PowerShares Buyback Achievers ETF

Latest PowerShares Buyback Achievers ETF News and Updates

What Is FedEx Management’s Outlook for the Future?

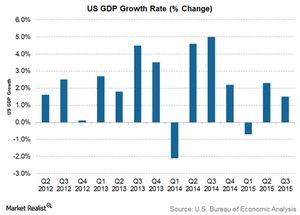

FedEx continues to see growth in the global economy. It expects the US GDP to grow by 2.4% in 2015 and by 2.6% in 2016, driven by increased consumer spending.

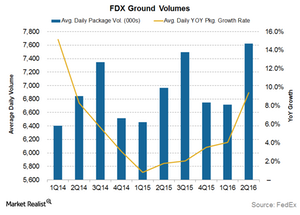

FedEx Ground: Delivering on E-Commerce Growth

FedEx Ground is being driven by the booming growth in e-commerce, and it contributed to 35% of the company’s revenues but 44% of its profits.

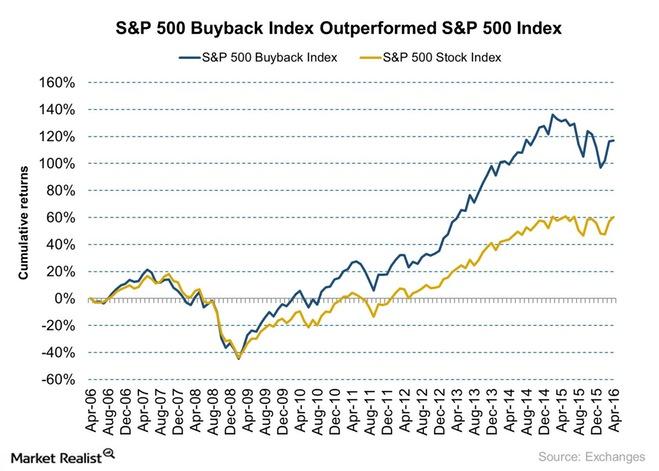

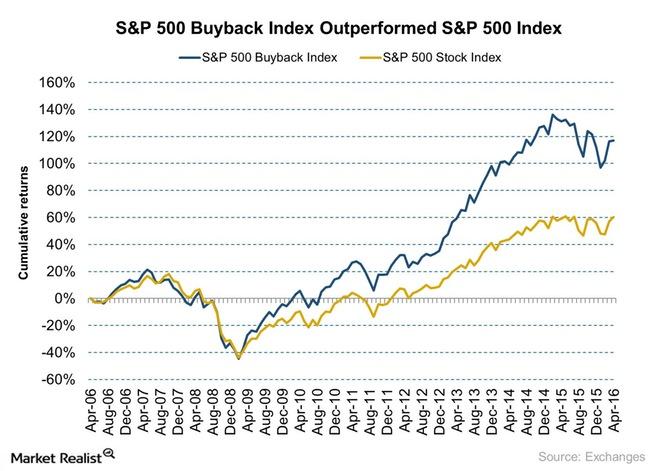

Icahn Identifies a Key Motivation behind the Buyback Spree in the US

Carl Icahn is one of the first activist investors to voice his opinion against share buybacks. He believes that companies are increasingly putting money into buybacks instead of using them for much-needed capital improvements.

Carl Icahn’s View on Share Buybacks Is Divided

Apple (AAPL) is one of the most cash-rich companies in the US. While Carl Icahn has been talking about share buybacks artificially inflating the Market and asset values, some buybacks have occurred as a result of his push.

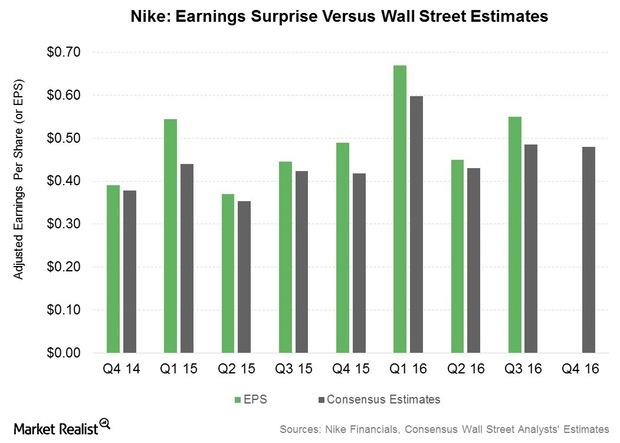

The Earnings Outlook for Nike in Fiscal 4Q16

After posting adjusted EPS growth rates exceeding 20% in the first three quarters of fiscal 2016, the earnings expectations for Nike (NKE) in the fourth quarter are modest.

