Which ETFs Give Exposure to Courier Stocks?

Smaller ETFs that provide exposure to the courier services industry include Buyback Achievers (PKW), the First Trust Capital Strength ETF (FTCS), and the MSCI Industrials Index ETF (FIDU).

July 24 2015, Updated 9:05 a.m. ET

The iShares Transportation ETF

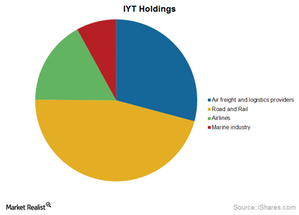

The iShares Transportation ETF (IYT) is a measure for the US transportation sector. It replicates the performance of the Dow Jones Transportation Average Index. The ETF has 29.11% exposure to air freight and logistics providers, 45.9% exposure to road and rail stocks, 16.85% to airlines stocks, and 7.98% exposure to the marine industry.

FedEx (FDX) forms the largest holding of the ETF at 12.81% and United Parcel Service (UPS) is the second highest at 7.5%. Other logistics providers included in the ETF are J.B. Hunt Transport Services (JBHT) and C.H. Robinson Worldwide (CHRW), both with a 4.97% holding.

The iShares US Industrials ETF

The iShares US Industrials ETF (IYJ) is a measure for the US industrial sector. It replicates the performance of the Dow Jones U.S. Industrials Index. Aerospace and defense stocks form 21.03% of the ETF, industrial conglomerate stocks form 16.89%, machinery stocks form 12.88%, IT services stocks form 9.38%, road and rail stocks form 6.83%, and electrical equipment stocks form 5.07%. Air freight and logistics stocks form only 5.04% of the ETF, of which 1.72% is in FDX and 2.6% is in UPS.

The Industrial Select Sector SPDR

The Industrial Select Sector SPDR (XLI) is a measure for the US industrial sector. It replicates the performance of the Industrial Select Sector Index. The ETF has the highest exposure to aerospace and defense stocks at 27%. Industrial conglomerates form 19.42%, machinery stocks form 16.19%, road and rail stocks form 9.71%, electrical equipment stocks form 5.73%, and airlines stocks form 4.62%. Air freight and logistics form ~7% of the ETF, of which 2.53% is in FDX and 3.59% is in UPS.

Other smaller ETFs that provide exposure to the courier services industry include Buyback Achievers (PKW), the First Trust Capital Strength ETF (FTCS), the MSCI Industrials Index ETF (FIDU), the Industrials ETF (VIS), and the iShares Global Industrials ETF (EXI).