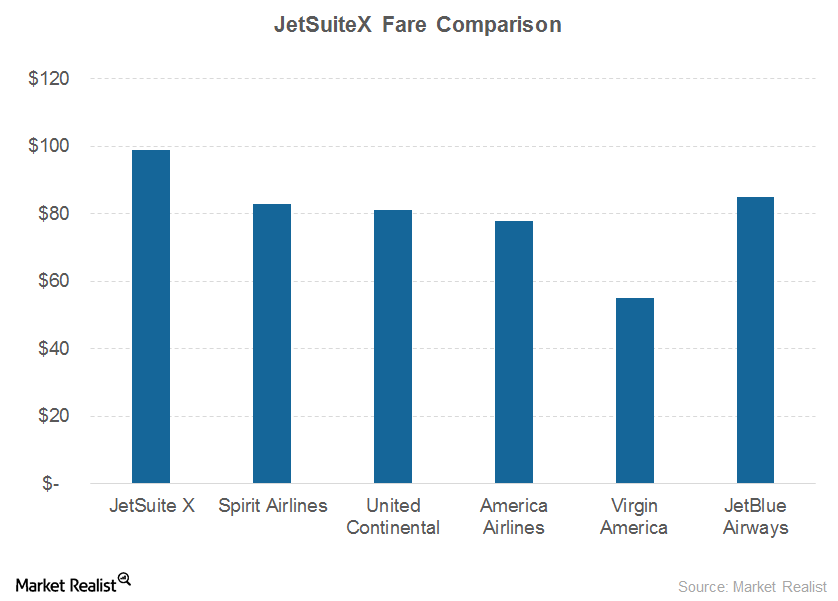

JetBlue’s New Investments: A Pioneer in Private Jet Services?

JetBlue announced that it had undertaken a small stake (the exact stake is unclear) in JetSuite, the fourth-biggest private jet operator in the United States.

Why Does JetBlue Expect Unit Costs to Rise in 4Q16?

For the third quarter of the year, JetBlue Airways’ (JBLU) operating expenses—excluding fuel and profit sharing—rose 3.1% to 7.86 cents.

JetBlue’s: Can Investors Expect Improved Revenue in 4Q16?

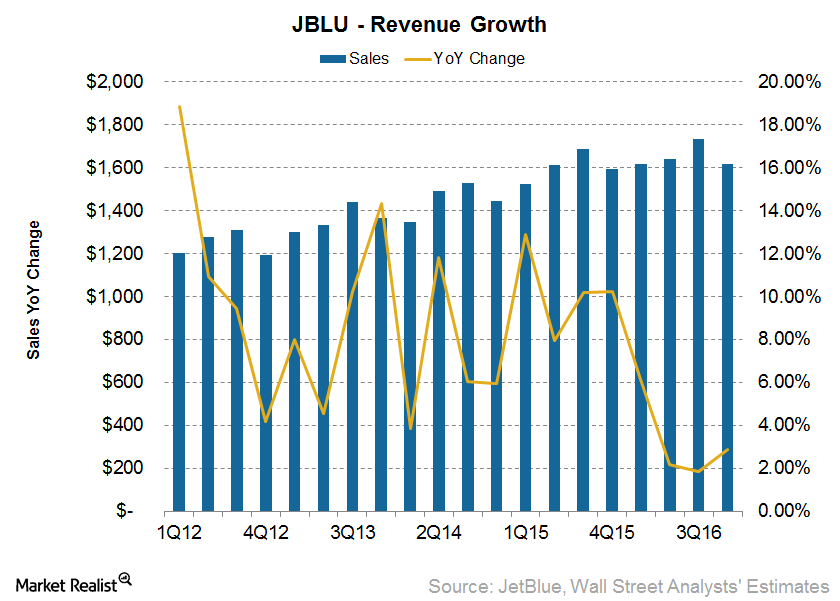

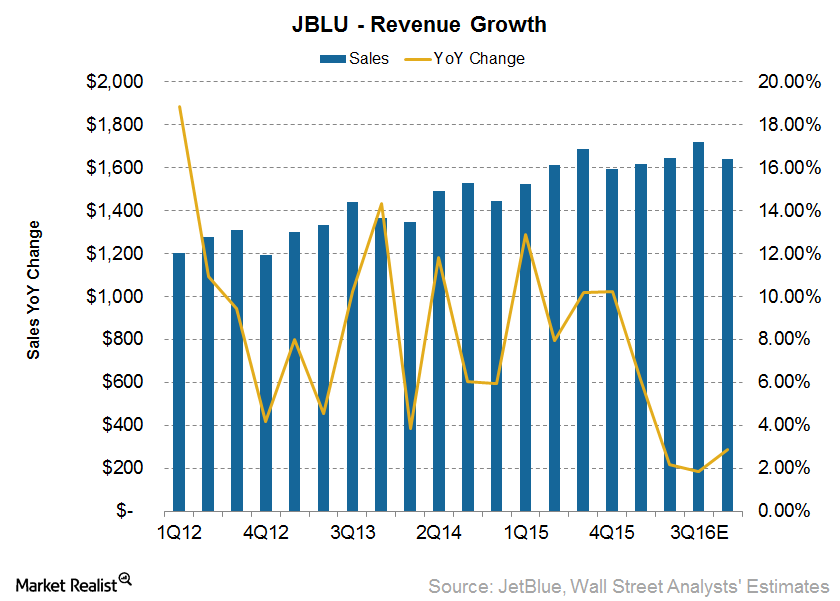

For 3Q16, JetBlue Airways’ (JBLU) revenues stood at $1.73 billion—a 2.6% year-over-year increase compared to revenue of $1.69 billion in 3Q15.

