SPDR® S&P Transportation ETF

Latest SPDR® S&P Transportation ETF News and Updates

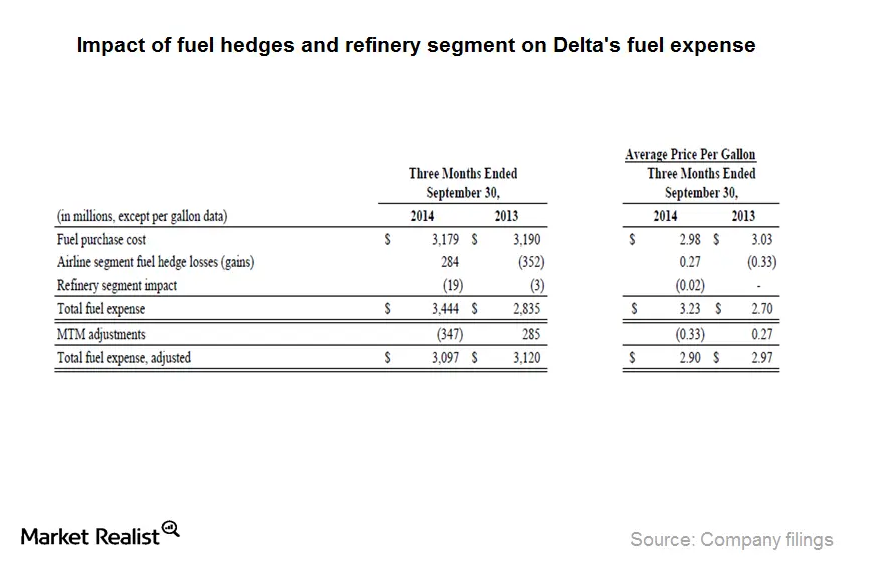

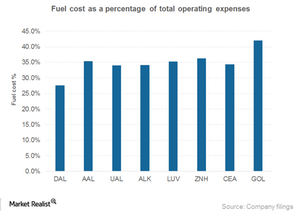

Why Delta’s 3Q14 fuel expense was impacted by fuel hedges

Fuel expense is Delta’s largest expense. It accounted for ~29% of the total operating expense in 3Q14. Fuel consumption per available seat mile decreased by 1.5% during the quarter.

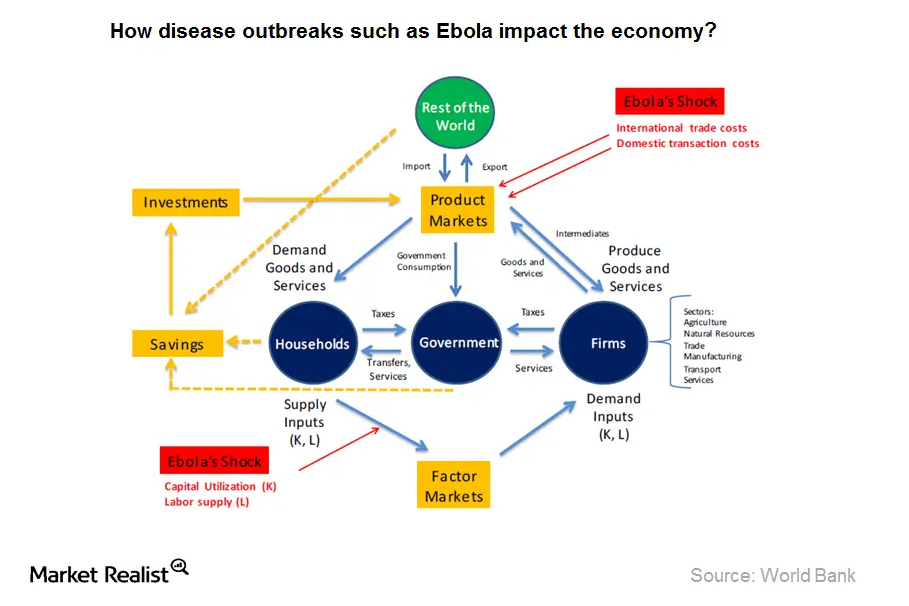

Why fatal disease outbreaks impact economic activity

The World Bank estimated Ebola’s impact by analyzing two scenarios—low Ebola and high Ebola. The scenarios are based on the probability of the disease spreading internationally.

What Should Airline Industry Investors Look Out for in 2016?

Growing capacity is necessary for revenue growth. However, capacity expansion that exceeds demand growth can lead to declining utilization.

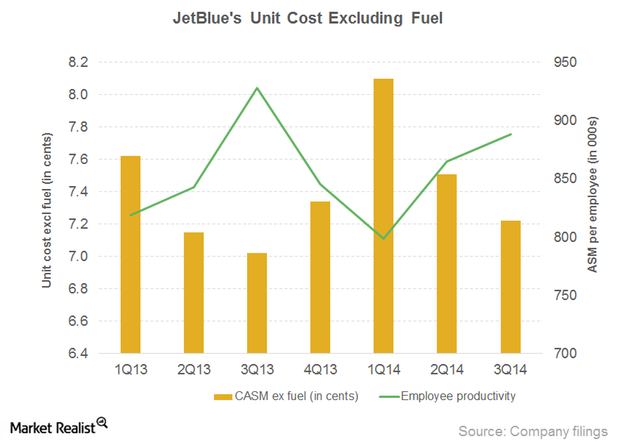

JetBlue’s unit cost growth: Employee costs up, lower productivity

Salary, wages, and benefits increased as a result of higher wage rates. Airlines have also had to increase headcount to adhere to the new Federal Aviation Administration (or FAA) regulations on flight, duty, and rest.

