Vanguard Industrials ETF

Latest Vanguard Industrials ETF News and Updates

Industrials Can manufacturing activity in the northeast increase the pace?

The Philadelphia Fed will release the results of its Business Outlook Survey for June, on Thursday, June 19.

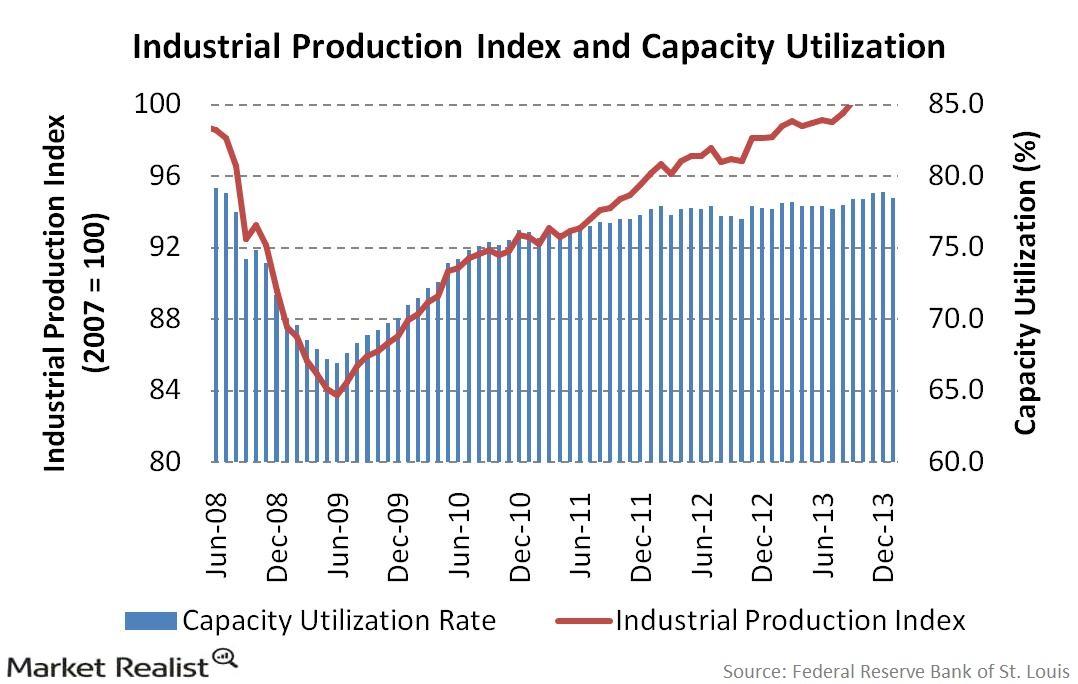

Why the bond market is affected by the Industrial Production Index

Although the industrial sector accounts for less than 20% of GDP, it creates much of the cyclical variability in the economy.

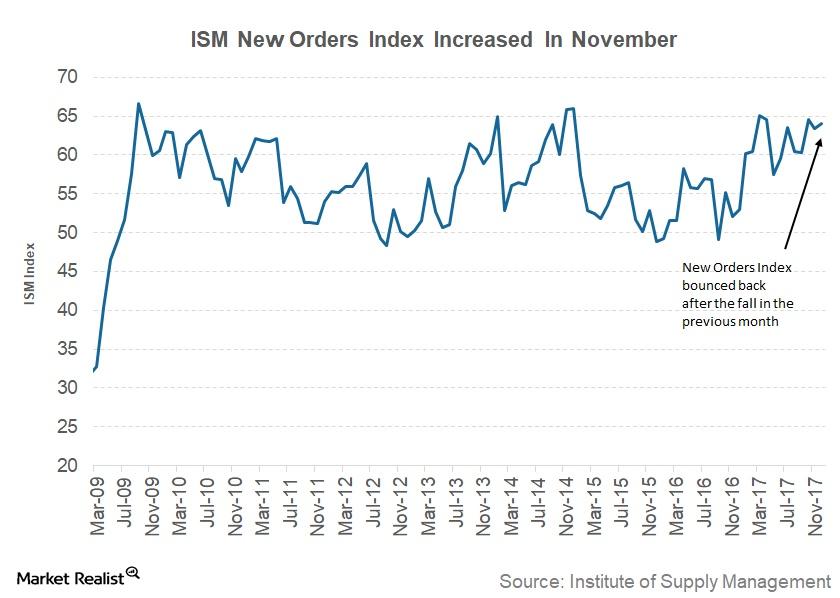

Analyzing the Institute of Supply Management’s New Orders Index

The Institute of Supply Management’s New Orders Index The ISM’s (Institute of Supply Management) New Orders Index is a monthly report on changes in new orders, supplier deliveries, inventories, production, and employment. New orders are a measure of future activity in any industry (VIS), as companies’ production depends on incoming orders. The ISM’s New Orders […]