JetBlue Airways: Checking Up on Operational Performance in 3Q16

JetBlue Airways (JBLU) saw average traffic of about 11.9 billion passenger miles for the quarter, a 7.6% year-over-year increase

Can Expedia Continue Its Revenue Growth in 2016?

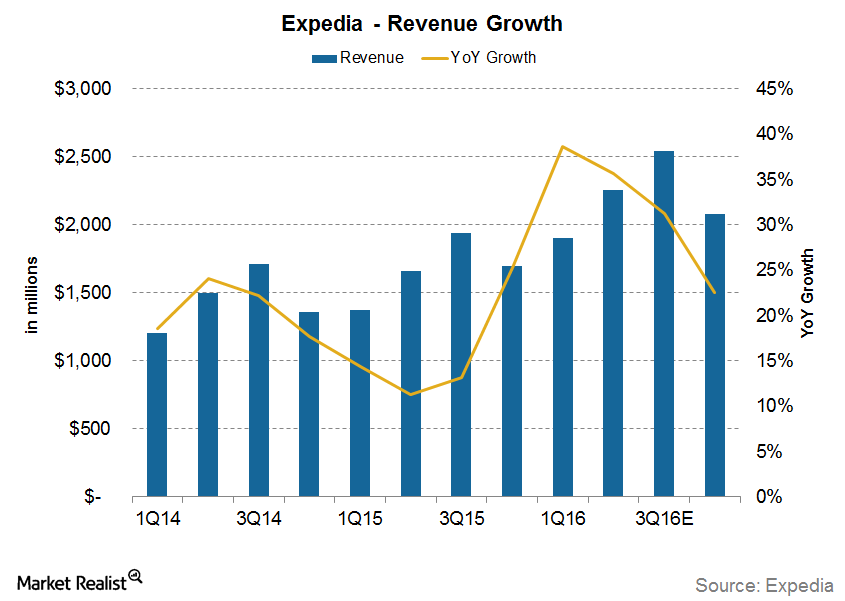

For 3Q16, analysts are estimating Expedia’s (EXPE) revenue to rise 31.3%. That’s slightly lower than the growth in the first and second quarters.

Do Analysts Expect JetBlue’s Revenue to Rise in 3Q16?

Analysts expect JetBlue Airways’ (JBLU) 3Q16 revenue to come in at $1.7 billion, a year-over-year rise of 2.2%.

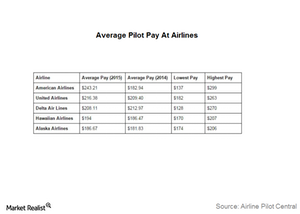

Why Is Delta’s Pilot Deal Important for the Airline Industry?

All airline pilots have their eyes on Delta Air Lines’ (DAL) final agreement with its pilots. This is because Delta’s deal will set a precedent in the industry.

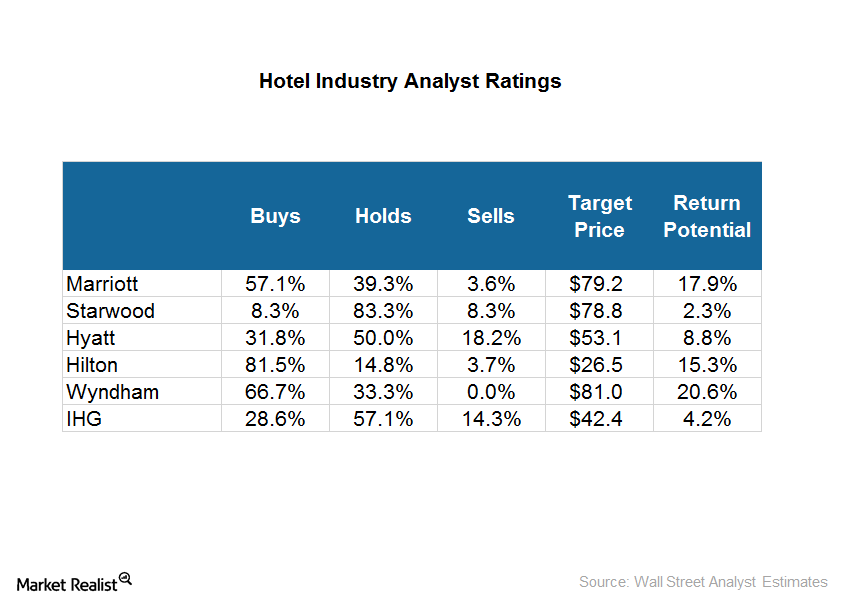

What Are Analysts’ Recommendations for Hotel Stocks?

