Ally Schmidt

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Ally Schmidt

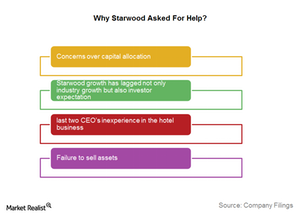

Why Did Starwood Sell Itself?

The last two years have been marked by turmoil for Starwood Hotels (HOT). Starwood’s properties include brands like the Sheraton, Westin, St. Regis, and W hotels.

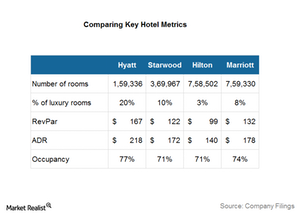

Marriott–Starwood Merger Synergies: The World’s Largest Hotel Chain

The Marriott–Starwood deal holds immense significance for Marriott International because the combined entity of Marriott International and Starwood Hotels and Resorts Worldwide would create the world’s largest lodging company.

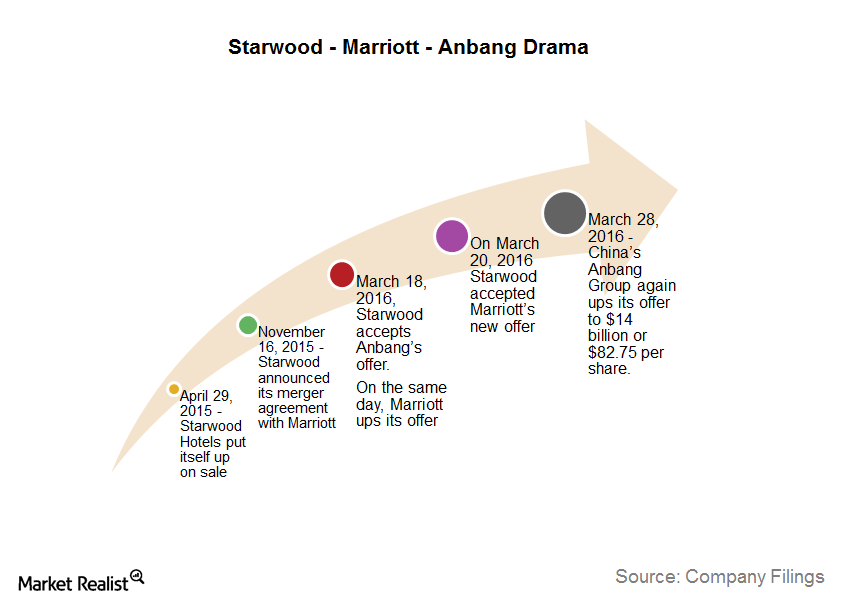

The Starwood Sale: The Story to Date

In this series, we will discuss why Starwood (HOT) decided to put itself up for sale, how a merger with Starwood would benefit either Marriott or Anbang, and who could probably win this takeover tussle.

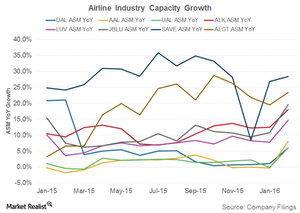

Is There Overcapacity in the Airline Industry?

In February 2016, the airline capacity of the eight major airlines exceeded their traffic growth by an average of 2%.