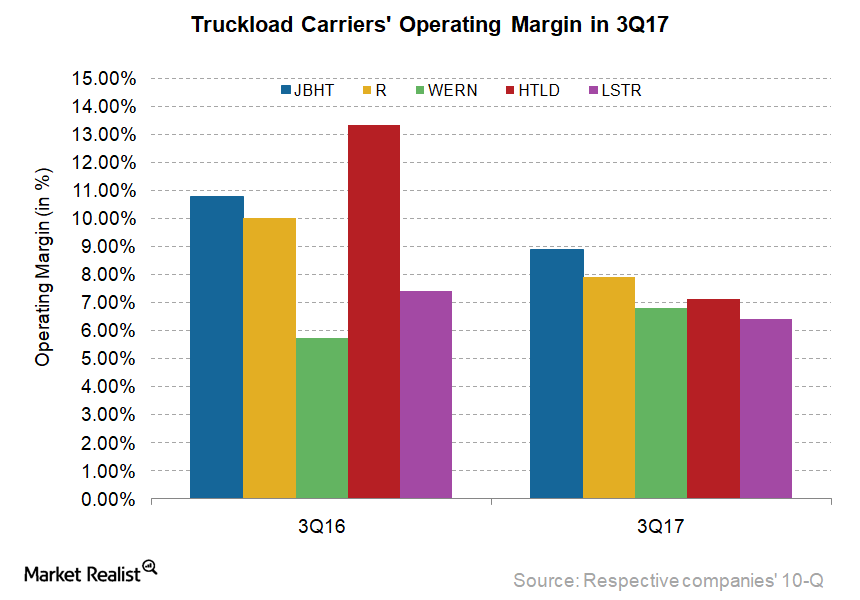

Will Rise in Crude Oil Benefit US Truckload Carriers in 2018?

The average US on-highway diesel prices in 3Q17 have risen 20% compared to the same quarter last year.

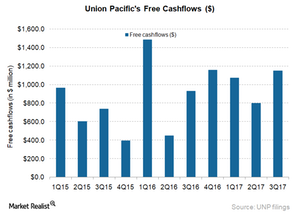

Can Union Pacific’s Free Cash Flows Support Its Higher Dividend?

Union Pacific had FCF of $3.02 billion in the first nine months of 2017, compared with $2.86 billion in the corresponding period of 2016.Industrials Estimating American Airlines’ earnings growth

Apart from improved operational efficiencies, American has outperformed its peers in pre-tax margin (excluding special items) improvement in the first half of 2014 to 8.7% from 4.1% in the previous year.

Comparison of China Eastern’s fuel costs with competitors

Chinese airlines have an advantage of having lower employee costs compared to their counterparts in the US. Operational efficiency of US airlines are comparatively higher.Company & Industry Overviews Gol’s passenger revenue increases on higher yields

Brazil is the third largest domestic aviation market. With double-digit traffic growth, Brazil was one of the fastest-growing domestic markets in 2010 and 2011.Industrials United sees major improvement in 3Q14 fuel cost efficiency

United achieved significant fuel cost savings during 3Q14 in the form of lower purchase costs and improved fuel efficiency.Industrials The must-know drivers of air cargo growth for US airlines

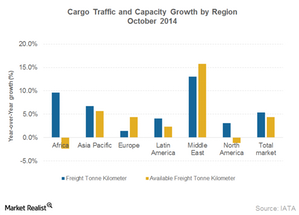

According to the IATA, global air freight volume has increased by 4.5%. Capacity, measured by available freight ton kilometers (or AFTK), increased by 3.5% year-over-year in August 2014.

Low yield, utilization drive down air cargo profitability

Growing trade activity drove the recovery in cargo traffic in emerging markets in Asia, but it was slightly offset by the slowing European economy.

UNP Rises 1.5% on Pricing Gains, Higher Volumes in Q3 2018

Union Pacific (UNP) announced its third-quarter earnings results before the market opened on October 25.