Wyndham has the highest return potential of 21% with a target price of $81. Marriott is next with a return potential of 18% and a target price of $79.15.

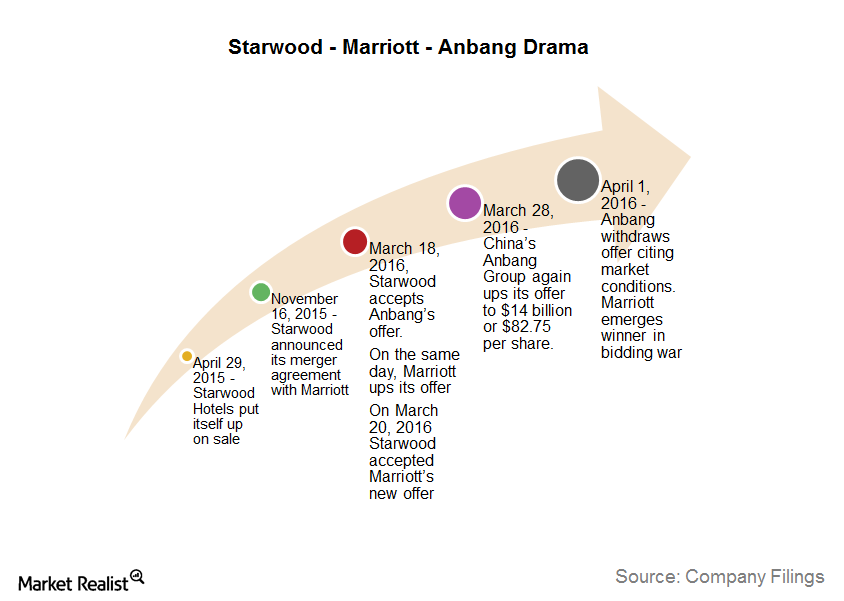

Analyzing the Key Events before the Marriott-Starwood Merger

On April 29, 2015, Starwood put itself up for sale. On August 29, 2015, Anbang offered to buy it at a 20% all-cash premium deal on its last closing price.

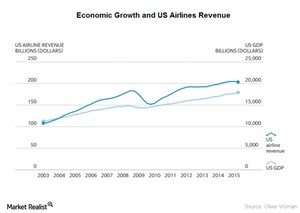

The Airline Industry’s Cyclical Nature Is a Mixed Blessing

The airline industry is cyclical, which means that its business depends on the country’s economic growth. Most analysts have revised their GDP estimates downward, resulting in a consensus estimate of 2.9% YoY growth.

Can Google Trips Reduce Travel Stress?

If done the right way, traveling can be fun and a huge stress buster, which is what Google (GOOGL) aims to tap into with Google Trips.

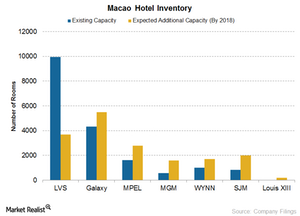

Hotel Inventory Is Rising, but Is There Enough Demand?

Macao casinos’ $28-billion investment in integrated resorts will change the city’s gaming. Capacity additions should increase the number of slot tables too.

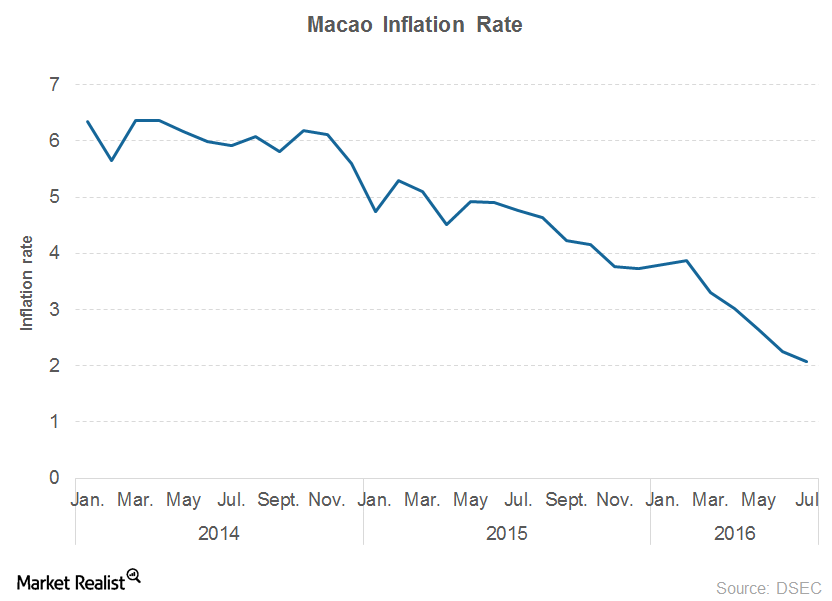

What Do Macao’s Inflation Numbers Indicate?

