Ally Schmidt

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Ally Schmidt

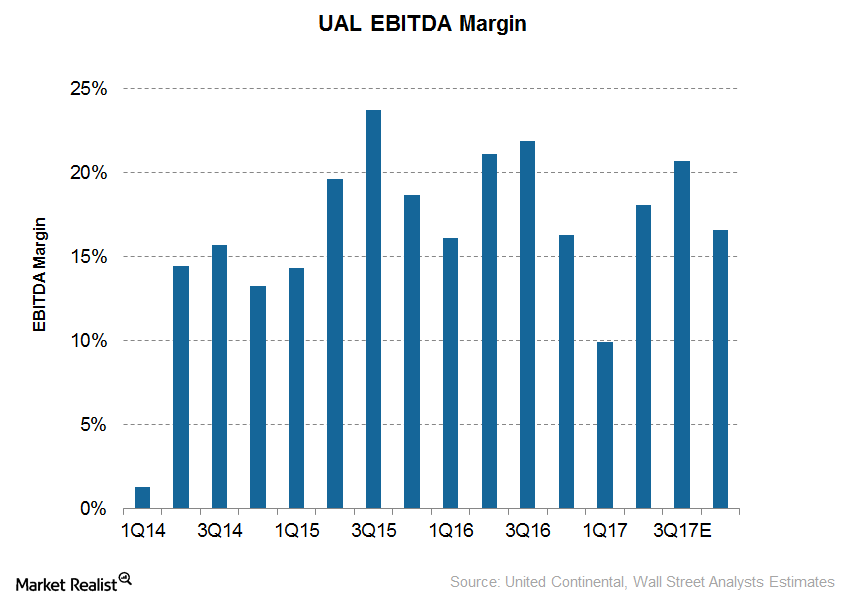

Can United Continental Improve Its Margins in 2017?

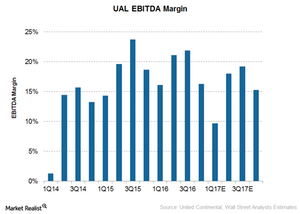

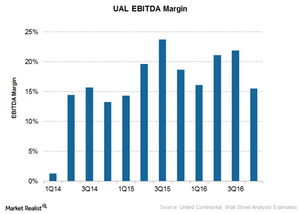

United Continental’s (UAL) EBITDA is expected to fall 10% to $1.8 billion.

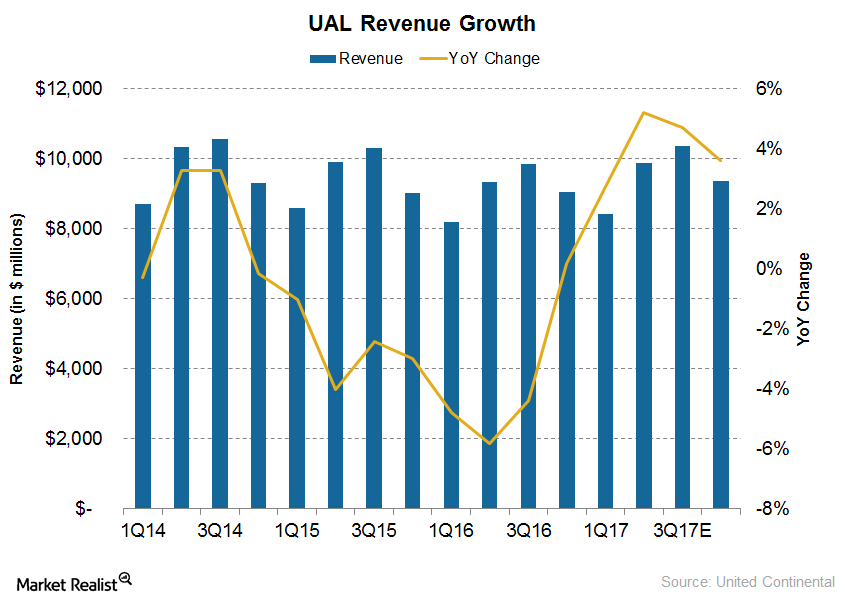

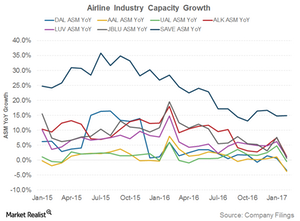

Will United Continental Meet Increased Capacity Growth Guidance?

At the start of the year, United announced its plan to grow its capacity by 0%–1%, in line with GDP growth expectations.

