Alaska Air Group Inc

Latest Alaska Air Group Inc News and Updates

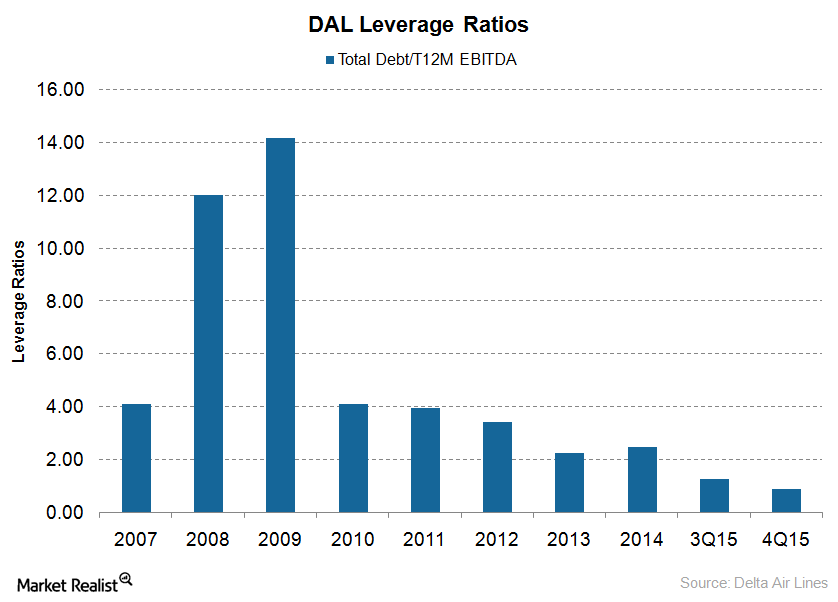

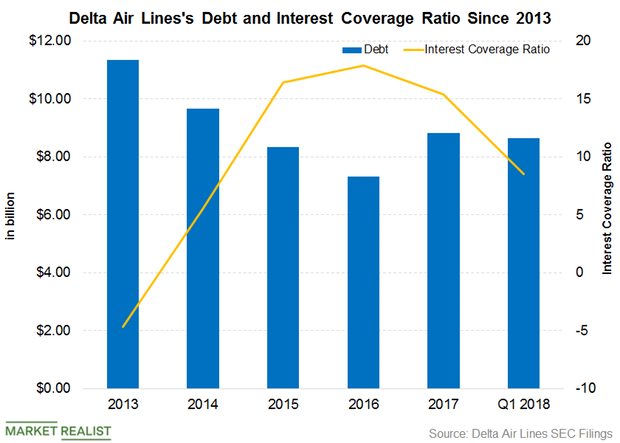

Can Delta Air Lines Continue to Reduce Its Debt in 2016?

Delta Air Lines (DAL) expects to generate more than $7 billion–$8 billion of operating cash flow and ~$4 billion–$5 billion of free cash flow. It plans to reduce its adjusted net debt to $4 billion by 2020.

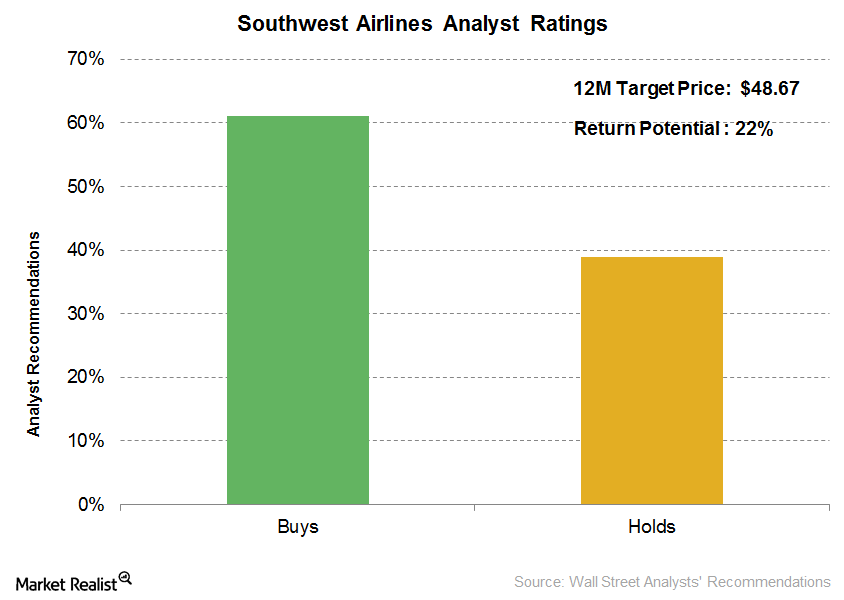

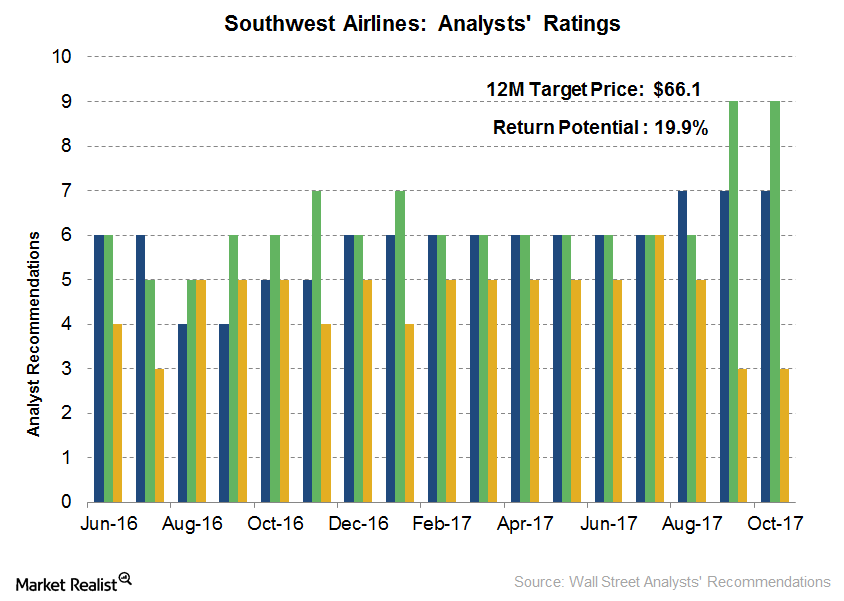

Why Did Analysts Fall Out of Love with Southwest Airlines?

Out of the 18 analysts tracking Southwest Airlines (LUV), 11 analysts (61.1%) have a “buy” recommendation on the stock versus 71% analysts that had a “buy” recommendation on Southwest in 2Q16.

