Priceline Group Inc

Latest Priceline Group Inc News and Updates

Eton Park Capital opens new positions in FDO, STZ, BID, EQIX, Sells NLSN, PCLN – 13F Flash

In this six-part series, we will go through some of the main positions Eton Park Capital traded this past quarter Eton Park Capital Management is a multi-strategy hedge fund founded in November 2004 by former Goldman Sachs partner Eric Mindich. The firm started new positions in Family Dollar Stores (FDO) , Constellation Brands (STZ), […]

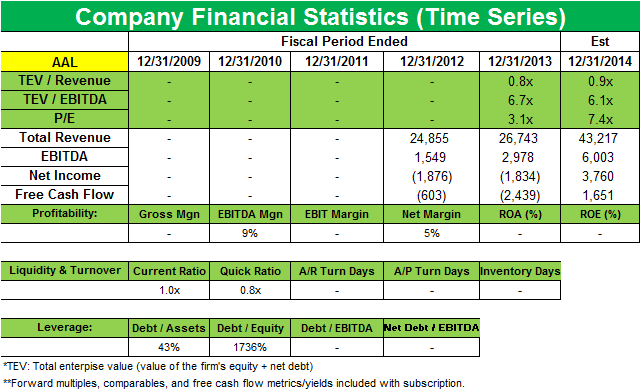

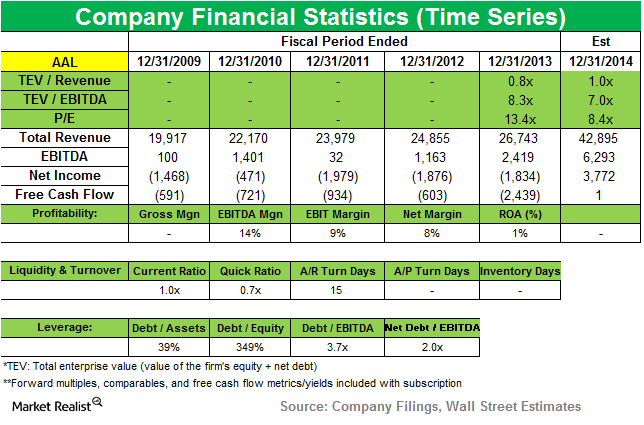

Appaloosa Management raises its stake in American Airlines Group

Appaloosa Management enhanced its position in American Airlines Group Inc. (AAL) last quarter that now accounts for 3.48% of Appaloosa’s total 1Q portfolio.

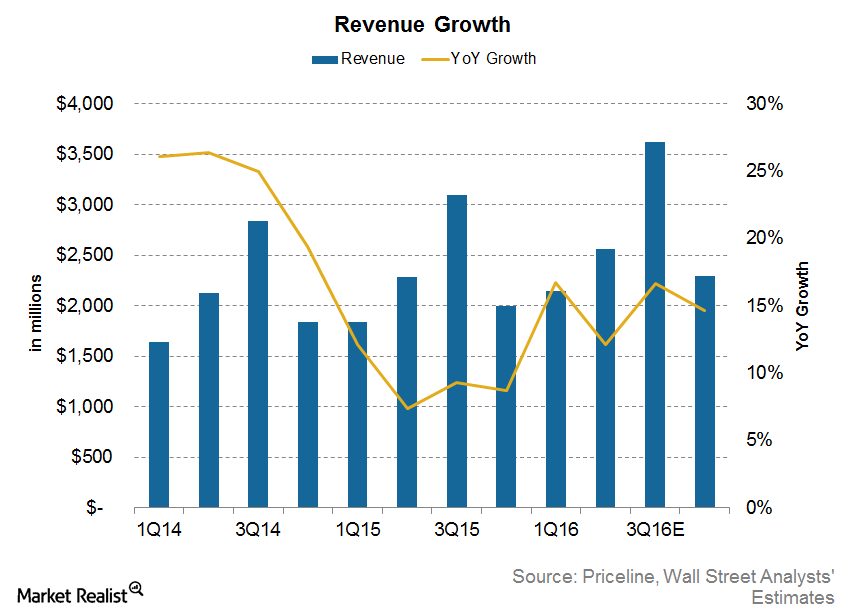

Will Market Share Gains Continue to Drive Priceline’s Revenue Growth in 2016?

