Delta Air Lines Inc

Latest Delta Air Lines Inc News and Updates

Delta Air Lines Pilots Authorize a Strike If New Contract Isn't Approved

After waiting two years for a new contract, Delta Air Lines pilots are ready to strike if a new agreement with pay increases isn’t approved.

Here's How to Take Advantage of Starbucks and Delta's New Partnership

Starting Oct. 12, Starbucks and Delta Airlines they are linking their loyalty programs to provide customers with more ways to earn rewards. Here's how it works.

Delta's Non-Unionized Flight Attendants Fight for Change

Delta Airlines employees are pushing for unionization. Here’s what the workers are demanding and what Delta will give them.

Masks Are Now Optional on U.S. Airlines — Will It Last?

A federal judge has struck down the mask mandate on airlines — does that mean that passengers are no longer required to wear masks on flights? The latest TSA update.

A Forecast for Airline Stocks As Restrictions On International Travel to the U.S. Ease

The U.S. has eased restrictions on international travel, meaning airline stocks could be in for a major liftoff.

How Much Do Flight Attendants Make? Delta Is Hiring Flight Attendants

Being a flight attendant is one of the most desirable positions in the job market. But how much do flight attendants make per year?

After Its Profitable Quarter, Will Delta Restore Dividends?

Delta managed to report its first profitable quarter since before the pandemic. When will the airline company restore dividends for DAL stock?

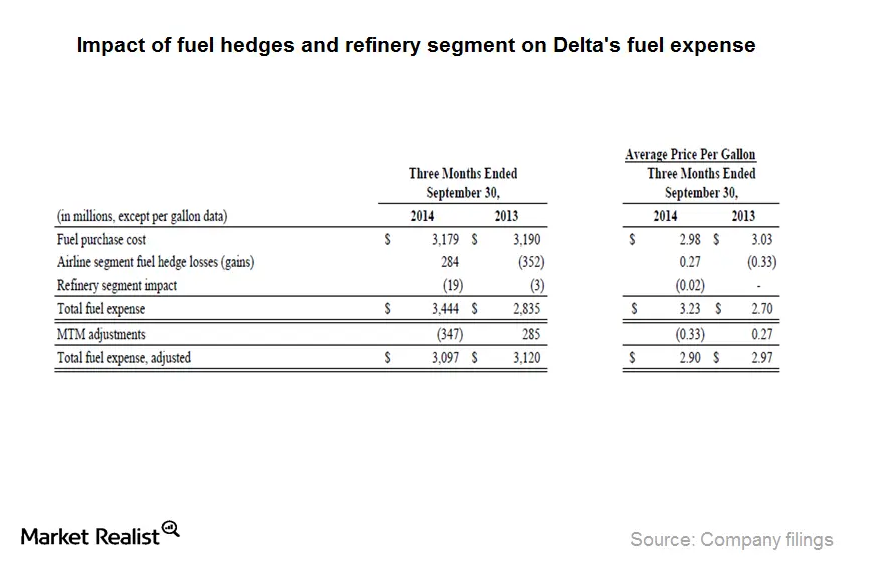

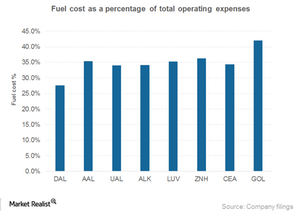

Why Delta’s 3Q14 fuel expense was impacted by fuel hedges

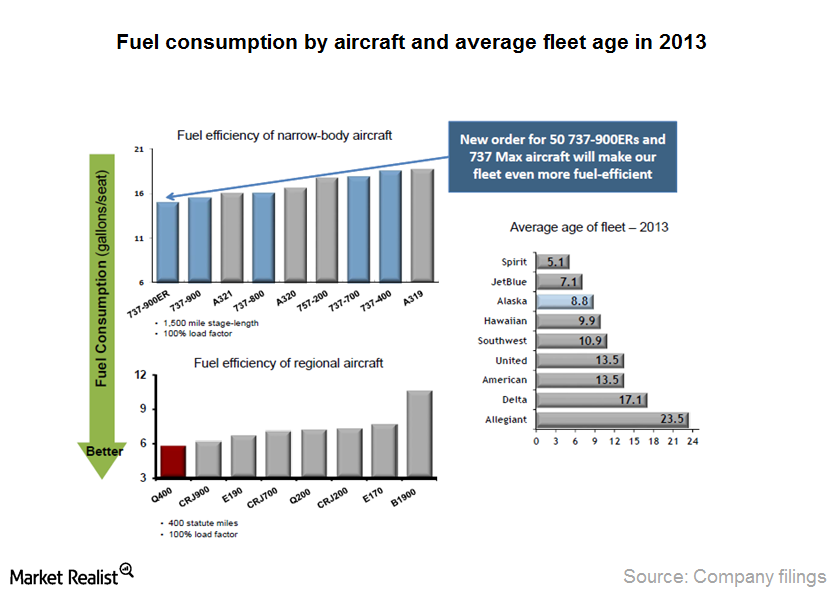

Fuel expense is Delta’s largest expense. It accounted for ~29% of the total operating expense in 3Q14. Fuel consumption per available seat mile decreased by 1.5% during the quarter.

