C.H. Robinson Worldwide, Inc.

Latest C.H. Robinson Worldwide, Inc. News and Updates

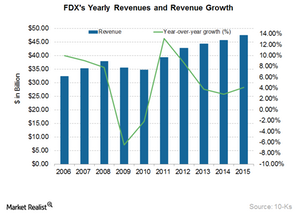

How Did FedEx Grow into One of the Largest Logistics Giants?

In the international arena, FedEx primarily competes with DHL, United Parcel Service (UPS), and foreign postal authorities.

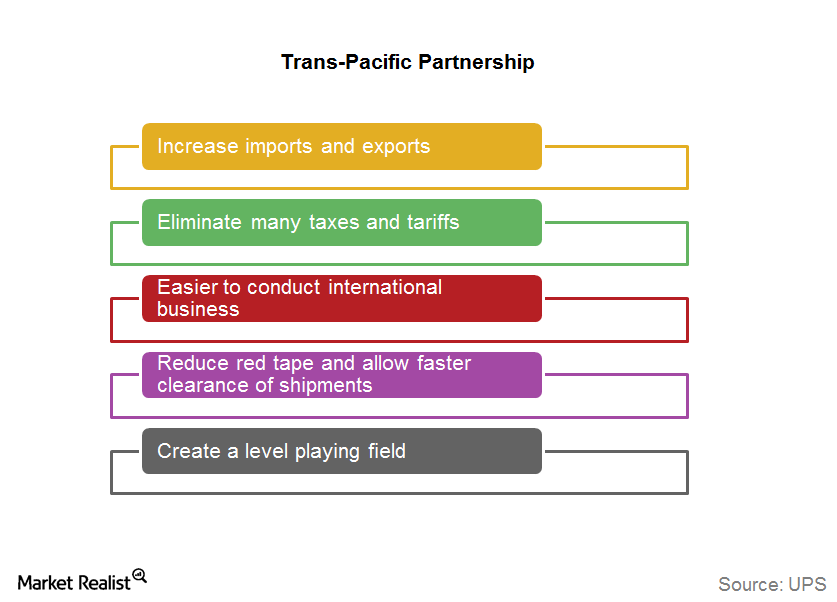

UPS and the Trans-Pacific Partnership: Simplicity in Trade?

The Trans-Pacific Partnership is expected open cross-border trade between member nations by increasing imports and exports and cutting taxes and tariffs.

How Is UPS Valued Compared to Its Peers?

UPS’s forward PE ratio stands at 17.1x compared to its current PE ratio of 22.3. Analysts are expecting UPS’s earnings to grow in the next four quarters.

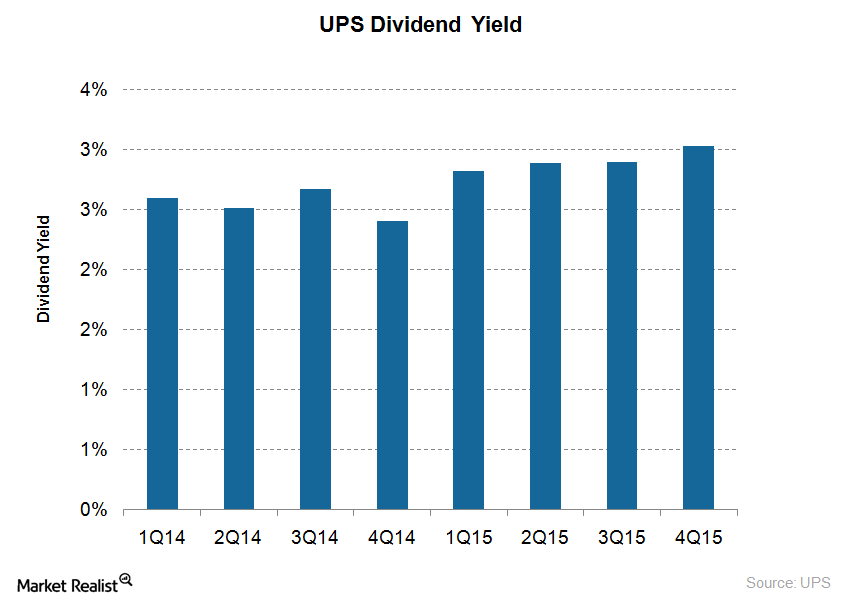

UPS Hikes Its Dividend

On February 15, UPS announced that it raised its quarterly dividend rate 5.5% to $0.96 from $0.91 paid in November.