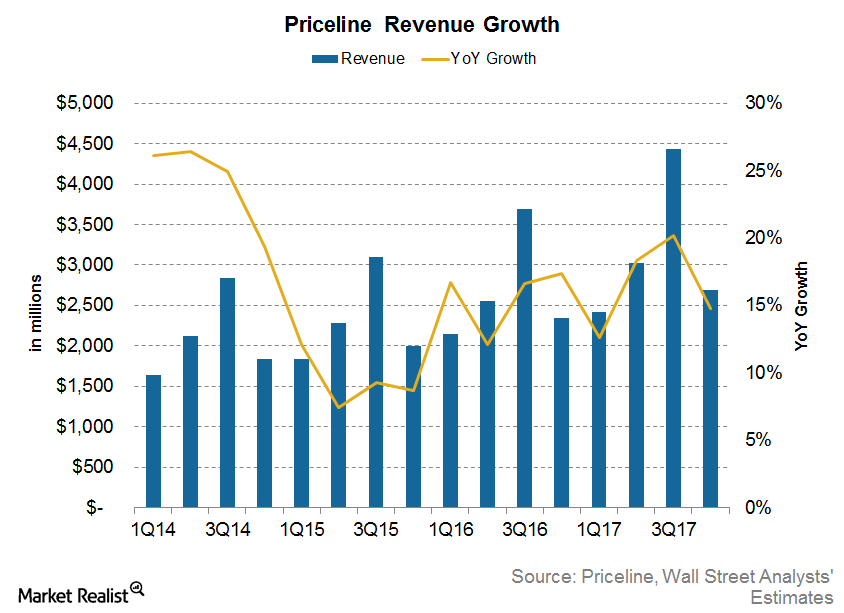

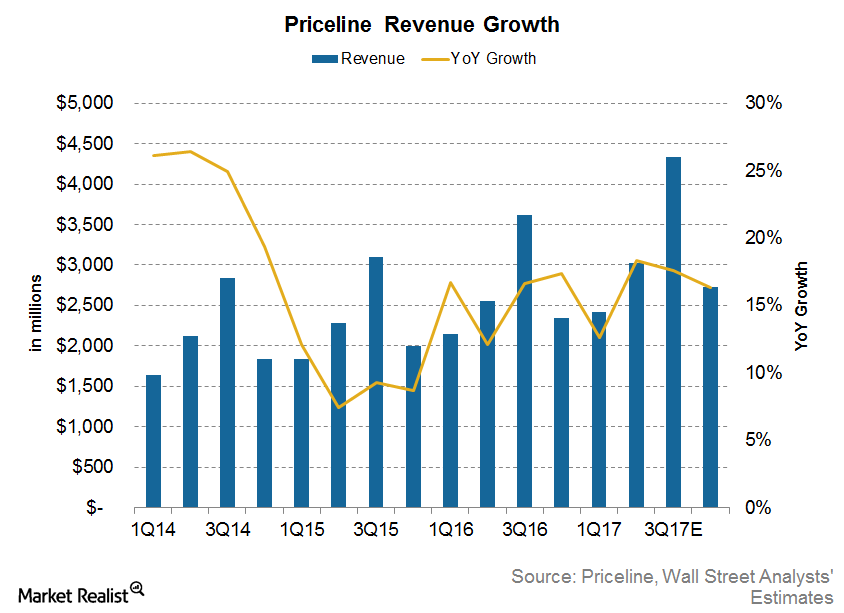

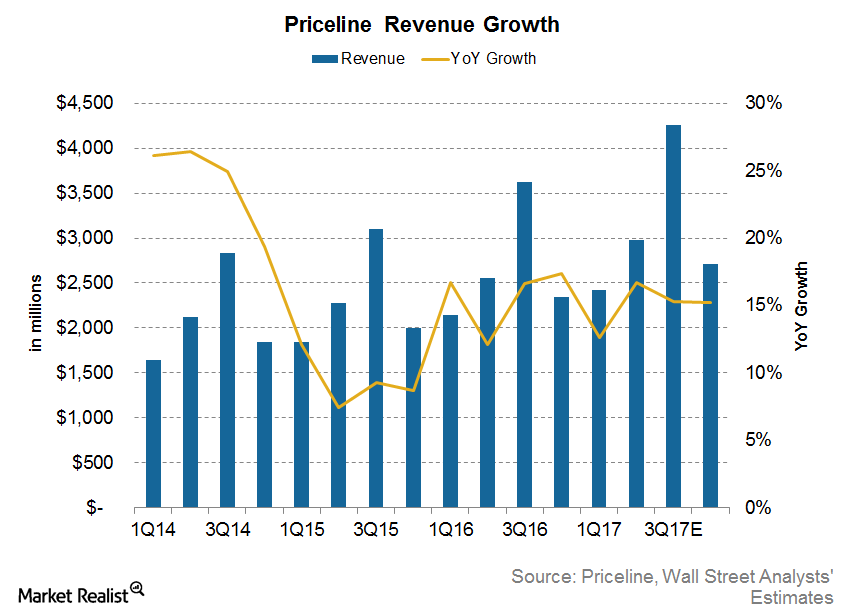

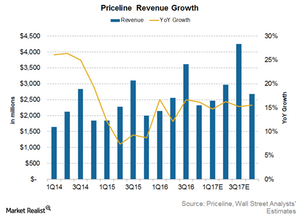

For 3Q16, analysts are estimating Priceline’s revenues to grow by 16.6%, which would be higher than the 12% growth the company saw in the second quarter.

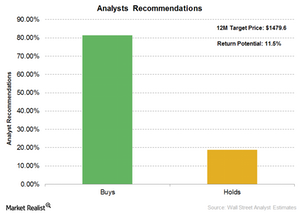

What Do Analysts Recommend for Priceline?

Priceline’s consensus 12-month target price is $1,479.55, which indicates an 11.5% return potential.

American Airlines gets significantly lower position in Appaloosa

Appaloosa Management significantly lowered its position in American Airlines (AAL) in the third quarter that ended in September 2014. The position accounts for 3.81% of the fund’s total third-quarter portfolio.

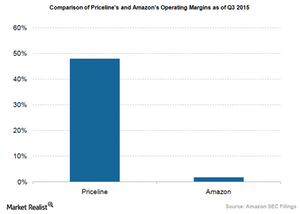

Why Did Amazon Shut Down Its Online Travel Business?

In April, Amazon had launched its new travel and hotel service, called Amazon Destinations.

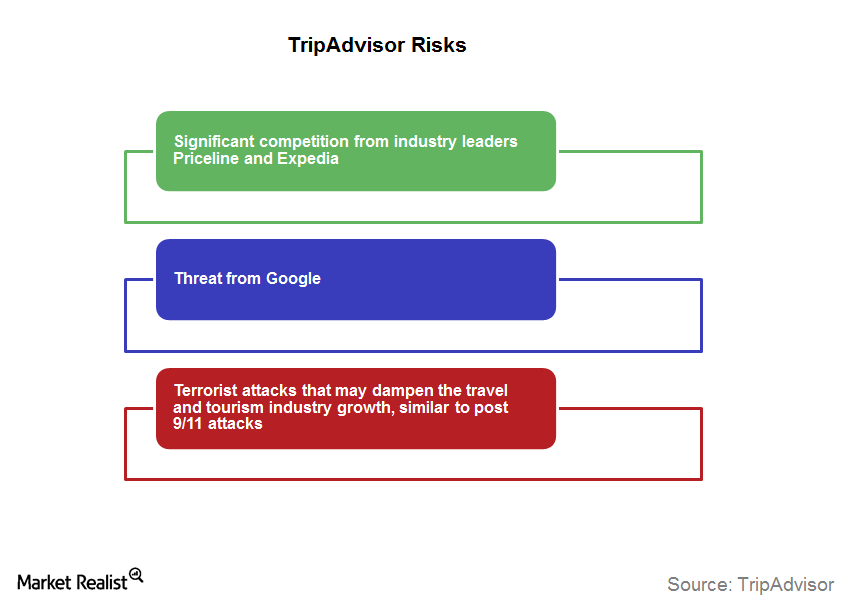

TripAdvisor’s Future: Key Risks that the Company Could Face

Online travel industry leaders like Priceline (PCLN) and Expedia (EXPE) have a mixed relationship. They’re partners as well as competitors.Consumer Why Priceline and Expedia clash over “opaque” hotel offerings

Priceline earns the majority of its revenues from the agency model, under which third parties such as hotel suppliers set the rates while Priceline earns a commission on the transaction.

