Analyzing the Key Variables for the Airline Industry

Investors should keep an eye on airfare trends. Despite a 40% fall in crude oil prices—the major cost for airlines—airfares have remained fairly stable.

Nov. 20 2020, Updated 11:12 a.m. ET

Assessing the key variables

As we explored in the beginning of this series, the US gross domestic product (or GDP) growth slowed down in 1Q15. However, it is forecast to increase by 2.8% for the full year 2015. Increasing GDP growth means good news for airlines, which perform well in times of economic prosperity, even if costs are high.

Similarly, world trade and industrial production have continued to grow, although this growth has slowed in recent months. Business confidence is also not as buoyant as it was six months ago, but it is above the 50 expansion/contraction line. Business confidence is considered to be a leading indicator to gauge airline industry demand. Business confidence is said to be in an expansionary phase if above 50 and a contraction phase when it is below 50.

Passenger and cargo traffic

Both passenger and cargo traffic have reiterated this sentiment of business confidence. Air travel has grown by more than 5% in year-to-date 2015. After several years of stagnation, cargo demand also grew in 2015. However, passenger traffic growth slowed in May 2015 and cargo demand remained flat.

In response to the increasing demand, airlines also have increased capacity—in some cases, more than the demand growth. As we discussed in Part 5, market concerns about unjustified capacity addition led to a selloff in airline stocks in 2015. However, industry capacity utilization has improved and is near the highest levels seen in the industry since 1971, which we discussed in Part 6 of this series.

What should investors watch?

Investors should keep an eye on increasing airline capacity. If airlines do embark on an unjustified expansion spree in a positive economic climate—similar to their pre-recession actions—it will come at the cost of yields and profitability.

Investors should keep an eye on airfare trends. Despite a 40% fall in crude oil prices—the major cost for airlines—airfares have remained fairly stable. This contradicts the historical tendency of airlines to pass on all cost benefits to customers. Also, consumer organizations have started putting pressure on airlines for fare reductions. Reduced fares will again result in lower profitability for the airlines.

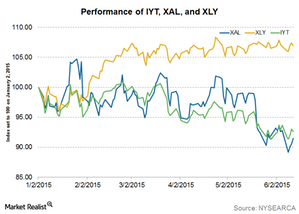

Major airlines in the US include Alaska Airlines (ALK), American Airlines (AAL), Delta Air Lines (DAL), United Continental (UAL), and Southwest Airlines (LUV). You can invest directly in individual airline stocks or through ETFs such as the iShares Transportation Average ETF (IYT). IYT holds ~38% in airline stocks.

For the latest industry updates, please visit Market Realist’s Airlines page.