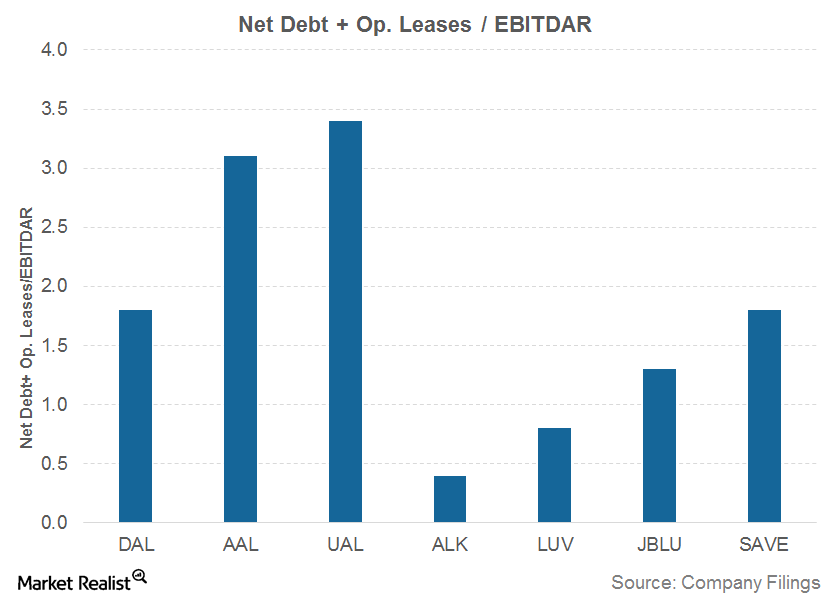

Which Airline Has the Highest Leverage?

The airline industry is a capital-intensive industry with heavy investments required in building infrastructure, fleets, and their maintenance. As a result, airline stocks generally have high levels of debt on their balance sheets.

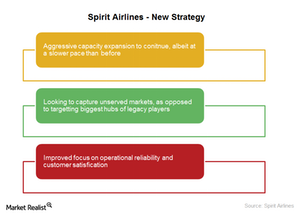

Spirit Airlines: New CEO, New Strategy

Spirit Airlines has historically followed a low-cost structure, and took numerous measures to keep its cost components the lowest in the industry.

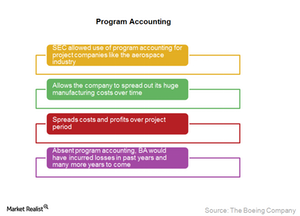

What Is Boeing’s Program Accounting Issue About?

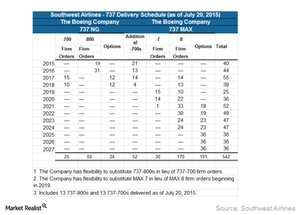

Boeing (BA) uses program accounting, a technique that allows the company to spread out its huge manufacturing costs over time by cutting the cost per plane in the early stages of a project, and smoothening profit margins over time.

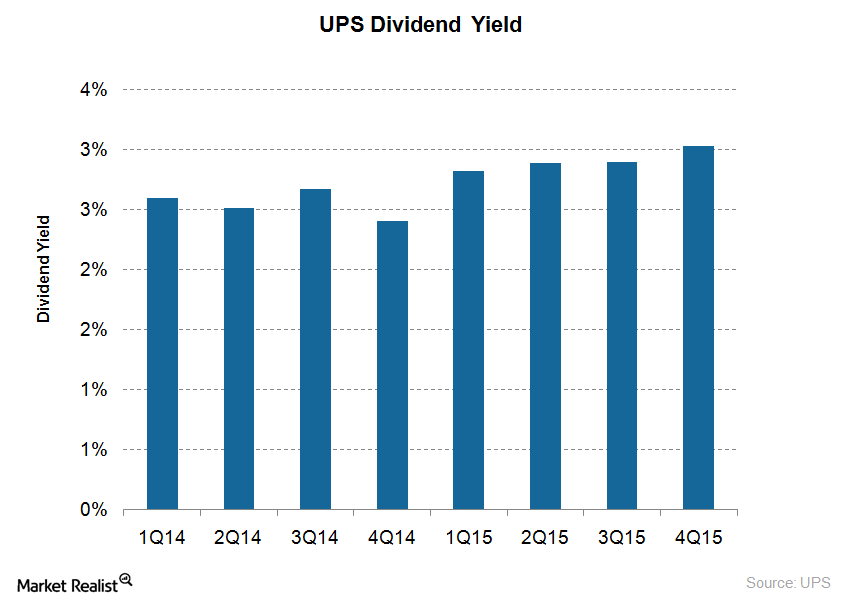

Will United Parcel Service Increase Its Dividend Payout in 2016?

United Parcel Service (UPS) has been a consistent dividend payer for the last 20 years.

Why Are Expedia’s Margins Declining despite Growing Revenues?

