Ally Schmidt

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Ally Schmidt

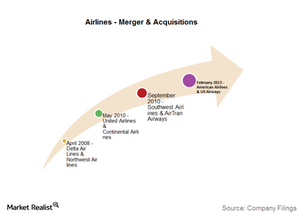

Airline Mergers and Acquisitions: Are We There Yet?

The most recent phase of consolidation that began in 2005 has seen 13 airline mergers and acquisitions. Four of these deals are worth special mention because they changed the face of the industry.

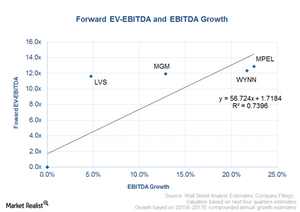

The Valuation of Macao Casino Stocks

Macao’s shift from VIP gaming to the mass gaming market and non-gaming revenue is expected to benefit Macao in the long run.

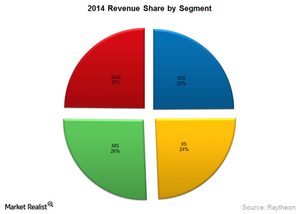

Raytheon Company: An Introduction

Raytheon is a global technology leader and US defense contractor. It primarily develops and manufactures weapons and military and commercial electronics.

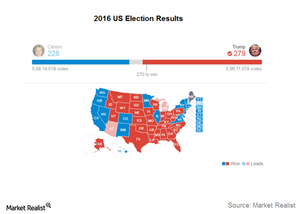

Initial Reactions from the Travel Industry after Trump’s Win

Just a few days ago, we wrote about how Trump had received very little support from the travel industry. Now that he’s been elected, what’s next?

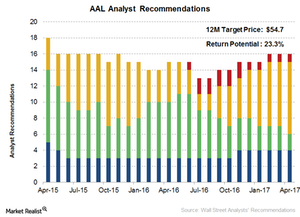

Wall Street Analysts’ Recommendations for American Airlines

According to Reuters, of the 17 analysts tracking American Airlines (AAL), 23.5% (or four) have “strong buy” ratings on the stock.

Why Delta Air Lines Stock Fell after Q4 Earnings

Delta Air Lines (DAL) reported its fourth quarter 2016 results on January 12, 2016. The airline’s revenue fell.

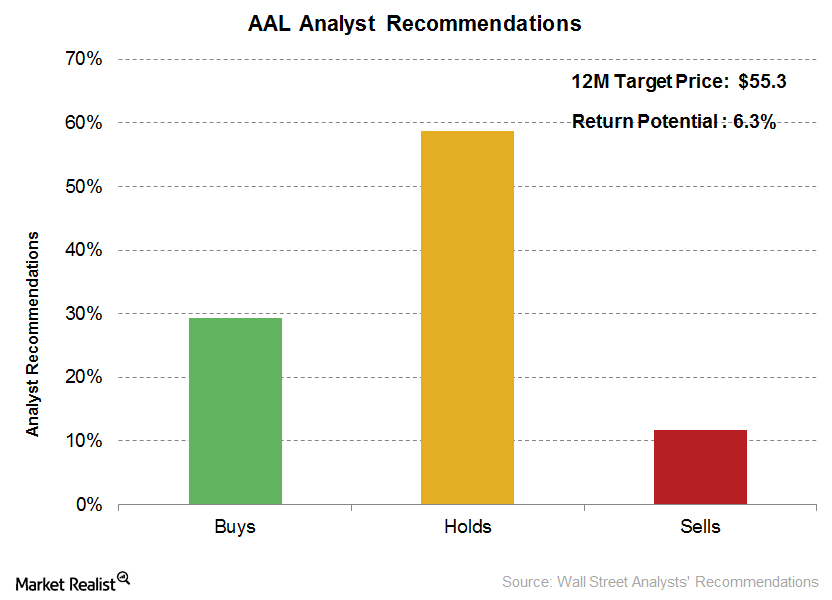

Fewer Analysts Recommend ‘Buys’ on American Airlines

Analysts’ “hold” ratings on American Airlines stock have risen significantly. Nine analysts, a total of 56.3%, now have “hold” ratings on the stock.

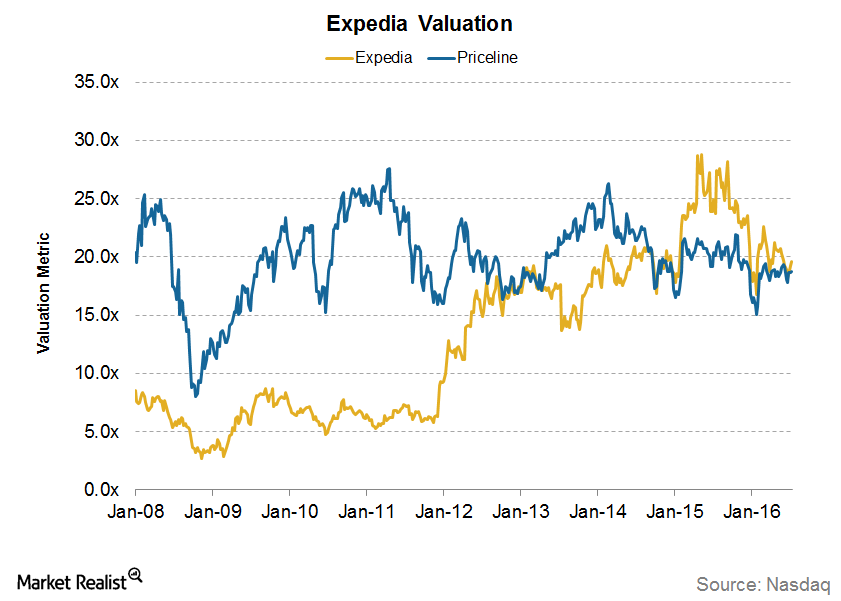

Priceline’s Valuation after 2Q16: What’s Priced In?

Priceline currently trades at a forward PE multiple of 19.5x. This is slightly lower than its average valuation of 19.9x since February 2006.

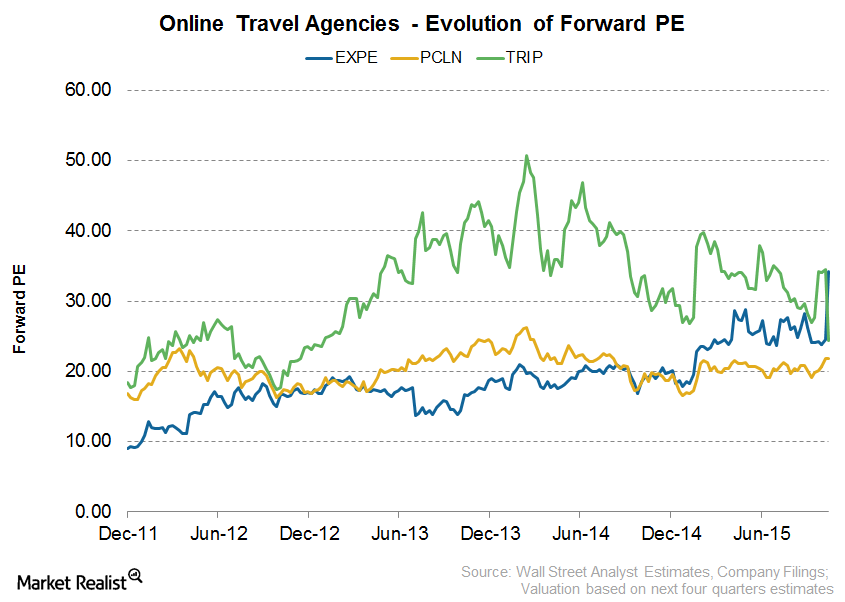

Valuation: Priceline Versus Its Peers

As of November 6, 2015, Priceline’s forward PE ratio stood at 21.8x, and its average valuation stands at 20x.