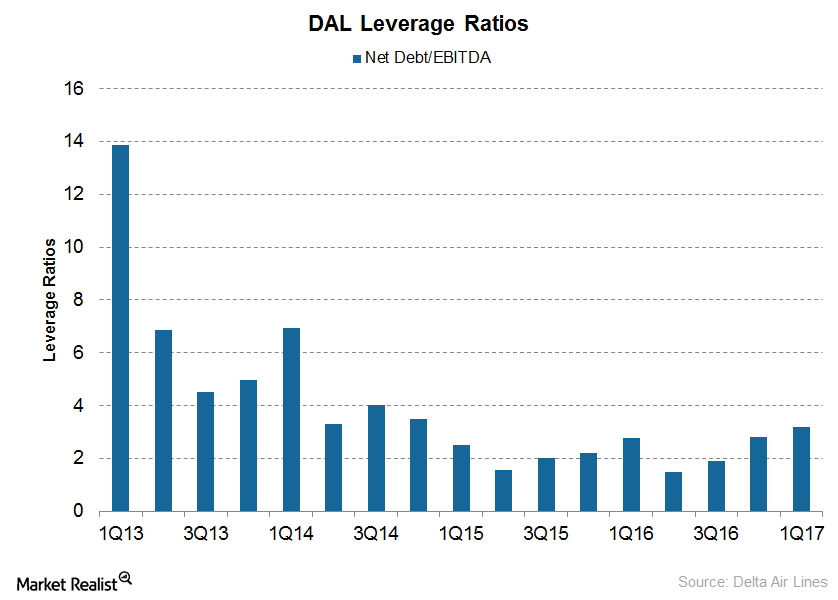

What Delta Air Lines’ Debt Position Means for Investors

During 1Q17, Delta Air Lines’ (DAL) debt rose by ~$2 billion at a blended interest rate of just 3.3%.

Average Daily Rate Will Drive US Hotel Industry Growth

The average daily rate (or ADR) measures the average room price paid in the market. In 1Q17, the ADR rose 2.5% year-over-year (or YoY) to $124.27.

US Hotel Industry Supply to Outpace Demand in 2017

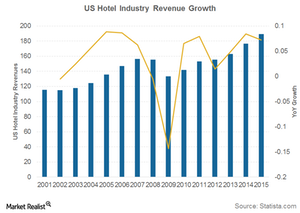

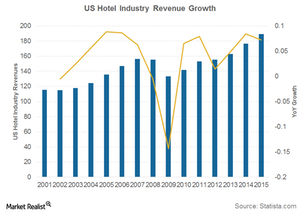

The US hotel industry saw its largest revenue fall of 14% year-over-year (or YoY) in 2009. Since then, recovery has been steep.

Is LUV on Track to Achieve Its Unit Revenue Guidance?

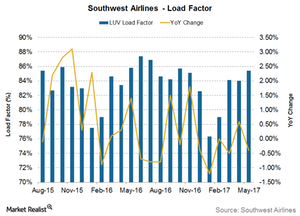

Because Southwest Airlines’ (LUV) traffic growth lagged its capacity growth in three of the first five months of 2017, its utilization also fell in three of the five months.

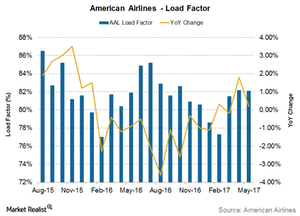

Why American Airlines Improved Its Unit Revenue Guidance for 2Q17

AAL’s utilization rose 0.3% YoY (year-over-year) in February, then by 1.8% YoY in April and 0.2% YoY in May.

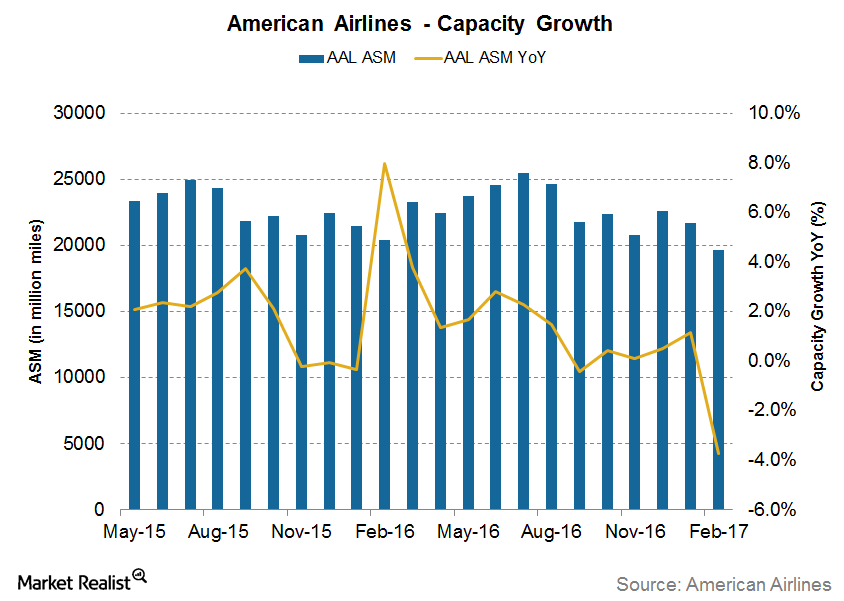

Will American Follow United Continental in High Capacity Growth?

For May 2017, American Airlines (AAL) reported a 2.3% YoY (year-over-year) growth in capacity—its highest growth so far in 2017.

