JetBlue Airways Corp

Latest JetBlue Airways Corp News and Updates

TrueBlue Is JetBlue's New Rewards Program — Check Out the Perks

JetBlue's new rewards program TrueBlue offers expanded levels and more ways to earn perks from the airline. Here's what we know about the program.

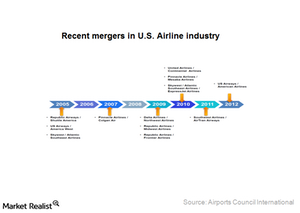

JetBlue and Spirit Want to Merge, Department of Justice Has the Final Say

JetBlue Airways and Spirit Airlines have reached a merger agreement. But the Department of Justice may not permit it as it cracks down on mergers due to antitrust laws.

Masks Are Now Optional on U.S. Airlines — Will It Last?

A federal judge has struck down the mask mandate on airlines — does that mean that passengers are no longer required to wear masks on flights? The latest TSA update.

Why Is JetBlue Canceling Flights? The Real Reason, Revealed

Travelers beware, JetBlue flight cancellations are on the rise and will continue throughout the summer. Why has JetBlue been forced to cancel flights?

JetBlue and American Airlines Formed an Alliance, Not a Merger

Did JetBlue merge with American Airlines? Not quite. The two carriers have partnered for flights that they offer in the northeastern U.S.

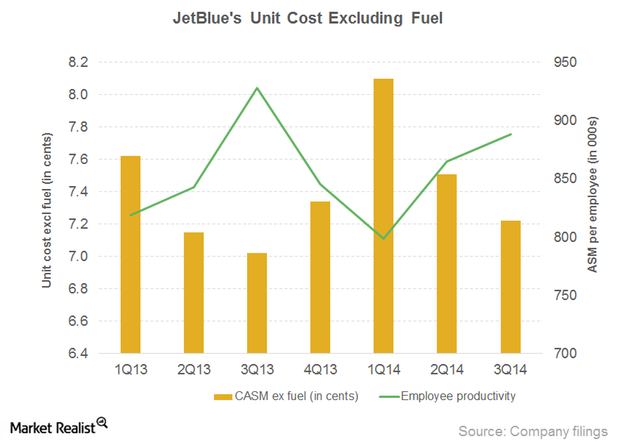

JetBlue’s unit cost growth: Employee costs up, lower productivity

Salary, wages, and benefits increased as a result of higher wage rates. Airlines have also had to increase headcount to adhere to the new Federal Aviation Administration (or FAA) regulations on flight, duty, and rest.

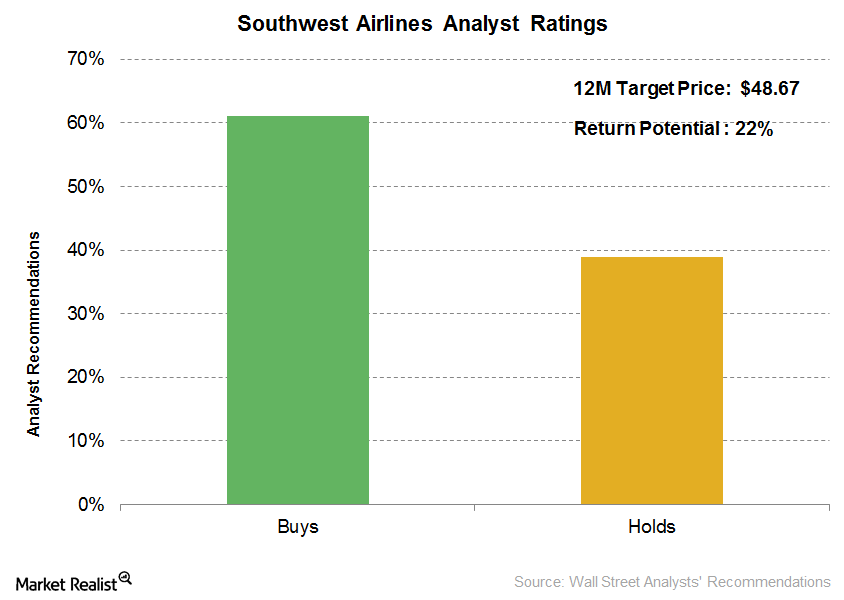

Why Did Analysts Fall Out of Love with Southwest Airlines?

Out of the 18 analysts tracking Southwest Airlines (LUV), 11 analysts (61.1%) have a “buy” recommendation on the stock versus 71% analysts that had a “buy” recommendation on Southwest in 2Q16.

