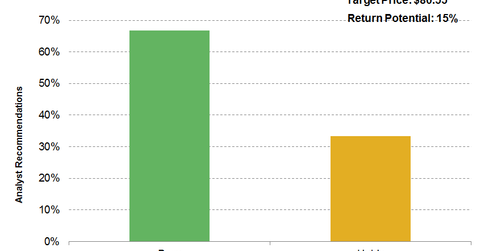

More Analysts Have Turned Positive on Alaska Air Group

Alaska Air Group’s (ALK) consensus 12-month target price is $80.55, which indicates a 15.2% return potential on October 10, 2016.

Dec. 4 2020, Updated 10:52 a.m. ET

Analyst views

Analysts’ recommendations or changes to recommendations can have a significant impact on stock prices. Changes may also indicate a shift in the long-term trend.

According to a Bloomberg consensus, out of the 12 analysts tracking Alaska Air Group (ALK), 66.7% (eight analysts) have a “buy” recommendation on the stock compared with 50% in 2Q16. The remaining 33.3% analysts (four analysts) have a “hold” rating, and none of the analysts have a “sell” rating.

Target price

Alaska Air Group’s (ALK) consensus 12-month target price is $80.55, which indicates a 15.2% return potential on October 10, 2016. Wolfe Research’s Hunter K. Keay has the highest target price of $90 and has maintained the “outperform” rating. Helane Becker from Cowen also has an “outperform” rating with a target price of $87. Buckingham Research Group’s Daniel McKenzie has the lowest target price of $65.

Investors can gain exposure to airlines through the iShares Transportation Average ETF (IYT). IYT holds 5.4% in Alaska Air Group (ALK), ~4.7% in United Continental (UAL), 4.3% in Delta Air Lines (DAL), 3.9% in Southwest Airlines (LUV), 3.6% in American Airlines (AAL), and 1.9% in JetBlue Airways (JBLU).

In the next few articles, we’ll discuss what led to these recommendations, helping investors judge whether analysts are being optimistic or conservative on the stock. We’ll also help you understand what may be priced into the stock.