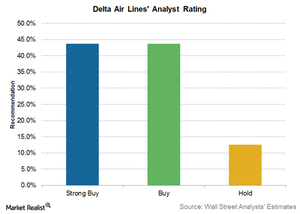

Analyst Ratings for Delta Air Lines after Traffic Release

Only one analyst has upgraded Delta Air Lines (DAL) since it released its traffic data on Friday, June 2, 2017.

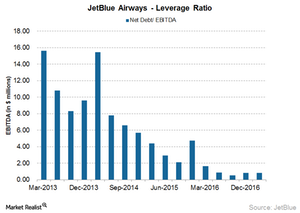

What Investors Should Know about JetBlue’s Debt

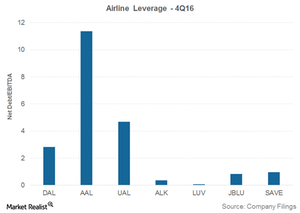

The airline industry is very capital-intensive, so airlines generally have huge debt numbers on their balance sheets.

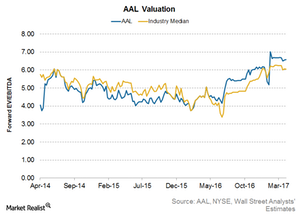

American Airlines’ Valuation: What’s Priced In?

Currently, American Airlines (AAL) is valued at 6.6x its forward EV-to-EBITDA ratio (enterprise value to earnings before interest, tax, depreciation, and amortization).

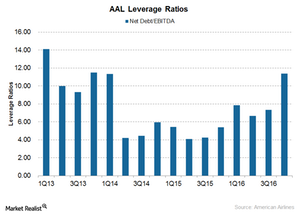

Why American Airlines Has Higher Debt Compared to Its Peers

As opposed to most other airlines that have been reducing their debts, American Airlines’ (AAL) debt has risen, partly due to its focus on completing its integration with US Airways.

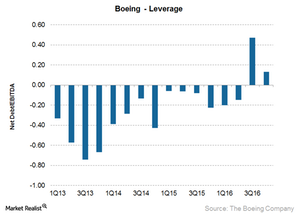

Why Boeing’s Increasing Leverage May Mean Higher Risk

At the end of 4Q16, Boeing’s leverage fell to ~$10 billion as compared to $10.5 billion at the end of 3Q16 and $11 billion at the end of 2Q16.

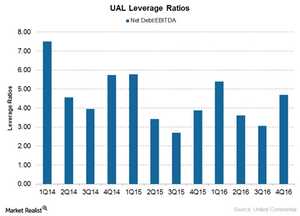

United Continental’s Debt: What You Need to Know

For 2016 overall, United Continental (UAL) has generated $5.5 billion in operating cash flow and $1.9 billion in free cash flow.

Can United Continental Improve Margins in 2017?

For 1Q17, analysts are now expecting United Continental’s (UAL) EBITDA to fall 39% to $0.81 billion.

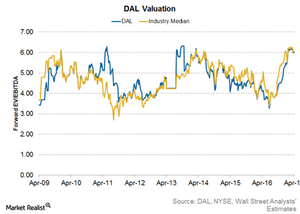

What’s Priced into Delta’s Valuation?

Delta Air Lines (DAL) is currently valued at 5.3x its forward EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiple.

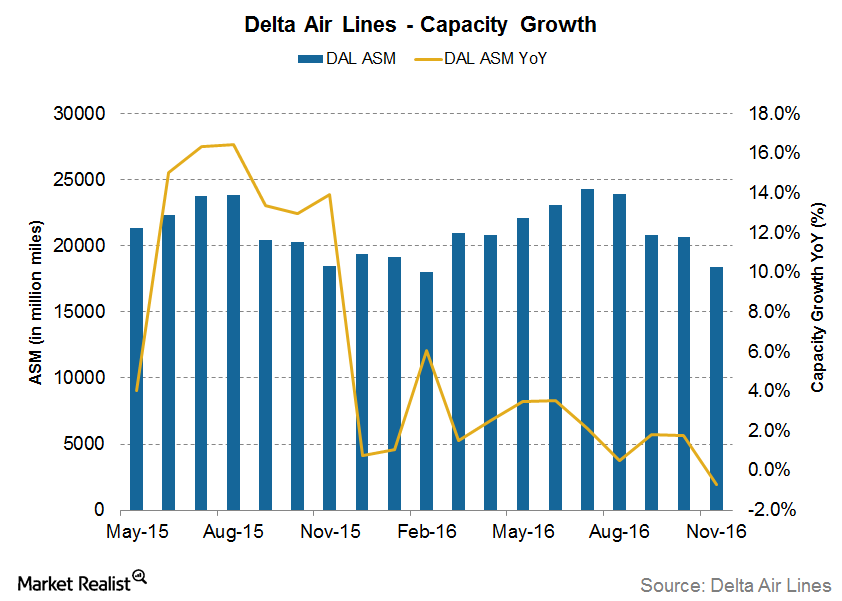

United’s Increased Capacity Growth: Should Investors Worry?

Airlines have long been known as capital destroyers. In times of profitability (such as now), they increase capacity to an extent that can’t be filled.

