iShares US Industrials

Latest iShares US Industrials News and Updates

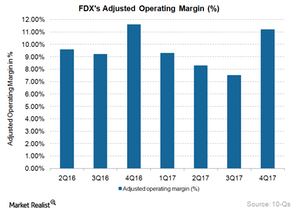

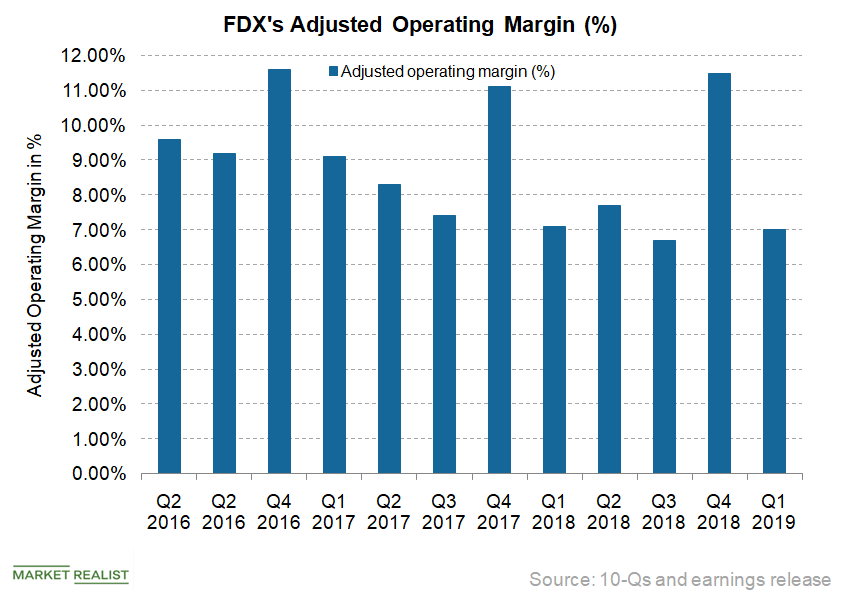

What Happened to FedEx’s Fiscal 4Q17 Operating Margin?

FedEx’s (FDX) operating margin was 11.2% on an adjusted basis in fiscal 4Q17, representing a 0.4% fall on a YoY (year-over-year) basis.

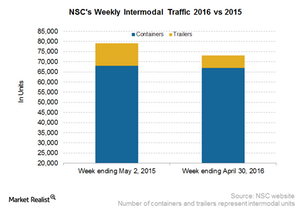

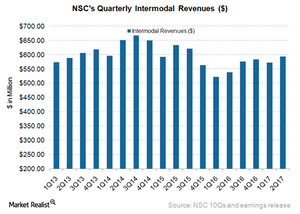

Norfolk Southern’s Intermodal Slump Equitable with Rival CSX

Norfolk Southern’s (NSC) total intermodal traffic for the week ended April 30, 2016, declined by 7.6%, at nearly 73,000 containers and trailers. This compares with 79,000-plus units in the corresponding week of 2015.

