Supplier Capacity: A Problem for Aircraft Manufacturers?

Boeing bought Vought Aircraft Industries, one of its Tier 1 suppliers. This acquisition helped Boeing gain more robust control of its manufacturing process.

April 9 2015, Updated 1:08 p.m. ET

Supplier woes

Aerospace giants Boeing (BA) and Airbus have huge order backlogs of more than 10,000 aircraft combined. Consulting firm Deloitte expects the output of the two companies to rise by 25% in the next decade as they plan a huge ramp-up in production. However, while both Boeing and Airbus have the ability to assemble the planes, there may be a major capacity problem at the supplier end.

Outsourcing: Boon or bane?

Like many companies worldwide, Boeing embraced outsourcing to reduce its costs. It raised outsourcing to 70% for the 787 Dreamliner in order to reduce the production time from six years to four years, as well as its costs from $10 billion to $6 billion. However, the result was far from what Boeing expected, as its marquee Dreamliner project is running late and over budget.

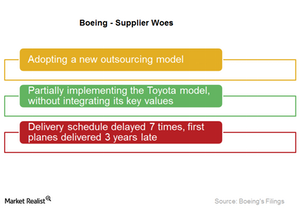

To add to its production woes, Boeing adopted a new three-tiered outsourcing structure. Tier 2 and Tier 3 suppliers manufacture the aircraft subsystems, which are then assembled by Tier 1 manufacturers. However, as Boeing came to realize, many of these manufacturers did not have the technological expertise to manufacture the required parts.

The Toyota model

These problems arose from Boeing’s partial implementation of the Toyota (TM) model, without integrating its key values. Toyota outsourced as much as 70% of its total manufacturing, while monitoring its suppliers continually to ensure their capability, quality, and timely delivery. This helped Toyota manufacture new cars in a much shorter timeframe while maintaining its reputation for high quality.

Boeing aerospace engineer L.J. Hart-Smith addressed this issue in a white paper that he presented during a 2001 Boeing conference. He noted, “In order to minimize these potential problems, it is necessary for the prime contractor to provide on-site quality, supplier-management, and sometimes technical support. If this is not done, the performance of the prime manufacturer can never exceed the capabilities of the least proficient of the suppliers. These costs do not vanish merely because the work itself is out-of-sight.”

How is Boeing addressing this problem?

Boeing bought Vought Aircraft Industries, one of its Tier 1 suppliers. This acquisition helped Boeing gain control of its manufacturing process. As noted above by Hart-Smith, this action should provide the necessary expertise to Boeing’s other suppliers. Airbus and Boeing realize the importance of working more closely with their suppliers. Both companies send inspectors to the supplier factories on a regular basis to assess production, provide on-site support, and share information.

The supplier end is experiencing consolidation as well. Boeing’s three biggest suppliers—Thales, Honeywell (HON) and United Technologies (UTX)—are also buying Tier 2 and Tier 3 suppliers. However, this gives more power to these suppliers in their ongoing battle with aircraft manufacturers over how to share the profits from this huge growth in plane orders. Currently, margins at the supplier levels are flatter than those of the aircraft manufacturers.

Investors who want exposure to the aircraft industry can consider investing in funds such as the Dow Jones Industrial Average ETF (DIA). Boeing forms 5.55% of DIA’s holdings.