iShares S&P Mid-Cap 400 Growth

Latest iShares S&P Mid-Cap 400 Growth News and Updates

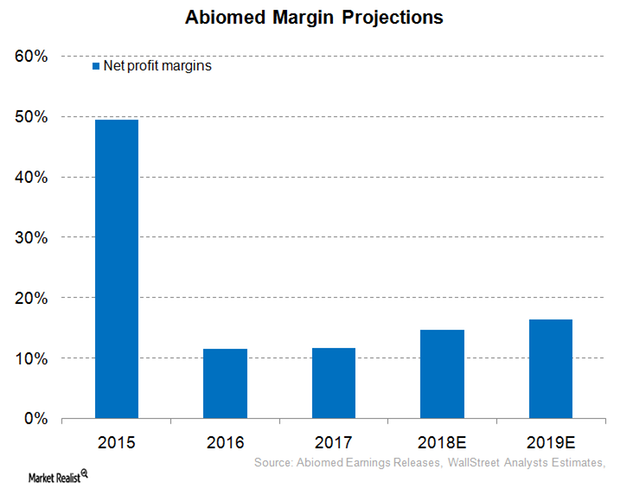

Inside Abiomed’s Profit Margin Expectations for Fiscal 2018

For fiscal 2018 (ended March 31, 2018), Abiomed (ABMD) has projected that its operating margins will be in the range of 22%–24%.

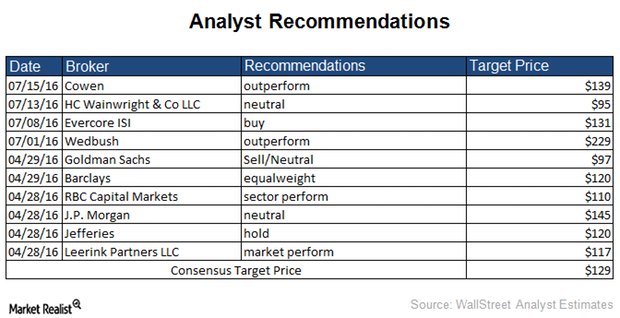

What Do Analysts Recommend for United Therapeutics?

23.1% of analysts gave United Therapeutics (UTHR) a “buy” recommendation while 69.2% of analysts rated the company a “hold.”

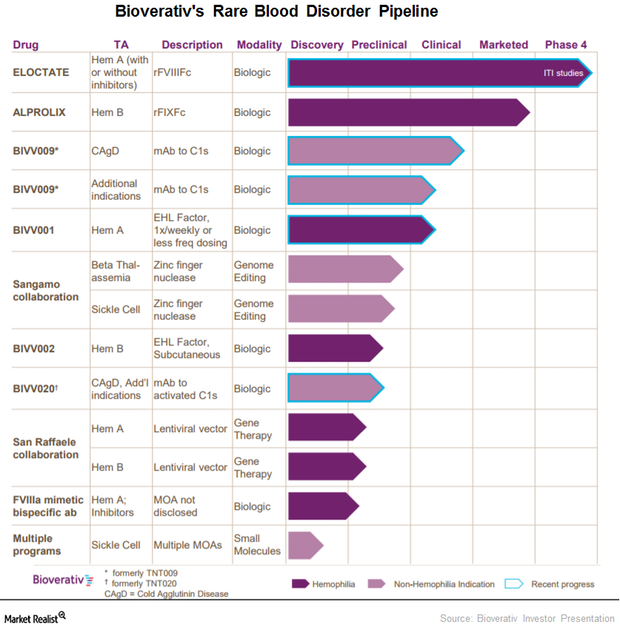

This Part of Bioverativ’s Pipeline Could Be a Major Long-Term Growth Driver

In June 2017, the FDA accepted Bioverativ’s investigative new drug application for BIVV001, a drug designed to treat prophylaxis from bleeding associated with hemophilia A.

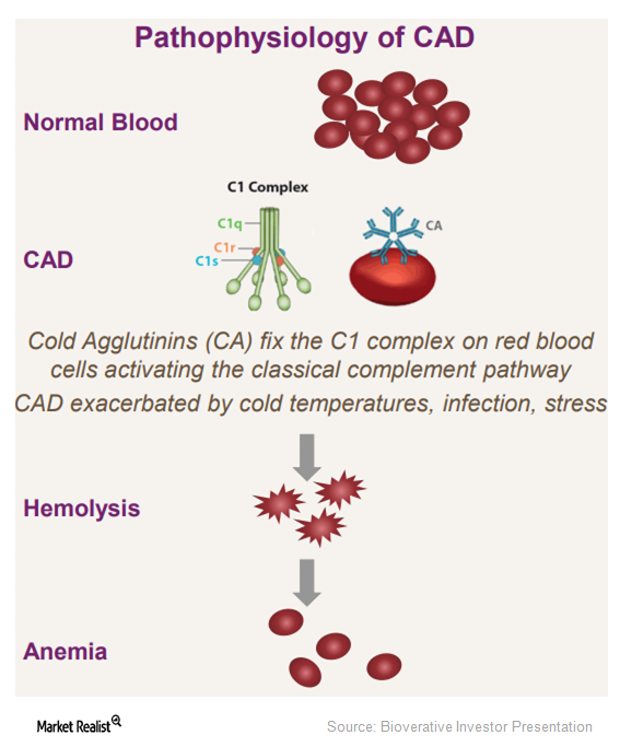

Bioverativ–True North Therapeutics: Stronger Research Pipeline

The acquisition of True North Therapeutics has paved the way for Bioverativ’s (BIVV) entry into cold agglutinin disease (or CAD).

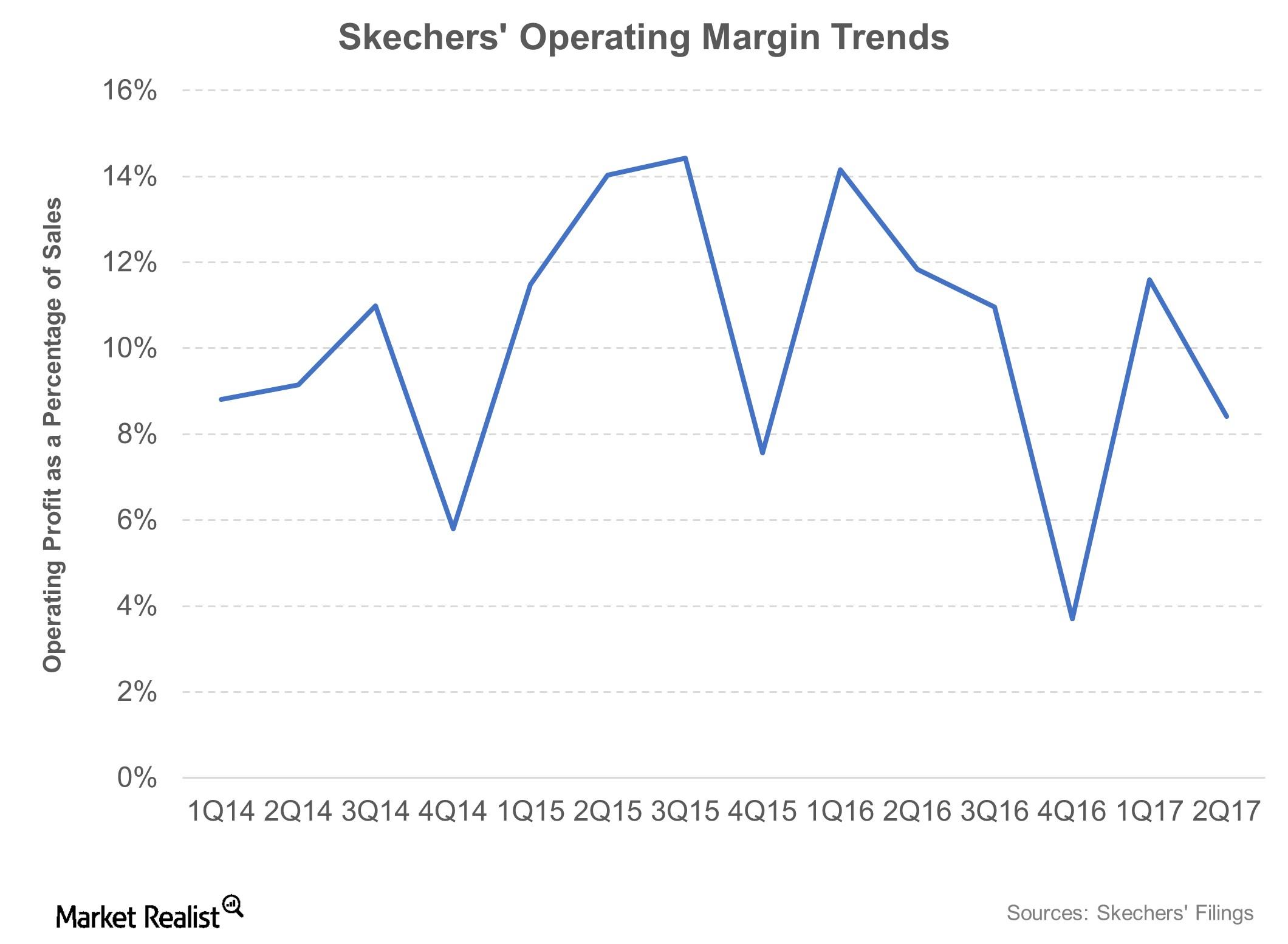

Skechers Reports Its Fifth Straight Fall in Earnings in 2Q17

Skechers, which released its 2Q17 results on July 20, 2017, reported earnings per share of $0.38. The company missed analysts’ consensus expectation by a margin of $0.06.

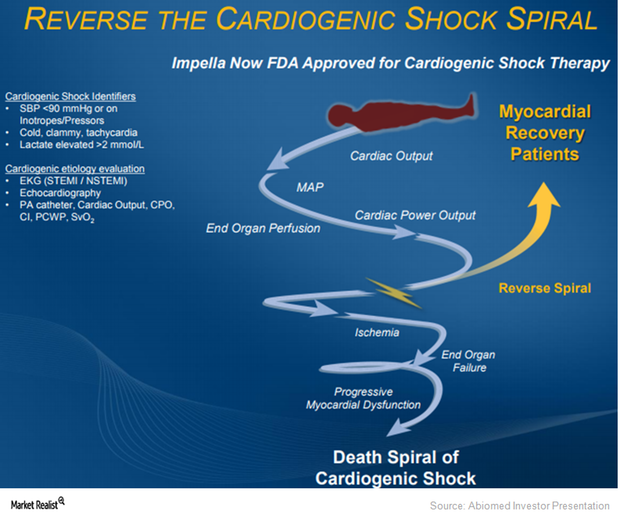

Why Abiomed Expects to Benefit from Impella in Cardiogenic Shock

On March 23, 2015, the FDA approved Abiomed’s Impella 2.5 heart pump as a temporary ventricular support device.

