Better SmartPost and Ground Yield Pushed Up FedEx Ground’s Revenue

The FedEx Ground segment’s revenues rose 6% from $4.4 billion in 3Q16 to $4.7 billion in fiscal 3Q17.

March 23 2017, Updated 4:05 p.m. ET

FedEx Ground’s 3Q17 revenue

After reviewing FedEx’s (FDX) Express segment’s 3Q17 performance, let’s examine the FedEx Ground segment. The FedEx Ground segment’s revenues rose 6% from $4.4 billion in 3Q16 to $4.7 billion in fiscal 3Q17. Higher e-commerce sales plus the inclusion of FedEx SmartPost in its Ground business drove FedEx Ground revenues in 3Q17.

Segmental statistics

The FedEx Ground segment consists of FedEx Ground and GENCO. In 3Q17, FDX announced the rebranding of GENCO, a third-party logistics provider in North America, into FedEx Supply Chain. On a standalone basis, FedEx Ground revenues rose 6.7% from $4.0 billion to $4.7 billion. The Supply Chain revenue increased from $383.0 million in 3Q16 to $392.0 million in 3Q17, a rise of 2.3%.

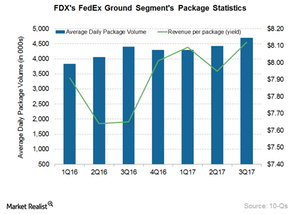

FedEx Ground’s average daily package volumes rose 2% in 3Q17. The ground yield per package rose 6% mainly due to the annual rate hike backed by FedEx Ground and SmartPost yield improvement. The change in FedEx’s Ground dim weight divisor from 166 to 139 also affected the growth in yield per package.

Management insight

FDX launched FedEx Fulfilment service in February 2017. The service is an e-commerce logistics solution for small and medium businesses. The company has increased the pricing in the FedEx Ground business from January 2, 2017, by an average 4.9%. Plus, FDX’s change in the dimensional weight divisor for FedEx Ground from 166 to 139 could boost revenues.

In February 2017, the company started updating the Ground business’s fuel surcharges on a weekly basis, which should also boost the Ground fuel surcharge revenue going forward. Apart from this, note that FedEx has entered a long-term agreement with Walgreens (WBA) for FedEx Onsite. FedEx Onsite is a pan-US network of alternate delivery locations.

ETF investment

Investors who are interested in the transportation and logistics sector can consider the iShares US Industrials ETF (IYJ). Major railroads like CSX (CSX) and Union Pacific (UNP) and prominent airlines (DAL) make up ~5.8% and 4.6%, respectively, of the portfolio holdings of the iShares US Industrials ETF (IYJ).

Continue reading to learn more about the FedEx Freight segment’s performance in 3Q17.