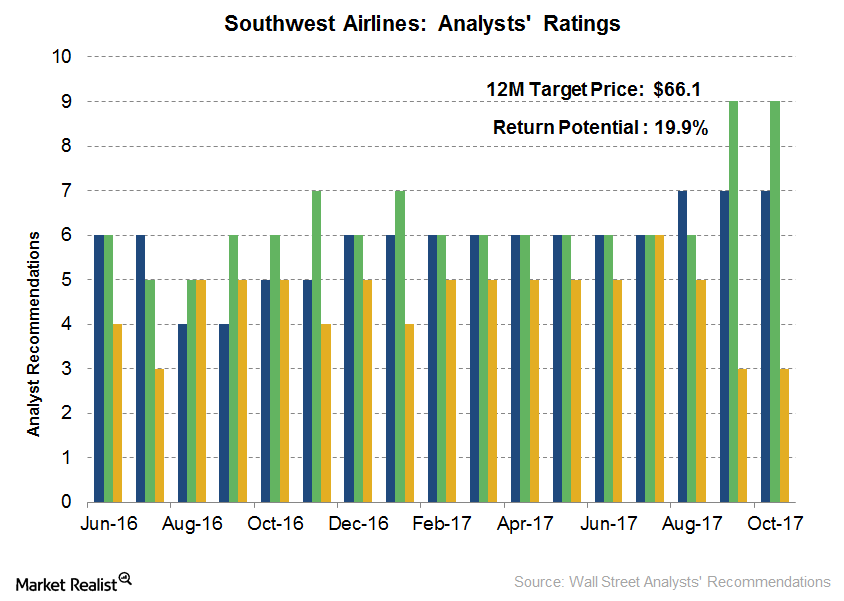

Analysts’ Recommendations for Southwest Airlines

Analysts’ recommendations Of the 17 analysts tracking Southwest Airlines (LUV), 36.8% of the analysts (seven analysts) gave a “strong buy” rating on the stock, while another 47.4% (nine analysts) gave a “buy” rating. The remaining 15.8% (three analysts) gave a “hold” rating. None of the analysts gave a “sell” or “strong sell” rating on the […]

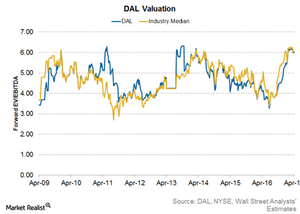

What’s Priced into Delta’s Valuation?

Delta Air Lines (DAL) is currently valued at 5.3x its forward EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiple.