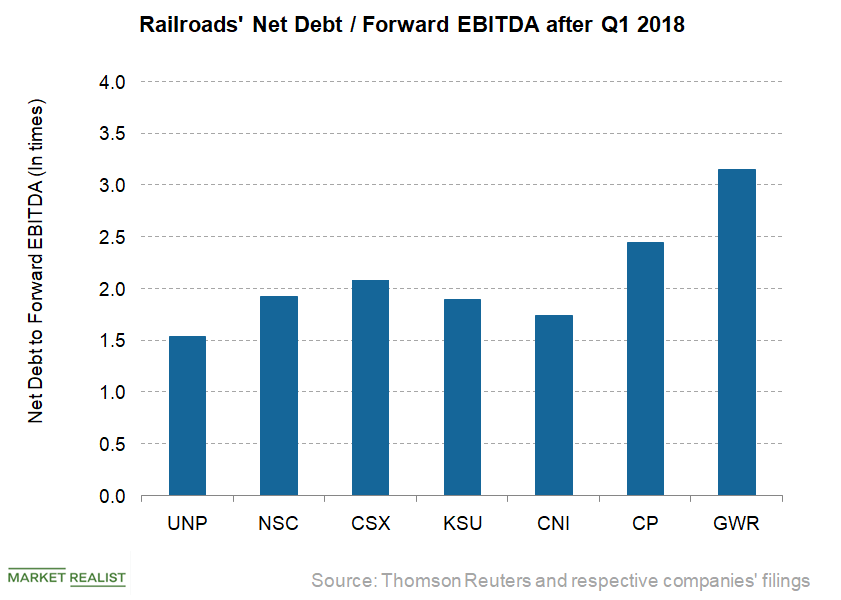

Evaluating Leverage Levels of Major Railroads after Q1 2018

As of March 31, Genesee & Wyoming (GWR) had a net debt-to-forward-EBITDA multiple of 3.2x, which was much higher than the industry average of 2.1x.

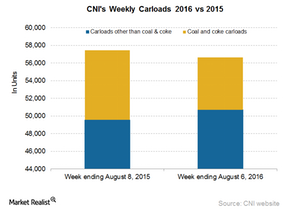

How Did Canadian National Measure up to Canadian Pacific in Carloads?

Canadian National recorded a 1.4% fall in total railcars in the week ended August 6, 2016, hauling ~57,000 railcars, compared to ~57,000 units one year ago.

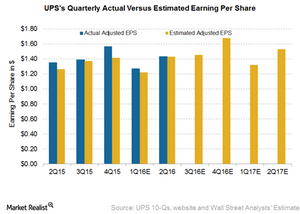

How Analysts Feel about United Parcel Service Post-2Q16

In this article, we’ll discuss what analysts are expecting for United Parcel Service (UPS) following its 2Q16 results.

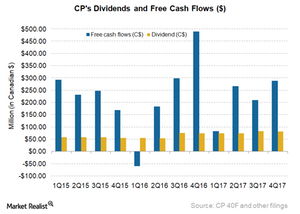

Is Canadian Pacific’s Free Cash Flow Enough for Dividend Growth?

Now let’s examine the free cash flow levels of Canadian Pacfic and compare it to its arch-rival Canadian National Railway (CNI).

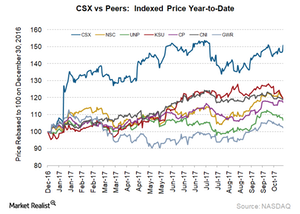

CSX’s 3Q17 Earnings Shine: Higher Freight Rates, Stock Up 2.6%

The eastern US rail freight carrier CSX (CSX) announced its 3Q17 earnings on October 17. The quarter marks the end of two full quarters under the leadership of Hunter Harrison.

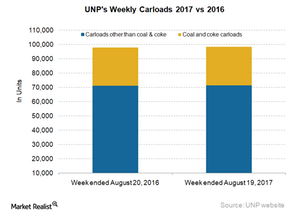

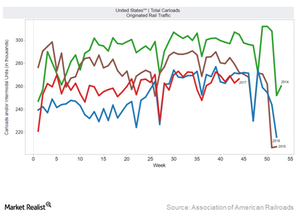

Comparing Union Pacific’s Freight Volumes with the Industry in Week 33

In week 33 of 2017, Union Pacific (UNP) recorded a marginal rise of 0.6% in its railcars, excluding intermodal.

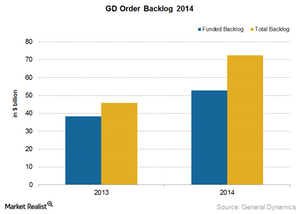

What does General Dynamics’ order backlog reflect?

General Dynamics’ total backlog grew from $45.9 billion at the end of 2013 and to $72.4 billion at the end of 2014. This was a whooping 58% increase.

BNSF: A Jewel in Berkshire Hathaway’s Crown

Burlington Northern Santa Fe (or BNSF) owns and operates the largest rail network in North America through its wholly owned subsidiary, BNSF Railway Company.

Who Are Old Dominion’s Biggest LTL Competitors Today?