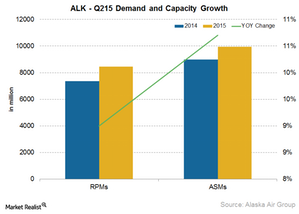

What Helped Alaska Air Group Drive its 2Q15 Earnings?

Adding newer destinations Alaska Air Group (ALK) added a number of new routes in the second quarter of 2015, such as: Boise to Reno Eugene to San Jose, California Los Angeles to Baltimore Los Angeles to Gunnison–Crested Butte Los Angeles to Monterey Los Angeles to San Jose, Costa Rica Portland to Austin Seattle to Charleston […]Industrials Estimating American Airlines’ earnings growth

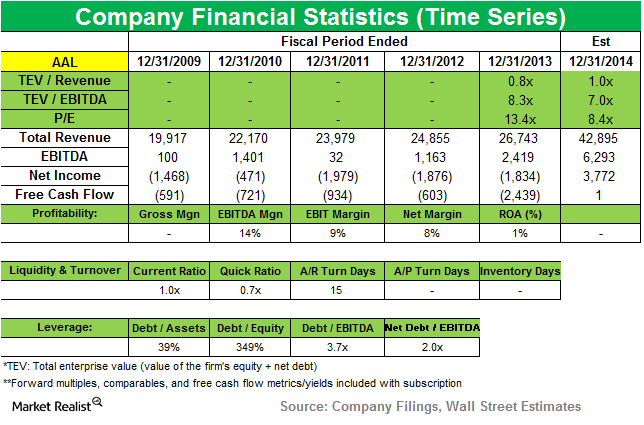

Apart from improved operational efficiencies, American has outperformed its peers in pre-tax margin (excluding special items) improvement in the first half of 2014 to 8.7% from 4.1% in the previous year.Industrials Delta Air Lines’ key strategy to increase shareholder returns

Capital expenditure is generally high in the airline industry. Delta manages to keep it low through its strategy of buying used aircraft.

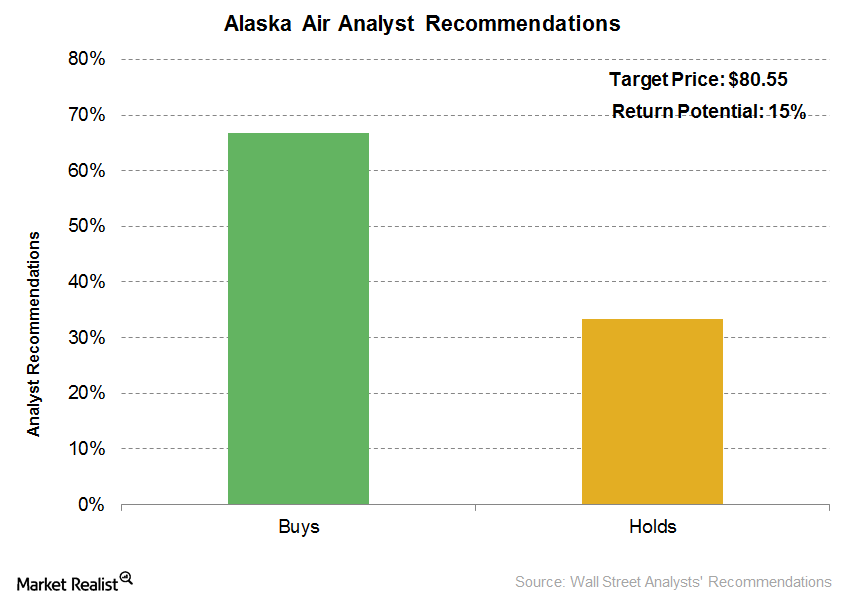

More Analysts Have Turned Positive on Alaska Air Group

Alaska Air Group’s (ALK) consensus 12-month target price is $80.55, which indicates a 15.2% return potential on October 10, 2016.Industrials Must-know: Delta Air Lines’ second quarter earnings

Today, Delta is one of the largest airlines in U.S. providing transportation services for passengers and cargo—it serves almost 165 million customers each year to 225 domestic and 97 international destinations.Industrials United sees major improvement in 3Q14 fuel cost efficiency

United achieved significant fuel cost savings during 3Q14 in the form of lower purchase costs and improved fuel efficiency.Industrials The must-know drivers of air cargo growth for US airlines

According to the IATA, global air freight volume has increased by 4.5%. Capacity, measured by available freight ton kilometers (or AFTK), increased by 3.5% year-over-year in August 2014.