The annual inflation in Macao fell to ~2.1% in July 2016. Inflation has, in fact, been on a declining trend in the region since February 2016.

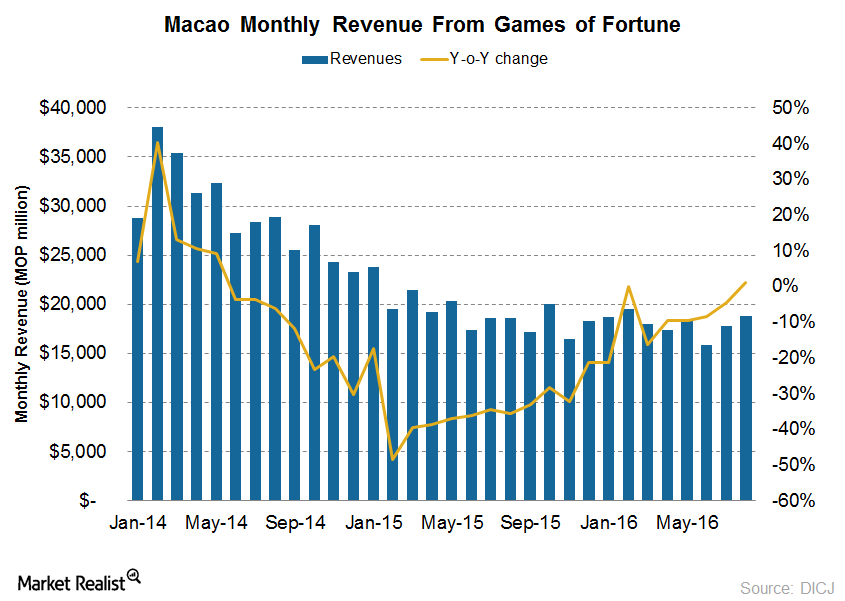

Revival or Luck: Analysts’ Takes on Macao’s Revenue Rise

After 26 consecutive months of declining revenues, Macao gaming revenues have finally shown a small spurt of growth.

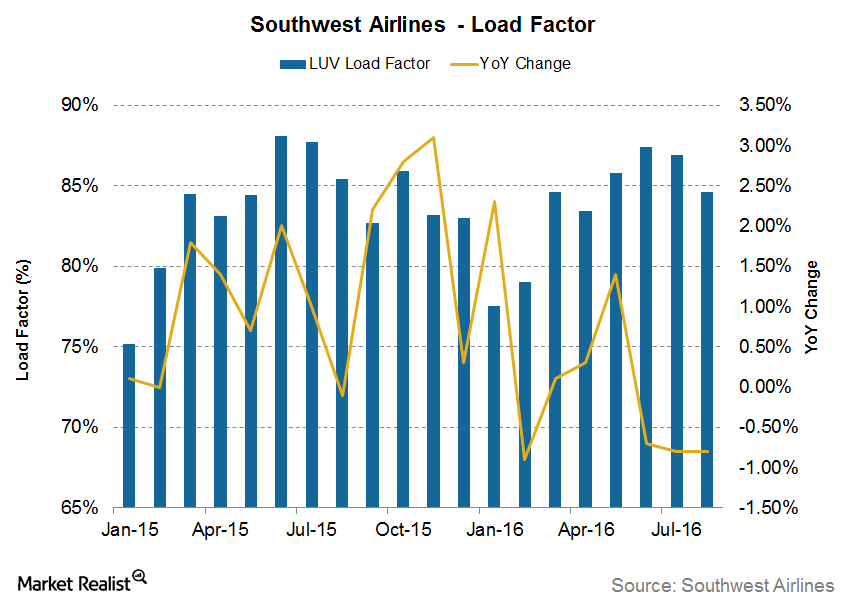

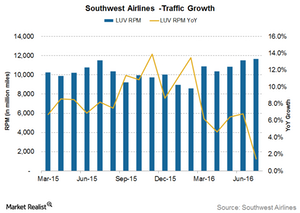

Is Southwest Airlines On Track to Achieve Its Utilization Goals?

In 2015, Southwest Airlines’ prudent approach to capacity growth resulted in the better utilization of its capacity.

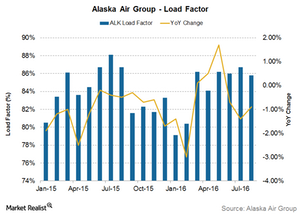

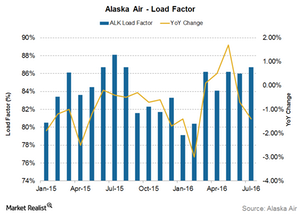

Will Alaska Air’s Unit Revenues Continue to Fall in September?

Foreign currency fluctuations and lower fuel surcharges in the international market will have a negative impact on Alaska Air Group’s unit revenues.