Old Dominion’s peer group includes LTL companies that compete in the national and regional marketplace. The company also competes with some US railroads.

BNSF: The Largest US Class I Railroad

Burlington Northern Santa Fe (or BNSF) owns and operates the largest rail network in North America. The company manages ~32,500 route miles of track.

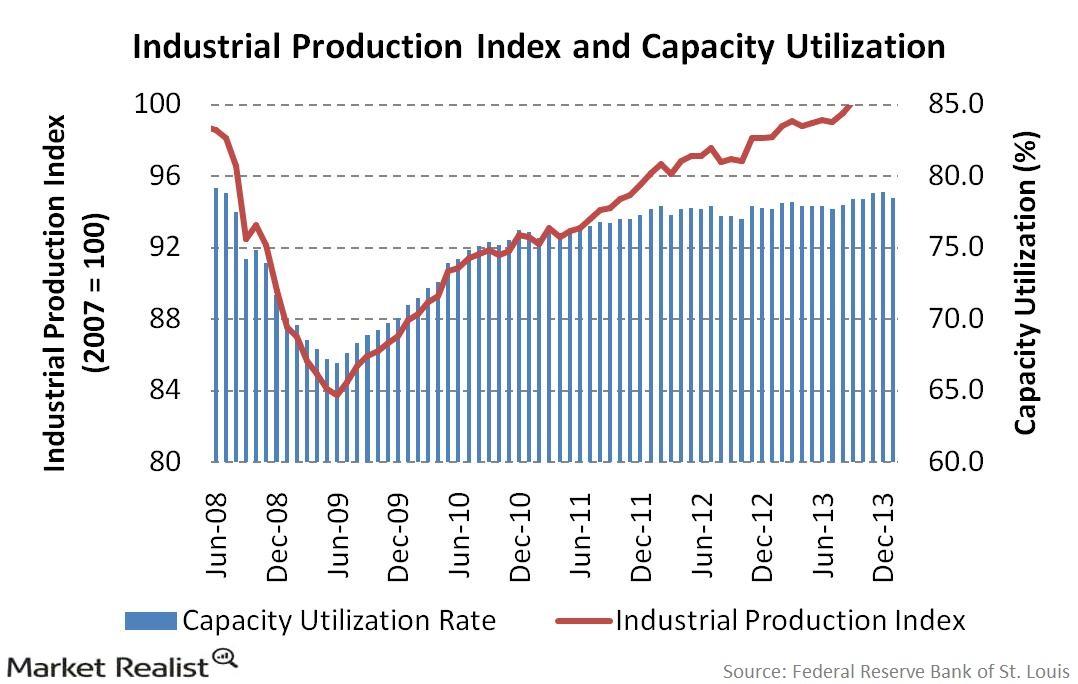

Why the bond market is affected by the Industrial Production Index

Although the industrial sector accounts for less than 20% of GDP, it creates much of the cyclical variability in the economy.

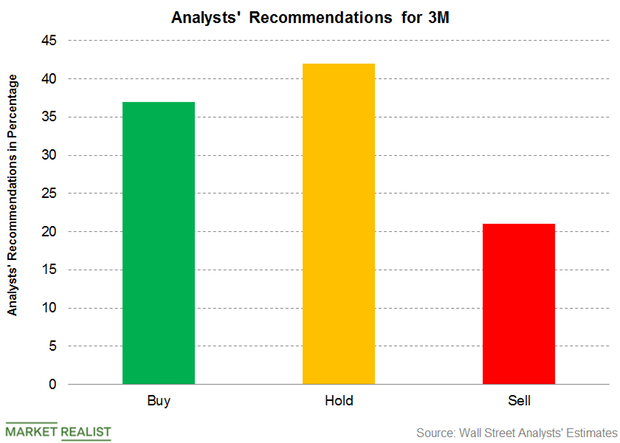

3M: Analysts Revised the Target Price

For 3M stock, 37% of the analysts recommended a “buy,” 42% recommended a “hold,” and 21% recommended a “sell.”