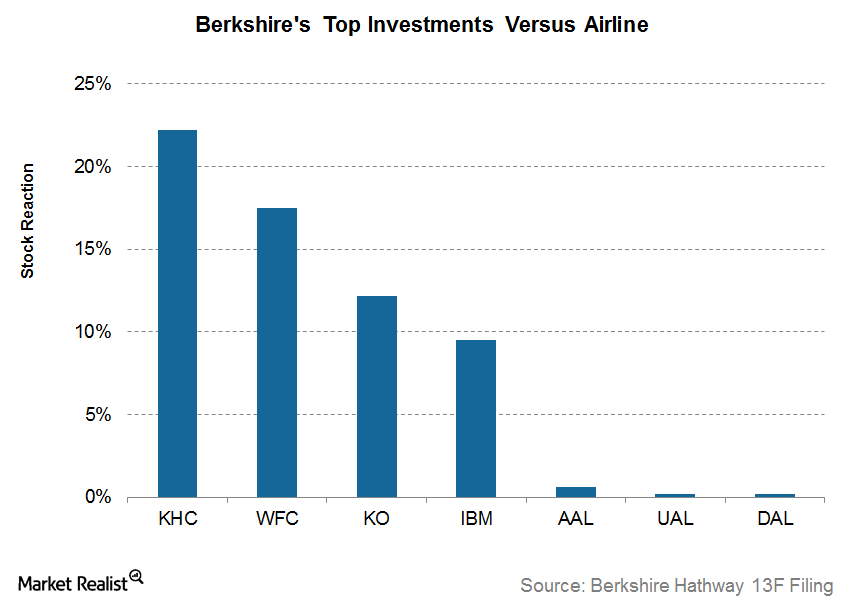

Why Is American Airlines Warren Buffett’s Top Pick?

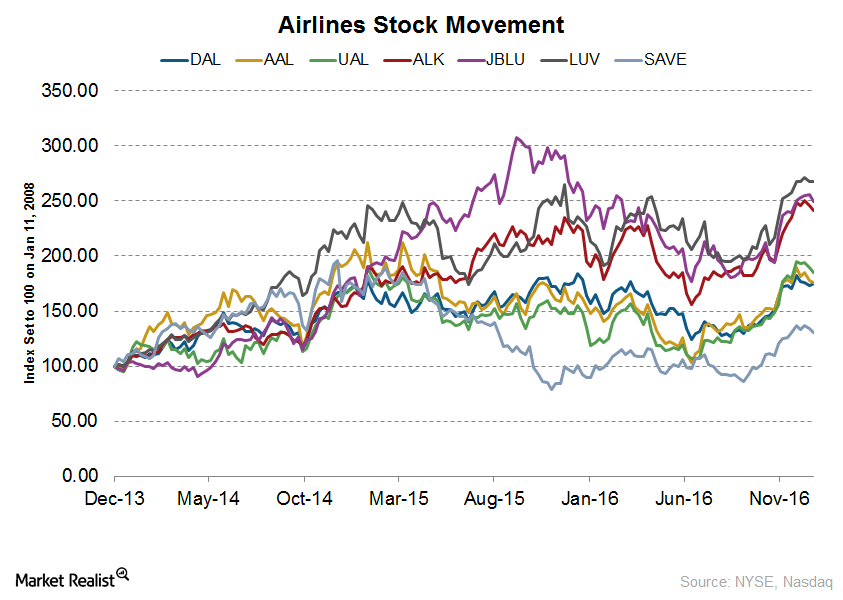

Berkshire Hathaway’s (BRK.B) November 2016 13F filing attracted considerable interest for airline investors. The 13F revealed Warren Buffett’s new investments in the airline sector—a sector he had written off during the past decade.

How Is UPS Valued Compared to Its Peers?

UPS’s forward PE ratio stands at 17.1x compared to its current PE ratio of 22.3. Analysts are expecting UPS’s earnings to grow in the next four quarters.

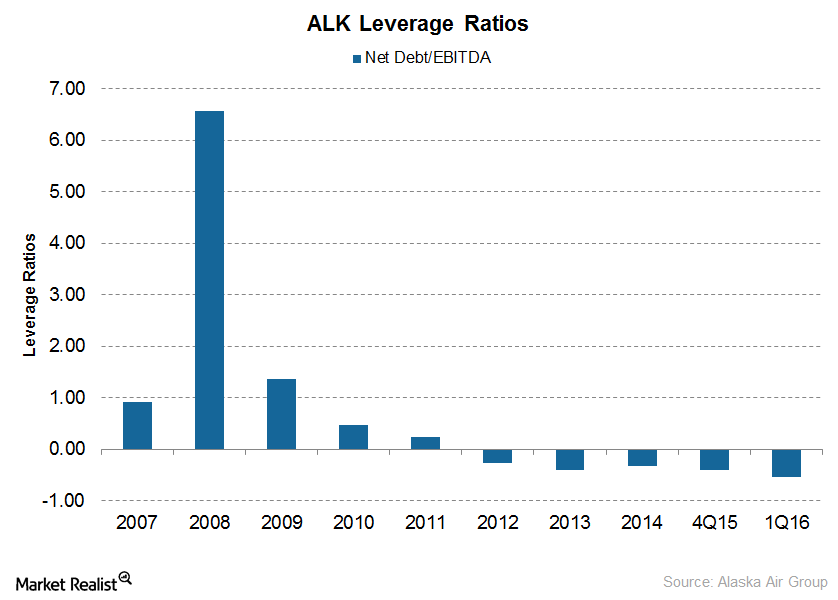

Alaska Air’s Low Debt: Is It an Advantage?

Alaska Air Group (ALK) has been trying to reduce its debt burden in order to strengthen its balance sheet in the long term.

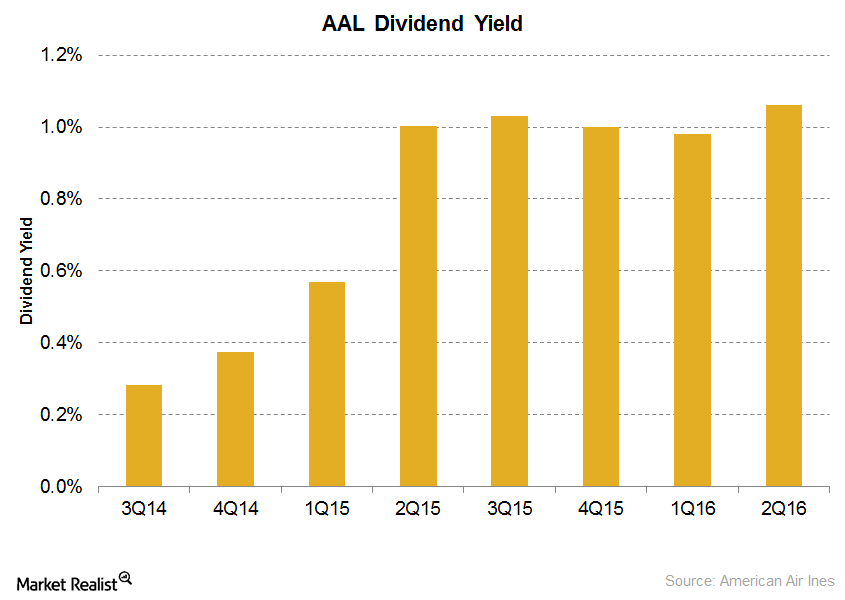

Will American Airlines Increase Dividend Payouts?