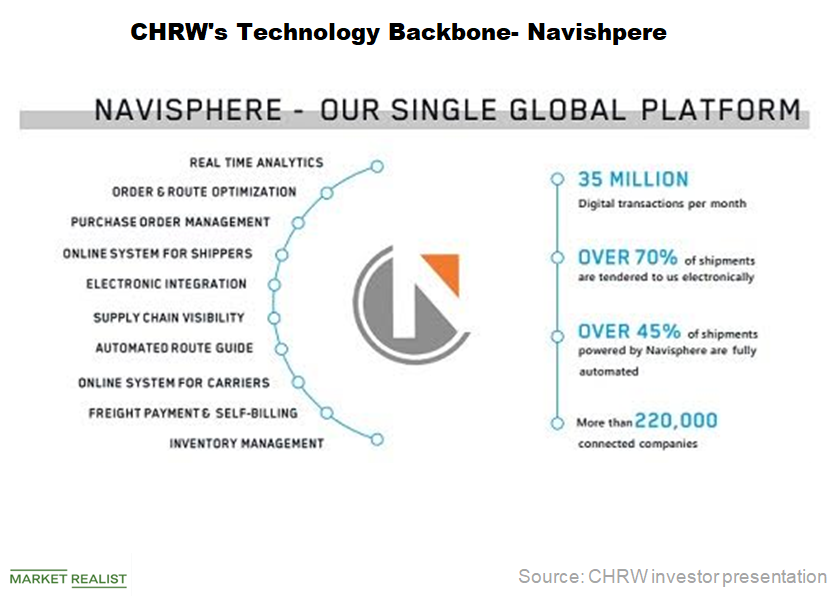

Navisphere: C.H. Robinson’s Technology Backbone

C.H. Robinson Worldwide’s (CHRW) Navisphere is a proprietary global technology platform that matches customer requirements with supplier capabilities to fit customers’ needs.

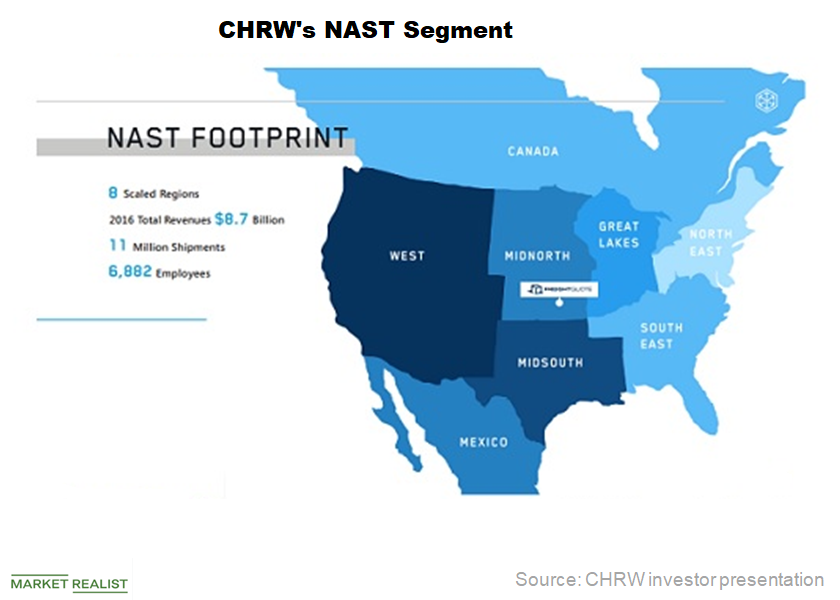

C.H. Robinson’s North American Surface Transport Segment

C.H. Robinson Worldwide’s (CHRW) NAST (North American Surface Transport) segment provides truckload, LTL (less-than-truckload), and intermodal freight transportation services across North America.

Inside C.H. Robinson’s Competition and Growth Strategy

C.H. Robinson Worldwide (CHRW) is the largest third-party logistics provider in the world.