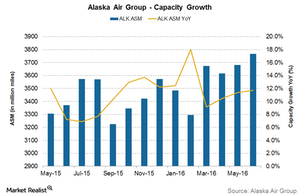

Will Alaska Air Group’s Capacity Expand More in 2016?

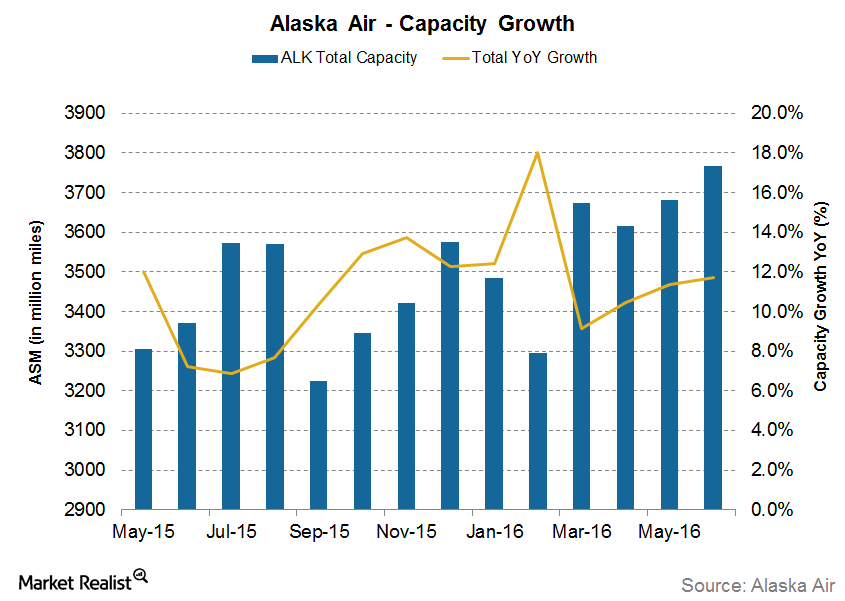

For August 2016, Alaska Air Group’s (ALK) capacity increased by 10.3% YoY. After average growth of 13% in 1Q16, its growth slowed down to 11% in 2Q16.

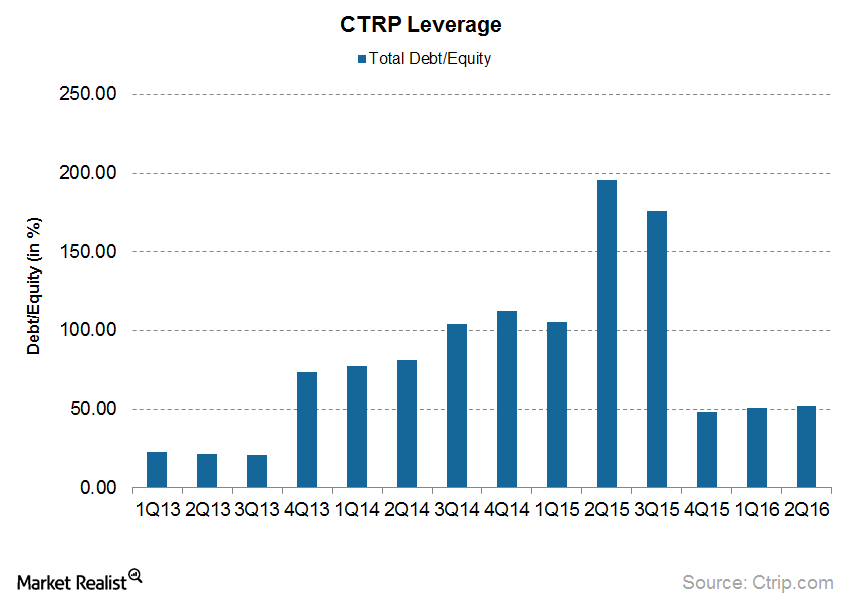

What Ctrip.com’s Increasing Leverage Means for Investors

As discussed in the previous articles, Ctrip.com has tried to consolidate the Chinese online travel industry by acquiring majority stakes in its rivals.