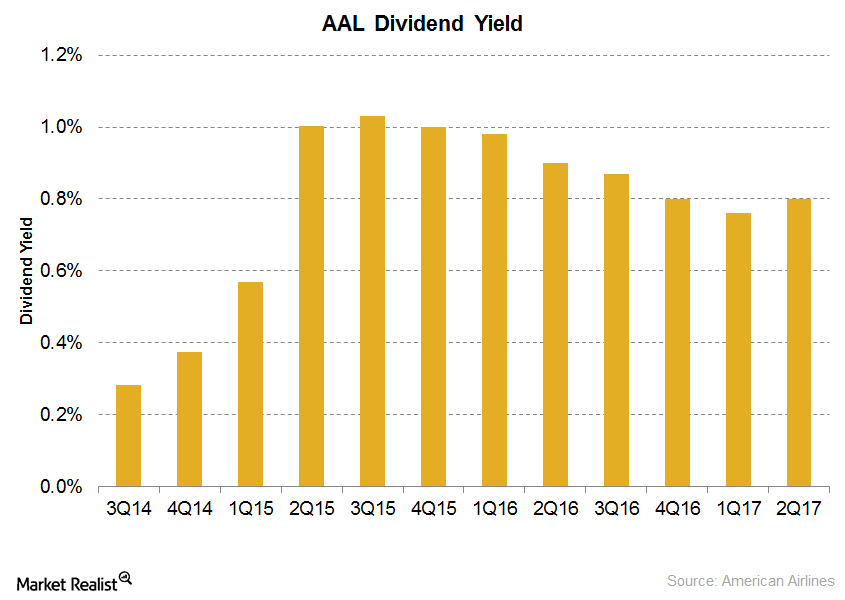

American Airlines started paying dividends in mid-2014, joining the ranks of Delta Airlines, Southwest Airlines, and Alaska Air Group, the few dividend-paying airlines.

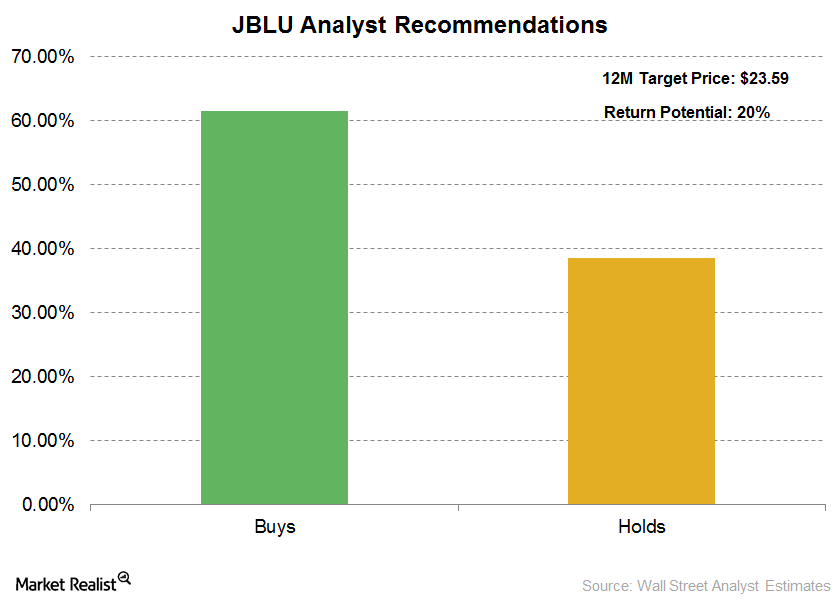

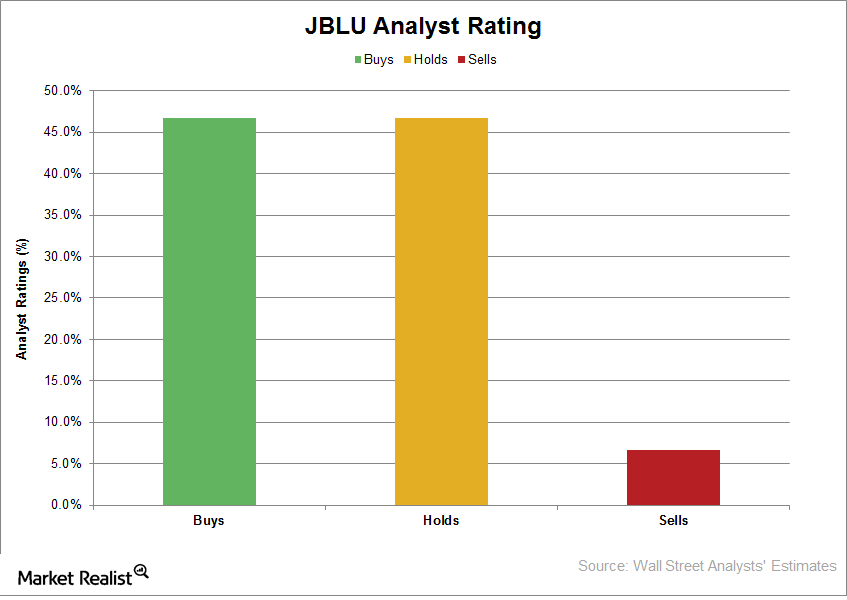

JetBlue Airways: What Are Analysts’ Recommendations?

JetBlue Airways (JBLU) is expected to release its 2Q16 earnings on July 26. According to an analyst consensus, JBLU is expected to earn $0.49 in 2Q16, compared to earnings per share of $0.44 in 2Q15.

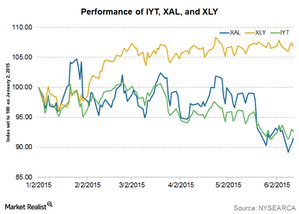

Analyzing the Key Variables for the Airline Industry

Investors should keep an eye on airfare trends. Despite a 40% fall in crude oil prices—the major cost for airlines—airfares have remained fairly stable.

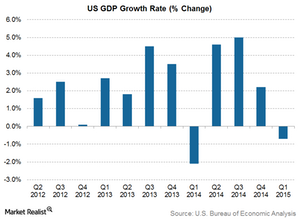

What are UPS’s Revenue Drivers?

Revenue drivers There are three main drivers of revenue growth for United Parcel Service (UPS): package volumes, product mix and pricing, and fuel surcharges. Package volumes and product mix and pricing are in turn driven by economic growth. Economic growth Increasing economic growth increases e-commerce demand, which in turn increases demand for courier services. […]

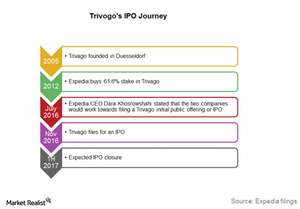

A Look at Trivago’s Journey toward Its IPO

In Expedia’s 2Q16 earnings call in July 2016, CEO Dara Khosrowshahi said it would work with Trivago to file a Trivago IPO before the end of 2016.

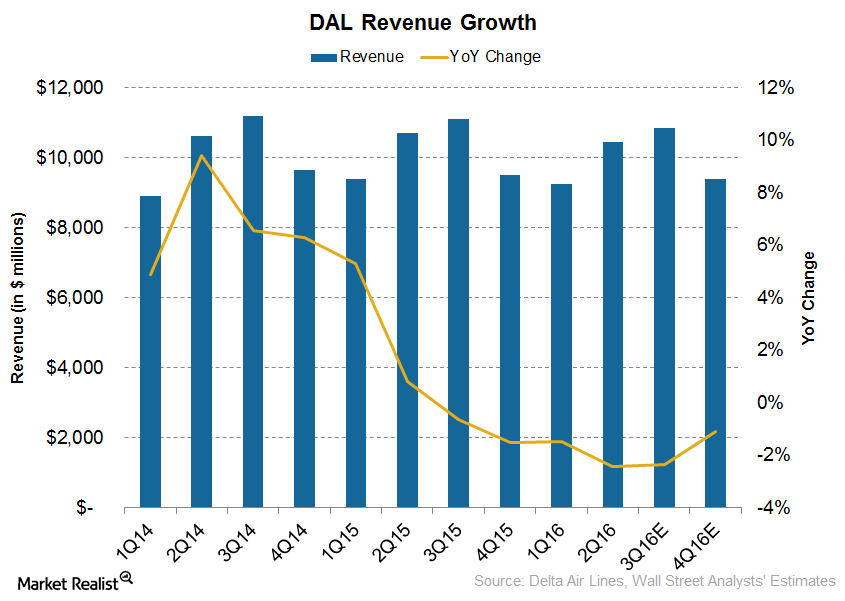

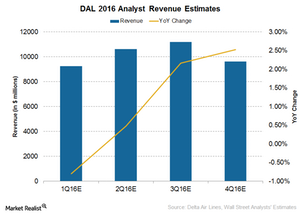

Why Is Delta Air Lines’s Revenue Expected to Fall in 2016?

