General Electric Co

Latest General Electric Co News and Updates

GE CEO Larry Culp Cuts Compensation to Appease Shareholders

Shareholders thought GE CEO Larry Culp was making too much money, so he’s agreed to cut his compensation this year.

The Net Worth of Business Titan Larry Bossidy

Former CEO of AlliedSignal, Chief Officer of General Electric, and author —Larry Bossidy is no stranger to success. What is his net worth?

Should You Buy or Sell GE Stock Ahead of the Spin-Off?

GE is splitting into three unique companies. Here's what that means for your investment. Is GE stock a buy or sell?

Should You Buy GE Stock Before the Spin-Off?

Industrial conglomerate General Electric (GE) is splitting into three companies. What's going to happen to GE stock after the spin-off?

Is GE Breaking Up? Plans to Split Into Three Companies by 2024

Is GE breaking up? The conglomerate announced that it will split into three publicly traded companies by 2024.

Wind Farm Stocks for Investors to Know About in 2021

Wind farm stocks are becoming crucial to the fabric of global energy. Which stocks should investors watch in 2021?

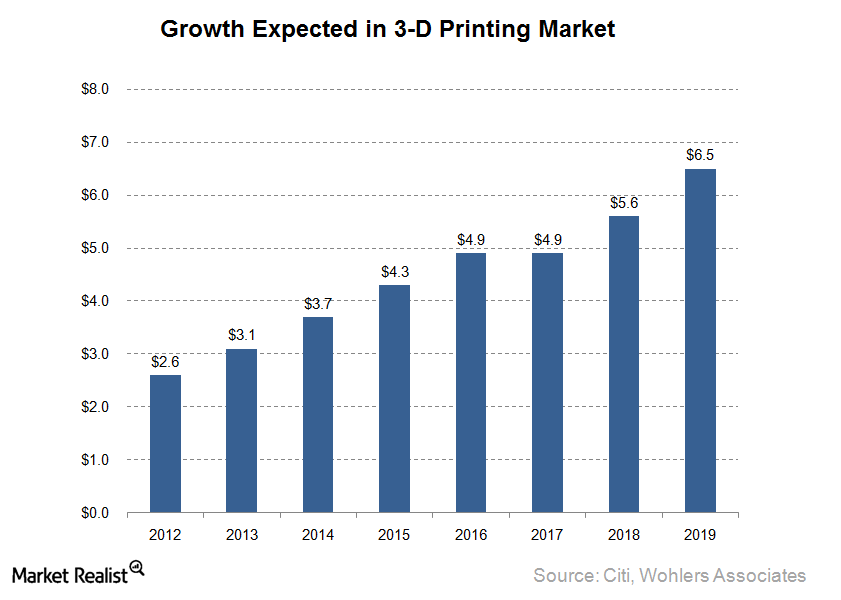

HP looks to rapid growth in 3D printing industry

According to Gartner, there are seven technologies making up the current 3D printing industry. Material extrusion is expected to lead growth in the market.

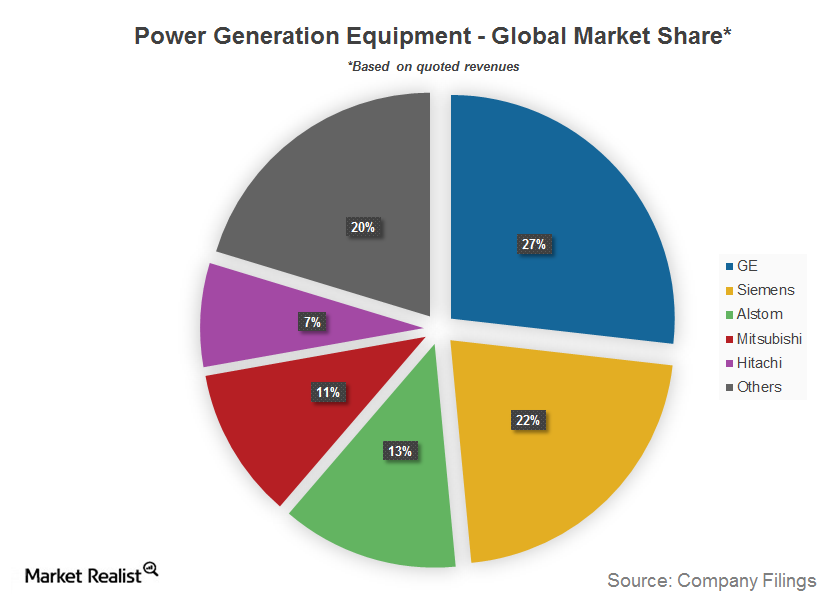

The major sub-industries of the global power equipment industry

The power generation equipment industry is made up of various sub-industries, each with a structure of its own.