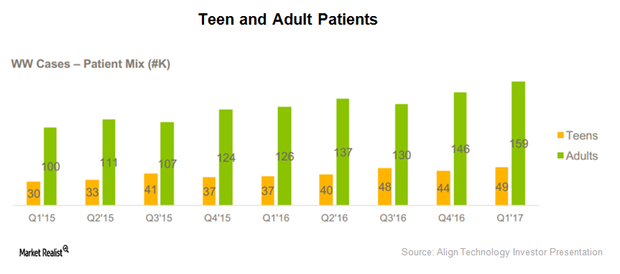

Inside Align Technology’s Market Expansion Strategy

In 1Q17, Align Technology (ALGN) also witnessed a robust rise of around 45.2% in volumes of Invisalign sold in Asia-Pacific markets on a YoY basis.

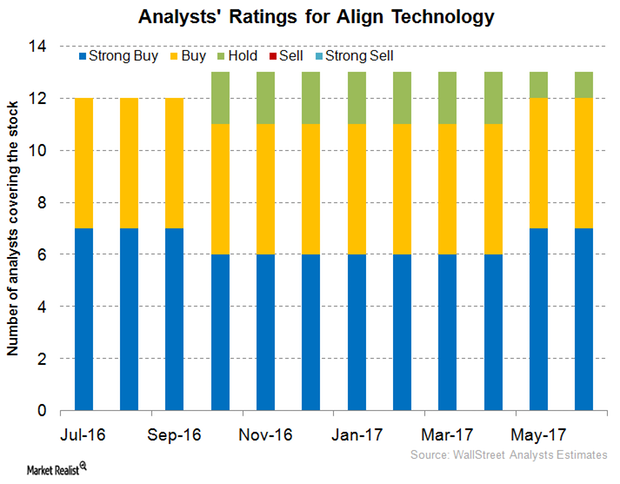

Align Technology versus Peers in June 2017: Analyst Recommendations

For 1Q17, Align Technology (ALGN) reported revenues close to $310.3 million, which represents YoY (year-over-year) growth of around 30.0%.

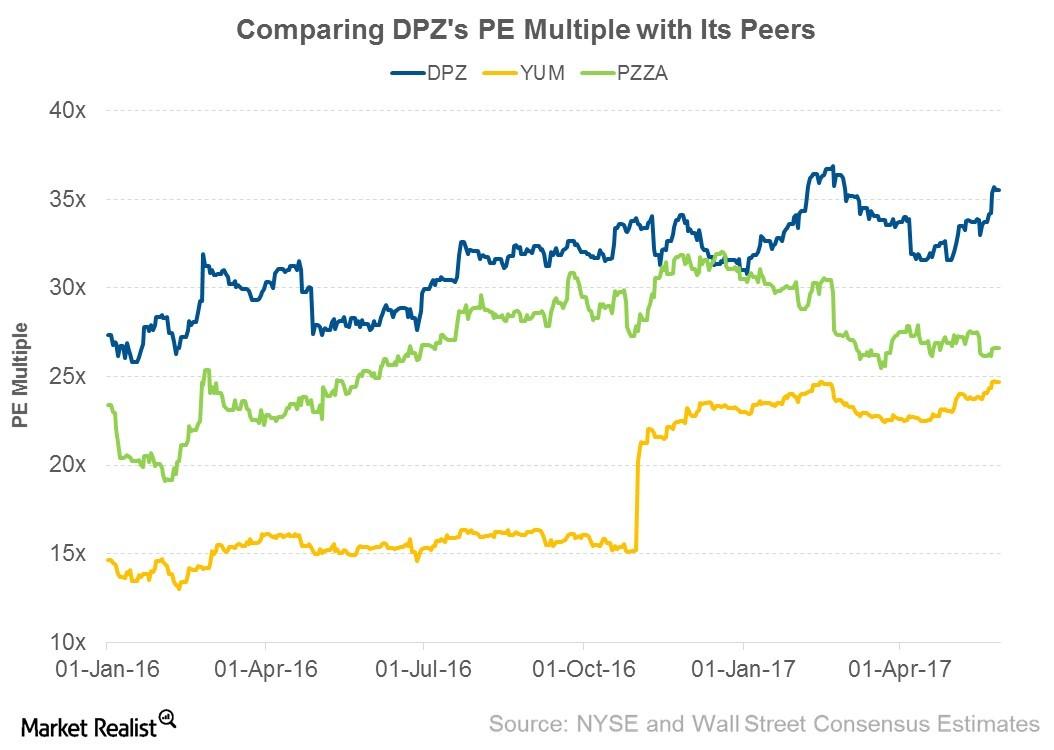

How Domino’s Pizza’s Valuation Multiple Compares to Its Peers

Domino’s better-than-expected SSSG and earnings in 1Q17 appear to have increased investor confidence, leading to rises in DPZ stock and its PE multiple.

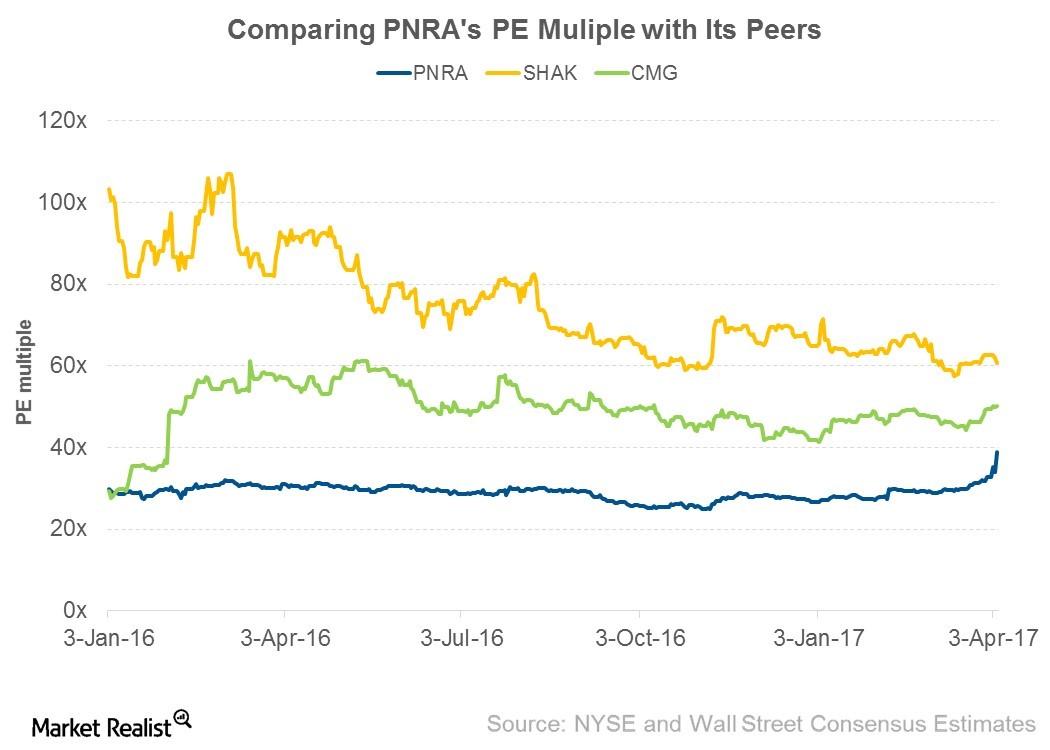

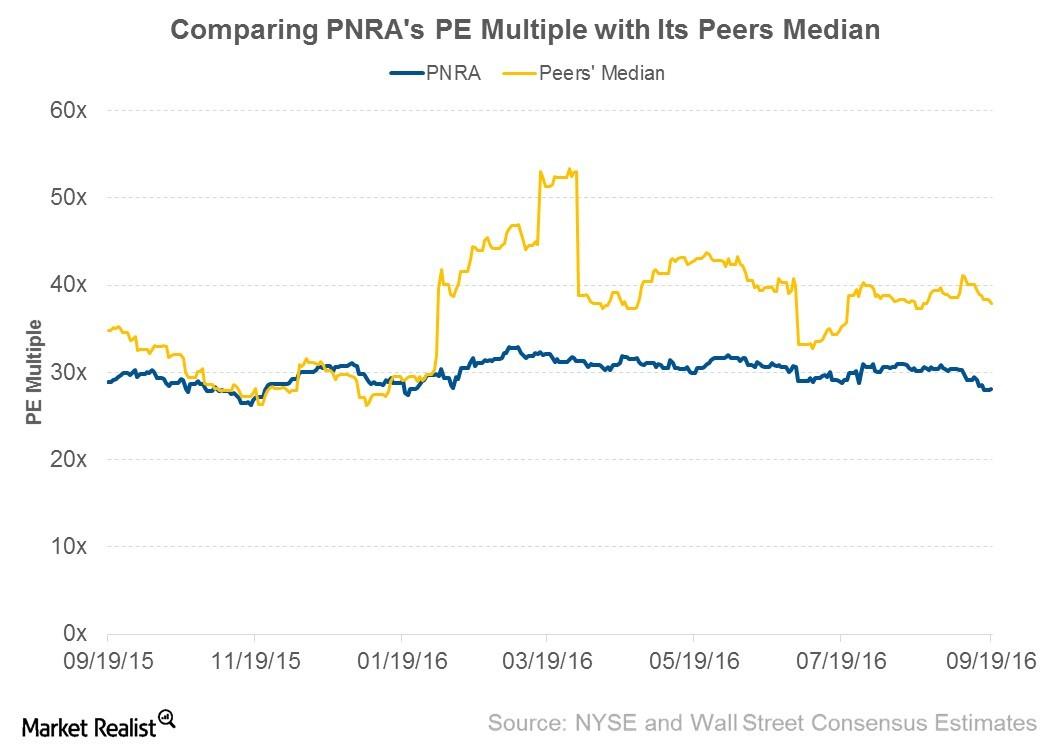

Why Panera’s Valuation Multiple Rose after JAB’s Offer

As of April 5, 2017, Panera was trading at a forward PE multiple of 38.8x—compared to 32.6x before the acquisition rumor started to surface on April 3.

