Why Did FedEx Switch to Mark-to-Market Pension Accounting?

FedEx suffered a loss of $895.0 million in connection with the shift to new pension accounting in 2015.

Nov. 20 2020, Updated 4:03 p.m. ET

FedEx’s mark-to-market pension accounting

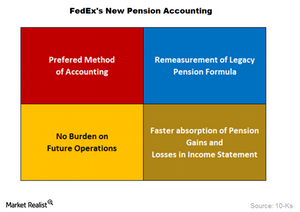

FedEx (FDX) announced a change in its accounting method for defined benefits pension and postretirement healthcare benefits on June 12, 2015. The company moved to this method to recognize actuarial gains and losses related to postretirement and pension. Earlier, the company used to amortize such gains and losses over a period of years. This shift will enable a clearer picture of the performance of pension plans.

Why the shift to new pension accounting?

FDX chose mark-to-market pension accounting for a variety of reasons. Instant recognition of gains and losses in the income statement is the most popular way of accounting for these plans because the method aligns the income statement treatment with the treatment required to measure the related assets and liabilities in the balance sheet.

Secondly, the accumulated actuarial losses relate mainly to the measurement of FDX’s legacy pension formula. The company had locked this formula for a substantial number of employees since 2008. In the wake of the low-interest-rate era and demographic assumption changes, the importance of these accumulated losses increased over a period. Amortization of such losses into future periods would have resulted in burdening future operations for legacy benefits costs.

The company is required to record year-end adjustments to its financial statements on an annual basis for the net funded status of its pension and postretirement healthcare plans. The funded status of FDX’s pension plans also influences its cash position. However, the cash funding rules operate on a different set of assumptions and standards than those used for financial reporting purposes.

The impact on FDX’s income statement

In connection with the adoption of new pension accounting, FDX recorded a charge of $2.1 billion and $15.0 million in 2015 and 2014, respectively. However, it reported a gain of $1.3 billion in 2013 in connection with mark-to-market adjustment of retirement plans. FedEx suffered a loss of $895.0 million, net of tax, in connection with the shift to new pension accounting in 2015. This annual adjustment is representative of the actual return on pension plan assets and changes in discount rates.

This led to a fall of 3.3% in FDX’s stock price on the day of the earnings announcement. On the same day, arch rival United Parcel Service’s (UPS) share went up by ~0.44%. FDX’s peers include Air Transport Service Group (ATSG), Singapore Post (SPSTY), Royal Mail (ROYMF), and TNT Express (TNTEY).

FedEx makes up 12.5% of the iShares Transportation Average ETF (IYT). Investors interested in the trucking (JBHT) and railroads (UNP) space can also consider IYT since it invests 11.6% in major US trucking companies and 20.8% in railroads.

Though FDX is one of the world’s most admired companies, it is ranked number two in terms of global logistics service providers. United Parcel Service (UPS) has the top position. Are FDX’s operating margins keeping it out of the top position? We’ll look at this question in the next part of the series.