iShares Transportation Average

Latest iShares Transportation Average News and Updates

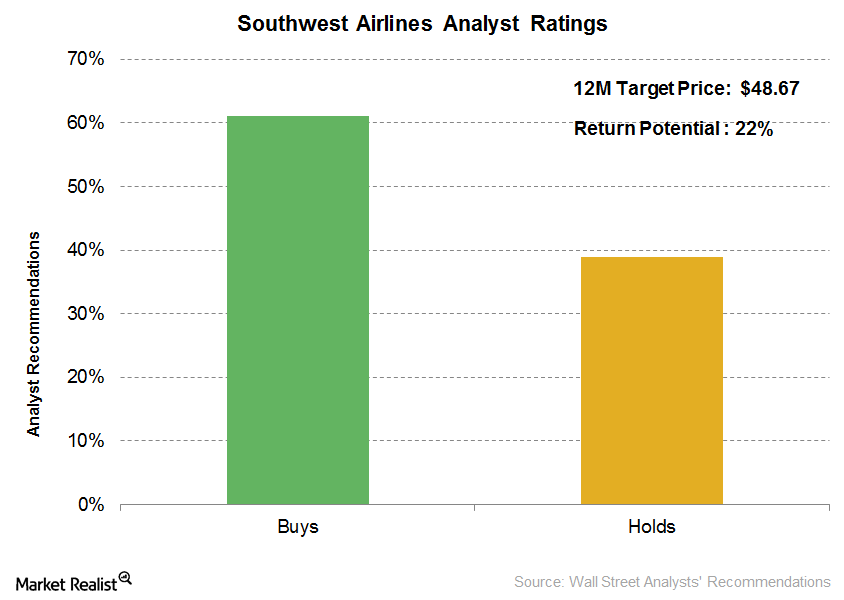

Why Did Analysts Fall Out of Love with Southwest Airlines?

Out of the 18 analysts tracking Southwest Airlines (LUV), 11 analysts (61.1%) have a “buy” recommendation on the stock versus 71% analysts that had a “buy” recommendation on Southwest in 2Q16.

What Helped Alaska Air Group Drive its 2Q15 Earnings?

Adding newer destinations Alaska Air Group (ALK) added a number of new routes in the second quarter of 2015, such as: Boise to Reno Eugene to San Jose, California Los Angeles to Baltimore Los Angeles to Gunnison–Crested Butte Los Angeles to Monterey Los Angeles to San Jose, Costa Rica Portland to Austin Seattle to Charleston […]

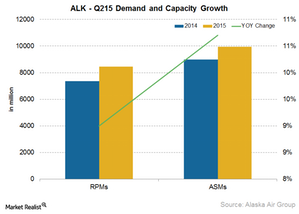

Alaska Airlines Capacity Growth Is Faster than That of Its Peers

Alaska Air Group saw the highest surge in traffic demand and was the leader in capacity growth, with a 6.4% YoY increase in its capacity in July 2015.