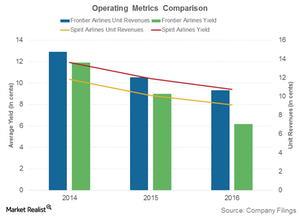

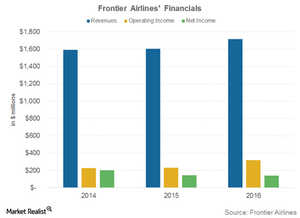

Is Frontier Airlines’ Business Model Sustainable?

One of the major risks to Frontier Airlines is the fact that almost 45% of its flights originate from a single hub—Denver.

Frontier Airlines Cut Costs and Became Profitable

Frontier Airlines earned 42% of its revenue from ancillary fees or non-ticket revenue in 2016—a significant rise compared to 25% in 2015.

Balance Sheet Analysis of the Major Airline Carriers

In 4Q16, regional carrier Spirit Airlines (SAVE) had a leverage ratio of 0.96x, JetBlue Airways (JBLU) had a leverage ratio of 0.83x, and Alaska Air Group (ALK) had a leverage ratio of 0.36x.

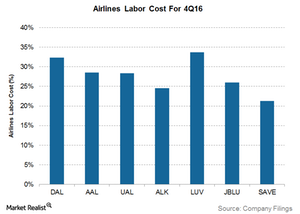

Behind the Airlines’ Increasing Labor Costs

Delta Air Lines (DAL), Southwest Airlines (LUV), United Continental (UAL), and American Airlines (AAL) renegotiated contracts with their pilots and other contract workers toward the end of 3Q16.

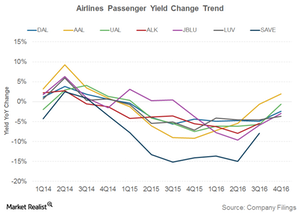

Airlines’ Passenger Yields Fall—What Does It Mean for Investors?

In 4Q16, Southwest Airlines’s (LUV) yields fell 4% year-over-year to 14.7 cents, followed by Alaska Air’s (ALK) 3.3% decline in yield to 13.4 cents.

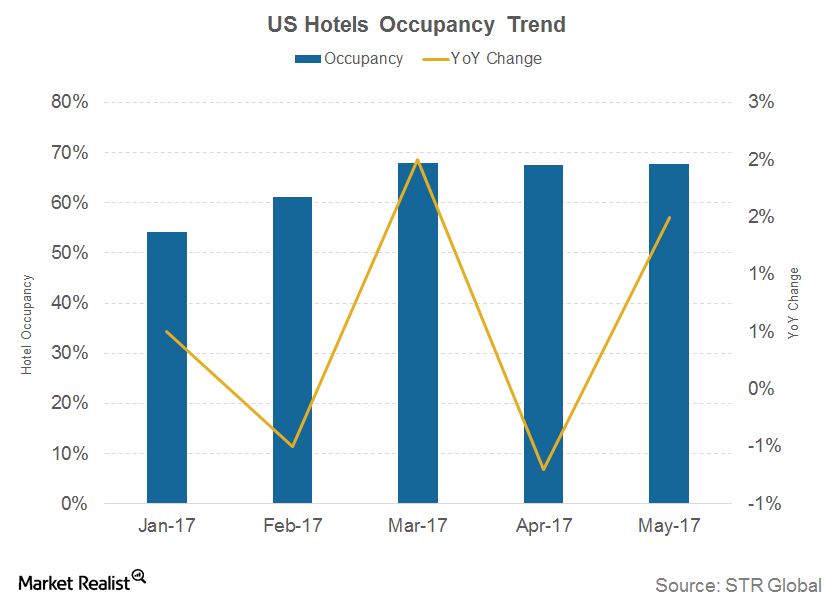

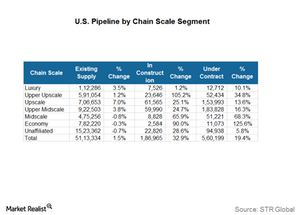

Why Hotel Investors Should Follow Construction Pipeline Data

According to STR Global’s US Construction Pipeline Report for January 2017, rooms under contract rose 16.1% to reach 576,000 rooms in 4,763 hotel properties.

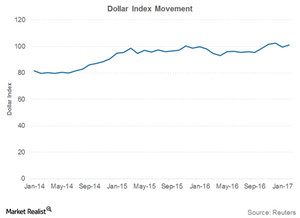

What a Strong US Dollar Means for the US Hotel Industry

The strength of the US dollar measured against currencies that are widely used in international trade is measured by the Trade Weighted Dollar Index.

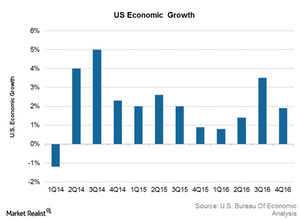

Why Economic Growth Is Important for the US Hotel Industry

A booming economy allows people to spend money on discretionary items such as air travel, so hotel revenues are higher during economic growth and lower during economic contraction.