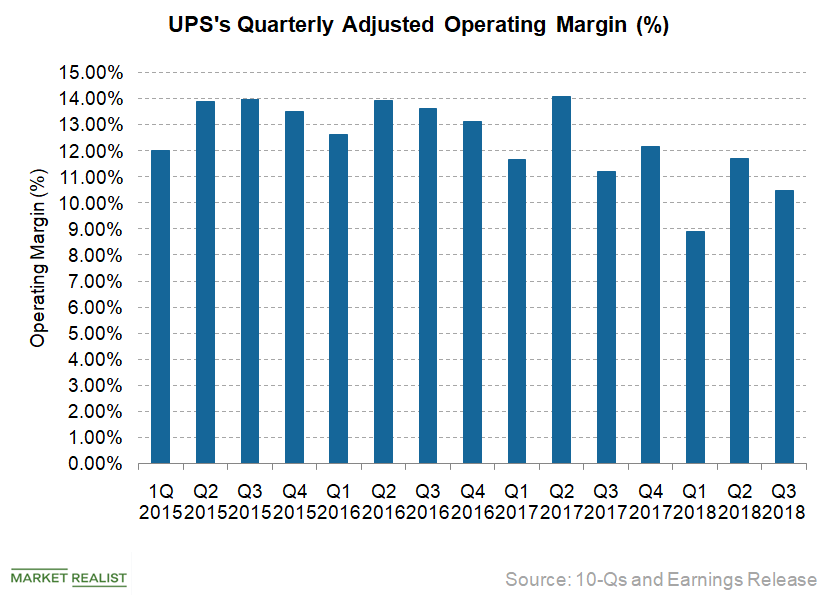

Why United Parcel Service’s Operating Margin Declined in Q3 2018

UPS’s operating profit declined 4.7% to $1.7 billion in the third quarter from $1.8 billion in the third quarter of 2017.

Did FedEx Deliver on Operating Margins in the First Quarter?

FedEx’s adjusted operating margin contracted by ten basis points to 7% in Q1 2019 from 7.1% in the first quarter of 2018.

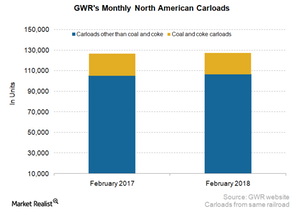

How GWR’s North American Carloads Trended in February

In February 2018, Genesee & Wyoming’s (GWR) North American carloads expanded 0.3% YoY (year-over-year) on a reported basis.

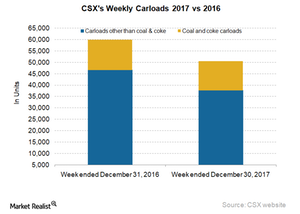

Commodities that Pulled Down CSX’s Carload Traffic in Week 52

Rail giant CSX (CSX) reported double-digit carload traffic loss in the 52nd week of 2017. The company’s carload traffic slumped 15.7% that week.

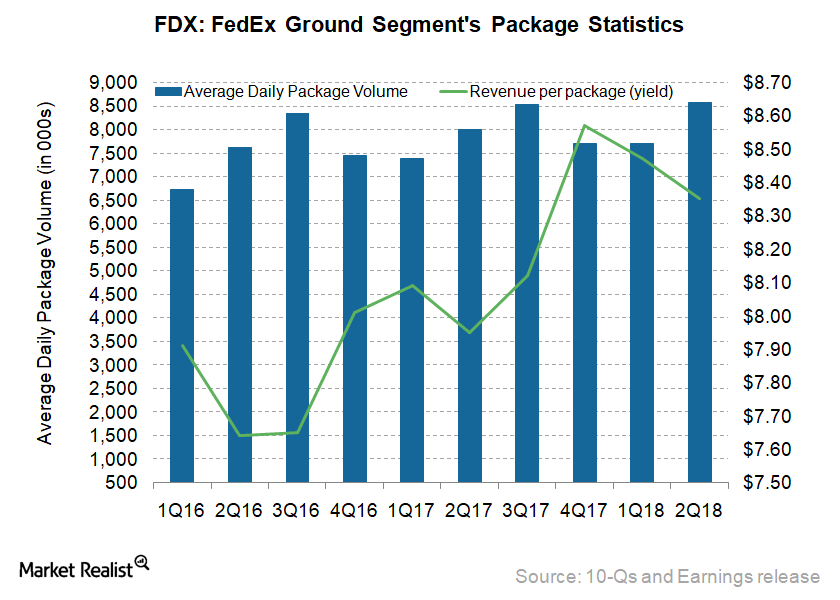

FedEx Ground’s Revenues in Fiscal 2Q18: What’s behind the Growth?