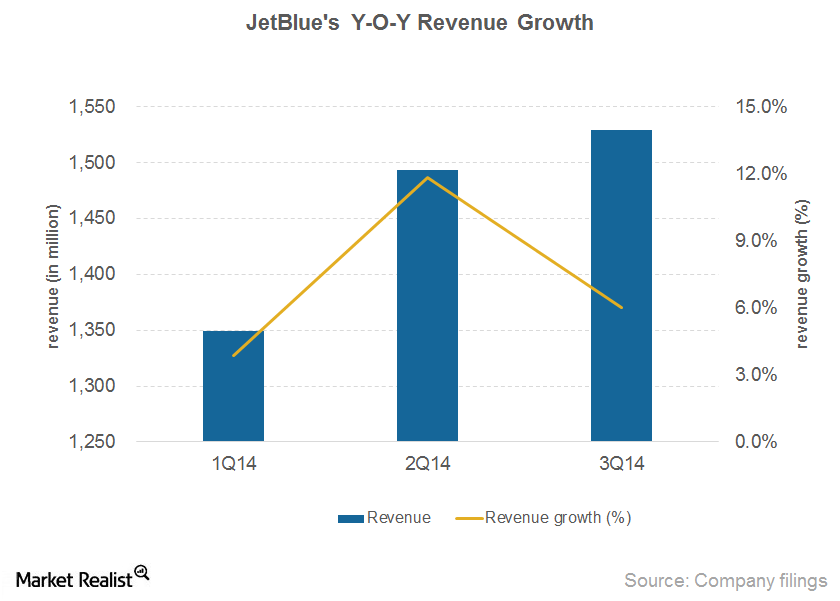

Higher passenger and ancillary revenue drive growth

JetBlue’s operating revenue increased by 6% to $1,529 million in 3Q14. The company states that its on-time performance was impacted by congestion in the air space.Industrials Key growth trends in airline passenger traffic by region

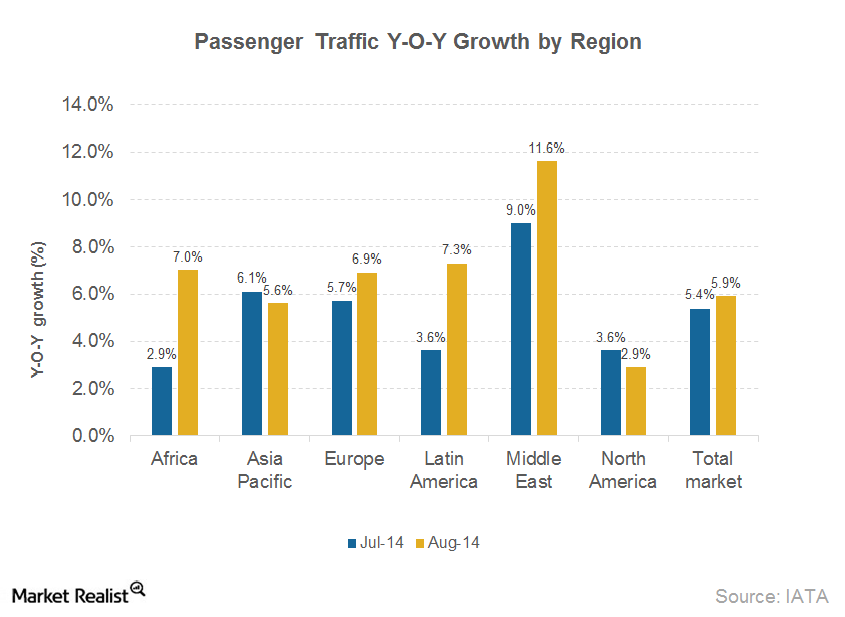

Global passenger traffic has increased by 5.8% year-over-year during the first eight months of 2014. Europe (29.7%), Asia-Pacifc (29.2%), and North America (25%) comprise ~85% of global market share by passenger traffic.Industrials Why Ebola impacted the airline industry

During fatal disease outbreaks, rules and restrictions are imposed—especially on air transportation. This includes canceling flights to the affected areas.

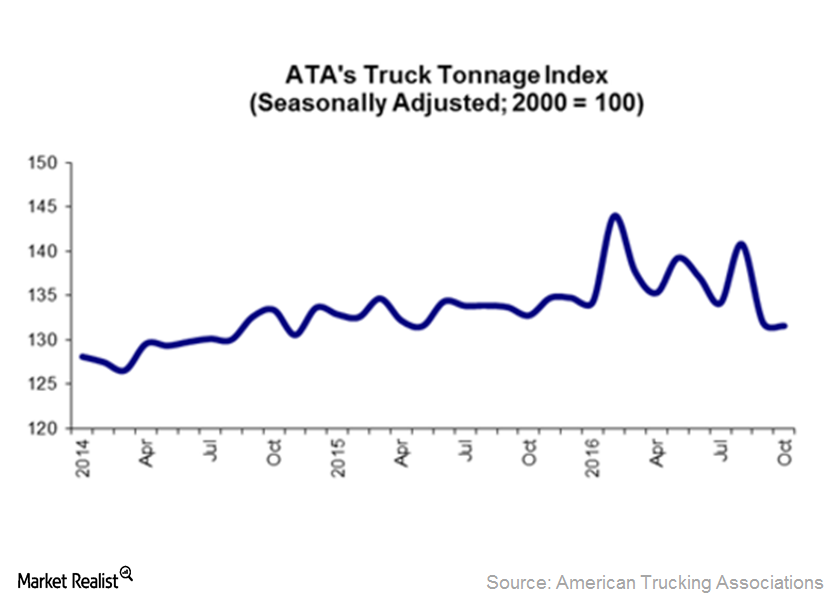

What the Direction of October’s Truck Tonnage Index Indicates

In this article, we’ll look at the direction of the Truck Tonnage Index (or TTI) in October 2016.Industrials Why the Ebola scare led to a 16% drop in the Airline Index

The share prices for major airline companies in the U.S. dropped substantially after the news of the first Ebola case in U.S. on September 30, 2014.

