Alaska Air Group Inc

Latest Alaska Air Group Inc News and Updates

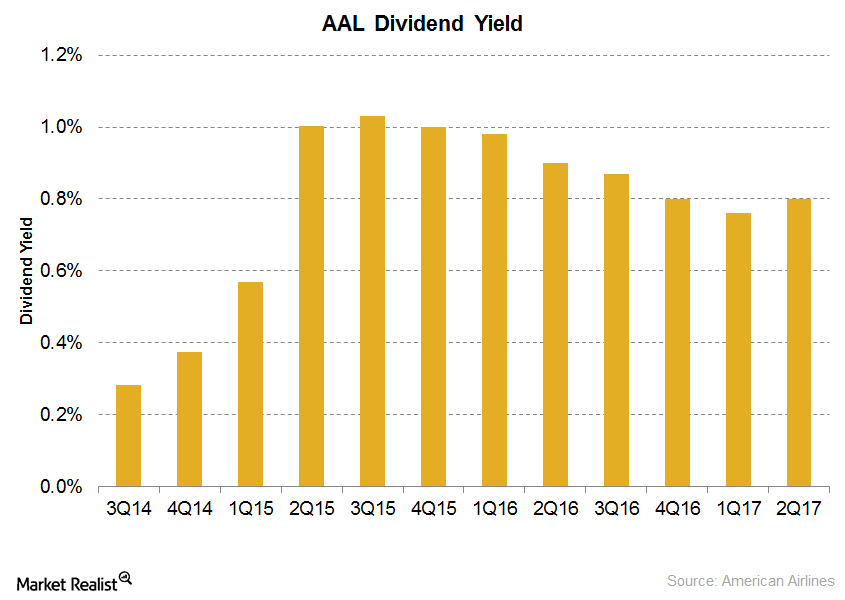

A Look at American Airlines’ Dividend Payouts

Only four airlines—Delta Air Lines (DAL), Southwest Airlines (LUV), American Airlines (AAL), and Alaska Air Group (ALK)—pay dividends to investors.

Could American Airlines’ Unit Revenues Decline in 2H17?

TK

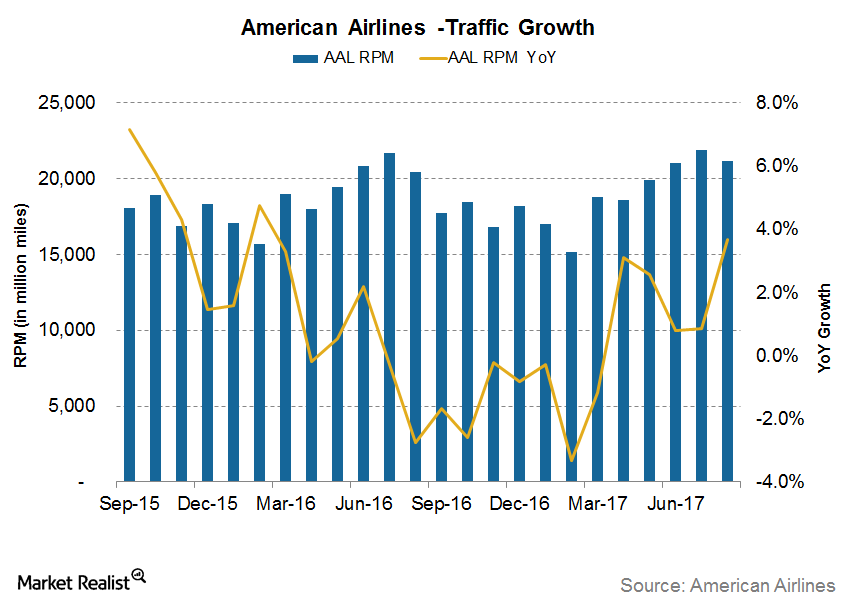

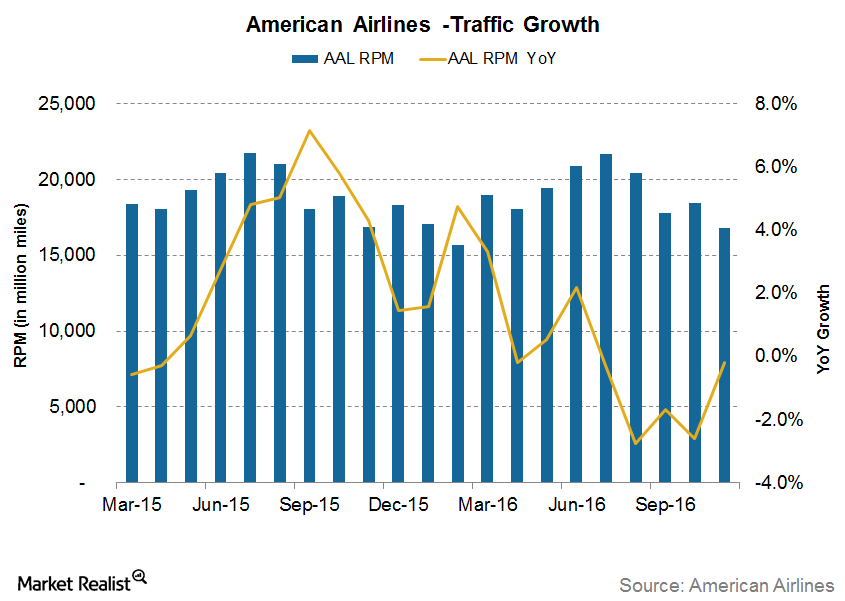

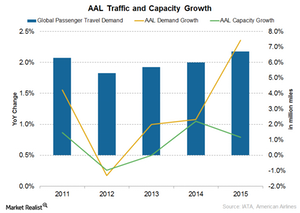

American Airlines’ Traffic Growth Exceeds Its Capacity Growth

For August 2017, AAL’s international traffic increased 6.9% year-over-year. Year-to-date, its international traffic has increased 5.5% YoY.