Analysts are estimating an ~4.5% decline in Delta Air Lines’s (DAL) revenue to $10.6 billion for 3Q16.

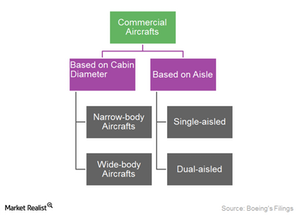

Boeing’s Commercial Aircraft Classifications

Boeing’s commercial aircraft carry 100–500 passengers, including dual-aisle wide-body aircraft and narrow-body planes with four- to seven-across seating.

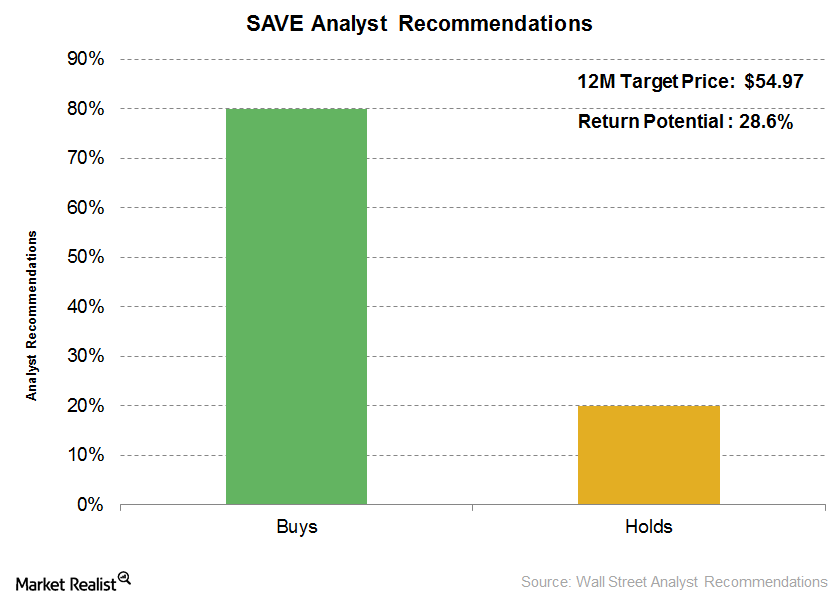

What Are Analysts Estimating for Spirit Airlines in 2016?

Of the 15 analysts rating Spirit Airlines’ stock, 80% (12 analysts) have a “buy” rating, 20% (three analysts) have a “hold” rating, and none of the analysts have a “sell” rating.

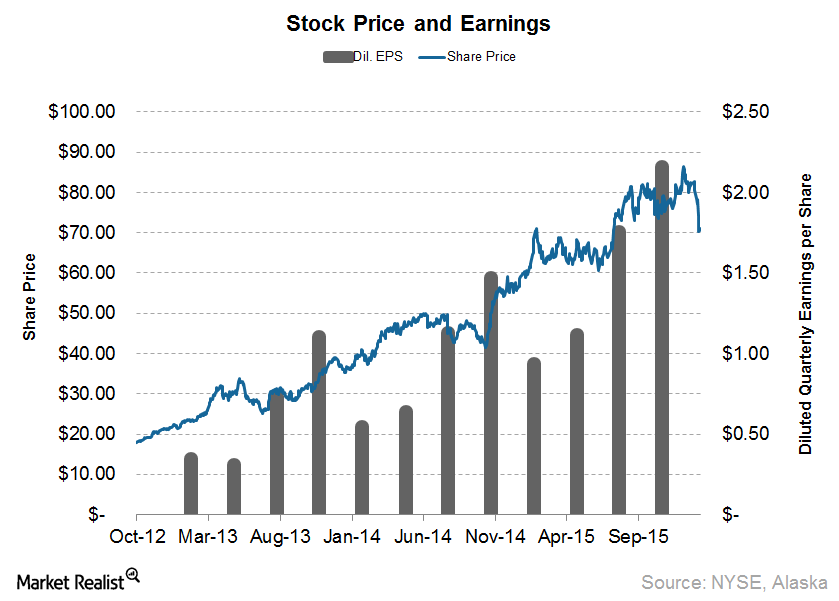

Can Alaska Air Stock Continue Its Stellar Performance in 2016?

Alaska Air Group plans to announce its 4Q15 and 2015 financial results on January 21, 2016. The company had a successful 2014 with record profits of $605 million on revenues of $5.37 billion.

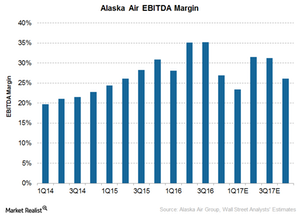

Could Alaska Air Group’s Margin Expand in 2017?

In 1Q17, Alaska Air Group’s (ALK) EBITDA (earnings before interest, tax, depreciation, and amortization) is expected to fall 5.8% to $385 million.

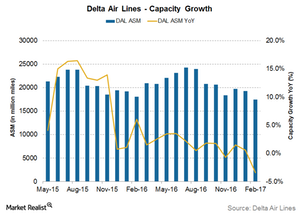

Delta Air Lines: On the Right Route to Achieve Capacity Guidance?

Delta Air Lines (DAL) has maintained a low-capacity growth profile throughout 2017. For May 2017, DAL’s capacity growth was flat at 22,072 million miles.

Why Analysts Reduced 2016 Revenue Estimates for Delta Air Lines

For 1Q16, analysts are estimating Delta Air Lines (DAL) revenues to decline by ~1.5% YoY (year-over-year) to about $9.3 billion.

What sets J.B. Hunt apart from its competitors?

In this part of the series, we’ll discuss what sets J.B. Hunt (JBHT) apart from its competitors. The company has more than 40 years of experience.Industrials Consider these key risks facing Lockheed Martin

The U.S. government is Lockheed Martin’s (LMT) major customer. With almost 82% of its revenues from the U.S. government, LMT highly depends on the government.Industrials An overview of Lockheed Martin’s business segments

Lockheed Martin (LMT) operates in five business segments—Aeronautics, Information Systems & Global Solutions, Mission and Fire Controls, Mission Systems & Trainings, and Space Systems.