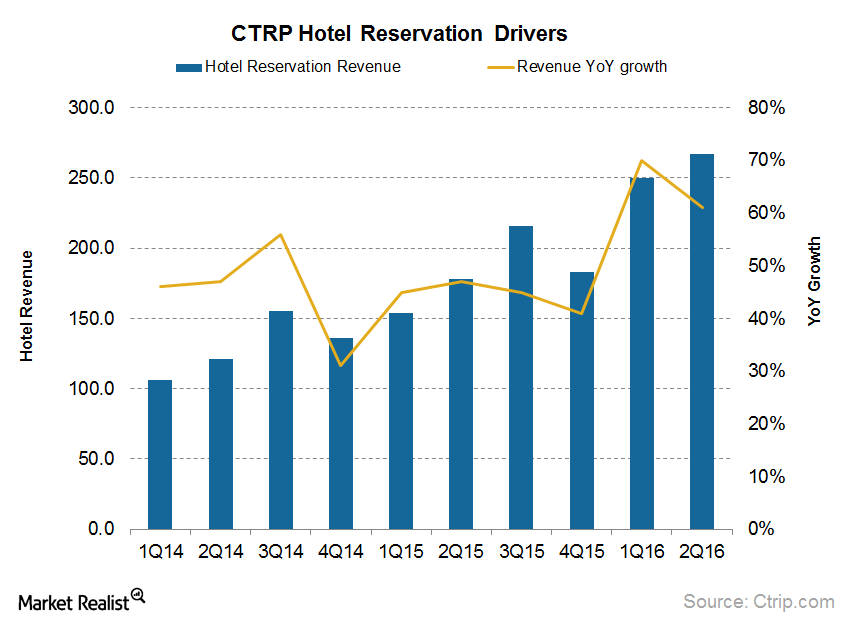

These Segments Will Contribute the Most to Ctrip’s Future Growth

At 39% in 2Q16, hotels formed a significant part of Ctrip’s revenue, much like other OTA (online travel agency) players.

How Traffic Growth Lags behind Capacity at Southwest Airlines

In July 2016, Southwest Airlines’ (LUV) traffic grew by 1.4% YoY, which was slightly lower than its capacity growth of 2.3% YoY.

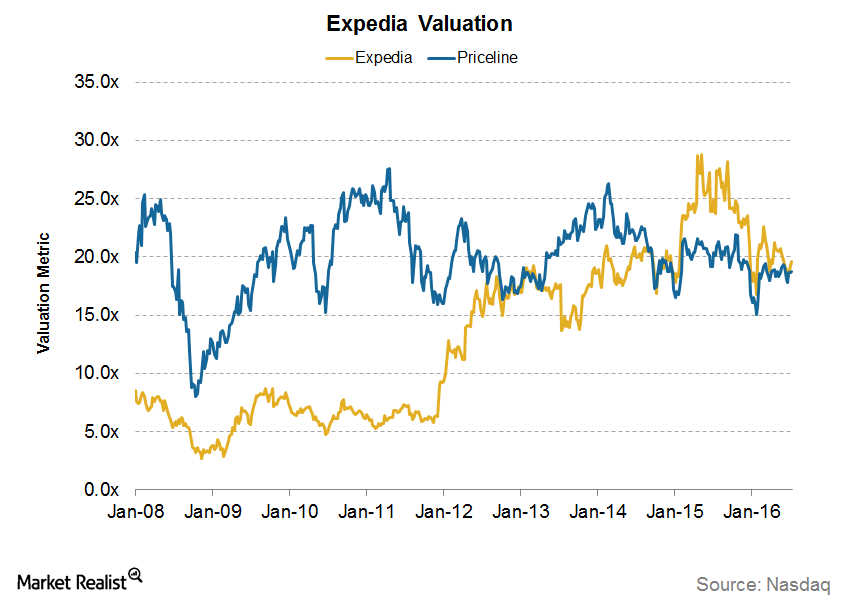

A Look at Expedia’s Valuation: How Does It Compare?

Expedia (EXPE) currently trades at a forward PE (price-to-earnings) multiple of 20x.

How Will Alaska Air Group’s Strategy Impact Unit Revenues?

Alaska Air Group (ALK) does not give any future unit revenue guidance. However, we can expect the PRASM’s decline to continue.

Can Alaska Air Group’s Capacity Growth Be Sustained for the Rest of 2016?

For July 2016, Alaska Air Group’s (ALK) capacity increased by 9.6% year-over-year. After an average growth of 13% in 1Q16, growth slowed to 11% in 2Q16 and is slowing further in the third quarter.

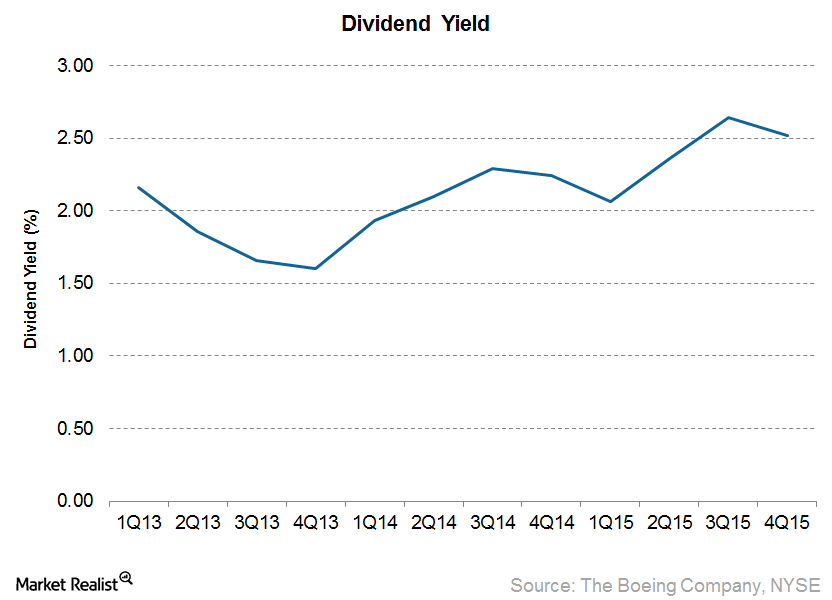

Will Boeing’s Dividend Payout Increase in the Rest of 2016?