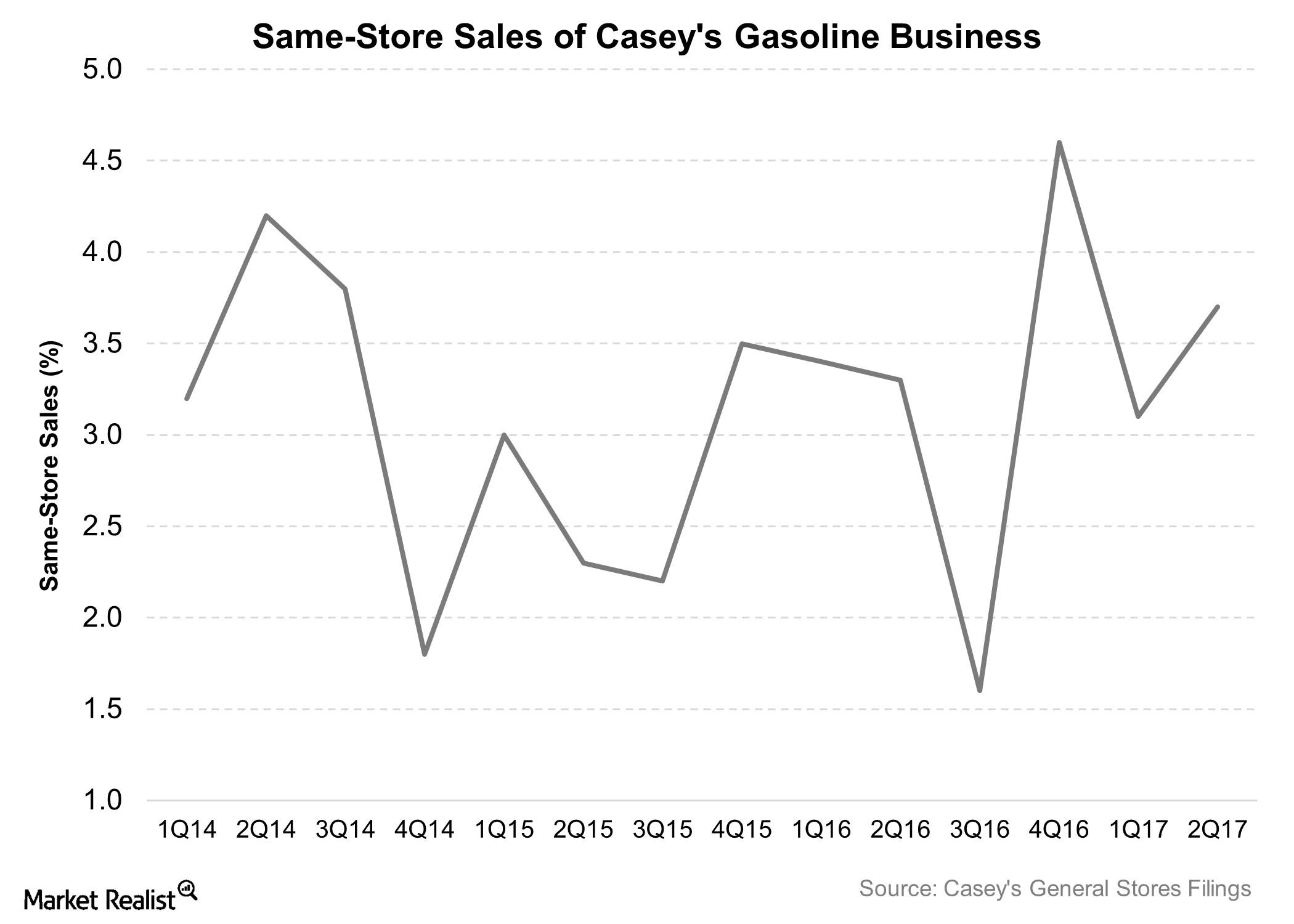

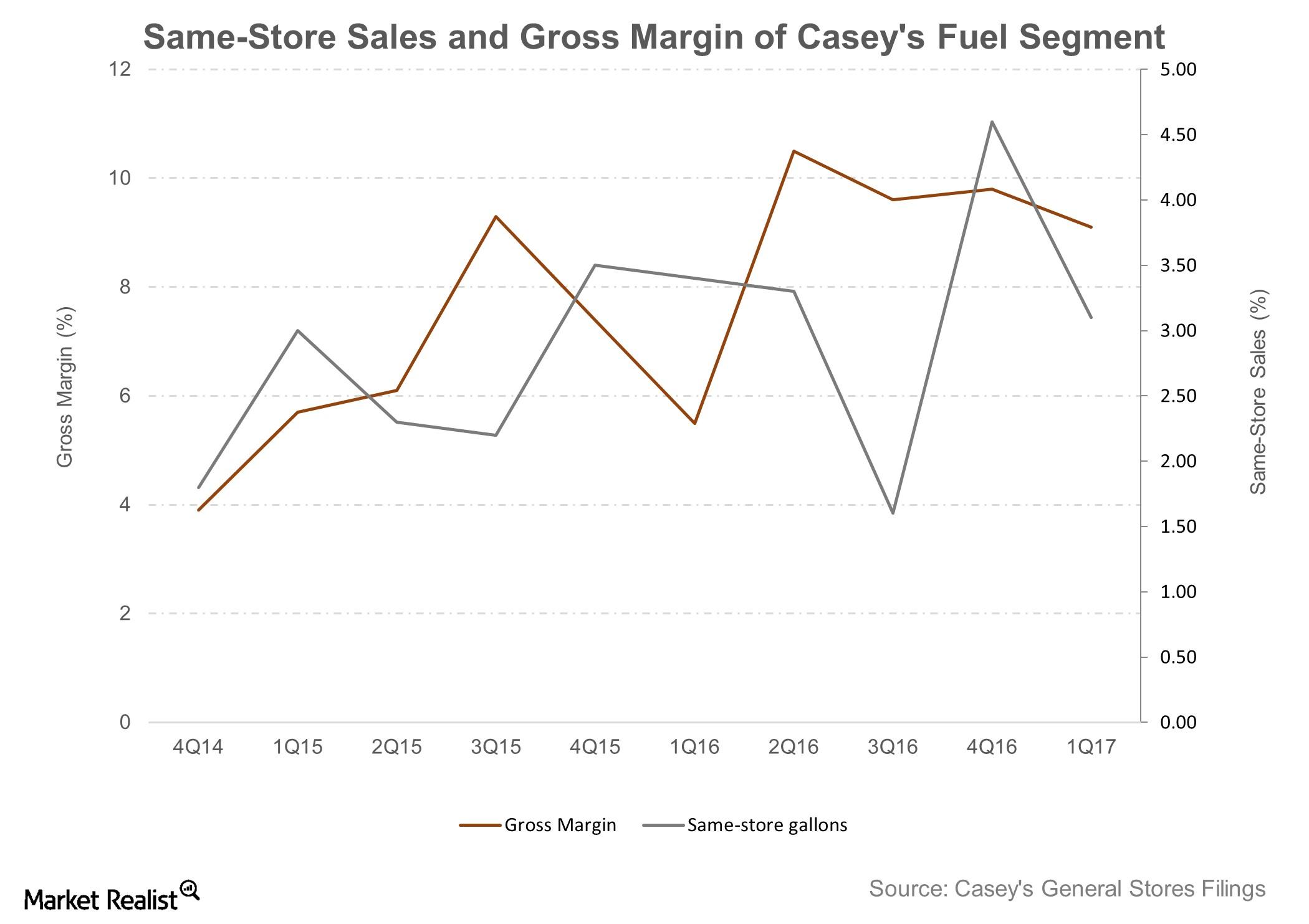

Lower Fuel Margins Drove Casey’s 2Q17 Earnings Miss

Gasoline sales accounted for 58.0% of Casey’s (CASY) total revenue in fiscal 2Q17. Total gasoline sales fell 4.6% YoY (year-over-year) in fiscal 2Q17.

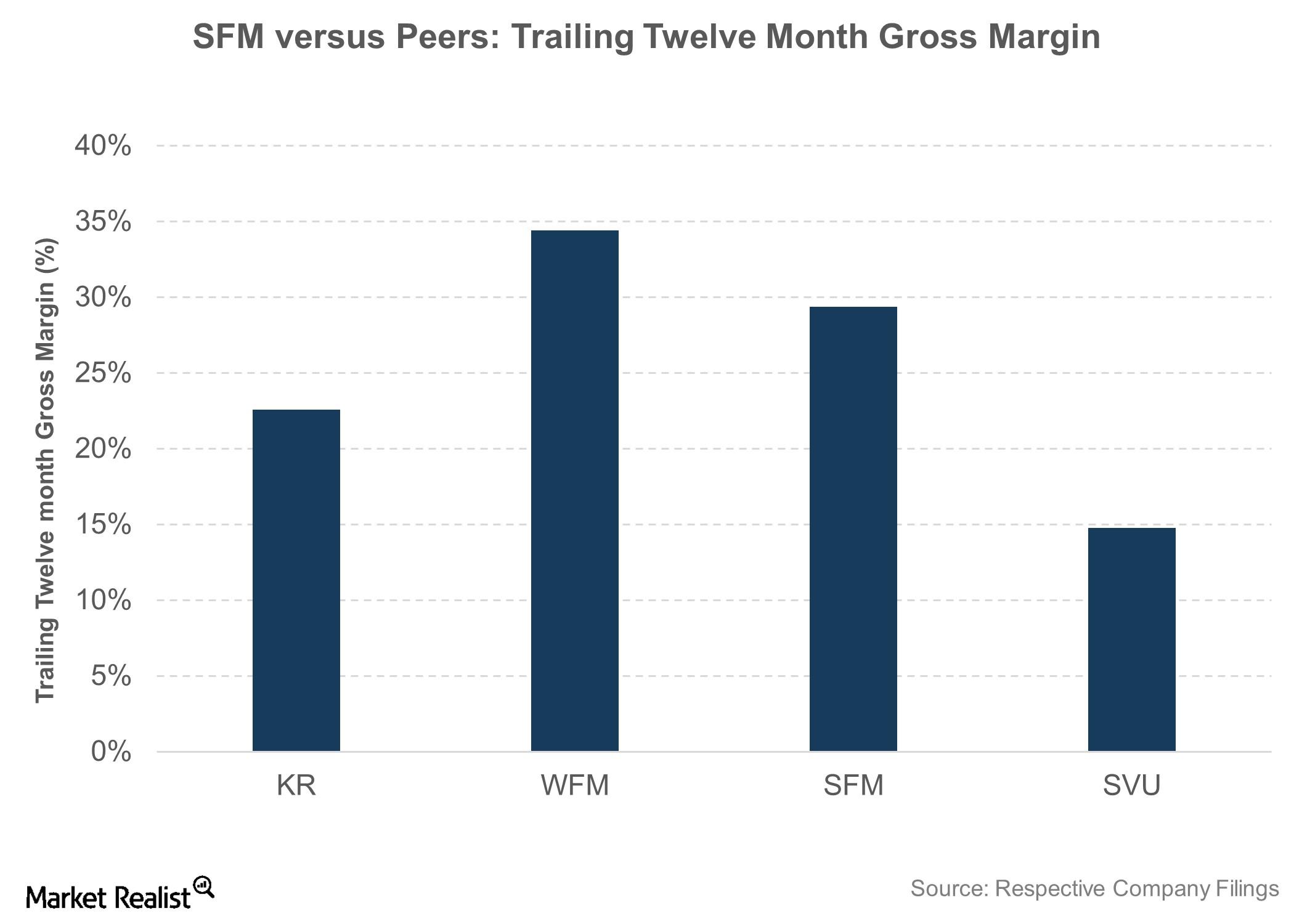

Analyzing Sprouts Farmers Market’s Margins and Profitability

Despite the slowdown, Sprouts Farmers Market continues to display better margins compared to Kroger (KR) and Supervalu (SVU).