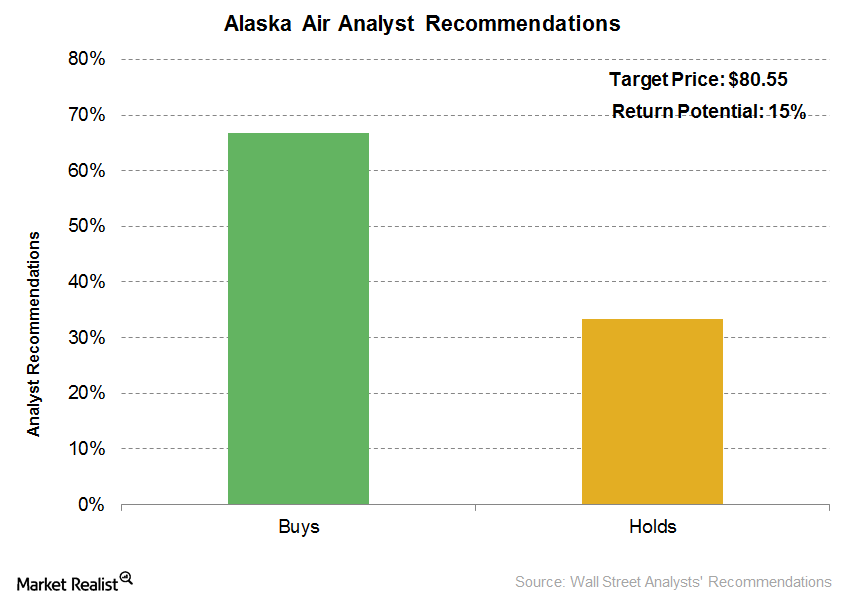

More Analysts Have Turned Positive on Alaska Air Group

Alaska Air Group’s (ALK) consensus 12-month target price is $80.55, which indicates a 15.2% return potential on October 10, 2016.

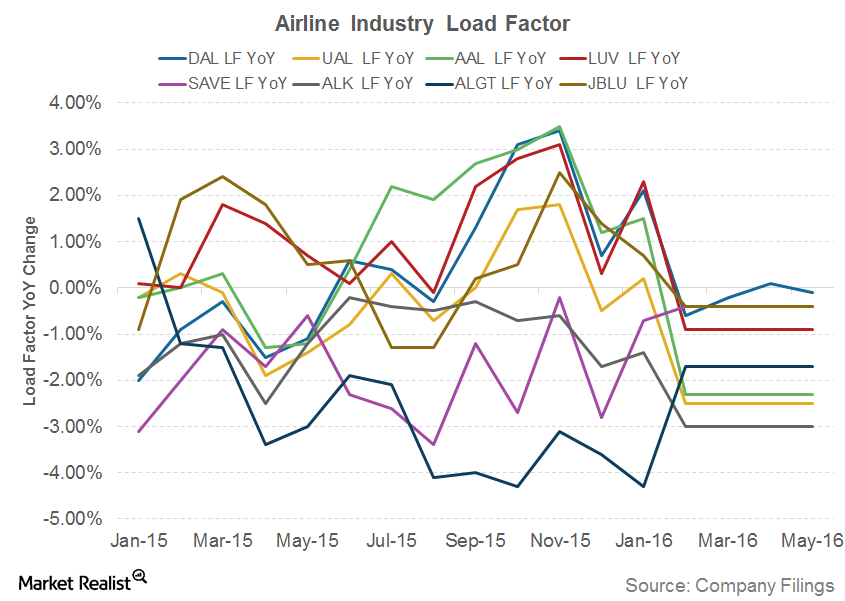

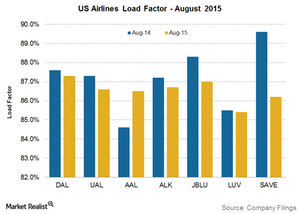

Can Airline Capacity Utilization Improve Going Forward?

Airline capacity utilization is measured using the passenger load factor, which is calculated by dividing traffic numbers by capacity numbers.Industrials United sees major improvement in 3Q14 fuel cost efficiency

United achieved significant fuel cost savings during 3Q14 in the form of lower purchase costs and improved fuel efficiency.Industrials The must-know drivers of air cargo growth for US airlines

According to the IATA, global air freight volume has increased by 4.5%. Capacity, measured by available freight ton kilometers (or AFTK), increased by 3.5% year-over-year in August 2014.

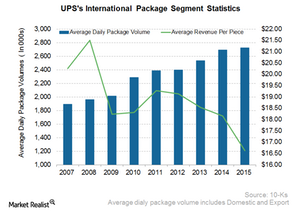

UPS’s Second-Largest Segment: International Package Segment

United Parcel Service’s international package segment includes small package operations in Europe, Asia-Pacific, Canada, Latin America, the Indian subcontinent, the Middle East, and Africa.