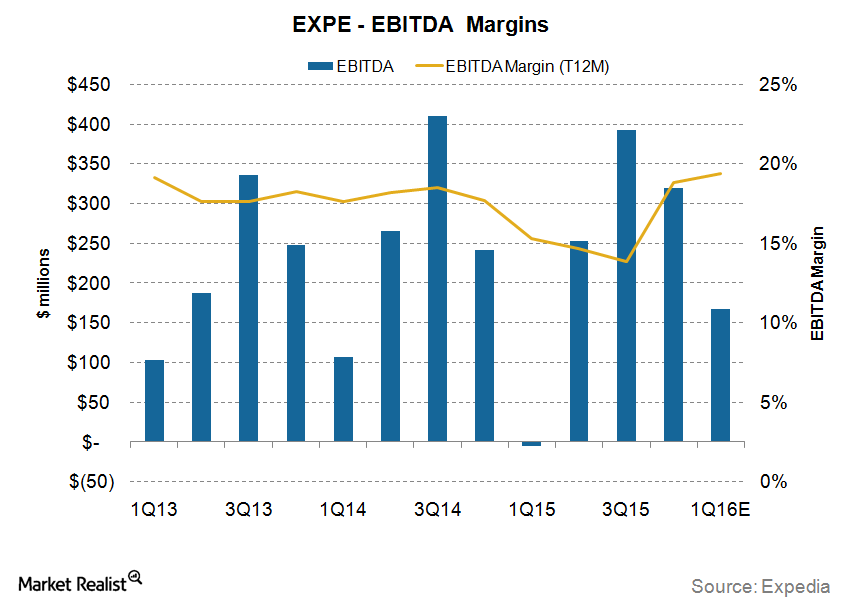

Expedia’s EBITDA margins are expected to increase to 19% in 2016 and then rise to 21% in 2017. As a result, EBITDA growth is expected to increase to 42% and 27% in 2016 and 2017, respectively.

What Do Expedia’s Key Metrics Suggest?

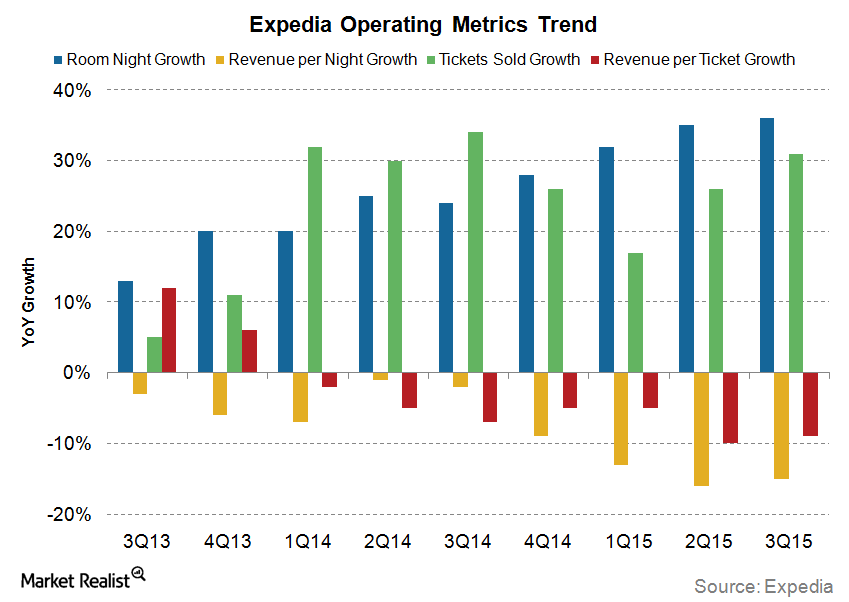

For the last year, Expedia’s gross bookings increased 28% after increasing 16% for the two years before that. For the first nine months of 2015, gross bookings have increased 20%.

Can Delta Air Lines Continue to Reduce Its Costs in 2016?

