Papa John's International Inc

Latest Papa John's International Inc News and Updates

Papa Johns Is Rebranding Itself and Will Offer Drive-Thru Services

Papa John's is rebranding itself and will be making exciting changes including adding a drive-thru service.

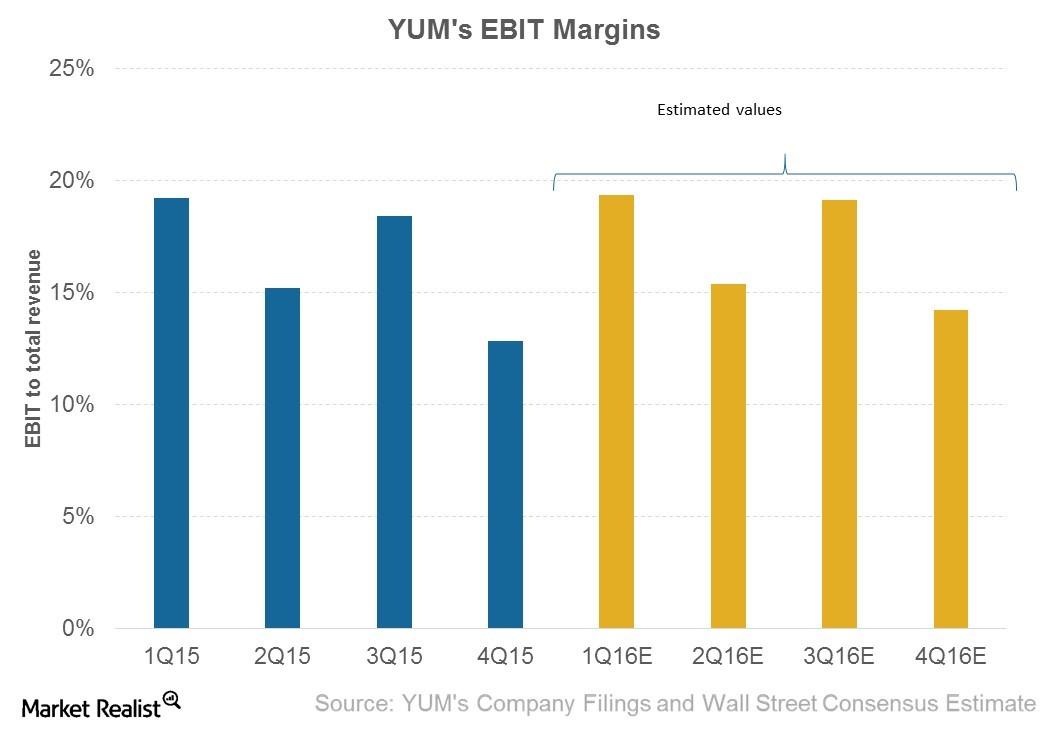

Could Yum! Brands’ Margins Increase in 1Q16?

With positive same-store sales growth expected in all three of YUM’s divisions, analysts are expecting the leverage to improve the company’s margins.

Why Analysts Say ‘Hold’ for Domino’s Stock ahead of Q1 Earnings

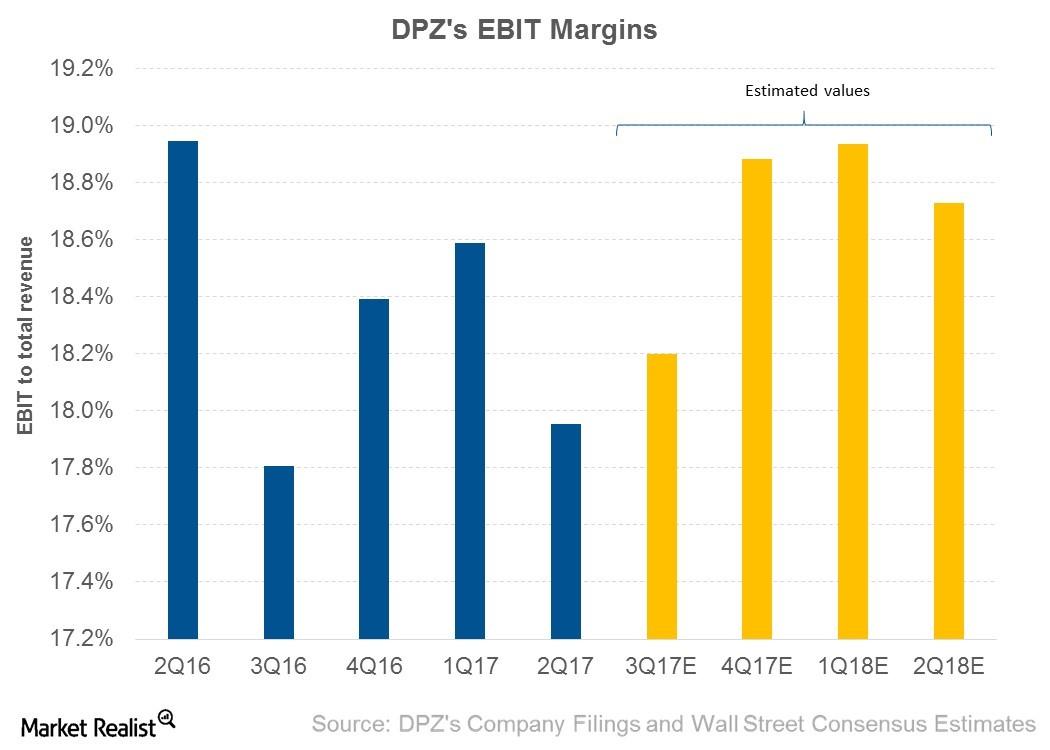

As of April 21, 2017, Domino’s Pizza (DPZ) was trading at $179.3. Domino’s stock price might have factored in the estimates we discussed in our previous articles.

Why Did Domino’s EBIT Margin Decline in 2Q17?

For 2Q17, Domino’s (DPZ) posted EBIT (earnings before interest and tax) of $113.27 million, which represents an EBIT margin of 18.0%, compared with 18.9% in 2Q16.

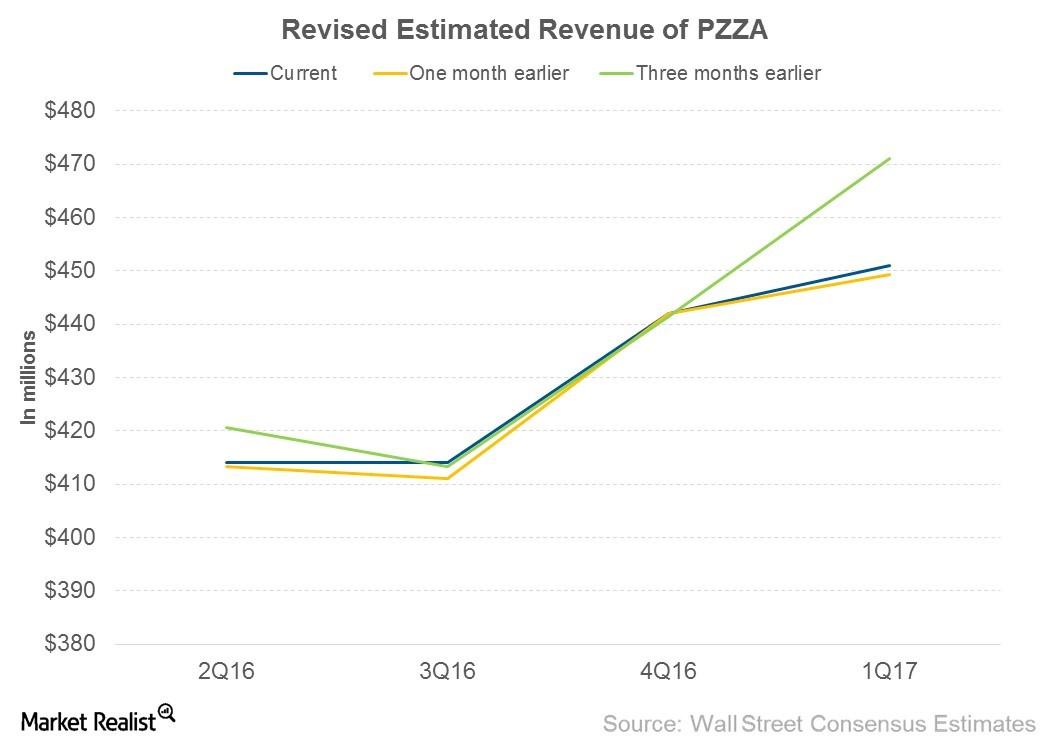

Why Have Analysts Raised their Revenue Estimates for Papa John’s?