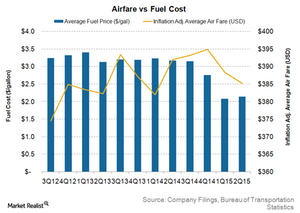

Will Airfares Continue to Decline in 2016?

According to a study by Expedia, airfares fell by about 5% in 2015. Despite this decline, passenger complaints are on the rise. Many consumer leaders also lobbied for airfare reductions.

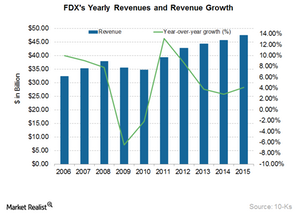

How Did FedEx Grow into One of the Largest Logistics Giants?

In the international arena, FedEx primarily competes with DHL, United Parcel Service (UPS), and foreign postal authorities.Industrials Why United Continental’s high-cost structure affects its margins

In 2013, almost 57% of United’s (UAL) $37,030 million total operating costs comprised fuel costs (33%) and salaries (23%), compared to Delta’s 46%.

American Airlines gets significantly lower position in Appaloosa

Appaloosa Management significantly lowered its position in American Airlines (AAL) in the third quarter that ended in September 2014. The position accounts for 3.81% of the fund’s total third-quarter portfolio.Industrials Changes in the US airline industry’s competitive landscape

The Airline Deregulation Act of 1978 removed all regulations governing the airline routes, airfares, entry, and exit of commercial airlines. Earlier, this was controlled by the Civil Aeronautics Board (or CAB). Airfares and all other factors would be determined by demand and supply market forces.