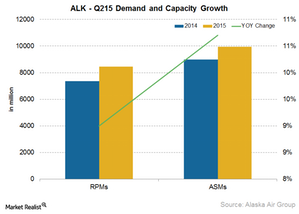

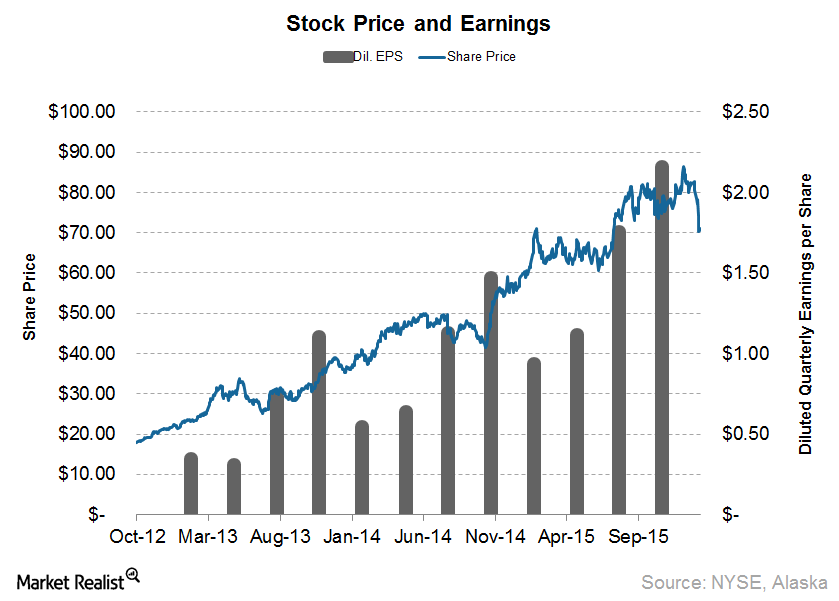

What Helped Alaska Air Group Drive its 2Q15 Earnings?

Adding newer destinations Alaska Air Group (ALK) added a number of new routes in the second quarter of 2015, such as: Boise to Reno Eugene to San Jose, California Los Angeles to Baltimore Los Angeles to Gunnison–Crested Butte Los Angeles to Monterey Los Angeles to San Jose, Costa Rica Portland to Austin Seattle to Charleston […]

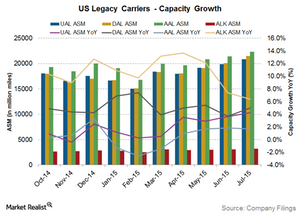

Alaska Airlines Capacity Growth Is Faster than That of Its Peers

Alaska Air Group saw the highest surge in traffic demand and was the leader in capacity growth, with a 6.4% YoY increase in its capacity in July 2015.

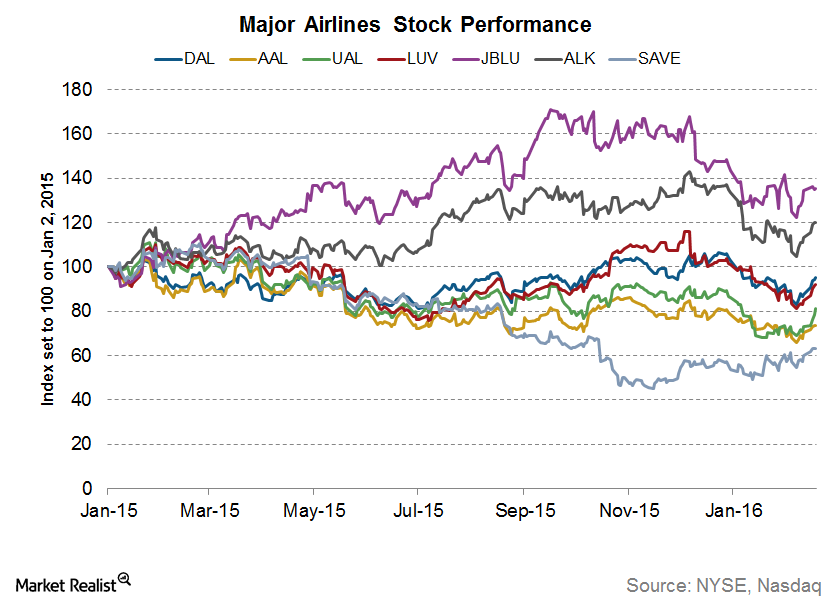

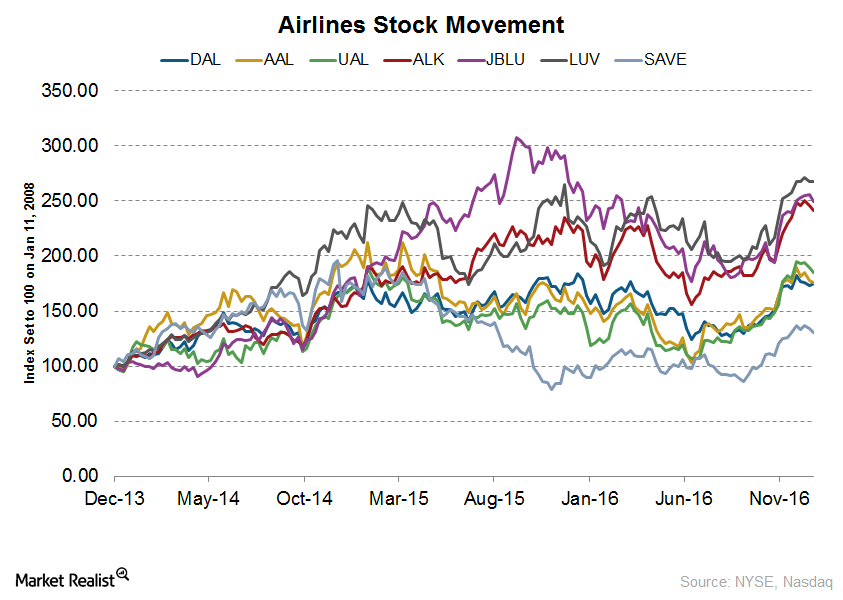

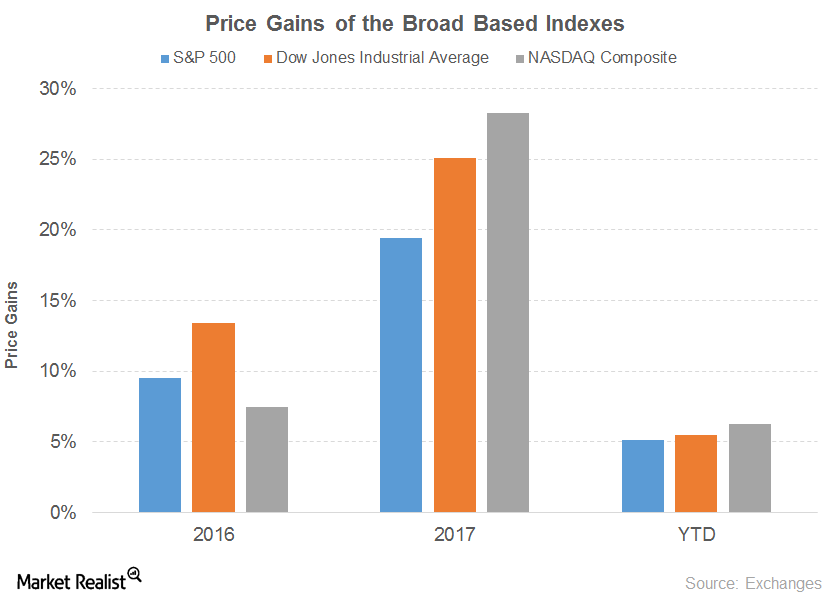

Why Airlines Got off to a Bad Start in 2016

2016 has been the worst start for the S&P 500 in the past eight years. US airlines also saw a bad start. The Dow Jones U.S. Airline Index has fallen 4% YTD.Industrials Must-know: Alaska’s commitment to increase shareholder returns

