How Market Share Gains Can Boost Priceline’s Revenue Growth Rate

Priceline’s (PCLN) fiscal 2016 performance was subdued by the dollar’s appreciation. Because Priceline has a widespread international presence, it’s prone to currency fluctuation risks.

March 6 2017, Updated 10:37 a.m. ET

Revenue growth

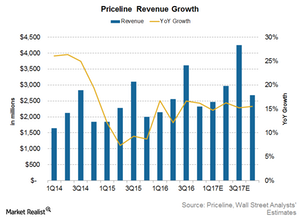

For fiscal 2016, Priceline’s (PCLN) gross bookings grew 22.6% to $68 billion. The strong upsurge in bookings helped Priceline record strong growth in its top line. Its fiscal 2016 revenues rose 16.5% to $10.7 billion, compared to $9.2 billion in 2015.

Priceline’s growth in fiscal 2016 also improved on its growth in the previous year. In fiscal 2015, the company’s revenues rose 9% to $9.2 billion, compared to $8.4 billion in fiscal 2014.

Strong dollar pressures PCLN’s performance

Priceline’s (PCLN) fiscal 2016 performance was subdued by the dollar’s appreciation. Because Priceline has a widespread international presence, it’s prone to currency fluctuation risks. PCLN’s currency-neutral gross bookings growth stood at a strong 25% YoY.

Acquisition-led growth

Priceline also recently acquired Momondo in an all-cash deal of $550 million, which is expected to close at the end of 2017. This acquisition is expected to boost Priceline’s revenues in 2017. For a detailed analysis of the acquisition, please read How Priceline’s Acquisition Affects the Online Travel Industry.

Outlook: High growth expected

As we discussed in the previous article, the Hotel segment should be PCLN’s key revenue driver in 2017. As the size of international travel far exceeds that of domestic travel within the US, the ongoing growth in international travel should be key to Priceline’s growth. The growth opportunities in the international market are robust, given the low Internet penetration compared to the US and rising disposable income.

These factors point to increased volatility for Priceline, given the dependence on a variety of economies and increased currency fluctuation risks. Given the buoyant gross bookings outlook, Priceline could be set for another year of growth, although there could be a subduing effect by the strong dollar.

Investors can gain exposure to Priceline by investing in the PowerShares DWA Consumer Cyclicals Momentum ETF (PEZ), which invests 6.1% of its holdings in Priceline. PEZ has no holdings in Expedia (EXPE), TripAdvisor (TRIP), or Ctrip (CTRP).