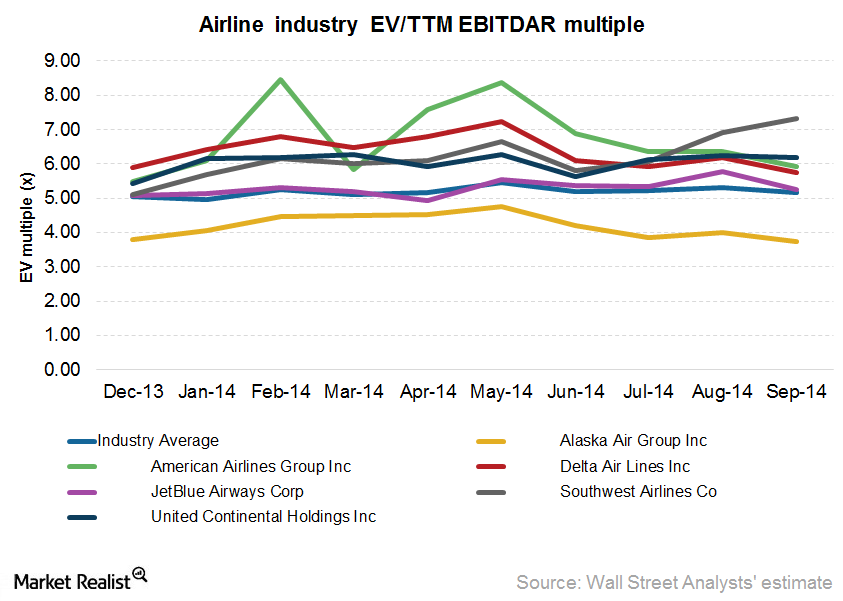

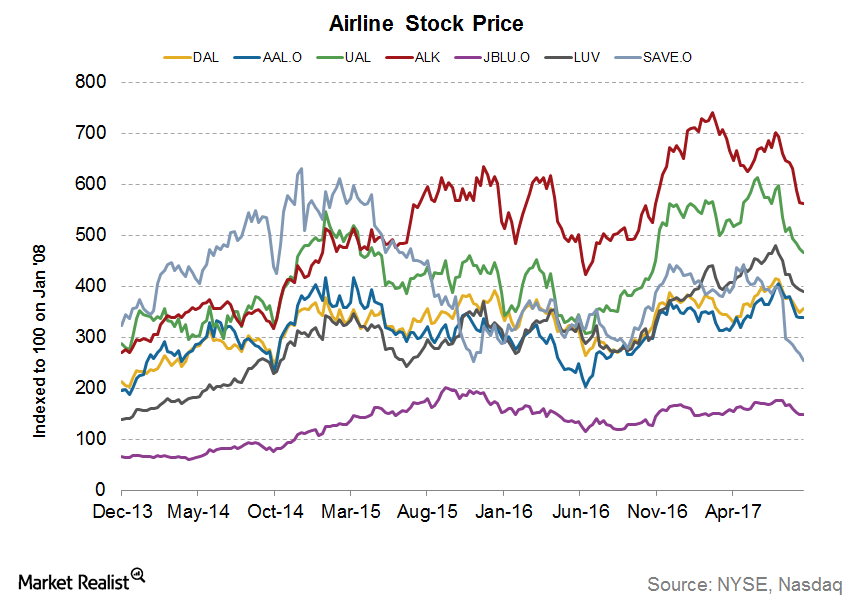

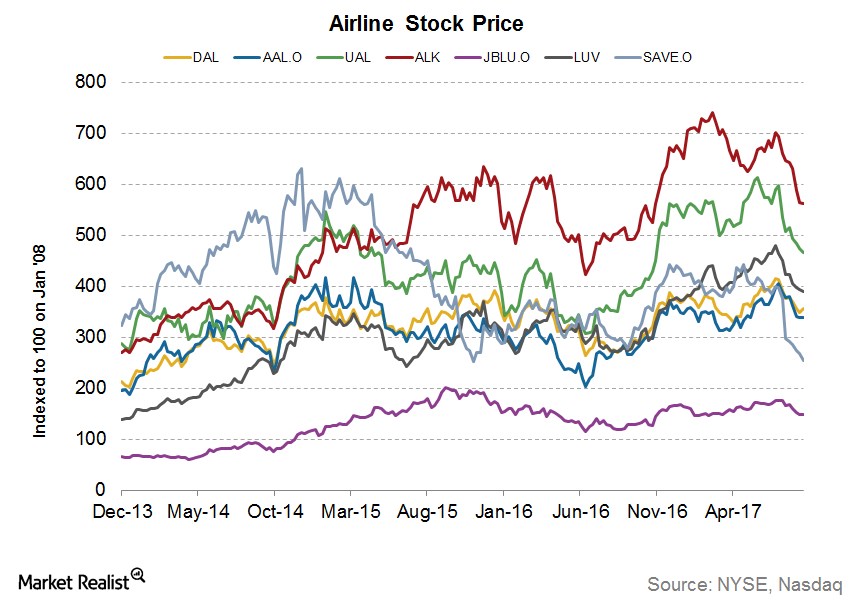

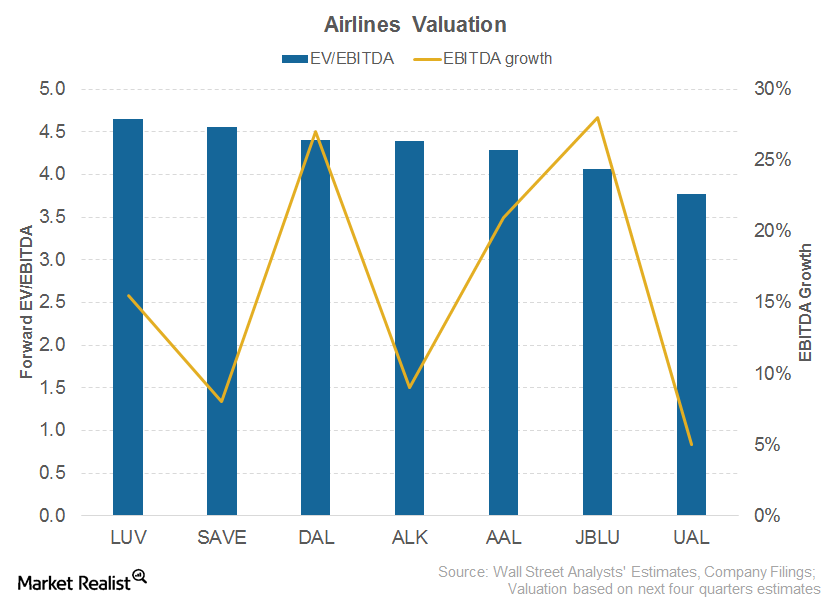

US airline industry: Summary of share prices and valuations

Southwest outperformed all its peers. Its share price increased 2.6% to $33.77 in September. That said, year-to-date results are positive overall.