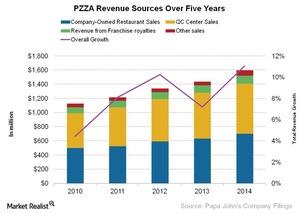

In 1Q16, PZZA’s domestic company-owned restaurants generated nearly 48% of Papa John’s revenue, while domestic commissaries and others generated 39.4%.

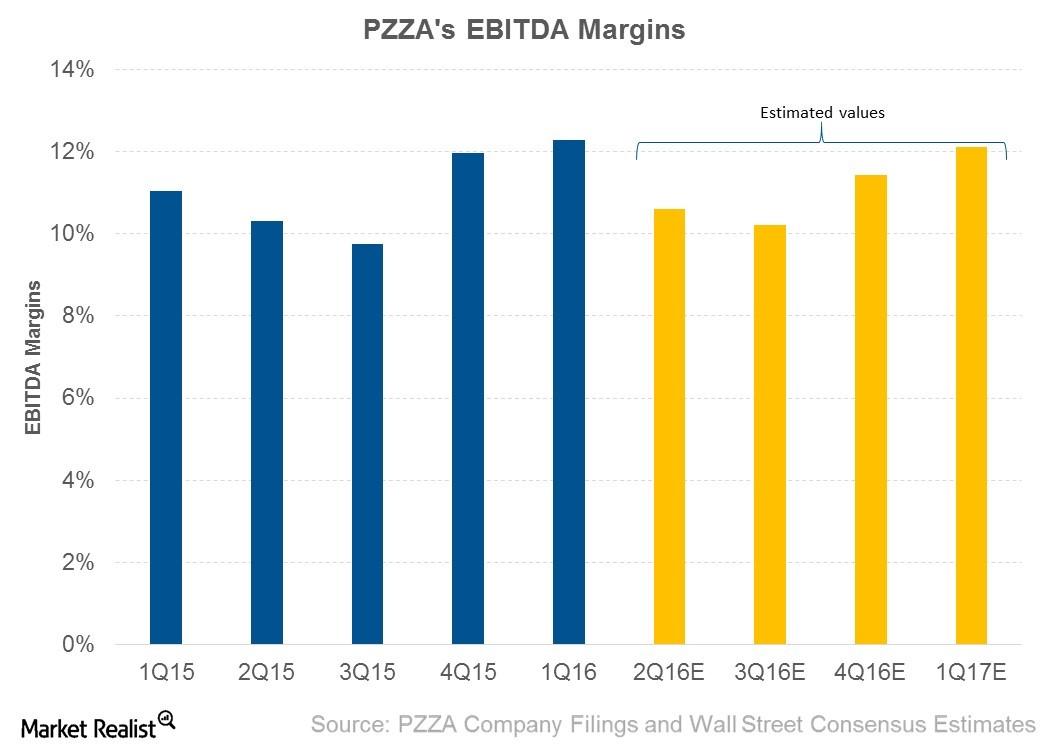

Why Are Analysts Expecting Papa John’s EBITDA Margins to Expand in 2Q16?

Analysts expect Papa John’s (PZZA) to post EBITDA of $43.9 million in 2Q16. This represents an EBITDA margin of 10.6%, compared to 10.3% in 2Q15.

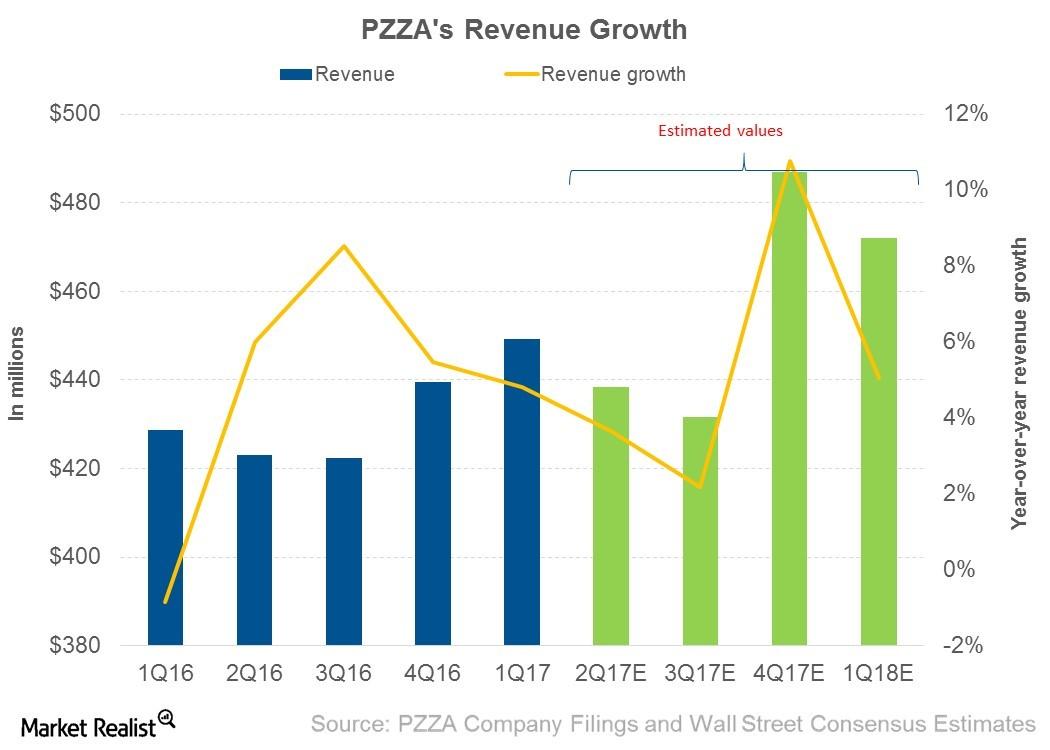

Papa John’s Revenue Estimates for the Next 4 Quarters

For the next four quarters, analysts expect Papa John’s (PZZA) to post revenue of $1.83 billion, which represents growth of 5.5%.

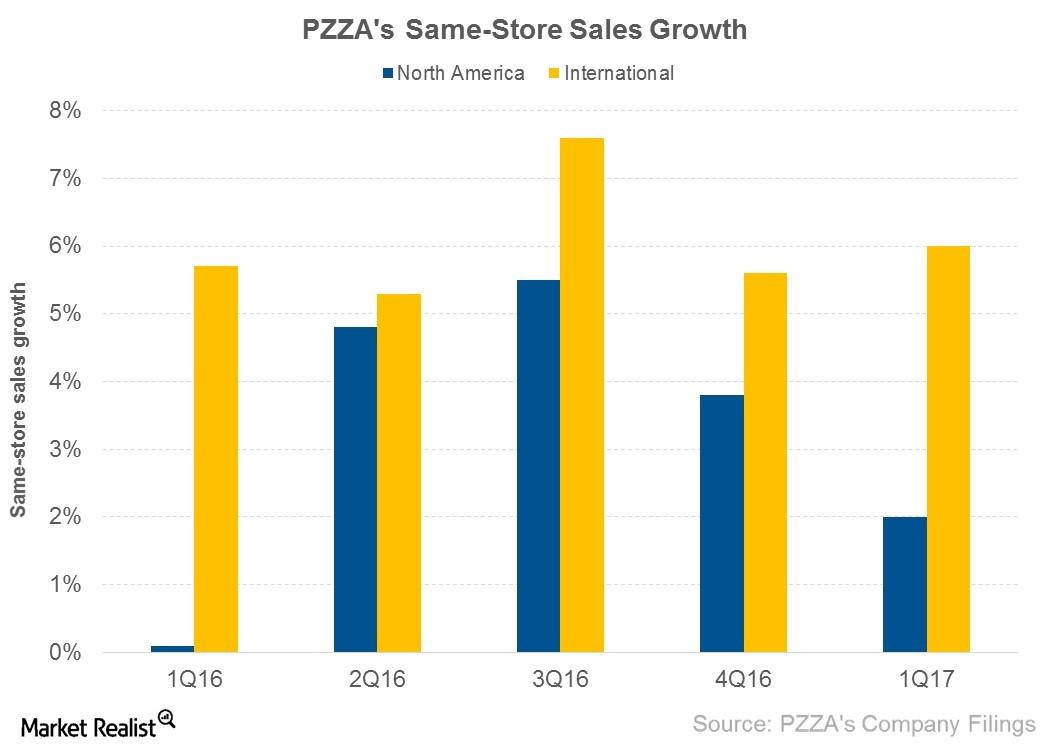

Factors That Drove Papa John’s Same-Store Sales Growth in 1Q17

In 1Q17, Papa John’s (PZZA) restaurants in North America posted SSSG of 2%. Company-owned restaurants posted SSSG of 3%, and franchised restaurants posted SSSG of 1.7%.