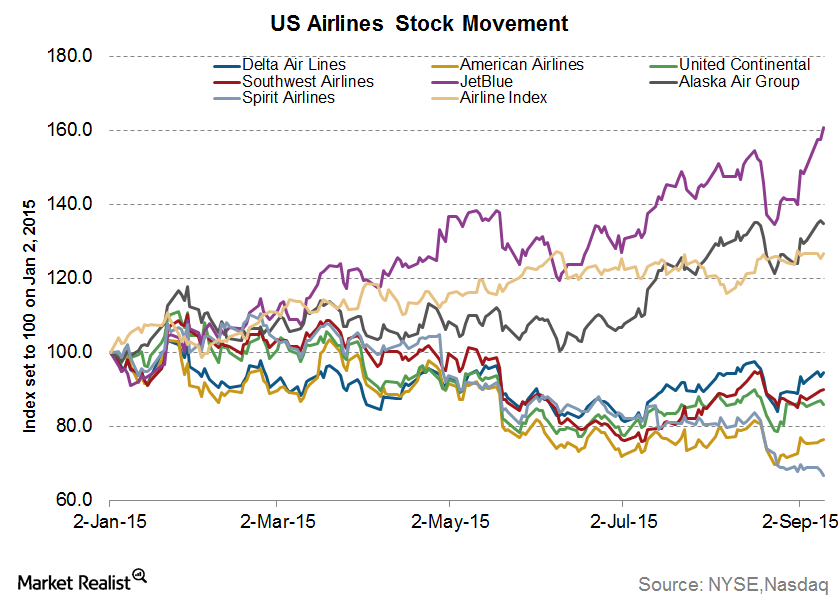

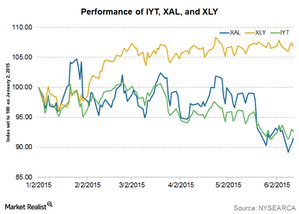

Most Airline Stocks Continue to Tumble in August

In 2015, most airline stocks have fallen, and the NYSE ARCA Airline Index (XAL), which is composed of the major US airline stocks, has also tumbled as much as 13.5% year-to-date.Industrials Why it’s important for airlines to improve load factor

Load factor measures capacity utilization. It indicates the percentage of total capacity that an airline utilizes. Airlines are capital intensive. They have high fixed costs.Industrials Key growth trends in airline passenger traffic by region

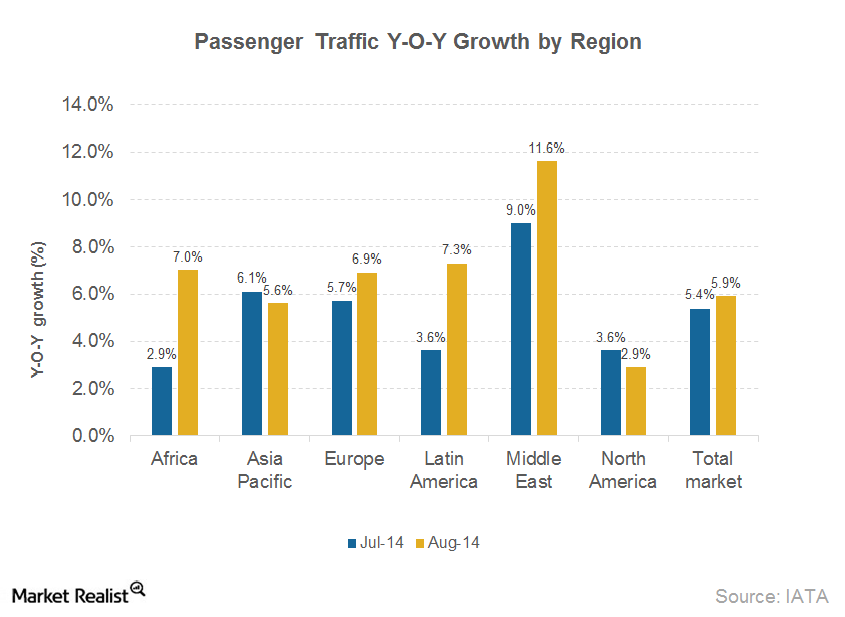

Global passenger traffic has increased by 5.8% year-over-year during the first eight months of 2014. Europe (29.7%), Asia-Pacifc (29.2%), and North America (25%) comprise ~85% of global market share by passenger traffic.

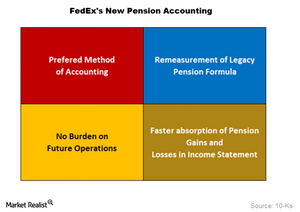

Why Did FedEx Switch to Mark-to-Market Pension Accounting?