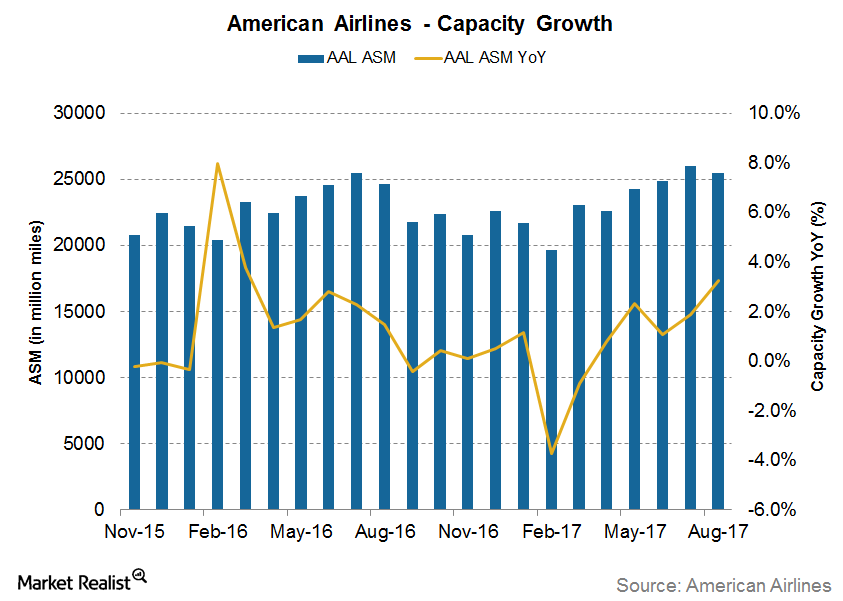

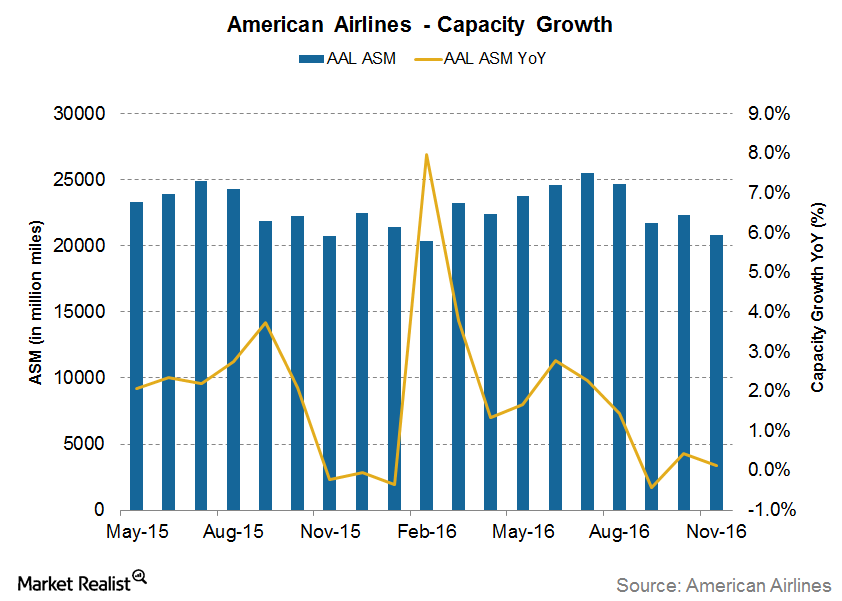

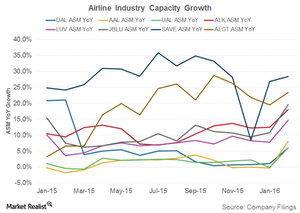

American Airlines’ Capacity Outpaced Its Legacy Peers in August

American Airlines’ (AAL) capacity grew 3.2% year-over-year in August, significantly higher than its 0.4% year-over-year growth reported in the previous seven months.

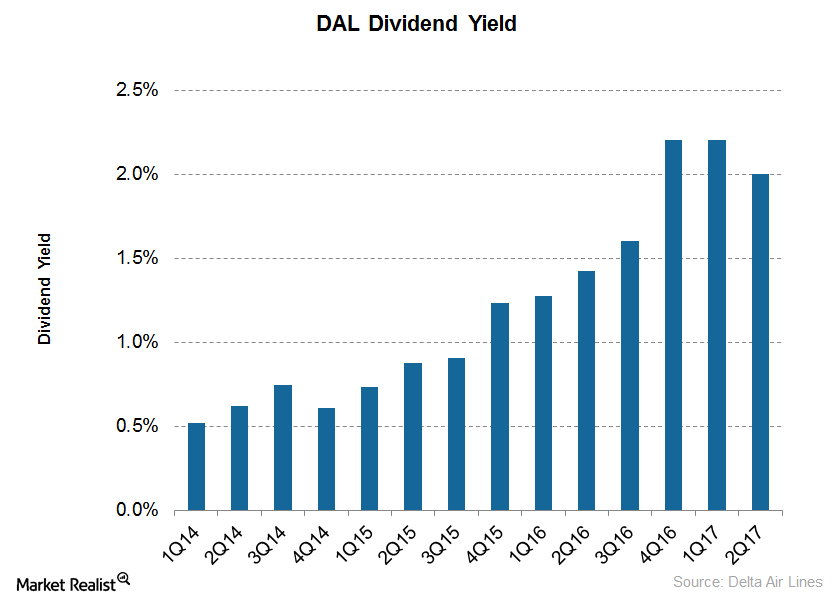

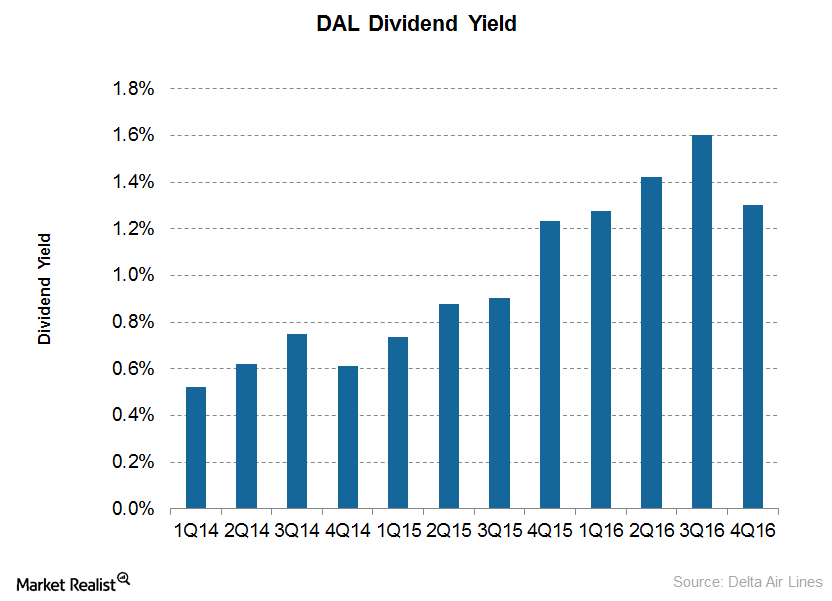

Can Delta Continue to Be the Best Airline Dividend Payer?

Delta Air Lines (DAL) has an indicated dividend yield of 2.0%, the highest among the four airlines that pay dividends.

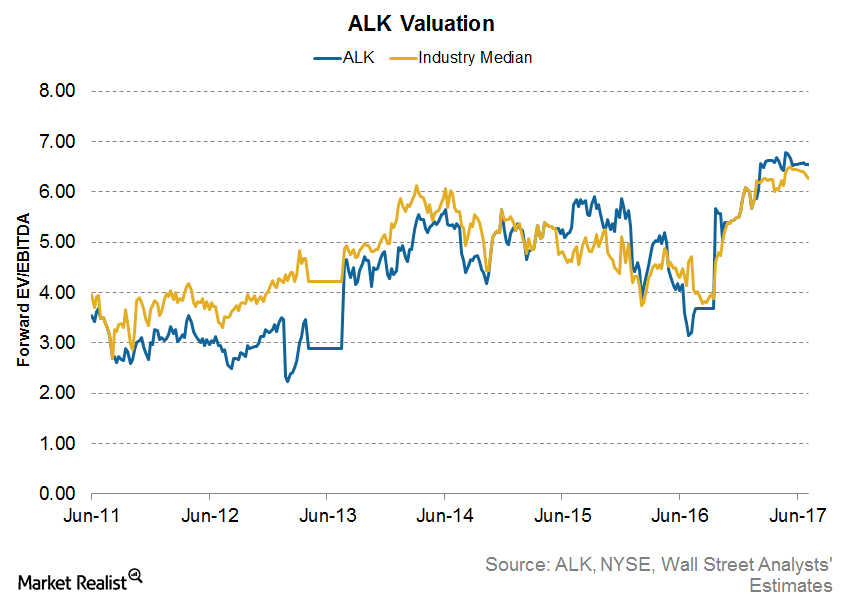

Inside Alaska Air’s Valuation: Cheap Enough?