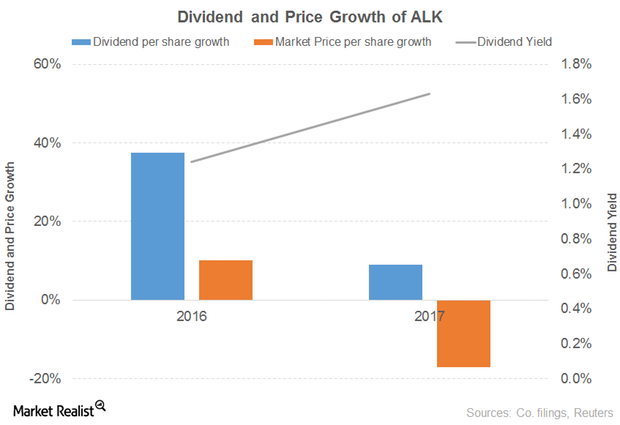

Increases in share prices and dividends provide direct benefits to shareholders. The increases in share prices give better returns. Share repurchases and stock splits provide indirect benefits. Share repurchases lead to a reduction in outstanding shares. This results in increased EPS.

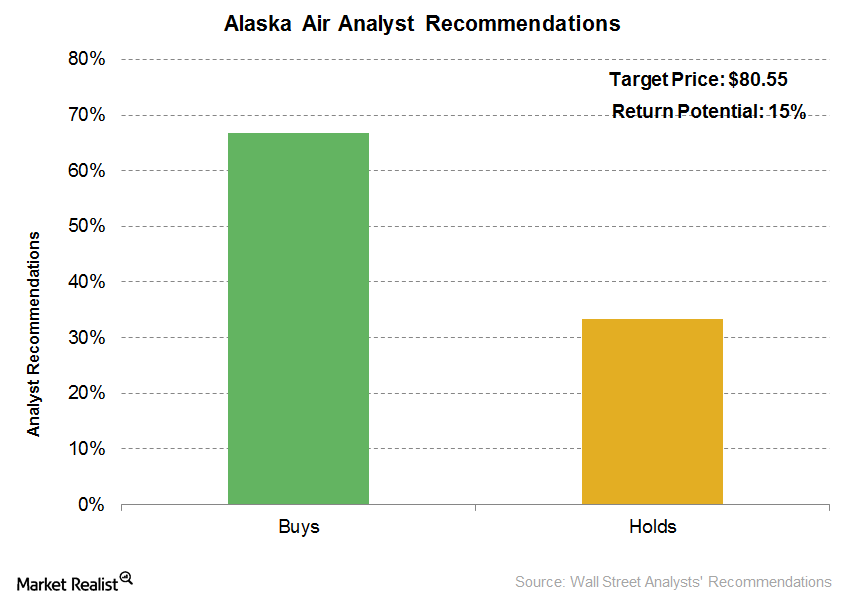

More Analysts Have Turned Positive on Alaska Air Group

Alaska Air Group’s (ALK) consensus 12-month target price is $80.55, which indicates a 15.2% return potential on October 10, 2016.

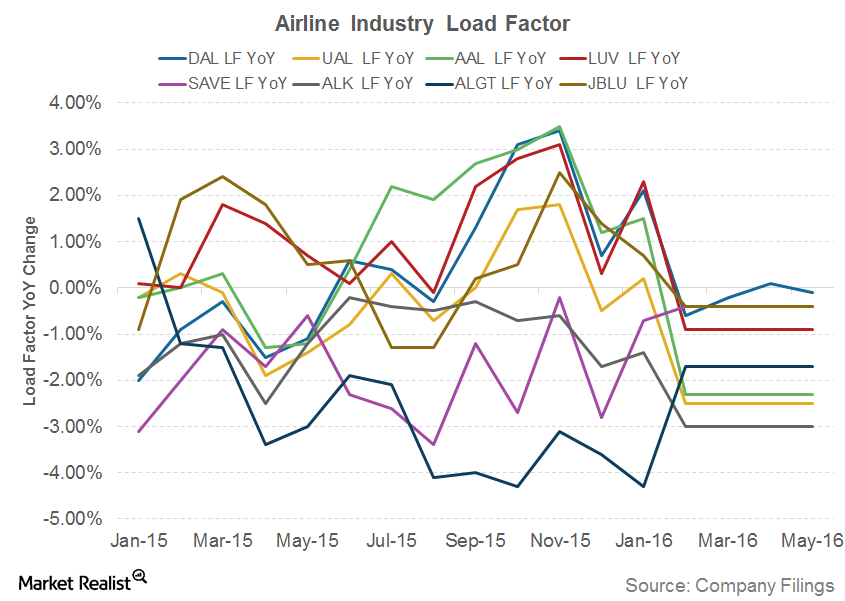

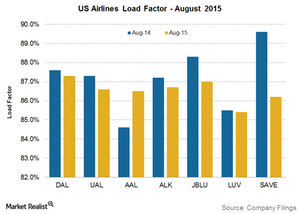

Can Airline Capacity Utilization Improve Going Forward?

Airline capacity utilization is measured using the passenger load factor, which is calculated by dividing traffic numbers by capacity numbers.Industrials United sees major improvement in 3Q14 fuel cost efficiency

United achieved significant fuel cost savings during 3Q14 in the form of lower purchase costs and improved fuel efficiency.