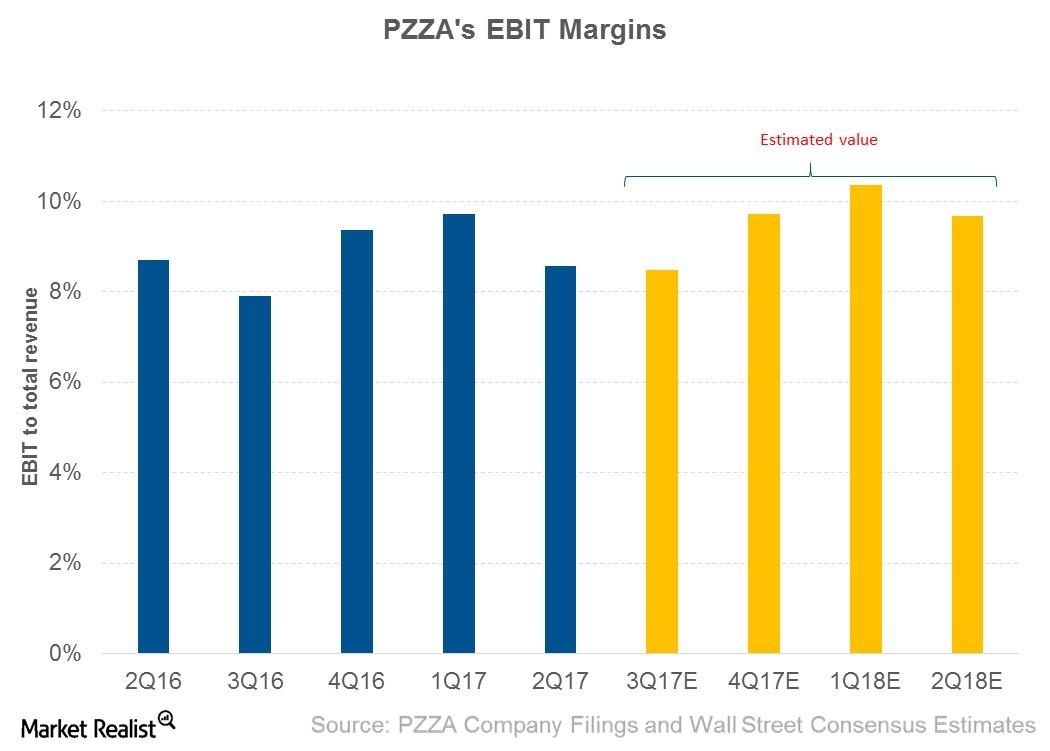

Why Papa John’s Earnings Margin Narrowed in 2Q17

Performance in 2Q17 In 2Q17, Papa John’s International (PZZA) posted EBIT (earnings before interest and tax) of $37.2 million, which represents an EBIT margin of 8.6%. In comparison, the company posted an EBIT margin of 8.7% in 2Q16. Why Papa John’s margins narrowed Papa John’s EBIT margins were impacted by a rise in the cost of […]

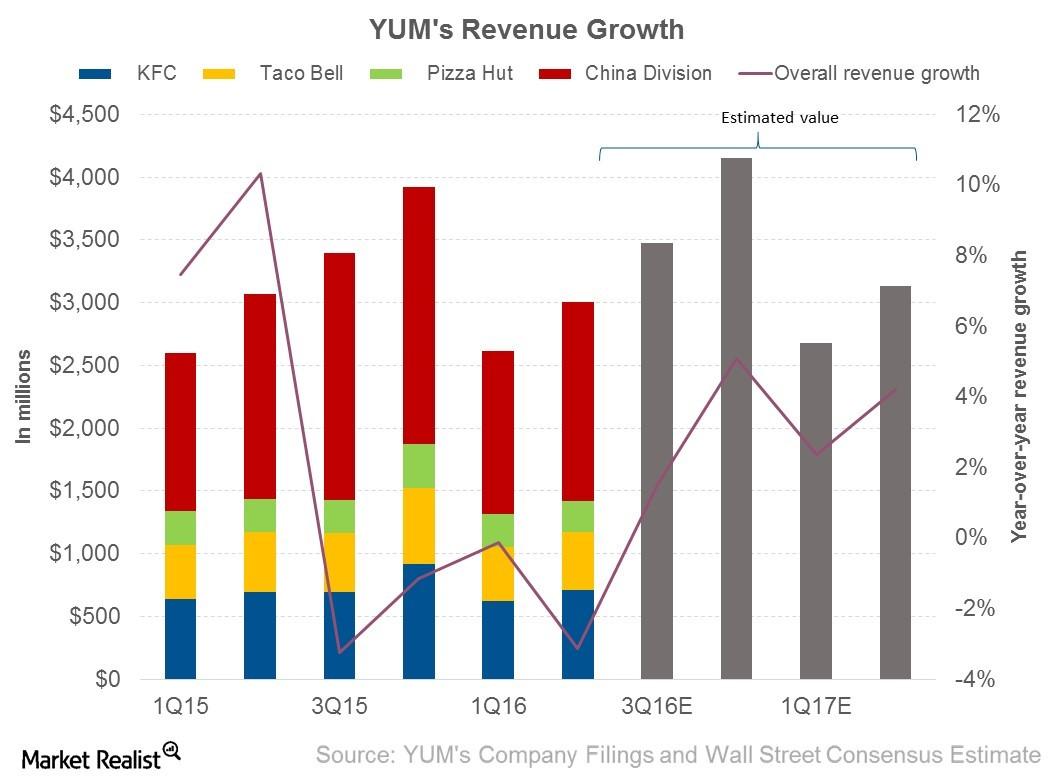

Why Investors Are Confident in YUM ahead of Its 3Q16 Results

Yum! Brands develops, operates, franchises, and licenses the Pizza Hut, KFC, and Taco Bell brands. It’s set to announce its 3Q16 results on October 5, 2016.

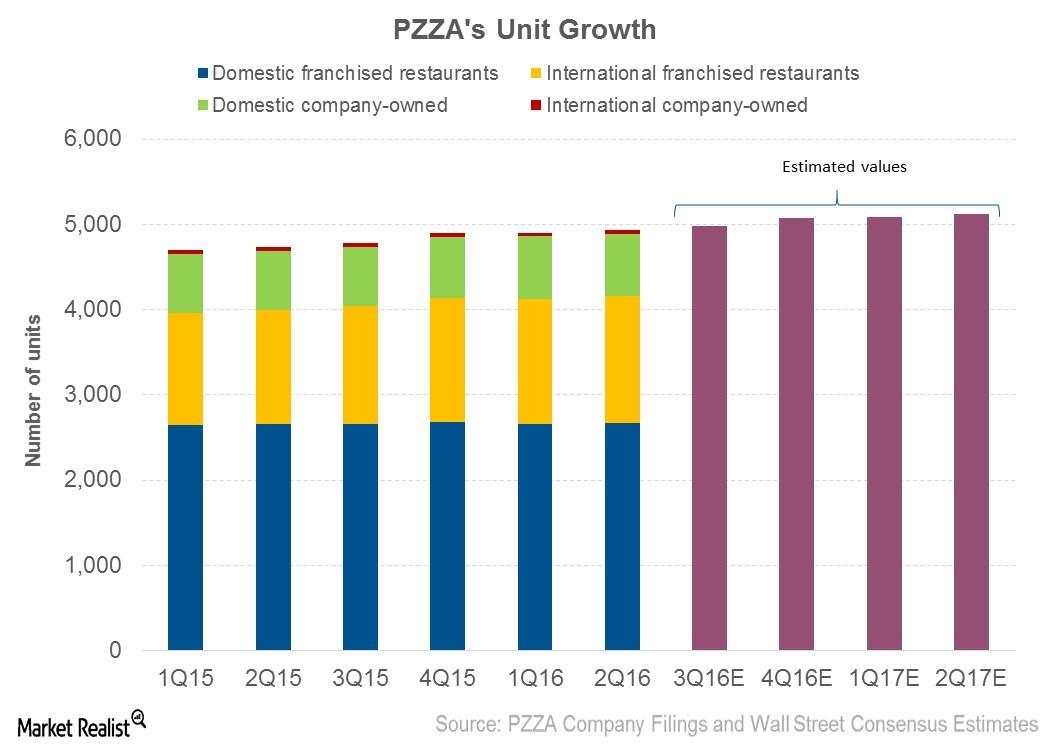

Franchising Dominates Papa John’s Expansion Plans

With 42 units added in the first two quarters of 2016, Papa John’s has maintained its 2016 guidance for unit growth at 180–200 units.