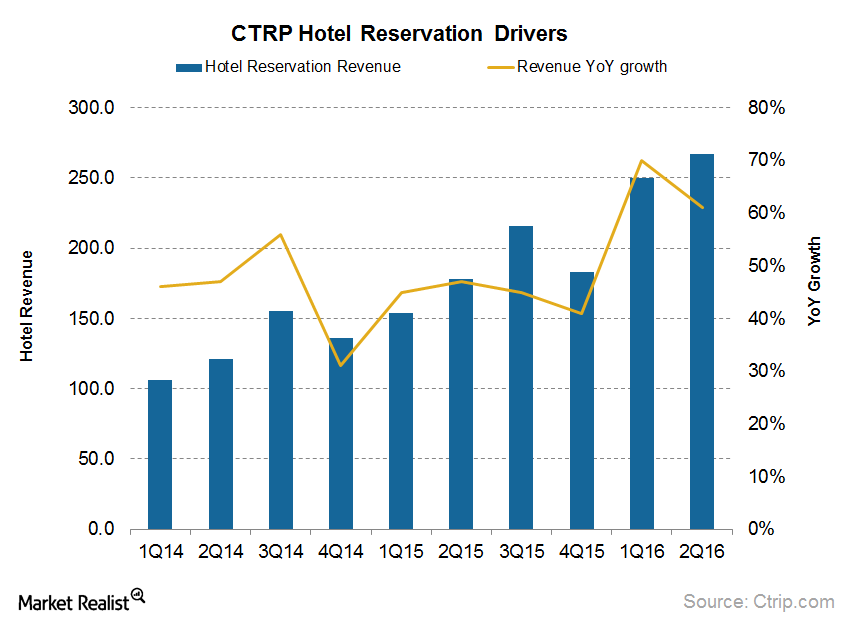

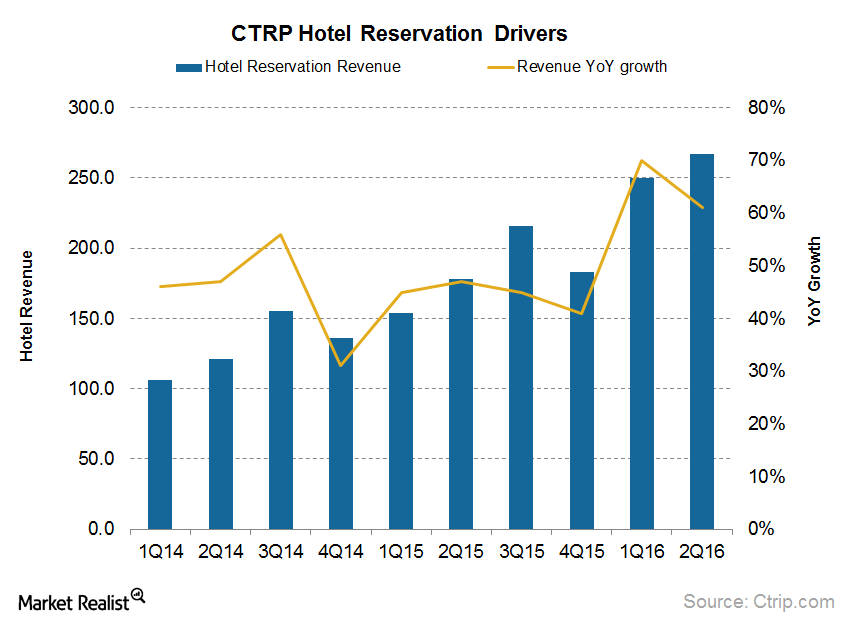

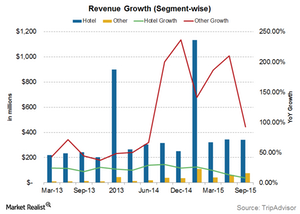

Which Segment Is Ctrip’s Biggest Contributor to Growth?

Hotels make up a significant part of Ctrip’s revenues—39% of total revenues in 2Q16—similar to OTA peers Priceline, Expedia, and TripAdvisor.Technology & Communications Why you should know the key differences between job reports

Few economic releases elicit as much reaction from both the stock (IVV) and bond (BND) markets as the employment reports issued by Automatic Data Processing (ADP) and the Bureau of Labor Statistics (the BLS).

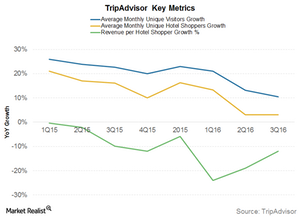

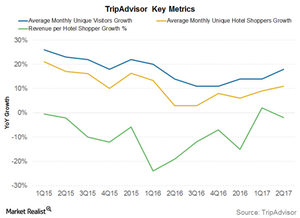

What Do the Key Metrics for TripAdvisor Suggest?

For 3Q16, TRIP’s revenue per shopper fell 12%. This is slightly better than the 24% decline seen in 1Q16 and the 19% decline seen in 2Q16.

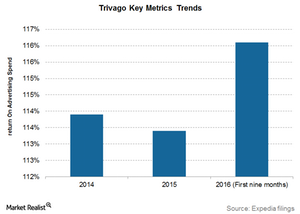

Analyzing Trivago’s Key Metrics

RQPR rose 2.1% in 2015 to 1.5 euros compared to 1.4 euros in 2014. For the nine months ended in September 2016, RQPR fell 6.0%.