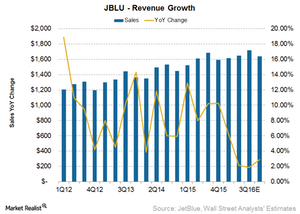

Are Analysts Expecting JetBlue Airways’s Revenue to Grow in 2Q16?

Analysts are estimating 2Q16 revenue of ~$1.7 billion for JetBlue Airways (JBLU), which is a year-over-year increase of 2.2%.

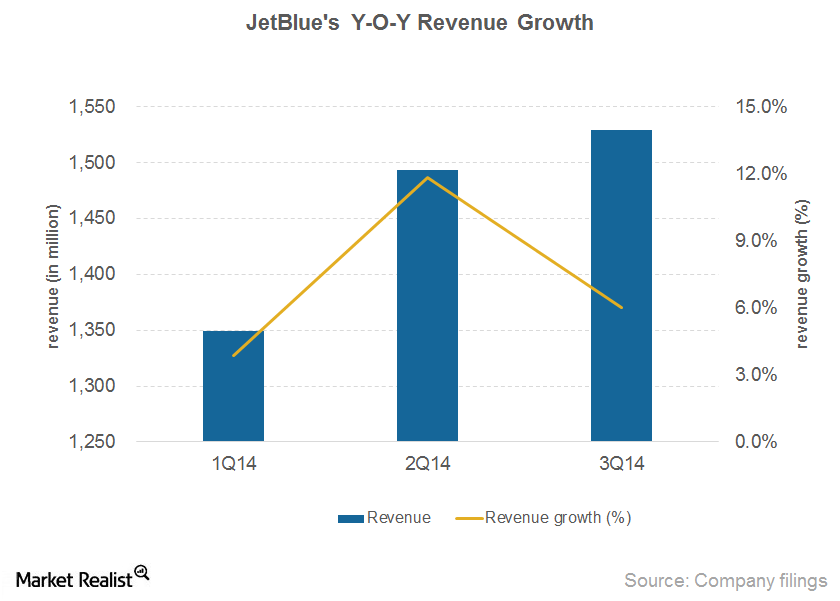

Higher passenger and ancillary revenue drive growth

JetBlue’s operating revenue increased by 6% to $1,529 million in 3Q14. The company states that its on-time performance was impacted by congestion in the air space.

How American Airlines Stock Reacted to Its Guidance Update

American Airlines (AAL) stock rose almost 0.94% on September 12, the day of its traffic release.Industrials Key growth trends in airline passenger traffic by region

Global passenger traffic has increased by 5.8% year-over-year during the first eight months of 2014. Europe (29.7%), Asia-Pacifc (29.2%), and North America (25%) comprise ~85% of global market share by passenger traffic.

Did Delta’s Guidance Cut Prompt a Losing Streak for Airlines?

Delta Air Lines (DAL) stock fell 3.5% after its traffic release on September 5, 2017. The negativity has spread to other players.

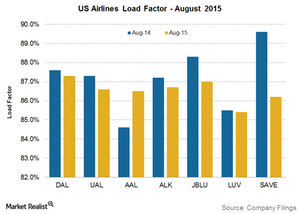

US Airlines Capacity Growth Outpaces Demand, Load Factor Drops

Decreasing load factors across the airline industry mean that airlines are not able to fill up their seats as fast as they are adding seats. This justifies investor fears of overcapacity.

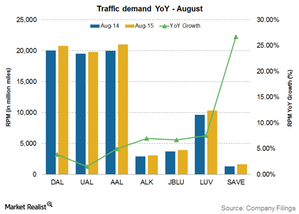

Airline Industry Demand Continues to Grow in August

The demand for air travel experienced considerable growth in the month of August, driven by traditional vacation travel as well as lower fares of major air carriers.