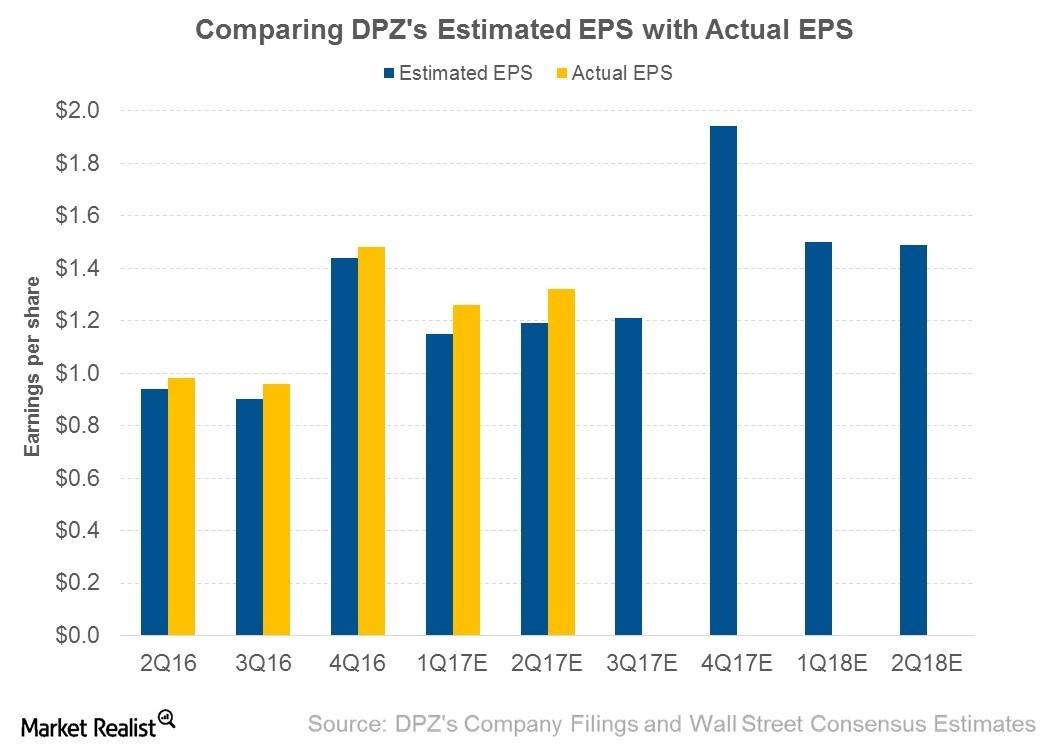

Could Domino’s Earnings Rise in the Next 4 Quarters?

Earnings expectations For the next four quarters, analysts expect Domino’s Pizza (DPZ) to post EPS (earnings per share) of $6.14, which represents a growth of 22.3% from the EPS of $5.02 seen in the four quarters prior. EPS growth Domino’s EPS growth is expected to be driven by higher revenue, EBIT (earnings before interest and tax) […]

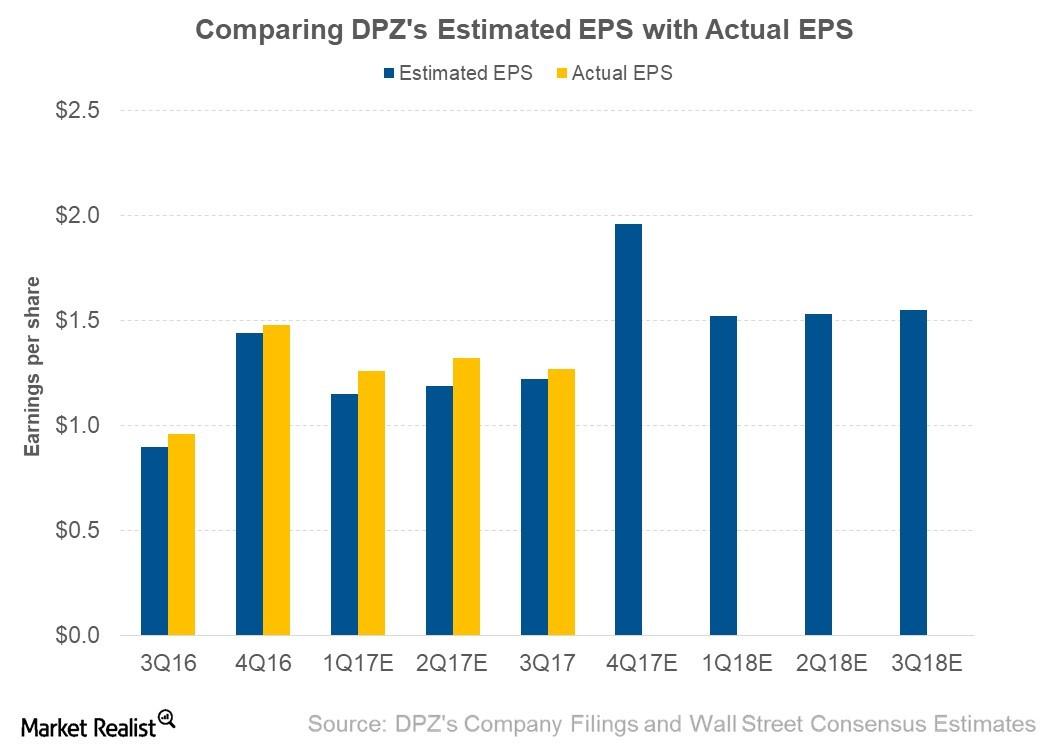

This Likely Drove Domino’s 3Q17 EPS

For 3Q17, Domino’s Pizza (DPZ) posted adjusted EPS (earnings per share) of $1.27, which represents a 32.3% YoY (year-over-year) rise from $0.96 in 3Q16.Consumer Why Yum! Brands’ division in India has been successful

Yum! Brands’ (YUM) division in India includes its businesses in India, Nepal, Bangladesh, and Sri Lanka. As of June 2014, the company had 714 restaurant units in India.