Alaska Air Group (ALK) is now trading at 6.6x its forward EV-to-EBITDA ratio—one of the highest valuations in the industry.

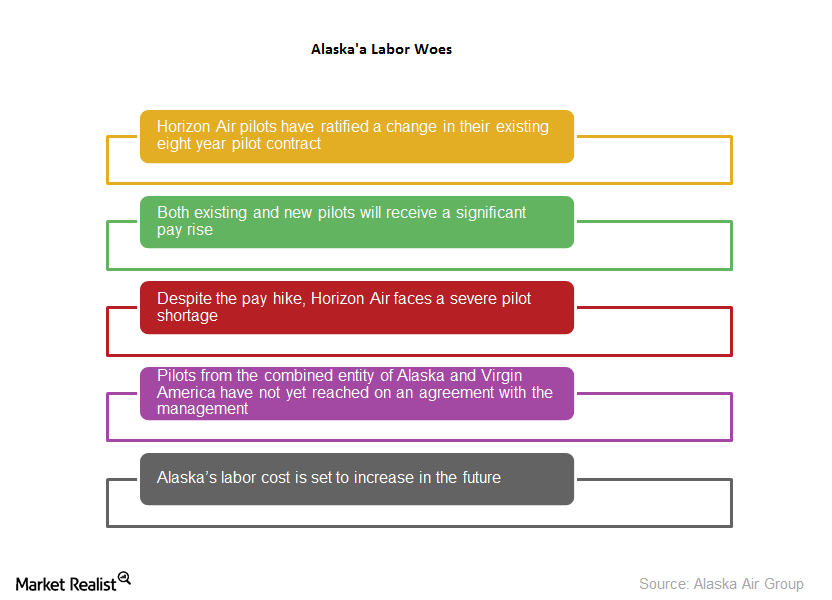

Horizon Air’s Pilots Ratify Change in Agreement

Horizon Air pilots have ratified a change in their existing eight-year pilot contract that entitles both existing and new pilots to receive significant pay raises.

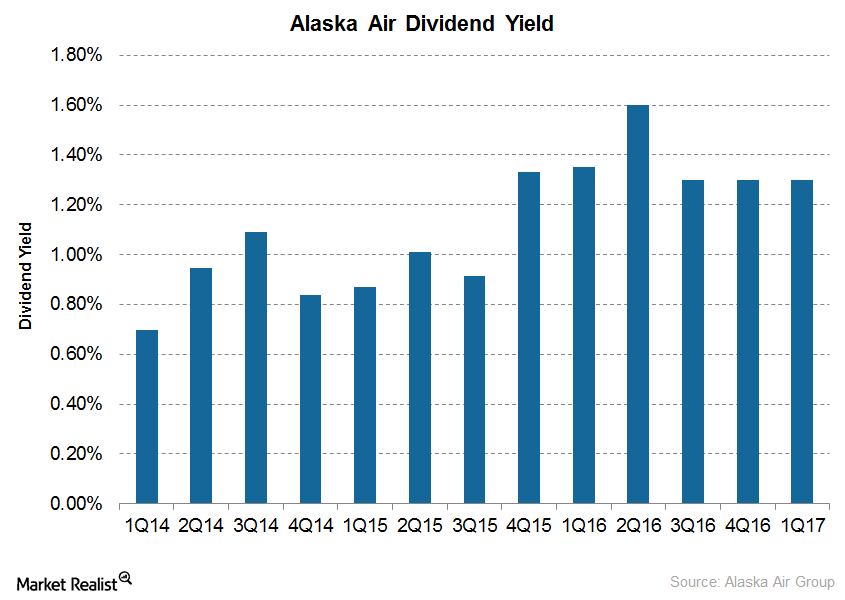

Inside Alaska Air’s Dividend Payout Prospects in 2017

There are only four airlines that currently pay dividends. This is due to the fact that airlines have struggled to stay profitable for a long time now.

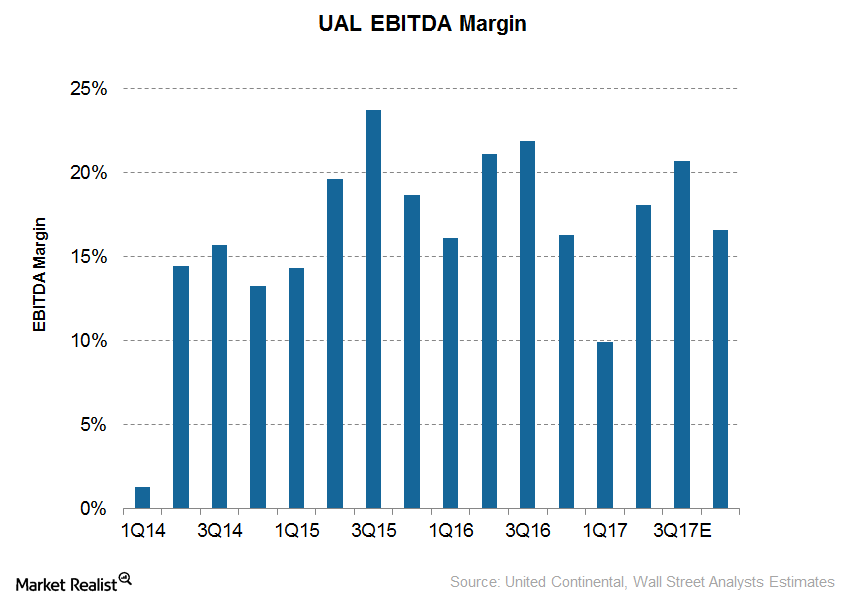

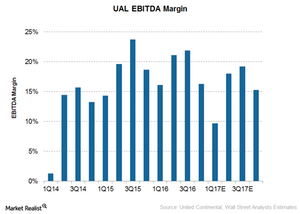

Can United Continental Improve Its Margins in 2017?

United Continental’s (UAL) EBITDA is expected to fall 10% to $1.8 billion.

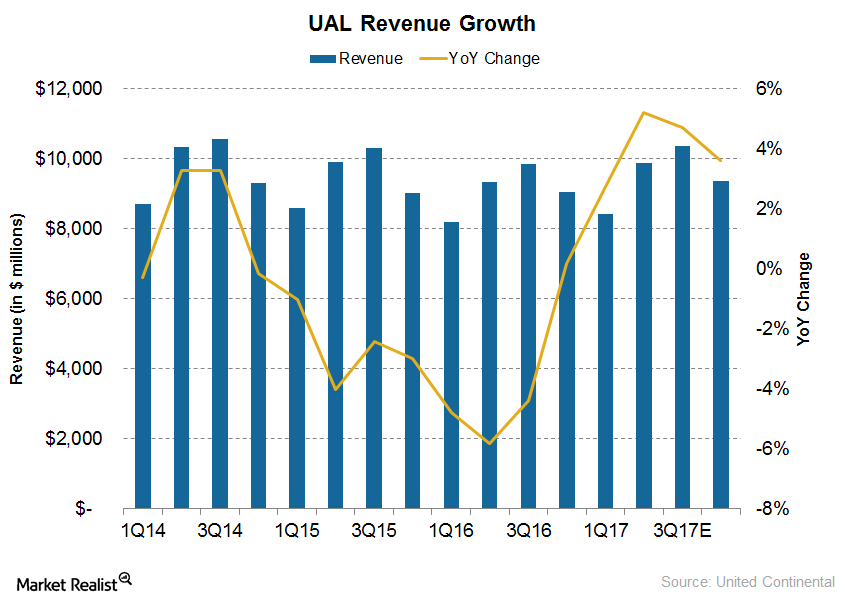

Will United Continental Meet Increased Capacity Growth Guidance?