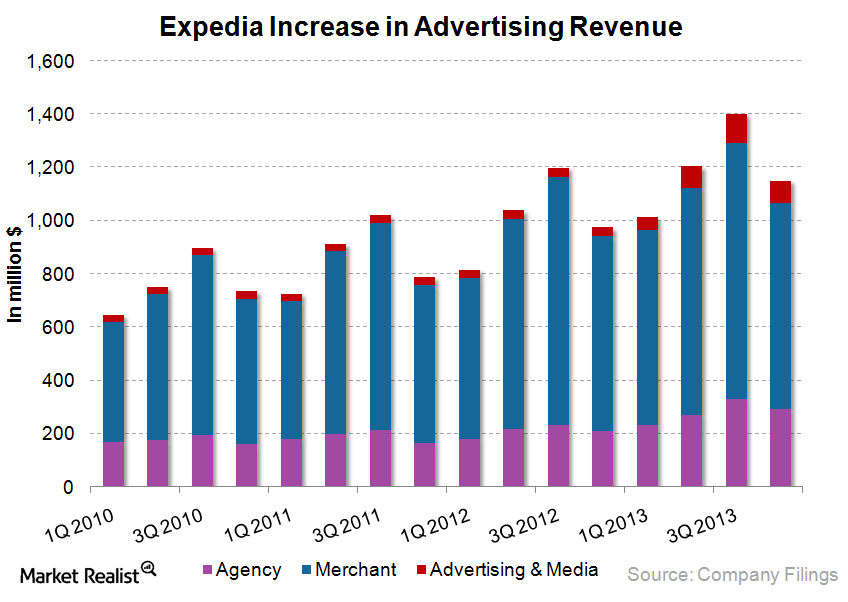

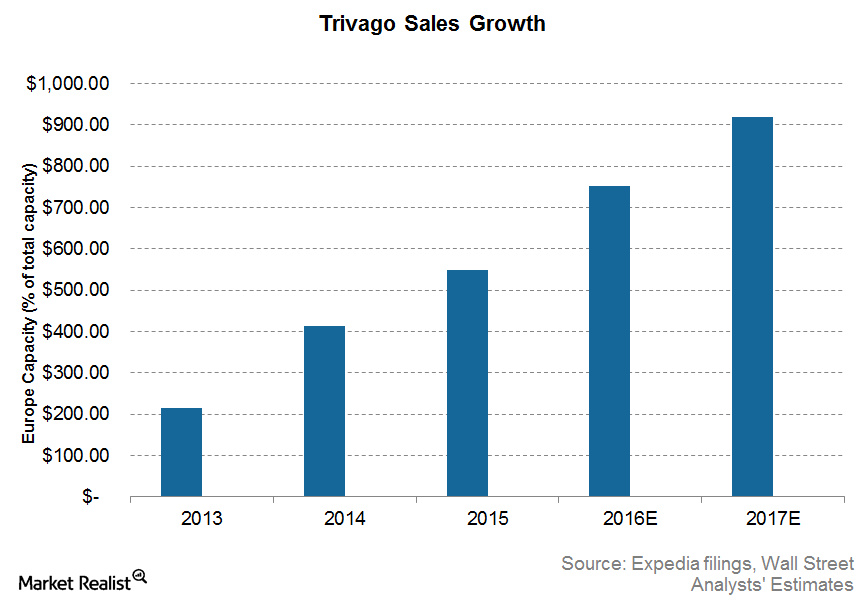

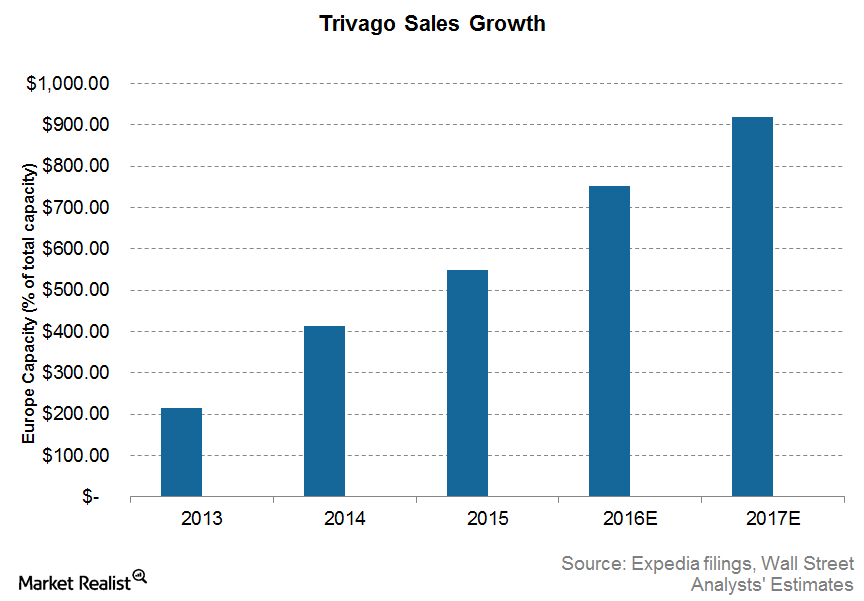

Expedia’s trivago acquisition raises advertising revenue growth

Officially launched in 2005, Expedia’s trivago is a known travel brand in Europe and continues to operate independently, and grow revenue via global expansion.

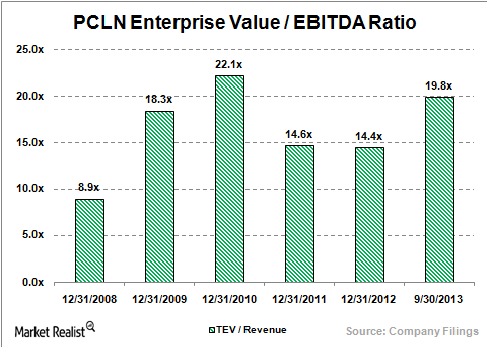

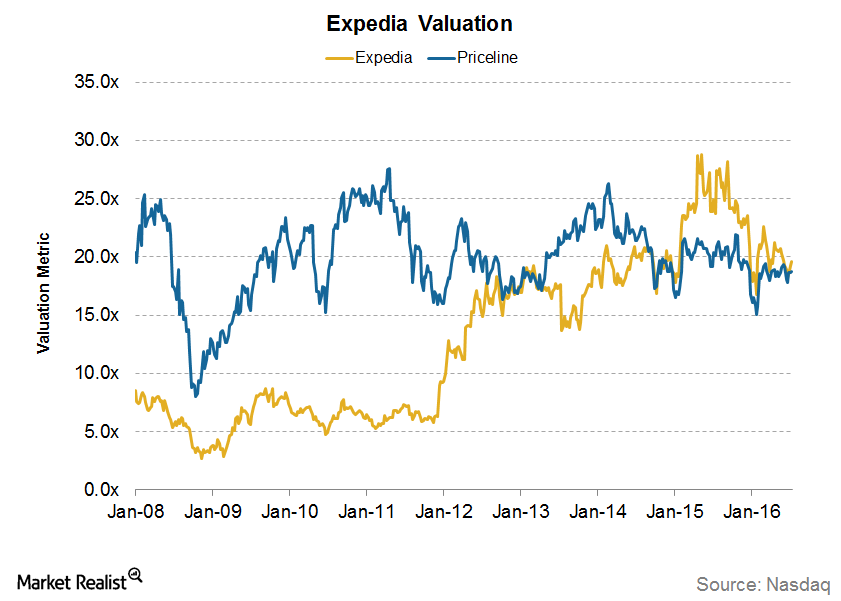

Priceline’s Valuation after 2Q16: What’s Priced In?

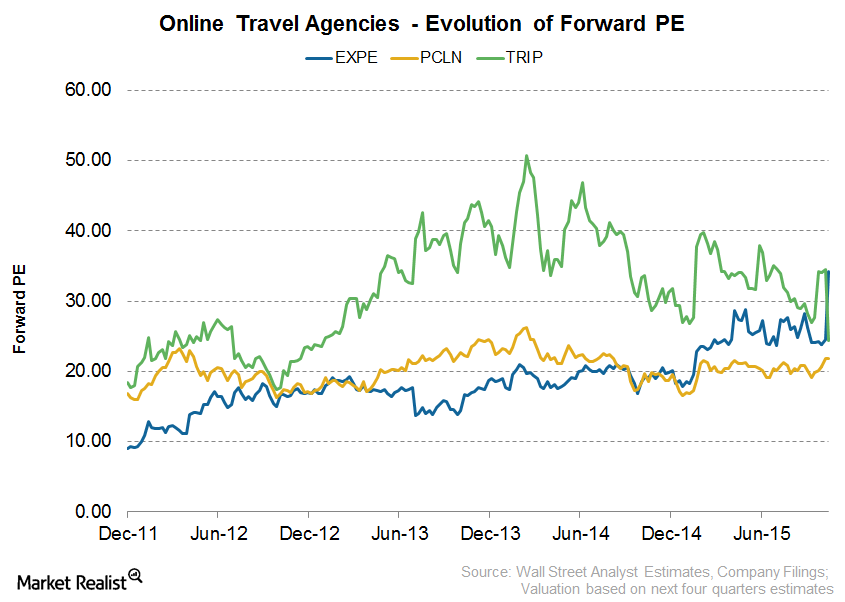

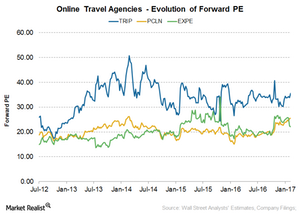

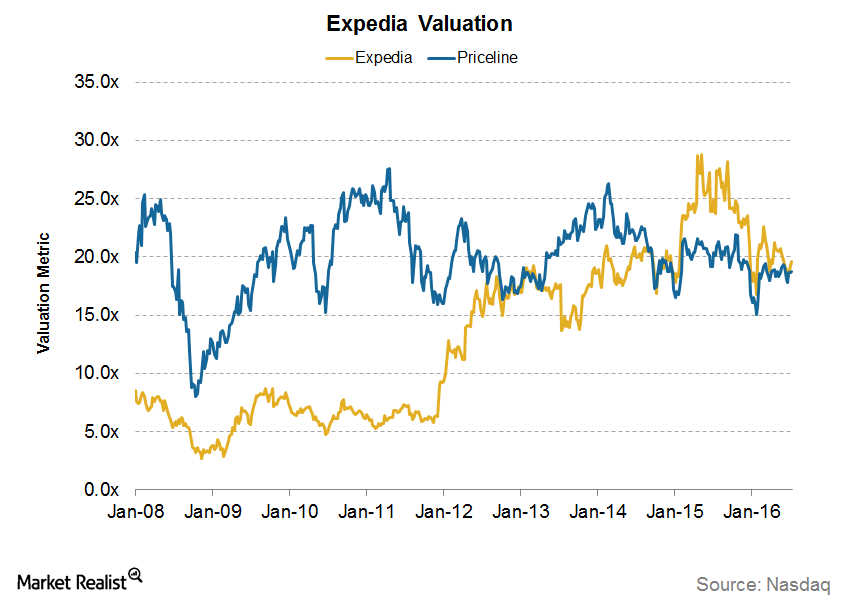

Priceline currently trades at a forward PE multiple of 19.5x. This is slightly lower than its average valuation of 19.9x since February 2006.