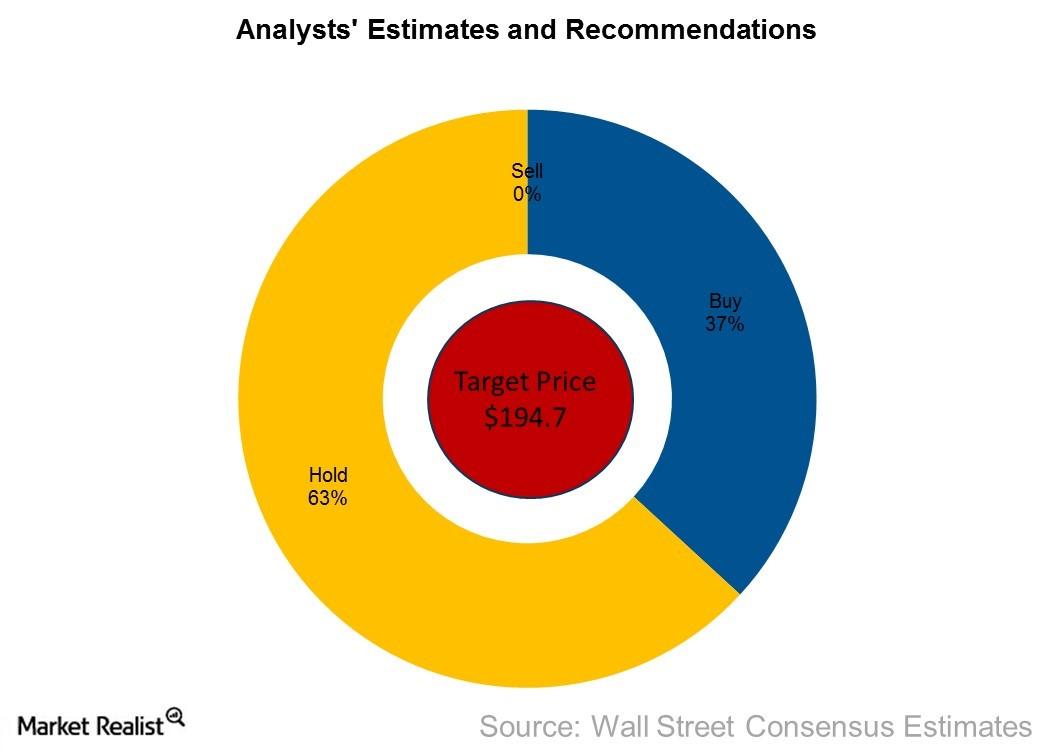

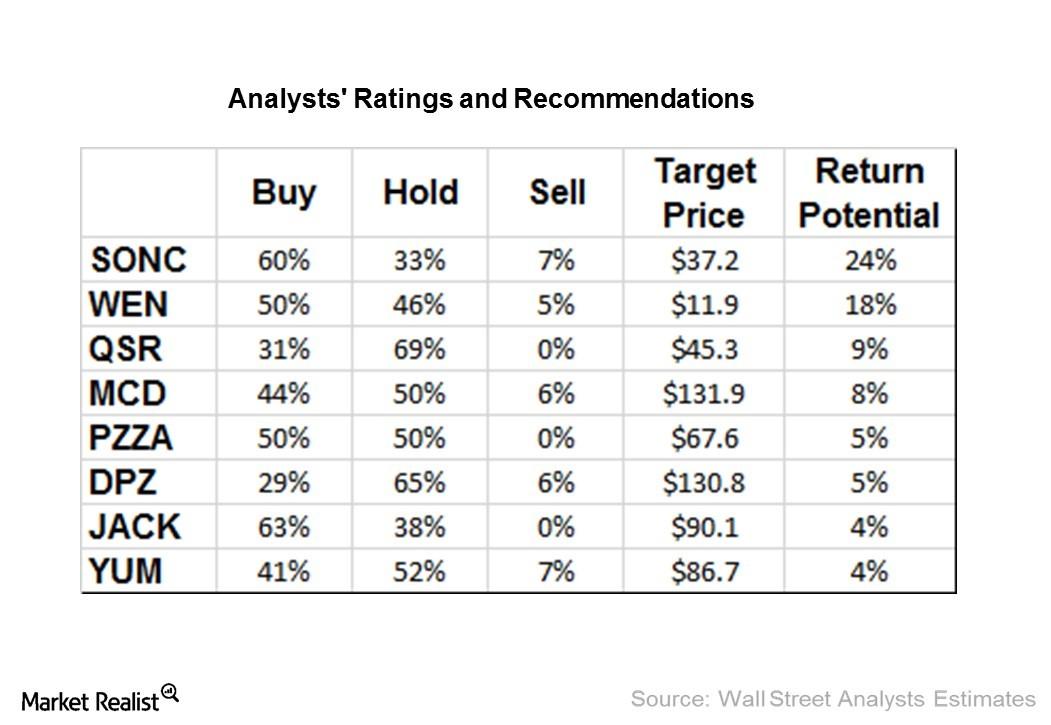

The Word on the Street: What Analysts Are Recommending for Fast-Food and Pizza Companies after 1Q16

JACK, PZZA, and QSR are the most favored stocks in our group of eight fast-food restaurants, with no analyst recommending a “sell” for their stocks.

An Investor’s Guide to Chipotle and Its Customers

Chipotle Mexican Grill (CMG) operates more than 1,700 fast-casual restaurants. Here’s everything you need to know about the business.

Wedbush Initiated Coverage on Papa John’s with a ‘Buy’ Rating

On Wednesday, Nick Setyan of Wedbush initiated his coverage on Papa John’s with a “buy” rating. He also gave a target price of $95.