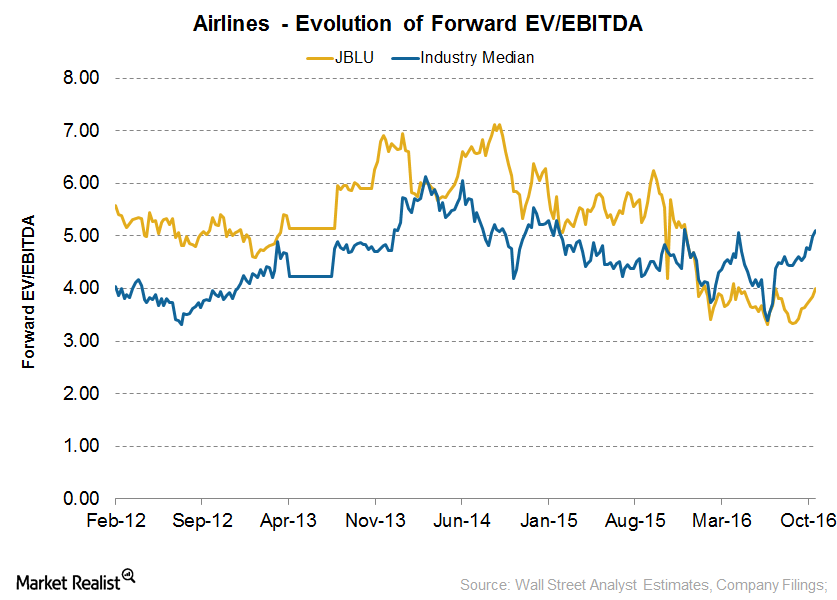

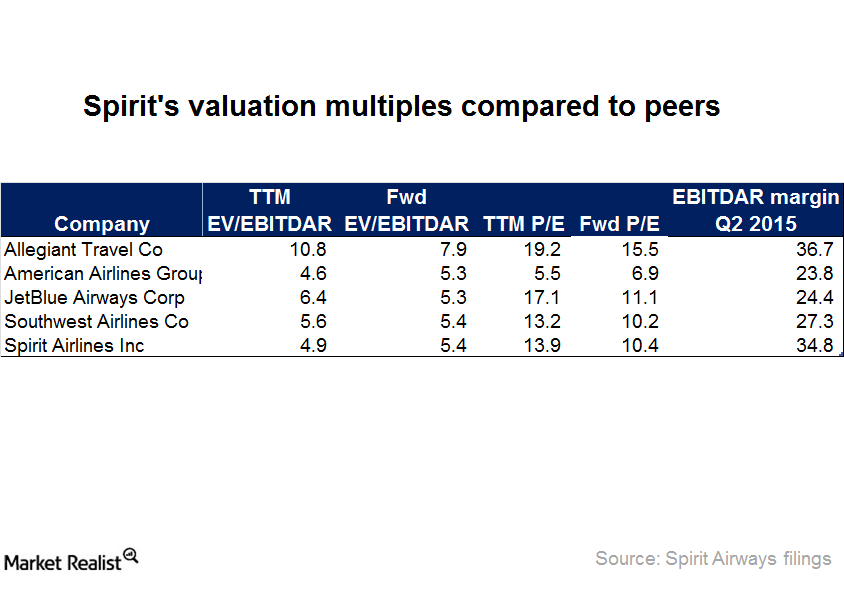

Is a Rerating of Airlines’ Valuation Multiple Possible?

Currently, American Airlines (AAL), Southwest Airlines (LUV), and Alaska Air Group (ALK) are all trading at ~5x their forward EV-to-EBITDA multiples.

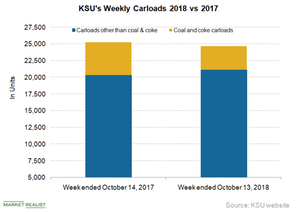

Kansas City Southern: Lowest Gainer in Week 41 Rail Traffic

In Week 41, Kansas City Southern (KSU) posted a 2.4% YoY (year-over-year) decline in carload traffic.

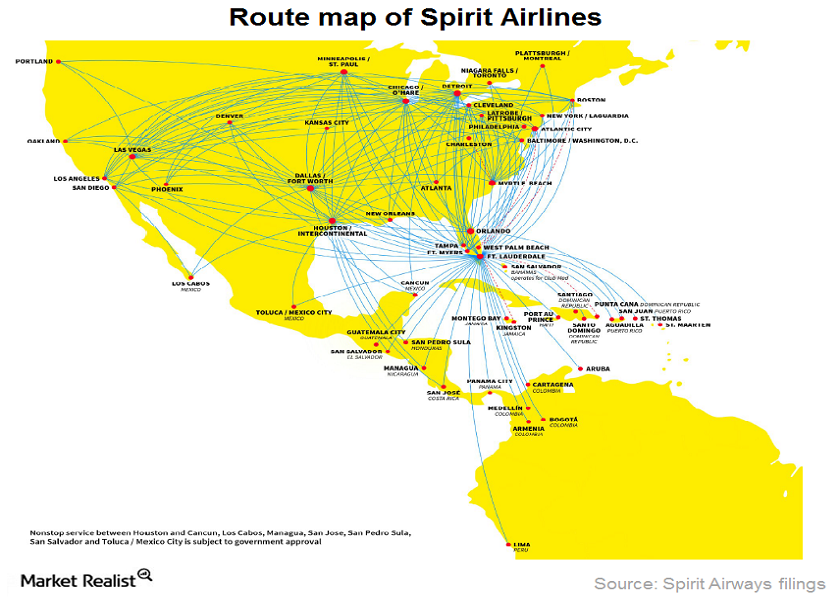

Spirit Airlines: An Introduction to a Low-Cost Pioneer

Spirit Airlines (SAVE) is headquartered in Miramar, Florida. It’s a pioneer of ultra-low-cost carrier or ULCC airlines.