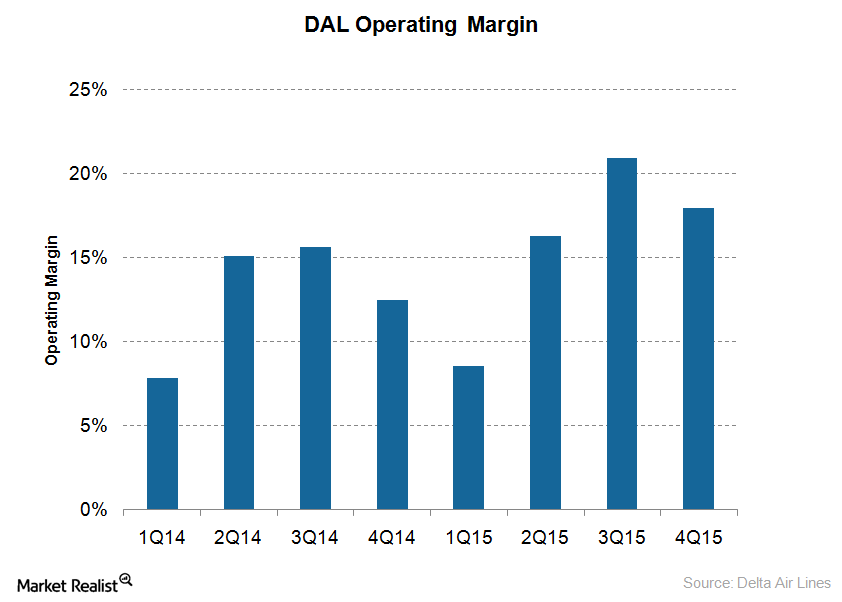

For 1Q16, Delta Air Lines (DAL) expects to see its operating margins improve to 18%–20%, backed by solid cost savings and lower fuel prices.

How Did Carnival Corporation Perform on Key Metrics?

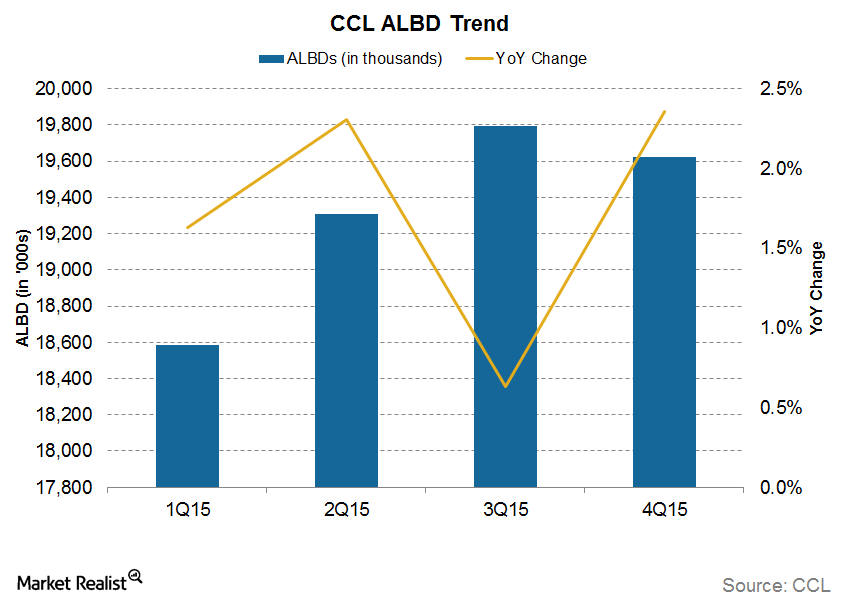

Carnival’s (CCL) competitors include Royal Caribbean Cruises and Norwegian Cruise Line. CCL forms 3.9% of the WBI Large Cap Tactical Value Shares (WBIF).