What You Need to Know about the US Hotel Industry Performance

The hotel industry is largely driven by the growth of the general economy, which instills spending confidence in both businesses and households.

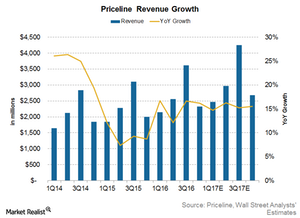

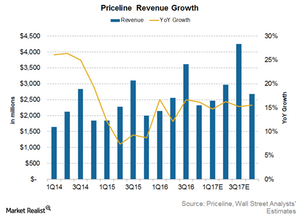

How Market Share Gains Can Boost Priceline’s Revenue Growth Rate

Priceline’s (PCLN) fiscal 2016 performance was subdued by the dollar’s appreciation. Because Priceline has a widespread international presence, it’s prone to currency fluctuation risks.

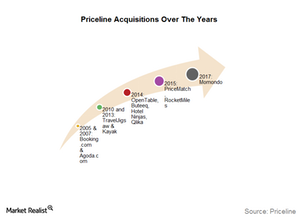

Priceline’s String of Acquisitions Continues with Momondo

Earlier this month, the Priceline Group (PCLN) signed a deal to acquire Momondo Group. Priceline will acquire all outstanding shares of Momondo for $550 million in an all-cash deal.

Will Market Share Gains Continue to Drive PCLN’s Revenue Growth?

For 4Q16, analysts expect Priceline’s (PCLN) revenue to rise 16.2%, less than the 18.9% growth the company saw in 3Q16.

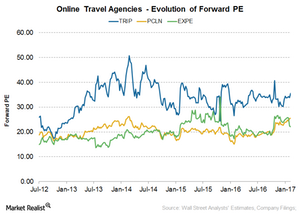

TripAdvisor’s Valuation: What Does It Mean for Investors?

Currently, TripAdvisor (TRIP) has a forward EV-to-EBITDA ratio of 17.9x—lower than its average of 18.5x.

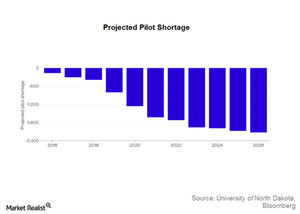

How Airlines Aim to Solve the Pilot Shortage

Issues concerning labor There is a host of issues that have been concerning the US labor workforce, including longer working hours, contentious relations with management, lower job security, work-life balance, and stability. However, the prime issue for regional airlines is that regional players pay much less than legacy peers, despite the regional sector accounting for more […]

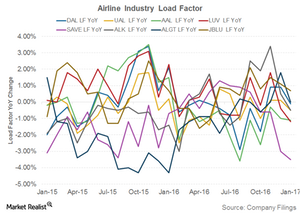

What Higher Capacity Means for Airlines’ Utilization

The load factor Airlines’ capacity utilization is measured using the passenger load factor, which is calculated by dividing traffic by capacity. Analyzing airlines’ load factors As discussed in the previous article, most airlines saw high capacity growth in January 2017. As a result, all airlines except JetBlue Airways witnessed a decline in their load factors. […]

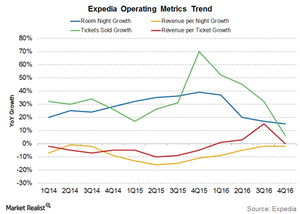

Takeaways from Expedia’s 4Q16 Key Metrics Performance

Hotel reservations accounted for 61% of Expedia’s 4Q16 revenue and remain the most important contributor to Expedia’s revenues.

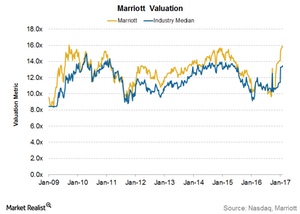

What Are Investors Willing to Pay for Marriott International?

Marriott (MAR) currently trades at a forward EV-to-EBITDA multiple of 15.8x. Its valuation has been significantly higher than its average valuation.

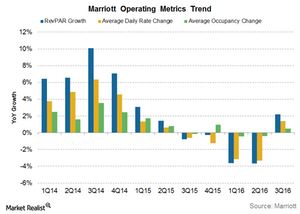

What Do Marriott’s Key Metrics Suggest ahead of 4Q16 Results?

For 3Q16, Marriott and Starwood Hotels & Resorts together added 17,600 rooms, taking the total to 4,554 properties and 777,000 timeshare resorts.

What Are Airlines Doing to Solve the Pilot Shortage?

As many as 30,000 pilots will reach the mandatory retirement age of 65 years 2026.