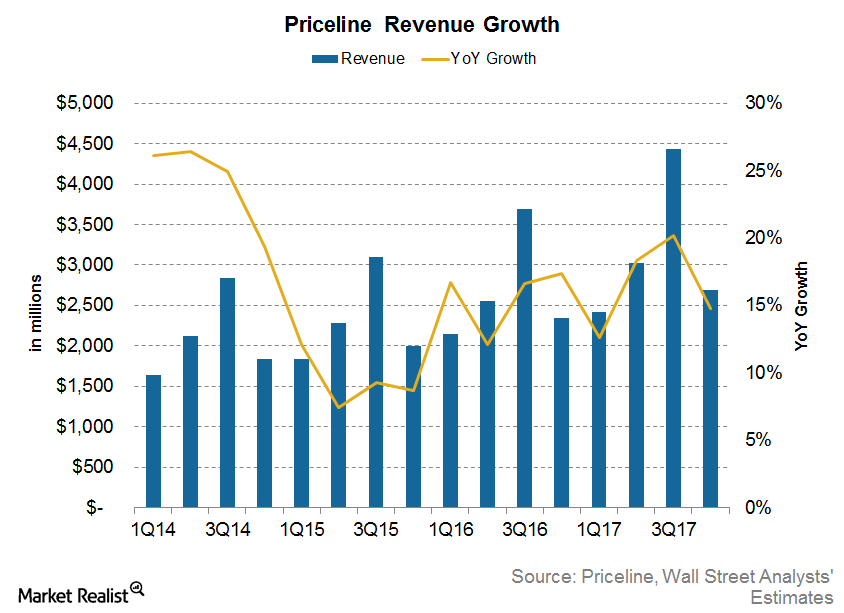

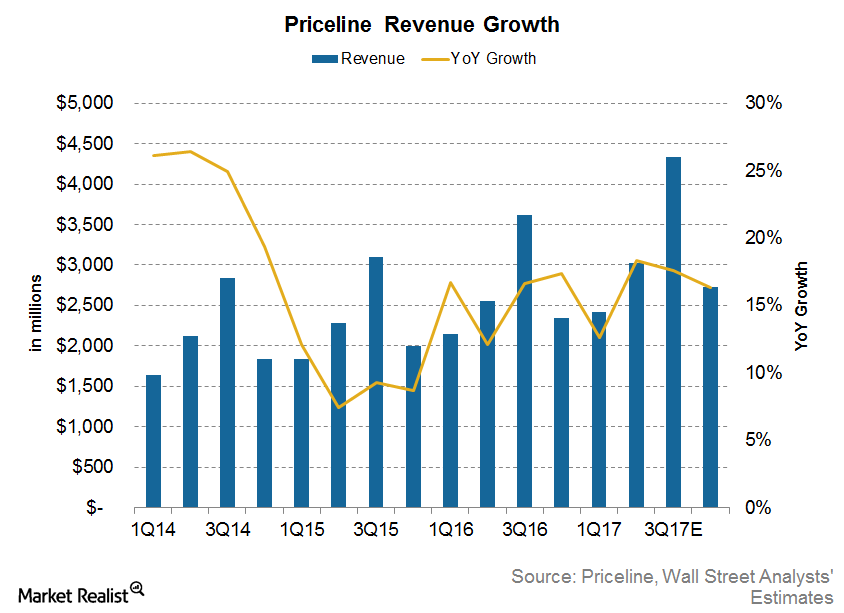

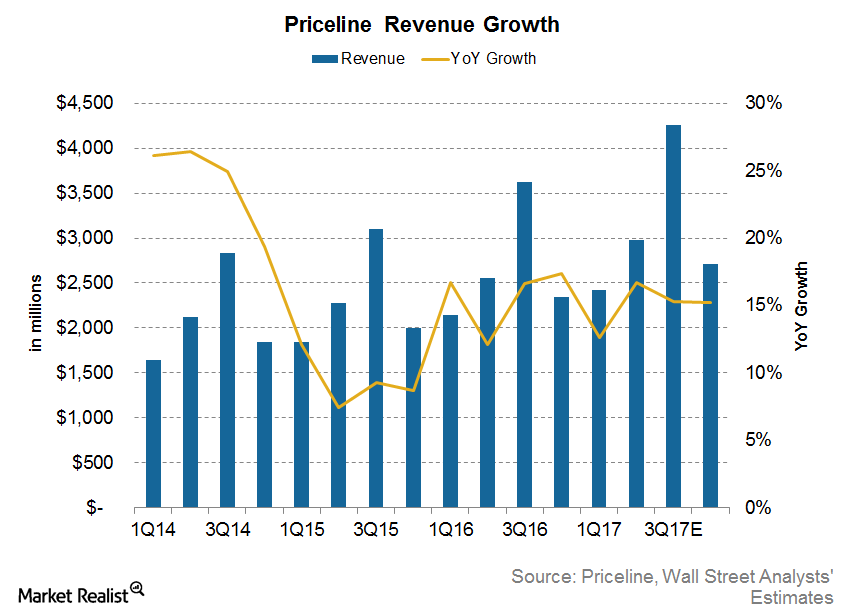

What Analysts Estimate for Priceline in 4Q17

After Priceline (PCLN) released its 3Q17 results, analysts’ estimates for 2017 and 2018 were revised downwards. For the fourth quarter of 2017, sales are expected to grow 14.8% year-over-year or YoY to $2.7 billion.

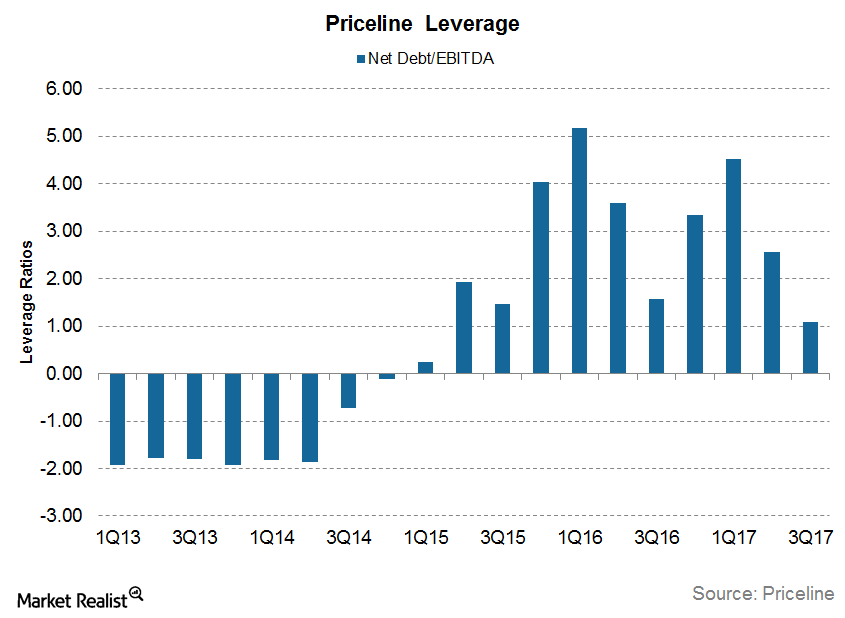

Priceline’s Increasing Leverage: What You Need to Know

A large part of Priceline’s (PCLN) growth in the past has come from acquiring smaller companies all over the world. It had to raise debt to finance some of these acquisitions.

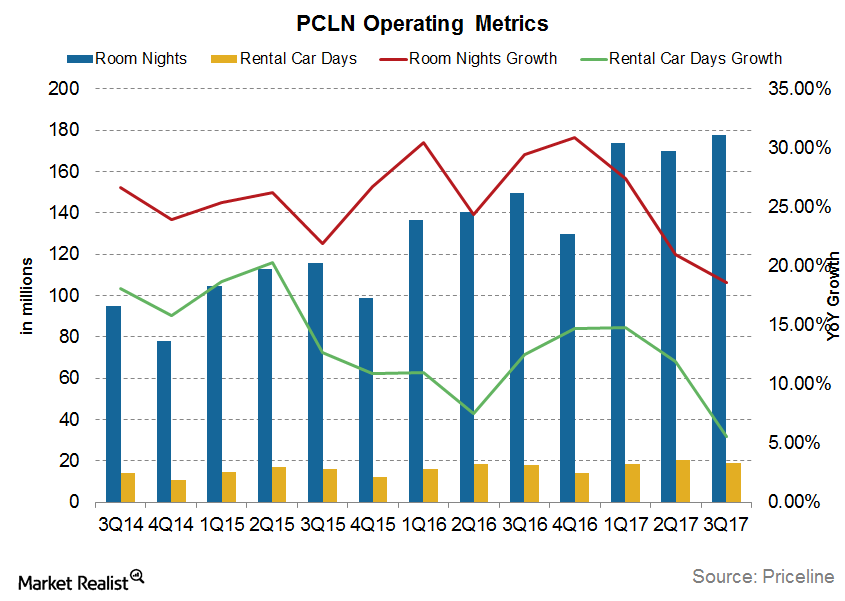

Priceline’s Key Metric Growth Is Slowing Down

Hotel accommodations have historically driven Priceline’s growth. During the third quarter of the year, Priceline’s global accommodation business booked 178 million room nights.

Assessing Priceline’s Revenue Growth in 2017

Analysts expect Priceline’s fiscal 2017 revenues to grow 16.7% YoY to $12.5 billion, which is slightly lower than the 16.5% YoY growth seen in 2016.