FedEx suffered a loss of $895.0 million in connection with the shift to new pension accounting in 2015.

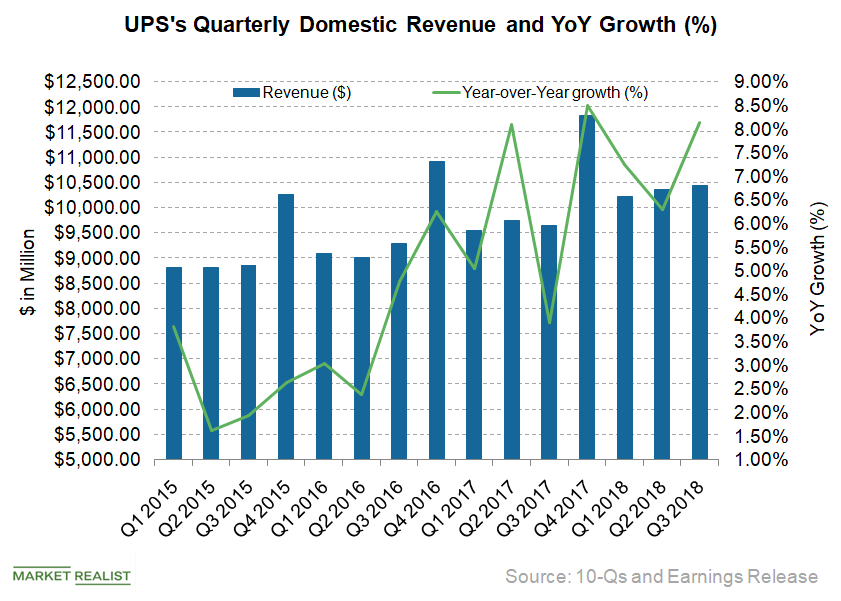

A Look into UPS’s Domestic Package Segment

UPS’s Domestic Package segment provides an array of guaranteed ground and air package transportation services, depending on the customer’s need.

FedEx Tax Bill: CEO Challenges New York Times’ Claims

FedEx (FDX) CEO Frederick Smith slammed the New York Times for its story about FDX’s tax bill. In a statement, Smith challenged the publisher to a debate.

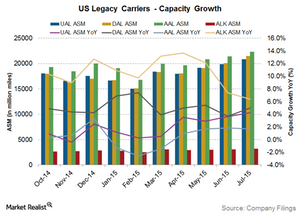

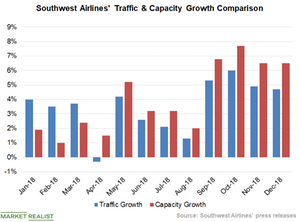

US Airlines Capacity Growth Outpaces Demand, Load Factor Drops

Decreasing load factors across the airline industry mean that airlines are not able to fill up their seats as fast as they are adding seats. This justifies investor fears of overcapacity.

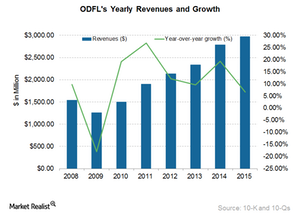

How Old Dominion Freight Line Dominates the Less-Than-Truckload Industry

Old Dominion Freight Line (ODFL) is the United States’ major provider of regional, interregional, and national LTL (less-than-truckload) services.

FedEx Delivers Strong Fourth-Quarter Earnings

FedEx (FDX) announced its fourth-quarter earnings after the market closed on June 19. FedEx surpassed analysts’ adjusted EPS estimate by 3.6%.

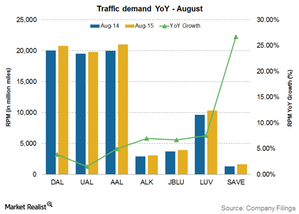

Airline Industry Demand Continues to Grow in August

The demand for air travel experienced considerable growth in the month of August, driven by traditional vacation travel as well as lower fares of major air carriers.

