Why Boeing Pension Plan Assumptions May Be Too Optimistic?

If BA manages to achieve its estimated returns and asset allocation, the weighted-average expected rate of return on plan assets would be short of 7%.

Nov. 9 2016, Updated 8:04 a.m. ET

Decoding the DB plan

A DB (defined benefit) plan is made up of two elements:

- the present value of money that the company required to pay employees as benefits after retirement, or “pension plan obligation”

- the money that the company has kept aside to make these payments, or “pension plan assets”

To arrive at its pension obligation, a company has to make many assumptions. These include a discount rate (used to calculate the present value of future liabilities), retirement age or years of service left, the average age of employees, and salary growth rate. Needless to say, each of these assumptions has a huge impact on a company’s obligation.

Plan assets refer simply to the money set aside by the company. At the end of each year, plan assets are adjusted to reflect fair value. These adjustments include additional contributions made by the company and gains or losses made on those assets during the year.

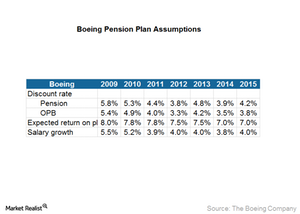

Boeing’s assumptions

The discount rate is calculated using a yield curve for a high-quality (Aa or better) bond from at least two rating agencies. The expected rate of return is determined using the actual historical performance of the fund and the expected future rate of return.

The assumption of a 7% rate of return is too farfetched. Such a return would have been possible to achieve when treasury yields were at 4% and not at the current rate of 2.562% (US 30-year Treasury yield). This assumption says a lot about a company’s ability to fund the obligations from its current plan assets.

Why is this assumption optimistic for Boeing?

We can assume fixed income to grow at the 30-year Treasury yield of 2.562%. Global Equity is expected to grow by over 8% over the long term. A Forbes study, private equity is expected to grow by 10%, while the US real estate market is expected to grow by 3.5% (according to real estate appreciation from 1968–2009 based on data from National Association of Realtors and US census, adjusted for the size of houses). According to studies done at Yale and NYU’s Stern School of Business, hedge funds have historically grown at an average rate of 13.6%.

Even if these assumptions are a bit optimistic, if BA manages to achieve these returns and its asset allocation, the weighted-average expected rate of return on plan assets would be 5.7%—nowhere close to the current 7% assumption. In fact, according to a study by Moody’s, this rate will likely be closer to 4%. And for a company like Boeing (BA), even a 0.25% difference makes an impact of a couple of billion dollars.

To be sure, General Motors (GM), Ford Motor (F), Lockheed Martin (LMT), United Technologies (UTX), AT&T (T), General Electric (GE), Alcatel-Lucent (ALU), and Verizon Communications (VZ) all make the same assumptions. Boeing (BA) makes up ~7.8% of the holdings of the Aerospace & Defense ETF (PPA).

Now let’s discuss what factors could help Boeing meet its high obligations.