Sprouts Farmers Market Beat Revenue Estimates in 3Q16

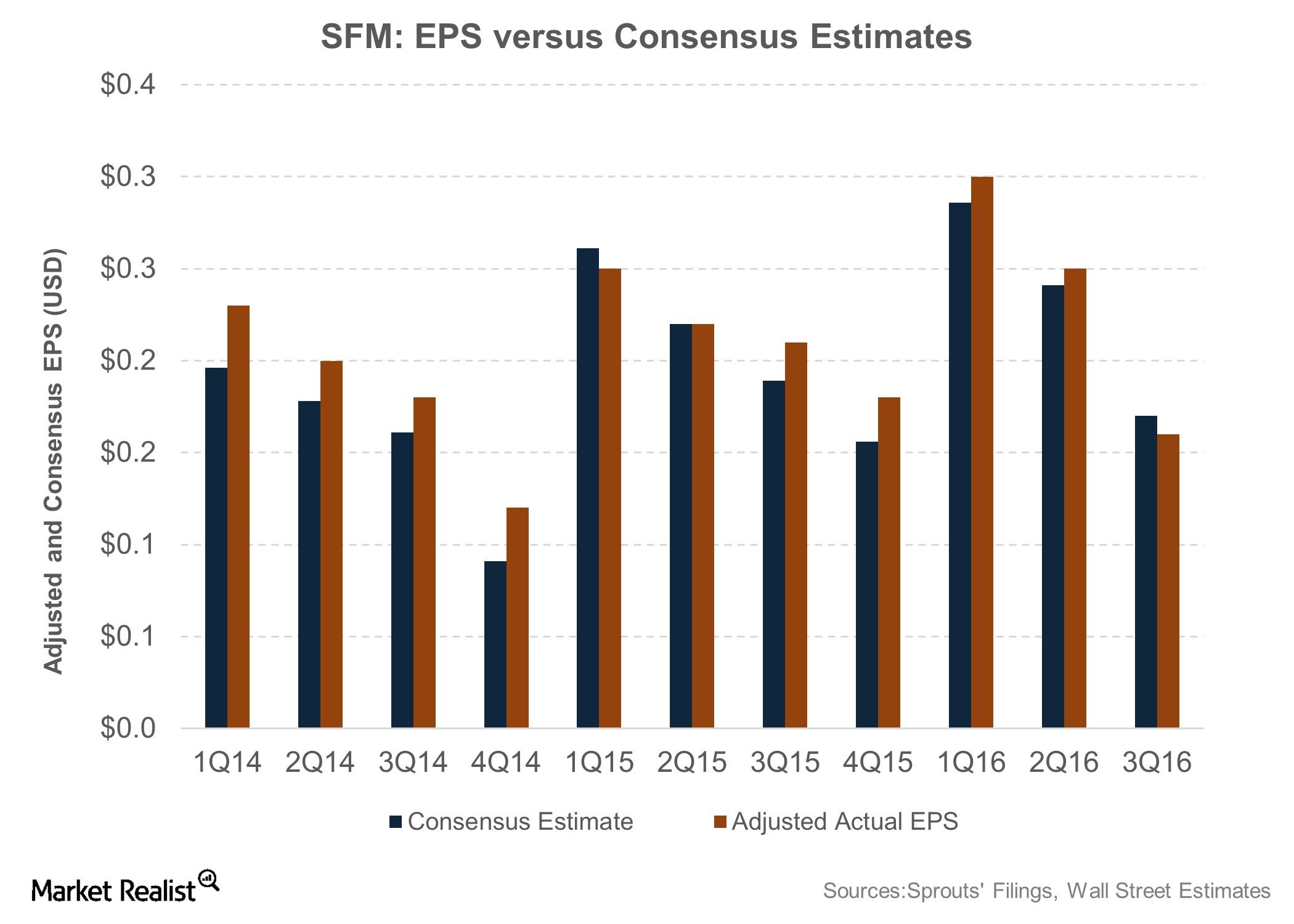

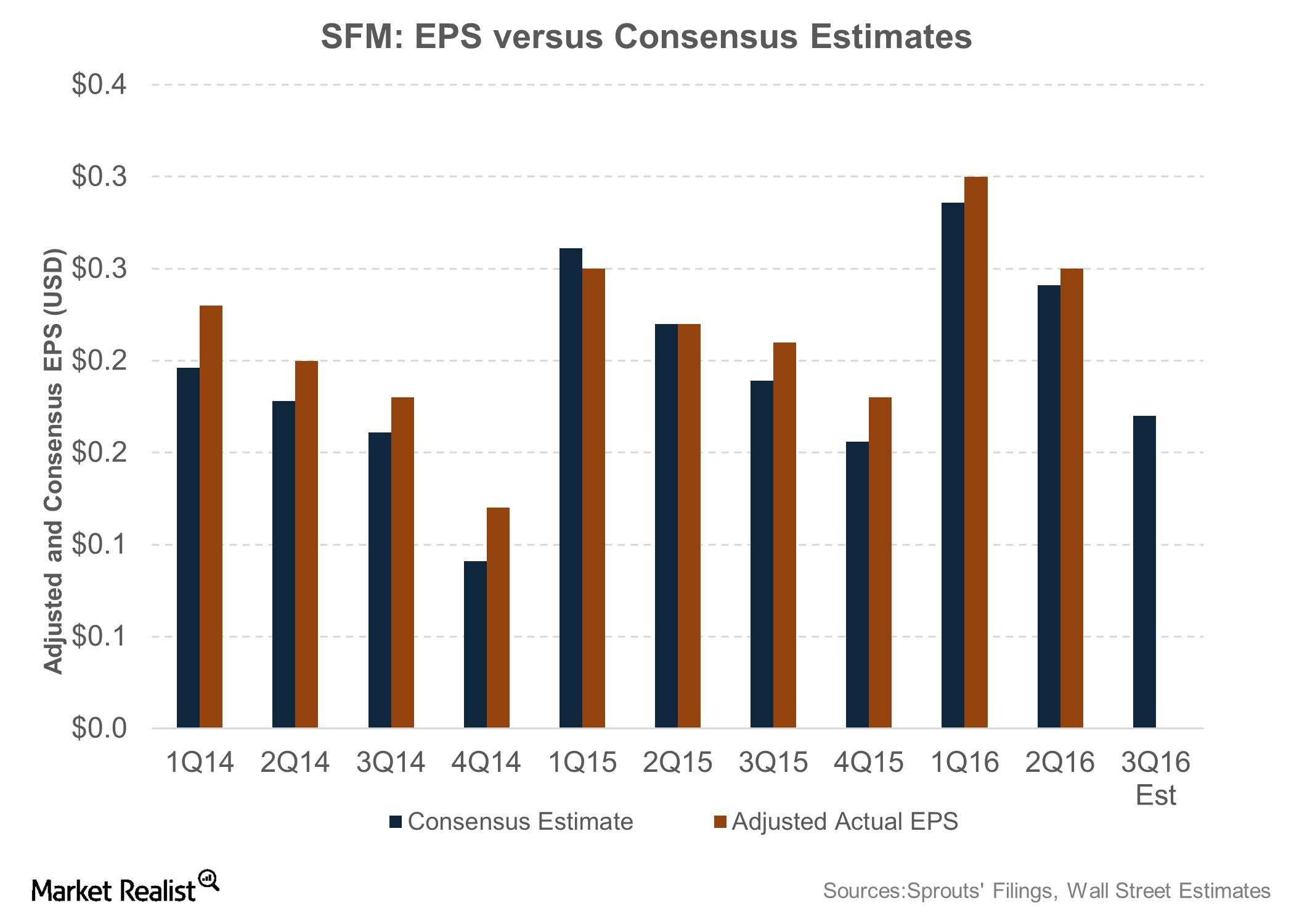

Sprouts Farmers Market (SFM) reported its 3Q16 results on November 3, 2016. The results relate to the three-month period ending October 2, 2016.

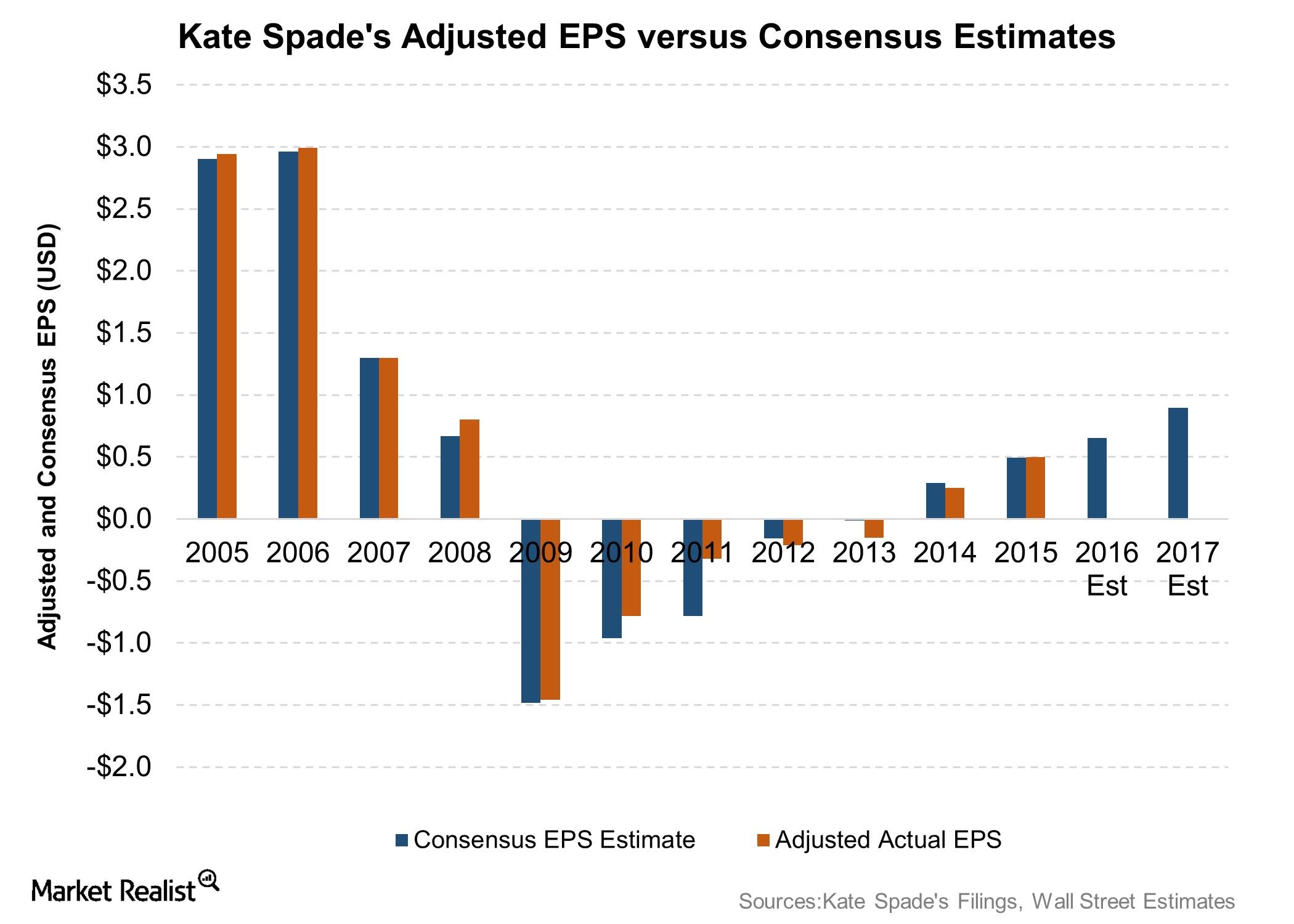

How Will Kate Spade’s Fiscal 2016 Performance Shape Up?