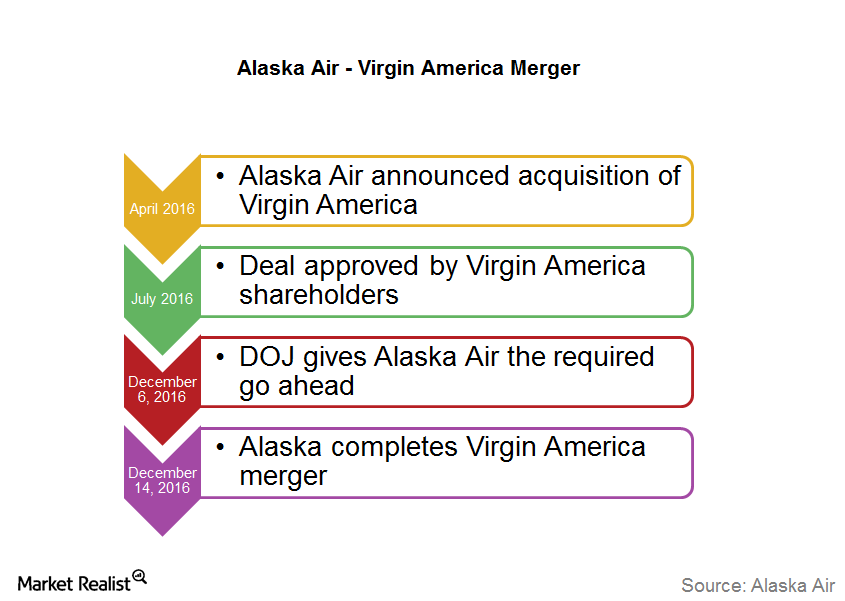

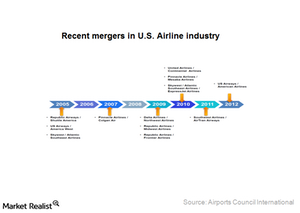

Alaska Air Group Completes Virgin America Merger

On April 4, 2016, Alaska Air Group (ALK) announced its acquisition of Virgin America for $57 per share in cash, which amounted to $2.6 billion.

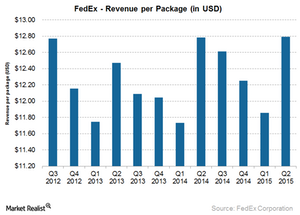

FedEx’s New Pricing Policy Improves Its Efficiency

Effective January 2015, FedEx changed its pricing policy for all of its FedEx Ground packages less than 3 cubic feet to a “dimensional weight pricing” mechanism.

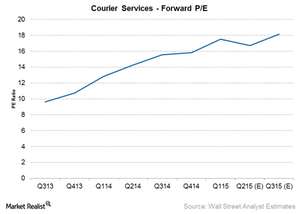

Analyzing the Valuation Trend of Courier Services

The economic upturn since 2009 has improved growth prospects for the courier companies. This coupled with improving industry margins has led to improving industry valuations.

Airlines Passenger Yield Continues to Decline in August 2015

Passenger yield declined by 8% year-over-year for August 2015 to 15.3 cents from 16.6 cents. This is the highest decline since the start of the year.

The global airline industry contributes to economic development

With 16,000 unique city pairs, connectivity by air is estimated to have doubled in the past two decades. Moreover, although demand continues to rise, the price of travel has fallen.

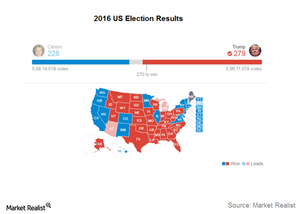

Initial Reactions from the Travel Industry after Trump’s Win

Just a few days ago, we wrote about how Trump had received very little support from the travel industry. Now that he’s been elected, what’s next?

The Economic Costs That Come with Climate Goals

Climate-related policies and a transition to a low-carbon economy require capital, and most countries are already burdened with high debt.

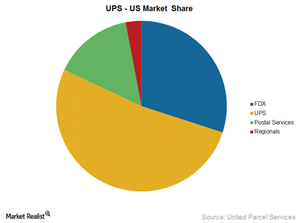

How Is UPS Valued Compared to Its Peers?

