Should You Buy GE Stock Before the Spin-Off?

Industrial conglomerate General Electric (GE) is splitting into three companies. What's going to happen to GE stock after the spin-off?

Nov. 10 2021, Published 5:42 a.m. ET

On Nov. 9, General Electric (GE) stock rose as much as 7 percent. The stock rose after the industrial conglomerate founded by Thomas Edison in 1892 announced plans to split into three separate companies. What's going to happen to GE stock after the spin-off?

GE stock has underperformed the broader market over the last two decades. As a result, Wall Street analysts praised GE’s decision to split.

General Electric is splitting into three companies

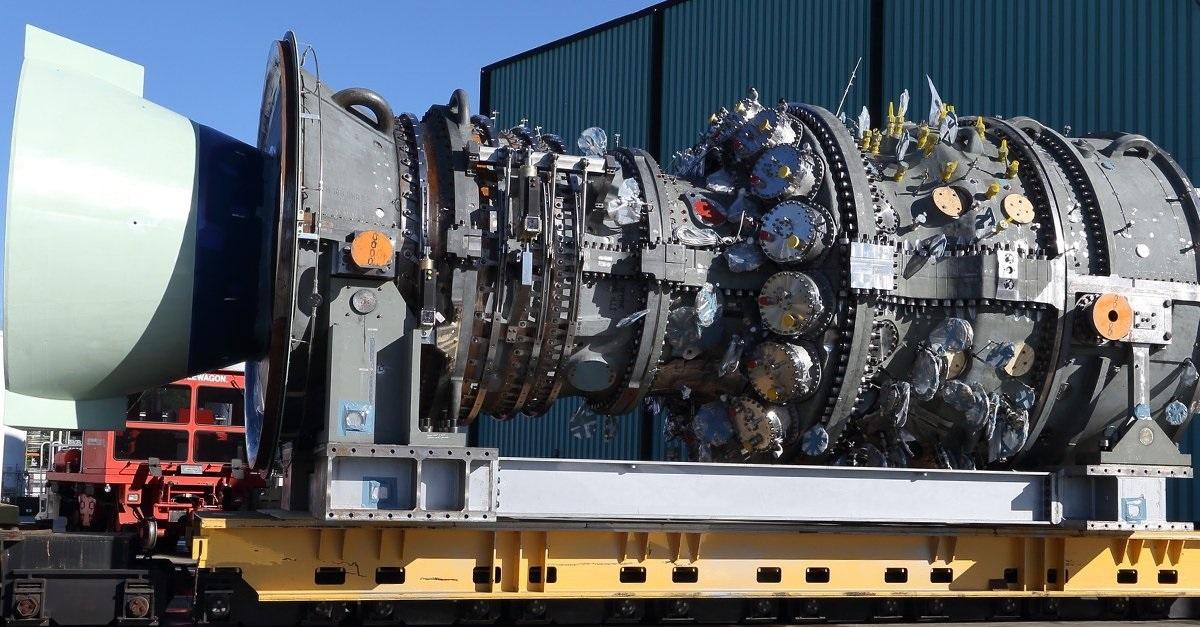

On Nov. 9, GE announced plans to break up into three public companies focused on healthcare, energy, and aviation, respectively. A tax-free spin-off of the healthcare unit is planned for early 2023. The renewable energy, fossil-fuel power, and digital units will combine to form a single energy-focused business with a tax-free spin-off targeted in 2024. After the spin-offs, the aviation-focused company will retain the GE name.

GE CEO Larry Culp plans to continue as CEO and chairman of the aviation company while also serving as non-executive chairman of the healthcare company. The new GE expects to retain a 19.9 percent position in the healthcare company. GE estimates a one-time $2 billion charge from separation, transition, and operating expenses associated with the plan, as well as tax costs of about $500 million.

Since Culp took over GE in 2018, he has divested assets and restructured the company to lower costs and reduce GE’s huge debt burden. GE has stated that it's set to reduce its debt by $75 billion by the end of 2021.

GE stock’s forecast

According to MarketBeat, analysts' average target price for GE stock is $115.71, which is 4 percent above its current price. Among the 15 analysts tracking GE, nine recommend "buy" and six recommend "hold." None recommend selling. Their highest target price of $136 is 22 percent above the stock's current price, while their lowest target of $80 is 28 percent below.

On Nov. 9, Deutsche Bank analyst Nicole DeBlase upgraded GE stock to "buy" from "hold," and raised its price target to $131 from $119. She upgraded the stock after updating her sum-of-the-parts valuation. According to The Fly, “DeBlase said she would rather be early given the amount of value that can be unlocked at GE.” RBC analyst Deane Dray believes the split could boost GE stock by 20 percent.

CNBC’s Mad Money host Jim Cramer also cheered GE’s plan to split. Cramer said it’s the correct and necessary financial decision, and that he has faith in GE’s Culp to steer it through. The split is anticipated to generate a lot of value. However, investors should be aware that the value won’t be recognized until at least 2024, when the splits are complete.

What will happen to GE stock after the spin-off?

When the GE spin-off happens, existing shareholders of the parent company get equivalent shares in the new company. New investors can buy shares of one or all three companies. GE stock is expected to fall immediately after the spin-off, as the assets that now belong to the subsidiary will have been removed from the parent company’s books, reducing its book value.