Looking at Boeing’s dividends, we see that it has been a consistent dividend payer for more than two decades. For 2Q16, it paid a total of $691 million in dividends.

Could JetBlue Airways’ Valuation Change after 2Q16?

As of July 22, 2016, JetBlue was valued at 3.8x its forward EV-to-EBITDA multiple, which is lower than its average valuation of 4.8x since September 2009.

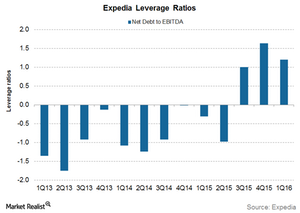

Investors Should Pay Attention to Expedia’s Increasing Leverage

Expedia and Priceline have shown interest in China’s Ctrip.com (CTRP), with Priceline also increasing its stake.

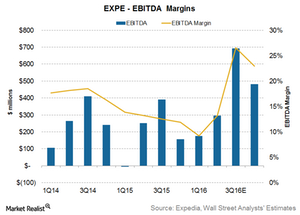

In Line with These Competitors, Expedia’s Margins to Increase

For 2Q16, analysts are estimating Expedia’s (EXPE) EBITDA to grow by 17% to $296 million with an EBITDA margin of 13%.

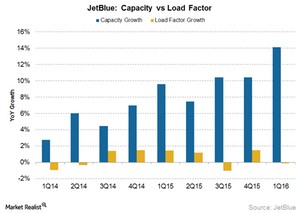

Does JetBlue Airways’s Capacity Growth Support Analyst Estimates?