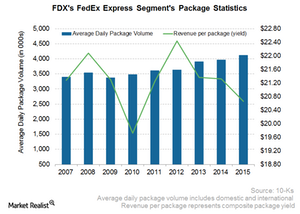

FedEx Express Is One of the Largest Express Networks in the World

FedEx Express offers three US overnight package delivery services: FedEx First Overnight, FedEx Priority Overnight, and FedEx Standard Overnight.

The global airline industry contributes to economic development

With 16,000 unique city pairs, connectivity by air is estimated to have doubled in the past two decades. Moreover, although demand continues to rise, the price of travel has fallen.

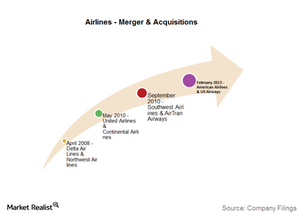

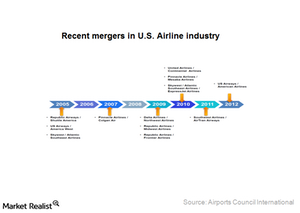

Airline Mergers and Acquisitions: Are We There Yet?

The most recent phase of consolidation that began in 2005 has seen 13 airline mergers and acquisitions. Four of these deals are worth special mention because they changed the face of the industry.

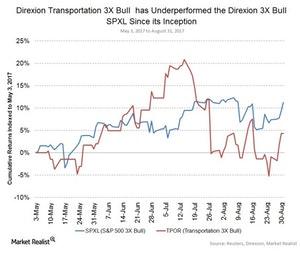

What to Expect from Transportation Stocks This Fall

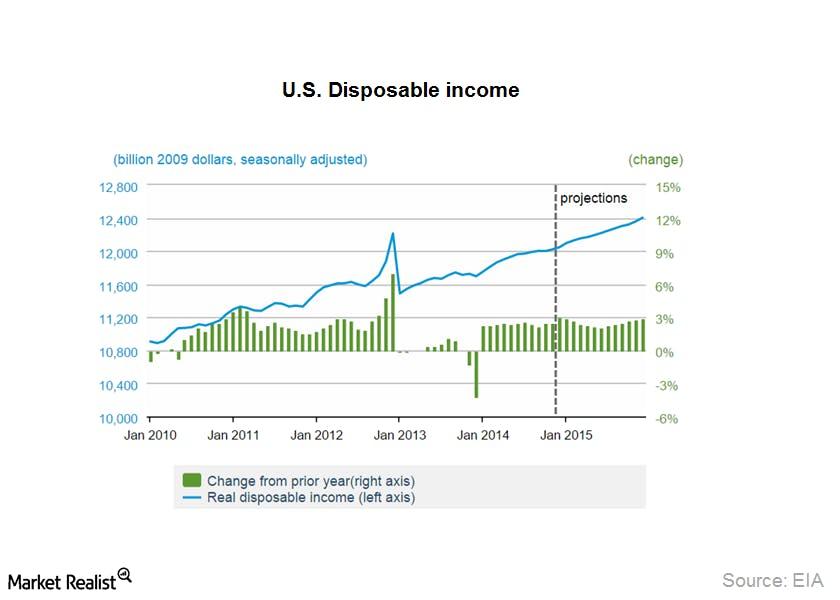

The airline industry has maintained its stellar performance in the last five years.Why economic indicators influence travel and tourism demand

The airline industry contributes to U.S. economic growth. The industry drives $1.5 trillion in U.S. economic activity. It also generates more than 11 million jobs in the U.S.

Low-entry barriers intensify competition in airline industry

Short-term outlook above expectations The IATA (International Air Transport Association) has revised its forecast upwards on global airline profitability after the free fall of crude oil prices in the second half of 2014. Global net profit for 2014 is now estimated at $19.9 billion, higher than $18 billion projected in June. Profitability is expected to […]Industrials Assessing the key drivers of global airline industry growth

There was an overall increase in worldwide passenger traffic and capacity in August. Passenger capacity increase of 5.5% year-over-year and was driven by strong growth in the international market.

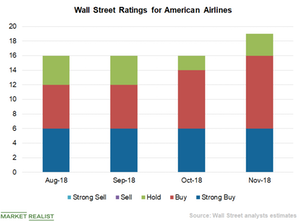

Wall Street Expects Double-Digit Price Surge in AAL Stock

American Airlines (AAL) has received a consensus “buy” rating from analysts polled by Reuters.