Valuation: Priceline Versus Its Peers

As of November 6, 2015, Priceline’s forward PE ratio stood at 21.8x, and its average valuation stands at 20x.

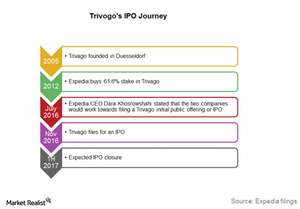

A Look at Trivago’s Journey toward Its IPO

In Expedia’s 2Q16 earnings call in July 2016, CEO Dara Khosrowshahi said it would work with Trivago to file a Trivago IPO before the end of 2016.

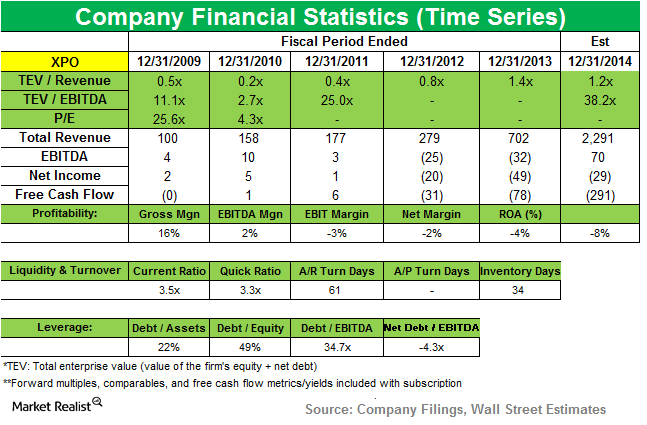

OTPP opens new position in XPO Logistics

OTPP added a new position in XPO Logistics Inc. (XPO) during the third quarter that ended in September. The position accounted for 0.46% of the fund’s total portfolio.

What Analysts Estimate for Priceline in 4Q17

After Priceline (PCLN) released its 3Q17 results, analysts’ estimates for 2017 and 2018 were revised downwards. For the fourth quarter of 2017, sales are expected to grow 14.8% year-over-year or YoY to $2.7 billion.

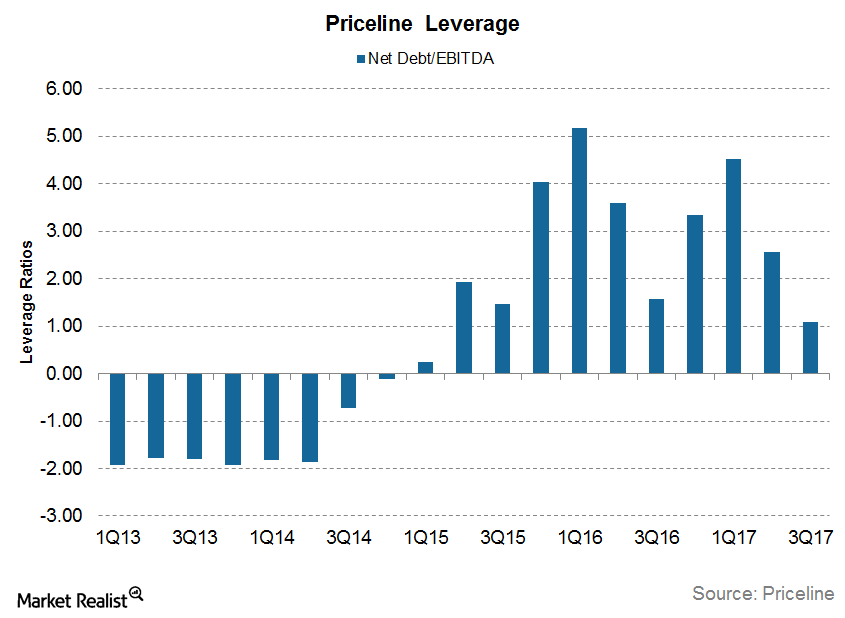

Priceline’s Increasing Leverage: What You Need to Know

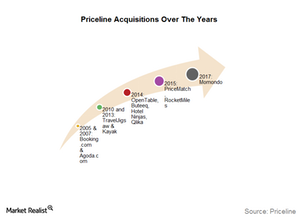

A large part of Priceline’s (PCLN) growth in the past has come from acquiring smaller companies all over the world. It had to raise debt to finance some of these acquisitions.

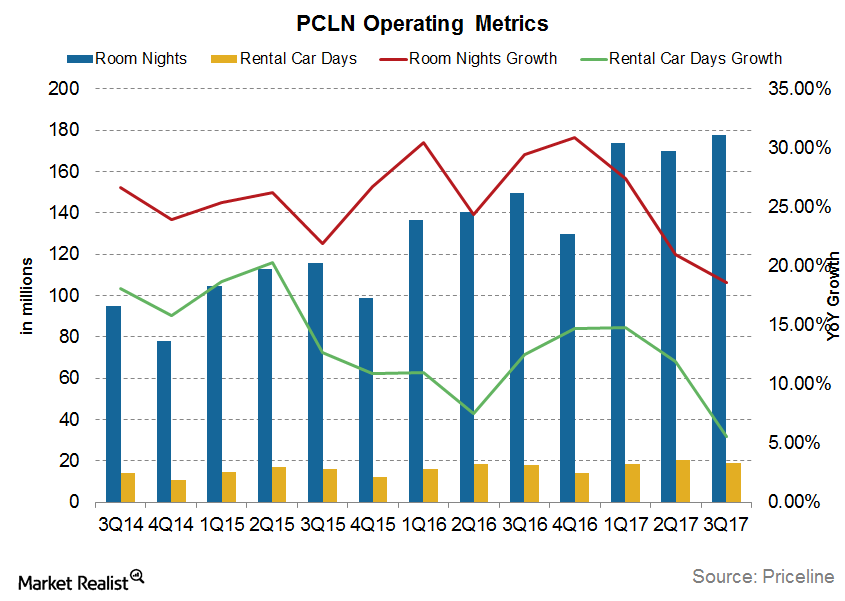

Priceline’s Key Metric Growth Is Slowing Down

Hotel accommodations have historically driven Priceline’s growth. During the third quarter of the year, Priceline’s global accommodation business booked 178 million room nights.