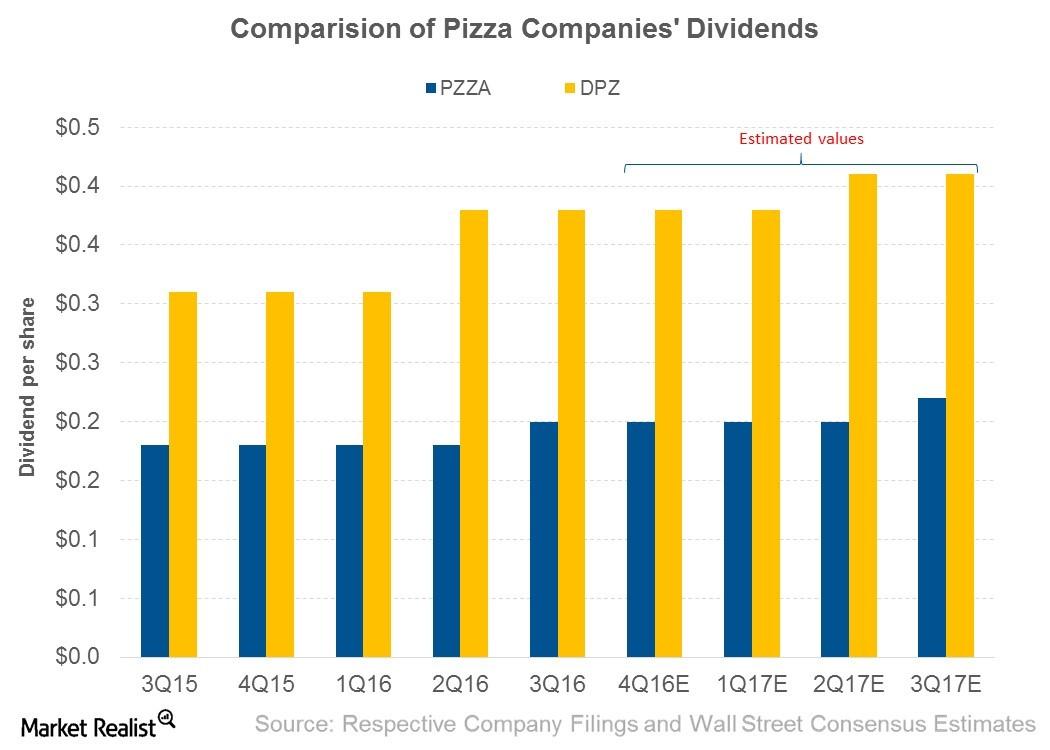

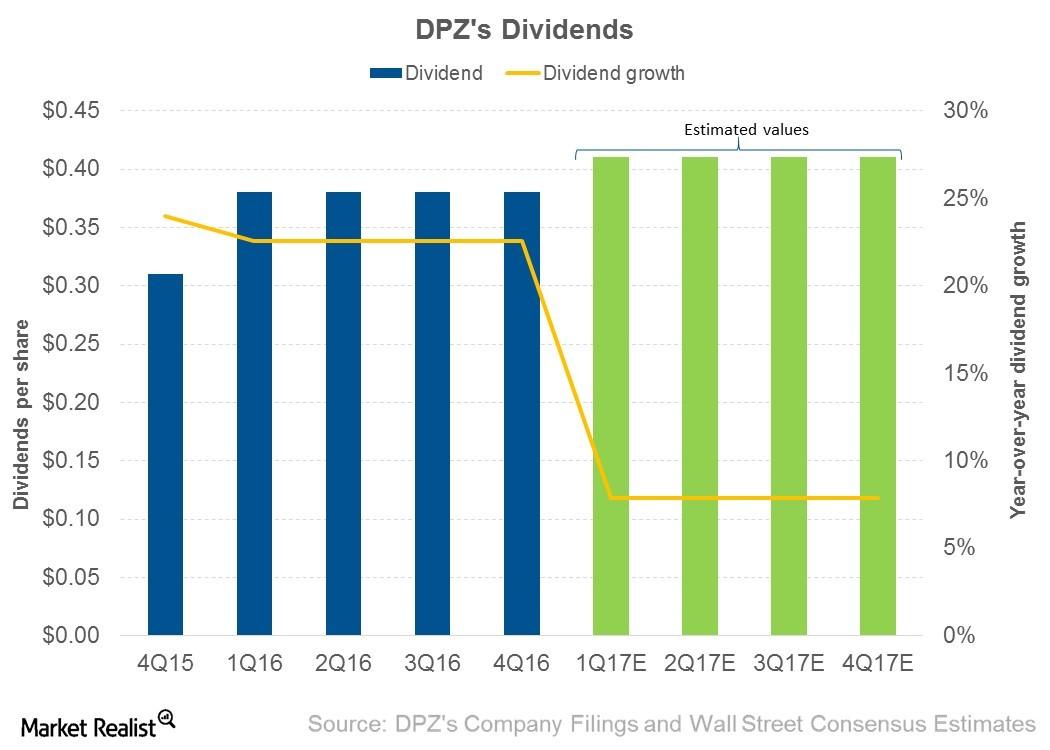

Comparing Domino’s and Papa John’s Dividend Policies

Importance of dividends Dividends help smooth out return volatility for shareholders. Both Domino’s Pizza (DPZ) and Papa John’s (PZZA) have a strong history of returning cash to shareholders. . 3Q16 dividends In 3Q16, Domino’s Pizza paid dividends of $0.38, which represents a growth of 22.6% from $0.31 in fiscal 3Q15. For the next four quarters, […]

Investors Should Consider Domino’s Pizza before Its Q2 Earnings

Domino’s Pizza (NYSE:DPZ) will likely report its second-quarter earnings on July 16. Should you buy the stock before its earnings?

Domino’s Pizza Stock Rises following Positive Business Update

Domino’s Pizza announced that in the first two months of the second quarter, its US SSSG grew by 14.0%, while its international SSSG rose by 1.0%.

Domino’s Pizza’s Q1 Results Might Drive Its Stock Price

The COVID-19 outbreak has created a meltdown in the global financial markets. However, Domino’s Pizza (NYSE:DPZ) has continued its impressive performance.

Is Domino’s Pizza a Safe Bet amid the Lockdown?

President Trump extended the lockdown to April 30 amid the COVID-19 pandemic. Will Domino’s Pizza (NYSE:DPZ) benefit from the extension?

Why Noodles and Company has short and long-term goals

Noodles & Company (or NDLS) has a few initiatives and tactics to drive short-term traffic. It also drives longer-term brand and customer loyalty building.Consumer Why it’s important to understand Noodles and Co.

Noodles & Company (or NDLS) was founded in 1995. It’s a fast-casual restaurant chain that serves classic noodle and pasta dishes.

Domino’s Stock Bounced Back despite Weak Q3

Domino’s reported a disappointing third-quarter financial performance on Tuesday. Domino’s stock pared the initial losses and closed about 5% higher.

The Restaurant Industry: An Overview

More Americans are eating out, and they’re eating out more often. The restaurant industry’s share of the food dollar is 51%, up from 25% in 1955.

PZZA Stock Rose Due to New CEO Appointment

Papa John’s (PZZA) stock rose more than 7% in morning trade on Tuesday following the news about the new CEO’s appointment.

Domino’s Stock Rises after J.P. Morgan’s Upgrade

Today, J.P. Morgan upgraded Domino’s Pizza (DPZ) from “neutral” to “overweight” while keeping its 12-month price target at $270.

Will 2018 Be a Good Year for Pizza Companies?

All major pizza companies have announced their 4Q17 earnings, so it’s time to compare their performance.

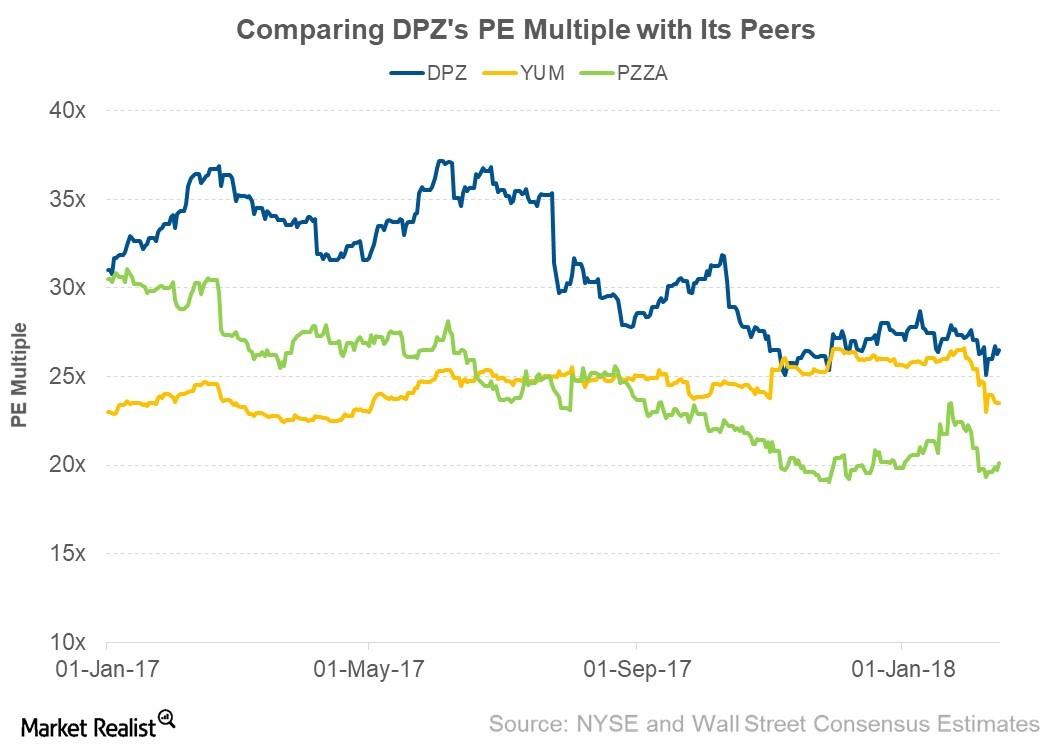

Domino’s Valuation Multiple Compared to Its Peers

As of February 14, 2018, Domino’s was trading at a forward PE multiple of 26.5x compared to 31.8% before the announcement of its 3Q17 earnings.