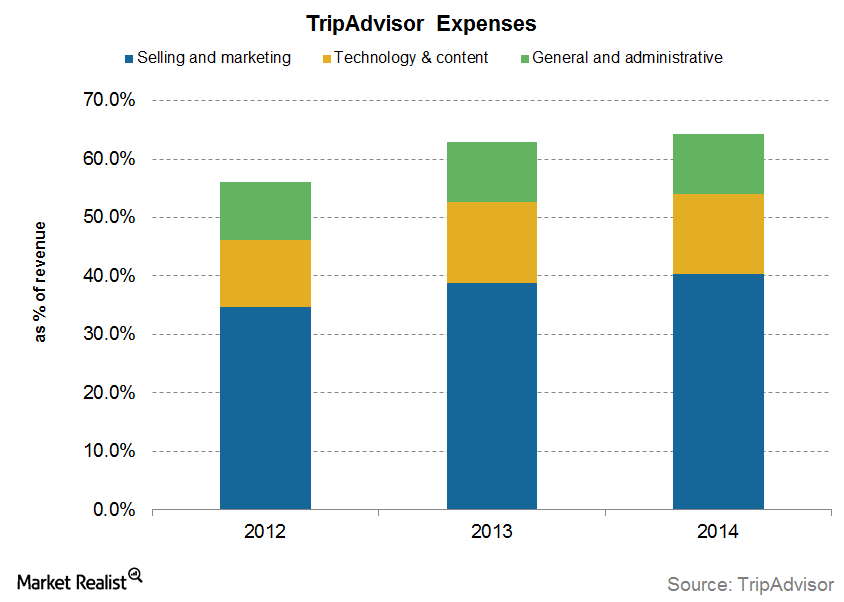

TripAdvisor’s Key Spending: Customer Acquisition Costs and More

TripAdvisor (TRIP) is a travel site, which means its business depends on getting loads of traffic that it can later monetize.

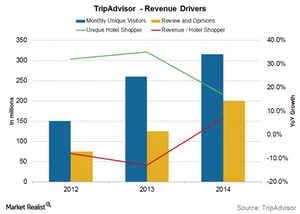

TripAdvisor’s Revenue Drivers for Its Largest Revenue Stream

What are the key revenue drivers of TripAdvisor’s (TRIP) click-based advertisement revenue? We can break them down into a few key metrics.

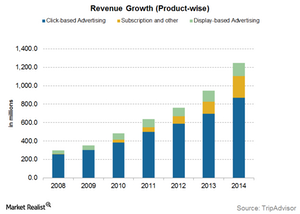

TripAdvisor’s Revenue Streams: A Cost-per-Click Model

Since all the content provided on TripAdvisor’s (TRIP) website is free and predominantly user-generated, the company shifted from earning on a per-query basis to a cost-per-click model.

TripAdvisor’s Business Model: What Investors Need to Know

In 1999, TripAdvisor founders Stephen Kaufer and his wife, Caroline Lipson Kaufer, decided to take a vacation. The vacation would have turned out to be a disaster if they hadn’t decided to check out the place online.

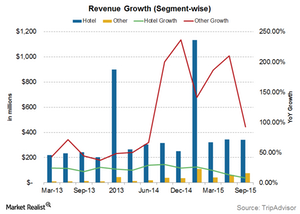

Which Segment Will Continue to Drive TripAdvisor’s Growth?

The hotels segment is TripAdvisor’s main segment, contributing about 82% of the company’s total revenues.

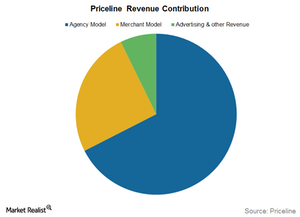

Understanding Priceline’s Business Model

Priceline has mostly followed the agency model, where hotels and other service providers list their own offers and pay Priceline a commission for every transaction.

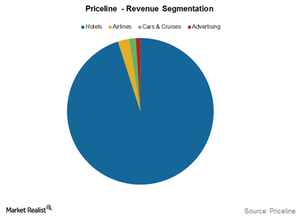

An Overview of Priceline’s Revenue Sources

Overview In 2014, Priceline (PCLN) saw a 24% year-over-year revenue growth, primarily boosted by strong advertising revenue growth. It is expected to reach $9.24 billion in sales by the end of 2015, versus $6.52 billion in forecasted sales for its competitor, Expedia (EXPE). Priceline has seen robust growth in revenue over the years after the […]

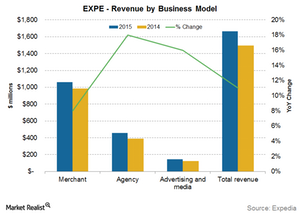

What Business Model Does Expedia Follow?