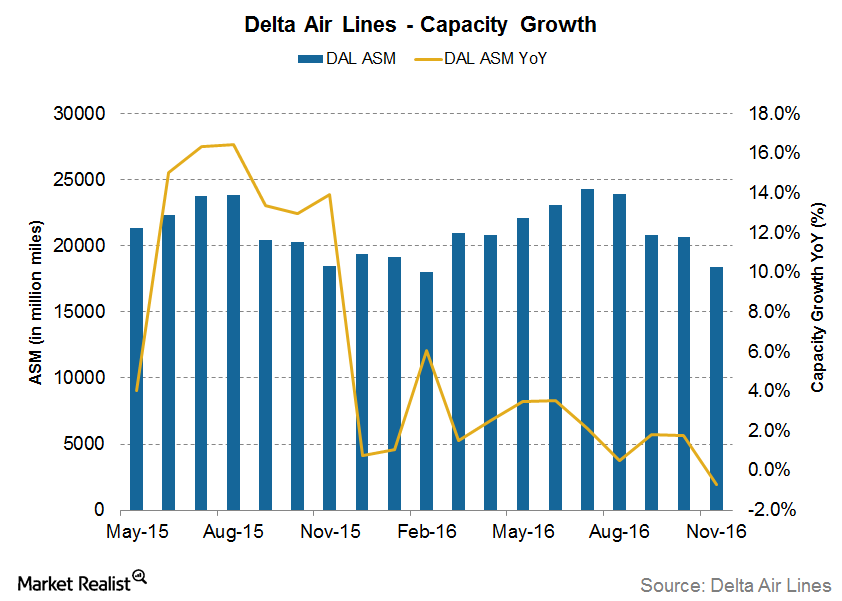

Will Delta Air Lines’ Strong Operational Performance Last?

Delta Air Lines (DAL) saw average traffic of about 50 million passenger miles for the quarter, a 0.8% year-over-year improvement

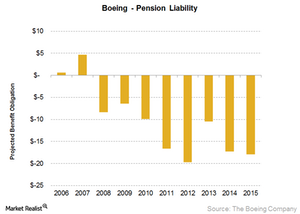

Inside Boeing’s Often Overlooked Risk: Pension Liabilities

For Boeing (BA) to fulfill this promise to its employees, it would require $17.9 billion—a huge sum by any standard.

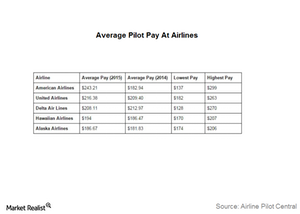

Why Is Delta’s Pilot Deal Important for the Airline Industry?

All airline pilots have their eyes on Delta Air Lines’ (DAL) final agreement with its pilots. This is because Delta’s deal will set a precedent in the industry.

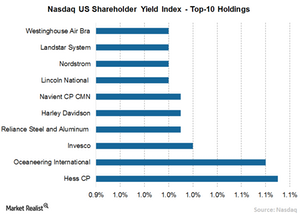

Shareholder Buyback: A Powerful Tool to Achieve Higher Income

What products single out specifically the share buyback companies?

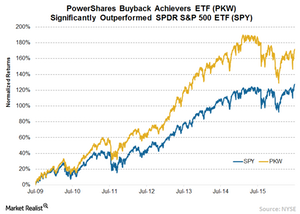

Buyback Achievers Strategy Significantly Outperforms Benchmark

Historically, we have seen Buyback does perform very well across all interest rate environments. Looking at the data back to the mid-80s, it does well.

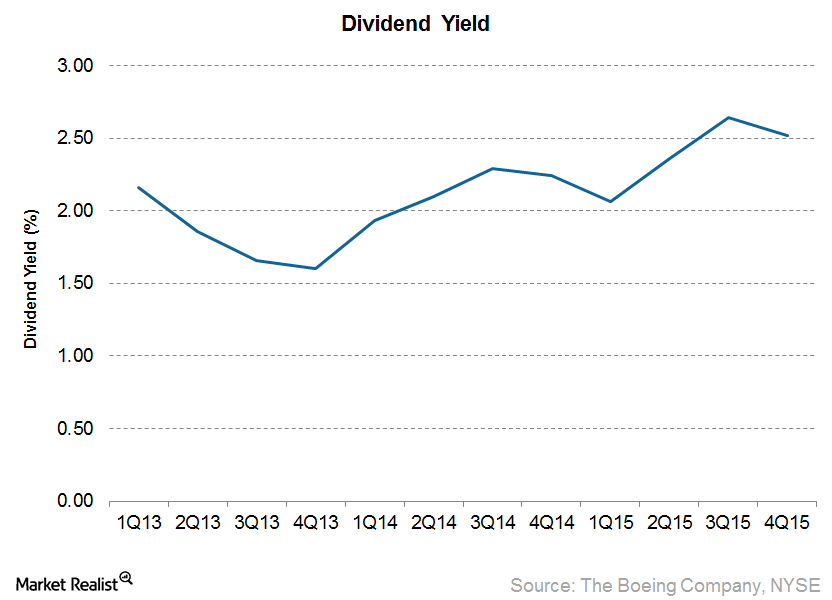

Will Boeing’s Dividend Payout Increase in the Rest of 2016?