Must-know: Alaska’s increasing return on invested capital

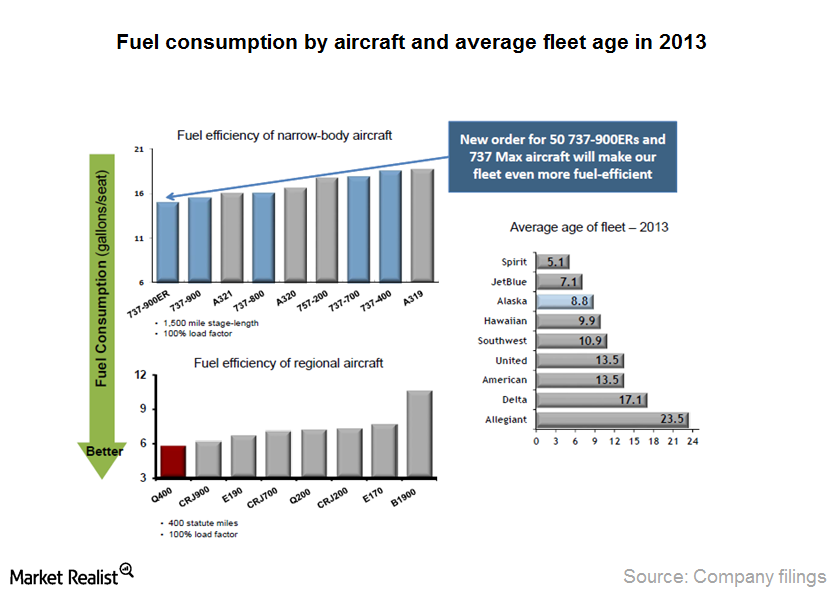

Alaska’s capital expenditure (or capex) mainly includes investment on aircraft. It increased since 2010. In 2013, ~80% of the total cash used for investing activities was on capital expenditure. The total capital expenditure was $566 million. $487 million was on aircraft and aircraft purchase deposits. $79 million was on flight equipment and other property and equipment.

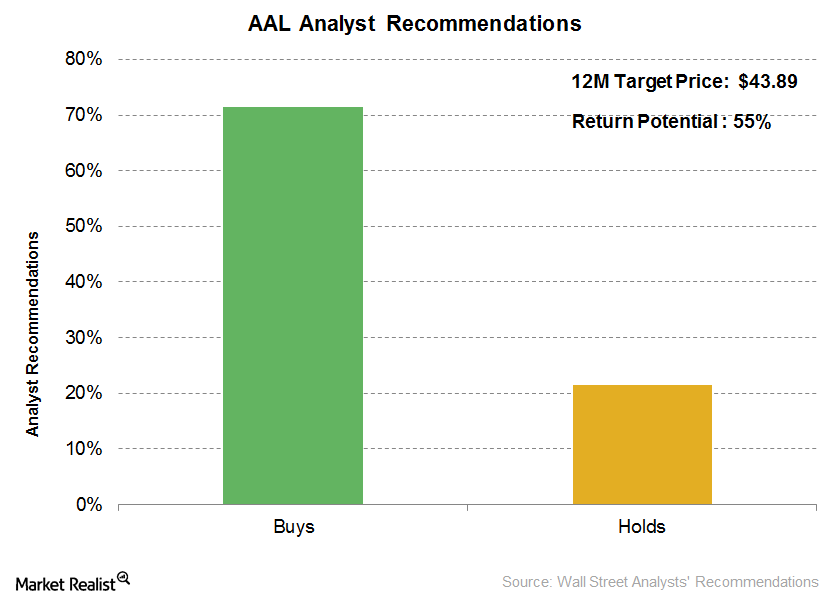

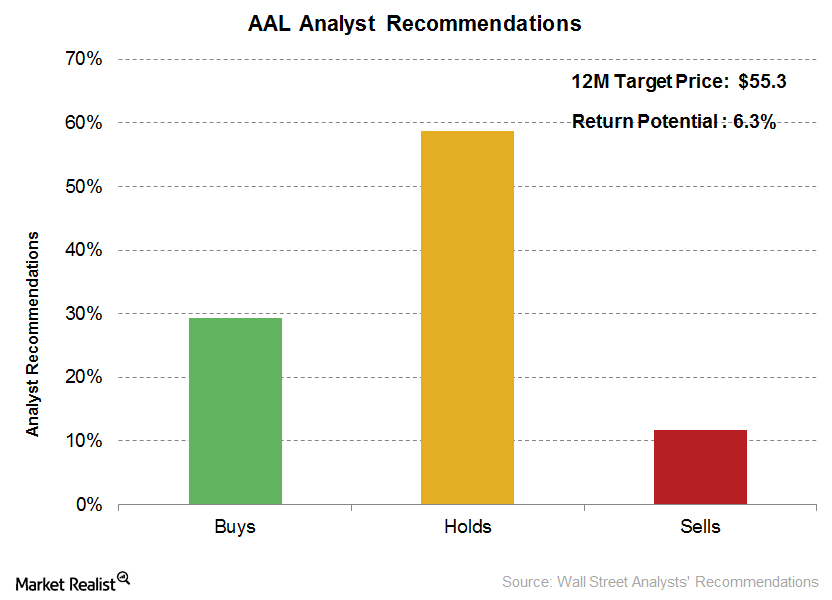

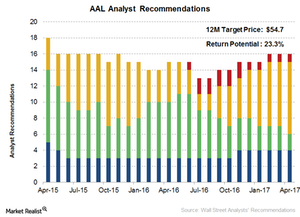

Why Most Analysts Still Recommend ‘Buys’ on American Airlines

According to Bloomberg’s consensus, out of the 14 analysts tracking American Airlines (AAL), 71.4% have “buy” recommendations.

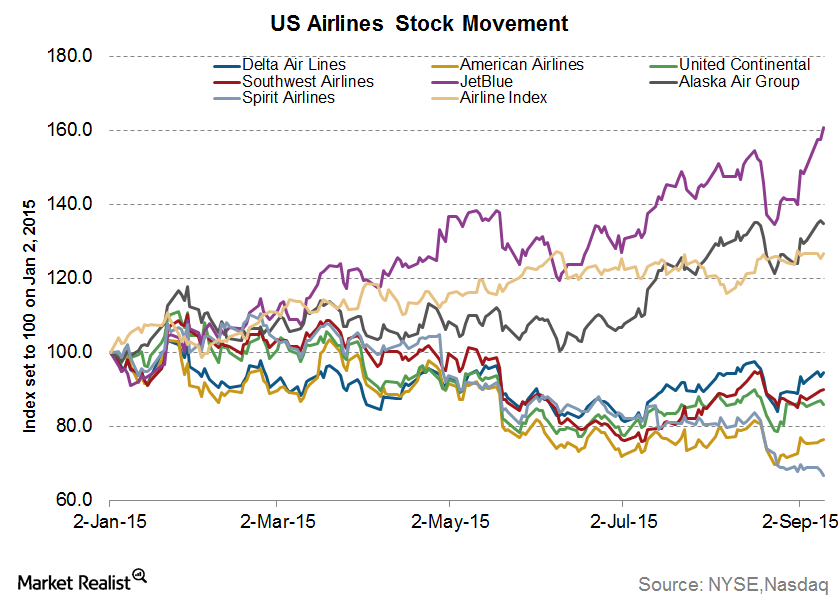

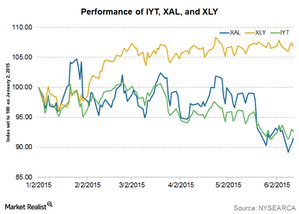

Most Airline Stocks Continue to Tumble in August

In 2015, most airline stocks have fallen, and the NYSE ARCA Airline Index (XAL), which is composed of the major US airline stocks, has also tumbled as much as 13.5% year-to-date.