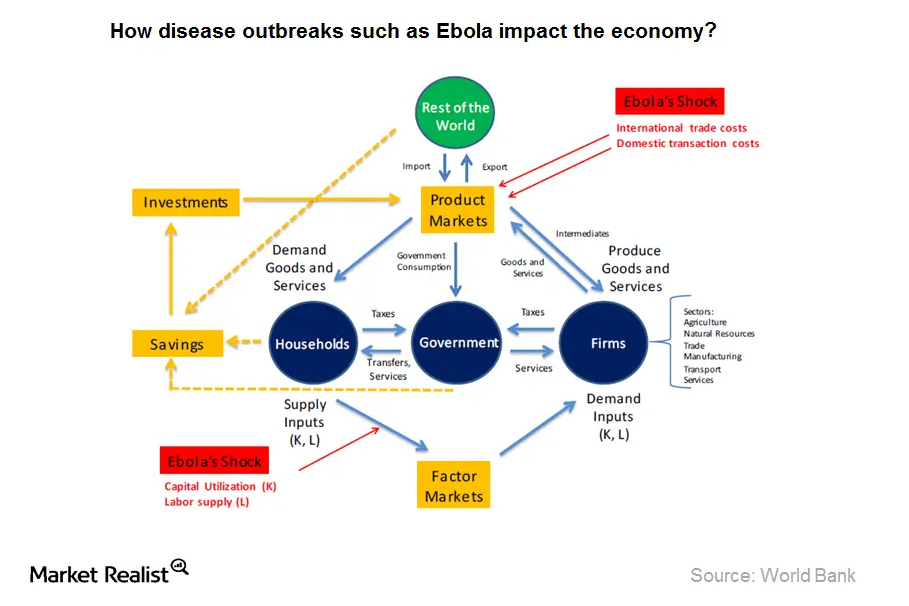

Why fatal disease outbreaks impact economic activity

The World Bank estimated Ebola’s impact by analyzing two scenarios—low Ebola and high Ebola. The scenarios are based on the probability of the disease spreading internationally.

What Should Airline Industry Investors Look Out for in 2016?

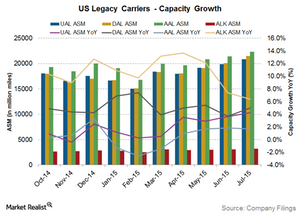

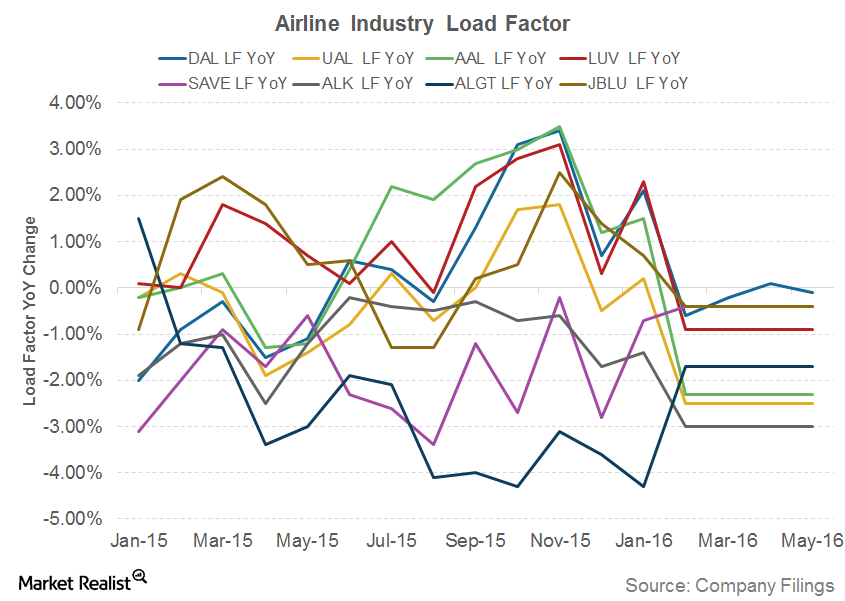

Growing capacity is necessary for revenue growth. However, capacity expansion that exceeds demand growth can lead to declining utilization.

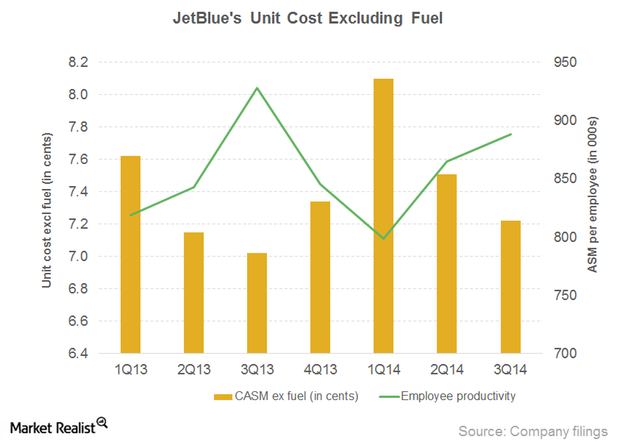

JetBlue’s unit cost growth: Employee costs up, lower productivity

Salary, wages, and benefits increased as a result of higher wage rates. Airlines have also had to increase headcount to adhere to the new Federal Aviation Administration (or FAA) regulations on flight, duty, and rest.