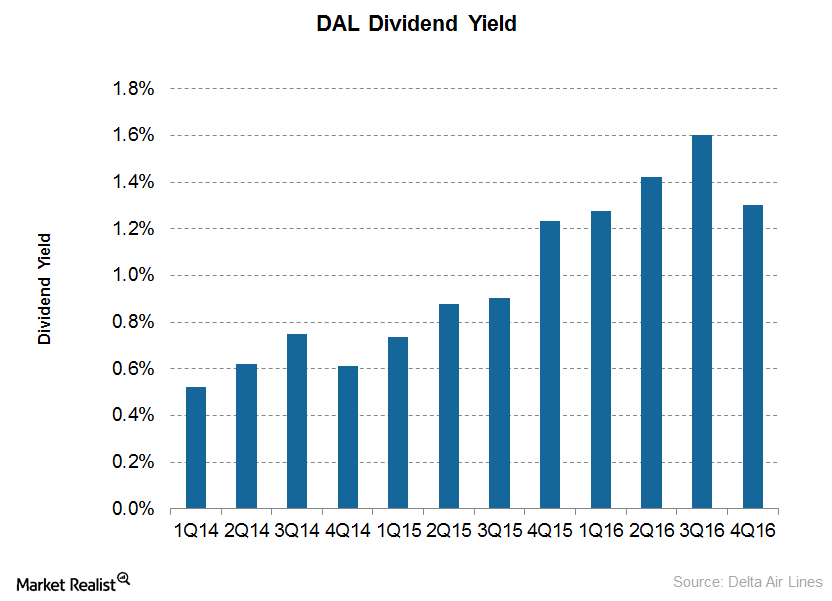

Can Delta Air Lines Increase Its Dividend Payouts in 2017?

Delta Air Lines started paying dividends only in 2013, and it’s one of the few airlines that pay dividends.

Will Delta Air Lines’ Fuel Costs Keep Falling in 2017?

Until 3Q16, Delta Air Lines (DAL) had managed to keep its costs flat if not decreasing. However…

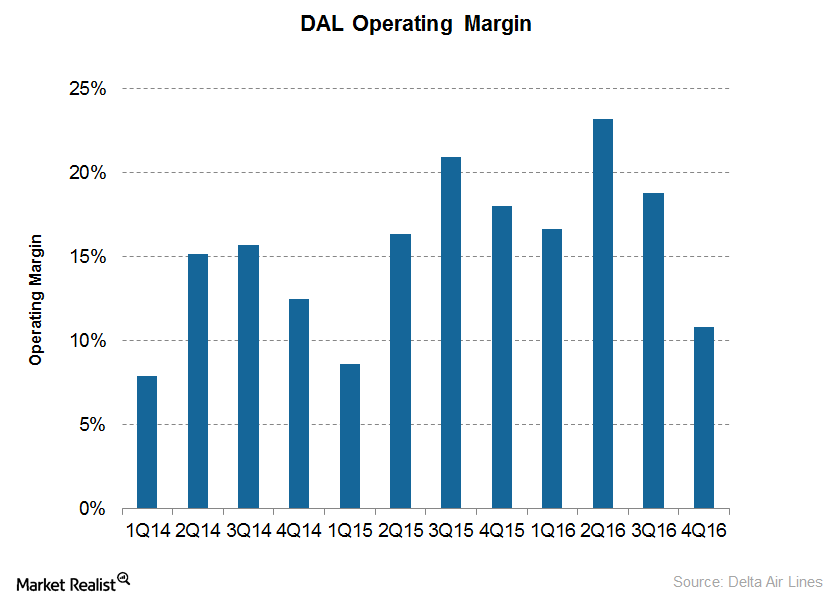

Will Delta Air Lines’ Strong Operational Performance Last?

Delta Air Lines (DAL) saw average traffic of about 50 million passenger miles for the quarter, a 0.8% year-over-year improvement

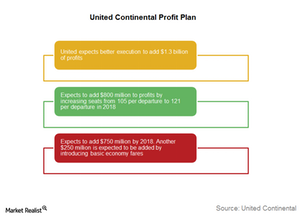

How Does United Continental Plan to Improve Margins?

United expects to add $800 million to profits by increasing seats from 105 per departure to 121 per departure in 2018.

Will United Continental’s Margins Improve in 2017?

For 4Q16, analysts are expecting United Continental’s (UAL) EBITDA to fall 26% to $1.4 billion.

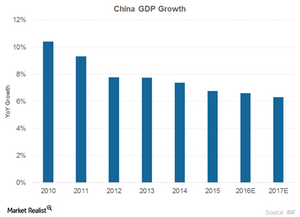

How China’s Weakening Economy Could Hurt Macao Casinos

The Macao region relies heavily on the Chinese mainland, as it garners the huge majority (about 67%) of its visitors and VIP gamers from China and its neighboring countries.

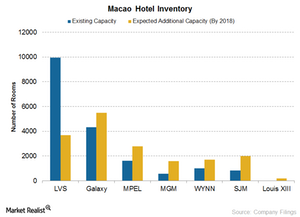

Is Oversupply a Concern for Macao Casinos?

Macao casinos’ $28 billion investment in integrated resorts is set to change the city’s gaming business.

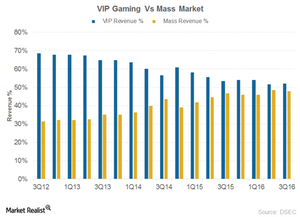

Is the Mass Market Shift Working for Macao Casinos?