The Anatomy of a Reverse Stock Split

A reverse stock split sounds complex, but it's fairly straightforward. We explain what happens in a reverse stock split and some reasons why a company might do one.

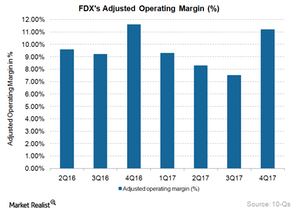

What Happened to FedEx’s Fiscal 4Q17 Operating Margin?

FedEx’s (FDX) operating margin was 11.2% on an adjusted basis in fiscal 4Q17, representing a 0.4% fall on a YoY (year-over-year) basis.

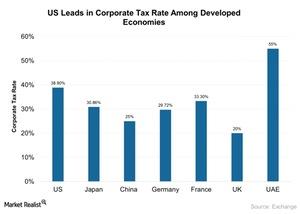

Inside the Market’s View of Corporate Tax Cuts

Are markets upbeat on potential tax reforms? The markets (SPY) (IVV) surged last week with the announcement of a phenomenal update on the corporate tax cut. The S&P and Nasdaq Comp gained ~2% in the week ended February 10, 2017. The Trump administration’s proposed tax cut is likely to boost the economy, though analysts have […]

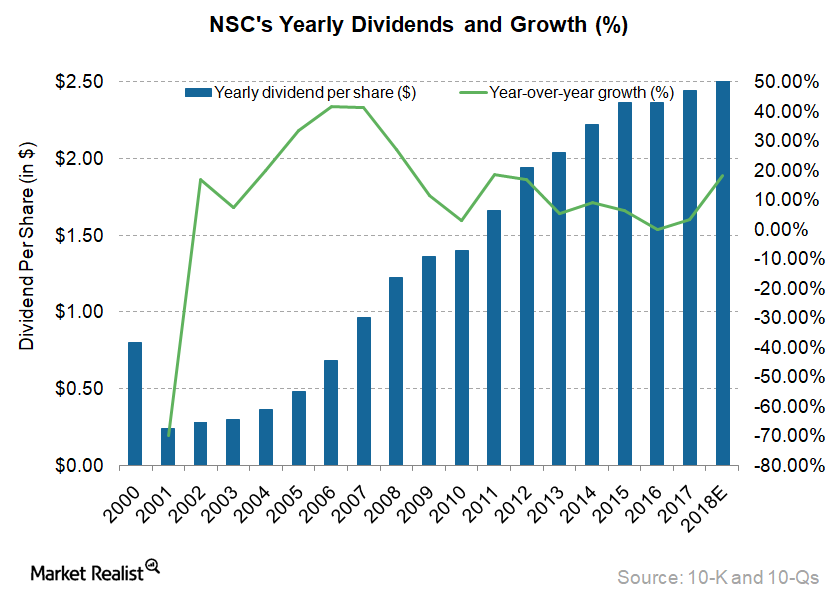

Could Norfolk Southern Increase Its Dividend in 2018?

On a long-term basis, NSC aims for a dividend payout ratio of 33.3%.

General Electric’s 1Q18 Earnings Beat Estimates

General Electric (GE) released its 1Q18 earnings on April 20. GE’s adjusted earnings per share were $0.16, up 14.0% year-over-year.Industrials Can manufacturing activity in the northeast increase the pace?

The Philadelphia Fed will release the results of its Business Outlook Survey for June, on Thursday, June 19.

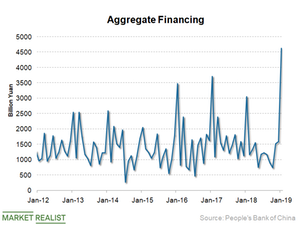

Can China Manage Growth without Fueling a Debt Crisis?