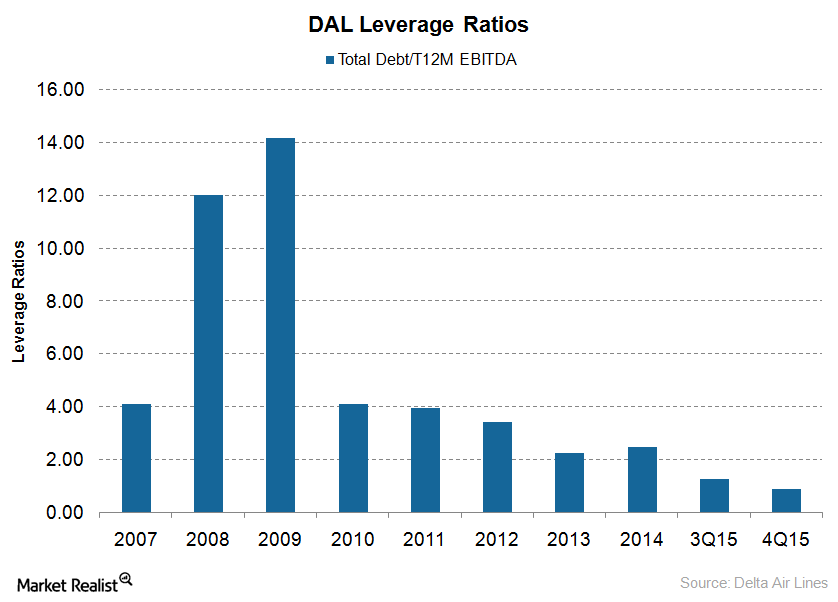

Can Delta Air Lines Continue to Reduce Its Debt in 2016?

Delta Air Lines (DAL) expects to generate more than $7 billion–$8 billion of operating cash flow and ~$4 billion–$5 billion of free cash flow. It plans to reduce its adjusted net debt to $4 billion by 2020.

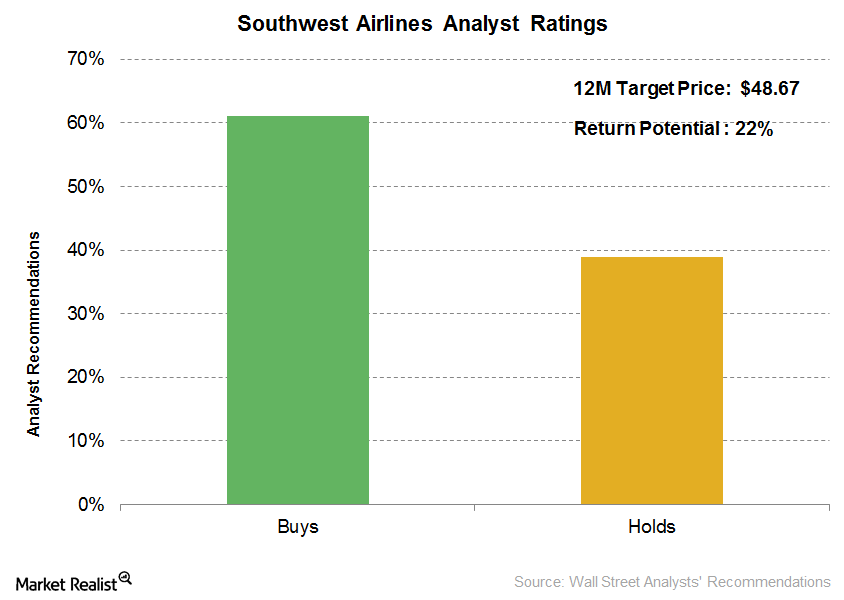

Why Did Analysts Fall Out of Love with Southwest Airlines?

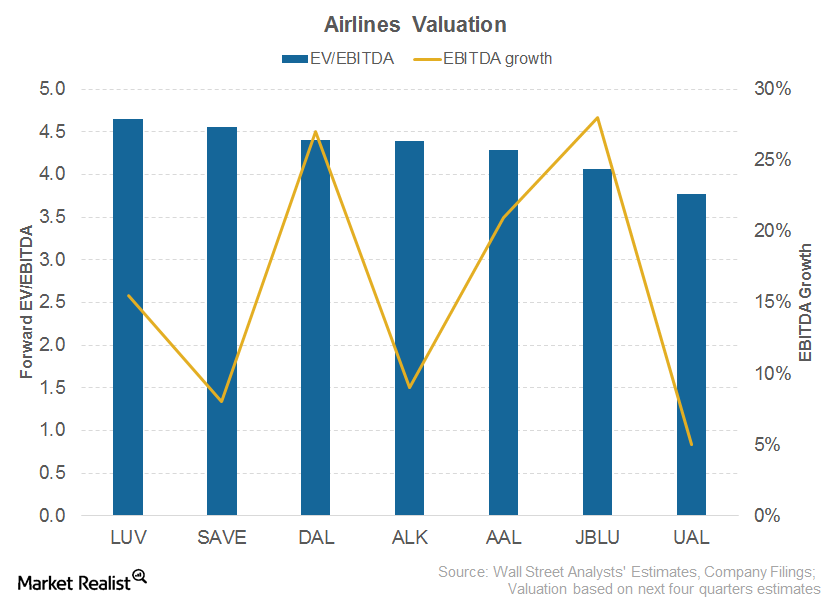

Out of the 18 analysts tracking Southwest Airlines (LUV), 11 analysts (61.1%) have a “buy” recommendation on the stock versus 71% analysts that had a “buy” recommendation on Southwest in 2Q16.