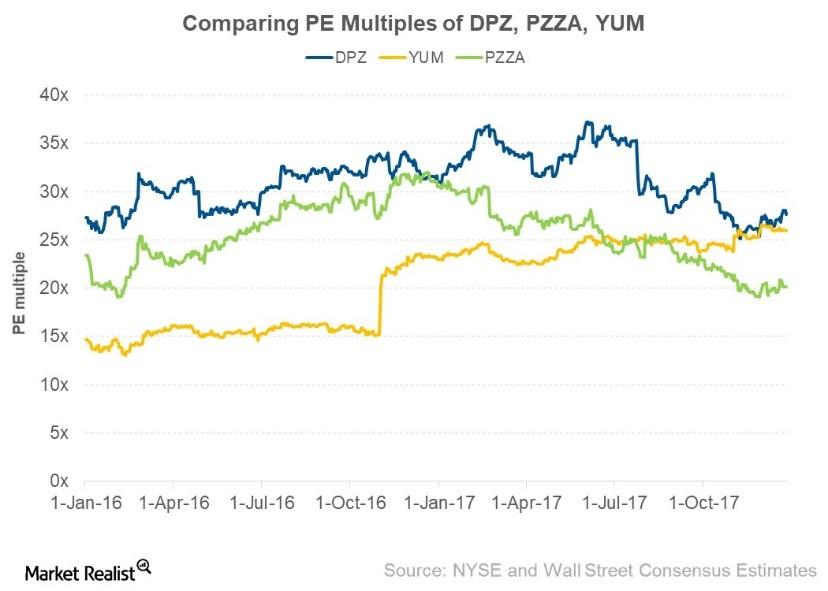

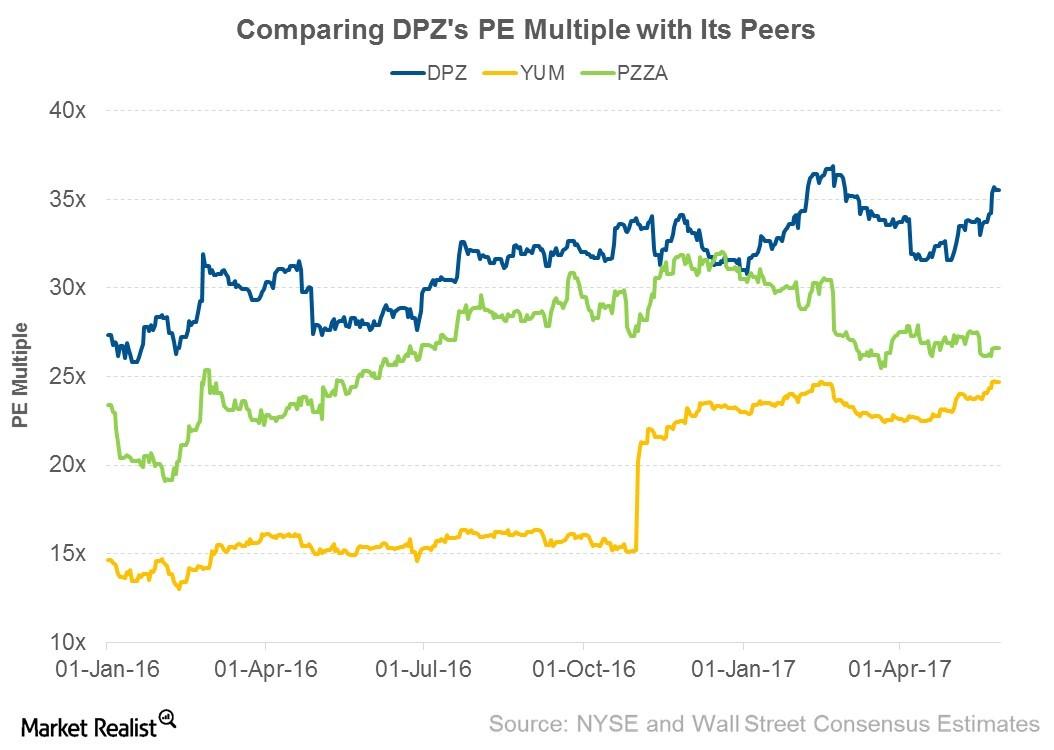

How Do Pizza Companies’ Valuation Multiples Compare?

Due to the high visibility of their earnings, we’ve opted to use the forward PE (price-to-earnings) multiple for our valuation analysis of the pizza companies in this series.

How Domino’s Pizza’s Valuation Multiple Compares to Its Peers

Domino’s better-than-expected SSSG and earnings in 1Q17 appear to have increased investor confidence, leading to rises in DPZ stock and its PE multiple.

Why Domino’s Dividend Policy Is Important

In 2016, Domino’s Pizza (DPZ) paid dividends of $1.52—growth of 22.5% from $1.24 in 2015. In 2017, analysts expect its dividends to rise 7.9% to $1.64.

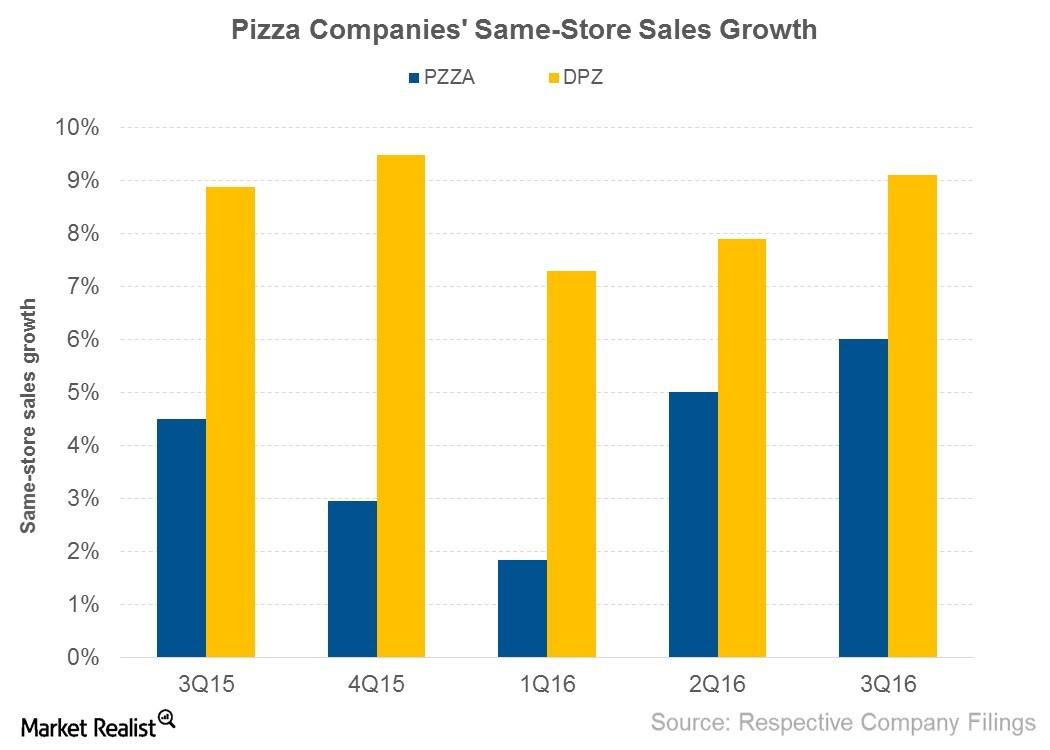

What Drove Domino’s and Papa John’s Same-Store Sales in 3Q16?

Same-store sales growth SSSG (same-store sales growth), which is expressed as a percentage, is a measure of revenue growth in existing stores over a certain period. SSSG is driven by ticket size and traffic. It’s an important metric for investors to monitor, as it increases a company’s revenue without increasing capital investment, and it’s a […]

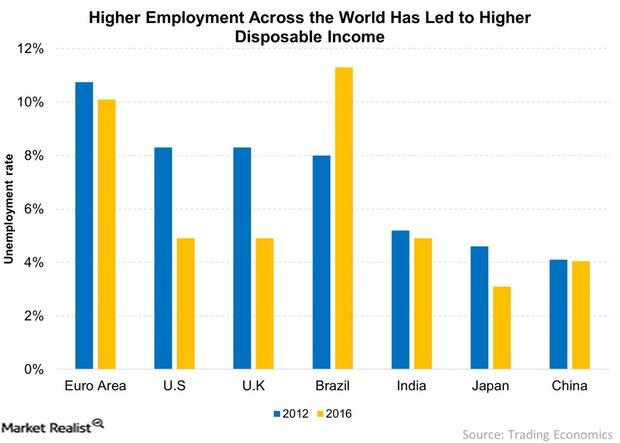

Positive Long-Term Macro Trends Can Grow the Restaurant Industry

Lower oil prices and unemployment rates globally could support the restaurant industry.

Why Did Yum! Brands’ Revenue Decline in 2Q16?

In 2Q16, Yum! Brands earned 84.9% of its revenue from company-owned restaurants and 15.1% from franchised restaurants.

