How Domino’s Pizza’s Valuation Multiple Compares to Its Peers

Domino’s better-than-expected SSSG and earnings in 1Q17 appear to have increased investor confidence, leading to rises in DPZ stock and its PE multiple.

May 31 2017, Updated 9:09 a.m. ET

Valuation multiple

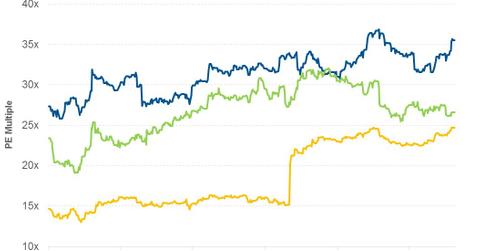

We’ve chosen the forward PE (price-to-earnings) ratio of all available valuation multiples due to the high visibility of Domino’s Pizza’s (DPZ) earnings. The forward PE multiple is calculated by dividing Domino’s stock by analysts’ earnings forecast for the next four quarters.

Domino’s PE multiple

Domino’s better-than-expected SSSG (same-store sales growth) and earnings in 1Q17 appear to have increased investor confidence, leading to rises in DPZ stock and its PE multiple. As of May 26, 2017, Domino’s was trading at a PE multiple of 35.5x compared to 32.6x before the announcement of its 1Q17 earnings. On the same day, peers Papa John’s (PZZA) and Yum! Brands (YUM) were trading at 24.7x, and 26.6x, respectively. Its aggressive expansion strategy and higher SSSG have allowed Domino’s Pizza to trade at a higher PE multiple than its peers.

Growth prospects

To drive its sales, Domino’s has been focusing on the enhancement of customer experience through the implementation of technological advancements such as the Domino’s AnyWare ordering platform and the integration of IFTTT into Pizza Tracker Tech. These initiatives are expected to increase the company’s expenses. If the initiatives fail to generate expected sales, the increased expenses are expected to put pressure on Domino’s margins, thus lowering its earnings. For the next four quarters, analysts are expecting the company’s EPS (earnings per share) to rise 19.7%, which could have already been incorporated into Domino’s stock price. If the company’s earnings come in lower than analysts’ estimate, the selling pressure could lower Domino’s stock and PE multiple.

You can mitigate these company-specific risks by investing in the iShares S&P Mid-Cap 400 Growth ETF (IJK). IJK has invested 1.1% of its holdings in Domino’s Pizza.

Next, let’s look at analysts’ recommendations and target price.