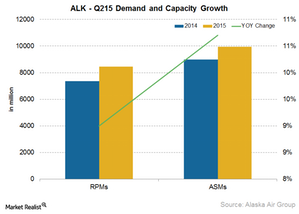

What Helped Alaska Air Group Drive its 2Q15 Earnings?

Adding newer destinations Alaska Air Group (ALK) added a number of new routes in the second quarter of 2015, such as: Boise to Reno Eugene to San Jose, California Los Angeles to Baltimore Los Angeles to Gunnison–Crested Butte Los Angeles to Monterey Los Angeles to San Jose, Costa Rica Portland to Austin Seattle to Charleston […]

Alaska Airlines Capacity Growth Is Faster than That of Its Peers

Alaska Air Group saw the highest surge in traffic demand and was the leader in capacity growth, with a 6.4% YoY increase in its capacity in July 2015.Industrials Estimating American Airlines’ earnings growth

Apart from improved operational efficiencies, American has outperformed its peers in pre-tax margin (excluding special items) improvement in the first half of 2014 to 8.7% from 4.1% in the previous year.

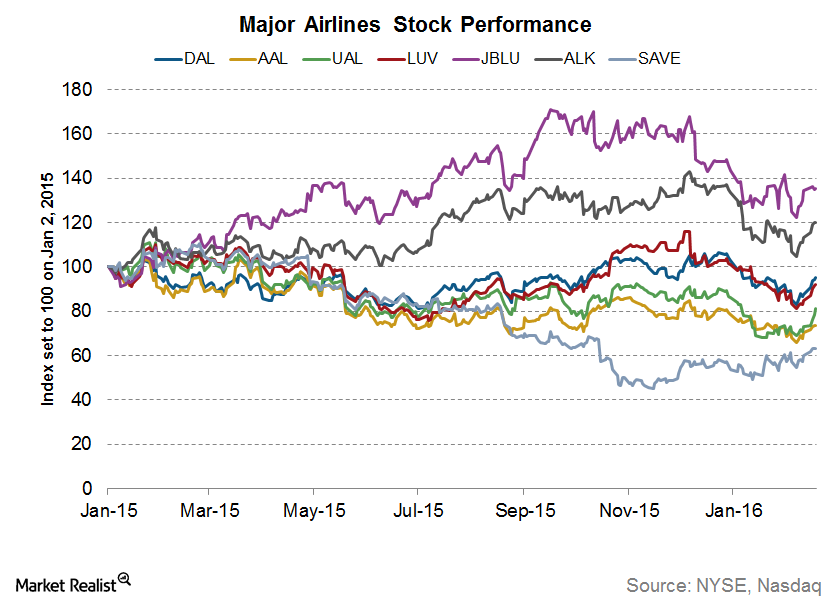

Why Airlines Got off to a Bad Start in 2016

2016 has been the worst start for the S&P 500 in the past eight years. US airlines also saw a bad start. The Dow Jones U.S. Airline Index has fallen 4% YTD.

Comparison of China Eastern’s fuel costs with competitors

Chinese airlines have an advantage of having lower employee costs compared to their counterparts in the US. Operational efficiency of US airlines are comparatively higher.Industrials Must-know: Alaska’s commitment to increase shareholder returns

Increases in share prices and dividends provide direct benefits to shareholders. The increases in share prices give better returns. Share repurchases and stock splits provide indirect benefits. Share repurchases lead to a reduction in outstanding shares. This results in increased EPS.Company & Industry Overviews Gol’s passenger revenue increases on higher yields

Brazil is the third largest domestic aviation market. With double-digit traffic growth, Brazil was one of the fastest-growing domestic markets in 2010 and 2011.Industrials Delta Air Lines’ key strategy to increase shareholder returns

Capital expenditure is generally high in the airline industry. Delta manages to keep it low through its strategy of buying used aircraft.