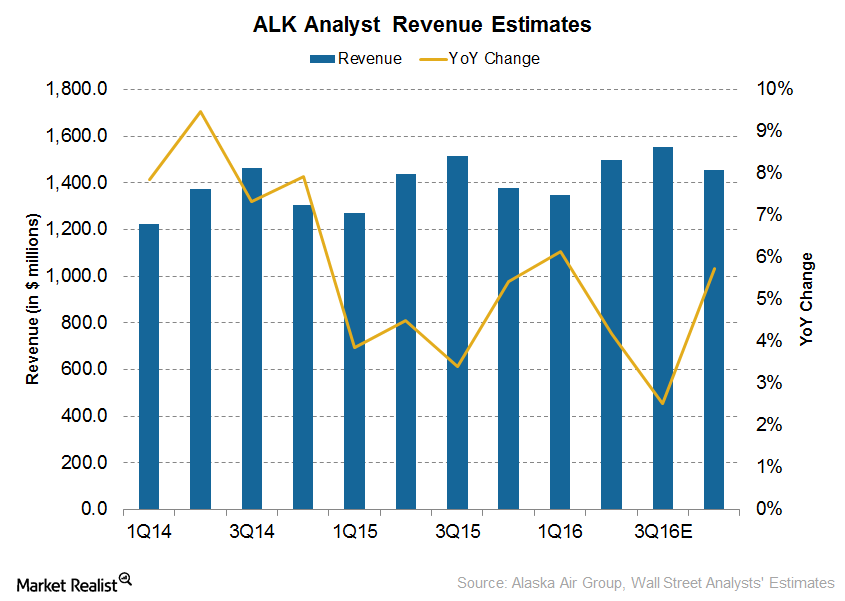

Alaska Air: Why Analysts Forecast Higher Revenue in Next 2 Years

For 2Q16, analysts are estimating 4.2% revenue growth for Alaska Air Group (ALK), which is slower than the 6.2% growth in 1Q16.Industrials Why airlines adopt approaches to improve yield and revenue

Alaska Airlines (ALK) has the lowest yield of $0.148 among all its peers. Its peers include Delta (DAL) at $0.1689, United (UAL) at $0.1614, American (AAL) at $0.1622, and Southwest (LUV) at $0.1602. Revenue management is essential for the airline industry. The industry needs to maximize revenue by selling the most aircraft seats possible to customers at the best price.

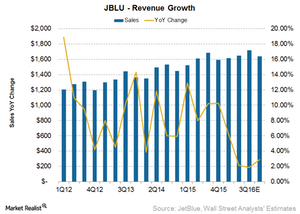

Are Analysts Expecting JetBlue Airways’s Revenue to Grow in 2Q16?

Analysts are estimating 2Q16 revenue of ~$1.7 billion for JetBlue Airways (JBLU), which is a year-over-year increase of 2.2%.Industrials Key growth trends in airline passenger traffic by region

Global passenger traffic has increased by 5.8% year-over-year during the first eight months of 2014. Europe (29.7%), Asia-Pacifc (29.2%), and North America (25%) comprise ~85% of global market share by passenger traffic.

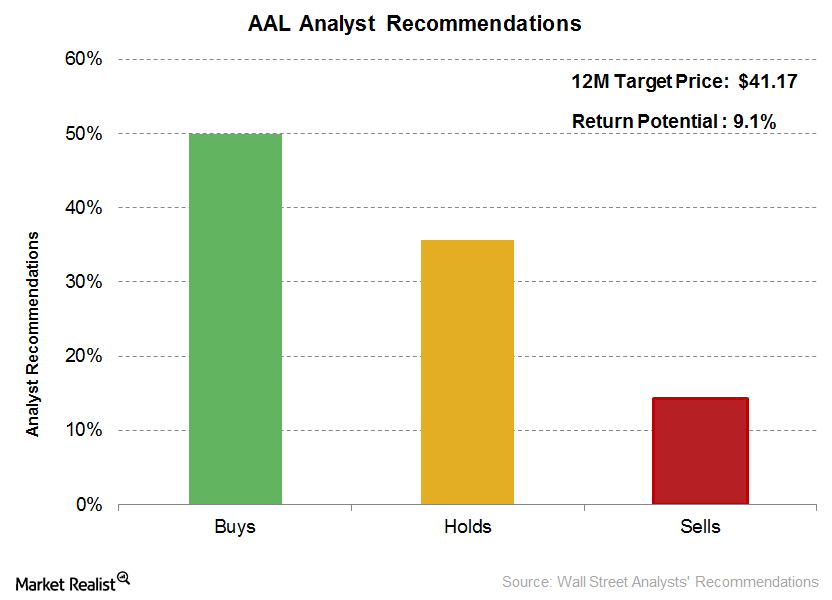

Why Have Some Analysts Become Less Positive on American Airlines?

Out of the 14 analysts tracking American Airlines (AAL), 50% have a “buy” recommendation on the stock as compared to the 71.4% that had a “buy” rating in 2Q16.

US Airlines Capacity Growth Outpaces Demand, Load Factor Drops

Decreasing load factors across the airline industry mean that airlines are not able to fill up their seats as fast as they are adding seats. This justifies investor fears of overcapacity.

Must-know: Alaska Airlines’ aircraft and fuel efficiency

In 2013, Alaska operated a fleet of 131 Boeing 737 jet aircraft. It had contracts with Horizon, Sky West Airlines, and Peninsula Airways for regional capacity. Horizon operated 51 Bombardier Q400 turboprop aircraft. It sells all of its capacity to Alaska according to its capacity purchase agreements.