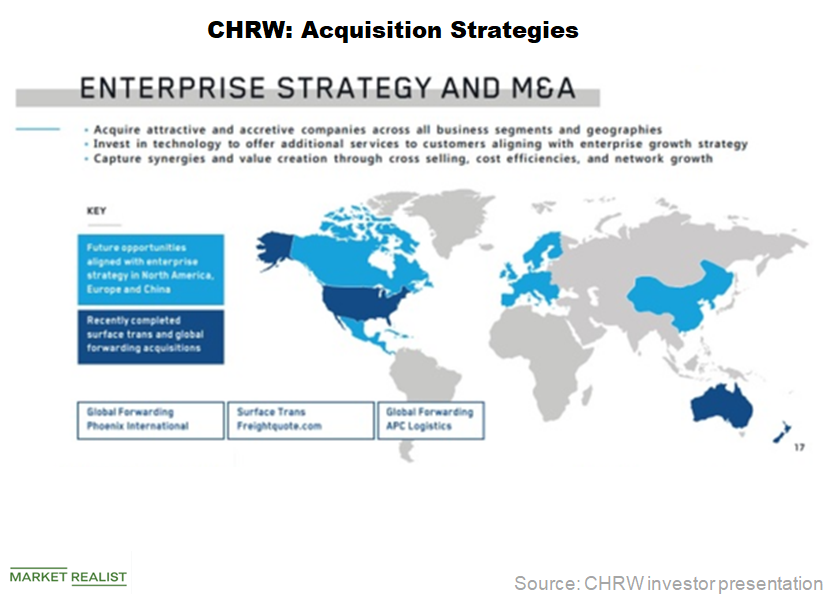

C.H. Robinson: Solid Business Growth through Acquisitions

C.H. Robinson Worldwide (CHRW) went public in 1997. Soon after, the company went on an acquisition spree to further its business interests in new geographies.

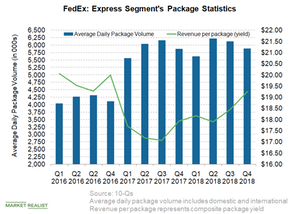

What’s behind FedEx Express’s Revenue Growth?

In this article, we’ll consider FedEx’s (FDX) Express segment’s performance in the fourth quarter.

XPO Logistics: A Brief Company Overview

XPO Logistics (XPO) stock closed at $98.66 on March 27, 2018, which was lower than its 52-week high of $106.20.

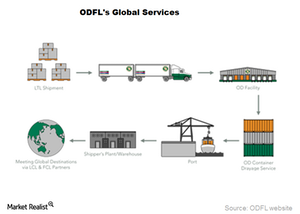

Inside Old Dominion Freight Line’s Global Services

Old Dominion unloads its less-than-truckload shipments dispatched by vendors onto an ocean container unit and onto the client’s steamship of choice.

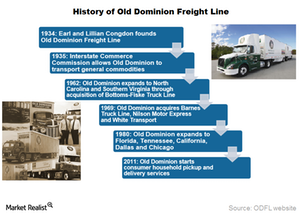

How Did Old Dominion Evolve as a Major US Trucking Company?

Old Dominion offers access, through agents or strategic alliances, to services in international locations including Canada, Mexico, Europe, and China.

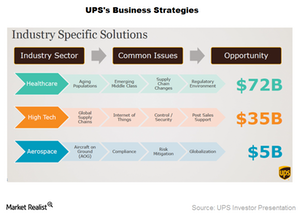

United Parcel Service: Key Growth Focus Areas

Recently, United Parcel Service has broadened the service offering of UPS My Choice to 15 more countries and territories in the Americas and Europe.

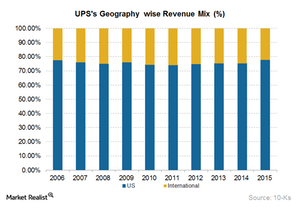

United Parcel Service: A Company Overview

In 2015, United Parcel Service reported total revenues of $58.4 billion. The company’s primary competitor in the US is the Memphis-headquartered FedEx Corporation.

Will United Parcel Service Increase Its Dividend Payout in 2016?

United Parcel Service (UPS) has been a consistent dividend payer for the last 20 years.

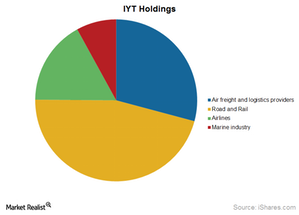

Which ETFs Give Exposure to Courier Stocks?

Smaller ETFs that provide exposure to the courier services industry include Buyback Achievers (PKW), the First Trust Capital Strength ETF (FTCS), and the MSCI Industrials Index ETF (FIDU).

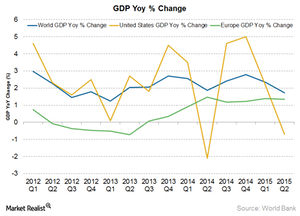

Why Is Economic Growth Important for the Courier Service Industry?

Over the past few years, the global courier services industry has managed to recover from the global economic slowdown.

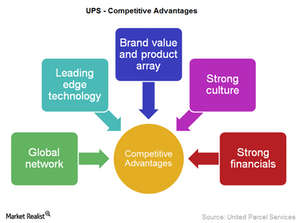

Key Strengths that Keep UPS ahead of Its Peers

Some of UPS’s key strengths that keep it ahead of its competitors include an integrated global network, leading-edge technology, a strong brand name, a strong culture, and impressive financials.

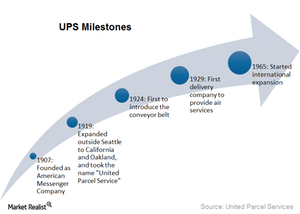

UPS: How the World’s Largest Package Delivery Service Began

United Parcel Service (UPS), originally called American Messenger Company, was founded in 1907 by 19-year-old James E. Casey with $100 borrowed from a friend.