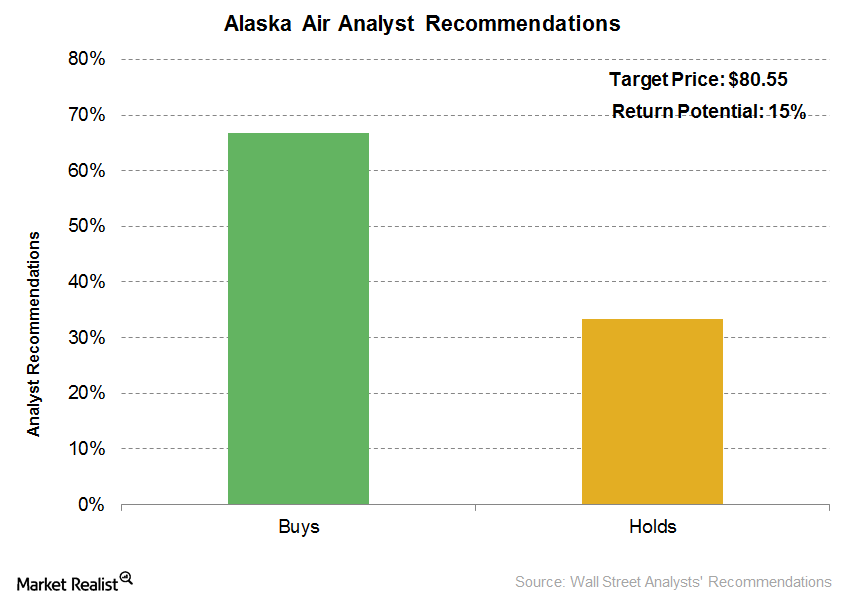

More Analysts Have Turned Positive on Alaska Air Group

Alaska Air Group’s (ALK) consensus 12-month target price is $80.55, which indicates a 15.2% return potential on October 10, 2016.Industrials Must-know: Delta Air Lines’ second quarter earnings

Today, Delta is one of the largest airlines in U.S. providing transportation services for passengers and cargo—it serves almost 165 million customers each year to 225 domestic and 97 international destinations.

Can Airline Capacity Utilization Improve Going Forward?

Airline capacity utilization is measured using the passenger load factor, which is calculated by dividing traffic numbers by capacity numbers.Industrials United sees major improvement in 3Q14 fuel cost efficiency

United achieved significant fuel cost savings during 3Q14 in the form of lower purchase costs and improved fuel efficiency.Industrials The must-know drivers of air cargo growth for US airlines

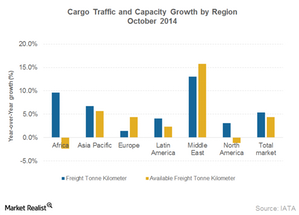

According to the IATA, global air freight volume has increased by 4.5%. Capacity, measured by available freight ton kilometers (or AFTK), increased by 3.5% year-over-year in August 2014.

Must-know: Alaska’s increasing return on invested capital

Alaska’s capital expenditure (or capex) mainly includes investment on aircraft. It increased since 2010. In 2013, ~80% of the total cash used for investing activities was on capital expenditure. The total capital expenditure was $566 million. $487 million was on aircraft and aircraft purchase deposits. $79 million was on flight equipment and other property and equipment.