While there is no denying that China (FXI) needs stimulus measures to kickstart its slowing economy, any propping up needs to be done in a way to avoid another debt-fueled crisis.

General Electric Stock Traded near Its Ten-Year Low

On December 7, General Electric’s closing price was $7.01. Currently, the stock trades near its ten-year low of $6.66.Industrials Why China’s slowing consumption demand is an important threat

Real estate and construction are the two important drivers of China’s economic growth. They account for more than 20% of China’s gross domestic product (or GDP) when you also factor in cement, steel, chemicals, furniture and other related industries.

General Electric’s Mission, Vision, and Strategy

General Electric’s strategy is to reshape its portfolio from a broad conglomerate to a more focused industrial leader.

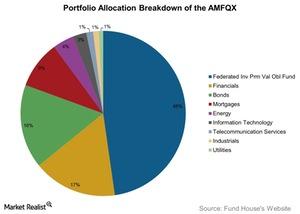

AMFQX: More Than 60% Exposure to Derivative Securities

AMFQX is an alternative mutual fund that seeks to generate positive absolute returns with a low correlation to the returns of broad stock and bond markets.

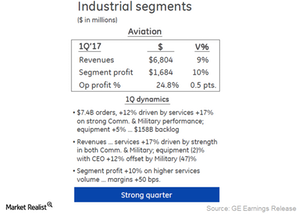

Why General Electric’s Aviation Segment Revenue Rose in 1Q17

Revenue for General Electric’s (GE) Aviation segment was $6.8 billion in 1Q17, a 9.0% rise from $6.2 billion in 1Q16.

How Has Roper Technologies’ Stock Fared ahead of Its 2Q16 Earnings?

Roper Technologies’ stock has declined since July 2015, after touching a high of $195.93 per share on November 30, 2015.

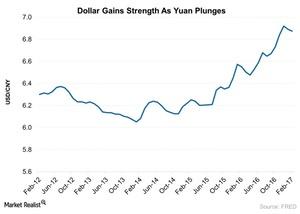

Currency warfare: A ‘beggar-thy-neighbor’ situation

In a currency war, the “beggar-thy-neighbor” strategy is about increasing the demand for a nation’s exports at the expense of other countries’ export share.

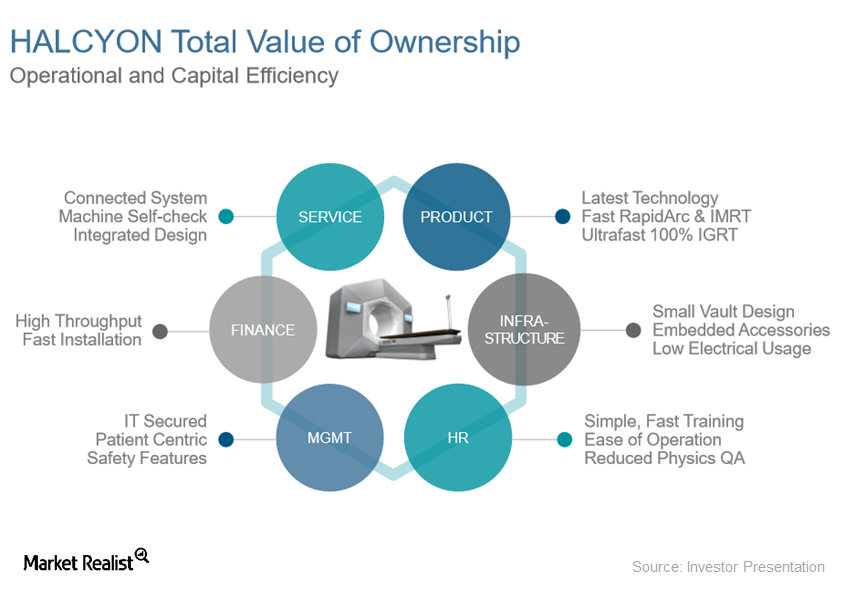

Varian’s Halcyon Treatment System Sees Emerging Market Demand

Halcyon The Halcyon system, Varian Medical Systems’ (VAR) recently launched cancer treatment device, aims to simplify and enhance IMRT (image-guided volumetric intensity modulated radiotherapy). The device has received clearance by the FDA (US Food and Drug Administration). By next year, Varian expects to receive regulatory approvals for the device in China and Japan. For more information […]