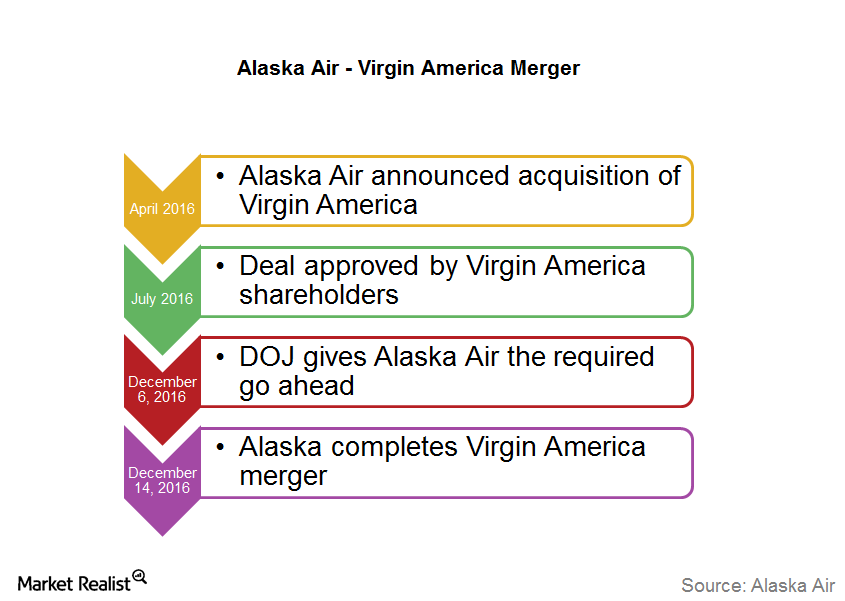

Alaska Air Group Completes Virgin America Merger

On April 4, 2016, Alaska Air Group (ALK) announced its acquisition of Virgin America for $57 per share in cash, which amounted to $2.6 billion.

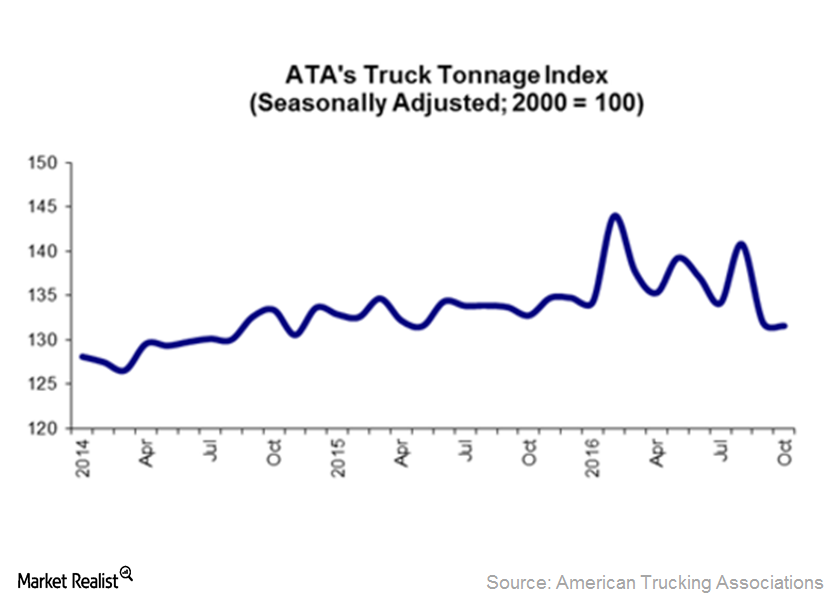

What the Direction of October’s Truck Tonnage Index Indicates

In this article, we’ll look at the direction of the Truck Tonnage Index (or TTI) in October 2016.

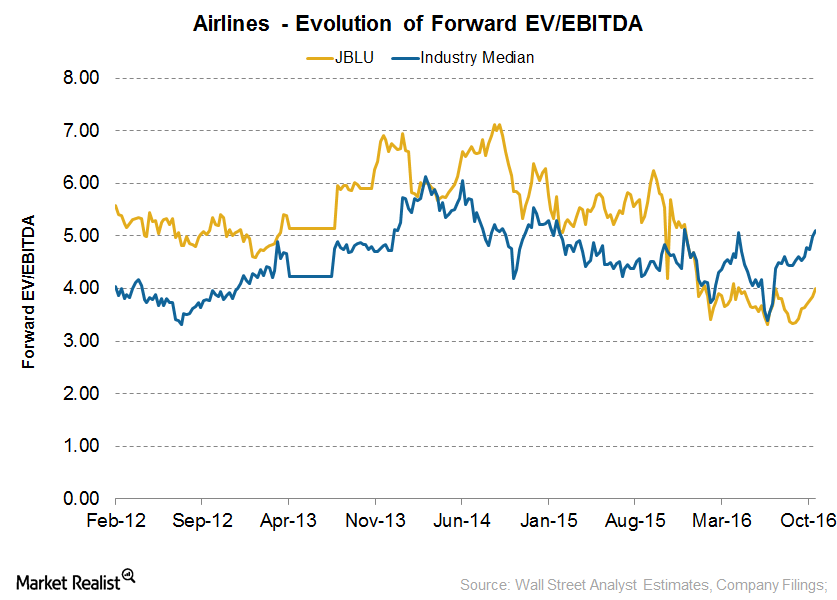

Is a Rerating of Airlines’ Valuation Multiple Possible?

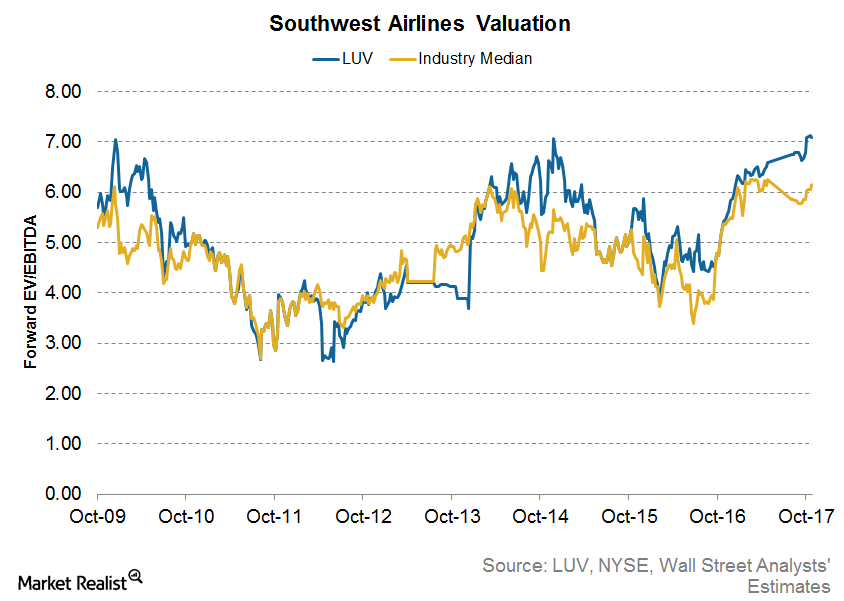

Currently, American Airlines (AAL), Southwest Airlines (LUV), and Alaska Air Group (ALK) are all trading at ~5x their forward EV-to-EBITDA multiples.

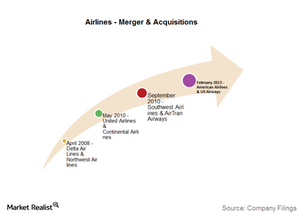

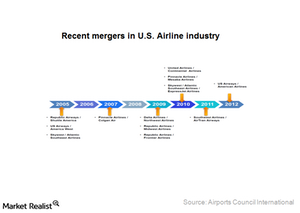

Airline Mergers and Acquisitions: Are We There Yet?