Assessing Priceline’s Revenue Growth in 2017

Analysts expect Priceline’s fiscal 2017 revenues to grow 16.7% YoY to $12.5 billion, which is slightly lower than the 16.5% YoY growth seen in 2016.

Chart in Focus: Priceline’s Booking Guidance for 3Q17

In 2Q17, Priceline’s (PCLN) gross bookings grew 16.4% year-over-year to $20.8 billion.

What Do TripAdvisor’s Key Metric Trends Suggest?

TripAdvisor’s (TRIP) average monthly unique visitors in 2Q17 rose 18.0% YoY (year-over-year) to 414.0 million users compared to 2Q16.

How Priceline Can Grow Its Revenue in 2017

For 2Q17, analysts are estimating that Priceline’s (PCLN) revenue will rise 16.7% YoY to $3.0 billion, which is higher than 12.6% in 1Q17.

How Market Share Gains Can Boost Priceline’s Revenue Growth Rate

Priceline’s (PCLN) fiscal 2016 performance was subdued by the dollar’s appreciation. Because Priceline has a widespread international presence, it’s prone to currency fluctuation risks.

Priceline’s String of Acquisitions Continues with Momondo

Earlier this month, the Priceline Group (PCLN) signed a deal to acquire Momondo Group. Priceline will acquire all outstanding shares of Momondo for $550 million in an all-cash deal.

Will Market Share Gains Continue to Drive PCLN’s Revenue Growth?

For 4Q16, analysts expect Priceline’s (PCLN) revenue to rise 16.2%, less than the 18.9% growth the company saw in 3Q16.

TripAdvisor’s Valuation: What Does It Mean for Investors?

Currently, TripAdvisor (TRIP) has a forward EV-to-EBITDA ratio of 17.9x—lower than its average of 18.5x.

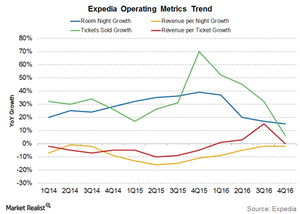

Takeaways from Expedia’s 4Q16 Key Metrics Performance

Hotel reservations accounted for 61% of Expedia’s 4Q16 revenue and remain the most important contributor to Expedia’s revenues.

Trivago Commercials Find a Huge Audience

Trivago spends a great deal of money on its popular ads. Three of its ads rank among the top ten most-watched travel videos on YouTube for 2016.

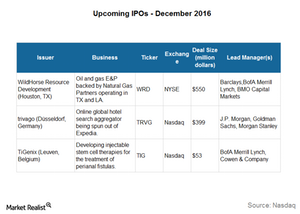

Trivago’s Expected IPO on December 16

Trivago, Expedia’s (EXPE) German hotel booking site, filed for an IPO in the US on November 14, 2016. The expected date for the Trivago IPO is Friday, December 16.

Analyzing Trivago’s Financials: Revenue at the Cost of Ads

Trivago’s revenue has risen an impressive 90.0% CAGR from 2010 to 2013. As Trivago’s markets mature, the growth rate will decline, as is evident from recent trends.

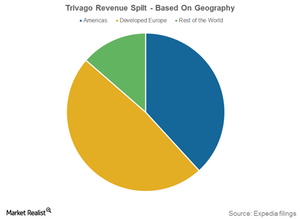

A Close Look at Trivago’s Business Model

Trivago combines hotel content from various sources on its platform. These hotels are then displayed to users based on their search criteria.

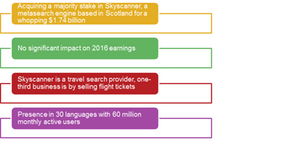

Why Did Ctrip Invest in Skyscanner?

In its earnings call on November 23, Ctrip.com (CTRP) announced that it acquired a majority stake in Skyscanner, a metasearch engine based in Scotland, for ~$1.7 billion.

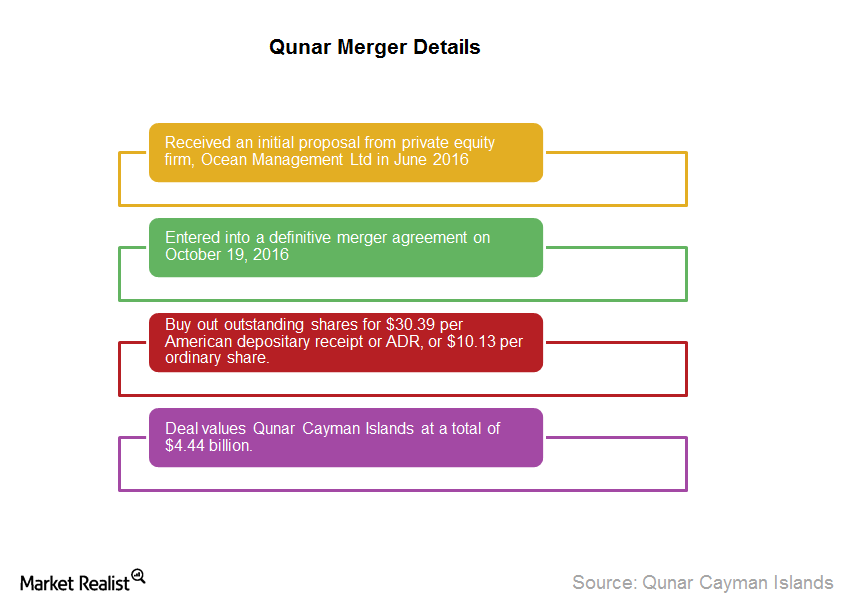

Qunar Is Going Private: How Does It Affect Investors?

In June 2016, Qunar (QUNR) received an initial proposal from private equity firm Ocean Management.

Why Isn’t Qunar Profitable Yet?

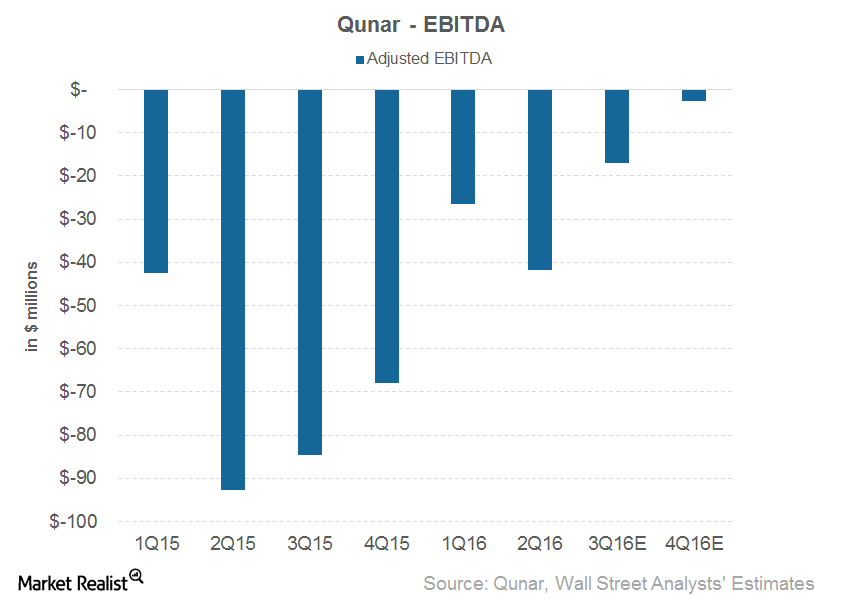

Analysts are estimating that Qunar Cayman Islands (QUNR) will incur an EBITDA loss of $17 million in 3Q16 and $3 million in 4Q16.

