Ally Schmidt

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Ally Schmidt

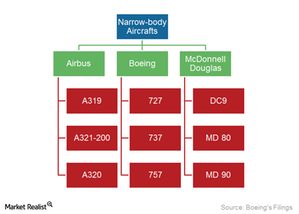

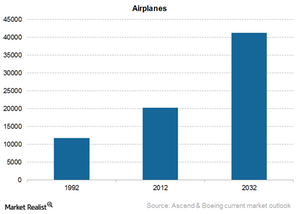

The Boeing Company’s Narrow-Body Aircraft

The Boeing 737 is the best-selling commercial airliner in history. Reliable and economical, the 737 dominates the short- and medium-haul markets.

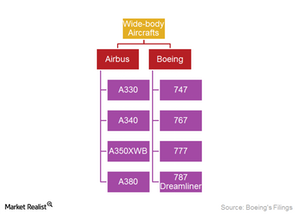

Boeing’s Fleet of Wide-Body Aircraft

Wide-body aircraft fly transoceanic routes, can accommodate 200–500 passengers, and often transport commercial cargo across the globe.

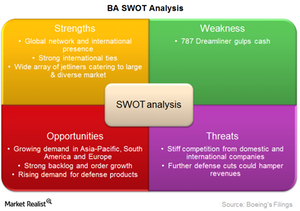

A SWOT Analysis of Boeing

Strengths and weakness are internal factors within a company’s control. Opportunities and threats are external factors outside its control.

Boeing: A Wide Diversification Wingspan

When Boeing bought McDonnell Douglas in 1996, the acquisition helped Boeing overtake Lockheed Martin as the largest defense contractor.

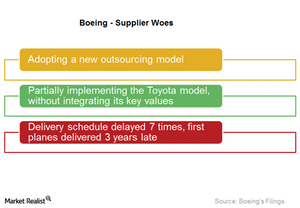

Supplier Capacity: A Problem for Aircraft Manufacturers?

Boeing bought Vought Aircraft Industries, one of its Tier 1 suppliers. This acquisition helped Boeing gain more robust control of its manufacturing process.

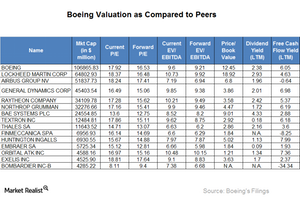

Comparing Boeing’s Valuation to Its Peers

Boeing is the largest company by market capitalization among our selected peers, while Bombardier is the smallest.

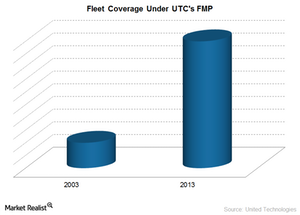

How Did UTC Improve Its Aftermarket Business?

Pratt & Whitney (UTX) originally focused only on selling airplane engines and spare parts. It covered only 10% of its engines under its aftermarket program.

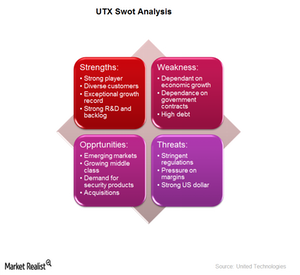

United Technologies Corporation: A SWOT Analysis

In this article, we’ll do a SWOT analysis of United Technologies Corporation (UTX), including its strengths, weaknesses, opportunities, and major threats.

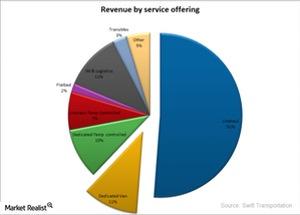

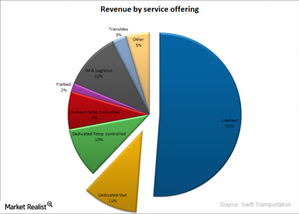

Swift Transportation: A Company Overview

Swift operates a diverse fleet of 18,000 tractors, 60,000 trailers, and 8,700 intermodal containers from more than 40 terminals in the US and Mexico.

What Should Investors Know About Raytheon?

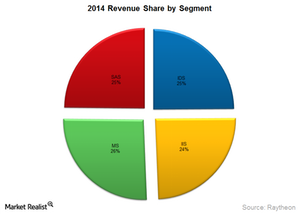

Raytheon is a leading technology company. It provides products and services in the defense, civil, and security markets globally.

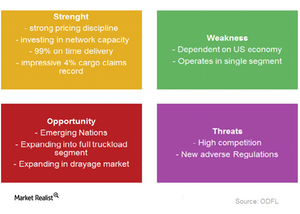

What are ODFL’s most significant strengths and weaknesses?

Old Dominion Freight Line (ODFL) has a strong pricing discipline and best-in-class service capabilities.

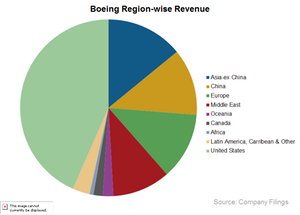

Boeing – a leader in the aerospace industry

Boeing (BA) is one of the world’s largest aerospace companies. The company is a top US exporter. It’s focused on innovation.

