Inside Alaska Air’s Valuation: Cheap Enough?

Alaska Air Group (ALK) is now trading at 6.6x its forward EV-to-EBITDA ratio—one of the highest valuations in the industry.

July 11 2017, Updated 10:37 a.m. ET

Current valuation

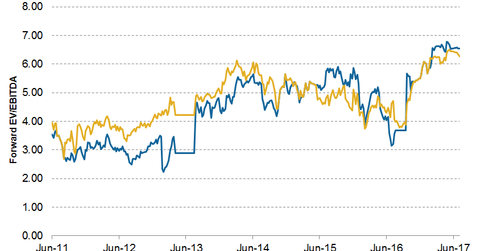

Alaska Air Group (ALK) is now trading at 6.6x its forward EV-to-EBITDA (enterprise vaue to earnings before interest, tax, depreciation, and amortization) ratio—one of the highest valuations in the industry. ALK’s average valuation has been ~4.7x since November 2009.

Peer comparisons

Southwest Airlines (LUV) is trading at 6.7x its forward EV-to-EBITDA multiple—a valuation higher than all major air carriers. American Airlines (AAL) is trading at 6.6x, which is similar to that of Alaska Air.

Spirit Airlines (SAVE) is trading at a forward EV-to-EBITDA multiple of 6.3x, while both United Continental Holdings (UAL) and JetBlue Airways (JBLU) are trading at 5.8x. Delta Air Lines has the lowest valuation multiple of 5.4x.

The market is expecting Alaska Air to record EBITDA per share growth of 30% in 2017. However, investors should remember that most of this growth will be coming from the Virgin America merger.

Southwest Airlines’ EBITDA is expected to rise 3.2% in 2017. AAL’s EBITDA per share, on the other hand, is expected to fall 0.1%. SAVE is expected to record EBITDA growth of 10.9% in 2017. UAL’s EBITDA is expected to grow 5.8%, while JBLU’s is expected to fall 0.4%.

The analysis

Valuation multiples represent what investors are willing to pay for a company’s stock, and so investors have to assess how high or low these multiples could go before actually investing.

For the short term, this assessment depends on the perceived future growth of the company. For Alaska Air, the short-term valuation will be dependent on how well the company can capitalize on its Virgin America deal. It has already announced several new routes to San Francisco, where Virgin America has a robust customer base. But in doing so, it has entered into direct competition with United Continental. (San Francisco is one of the primary hubs for UAL.) This could drive down ticket costs and airline profitability.

In the long term, multiples will track the broader industry situation. If industry fundamentals deteriorate or if investors’ risk appetites fall, valuation multiples can fall as well. The current risk to a valuation includes an overcapacity situation in the industry, unsustainable leverage, and a sudden rise in the fuel costs.

Investors can gain exposure to Alaska Air by investing in the First Trust Rising Dividend Achievers ETF (RDVY), which has 8% of its portfolio in ALK.