At the start of the year, United announced its plan to grow its capacity by 0%–1%, in line with GDP growth expectations.

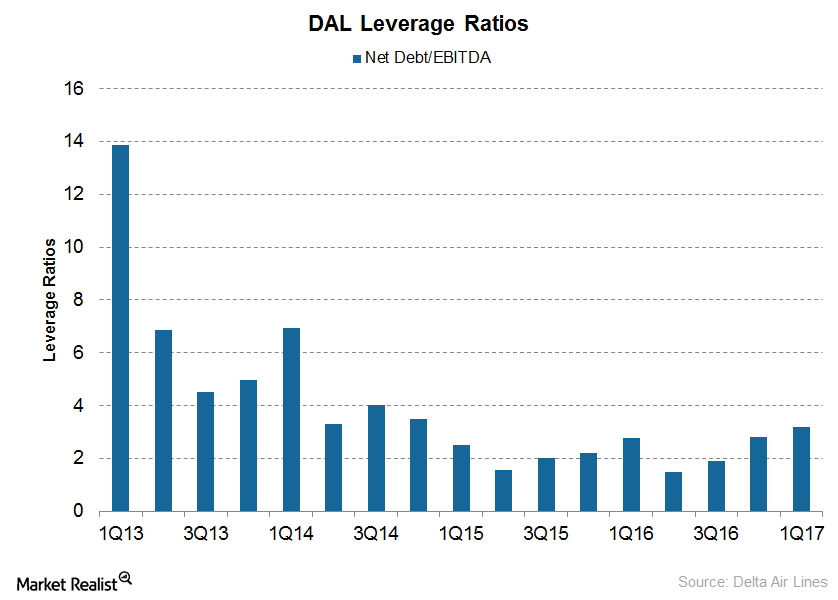

What Delta Air Lines’ Debt Position Means for Investors

During 1Q17, Delta Air Lines’ (DAL) debt rose by ~$2 billion at a blended interest rate of just 3.3%.

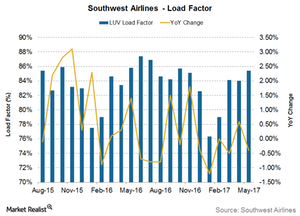

Is LUV on Track to Achieve Its Unit Revenue Guidance?

Because Southwest Airlines’ (LUV) traffic growth lagged its capacity growth in three of the first five months of 2017, its utilization also fell in three of the five months.

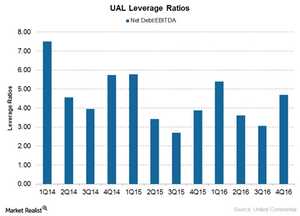

United Continental’s Debt: What You Need to Know

For 2016 overall, United Continental (UAL) has generated $5.5 billion in operating cash flow and $1.9 billion in free cash flow.

Can United Continental Improve Margins in 2017?

For 1Q17, analysts are now expecting United Continental’s (UAL) EBITDA to fall 39% to $0.81 billion.

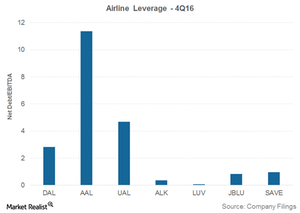

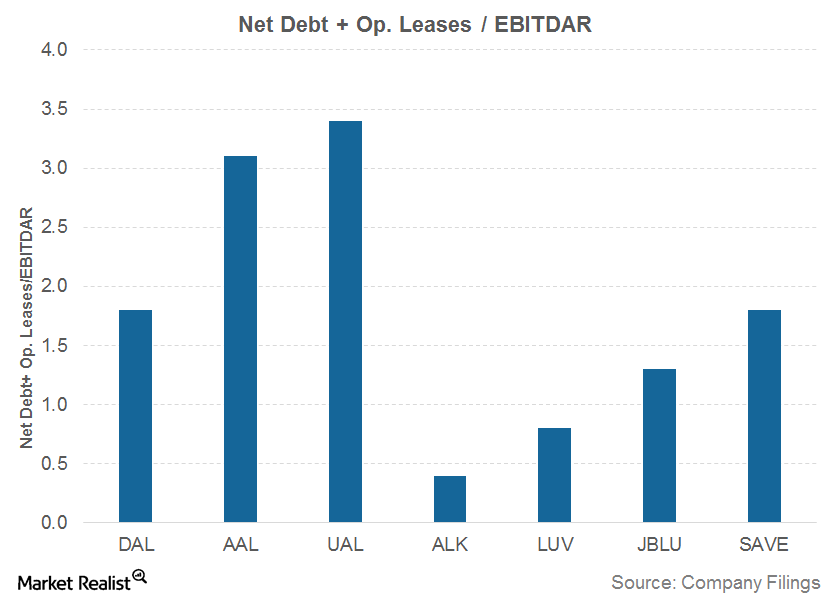

Balance Sheet Analysis of the Major Airline Carriers

In 4Q16, regional carrier Spirit Airlines (SAVE) had a leverage ratio of 0.96x, JetBlue Airways (JBLU) had a leverage ratio of 0.83x, and Alaska Air Group (ALK) had a leverage ratio of 0.36x.

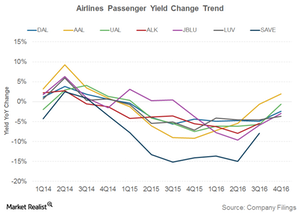

Airlines’ Passenger Yields Fall—What Does It Mean for Investors?

In 4Q16, Southwest Airlines’s (LUV) yields fell 4% year-over-year to 14.7 cents, followed by Alaska Air’s (ALK) 3.3% decline in yield to 13.4 cents.

Can Delta Air Lines Increase Its Dividend Payouts in 2017?

Delta Air Lines started paying dividends only in 2013, and it’s one of the few airlines that pay dividends.

Will Delta Air Lines’ Fuel Costs Keep Falling in 2017?

Until 3Q16, Delta Air Lines (DAL) had managed to keep its costs flat if not decreasing. However…

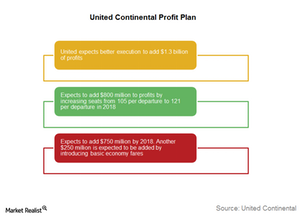

How Does United Continental Plan to Improve Margins?

United expects to add $800 million to profits by increasing seats from 105 per departure to 121 per departure in 2018.