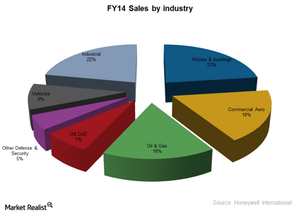

Analyzing how Honeywell makes money

Honeywell International Inc. (HON) is headquartered in Morristown, New Jersey. It was incorporated in 1985. It’s a Fortune 100 company.

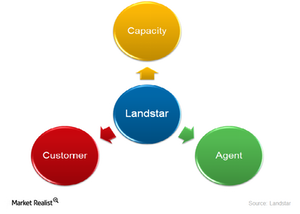

A look at Landstar’s business model

Landstar’s success is highly dependent on high revenue-generating sales reps, as well as on the volume increases by BCOs and customers.

How Landstar System makes money

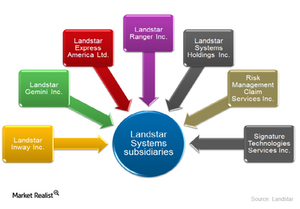

Landstar’s success lies in its ability to provide a complete logistics solution through various transportation modes and up-to-date technology.

What are Landstar’s competitive advantages?

Landstar and other 3PLs perform better during supply disruptions, when they can secure trucks among their large networks of small carriers.

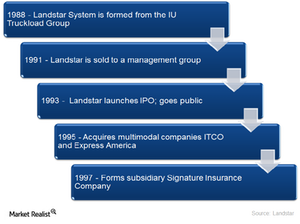

Landstar: Where it all started

Landstar invested $12 million in upgrading its IT and communications systems, making use of satellite technology and mobile equipment to track its fleet.

Where did Swift Transportation Company start?

Swift Transportation (SWFT) was founded in 1966 by Jerry Moyes. The company started with a single truck in Phoenix, Arizona. It grew steadily.

J.B. Hunt’s Integrated Capacity Solutions segment

J.B. Hunt’s (JBHT) Integrated Capacity Solutions segment provides non-asset, asset-light, traditional freight brokerage and transportation logistics solutions to customers.

J.B. Hunt’s Dedicated Contract Services segment

J.B. Hunt’s (JBHT) Dedicated Contract Services segment supplies customers with drivers and equipment. For 2013, the segment’s revenue was $1.2 billion.

A look into J.B. Hunt’s Intermodal segment

J.B. Hunt’s (JBHT) Intermodal segment is the leader in the industry. The segment has transportation service agreements with most North American rail carriers.

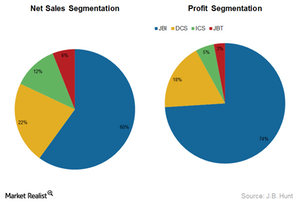

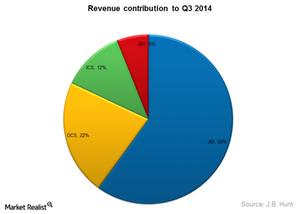

Analyzing how J.B. Hunt makes money

In this part of the series, we’ll discuss how JBHT makes money. In 2013, JBHT’s revenues increased by 500 million. Its total revenue was $5.6 billion.

SWOT analysis of Rockwell Collins

Rockwell Collins expects its Airborne Solutions/Avionics division to see good growth in the future due to the rising demand in Unmanned Air Vehicles (or UAVs).

An overview of J.B. Hunt Transport Services

J.B. Hunt Transport Services, Inc. (JBHT) is one of the leading transport and logistics companies in North America. The company operates a huge fleet of semi-trailer trucks.

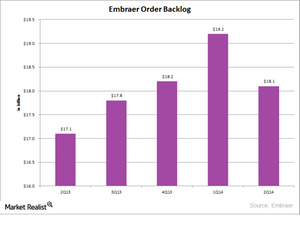

What makes Embraer successful?

In order to find out what makes Embraer successful, we need to look at its major strengths and what the company has done right.

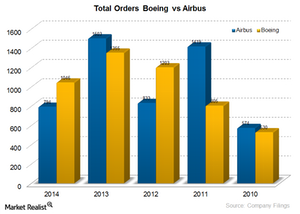

Boeing’s global competitors

Boeing’s global competitors include Airbus, Embraer, and Bombardier.

Boeing’s competitive advantages

One of Boeing’s competitive advantages is that it enjoys strong relations with many companies, even its competitors.

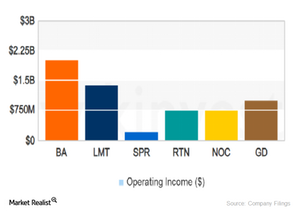

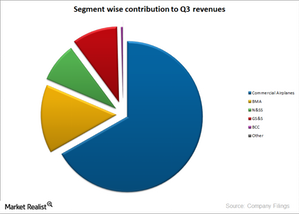

An overview of BA’s business segments

BA’s business segments are Boeing Commercial Airplanes (or BCA) and Boeing Defense, Space & Security (or BDS).Earnings Report Analyzing General Dynamics’ business segments

General Dynamics has four major business segments. In this article, we’ll analyze General Dynamics’ business segments.Earnings Report Why Northrop’s business segments’ performance is important

The Aerospace segment is Northrop Grumman’s (NOC) highest contributor. It contributed ~41% of the company’s total third quarter revenues. The segment was still NOC’s strength.