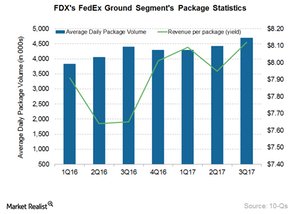

FedEx Ground’s (FDX) revenues rose 11.5% to $4.9 billion in fiscal 2Q18, from $4.4 billion in fiscal 2Q17.

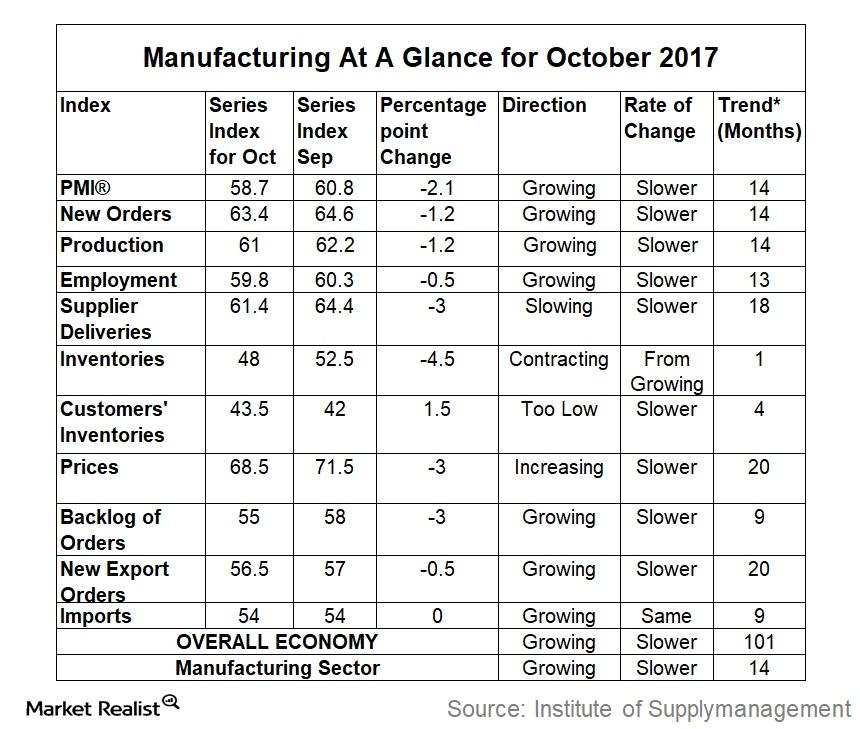

Strength of the Manufacturing Sector: Purchasing Managers’ Index

This has been one of the best years since 2004 for manufacturing activity, viewed through the Purchasing Managers’ Index (or PMI).