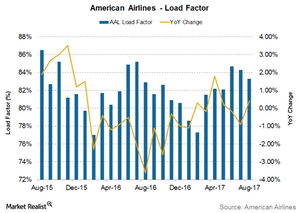

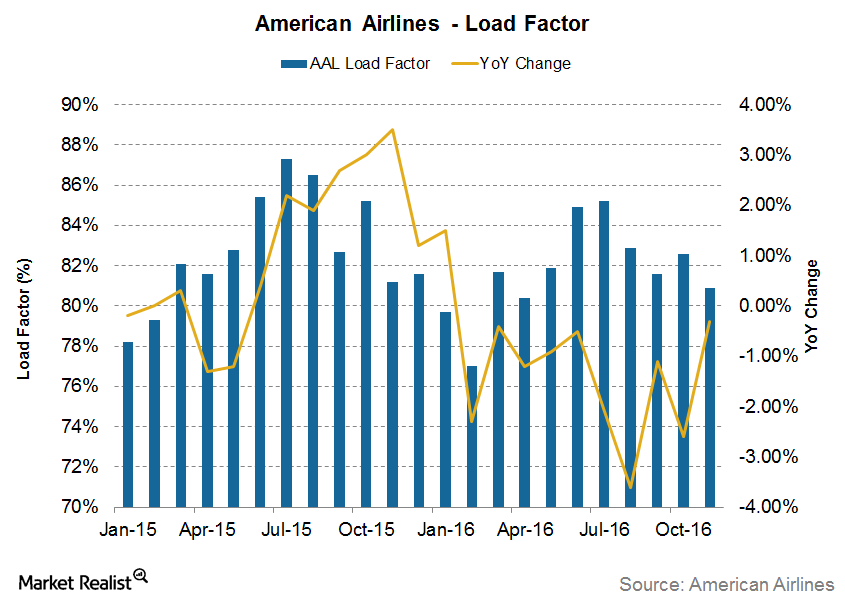

Will American Airlines’s Unit Revenues Continue to Decline?

For November 2016, American Airlines’s (AAL) load factor fell 0.3% and year-to-date 2016, its load factor fell 1.3%.

American Airlines’s Traffic Growth Lags Capacity Growth

In November 2016, American Airlines’s (AAL) traffic fell 0.2% year-over-year, slightly lagging its capacity growth in the same period. Year-to-date, AAL’s traffic has increased 0.3%.

Is American Airlines’s Capacity Growth Finally Slowing Down?

American Airlines’s (AAL) capacity grew 0.1% year-over-year in November 2016, similar to the growth seen during most of 2016. Year-to-date, AAL’s capacity has grown 1.9%.

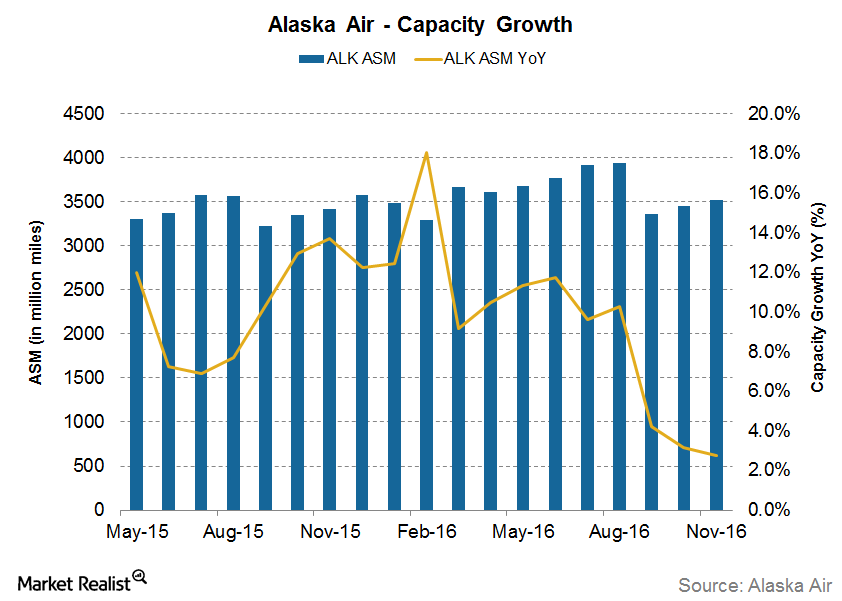

Capacity Growth: Is Alaska Air Group Reducing the Pace?

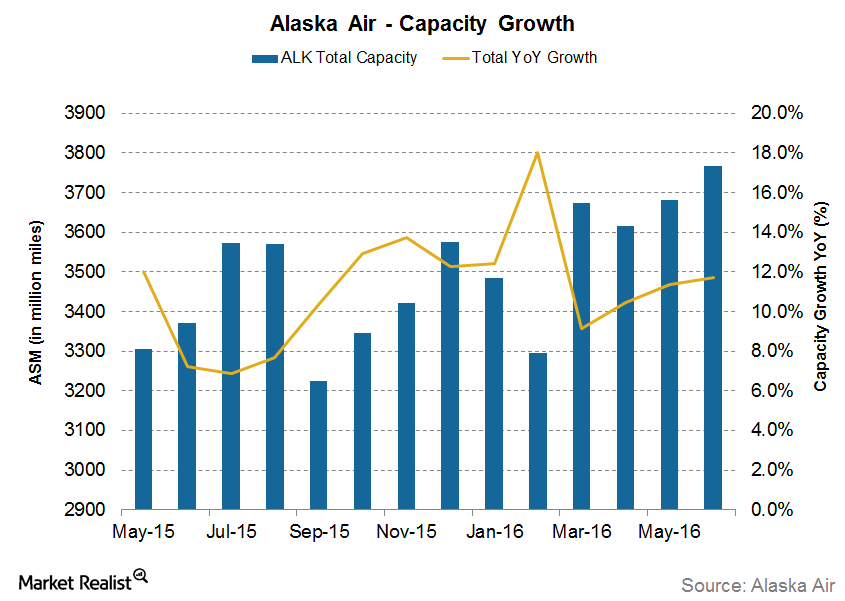

For November 2016, Alaska Air Group’s capacity rose 2.8% YoY (year-over-year). It’s the slowest growth in any month in 2016.