As VIP business continues to remain sluggish, casinos are increasingly turning their attention towards the mass market.

Why Should Investors Keep an Eye on Macao’s Unemployment Rate?

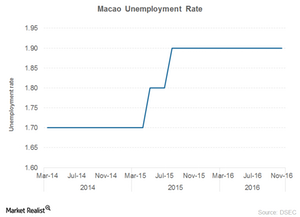

For September 2016 through November 2016, the unemployment rate stood at 1.9%.

Will American Airlines’s Unit Revenues Continue to Decline?

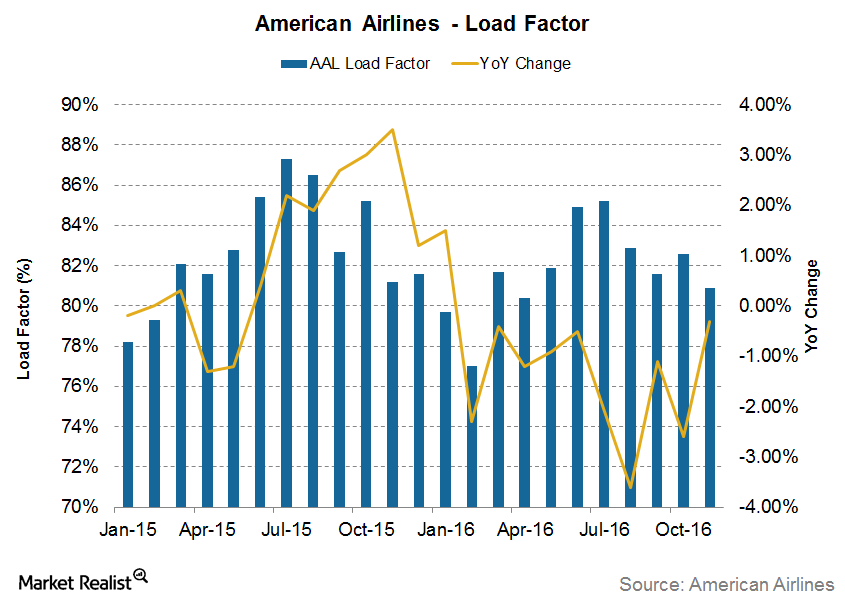

For November 2016, American Airlines’s (AAL) load factor fell 0.3% and year-to-date 2016, its load factor fell 1.3%.

American Airlines’s Traffic Growth Lags Capacity Growth

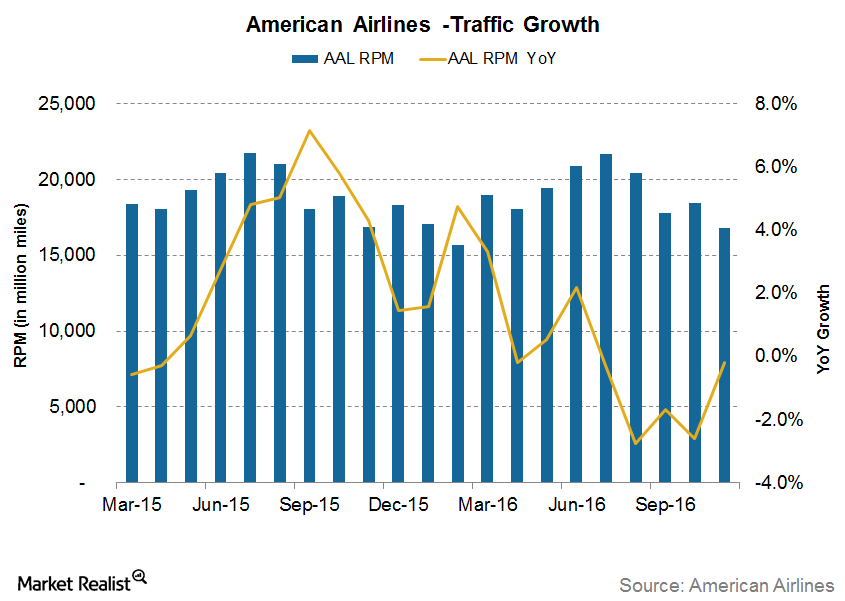

In November 2016, American Airlines’s (AAL) traffic fell 0.2% year-over-year, slightly lagging its capacity growth in the same period. Year-to-date, AAL’s traffic has increased 0.3%.

Is American Airlines’s Capacity Growth Finally Slowing Down?