As a result of its second quarter headwinds, Kate Spade (KATE) lowered its full fiscal 2016 outlook.

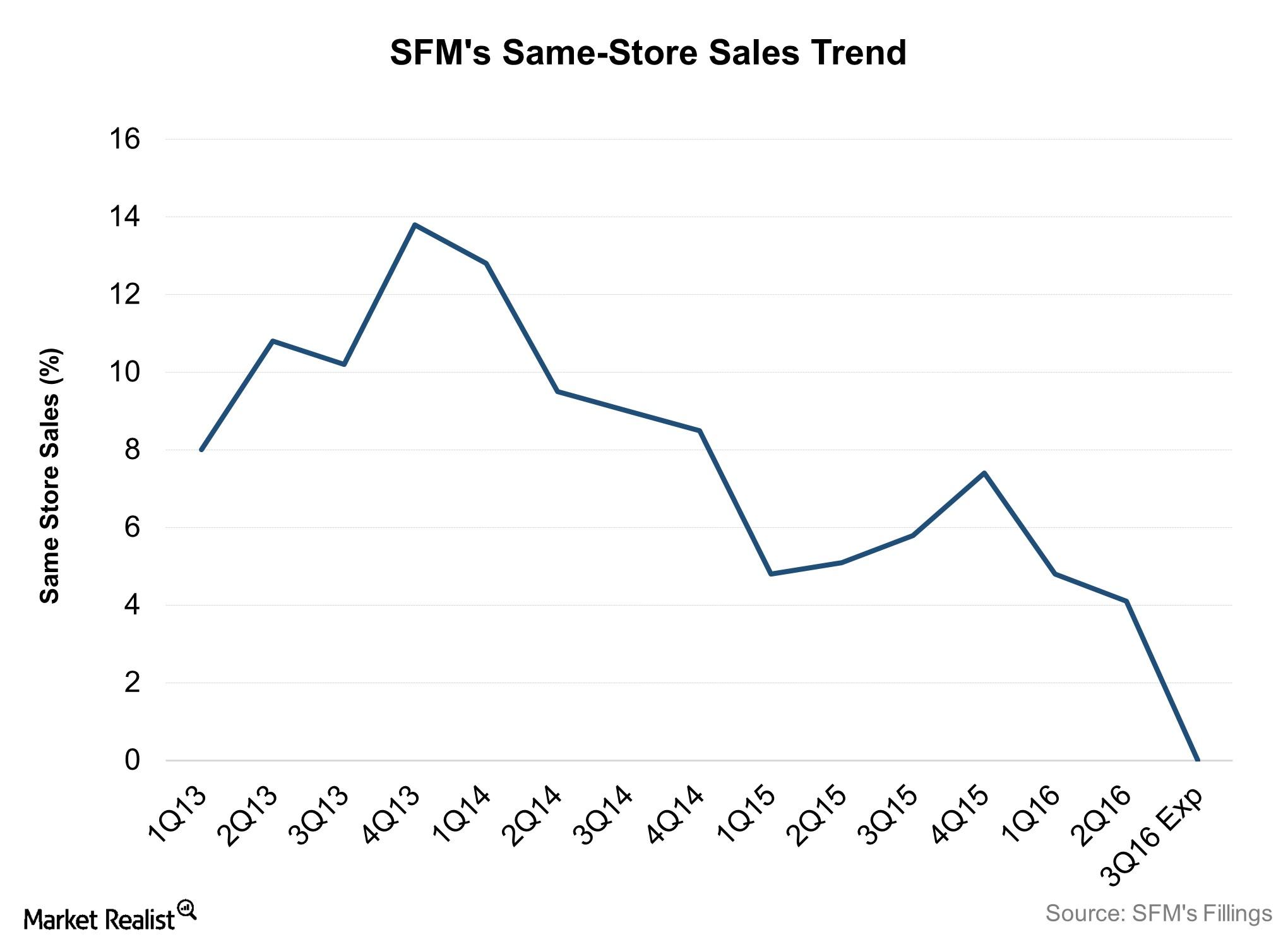

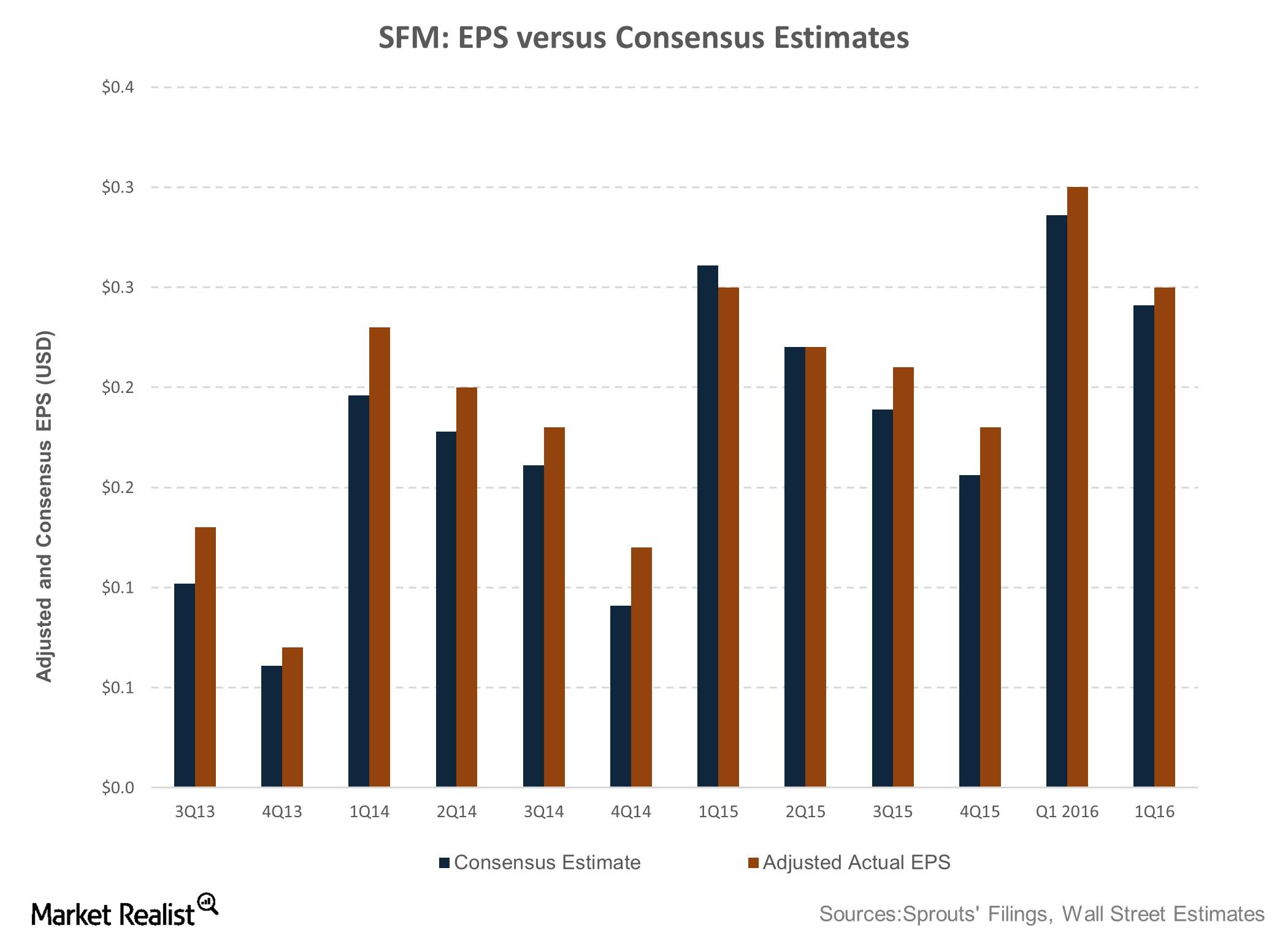

Sprouts Farmers Market May Not Have the Best Quarter

Sprouts Farmers Market (SFM) is slated to release its 3Q16 results on Thursday, November 3, 2016, before the market opens. Wall Street is expecting a fall of 19.0% in EPS.

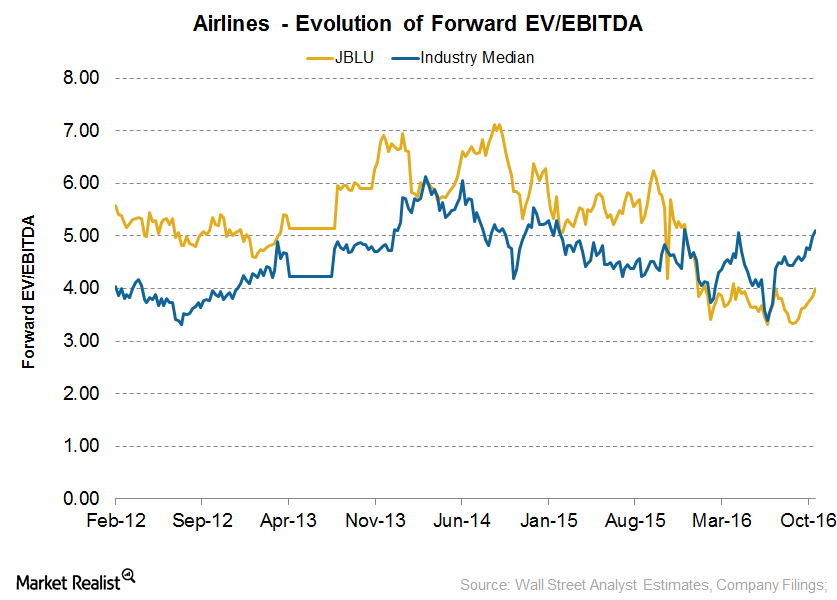

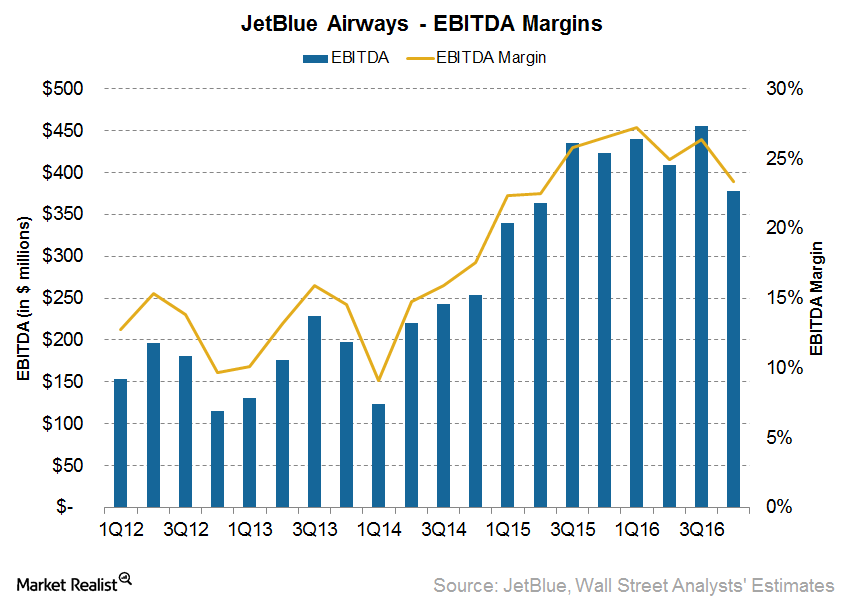

Could JetBlue’s Valuation Change after 3Q16?