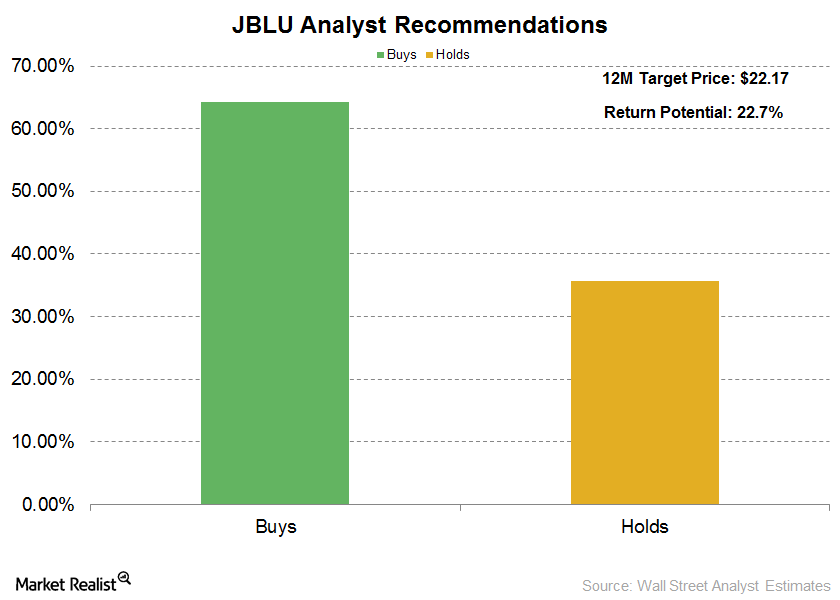

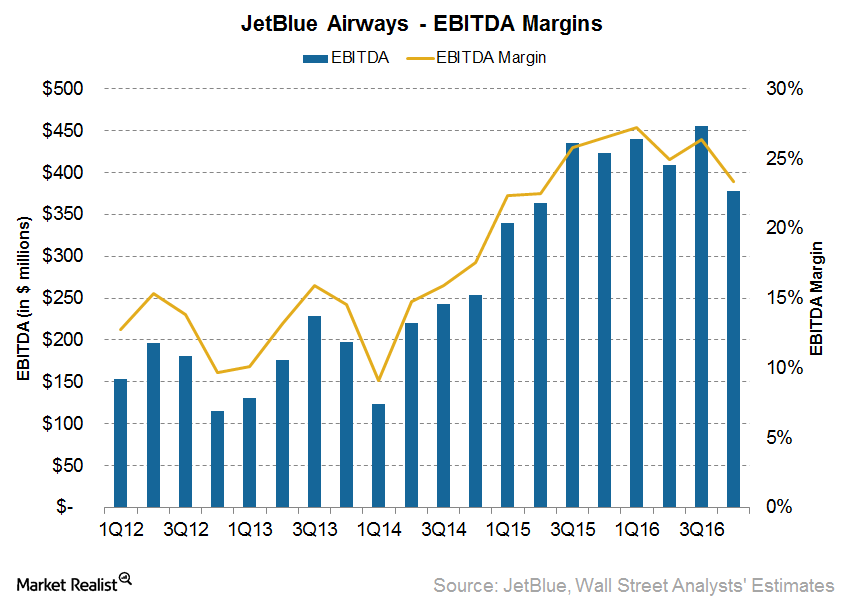

JetBlue: The Latest Analyst Estimates and Recommendations

Following JetBlue’s 2Q16 earnings release, analysts’ consensus estimate for revenues remains unchanged.

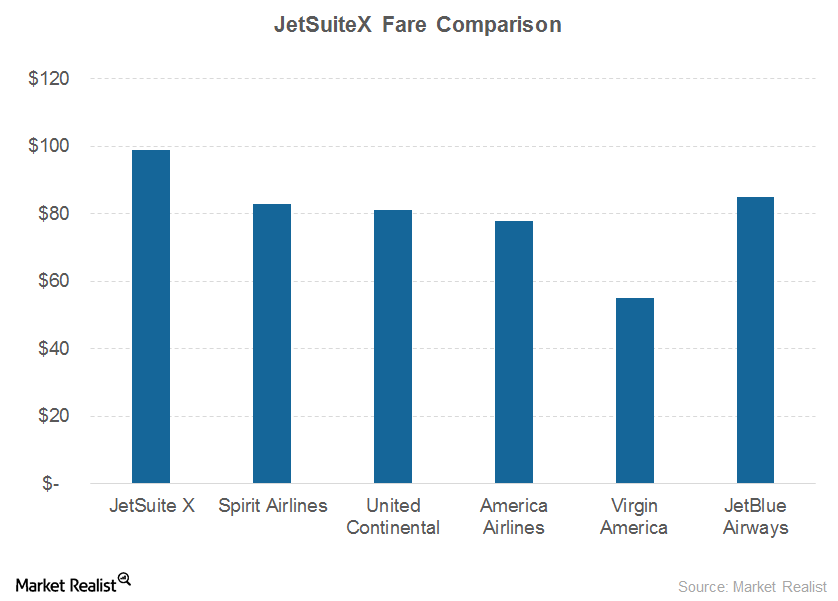

JetBlue’s New Investments: A Pioneer in Private Jet Services?

JetBlue announced that it had undertaken a small stake (the exact stake is unclear) in JetSuite, the fourth-biggest private jet operator in the United States.

Why Does JetBlue Expect Unit Costs to Rise in 4Q16?

For the third quarter of the year, JetBlue Airways’ (JBLU) operating expenses—excluding fuel and profit sharing—rose 3.1% to 7.86 cents.

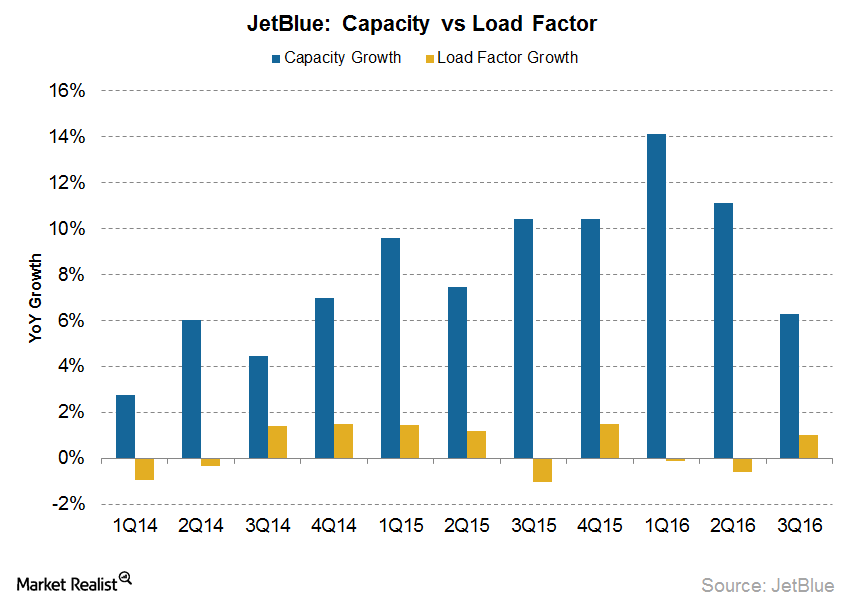

JetBlue Airways: Checking Up on Operational Performance in 3Q16

JetBlue Airways (JBLU) saw average traffic of about 11.9 billion passenger miles for the quarter, a 7.6% year-over-year increase

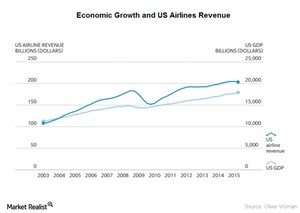

The Airline Industry’s Cyclical Nature Is a Mixed Blessing

The airline industry is cyclical, which means that its business depends on the country’s economic growth. Most analysts have revised their GDP estimates downward, resulting in a consensus estimate of 2.9% YoY growth.

Will Alaska Air’s Unit Revenues Continue to Fall in September?

Foreign currency fluctuations and lower fuel surcharges in the international market will have a negative impact on Alaska Air Group’s unit revenues.

Will Alaska Air Group’s Capacity Expand More in 2016?