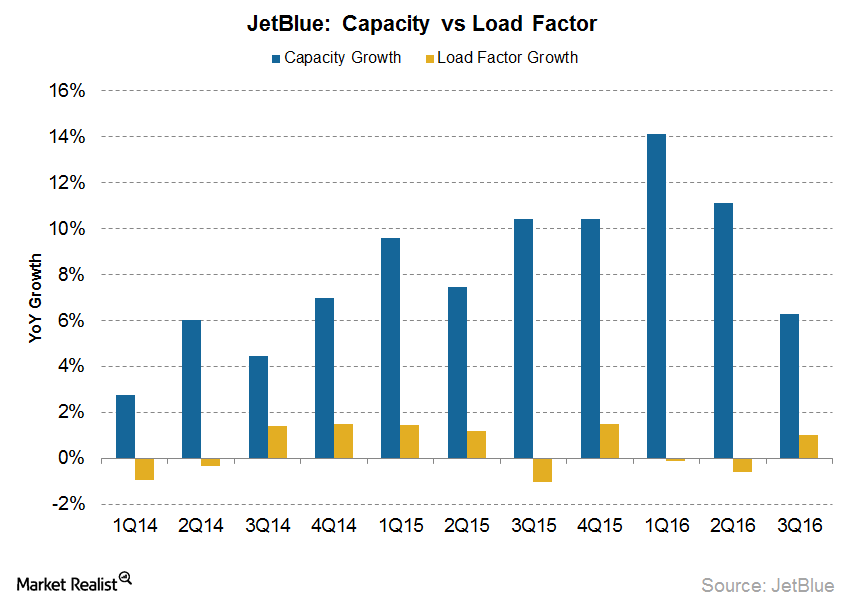

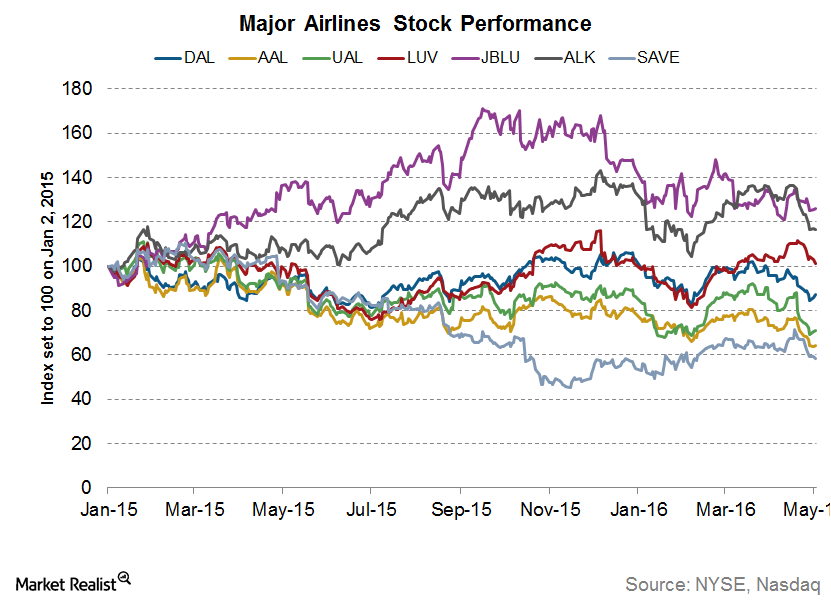

Capacity growth Like other airlines, JetBlue Airways (JBLU) has taken advantage of falling crude oil prices to expand its existing fleet. JetBlue’s double-digit revenue growth has been fueled by double-digit growth in its capacity. Historically, JetBlue Airways has seen the highest capacity growth among the seven major airlines. Spirit Airlines (SAVE) has seen the highest growth, followed by Alaska […]

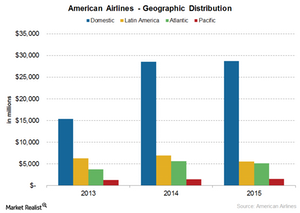

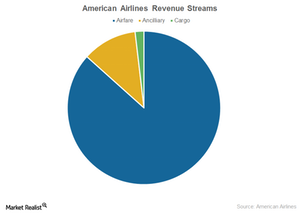

American Airlines and Its Geographic Mix of Revenues

Revenues from American Airlines’ foreign operations make up about 30% of its total operating revenues. The airline has been consistently expanding its global footprint by adding new routes.

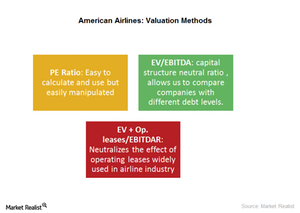

What’s the Best Approach for Valuing American Airlines?

For airlines such as American Airlines (AAL), we go a step further and use an EV+ Op. leases-to-EBITDAR ratio.

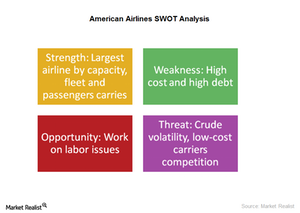

What Are American Airlines’ Key Strengths and Weaknesses?

Some key strengths keep American Airlines ahead of its competitors. It’s the largest airline in fleet, capacity, and number of passengers. It also has a strong hold on key hubs.

What Are American Airlines’ Major Revenue Drivers?

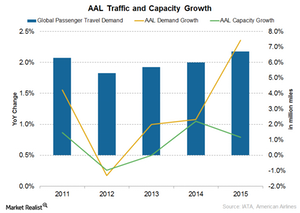

American Airlines’ (AAL) capacity growth is one of the slowest in the industry. However, it has the highest capacity among its peers.

What Are American Airlines’ Key Revenue Streams?

In this part of the series, we’ll look at the main services and categories that add to American Airlines’ (AAL) revenues. The major component of revenues still comes from airfares.

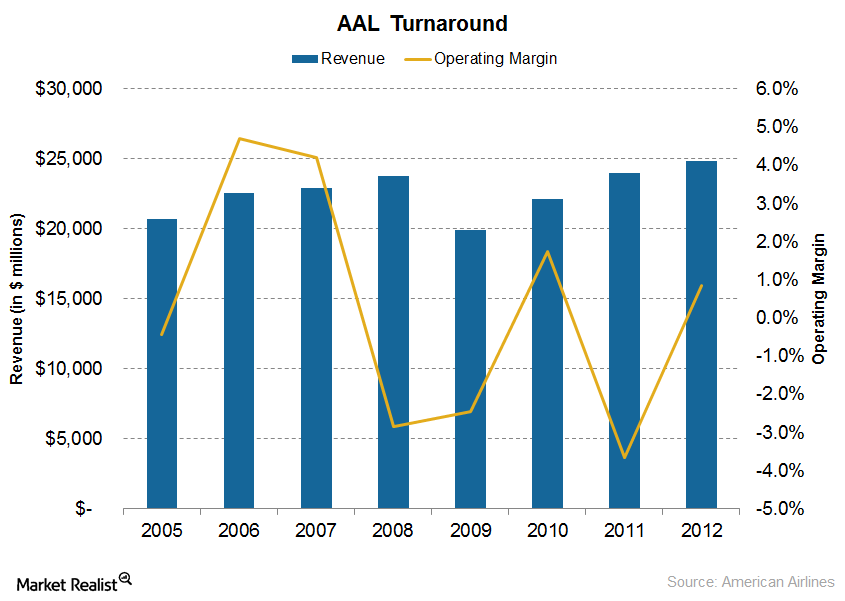

American Airlines Stock: The Past, the Crisis, the Recovery

After the merger, American Airlines became the world’s leading airline in terms of fleet size, network, and finances. American Airlines stock has risen more than 270% since 2011.

How Did American Airlines Recover from Bankruptcy?

Soon after US Airways declared its intention to merge with American Airlines, AAL started working on its weak points and restructuring costs.