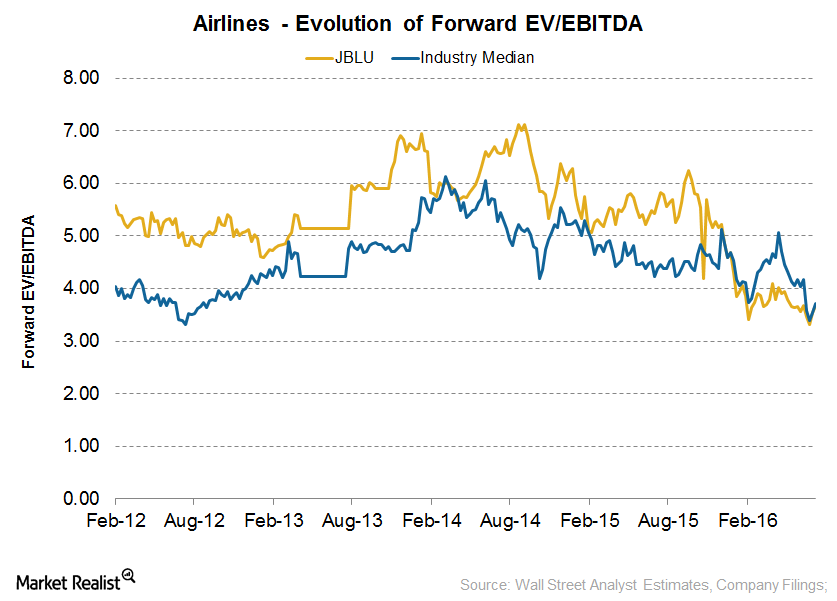

Currently, JetBlue Airways (JBLU) is valued at 4x its forward EV/EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiple.

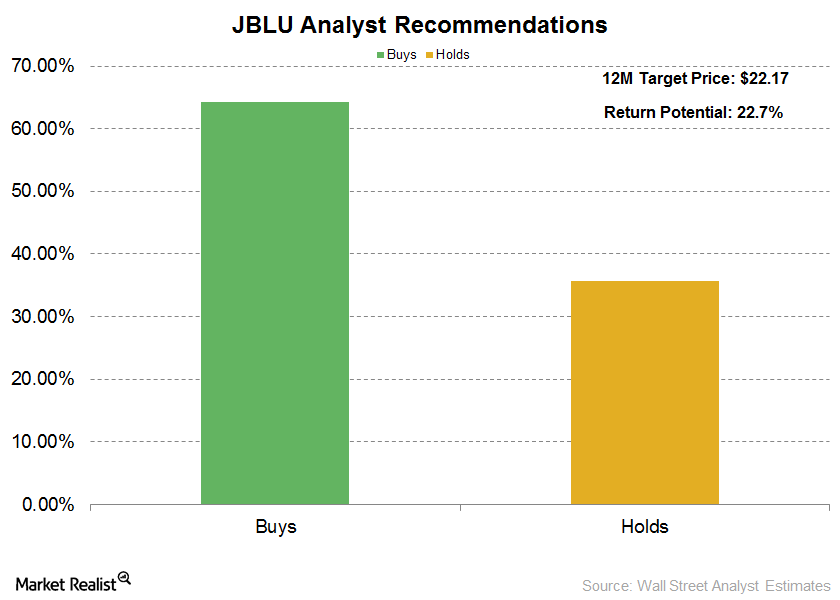

JetBlue: The Latest Analyst Estimates and Recommendations

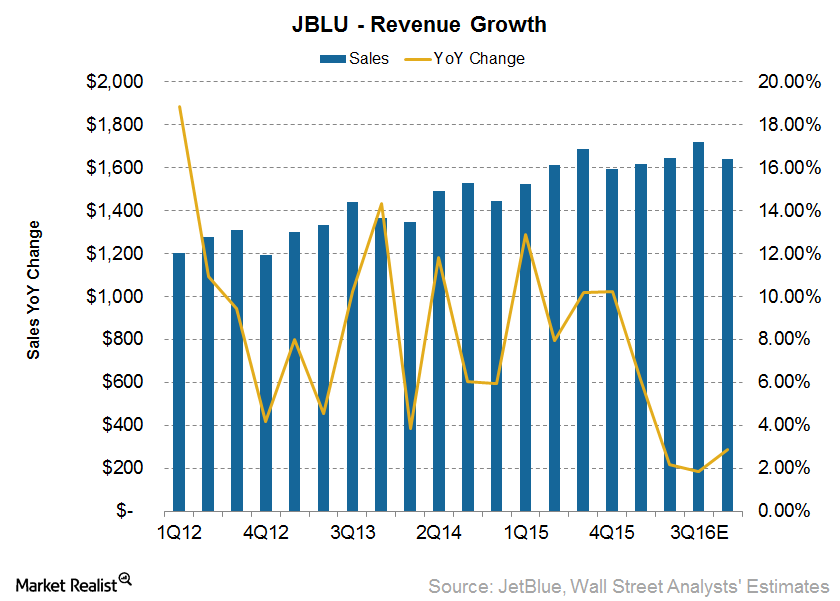

Following JetBlue’s 2Q16 earnings release, analysts’ consensus estimate for revenues remains unchanged.

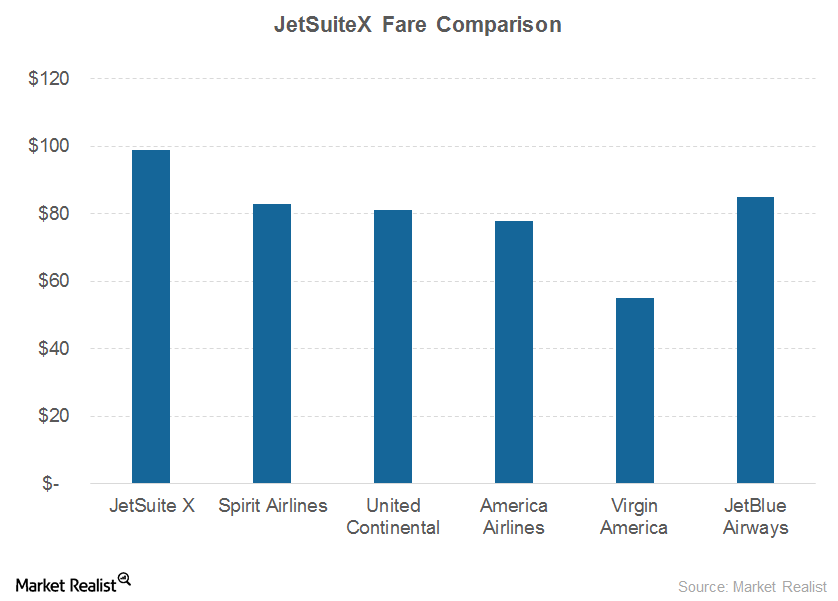

JetBlue’s New Investments: A Pioneer in Private Jet Services?

JetBlue announced that it had undertaken a small stake (the exact stake is unclear) in JetSuite, the fourth-biggest private jet operator in the United States.

Why Does JetBlue Expect Unit Costs to Rise in 4Q16?

For the third quarter of the year, JetBlue Airways’ (JBLU) operating expenses—excluding fuel and profit sharing—rose 3.1% to 7.86 cents.

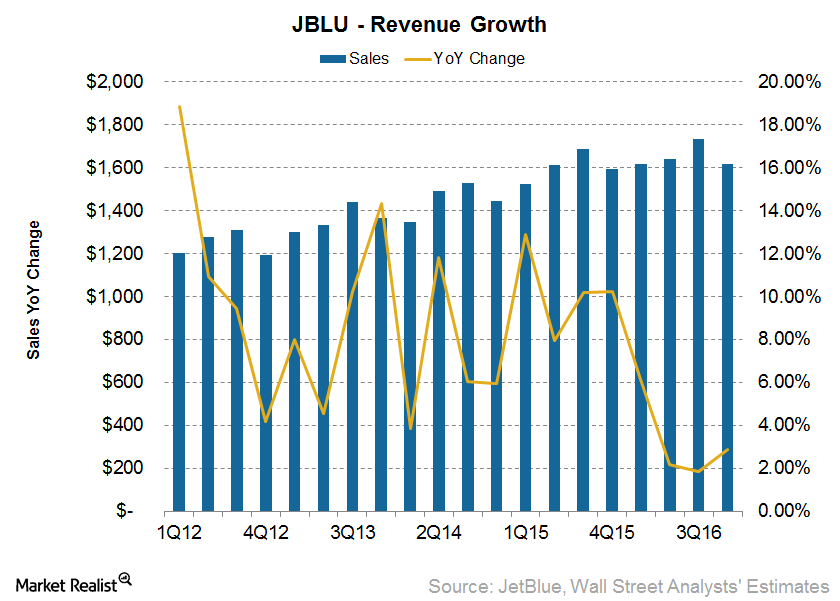

JetBlue’s: Can Investors Expect Improved Revenue in 4Q16?

For 3Q16, JetBlue Airways’ (JBLU) revenues stood at $1.73 billion—a 2.6% year-over-year increase compared to revenue of $1.69 billion in 3Q15.

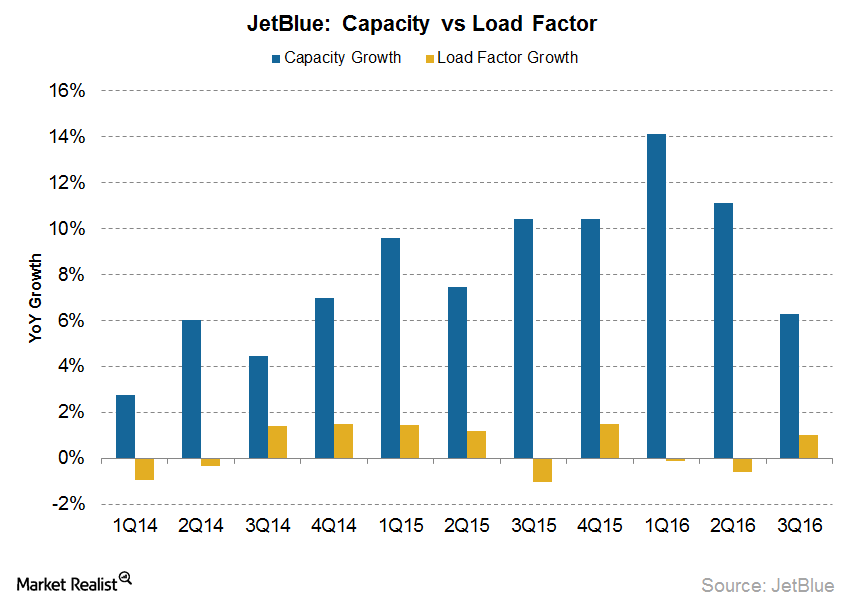

JetBlue Airways: Checking Up on Operational Performance in 3Q16

JetBlue Airways (JBLU) saw average traffic of about 11.9 billion passenger miles for the quarter, a 7.6% year-over-year increase

Do Analysts Expect JetBlue’s Revenue to Rise in 3Q16?