Chart in Focus: Priceline’s Booking Guidance for 3Q17

In 2Q17, Priceline’s (PCLN) gross bookings grew 16.4% year-over-year to $20.8 billion.

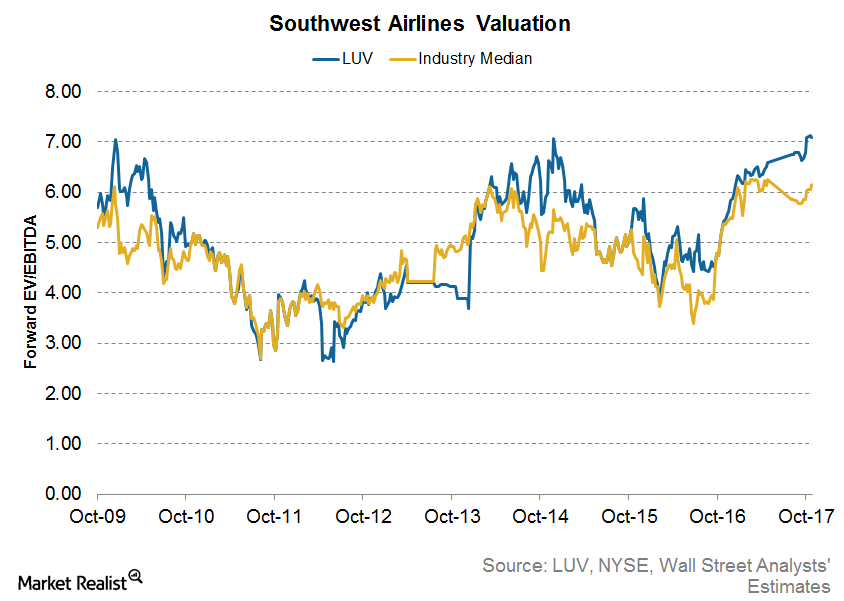

What Does Southwest Airlines’ Current Valuation Indicate?

Current valuation Southwest Airlines (LUV) has a forward EV-to-EBITDA[1. enterprise value to earnings before interest, tax, depreciation, and amortization] multiple of 7.1x. This is the highest multiple among the major airline carriers and is higher than its average valuation of 6.3x since September 2008. Peer comparisons American Airlines (AAL) is trading at a similar valuation […]

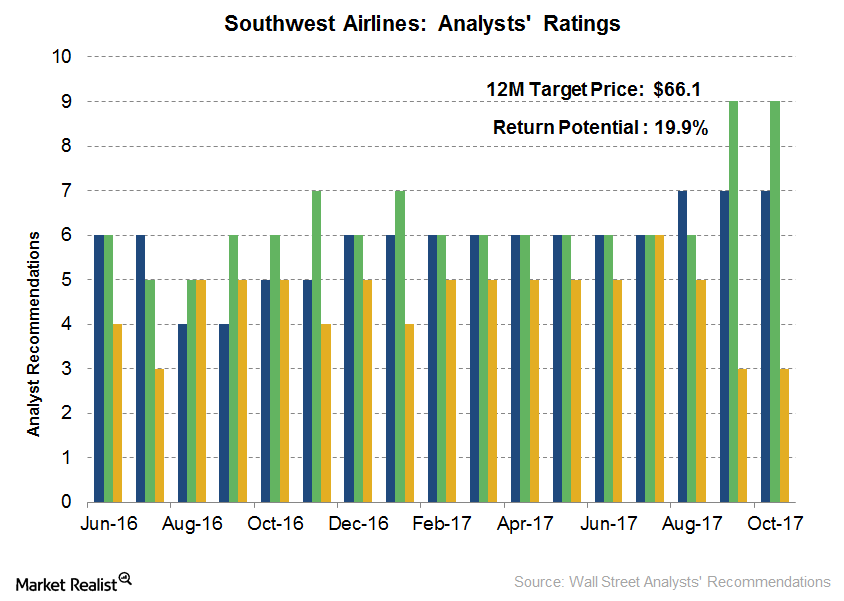

Analysts’ Recommendations for Southwest Airlines

Analysts’ recommendations Of the 17 analysts tracking Southwest Airlines (LUV), 36.8% of the analysts (seven analysts) gave a “strong buy” rating on the stock, while another 47.4% (nine analysts) gave a “buy” rating. The remaining 15.8% (three analysts) gave a “hold” rating. None of the analysts gave a “sell” or “strong sell” rating on the […]

A Look at American Airlines’ Dividend Payouts

Only four airlines—Delta Air Lines (DAL), Southwest Airlines (LUV), American Airlines (AAL), and Alaska Air Group (ALK)—pay dividends to investors.

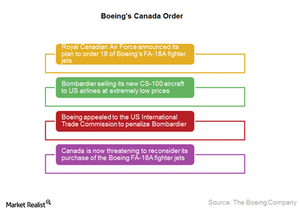

Canada Puts Boeing Defense Order on Hold

The Canadian Air Force placed an order for 65 Lockheed Martin (LMT) F-35 fighter jets for $30 billion. The CAF canceled the order and replaced it with 18 Boeing CF-18 aircraft for $5.2 billion.

What Wall Street Analysts Recommend for JetBlue Airways

As of September 19, 2017, one analyst out of the 15 analysts tracking JetBlue Airways (JBLU) had a “strong buy” recommendation on the stock.

Could American Airlines’ Unit Revenues Decline in 2H17?

TK

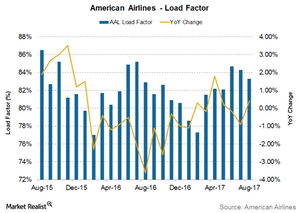

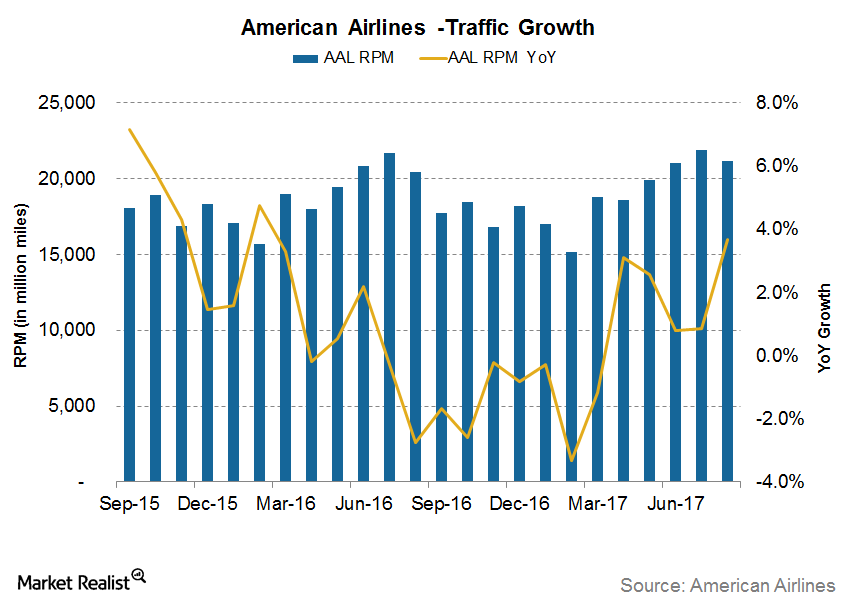

American Airlines’ Traffic Growth Exceeds Its Capacity Growth

For August 2017, AAL’s international traffic increased 6.9% year-over-year. Year-to-date, its international traffic has increased 5.5% YoY.