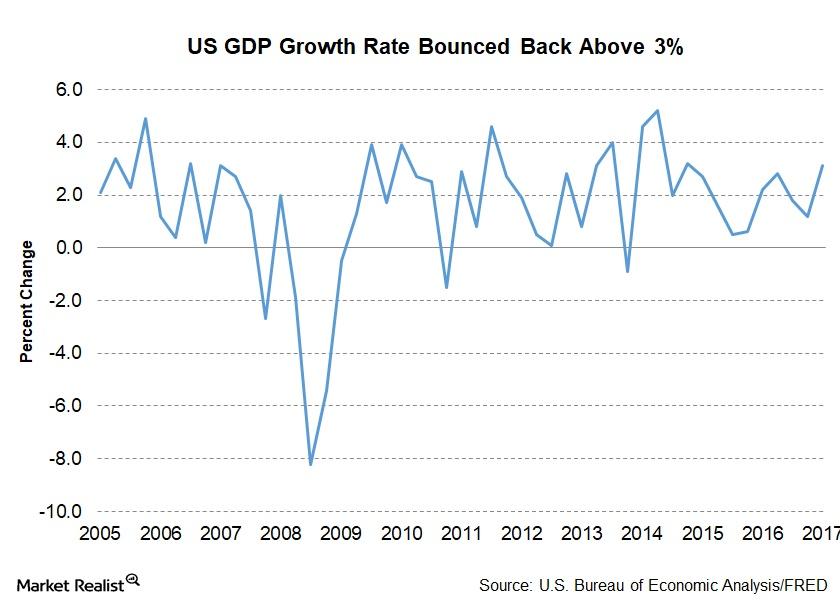

How the US Economy Performed in 2017

This year has been a year to watch the US economy. Hopes for change, tax reform, and industry-friendly policies drove the markets (SPY) higher.

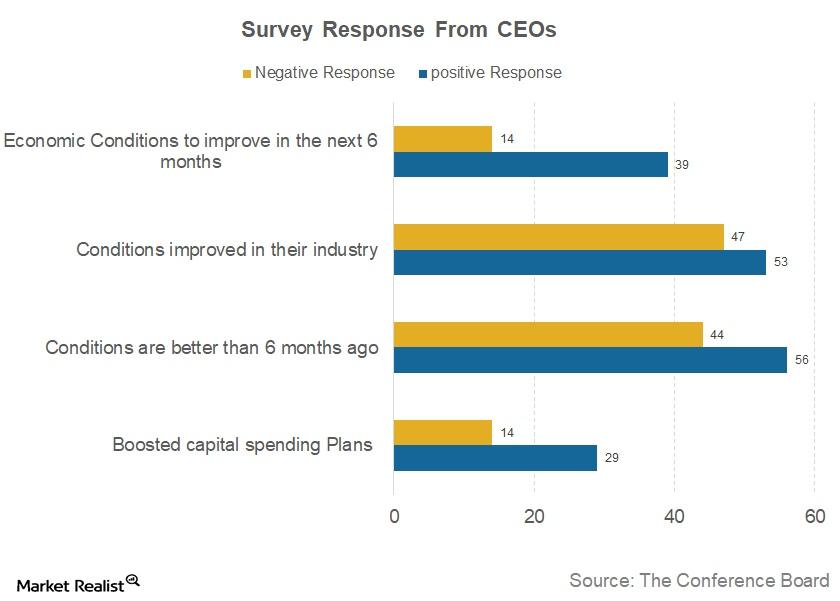

How Does CEO Confidence Index Assess US and Global Economies?

The Conference Board CEO Confidence Survey is a quarterly report based on a survey that collects responses from approximately 100 CEOs who represent a variety of industries.

Week 44 Failed to Lift US Rail Freight Volumes

In the 44th week of 2017, total rail freight traffic in the United States recorded a ~0.9% fall. Overall volumes, including intermodal, decreased to ~539,000 units.

What Caused the Fall in Manufacturing Activity in October?

The US Manufacturing PMI (purchasing managers’ index) for the month of October fell to 58.7, compared with 60.8 in September.

Norfolk Southern: International Pushed Intermodal Revenues in 2Q17

NSC’s Intermodal segment’s revenues rose 10% to $593.0 million from $538.0 million in 2Q16.

Better SmartPost and Ground Yield Pushed Up FedEx Ground’s Revenue

The FedEx Ground segment’s revenues rose 6% from $4.4 billion in 3Q16 to $4.7 billion in fiscal 3Q17.

How TNT Acquisition Is Driving FedEx’s European Growth

On May 25, 2016, FedEx (FDX) completed the 4.4 billion euro acquisition of the Netherlands-based TNT Express NV.