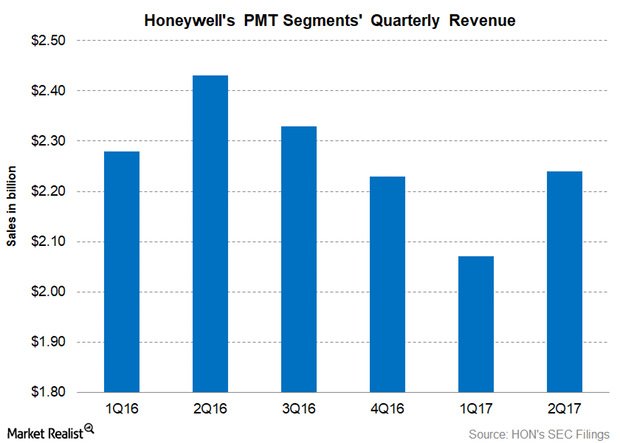

Honeywell’s Performance Materials and Technologies: Why It Fell

Honeywell’s (HON) Performance Materials and Technologies (or PMT) segment accounted for 22.2% of HON’s total revenue in 2Q17.

Graphical Representation of General Electric’s Business Model

General Electric’s industrials and finance services are its two broader divisions, contributing 91% and 9%, respectively, to its consolidated 2015 earnings.Industrials Coal is losing its market share in China’s electricity generation

Coal is the cheapest fossil fuel, but it’s also the most polluting. With its massive electricity generation capacity—mainly coal-fired—China emits the most carbon dioxide in the world.

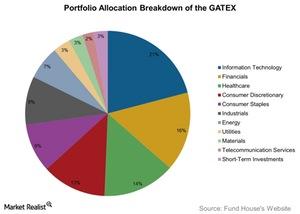

GATEX: A Sectorial Portfolio Breakdown

The Gateway Fund – Class A (GATEX) seeks to attain capital appreciation through its equity market investments. It has less risk compared to equity markets.

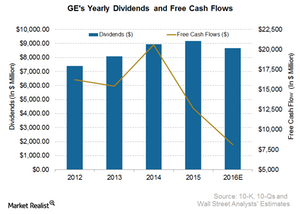

Does GE Have Enough Free Cash Flow to Support Dividend Growth?

General Electric’s dividend compound annual growth rate in the last seven years ended in 2015 was 7.1%. This single-digit growth wasn’t that impressive.