Analysts expect JetBlue Airways’ (JBLU) 3Q16 revenue to come in at $1.7 billion, a year-over-year rise of 2.2%.

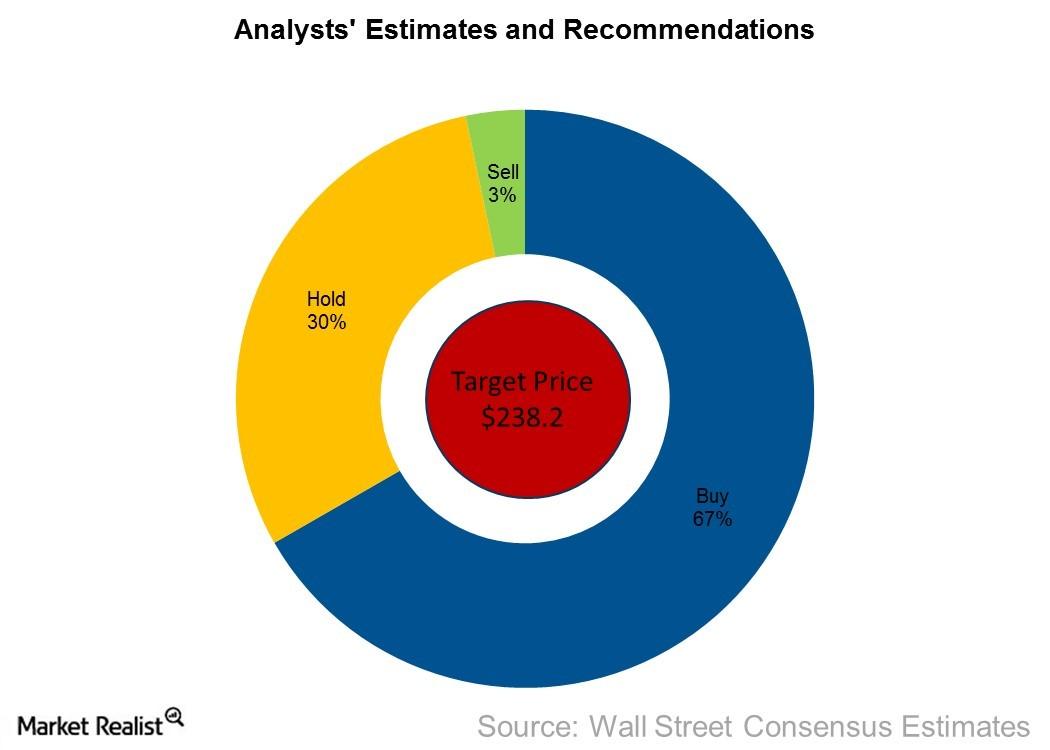

What Are Analysts’ Recommendations for Panera Bread?

Despite the recent fall in Panera’s share prices, analysts are still maintaining their price target of $238.2 for the next year—a return potential of 18.5%.

Analyzing Panera Bread’s Valuation Multiples

Lower revenue and EPS estimates made investors skeptical about investing in Panera. As of September 19, it was trading at 28.1x—down from 30.9x on July 28.

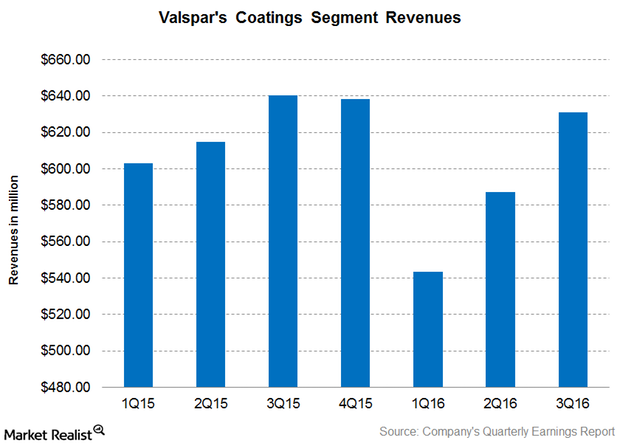

Why Did Valspar’s Coatings Segment Revenue Fall in 3Q16?

Valspar (VAL) reports its revenue under two segments, namely: the coatings segment and paints segment.

A Quick Look at SFM’s Guidance Update for Fiscal 2016

Sprouts Farmers Market has displayed industry-leading earnings growth in the past few years.

Casey’s Gasoline Sales Witnessed a Resurgence in 1Q17

Gasoline sales accounted for 58.2% of Casey’s (CASY) total revenue in 1Q17.

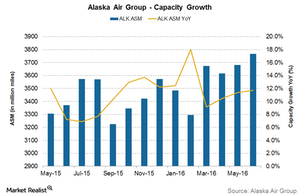

Will Alaska Air Group’s Capacity Expand More in 2016?

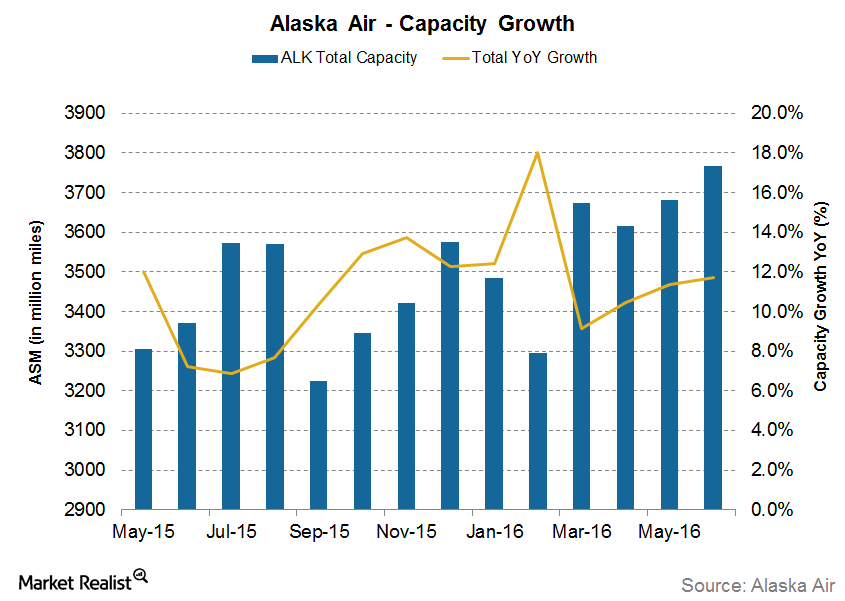

For August 2016, Alaska Air Group’s (ALK) capacity increased by 10.3% YoY. After average growth of 13% in 1Q16, its growth slowed down to 11% in 2Q16.

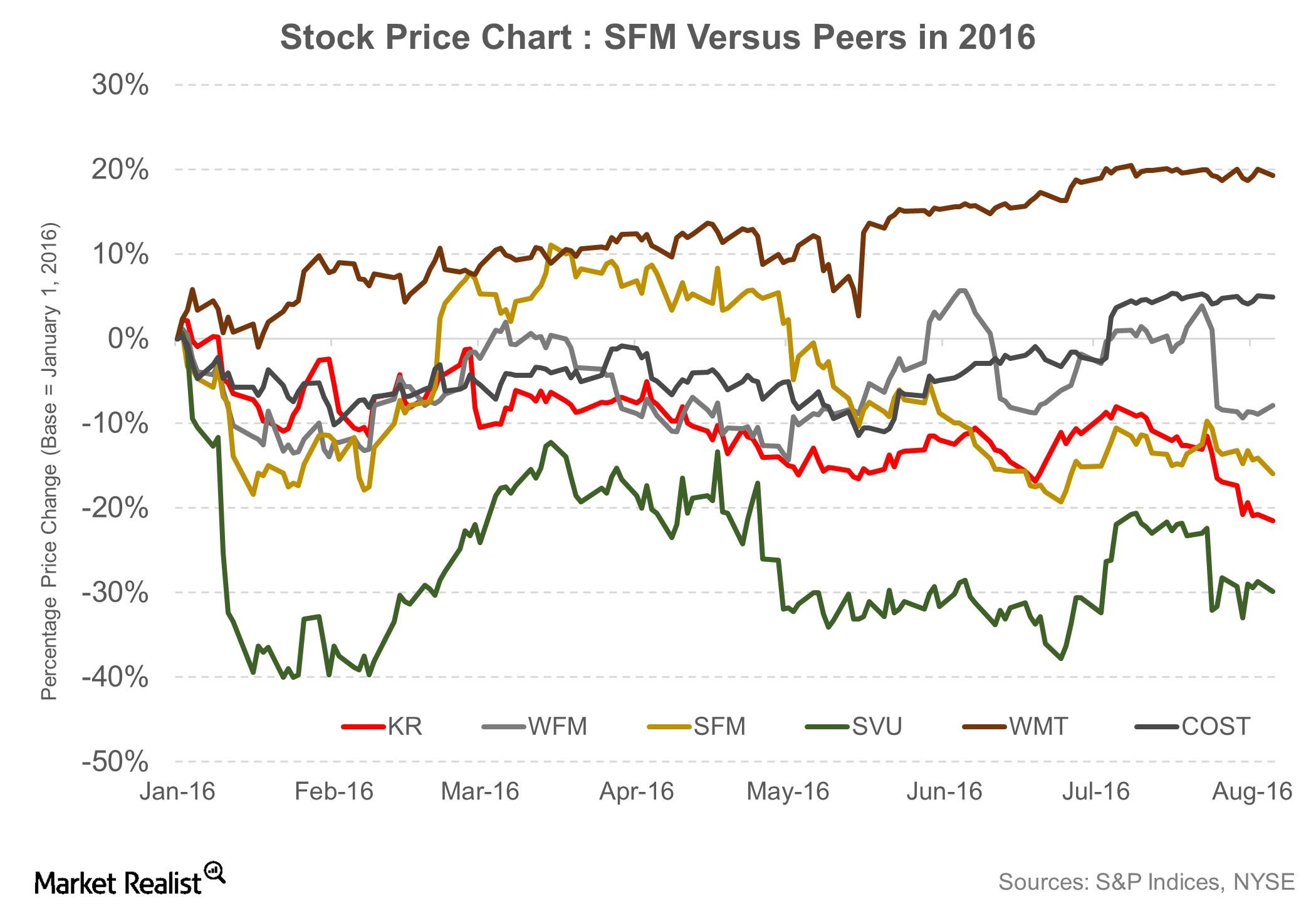

Stock Market Performance and Valuations Summary: SFM versus Peers

Of the 18 analysts who have rated SFM, 12 have recommended a “buy,” and 6 have recommended a “hold.” None of the analysts have a “sell” rating on the stock.

2Q16 Earnings Overview: SFM Beats on Earnings, Misses on Revenue

Sprouts Farmers Market (SFM) reported results for fiscal 2Q16 on August 4, 2016. The value-oriented organic and natural food retailer reported a 14% year-over-year increase in adjusted diluted EPS, beating the consensus by 1 cent.