UPS’s forward PE ratio stands at 17.1x compared to its current PE ratio of 22.3. Analysts are expecting UPS’s earnings to grow in the next four quarters.

Analyzing the Key Variables for the Airline Industry

Investors should keep an eye on airfare trends. Despite a 40% fall in crude oil prices—the major cost for airlines—airfares have remained fairly stable.

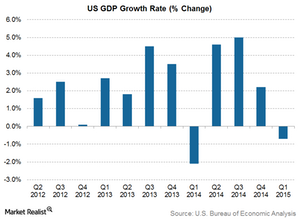

What are UPS’s Revenue Drivers?

Revenue drivers There are three main drivers of revenue growth for United Parcel Service (UPS): package volumes, product mix and pricing, and fuel surcharges. Package volumes and product mix and pricing are in turn driven by economic growth. Economic growth Increasing economic growth increases e-commerce demand, which in turn increases demand for courier services. […]

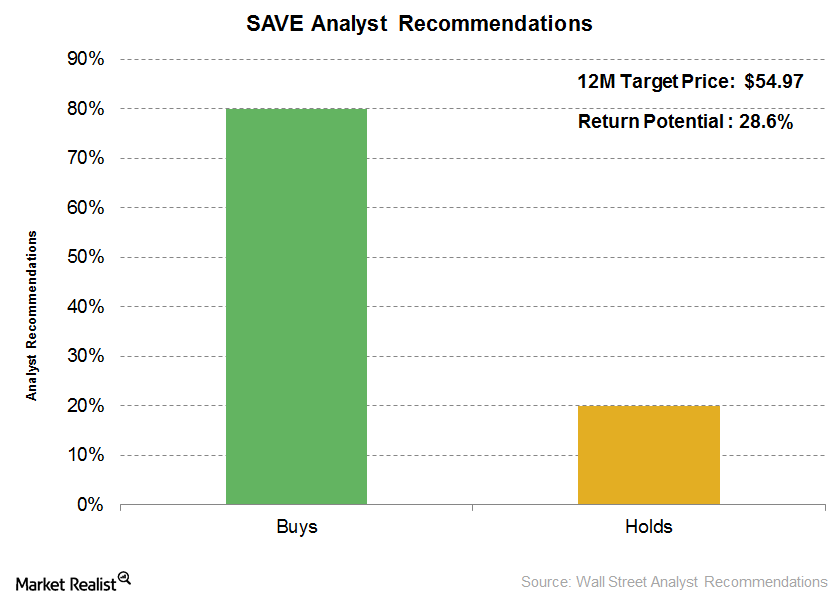

What Are Analysts Estimating for Spirit Airlines in 2016?

Of the 15 analysts rating Spirit Airlines’ stock, 80% (12 analysts) have a “buy” rating, 20% (three analysts) have a “hold” rating, and none of the analysts have a “sell” rating.

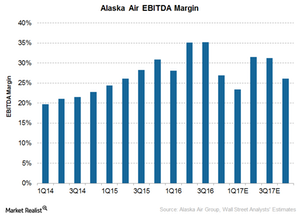

Could Alaska Air Group’s Margin Expand in 2017?

In 1Q17, Alaska Air Group’s (ALK) EBITDA (earnings before interest, tax, depreciation, and amortization) is expected to fall 5.8% to $385 million.

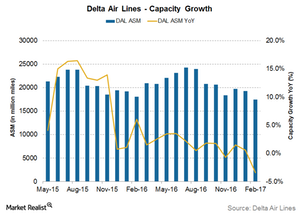

Delta Air Lines: On the Right Route to Achieve Capacity Guidance?

Delta Air Lines (DAL) has maintained a low-capacity growth profile throughout 2017. For May 2017, DAL’s capacity growth was flat at 22,072 million miles.

Low-entry barriers intensify competition in airline industry

Short-term outlook above expectations The IATA (International Air Transport Association) has revised its forecast upwards on global airline profitability after the free fall of crude oil prices in the second half of 2014. Global net profit for 2014 is now estimated at $19.9 billion, higher than $18 billion projected in June. Profitability is expected to […]

Why FedEx Stock Fell More than 4% Yesterday

FedEx stock fell 4.4% yesterday following an earnings estimate reduction and fears that a trade deal between the US and China could be delayed.Industrials Assessing the key drivers of global airline industry growth

There was an overall increase in worldwide passenger traffic and capacity in August. Passenger capacity increase of 5.5% year-over-year and was driven by strong growth in the international market.