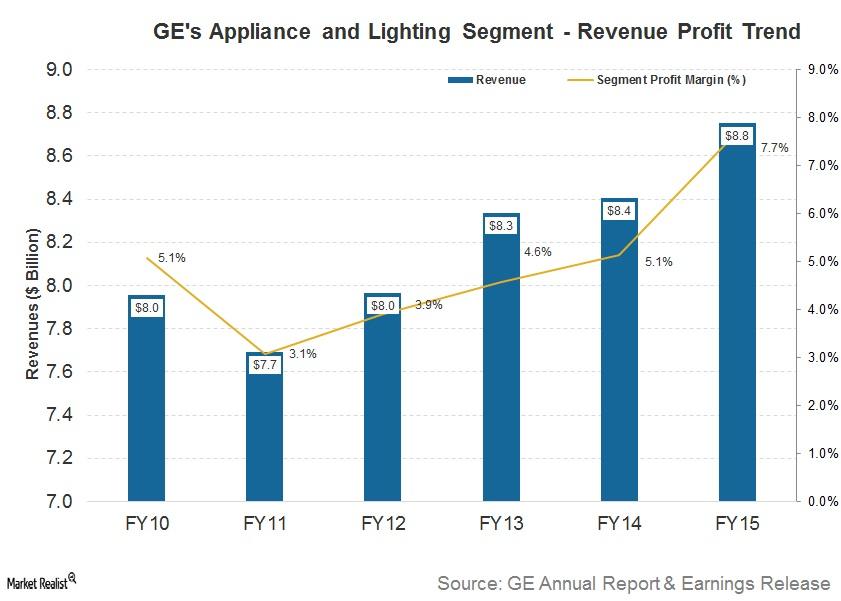

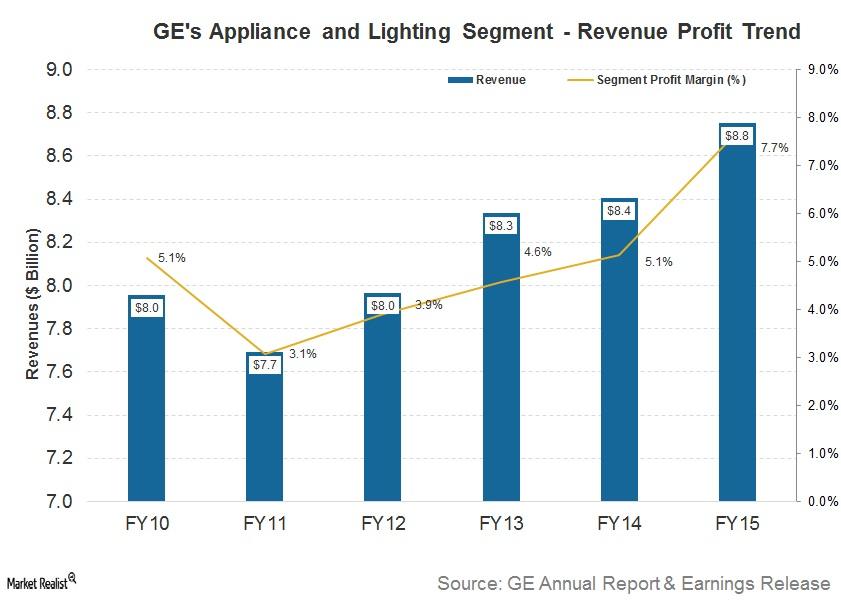

Gauging General Electric’s Appliance Segment

General Electric recently announced that its appliance and lighting division would be sold to Haier.

Why General Electric Sold Its Appliances Business to Haier

General Electric wants to shift away from the appliances business, as this segment doesn’t fit into its core business portfolio.

How Much Is China Really Devaluing Its Currency?

China had pegged its currency, the yuan, to the US dollar as it was a developing nation.

Get Real: Breaking Down and Bouncing Back

In this morning’s edition of Get Real, we saw that WeWork’s layoffs are taking a toll. Meanwhile, the cannabis industry could be bouncing back.

The Lowe’s-Rona Transaction: Sizing Up the Potential Synergies

Lowe’s (LOW) expects the Rona (RON.TO) transaction to be accretive to its earnings per share or EPS from the very first year after the acquisition.

How the Boeing 737 Max Crash Could Affect Berkshire Hathaway

Boeing (BA) has been feeling the heat after its 737 Max 8 aircraft crashed on March 10—the second crash in five months.

Jim Simons’ Renaissance Technologies Is Bearish on TSLA

On May 14, Jim Simons’ Renaissance Technologies filed its 13F for the first quarter of 2020. The hedge fund reduced its holdings in Tesla.

3M Stock: Analysts Raise Target Price after Q1 Results

Today, several analysts raised their target price for 3M (NYSE:MMM) stock. The company reported better-than-anticipated first-quarter results on April 28.

Boeing 737 NG: FAA Fine Might Drive Customers Away

The FAA said that Boeing knowingly certified 133 units of its 737 NG aircraft even though they were installed with faulty parts.

Warren Buffett Has Loads of Cash and No Takers

Berkshire Hathaway’s huge cash pile might stay in place for a while. Warren Buffett was outbid by Apollo Global Management in his efforts to buy Tech Data.

Boeing 777X versus Airbus A350: War Heats Up

Lately, the Boeing 777X (BA) has made headlines for the wrong reasons. Airbus might be winning the war against Boeing on more than one battlefield.

Boeing 797: Which Airlines Want It and Why?

For Boeing, most of 2019 has been about the 737 MAX. It’s curbed the decision about whether to build its 797 model until the 737 MAX crisis is resolved.Financials Must-know investment pledges to India from Fortune 500 CEOs

The group spoke about how these companies and India could benefit from investment flow into the country. Modi sought investment pledges from many of these CEOs, who were impressed with what India had to offer.