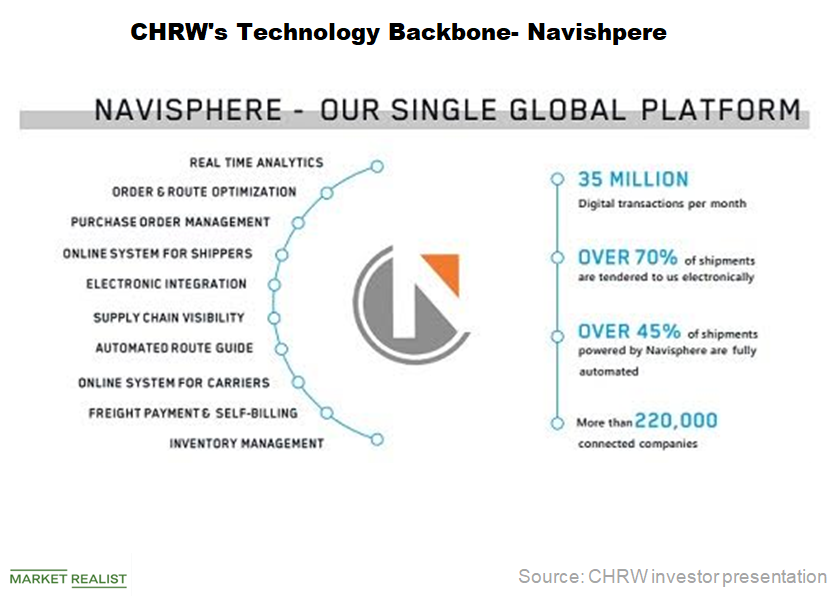

Navisphere: C.H. Robinson’s Technology Backbone

C.H. Robinson Worldwide’s (CHRW) Navisphere is a proprietary global technology platform that matches customer requirements with supplier capabilities to fit customers’ needs.

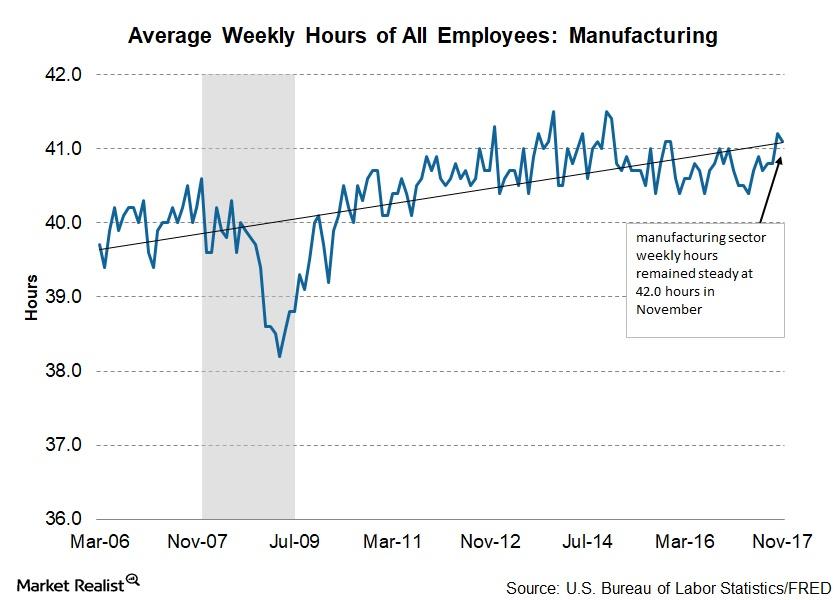

The Effects of Flat Manufacturing Production Hours

The average work week The US Bureau of Labor Statistics’ establishment survey includes data on the number of hours worked by manufacturing employees. Changes in the number of working hours help investors assess the health of the sector. A rise in the number of working hours signals that companies are projecting higher demand in the manufacturing sector […]

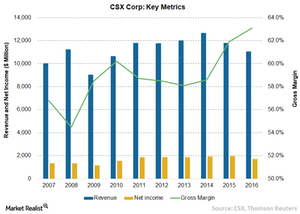

CSX Corporation Has a Wide Economic Moat

To demonstrate the power of efficient scale in creating economic moats, we highlight four companies: U.S.-based wide moats CSX Corporation and UPS, and international narrow moats Telefonica SA (Spain) and CapitaLand Commercial (Singapore).

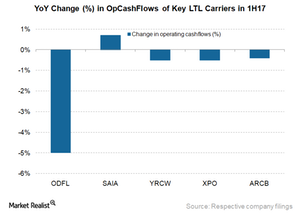

Which Less-than-Truckload Carrier Saw Highest Operating Cashflows?

In this article, we’ll analyze the operating cash flows of these LTL (less-than-truckload) carriers in 1H17.

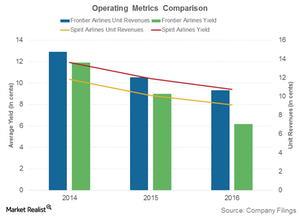

Is Frontier Airlines’ Business Model Sustainable?

One of the major risks to Frontier Airlines is the fact that almost 45% of its flights originate from a single hub—Denver.

