Could JetBlue Airways’ Valuation Change after 2Q16?

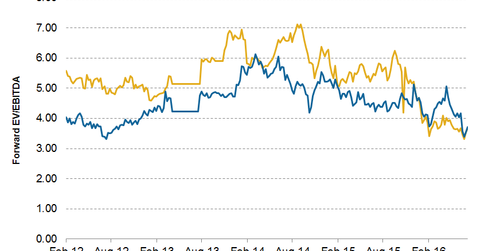

As of July 22, 2016, JetBlue was valued at 3.8x its forward EV-to-EBITDA multiple, which is lower than its average valuation of 4.8x since September 2009.

Aug. 1 2016, Updated 9:04 a.m. ET

Current valuation

As of July 22, 2016, JetBlue Airways (JBLU) is valued at 3.8x its forward EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiple. JetBlue Airways’ valuation is lower than its average valuation of 4.8x since September 2009.

Peer comparison

Spirit Airlines (SAVE) is trading at 6.8x, and Allegiant Travel (ALGT) at 6.4x. American Airlines (AAL) is trading at 4.9x, whereas Southwest Airlines (LUV) is trading at 4.8x, and Delta Air Lines (DAL) is trading at 3.9x. Alaska Air Group (ALK) and United Continental Holdings (UAL) are trading at 3.7 and 3.5x, respectively.

Markets are expecting SAVE’s EBITDA to decline slightly by 0.2% in 2016. In the same period, UAL’s EBITDA is expected to decline by 7%, and AAL’s by 0.5%. By comparison, DAL’s EBITDA is expected to grow by 18%, LUV’s at 9%, JBLU’s at 10%, ALK’s by 7.4%, and ALGT’s by 4%.

Our analysis

Falling crude oil prices since the start of 2014 have been one of the major reasons for the improved profitability we’ve seen across airlines. Capacity growth aided by increasing air travel demand has also boosted growth. However, capacity growth has been exceeding industry demand, and investors are concerned about overcapacity in the industry. This is also reflected in airline stocks’ lackluster performances so far in 2016

JetBlue’s high-value geography, maturing markets, and premium product have helped it grow in the past. It operates on airports having controlled gates and slots, limiting competition. JBLU’s low-cost structure and strong domestic presence position it well to outperform peers. These along with its innovative services like its “Mint” service will help the company grow in the future.

That said, JBLU’s ability to turn around its yield performance and maintain leverage at the same time will be key to changing valuation multiples in the short term. JBLU makes up ~0.79% of the iShares S&P Mid-Cap 400 Growth ETF (IJK).