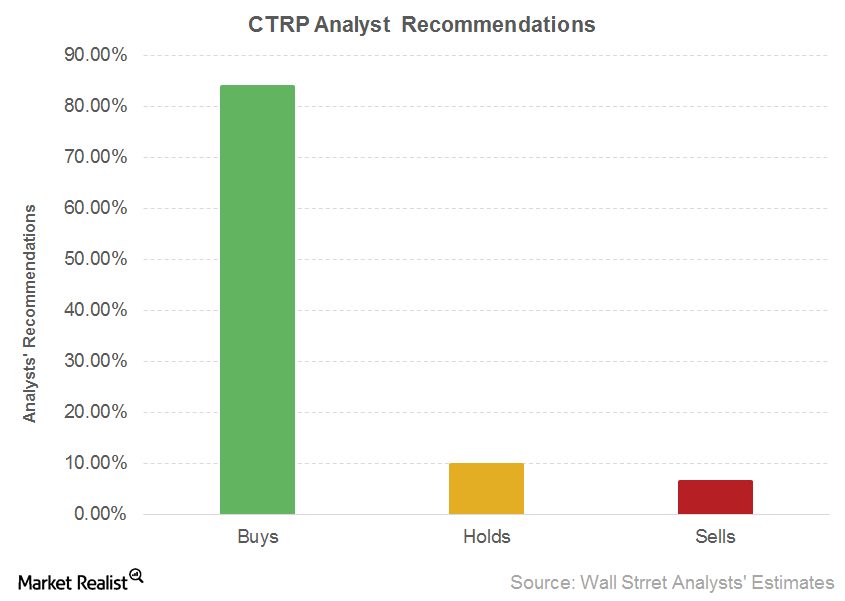

What Are Analysts Recommending for Ctrip?

According to Reuter, of the 31 analysts tracking Ctrip, 26 analysts have issued a “buy,” while three have issued a “hold,” and two have issued a “sell.”

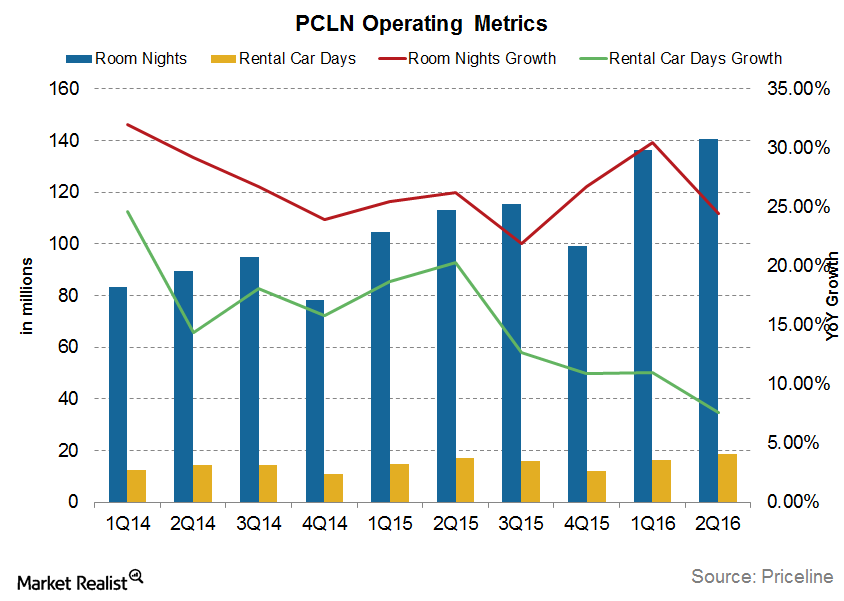

What Do Priceline’s Key Metrics Suggest?

From 2012 to 2014, Priceline Group’s (PCLN) gross bookings grew at an average of 30%. For 2015, accounting for the strong US dollar, growth was just 10%.

These Segments Will Contribute the Most to Ctrip’s Future Growth

At 39% in 2Q16, hotels formed a significant part of Ctrip’s revenue, much like other OTA (online travel agency) players.

A Look at Expedia’s Valuation: How Does It Compare?

Expedia (EXPE) currently trades at a forward PE (price-to-earnings) multiple of 20x.

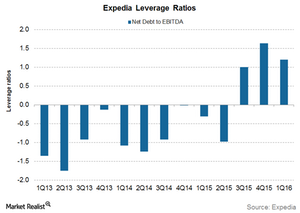

Investors Should Pay Attention to Expedia’s Increasing Leverage

Expedia and Priceline have shown interest in China’s Ctrip.com (CTRP), with Priceline also increasing its stake.

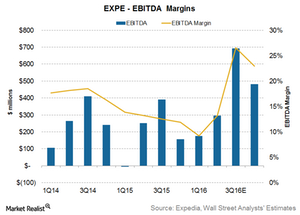

In Line with These Competitors, Expedia’s Margins to Increase

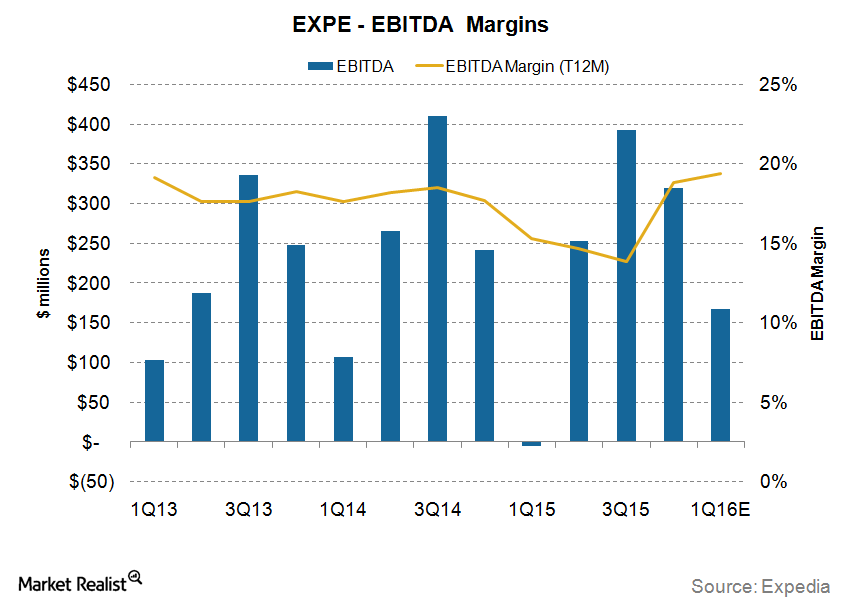

For 2Q16, analysts are estimating Expedia’s (EXPE) EBITDA to grow by 17% to $296 million with an EBITDA margin of 13%.

Why Are Expedia’s Margins Declining despite Growing Revenues?

