Airlines’ Passenger Yields Fall—What Does It Mean for Investors?

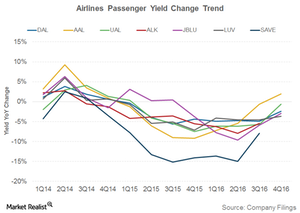

In 4Q16, Southwest Airlines’s (LUV) yields fell 4% year-over-year to 14.7 cents, followed by Alaska Air’s (ALK) 3.3% decline in yield to 13.4 cents.

March 24 2017, Updated 7:35 a.m. ET

Passenger yield

Yield is the average airfare per passenger per mile, and it’s calculated by dividing the passenger revenues by revenue passenger miles (or RPM). As the yield increases, an airline’s revenues and margins would also increase. Air travel supply and demand play an important role in determining yield.

Declining utilization, airfares, and fuel surcharges have negatively affected airline yields. Yields for all major carriers fell in 2016.

In 4Q16, Southwest Airlines (LUV) recorded the highest decline so far. In 4Q16, LUV’s yields fell 4% year-over-year (or YoY) to 14.7 cents. Alaska Air (ALK) had a 3.3% decline in yield to 13.4 cents, and JetBlue Airways (JBLU) saw a 3% YoY decline to 13.2 cents.

Delta Air Lines’s (DAL) yields fell 2% YoY to 16 cents, followed by Spirit Airlines’s (SAVE) drop in yields of 1.9% YoY to 10.8 cents. United Continental’s (UAL) yields fell 1% YoY to 15.1 cents.

Spirit Airlines’s falling yields slowed drastically in 4Q16. SAVE’s yield fell 7.9% in 3Q16 and 14% in 2Q16. This is also true for all major carriers. Compared to the first half of 2016, its yield decline slowed substantially in the fourth quarter.

Declining utilization

Declining utilization for all airlines was one of the major factors adding pressure on yields. Major airlines—legacy and regional players—now seem to focus on reducing capacity growth to improve utilization.

Outlook for 2017

Low fuel prices have allowed airlines to keep airfares low, which also led to declining yields for more than a year. Various attempts to hike airfares and the slowdown in capacity is an effort to stop this yield decline, which may continue through the rest of the year. Most airlines seem to be working toward improving their yields.

Investors can gain exposure to the industry by investing in the SPDR S&P Transportation ETF (XTN), which invests ~15% of its holdings in airlines.