Of the two most popular business models in the online travel agency industry, Expedia uses both the merchant model and the agency model.

Expedia: A Global Heavyweight in the Travel Industry

Expedia is one of the world’s largest online travel companies. Its strong global presence boasts more than 150 booking sites in over 70 countries.

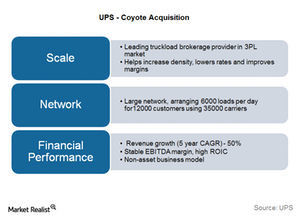

How Does UPS Benefit from Its Acquisition of Coyote Logistics?

United Parcel Services (UPS) announced its agreement to acquire Coyote Logistics. It’s a Chicago-based logistics firm with contract carrier companies.

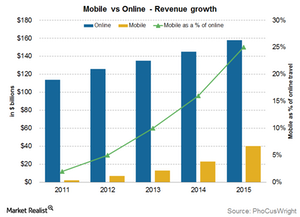

Online Travel Agencies: Future Industry Outlook

OTAs have done well in the past few years. They’ve ridden on the surge in the travel industry because more people are travelling for business and leisure.

Southwest’s Low Cost Strategy Helps Maintain a Competitive Edge

Southwest is known to be the pioneer of low cost travel in the industry. Its 42-year record of profitable operations is enough to prove the success of the company’s business model.

Which ETFs Give Exposure to Courier Stocks?

Smaller ETFs that provide exposure to the courier services industry include Buyback Achievers (PKW), the First Trust Capital Strength ETF (FTCS), and the MSCI Industrials Index ETF (FIDU).

The Key Trends that Could Shape the Courier Industry in 2015

The US has witnessed the emergence of a number of regional carriers such as OnTrac and Eastern Connection, which are providing cheaper, faster delivery options.

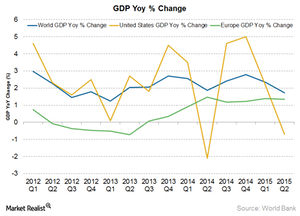

Why Is Economic Growth Important for the Courier Service Industry?

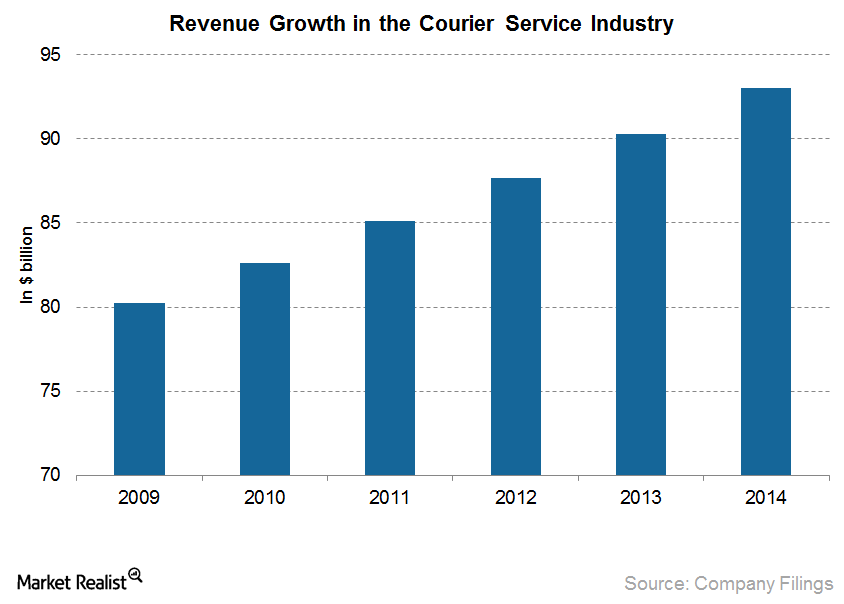

Over the past few years, the global courier services industry has managed to recover from the global economic slowdown.

Possible Key Growth Drivers for UPS in the Near Future

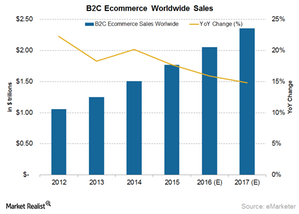

The e-commerce industry is poised to grow rapidly in the future. With this growth will come the need for package delivery.