The most recent phase of consolidation that began in 2005 has seen 13 airline mergers and acquisitions. Four of these deals are worth special mention because they changed the face of the industry.

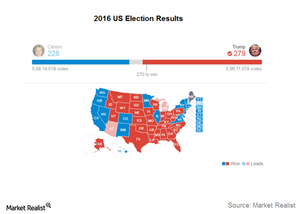

Initial Reactions from the Travel Industry after Trump’s Win

Just a few days ago, we wrote about how Trump had received very little support from the travel industry. Now that he’s been elected, what’s next?

Wall Street Analysts’ Recommendations for American Airlines

According to Reuters, of the 17 analysts tracking American Airlines (AAL), 23.5% (or four) have “strong buy” ratings on the stock.

Why Delta Air Lines Stock Fell after Q4 Earnings

Delta Air Lines (DAL) reported its fourth quarter 2016 results on January 12, 2016. The airline’s revenue fell.

Fewer Analysts Recommend ‘Buys’ on American Airlines

Analysts’ “hold” ratings on American Airlines stock have risen significantly. Nine analysts, a total of 56.3%, now have “hold” ratings on the stock.

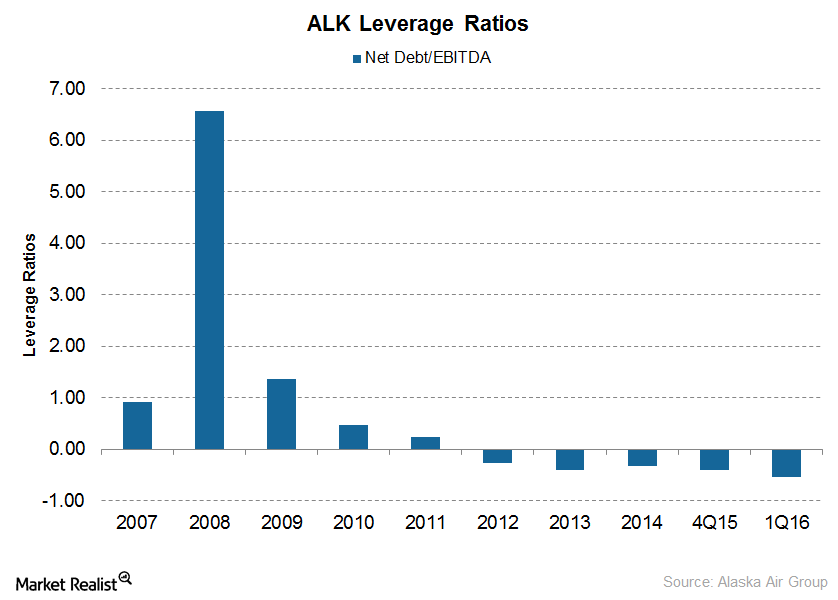

Alaska Air’s Low Debt: Is It an Advantage?

Alaska Air Group (ALK) has been trying to reduce its debt burden in order to strengthen its balance sheet in the long term.

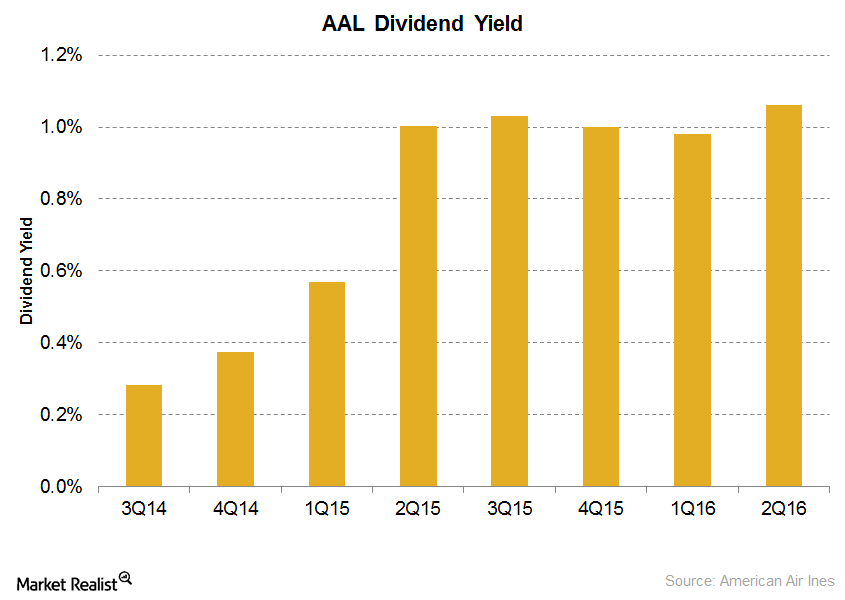

Will American Airlines Increase Dividend Payouts?

American Airlines started paying dividends in mid-2014, joining the ranks of Delta Airlines, Southwest Airlines, and Alaska Air Group, the few dividend-paying airlines.

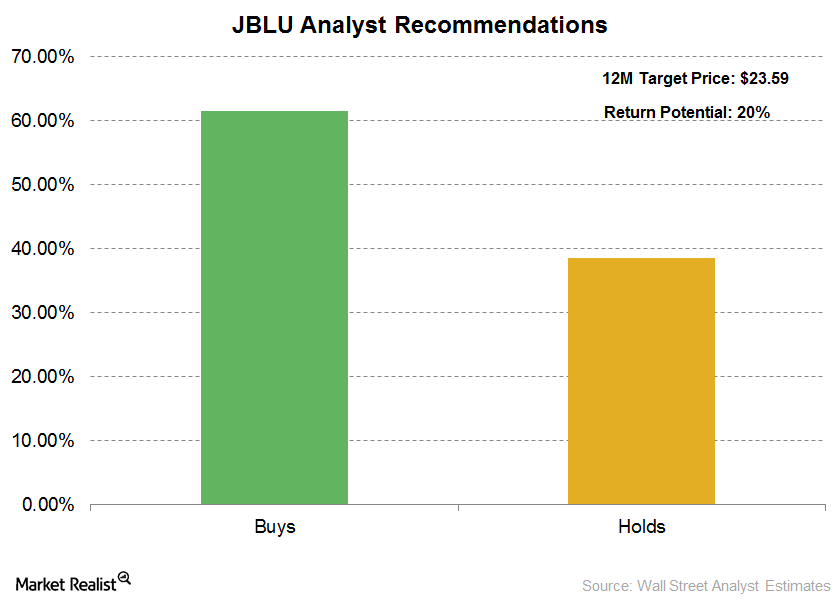

JetBlue Airways: What Are Analysts’ Recommendations?

