Inside Alaska Air’s Dividend Payout Prospects in 2017

There are only four airlines that currently pay dividends. This is due to the fact that airlines have struggled to stay profitable for a long time now.

July 10 2017, Updated 7:39 a.m. ET

Dividend paying airlines

There are only four airlines that currently pay dividends. This is due to the fact that airlines have struggled to stay profitable for a long time now. High input costs like fuel and labor made this impossible.

Although airlines were in a position to pay dividends during times of profitability, sustaining dividend payouts in times of a downturn can be very difficult. Not being able to pay dividends consistently is viewed by investors as extremely negative and can have a strong impact on a stock’s price, and for this reason, most airlines have stayed away from dividend payouts altogether.

However, Alaska Air (ALK) and Southwest Airlines (LUV) have managed to remain profitable due to their low costs and thus pay dividends. Delta Air Lines (DAL) can do so due to its clean balance sheet and achieve efficient operation. American Airlines (AAL) has recently joined these players.

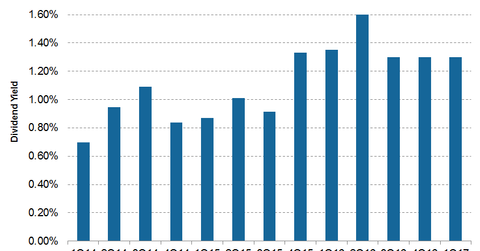

Dividend yield

Alaska Air is expected to pay a dividend per share of $1.2 in 2017. At its current price of $91.4, it has an indicated dividend yield of 1.3%—the second-highest yield among the four airlines.

Delta has the highest indicated dividend yield of 2.0%. American Airlines (AAL) has an indicated dividend yield of 0.81%, while Southwest Airlines (LUV) has a dividend yield of 0.67%.

Cash dividend ratio

Alaska’s cash dividend ratio stood at 6.2x at the end of 1Q17, indicating ALK’s ability to sustain dividend payouts. Remember, a ratio of less than 1.0x indicates dividend payouts higher than the company’s cash flows, which may be difficult to sustain in the future.

Outlook

ALK’s increased its dividend payout by 9% in 1Q17 to $0.3 per share. Since it has a history of increasing its dividend every four quarters, investors can expect the company’s dividend payout to remain constant at $0.2 per share for the remaining quarters of 2017.

Investors can gain exposure to ALK by investing in the First Trust Rising Dividend Achievers ETF (RDVY), which invests 8% of its portfolio in the company’s stock.

Continue to the next part for a look at what are analysts recommending for Alaska Air.