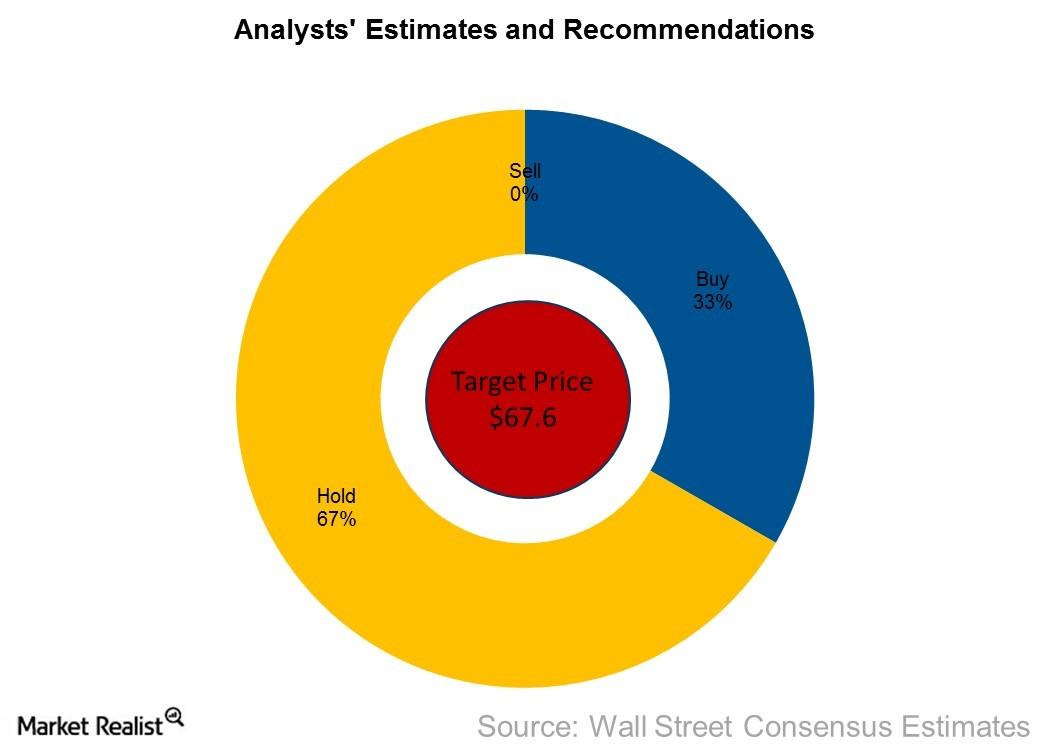

The Word on the Street: How Analysts See Papa John’s

Analysts are maintaining a price target of $67.6 for Papa John’s for the next 12-months, which represents a return potential of 2.5% for the company.

Getting to Know The Cheesecake Factory’s Management

A company is greatly impacted by its management’s decisions. In this article, we’ll discuss The Cheesecake Factory’s (CAKE) management and its achievements.

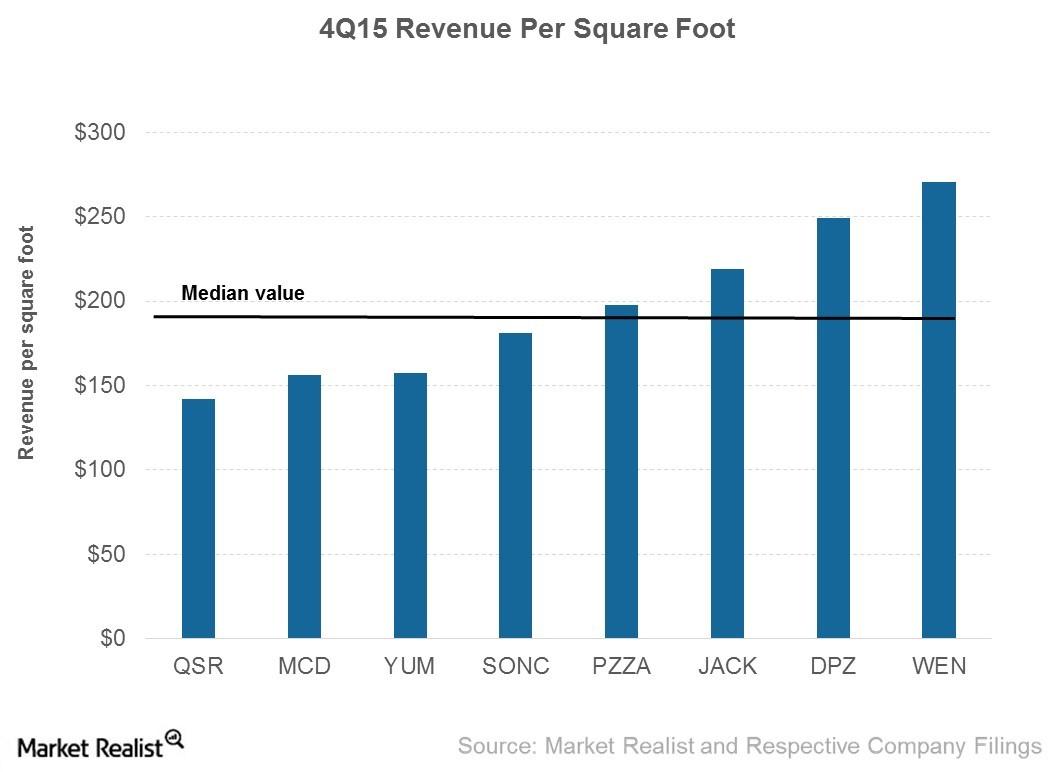

Which Fast Food Restaurant Led in 4Q15 Revenue Per Square Foot?

In 4Q15, MCD, YUM, WEN, QSR, JACK, SONC, PZZA, and DPZ generated an average revenue of $189 per square foot.

Why Papa John’s Leads the Pack in Technology Implementation

Papa John’s was first to introduce online ordering at all of its US delivery restaurants in 2001 as well as first to introduce SMS text ordering in 2007.

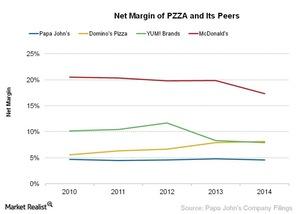

Comparing Papa John’s Net Margins with Other Quick-Service Big Guns

In 2014, Papa John’s net profits as a percentage of total sales decreased by 0.2% due to increases in interest levels.

Papa John’s Franchising and Quality Centers—the Foremost Piece of Company Pie

To maintain the quality and consistency of products, Papa John’s has QC (quality control) centers that supply ingredients to its restaurants.

Papa John’s Marketing and Promotional Strategies: What’s in the Oven?

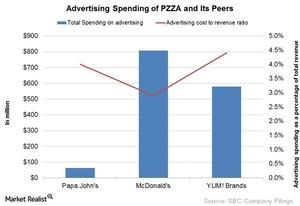

In 2014, Papa John’s spent $63 million, or 4% of its total revenues, on advertising, whereas McDonald’s spent $808 million, or 2.9% of its total revenues.

Sizing up the International Reach of Papa John’s Pizza

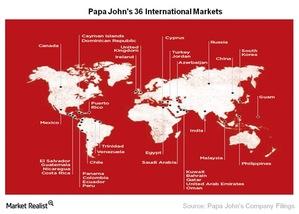

In 1998, Papa John’s decided to venture outside the US by opening outlets in Mexico and Puerto Rico. In 1999, it acquired the UK’s Perfect Pizza Holdings.

Technology: The Driving Force behind Domino’s Pizza

Domino’s continues its investment in the technology space with its recent launch of Domino’s pizza delivery tracker available on Apple Watch.

Domino’s Pizza and Its Master Franchise Model

The master franchise agreement gives the master franchisee operating rights to a supply chain in a given international region.

Why Domino’s Pizza Has So Much Debt

Domino’s debt is high because it was the product of a leveraged buyout. The latest recapitalization happened in 2012, leaving it with $1.57 billion in debt.

Domino’s Pizza Enjoys the Dual Benefits of Vertical Integration

Because Domino’s Pizza sells dough and ingredients to its own franchises, the company derives dual benefits from the supply chain segment.

Domino’s Pizza Relies on its Supply Chain to Get It Right

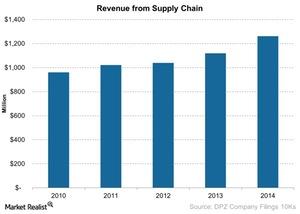

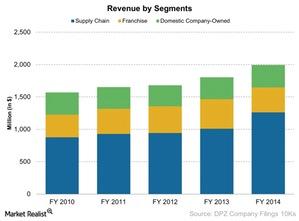

Supply chain segment In terms of revenue, the supply chain is Domino’s Pizza’s (DPZ) most important segment. In fiscal 2014, it contributed 63%, or $1.26 billion, toward the company’s total revenue. Domino’s international master franchises have the right to operate a supply chain in their respective regions. The facilities The supply chain segment consists of the […]

Which of Domino’s Pizza’s Three Business Segments Performs Best?

Of its three main business segments, Domino’s Pizza earns least revenue from its company-owned stores.