Key Strengths that Keep UPS ahead of Its Peers

Some of UPS’s key strengths that keep it ahead of its competitors include an integrated global network, leading-edge technology, a strong brand name, a strong culture, and impressive financials.

How Has E-Commerce Changed the Courier Services Industry?

In the recent past, there has been a surge in the use of e-commerce across the globe. The impact of this new form of commerce has been felt in each and every industry.

Types of Courier Services and Service Providers

Standard courier services involve collecting the parcels, sorting the parcels, and transferring the parcels to the closest depot to the delivery location.

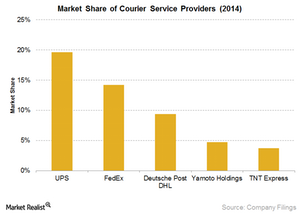

Who Are the Key Players in the US Delivery Services Industry?

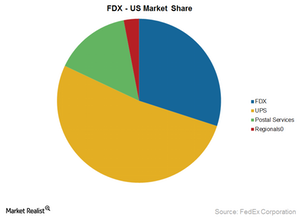

The US courier and parcel delivery services industry consists of about 7,500 companies both large and small, which have combined annual revenue of about $90 billion.

A Look at the Courier Service Industry in the United States

The growth in e-commerce among various economies across the globe has helped shape the highly competitive courier service industry that we know today.

How Is UPS Performing against Its Peers?

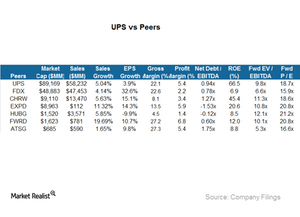

UPS has the highest sales among its peer group with $58.2 billion in sales in 2014. Rival FedEx wasn’t far behind with $47.45 billion in sales.

United Parcel Service: How It Delivers Packages to the World

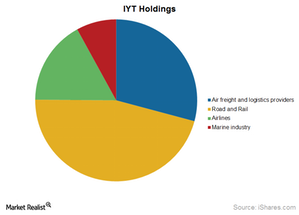

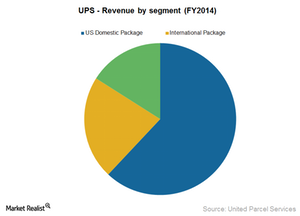

United Parcel Service is the world’s largest package delivery company and a leading global provider of specialized transportation and logistics services. It forms the largest holding of 7.6% in IYT.

UPS: How the World’s Largest Package Delivery Service Began

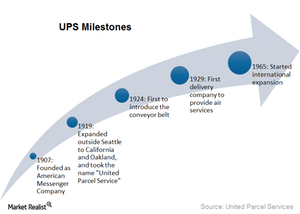

United Parcel Service (UPS), originally called American Messenger Company, was founded in 1907 by 19-year-old James E. Casey with $100 borrowed from a friend.

FedEx’s Delivery Market Share Is Threatened by New Competitors

FedEx was formed with a vision to change the way delivery services worked prior to 1971. It established a new industry and it has been leading its peers since then.

What Are FedEx’s Key Strategic Business Advantages?

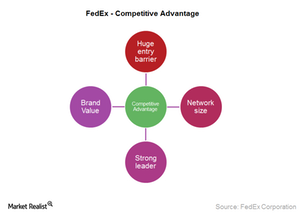

FedEx has been in the marketplace for over 40 years. It has established a huge network spread across more than 220 countries and territories worldwide.

What Are FedEx’s Major Costs?

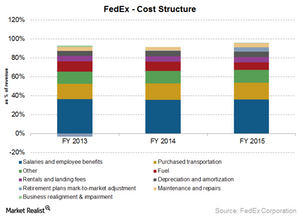

Salaries and employee benefits form the highest cost for FedEx. They account for ~36% as a percentage of revenue. Salary costs rose 6% for fiscal 2015.

FedEx’s Financial Performance and Long-Term Goals

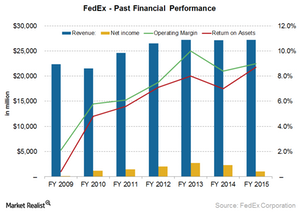

FedEx’s (FDX) financial performance during the last few years has been extraordinary. It successfully bounced back from the recessionary downturn.