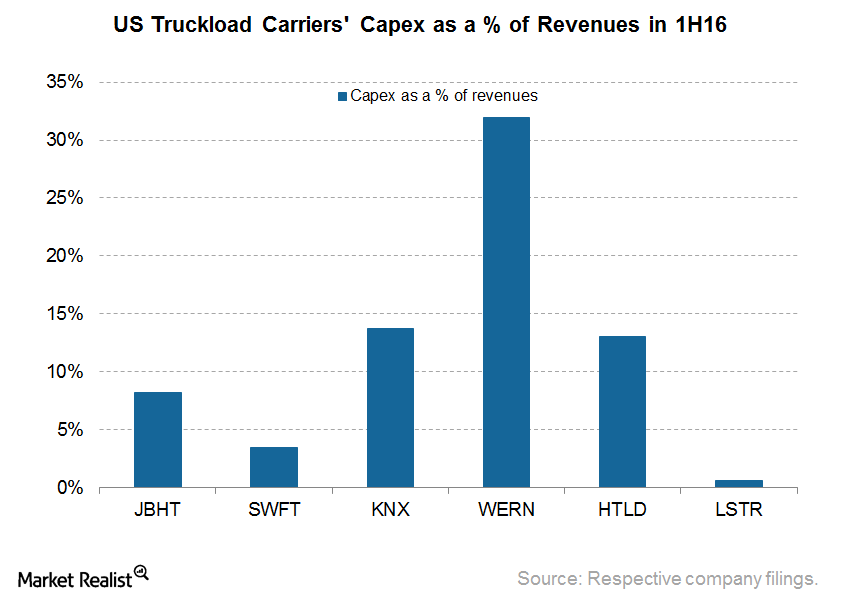

This Truckload Carrier’s Capital Expenditure Bucks the Trend

In the current weak freight regime, the extent of capital expenditure throws light on the growth prospects of these trucking carriers.

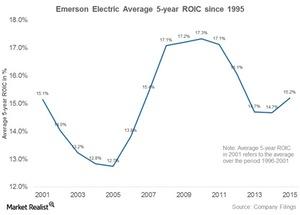

Does Emerson Have a Competitive Advantage?

An analysis of Emerson Electric’s (EMR) ROIC between 1995 and 2015 shows that 2001–2003 were the only years when ROIC fell below 13%.

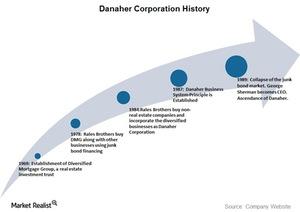

Danaher’s Journey from Corporate Raider to Corporate Statesman

Danaher (DHR) was the brainchild of brothers Steven and Mitchell Rales. It was incorporated as a holding company in 1984.

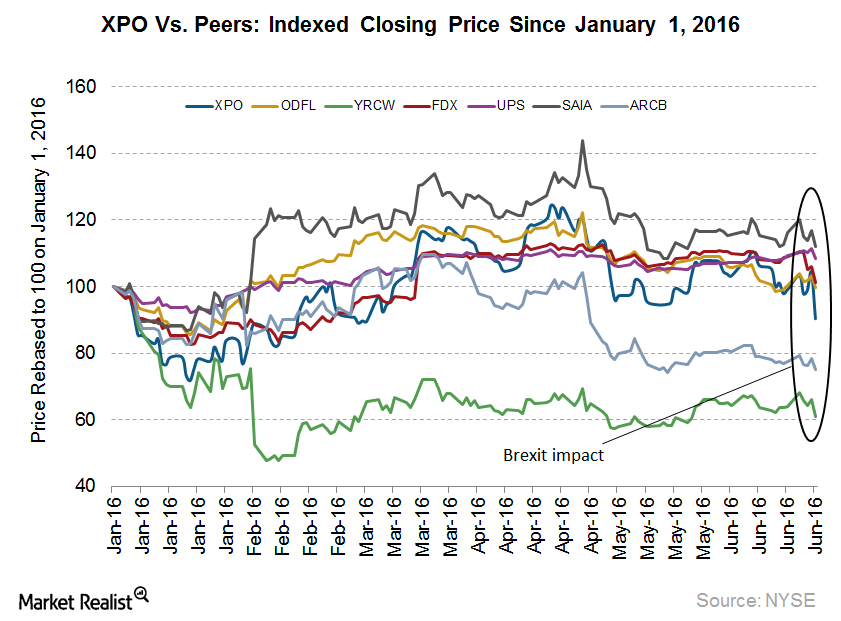

Will Brexit Continue to Impact XPO Logistics?