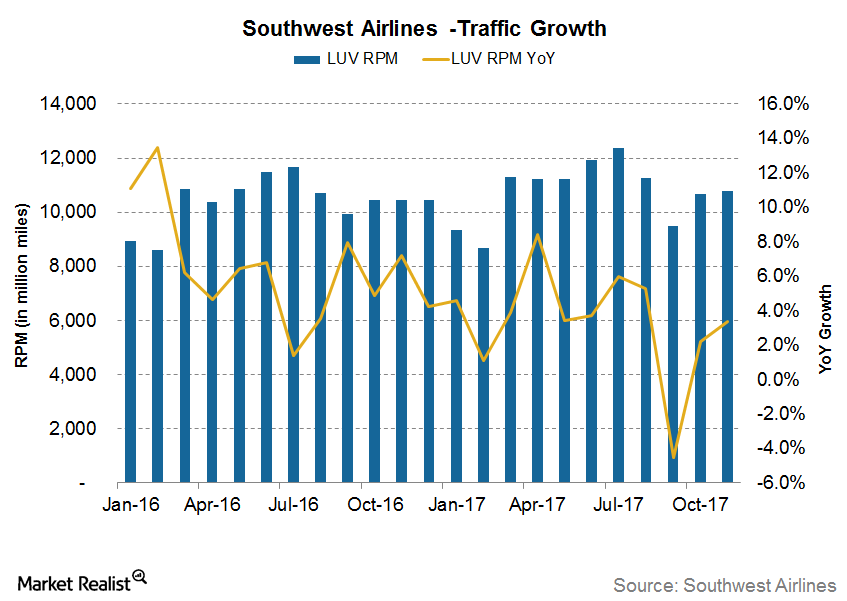

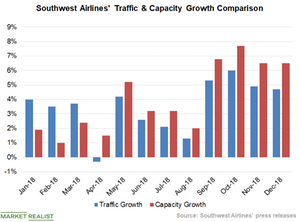

Is Southwest’s Demand Growth Enough to Fill Its Added Capacity?

In November 2017, Southwest Airlines’ (LUV) traffic grew 3.4% year-over-year (or YoY). This growth was higher than its capacity growth of 2.5% YoY in the same month.

Airline Relative Valuations: What Is Priced In?

The airline industry is capital-intensive, with high levels of depreciation and amortization and varying degrees of debt and operating leases. To neutralize these factors, we use the EV-to-EBITDA ratio to value airline stocks.

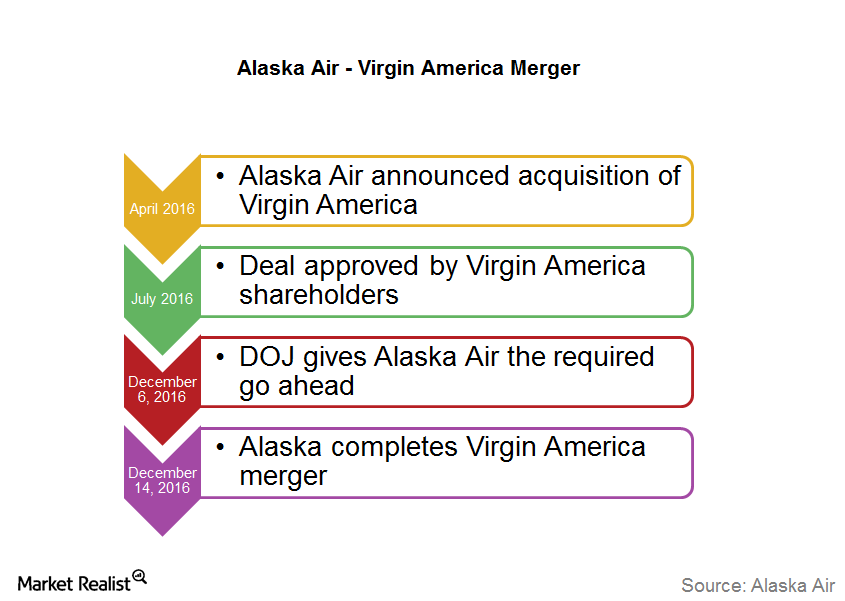

Alaska Air Group Completes Virgin America Merger

On April 4, 2016, Alaska Air Group (ALK) announced its acquisition of Virgin America for $57 per share in cash, which amounted to $2.6 billion.

Airlines Passenger Yield Continues to Decline in August 2015

Passenger yield declined by 8% year-over-year for August 2015 to 15.3 cents from 16.6 cents. This is the highest decline since the start of the year.

Spirit Airlines: An Introduction to a Low-Cost Pioneer

Spirit Airlines (SAVE) is headquartered in Miramar, Florida. It’s a pioneer of ultra-low-cost carrier or ULCC airlines.Industrials Delta Air Line’s key operating segments and geographic segments

Delta Air Lines (DAL) derives 65.8% of its revenue from the passenger segment, 2.5% from the cargo segment, and 10.3% from other sources.