Looking at Boeing’s dividends, we see that it has been a consistent dividend payer for more than two decades. For 2Q16, it paid a total of $691 million in dividends.

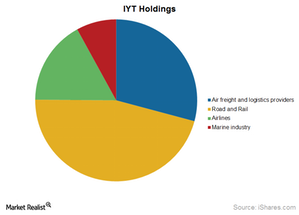

Which ETFs Give Exposure to Courier Stocks?

Smaller ETFs that provide exposure to the courier services industry include Buyback Achievers (PKW), the First Trust Capital Strength ETF (FTCS), and the MSCI Industrials Index ETF (FIDU).

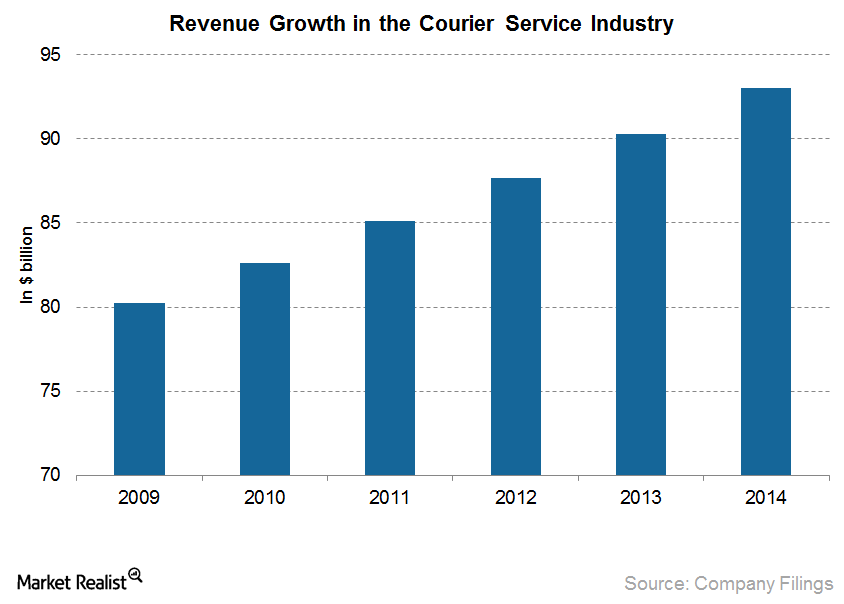

A Look at the Courier Service Industry in the United States

The growth in e-commerce among various economies across the globe has helped shape the highly competitive courier service industry that we know today.

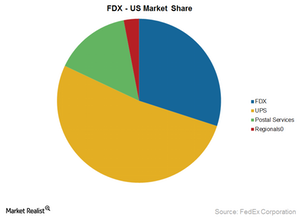

FedEx’s Delivery Market Share Is Threatened by New Competitors

FedEx was formed with a vision to change the way delivery services worked prior to 1971. It established a new industry and it has been leading its peers since then.

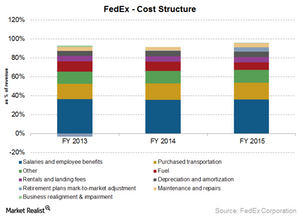

What Are FedEx’s Major Costs?

Salaries and employee benefits form the highest cost for FedEx. They account for ~36% as a percentage of revenue. Salary costs rose 6% for fiscal 2015.

FedEx’s Growth Is Led by Acquisitions and Technology

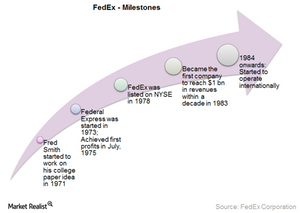

By 1983, FedEx (FDX) had become the strongest delivery business in the nation. It started a string of acquisitions in order to grow more.

FedEx: How a College Paper Idea Turned into a Delivery Giant

The idea behind FedEx (FDX) started off as a term paper by undergraduate Frederick W. Smith in 1965 at Yale University. The company started operations in 1973.