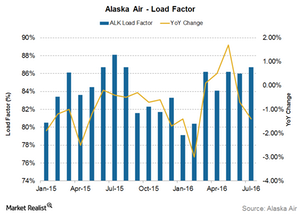

For August 2016, Alaska Air Group’s (ALK) capacity increased by 10.3% YoY. After average growth of 13% in 1Q16, its growth slowed down to 11% in 2Q16.

How Will Alaska Air Group’s Strategy Impact Unit Revenues?

Alaska Air Group (ALK) does not give any future unit revenue guidance. However, we can expect the PRASM’s decline to continue.

Can Alaska Air Group’s Capacity Growth Be Sustained for the Rest of 2016?

For July 2016, Alaska Air Group’s (ALK) capacity increased by 9.6% year-over-year. After an average growth of 13% in 1Q16, growth slowed to 11% in 2Q16 and is slowing further in the third quarter.

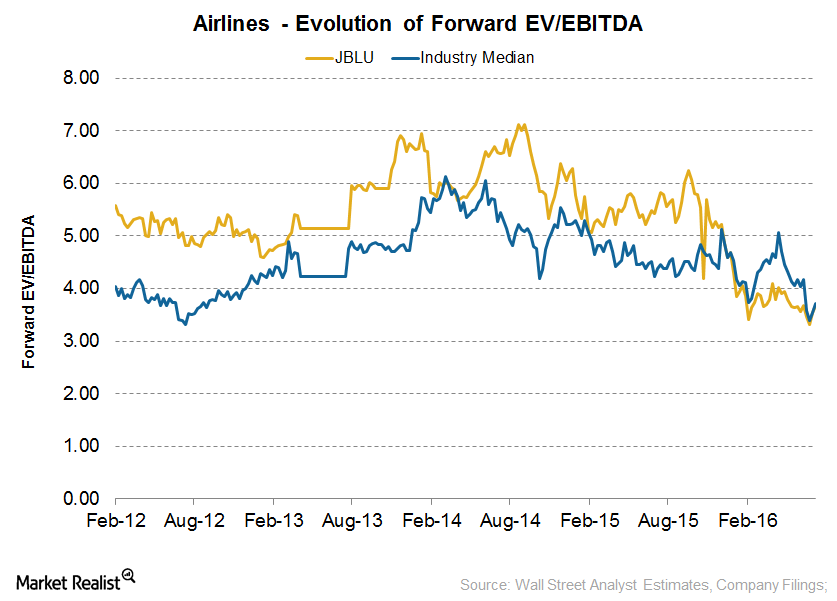

Could JetBlue Airways’ Valuation Change after 2Q16?

As of July 22, 2016, JetBlue was valued at 3.8x its forward EV-to-EBITDA multiple, which is lower than its average valuation of 4.8x since September 2009.

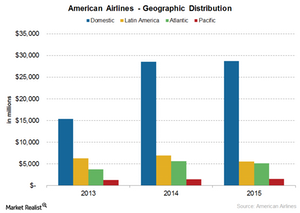

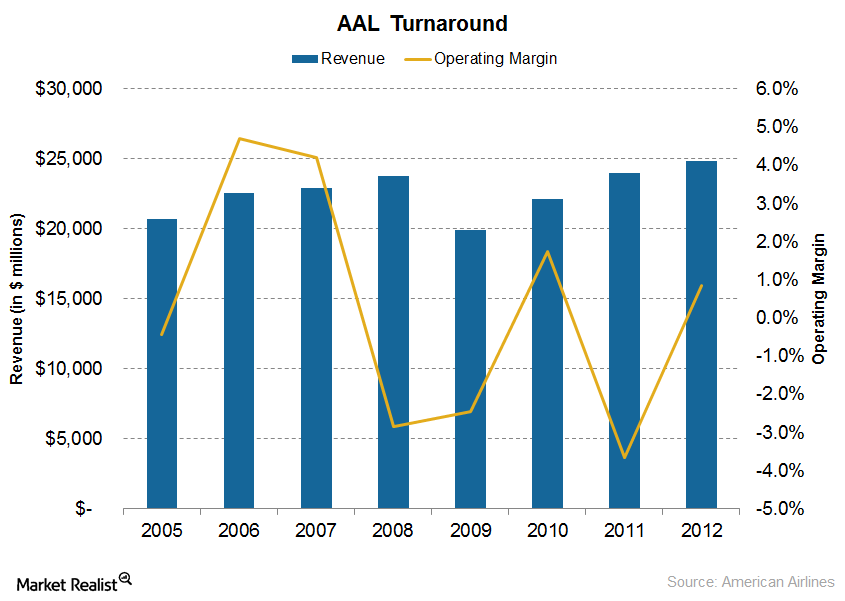

American Airlines and Its Geographic Mix of Revenues

Revenues from American Airlines’ foreign operations make up about 30% of its total operating revenues. The airline has been consistently expanding its global footprint by adding new routes.

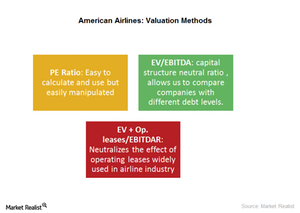

What’s the Best Approach for Valuing American Airlines?

For airlines such as American Airlines (AAL), we go a step further and use an EV+ Op. leases-to-EBITDAR ratio.

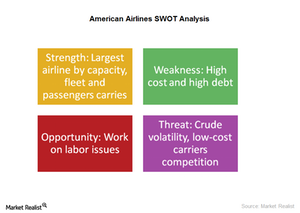

What Are American Airlines’ Key Strengths and Weaknesses?

Some key strengths keep American Airlines ahead of its competitors. It’s the largest airline in fleet, capacity, and number of passengers. It also has a strong hold on key hubs.

What Are American Airlines’ Major Revenue Drivers?

American Airlines’ (AAL) capacity growth is one of the slowest in the industry. However, it has the highest capacity among its peers.

How Did American Airlines Recover from Bankruptcy?

Soon after US Airways declared its intention to merge with American Airlines, AAL started working on its weak points and restructuring costs.

Is There Overcapacity in the Airline Industry?

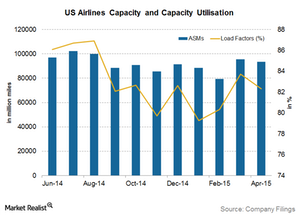

In February 2016, the airline capacity of the eight major airlines exceeded their traffic growth by an average of 2%.

Which Airline Has the Highest Leverage?

The airline industry is a capital-intensive industry with heavy investments required in building infrastructure, fleets, and their maintenance. As a result, airline stocks generally have high levels of debt on their balance sheets.

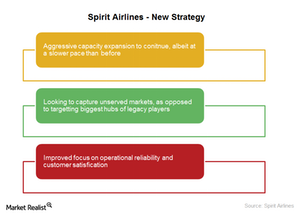

Spirit Airlines: New CEO, New Strategy

Spirit Airlines has historically followed a low-cost structure, and took numerous measures to keep its cost components the lowest in the industry.