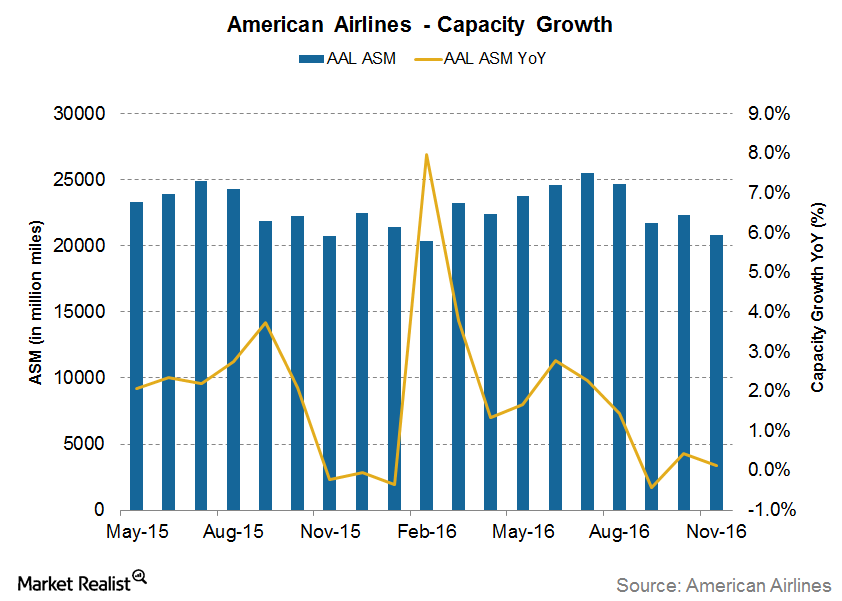

American Airlines’s (AAL) capacity grew 0.1% year-over-year in November 2016, similar to the growth seen during most of 2016. Year-to-date, AAL’s capacity has grown 1.9%.

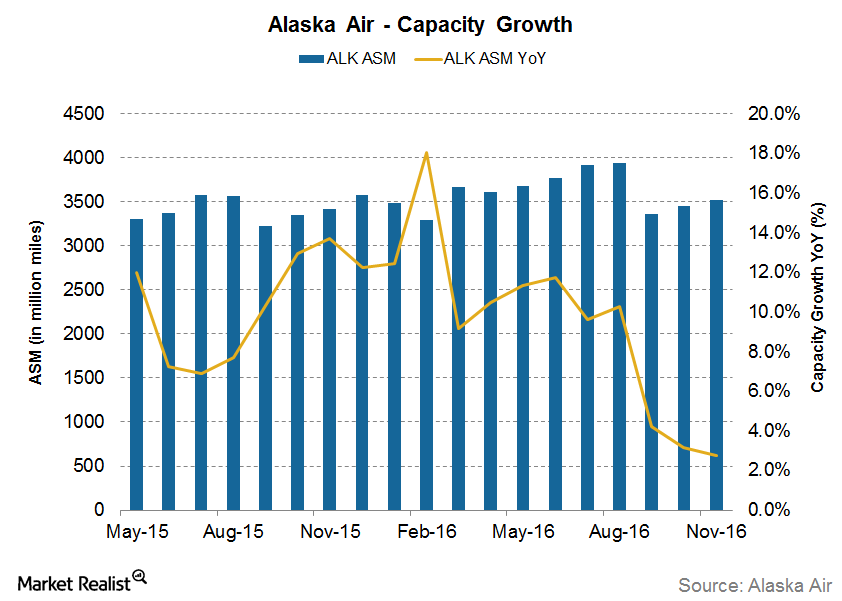

Capacity Growth: Is Alaska Air Group Reducing the Pace?

For November 2016, Alaska Air Group’s capacity rose 2.8% YoY (year-over-year). It’s the slowest growth in any month in 2016.

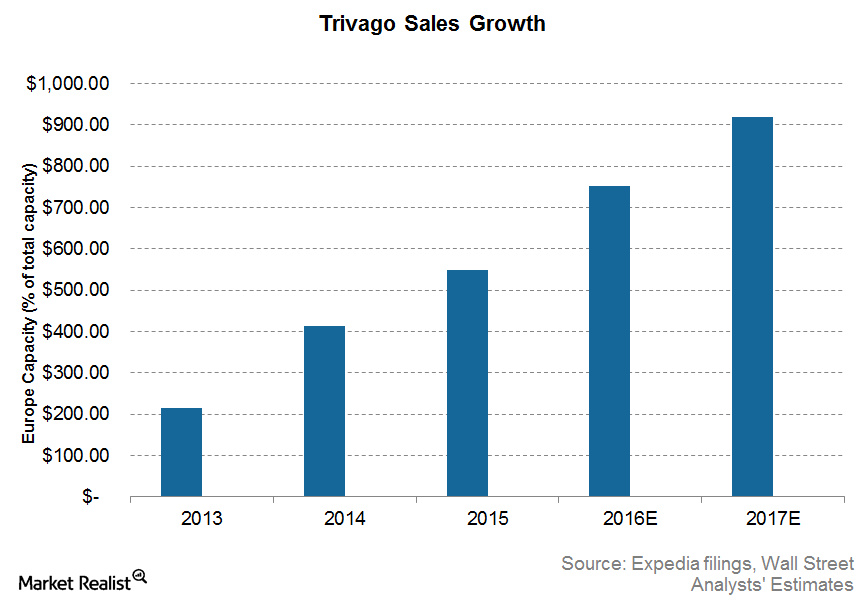

Trivago Commercials Find a Huge Audience

Trivago spends a great deal of money on its popular ads. Three of its ads rank among the top ten most-watched travel videos on YouTube for 2016.