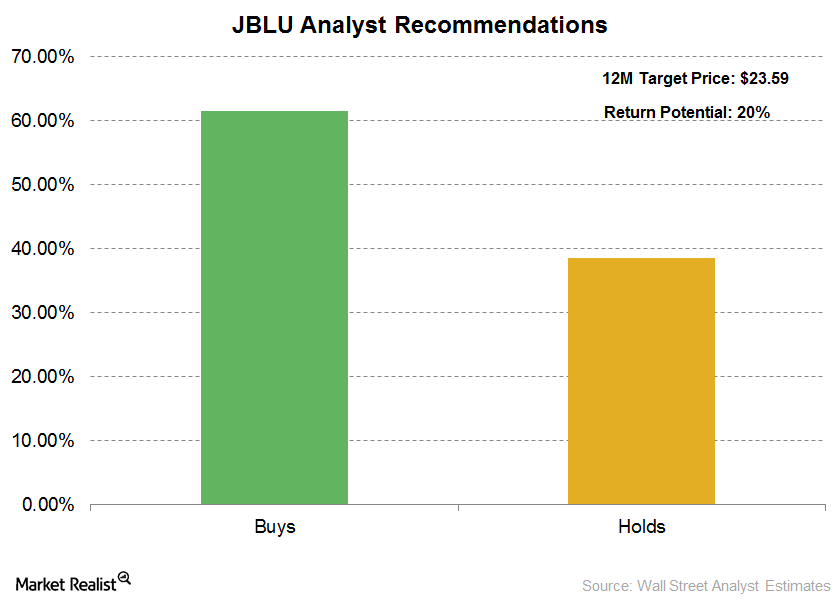

JetBlue Airways: What Are Analysts’ Recommendations?

JetBlue Airways (JBLU) is expected to release its 2Q16 earnings on July 26. According to an analyst consensus, JBLU is expected to earn $0.49 in 2Q16, compared to earnings per share of $0.44 in 2Q15.

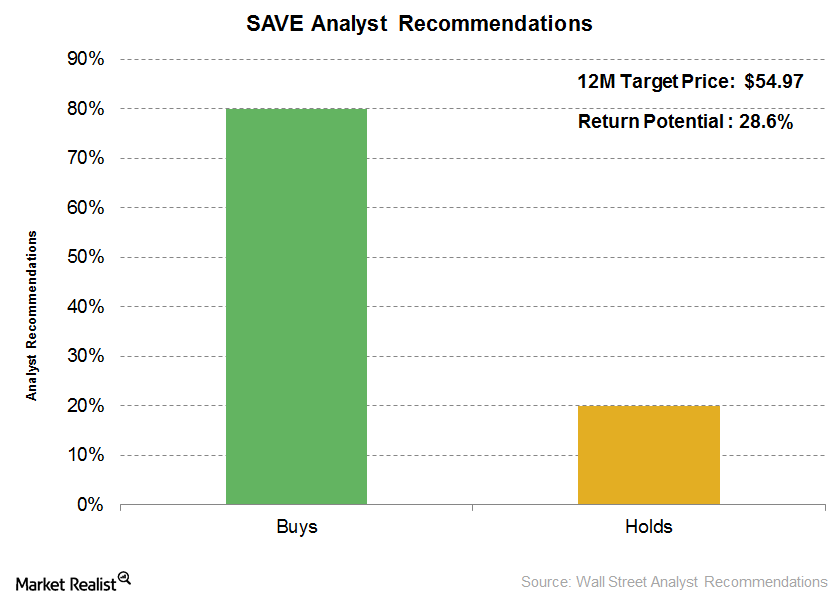

What Are Analysts Estimating for Spirit Airlines in 2016?

Of the 15 analysts rating Spirit Airlines’ stock, 80% (12 analysts) have a “buy” rating, 20% (three analysts) have a “hold” rating, and none of the analysts have a “sell” rating.

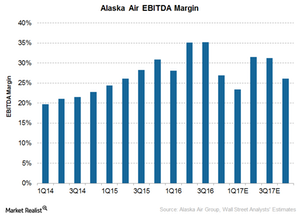

Could Alaska Air Group’s Margin Expand in 2017?

In 1Q17, Alaska Air Group’s (ALK) EBITDA (earnings before interest, tax, depreciation, and amortization) is expected to fall 5.8% to $385 million.

JetBlue Airways Announces Growth Plans amid COVID-19 Crisis

On June 18, to support revenue recovery, JetBlue announced that it will add 30 domestic routes, especially in its leisure markets.

Spirit Airlines Reports Q1 Losses, Plans to Cut Costs

Spirit Airlines (NASDAQ:SAVE) reported its results for the first quarter of fiscal 2020 on Thursday. The company’s first-quarter revenue missed the estimates.