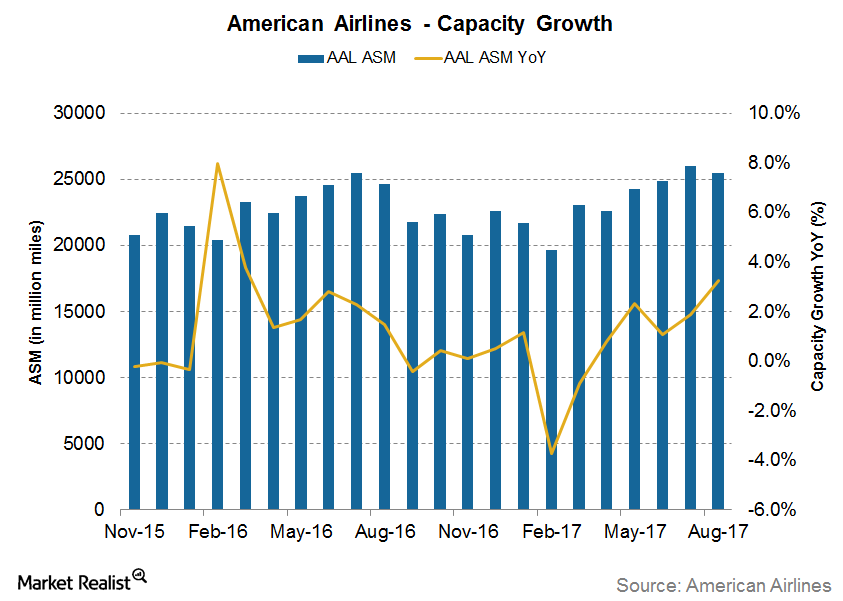

American Airlines’ Capacity Outpaced Its Legacy Peers in August

American Airlines’ (AAL) capacity grew 3.2% year-over-year in August, significantly higher than its 0.4% year-over-year growth reported in the previous seven months.

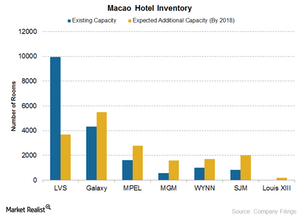

Macao Casinos Hope Hotel Supply Will Drive Demand

Macao’s casinos are trying to change Macao from a gaming-only destination to more of a Las Vegas–like destination.

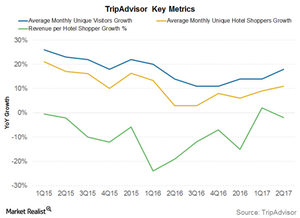

What Do TripAdvisor’s Key Metric Trends Suggest?

TripAdvisor’s (TRIP) average monthly unique visitors in 2Q17 rose 18.0% YoY (year-over-year) to 414.0 million users compared to 2Q16.

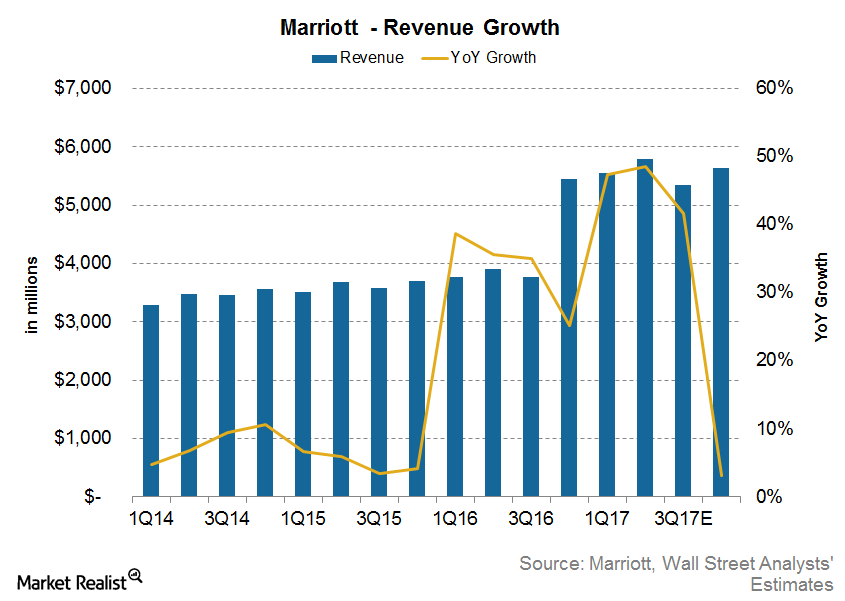

Marriott’s Revenue Is Now Expected to Go This Way in 2017

In 2Q17, Marriott’s revenues grew 49% YoY to $5.8 billion, compared with $3.9 billion in 2Q16, due to higher fee revenues and RevPAR and room growth.

How Priceline Can Grow Its Revenue in 2017

For 2Q17, analysts are estimating that Priceline’s (PCLN) revenue will rise 16.7% YoY to $3.0 billion, which is higher than 12.6% in 1Q17.

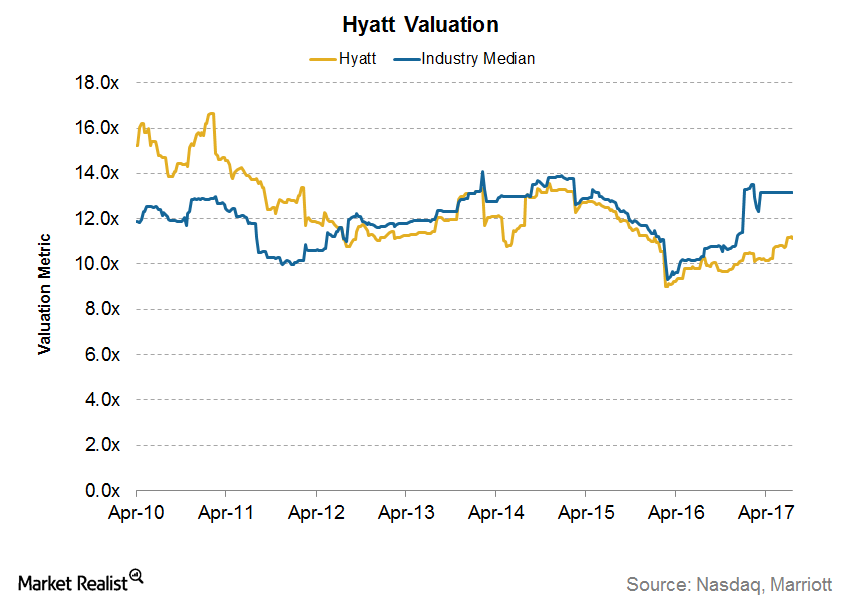

How Hyatt’s Valuation Compares

Current valuation Hyatt (H) currently trades at a forward EV-to-EBITDA multiple of 15.1x. Hyatt’s valuation is significantly higher than its average valuation since January 2010 of 13.0x. Peer comparison Hyatt’s valuation is among the highest in its peer group. Marriott International (MAR) has a multiple of 15.3x, Hilton Worldwide Holdings (HLT) is trading at a […]

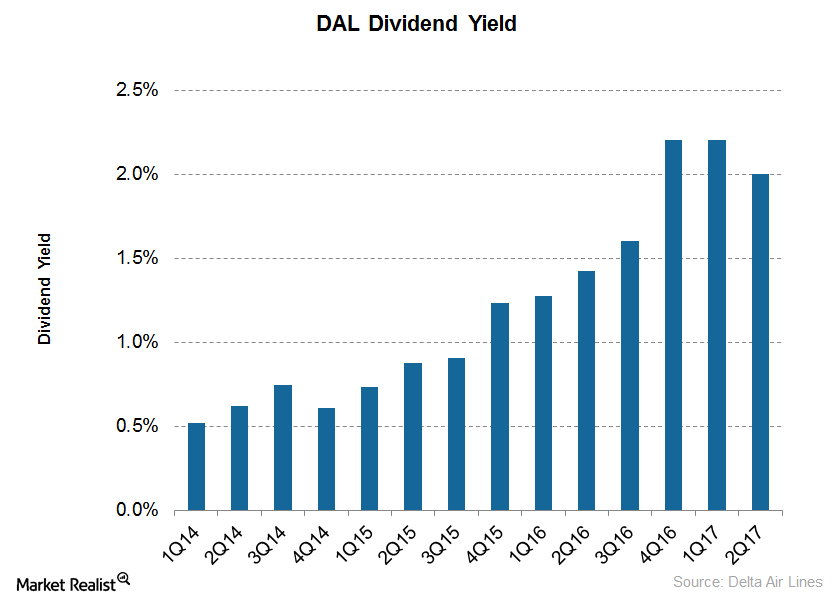

Can Delta Continue to Be the Best Airline Dividend Payer?