Get Real: Is Unrest Sweeping the Markets?

In today’s Get Real, we took a closer look at Uber’s trouble and an unexpected boost for Canopy Growth while markets react to more unrest.

Boeing Gets Order Boost for Troubled 787 Dreamliner

This morning, Boeing (BA) received a major boost for its troubled 787 Dreamliner, whose order backlog has depleted rapidly.

Boeing Needs to Redesign Thousands of 737NG Parts

The NTSB (National Transportation Safety Board) requested Boeing (BA) redesign an engine part of its 737NG (Next Generation) aircraft.

Boeing Proposes Alternative to Qantas amid 777X Delays

Reportedly, Boeing (BA) has provided a temporary solution to Australia-based Qantas Airways’ ultra-long-range aircraft requirements.

Boeing Drops Robotic Assembly for 777 Fuselage

Boeing (BA) has decided to lower its dependency on robots for assembling its 777 aircraft’s fuselage section due to reliability issues.

Boeing Loses Huge Aircraft Order to Airbus

Boeing has reportedly lost a huge aircraft order to Airbus. According to Reuters, GE Capital Aviation Services has ordered 25 Airbus planes.

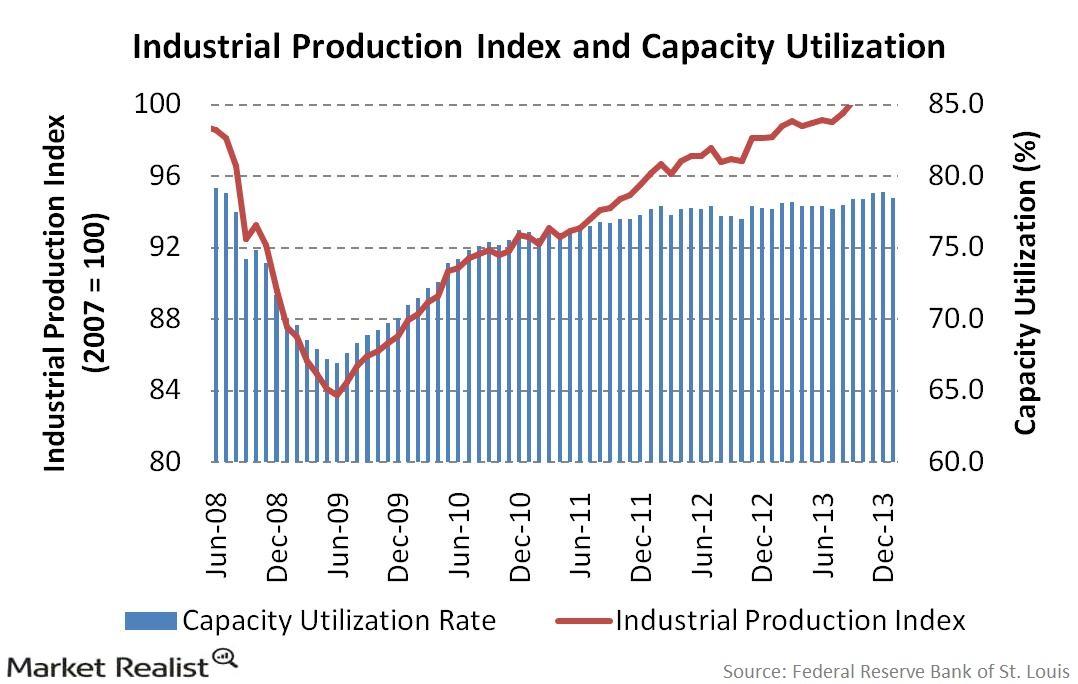

Why the bond market is affected by the Industrial Production Index

Although the industrial sector accounts for less than 20% of GDP, it creates much of the cyclical variability in the economy.

The Boeing 737 Curse: Qantas Grounds Three 737NGs

Australia’s Qantas Airways has completed the inspection of its 33 Boeing 737NG (Next Generation) planes and has grounded three of them.

Get Real: Warren Buffett’s Next Elephant

In today’s Get Real, we saw that California Governor Gavin Newsom has ideas about Warren Buffett’s next elephant. Plus, earnings takeaways, the Fed, oil risk, and more.