JetBlue Stock: Analysts’ Ratings and Target Prices

With a year-to-date return of 21.9%, JetBlue Airways (JBLU) stock is one of the airline industry’s top performers. Here are analysts’ views on the stock.

United Airlines Stock: Is It Worth Buying Right Now?

Analysts have remained bullish about United Airlines stock. The analysts polled by Reuters provided a consensus “buy” recommendation on the stock.Industrials An investor’s must-know overview of the airline industry

The global airline industry is large and complex, offering opportunity for informed investors. The largest U.S. carriers are Delta Air Lines (DAL), United Continental (UAL), American Airlines (AAL), and Southwest Airlines (LUV).

FedEx Stock: Analysts’ Ratings and Target Prices

Back-to-back dismal quarterly performance and a downbeat outlook have kept analysts increasingly cautious about FedEx’s (FDX) growth prospects.

FedEx Teams Up with Google Wing to Test Drone Delivery

FedEx (FDX) has teamed up with Alphabet’s (GOOGL) Wing to make drone delivery a reality. Let’s take a closer look at how.

Delta: Lowest Cancellation Rate of Top Four US Airlines

In August, Delta Air Lines had the lowest flight cancellation rate and the best on-time performance versus its top peers—Southwest, United, and American.

737 MAX: American, United Extend Cancellations Again

Two major US airlines that own Boeing’s (BA) 737 MAX planes have pulled the model from their schedules until early December.

UPS Enters Self-Driving Race, Buys Stake in TuSimple

United Parcel Service (UPS) has joined the self-driving vehicle race. Last week, the company announced its purchase of a minority stake in autonomous tech startup TuSimple. The delivery giant made the investment following the results of ongoing self-driving truck road tests. However, neither company has disclosed the investment amount. Founded in 2015, TuSimple is trying […]

Kansas City Southern Outshines Its Peers in Q2

Kansas City Southern (KSU) stock opened nearly 3% higher on Friday after reporting better-than-expected second-quarter results.

FedEx Focuses on Cost-Cutting Measures to Boost Profitability

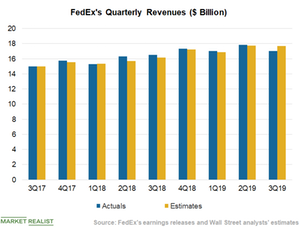

FedEx’s (FDX) fiscal 2019 third-quarter adjusted EPS of $3.03 fell 18.5% from its EPS of $3.72 in the third quarter of fiscal 2018.

Analysts Lower Target Price on FedEx after Its 2019 Outlook Cut

Most analysts reduced their target prices on FedEx after the delivery giant trimmed its fiscal 2019 earnings outlook.

Southwest Stock Rose on Speculation about Warren Buffett Takeover

Southwest Airlines (LUV) rose over 4% yesterday on social media speculation that Warren Buffett’s Berkshire Hathaway is considering a takeover bid.

UPS Hikes Its Dividend

On February 15, UPS announced that it raised its quarterly dividend rate 5.5% to $0.96 from $0.91 paid in November.

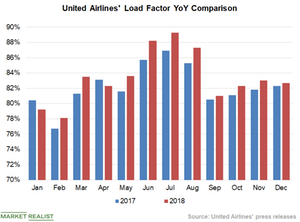

United Airlines’ Utilization Rate Continued to Expand

Disciplined capacity additions, promotional offers, and marketing strategies to drive traffic have helped United Airlines improve its utilization rate.

Southwest Airlines: Traffic Growth Lags the Capacity Growth Rate

Southwest Airlines’ (LUV) traffic or RPM continued to lag its capacity or ASM. The company reported its operating performance on January 8.

UPS: Decoding Its Domestic Segment’s Q3 Revenue Growth

In the third quarter, the US Domestic Package segment’s revenues jumped 8.1% YoY to $10.4 billion from $9.6 billion in the third quarter of 2017.