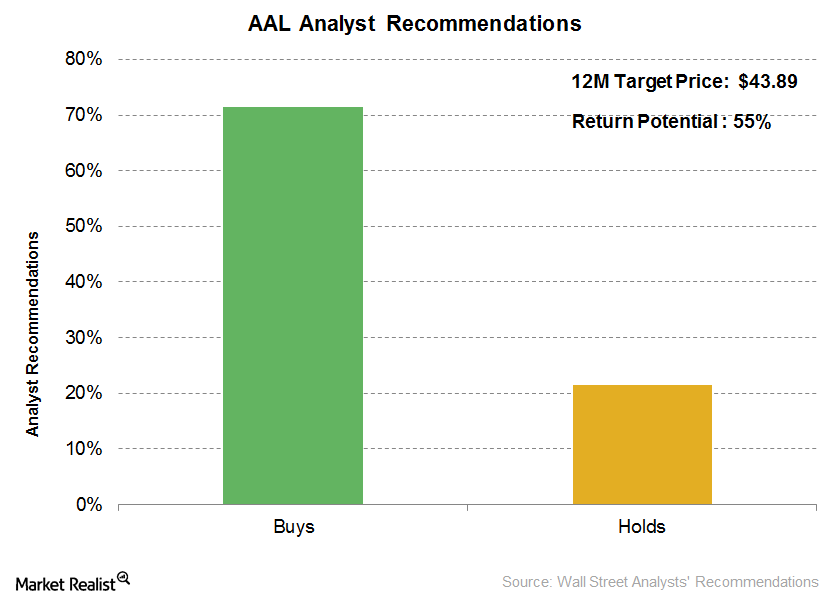

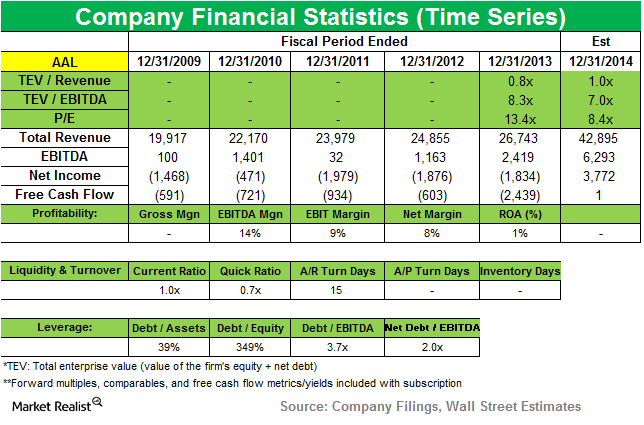

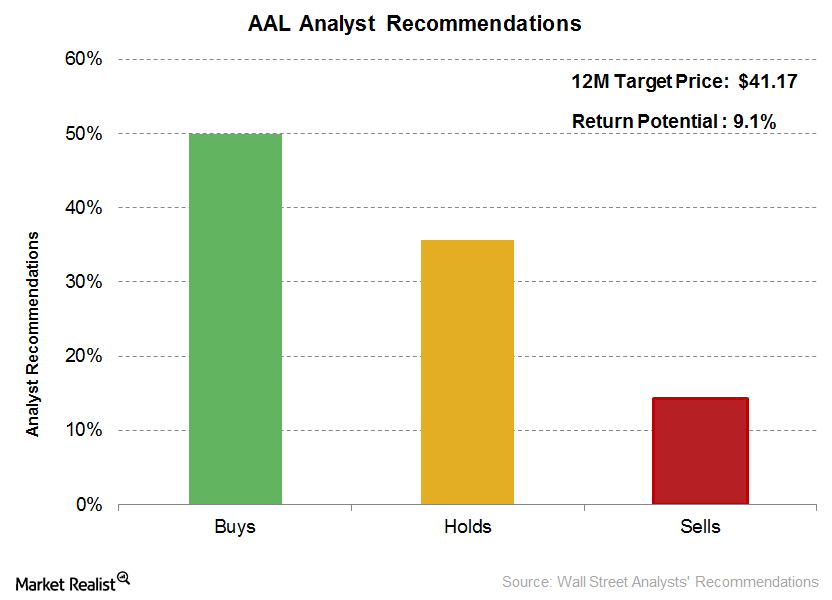

Why Most Analysts Still Recommend ‘Buys’ on American Airlines

According to Bloomberg’s consensus, out of the 14 analysts tracking American Airlines (AAL), 71.4% have “buy” recommendations.

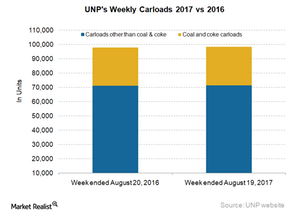

Comparing Union Pacific’s Freight Volumes with the Industry in Week 33

In week 33 of 2017, Union Pacific (UNP) recorded a marginal rise of 0.6% in its railcars, excluding intermodal.

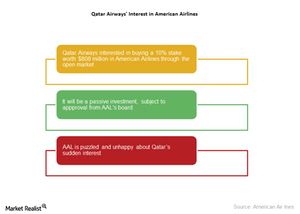

Why Is Qatar Airways Interested in American Airlines?

In the last week of June 2017, Qatar Airways’ CEO, Akbar Al Baker, disclosed the carrier’s interest in buying a 10% stake worth $808 million in American Airlines through the open market.

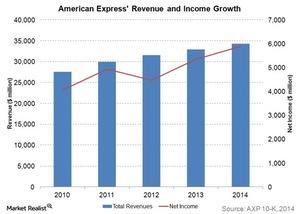

American Express: Opportunities Abound in a Challenging Market

Co-branding relationships are an important part of the American Express business model. The costs of renewing and extending these relationships is increasing.

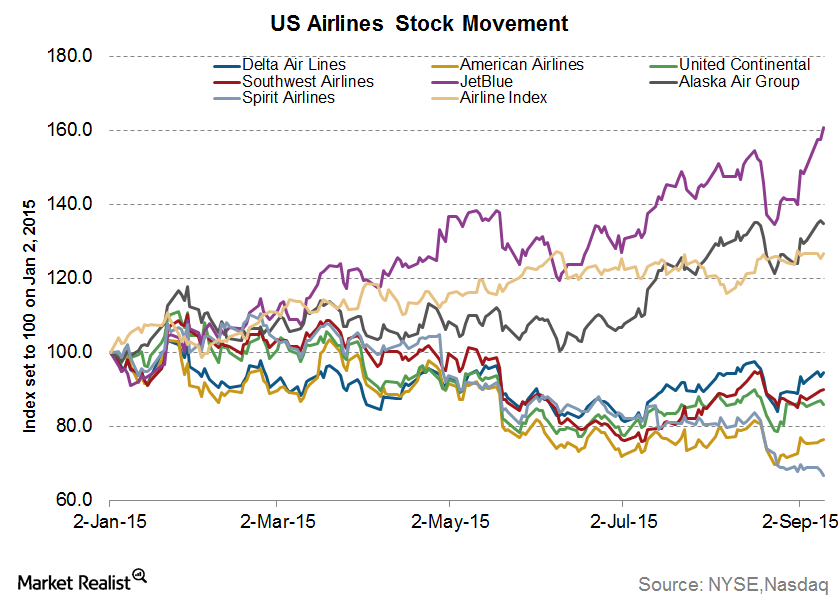

Most Airline Stocks Continue to Tumble in August

In 2015, most airline stocks have fallen, and the NYSE ARCA Airline Index (XAL), which is composed of the major US airline stocks, has also tumbled as much as 13.5% year-to-date.Industrials Why it’s important for airlines to improve load factor

Load factor measures capacity utilization. It indicates the percentage of total capacity that an airline utilizes. Airlines are capital intensive. They have high fixed costs.

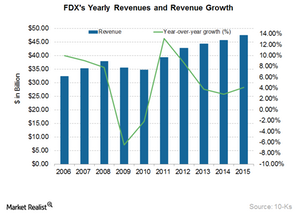

How Did FedEx Grow into One of the Largest Logistics Giants?