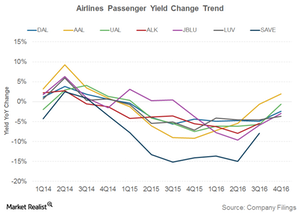

Airlines’ Passenger Yields Fall—What Does It Mean for Investors?

In 4Q16, Southwest Airlines’s (LUV) yields fell 4% year-over-year to 14.7 cents, followed by Alaska Air’s (ALK) 3.3% decline in yield to 13.4 cents.

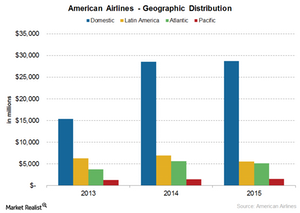

American Airlines and Its Geographic Mix of Revenues

Revenues from American Airlines’ foreign operations make up about 30% of its total operating revenues. The airline has been consistently expanding its global footprint by adding new routes.

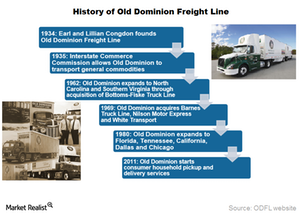

How Did Old Dominion Evolve as a Major US Trucking Company?

Old Dominion offers access, through agents or strategic alliances, to services in international locations including Canada, Mexico, Europe, and China.

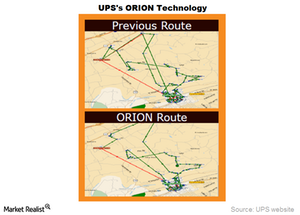

ORION: A Star in United Parcel Service’s Technology Crown

United Parcel Service, through 10,000 routes optimized with ORION, saves up to 1.5 million gallons of fuel per year.

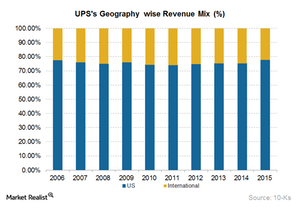

United Parcel Service: A Company Overview

In 2015, United Parcel Service reported total revenues of $58.4 billion. The company’s primary competitor in the US is the Memphis-headquartered FedEx Corporation.

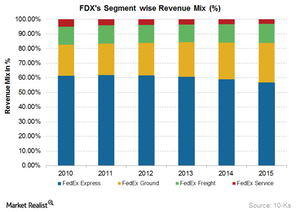

Analyzing FedEx’s Revenue Streams

In fiscal 2015, FDX increased its revenues by $1.9 billion. Its total revenue was a $47.4 billion for the year.

How Stanley Works and Black & Decker Got Their Starts

Black & Decker was eventually merged with Stanley Works in 2010 to form the Stanley Black & Decker company (SWK).

J.B. Hunt 360: J.B. Hunt Transport’s Technological Innovation

JHBT calls J.B. Hunt 360 an intuitive transportation management system. The company claims to realize improved workflows, tighter integration, and mobile tools.

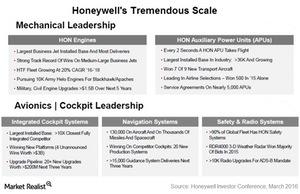

A Closer Look at Honeywell Aerospace’s Business Model

Honeywell has an installed base of 6,000 integrated cockpits, which is ten times greater than the next competitor.

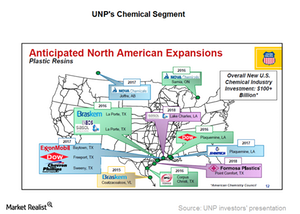

Union Pacific’s Chemical Freight Revenues: An Anticipated Mixed Bag in 2016

Union Pacific’s chemical freight carloads were down by 4% in 4Q15 compared to 4Q14. Petroleum products carloads were down by 18% during the same period.

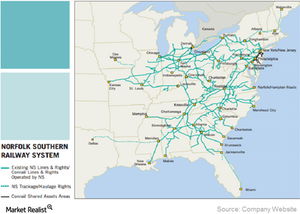

Norfolk Southern: A Class I Railroad Carrier

Norfolk Southern Corporation operates ~20,000 route miles in 22 states and the District of Columbia. The company mainly transports coal and general merchandise.

Spirit Airlines’ Valuation Ratio: How Does It Stack Up?

Spirit and its competitors have seen their EV/EBITDA decrease in the last six months due to the fear of a large increase in available seat miles.