Expedia’s EBITDA margins are expected to increase to 19% in 2016 and then rise to 21% in 2017. As a result, EBITDA growth is expected to increase to 42% and 27% in 2016 and 2017, respectively.

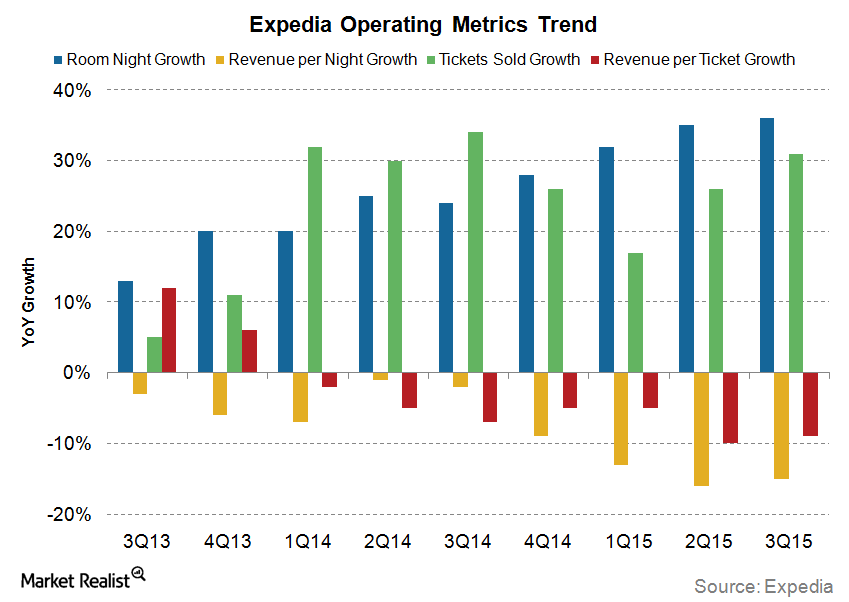

What Do Expedia’s Key Metrics Suggest?

For the last year, Expedia’s gross bookings increased 28% after increasing 16% for the two years before that. For the first nine months of 2015, gross bookings have increased 20%.

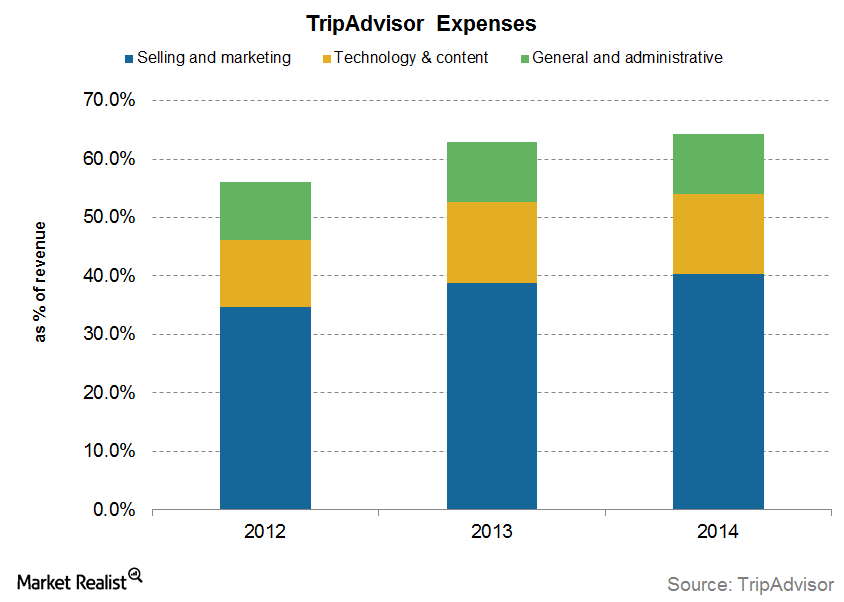

TripAdvisor’s Key Spending: Customer Acquisition Costs and More

TripAdvisor (TRIP) is a travel site, which means its business depends on getting loads of traffic that it can later monetize.

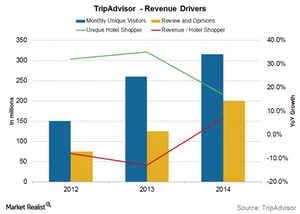

TripAdvisor’s Revenue Drivers for Its Largest Revenue Stream

What are the key revenue drivers of TripAdvisor’s (TRIP) click-based advertisement revenue? We can break them down into a few key metrics.

Which Segment Will Continue to Drive TripAdvisor’s Growth?

The hotels segment is TripAdvisor’s main segment, contributing about 82% of the company’s total revenues.

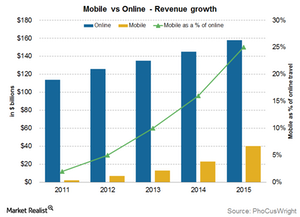

Online Travel Agencies: Future Industry Outlook

OTAs have done well in the past few years. They’ve ridden on the surge in the travel industry because more people are travelling for business and leisure.

Highlights of Citadel Advisors’ 4Q14 Portfolio

Citadel Advisors’ 4Q14 portfolio increased by 3.63% to $82.66 billion from $76.77 billion in 3Q14.

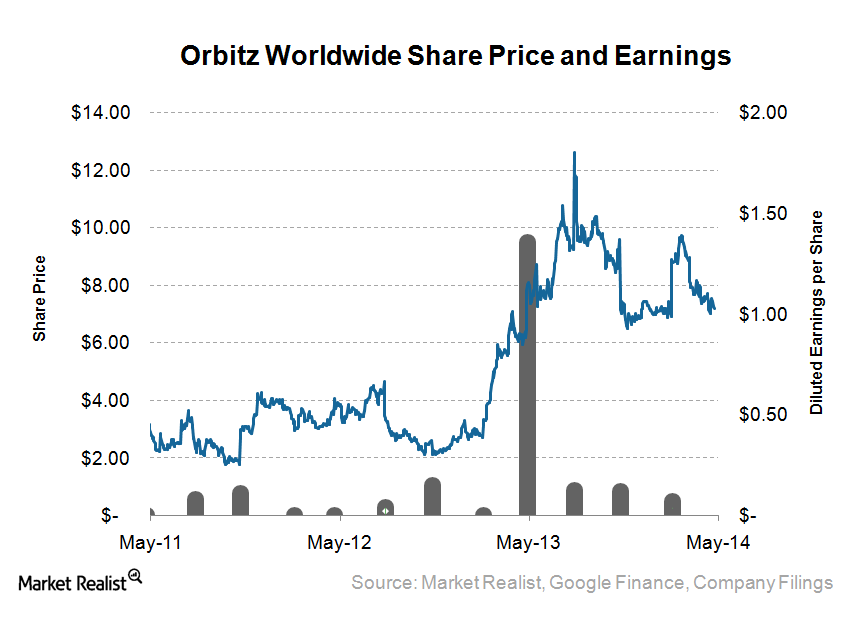

A key overview of global online travel company Orbitz Worldwide

The Chicago-based Orbitz Worldwide Inc. (OWW) is a global online travel company (or OTC). It recently posted a net loss for the first quarter of 2014 although its revenue grew, driven by hotel bookings.