How Will Alaska Air Group’s Strategy Impact Unit Revenues?

Alaska Air Group (ALK) does not give any future unit revenue guidance. However, we can expect the PRASM’s decline to continue.

Can Alaska Air Group’s Capacity Growth Be Sustained for the Rest of 2016?

For July 2016, Alaska Air Group’s (ALK) capacity increased by 9.6% year-over-year. After an average growth of 13% in 1Q16, growth slowed to 11% in 2Q16 and is slowing further in the third quarter.

Could JetBlue Airways’ Valuation Change after 2Q16?

As of July 22, 2016, JetBlue was valued at 3.8x its forward EV-to-EBITDA multiple, which is lower than its average valuation of 4.8x since September 2009.

How’s Cal-Maine Trading Compared to Its Key Moving Averages?

As of July 18, 2016, Cal-Maine Foods (CALM) closed at $44.18. It traded 8.3% below its 100-day moving average and 0.7% below it 50-day moving average.

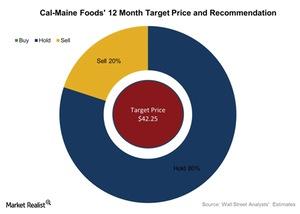

What Do Analysts Recommend for Cal-Maine Foods after 4Q16?

The average broker target price for Cal-Maine Foods rose slightly to $42.25 from $41.5—4.5% lower than the closing price of $44.18 on July 18, 2016.

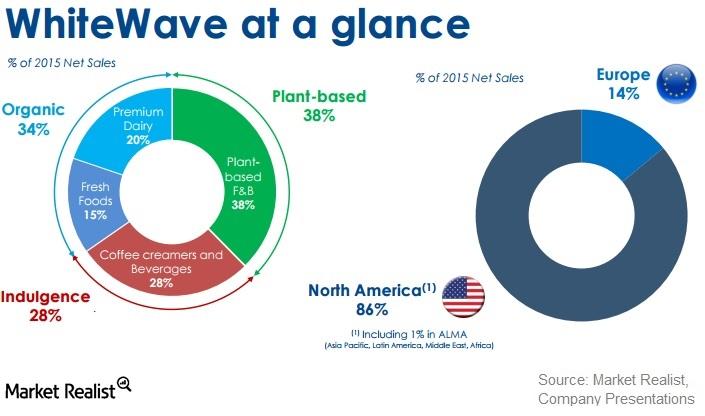

How Can WhiteWave Foods Add to Danone’s Business?

WhiteWave Foods (WWAV) currently generates around 80%–85% of its total revenue and operating profit from North America alone.

Why Did JPMorgan Chase Downgrade WhiteWave Foods?

On July 8, 2016, JPMorgan Chase (JPM) downgraded WhiteWave Foods’ (WWAV) stock to a “neutral” rating from an “overweight” rating.

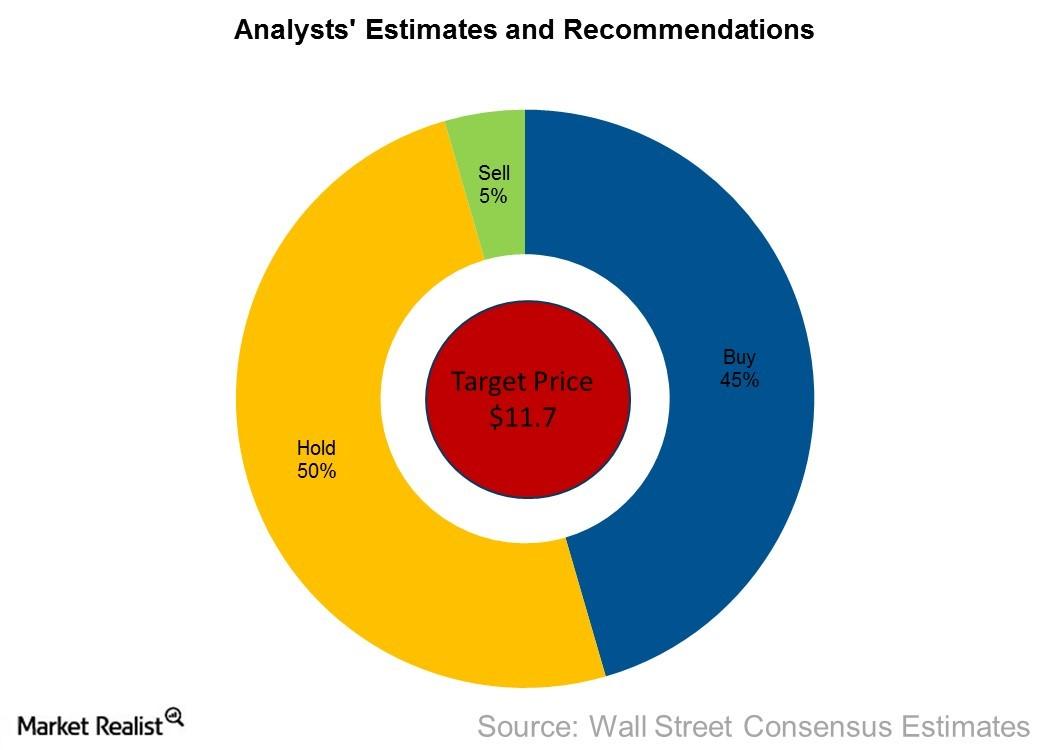

The Word on the Street: What Analysts Are Saying about Wendy’s

According to Bloomberg, of the ten analysts surveyed, 45.5% have issued “buy” recommendations for Wendy’s, while 50% have issued “hold” recommendations.

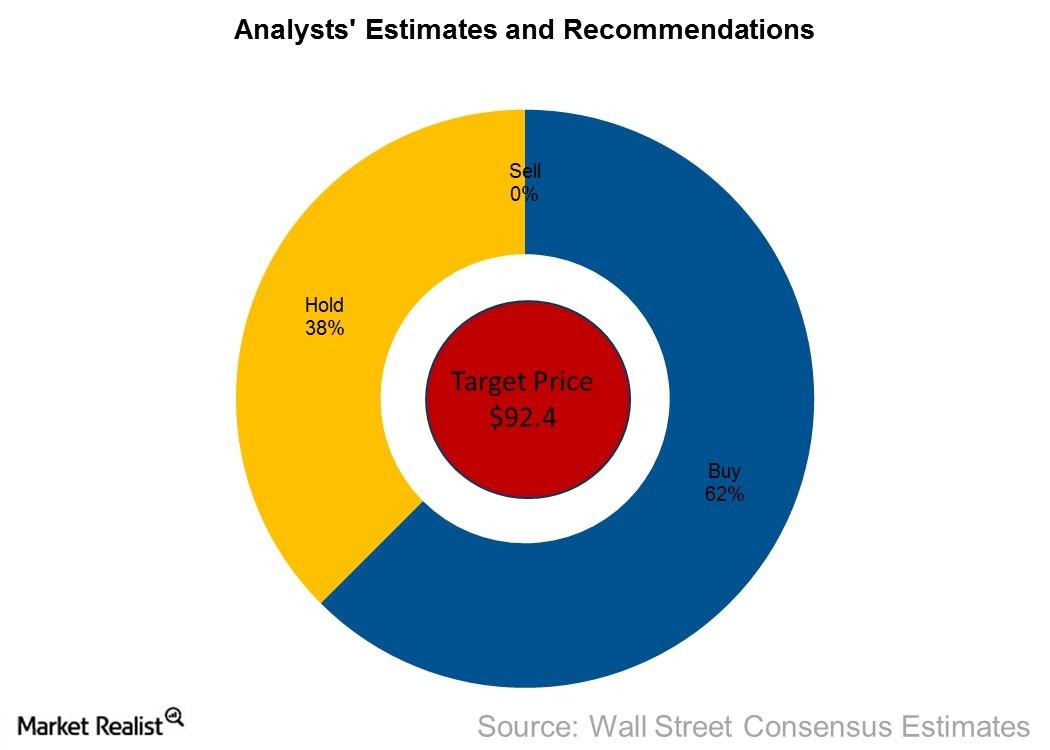

The Word on the Street: How Analysts See JACK

According to a Bloomberg survey of 16 analysts, 62.5% have given “buy” recommendations for JACK, and 37.5% have given “hold” recommendations.

Exploring The Cheesecake Factory’s Other Brands

The Cheesecake Factory (CAKE) created the Grand Lux Cafe brand at the request of Venetian Resort Hotel Casino in Las Vegas in 1999.

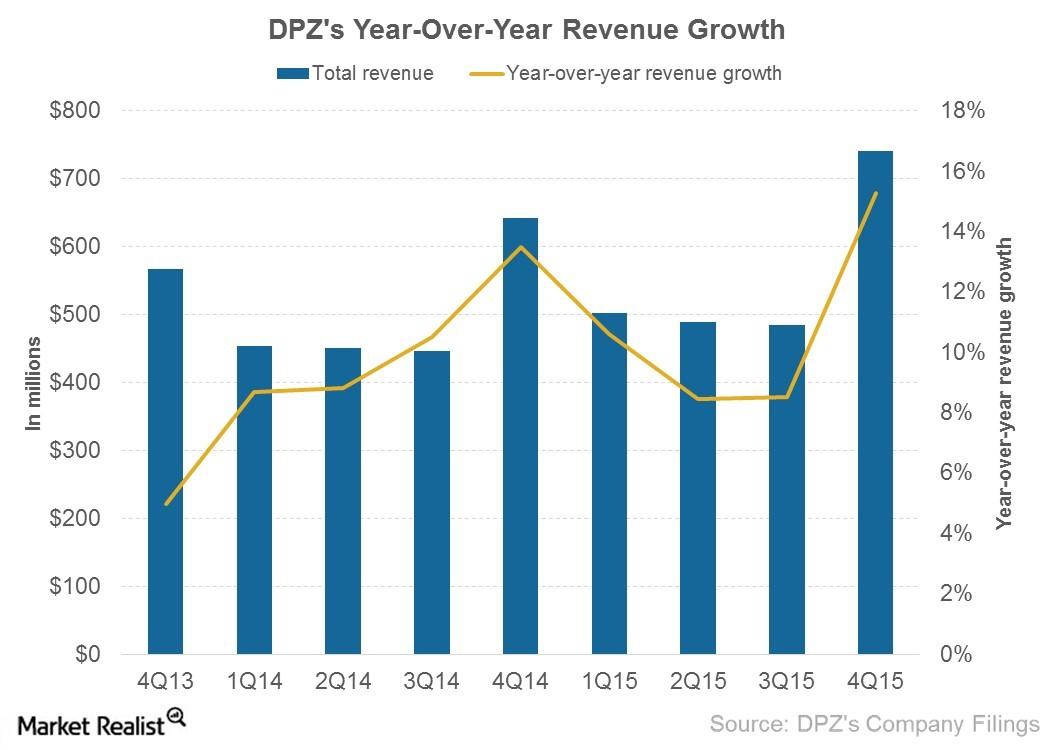

What Contributed to Domino’s Pizza’s Revenue Expansion in 4Q15?

In 4Q15, Domino’s Pizza (DPZ) recorded an overall revenue growth of $98.2 million from its 4Q14 revenues of $643 million.