JetBlue Airways’ Q1 Earnings: Losses Could Rise in 2020

JetBlue Airways (NASDAQ:JBLU) will likely report its results for the first quarter of fiscal 2020 on May 7 after the market opens.

United Airlines Will Sell 22 Planes to BOC Aviation amid COVID-19

United Airlines (NYSE:UAL) has fallen 3.7% in pre-market trading as of 7:03 AM ET today. The airline industry has been hit hard by the COVID-19 pandemic.

Low-entry barriers intensify competition in airline industry

Short-term outlook above expectations The IATA (International Air Transport Association) has revised its forecast upwards on global airline profitability after the free fall of crude oil prices in the second half of 2014. Global net profit for 2014 is now estimated at $19.9 billion, higher than $18 billion projected in June. Profitability is expected to […]

Boeing-Embraer Deal on EU Radar: Is Trump to Blame?

Boeing and Embraer are pushing for a joint venture. In a $4.2 billion deal, Boeing is to buy 80% of Embraer’s commercial aircraft division.Industrials Assessing the key drivers of global airline industry growth

There was an overall increase in worldwide passenger traffic and capacity in August. Passenger capacity increase of 5.5% year-over-year and was driven by strong growth in the international market.

JetBlue Stock: Analysts’ Ratings and Target Prices

With a year-to-date return of 21.9%, JetBlue Airways (JBLU) stock is one of the airline industry’s top performers. Here are analysts’ views on the stock.

Is Airbus Trying to Leverage the Boeing MAX Fallout?

French aircraft maker Airbus seems to be leveraging the Boeing (BA) 737 MAX fallout by expanding its aircraft production capacity in China.

Get Real: Third-Quarter Roller Coaster

In today’s Get Real, we saw that several third-quarter results are out and all over the board. We also have recommendations for stocks to watch going forward.

JetBlue Q3 Earnings Soar on High Revenues, Low Costs

JetBlue Airways (JBLU) reported strong Q3 results today. Revenues and earnings beat analysts’ expectations and improved significantly year-over-year.

Delta Air Lines Is Waiting for the 797—Is Boeing Ready?

Last week, Delta Air Lines’ CEO told Bloomberg that the carrier is still hoping Boeing will build a new midmarket airplane, dubbed the Boeing 797.

Southwest Airlines: Traffic Growth Lags the Capacity Growth Rate

Southwest Airlines’ (LUV) traffic or RPM continued to lag its capacity or ASM. The company reported its operating performance on January 8.

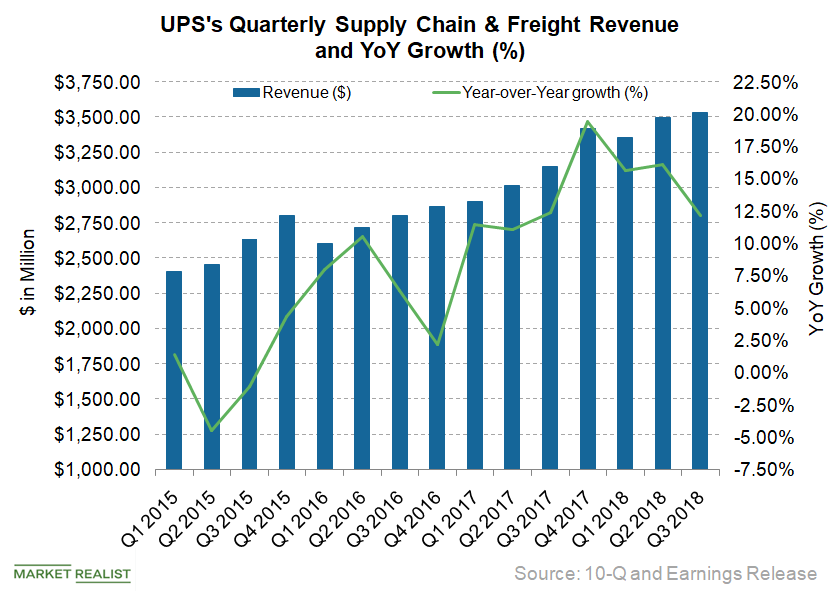

UPS: What Led Its Supply Chain and Freight Growth in Q3 2018?

United Parcel Service’s (UPS) Supply Chain & Freight vertical accounts for ~20% of its total revenues.