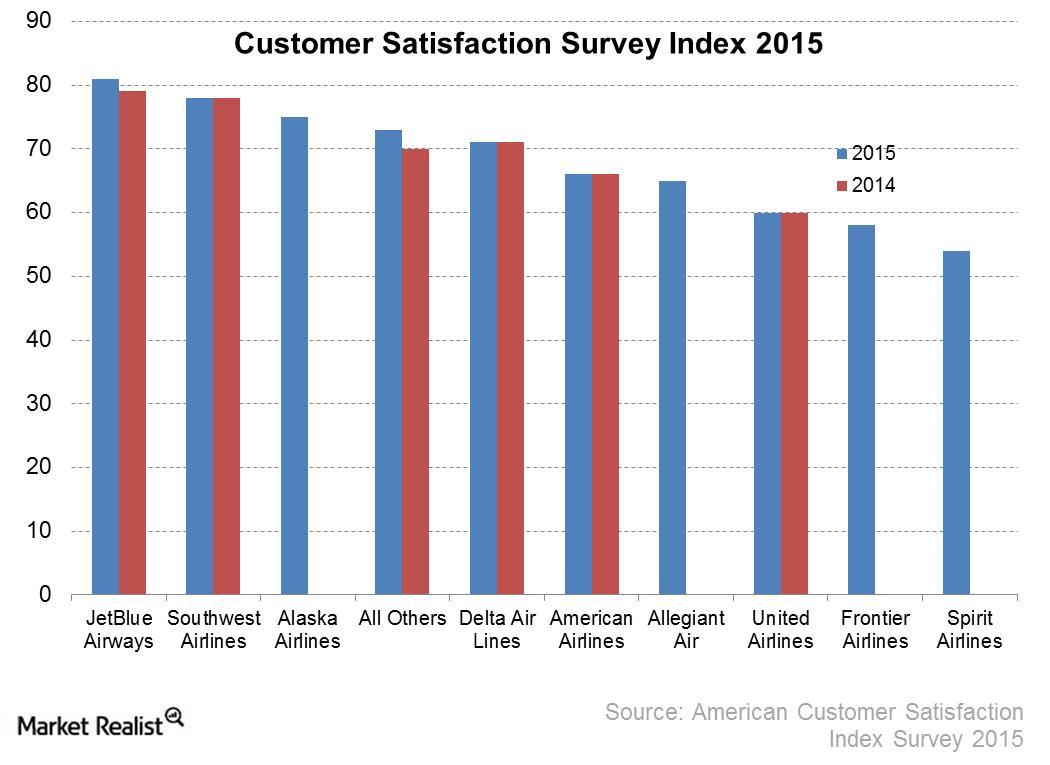

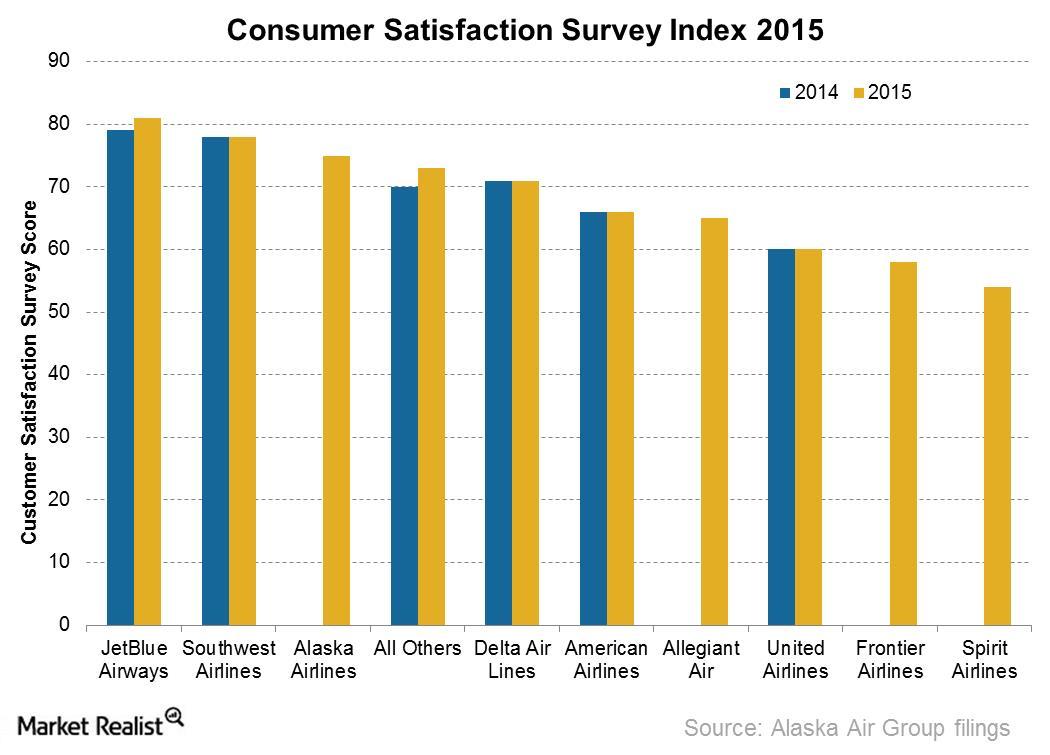

Alaska Airlines’ Keys to High Customer Satisfaction

For the seventh consecutive year, Alaska Airlines held the top spot in Customer Satisfaction among the Traditional Network Carriers survey conducted by J.D. Power.

Understanding Spirit Airlines’ Low-Cost Business Model

Spirit Airlines (SAVE) follows a simple business model of reducing base airfares as much as possible. All its other services are charged separately.

China Eastern’s operating margin declines due to rising costs

Rising costs impacted China Eastern’s (CEA) operating margins, which declined from 5% in FY09 to 1.8% in FY13.

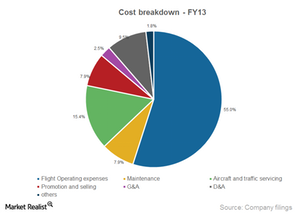

Rising operating expenses as a percentage of revenue

More than half of China Southern’s total operating expenses in FY13 were related to flight operating expenses.