Following the United Kingdom’s decision to exit the European Union, XPO Logistic’s (XPO) stock fell 13.4% on June 24.

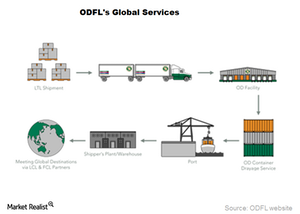

Inside Old Dominion Freight Line’s Global Services

Old Dominion unloads its less-than-truckload shipments dispatched by vendors onto an ocean container unit and onto the client’s steamship of choice.

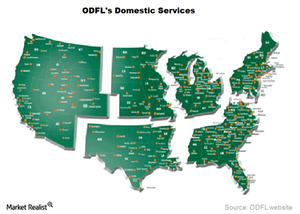

Understanding Old Dominion Freight Line’s Domestic Services

Old Dominion Freight Line has 224 shipping service centers and 32 transfer points. ODFL serves nine major regions and thousands of direct points in the US.

How to Navigate Uneven Economic Growth

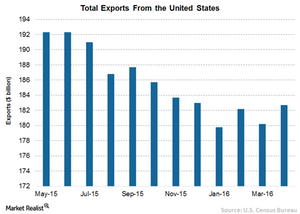

A number of factors have contributed to the slowdown, including soft overseas growth and a sharp drop in capital spending by energy and mining companies.

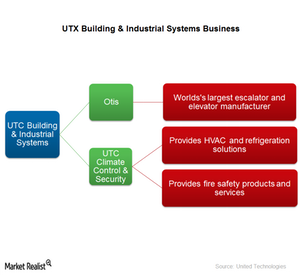

What Is UTC Building & Industrial Systems?

UTC offers some products and services through UTC Building & Industrial Systems, a combination of two segments, Otis and UTC Climate, Controls & Security.

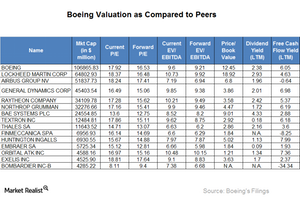

Comparing Boeing’s Valuation to Its Peers

Boeing is the largest company by market capitalization among our selected peers, while Bombardier is the smallest.

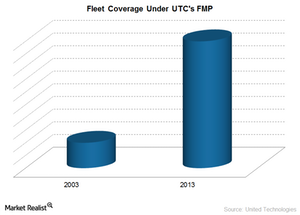

How Did UTC Improve Its Aftermarket Business?

Pratt & Whitney (UTX) originally focused only on selling airplane engines and spare parts. It covered only 10% of its engines under its aftermarket program.

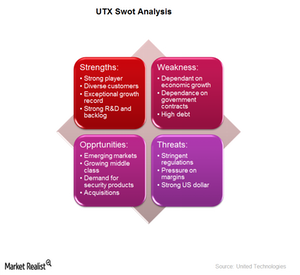

United Technologies Corporation: A SWOT Analysis

In this article, we’ll do a SWOT analysis of United Technologies Corporation (UTX), including its strengths, weaknesses, opportunities, and major threats.

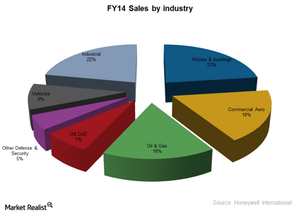

Analyzing how Honeywell makes money

Honeywell International Inc. (HON) is headquartered in Morristown, New Jersey. It was incorporated in 1985. It’s a Fortune 100 company.Technology & Communications Why New York’s Manufacturing Survey may mean upbeat tech earnings

Even though the current conditions index reached a four-year high, survey respondents were less optimistic over future business conditions.Industrials The ADP jobs report: A must-know guide for ETF investors

The ADP National Employment Report (also popularly known as “the ADP Jobs Report” or “ADP Employment Report”) is a monthly report summarizing the employment situation.