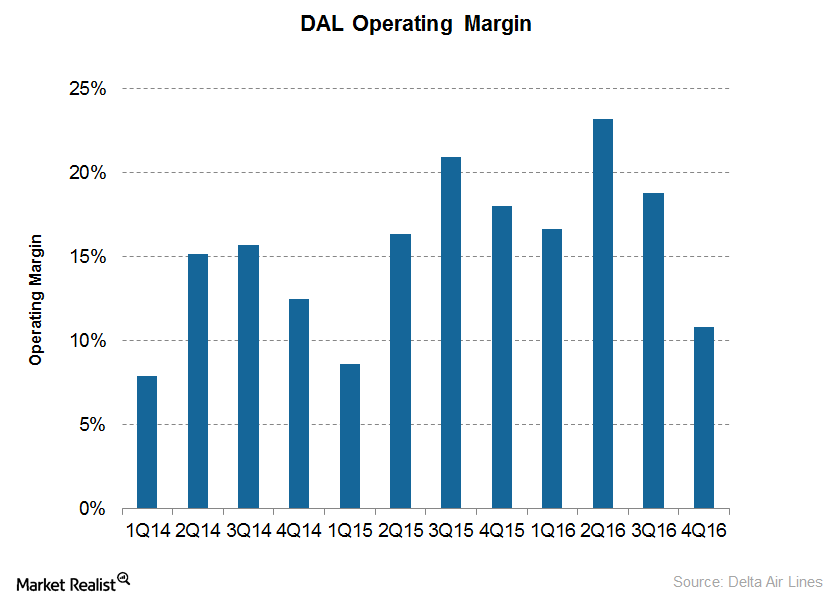

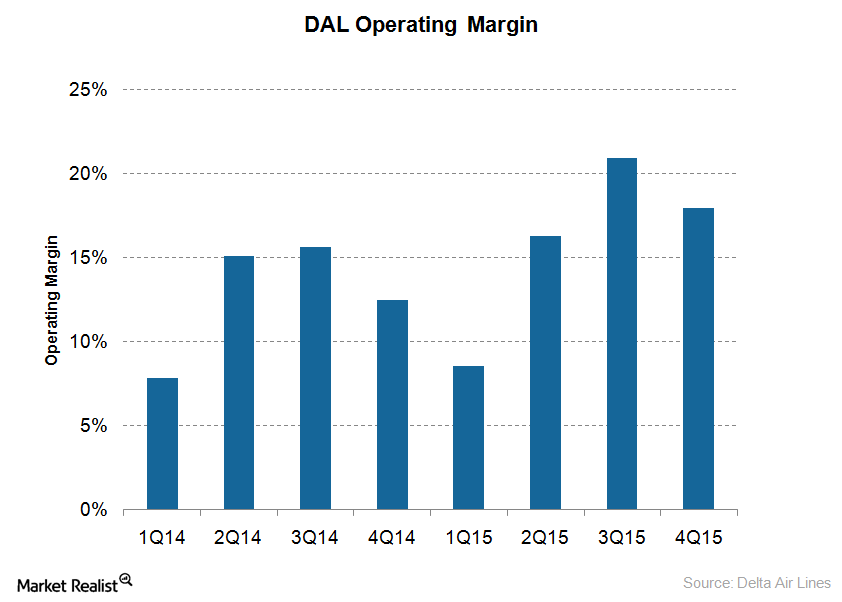

Can Delta Air Lines Continue to Reduce Its Costs in 2016?

For 1Q16, Delta Air Lines (DAL) expects to see its operating margins improve to 18%–20%, backed by solid cost savings and lower fuel prices.

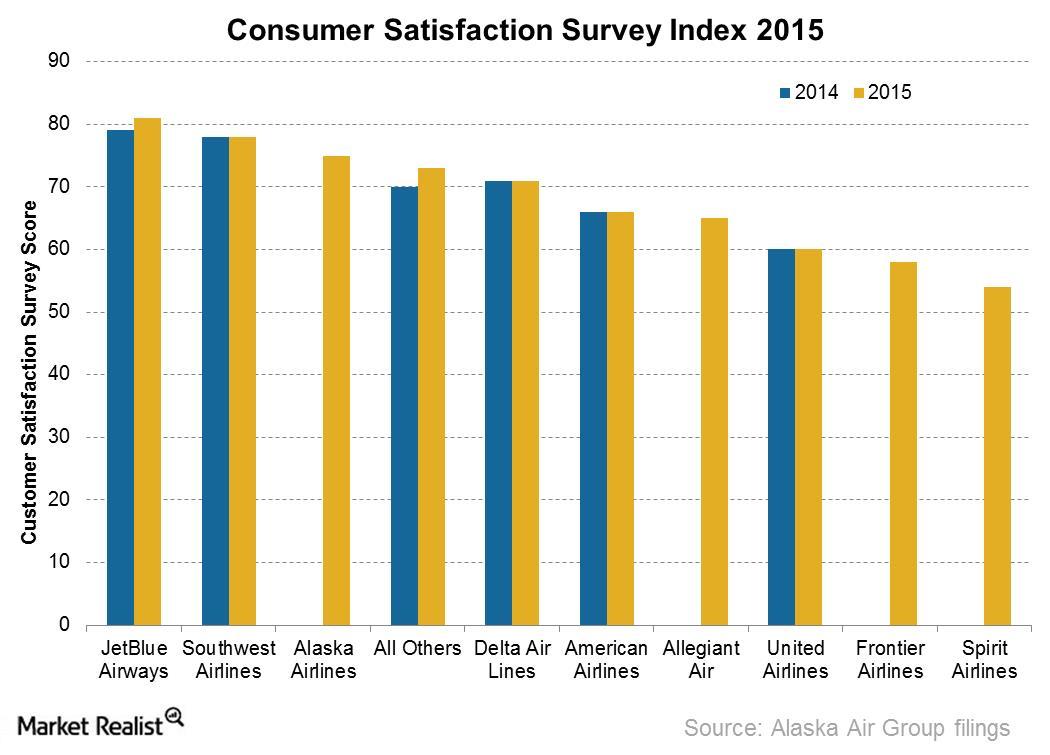

Alaska Airlines’ Keys to High Customer Satisfaction

For the seventh consecutive year, Alaska Airlines held the top spot in Customer Satisfaction among the Traditional Network Carriers survey conducted by J.D. Power.

Improving Capacity Utilization Adds to Airline Profitability

Capacity utilization has improved from the lows of ~57% in the 1970s to ~76% in 2014 and 81.88% in year-to-date 2015.

The Key Variables Impacting Airline Stocks

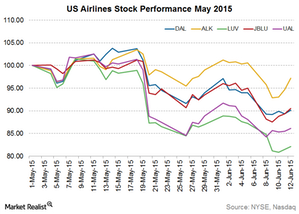

A strengthening dollar led to improved profitability for US airlines in 1Q15 while subduing profitability for non-US airlines. This further increased the industry’s performance gap across the globe.

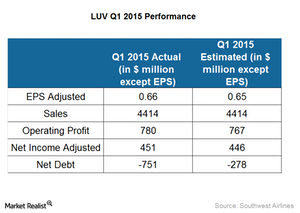

What Were Southwest’s Key Performance Drivers for 1Q15?

Southwest Airlines posted excellent financial performance metrics in 1Q15, including ~6% growth in available seat miles.

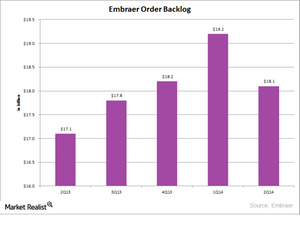

What makes Embraer successful?

In order to find out what makes Embraer successful, we need to look at its major strengths and what the company has done right.