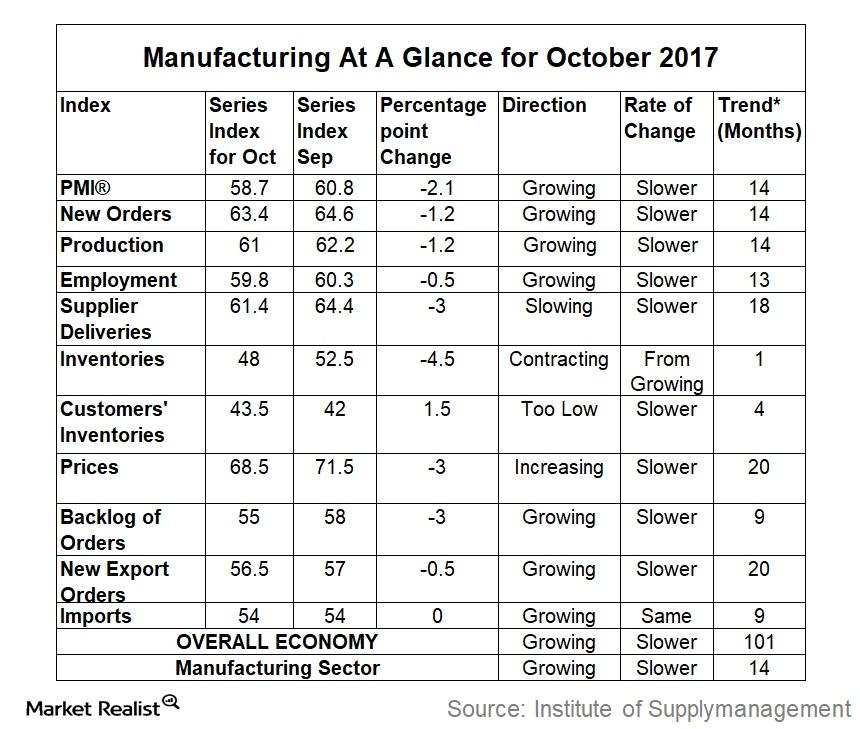

Strength of the Manufacturing Sector: Purchasing Managers’ Index

This has been one of the best years since 2004 for manufacturing activity, viewed through the Purchasing Managers’ Index (or PMI).

What Caused the Fall in Manufacturing Activity in October?

The US Manufacturing PMI (purchasing managers’ index) for the month of October fell to 58.7, compared with 60.8 in September.

How 3M Company’s Acquisition Strategy Has Changed

3M Company’s (MMM) acquisition strategy for the last ten years can be classified as “BI” (before Inge) and “AI” (after Inge).

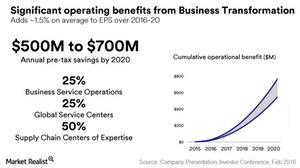

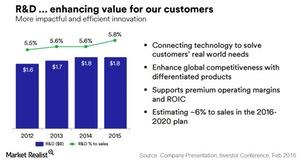

What Are the Financial Objectives of 3M Company’s 5-Year Plan?

In February 2016, 3M Company (MMM) set financial objectives for the five-year period from 2016 to 2020 that were slightly below its previous expectations.

What Strategy Is 3M Company Using to Increase Cost Savings?

Realizing that its capital structure was sub-optimal and was leading to a high cost of capital, 3M Company started adding leverage.

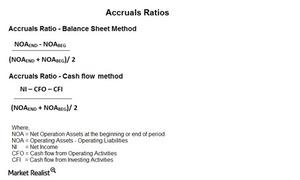

How Good Is the Quality of 3M Company’s Earnings?

3M Company’s (MMM) accruals ratios using the balance sheet and the cash flow methods rose considerably in 2015.

3M Consumer Products: Your Everyday Kitchen and Office Companions

3M Company’s (MMM) Consumer Solutions segment is made up of four diverse businesses, which garnered a combined annual revenue of $4.4 billion in 2015.

What Strengths Differentiate 3M Company from the Competition?

3M Company is generating a massive 30%–32% of its annual revenue from products it’s introduced in the last five years.

Essentials of the SaaS Business Model in Honeywell’s ACS Unit

Honeywell’s ACS unit uses the software-as-a-service (or SaaS) business model. In the SaaS model, software is licensed on a subscription basis to users.

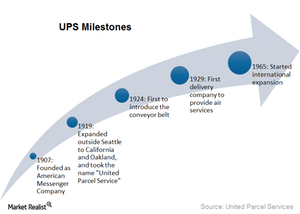

UPS: How the World’s Largest Package Delivery Service Began

United Parcel Service (UPS), originally called American Messenger Company, was founded in 1907 by 19-year-old James E. Casey with $100 borrowed from a friend.Industrials The ADP jobs report: A must-know guide for ETF investors

The ADP National Employment Report (also popularly known as “the ADP Jobs Report” or “ADP Employment Report”) is a monthly report summarizing the employment situation.