Delta Air Lines (DAL) has an indicated dividend yield of 2.0%, the highest among the four airlines that pay dividends.

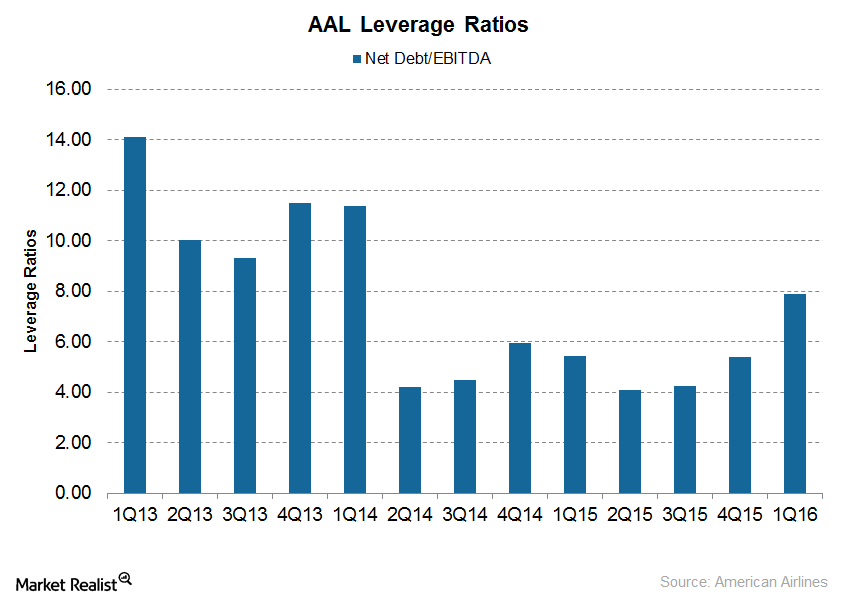

Why Investors Should Be Concerned about American Airlines’ Debt

AAL has paid little attention to its total debt, which rose from $20.8 billion at the end of 2015 to $24.3 billion at the end of 2016 and $24.5 billion at the end of 1Q17.

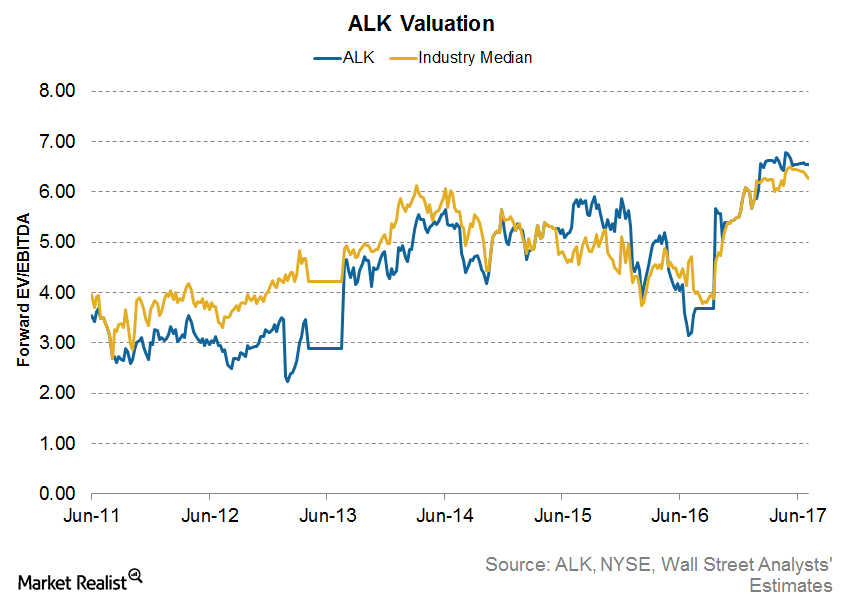

Inside Alaska Air’s Valuation: Cheap Enough?

Alaska Air Group (ALK) is now trading at 6.6x its forward EV-to-EBITDA ratio—one of the highest valuations in the industry.

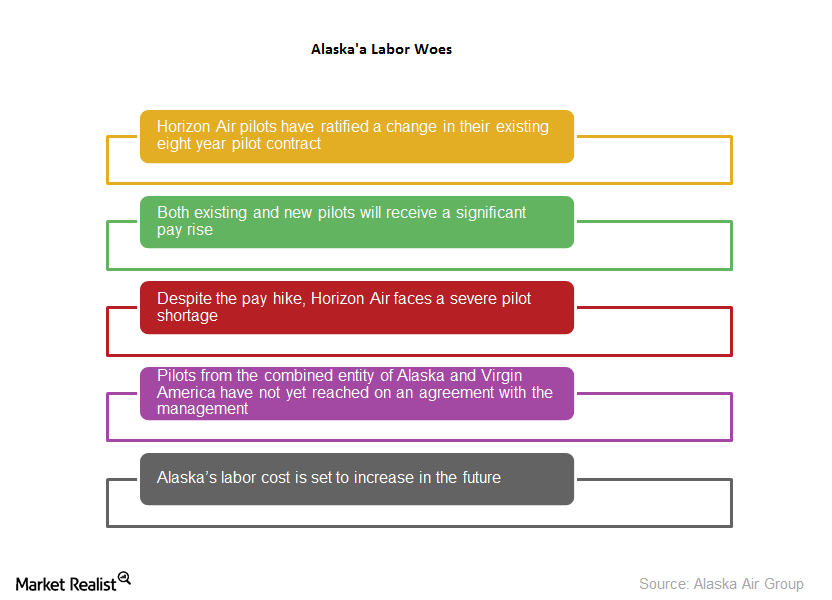

Horizon Air’s Pilots Ratify Change in Agreement

Horizon Air pilots have ratified a change in their existing eight-year pilot contract that entitles both existing and new pilots to receive significant pay raises.

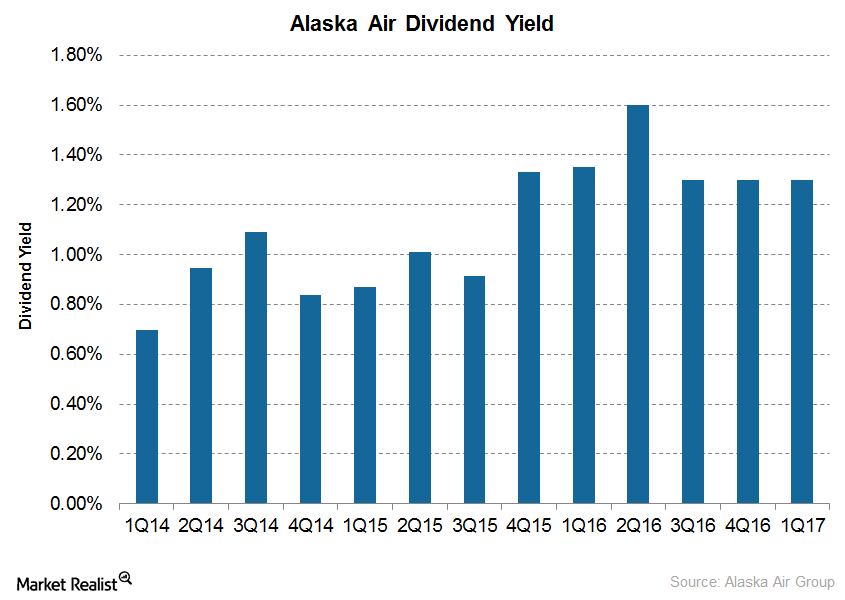

Inside Alaska Air’s Dividend Payout Prospects in 2017

There are only four airlines that currently pay dividends. This is due to the fact that airlines have struggled to stay profitable for a long time now.