JetBlue Airways (JBLU) is expected to release its 2Q16 earnings on July 26. According to an analyst consensus, JBLU is expected to earn $0.49 in 2Q16, compared to earnings per share of $0.44 in 2Q15.

Analyzing the Key Variables for the Airline Industry

Investors should keep an eye on airfare trends. Despite a 40% fall in crude oil prices—the major cost for airlines—airfares have remained fairly stable.

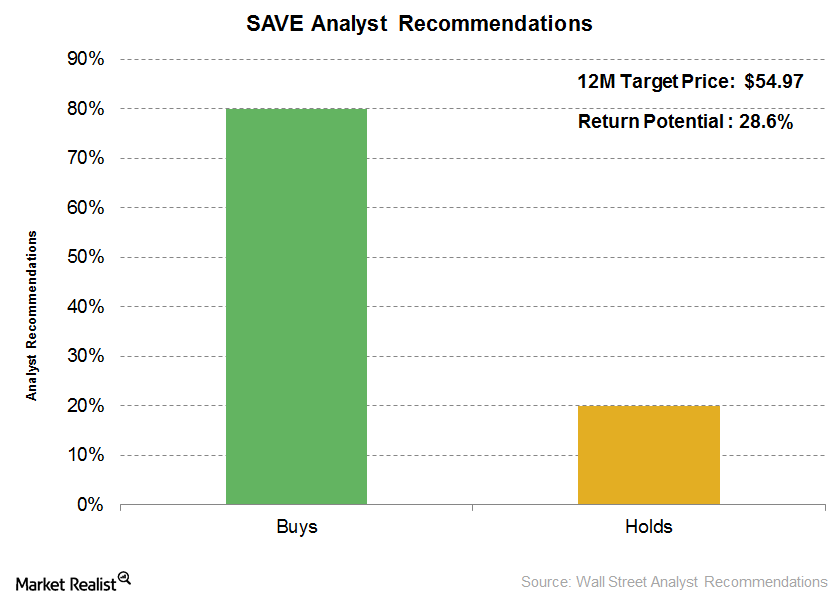

What Are Analysts Estimating for Spirit Airlines in 2016?

Of the 15 analysts rating Spirit Airlines’ stock, 80% (12 analysts) have a “buy” rating, 20% (three analysts) have a “hold” rating, and none of the analysts have a “sell” rating.

Can Alaska Air Stock Continue Its Stellar Performance in 2016?

Alaska Air Group plans to announce its 4Q15 and 2015 financial results on January 21, 2016. The company had a successful 2014 with record profits of $605 million on revenues of $5.37 billion.

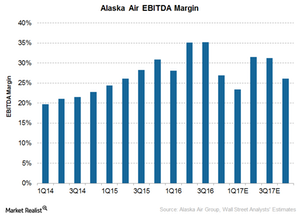

Could Alaska Air Group’s Margin Expand in 2017?

In 1Q17, Alaska Air Group’s (ALK) EBITDA (earnings before interest, tax, depreciation, and amortization) is expected to fall 5.8% to $385 million.

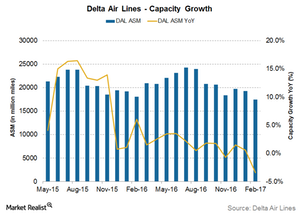

Delta Air Lines: On the Right Route to Achieve Capacity Guidance?

Delta Air Lines (DAL) has maintained a low-capacity growth profile throughout 2017. For May 2017, DAL’s capacity growth was flat at 22,072 million miles.

United Airlines’ Q2 Results Paint Bleak Outlook for Airlines

United Airlines reported its second-quarter results on July 21. The quarter hit airlines hard, and they suffered huge losses owing to almost-zero demand.

Delta Air Lines Reports Wider-than-Expected Losses in Q2

Delta Air Lines’ adjusted revenue, excluding refinery sales, came in at $1.2 billion. The airline saw a capacity reduction of 85%.

Goldman Sachs Upgraded Southwest Airlines to ‘Buy’

Southwest Airlines stands out due to its strong balance sheet. A Goldman Sachs analyst is bullish about the stock making a strong recovery.

JetBlue Airways Announces Growth Plans amid COVID-19 Crisis

On June 18, to support revenue recovery, JetBlue announced that it will add 30 domestic routes, especially in its leisure markets.

Why Does Jim Cramer Favor Southwest Airlines?

Southwest Airlines (NYSE:LUV) has been gearing up to give other airlines though competition. Air travel demand has been picking up again.

United Airlines Will Sell 22 Planes to BOC Aviation amid COVID-19

United Airlines (NYSE:UAL) has fallen 3.7% in pre-market trading as of 7:03 AM ET today. The airline industry has been hit hard by the COVID-19 pandemic.

Low-entry barriers intensify competition in airline industry

Short-term outlook above expectations The IATA (International Air Transport Association) has revised its forecast upwards on global airline profitability after the free fall of crude oil prices in the second half of 2014. Global net profit for 2014 is now estimated at $19.9 billion, higher than $18 billion projected in June. Profitability is expected to […]

Southwest Extends MAX Grounding, Updates Q4 Outlook

Today, Southwest Airlines (LUV) announced that it is removing all Boeing (BA) 737 MAX flights from its flying schedule through April 13.

Airline Stocks Soar on Strong Job Market Report

Almost every US airline stock soared last Friday after the US Department of Labor reported stronger-than-expected job market data.

How Top US Airlines Are Faring on the Valuation Front

With a return of more than 43% YTD (year-to-date), United Continental (UAL) shares have remained the biggest gainer in 2018.

Delta Air Lines: Is Higher Debt a Concern?

Delta Air Lines’ higher debt means a higher interest expense and a higher DE (debt-to-equity) ratio. Delta Air Lines’ current DE ratio is 0.69x.

Which Stocks Have Announced $1,000 Bonuses?

In this series, we’ll be taking a look at the companies that have announced $1,000 dollar bonuses, pay raises, increased dividends, and buybacks in the last two months.

What’s the Outlook for Alaska Air Group?

Alaska Air Group’s (ALK) operating revenue rose 6% and 35% in 2016 and 9M17, respectively.

What Does Southwest Airlines’ Current Valuation Indicate?

Current valuation Southwest Airlines (LUV) has a forward EV-to-EBITDA[1. enterprise value to earnings before interest, tax, depreciation, and amortization] multiple of 7.1x. This is the highest multiple among the major airline carriers and is higher than its average valuation of 6.3x since September 2008. Peer comparisons American Airlines (AAL) is trading at a similar valuation […]

Analysts’ Recommendations for Southwest Airlines

Analysts’ recommendations Of the 17 analysts tracking Southwest Airlines (LUV), 36.8% of the analysts (seven analysts) gave a “strong buy” rating on the stock, while another 47.4% (nine analysts) gave a “buy” rating. The remaining 15.8% (three analysts) gave a “hold” rating. None of the analysts gave a “sell” or “strong sell” rating on the […]