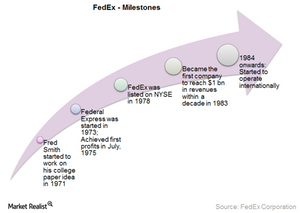

FedEx’s Growth Is Led by Acquisitions and Technology

By 1983, FedEx (FDX) had become the strongest delivery business in the nation. It started a string of acquisitions in order to grow more.

Why FedEx Is Expanding Its Global Reach

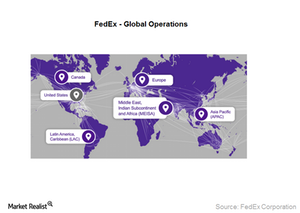

FedEx has assembled a portfolio of solutions, from express and freight forwarding to critical inventory logistics, that can solve any global commerce challenge.

FedEx: How a College Paper Idea Turned into a Delivery Giant

The idea behind FedEx (FDX) started off as a term paper by undergraduate Frederick W. Smith in 1965 at Yale University. The company started operations in 1973.

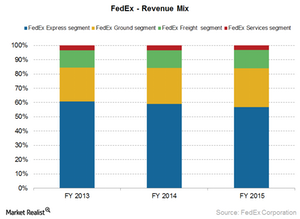

A Key Analysis of FedEx’s Business Model

Currently, FedEx is the global leader in the express delivery market. It offers delivery to and from individuals and businesses. It has various business units.

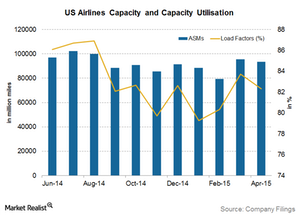

Improving Capacity Utilization Adds to Airline Profitability

Capacity utilization has improved from the lows of ~57% in the 1970s to ~76% in 2014 and 81.88% in year-to-date 2015.

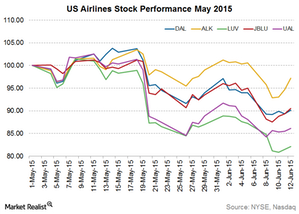

The Key Variables Impacting Airline Stocks

A strengthening dollar led to improved profitability for US airlines in 1Q15 while subduing profitability for non-US airlines. This further increased the industry’s performance gap across the globe.

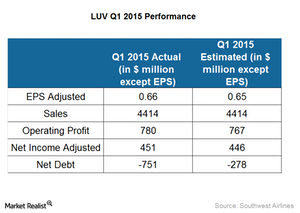

What Were Southwest’s Key Performance Drivers for 1Q15?

Southwest Airlines posted excellent financial performance metrics in 1Q15, including ~6% growth in available seat miles.

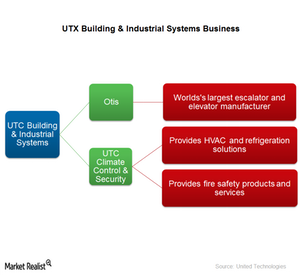

What Is UTC Building & Industrial Systems?

UTC offers some products and services through UTC Building & Industrial Systems, a combination of two segments, Otis and UTC Climate, Controls & Security.

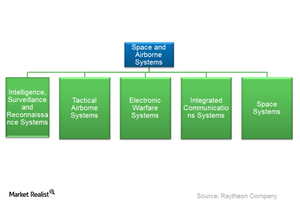

What Is Raytheon’s Space and Airborne Systems Segment?

Revenues for Raytheon’s Space and Airborne Systems segment declined in 2014 by 5%. This led to lower income and slight growth in margins.

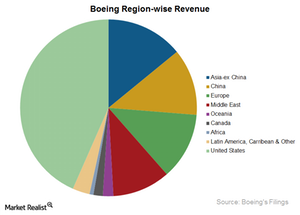

The Boeing Company: From the Beginning

Boeing is the world’s largest aerospace company. It is the largest commercial jet manufacturer in the US and the world’s second largest behind Airbus.