In the international arena, FedEx primarily competes with DHL, United Parcel Service (UPS), and foreign postal authorities.Industrials Why United Continental’s high-cost structure affects its margins

In 2013, almost 57% of United’s (UAL) $37,030 million total operating costs comprised fuel costs (33%) and salaries (23%), compared to Delta’s 46%.

Low yield, utilization drive down air cargo profitability

Growing trade activity drove the recovery in cargo traffic in emerging markets in Asia, but it was slightly offset by the slowing European economy.

American Airlines gets significantly lower position in Appaloosa

Appaloosa Management significantly lowered its position in American Airlines (AAL) in the third quarter that ended in September 2014. The position accounts for 3.81% of the fund’s total third-quarter portfolio.Industrials Why airlines adopt approaches to improve yield and revenue

Alaska Airlines (ALK) has the lowest yield of $0.148 among all its peers. Its peers include Delta (DAL) at $0.1689, United (UAL) at $0.1614, American (AAL) at $0.1622, and Southwest (LUV) at $0.1602. Revenue management is essential for the airline industry. The industry needs to maximize revenue by selling the most aircraft seats possible to customers at the best price.Industrials Changes in the US airline industry’s competitive landscape

The Airline Deregulation Act of 1978 removed all regulations governing the airline routes, airfares, entry, and exit of commercial airlines. Earlier, this was controlled by the Civil Aeronautics Board (or CAB). Airfares and all other factors would be determined by demand and supply market forces.

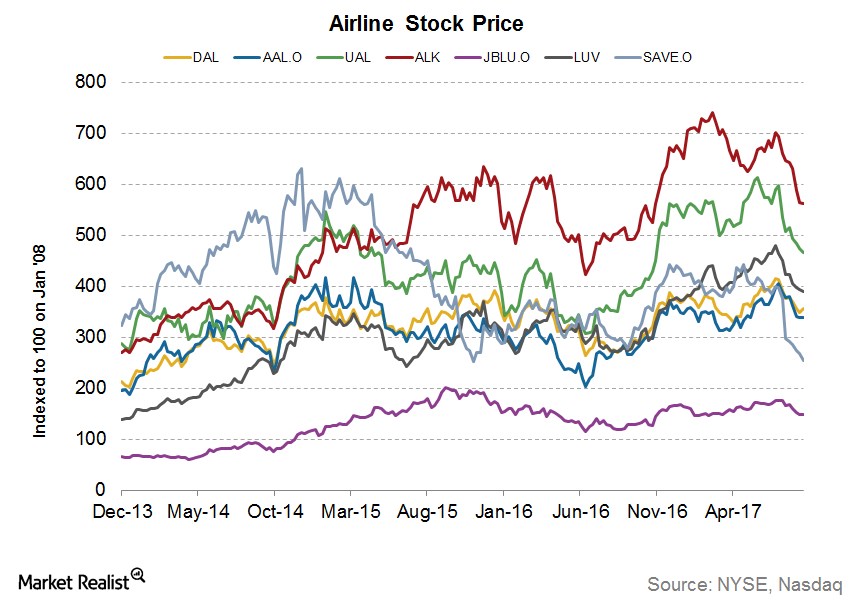

US airline industry: Summary of share prices and valuations

Southwest outperformed all its peers. Its share price increased 2.6% to $33.77 in September. That said, year-to-date results are positive overall.

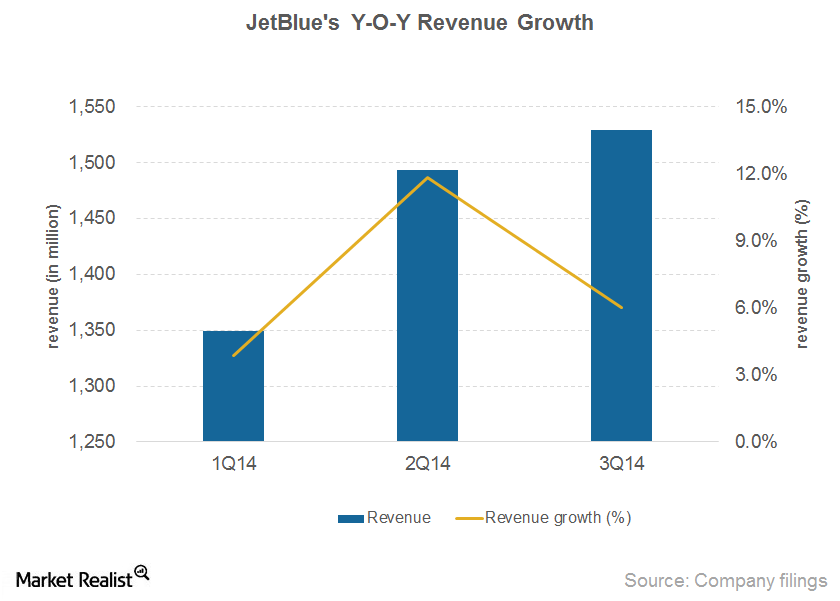

Higher passenger and ancillary revenue drive growth

JetBlue’s operating revenue increased by 6% to $1,529 million in 3Q14. The company states that its on-time performance was impacted by congestion in the air space.Industrials Key growth trends in airline passenger traffic by region

Global passenger traffic has increased by 5.8% year-over-year during the first eight months of 2014. Europe (29.7%), Asia-Pacifc (29.2%), and North America (25%) comprise ~85% of global market share by passenger traffic.

Why Have Some Analysts Become Less Positive on American Airlines?

Out of the 14 analysts tracking American Airlines (AAL), 50% have a “buy” recommendation on the stock as compared to the 71.4% that had a “buy” rating in 2Q16.

Did Delta’s Guidance Cut Prompt a Losing Streak for Airlines?

Delta Air Lines (DAL) stock fell 3.5% after its traffic release on September 5, 2017. The negativity has spread to other players.

Must-know: Alaska Airlines’ aircraft and fuel efficiency

In 2013, Alaska operated a fleet of 131 Boeing 737 jet aircraft. It had contracts with Horizon, Sky West Airlines, and Peninsula Airways for regional capacity. Horizon operated 51 Bombardier Q400 turboprop aircraft. It sells all of its capacity to Alaska according to its capacity purchase agreements.Industrials Why Ebola impacted the airline industry

During fatal disease outbreaks, rules and restrictions are imposed—especially on air transportation. This includes canceling flights to the affected areas.

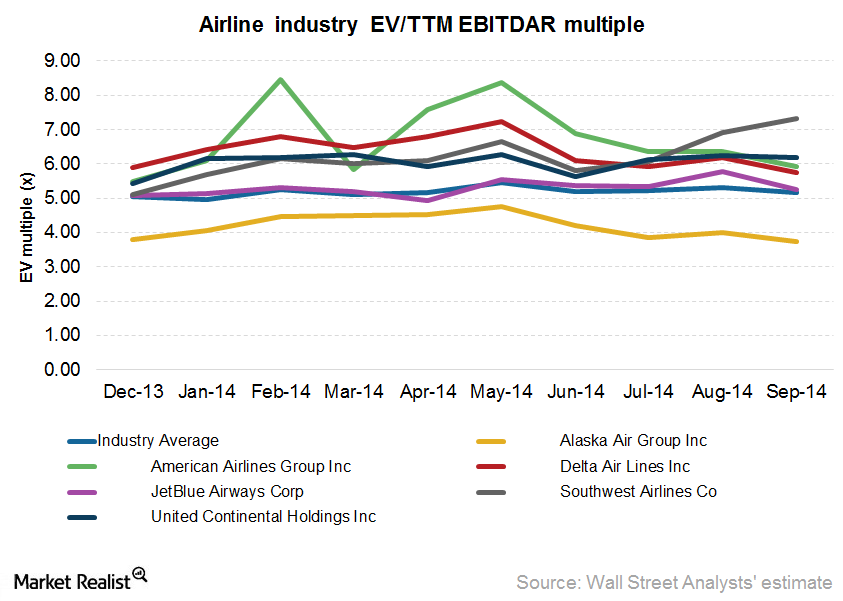

Airline Relative Valuations: What Is Priced In?

The airline industry is capital-intensive, with high levels of depreciation and amortization and varying degrees of debt and operating leases. To neutralize these factors, we use the EV-to-EBITDA ratio to value airline stocks.

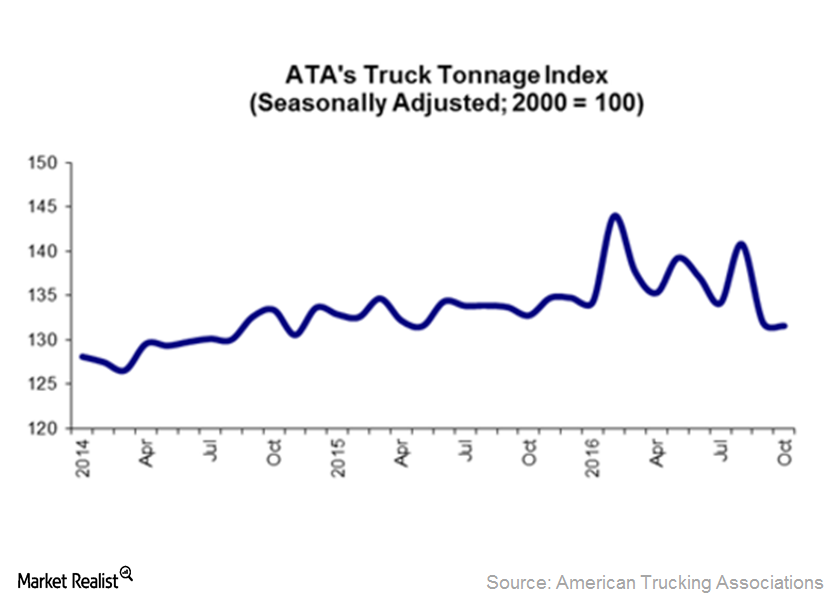

What the Direction of October’s Truck Tonnage Index Indicates

In this article, we’ll look at the direction of the Truck Tonnage Index (or TTI) in October 2016.Industrials Why the Ebola scare led to a 16% drop in the Airline Index

The share prices for major airline companies in the U.S. dropped substantially after the news of the first Ebola case in U.S. on September 30, 2014.

Airlines Passenger Yield Continues to Decline in August 2015

Passenger yield declined by 8% year-over-year for August 2015 to 15.3 cents from 16.6 cents. This is the highest decline since the start of the year.